Accept Buy Now Pay Later in the Philippines

Accept Buy Now Pay Later in the Philippines

Accept Buy Now Pay Later in the Philippines

Give your customers a flexible way to pay — while you get paid upfront. Set up Buy Now Pay Later for your business in the Philippines, and grow your sales with no added risk.

Give your customers a flexible way to pay — while you get paid upfront. Set up Buy Now Pay Later for your business in the Philippines, and grow your sales with no added risk.

Give your customers a flexible way to pay — while you get paid upfront. Set up Buy Now Pay Later for your business in the Philippines, and grow your sales with no added risk.

Why offer Buy Now Pay Later in the Philippines?

Why offer Buy Now Pay Later in the Philippines?

Why offer Buy Now Pay Later in the Philippines?

Increase Conversions and Cart Size

Increase Conversions and Cart Size

Let customers buy what they want now and pay over time — boosting sales with less hesitation.

Get Paid Upfront

Get Paid Upfront

With HitPay, you receive the full payment right away. BillEase handles customer repayments.

Meet Local Expectations

Meet Local Expectations

BillEase is one of the Philippinesʼ most trusted BNPL platforms — widely used across online stores and marketplaces.

Risk-free for Merchants

Risk-free for Merchants

No need to manage collections or credit. You get paid immediately

Quick, No-Code Setup

Quick, No-Code Setup

Activate BillEase in minutes via HitPayʼs dashboard — works with Shopify, WooCommerce, and more.

What is BNPL?

What is BNPL?

What is BNPL?

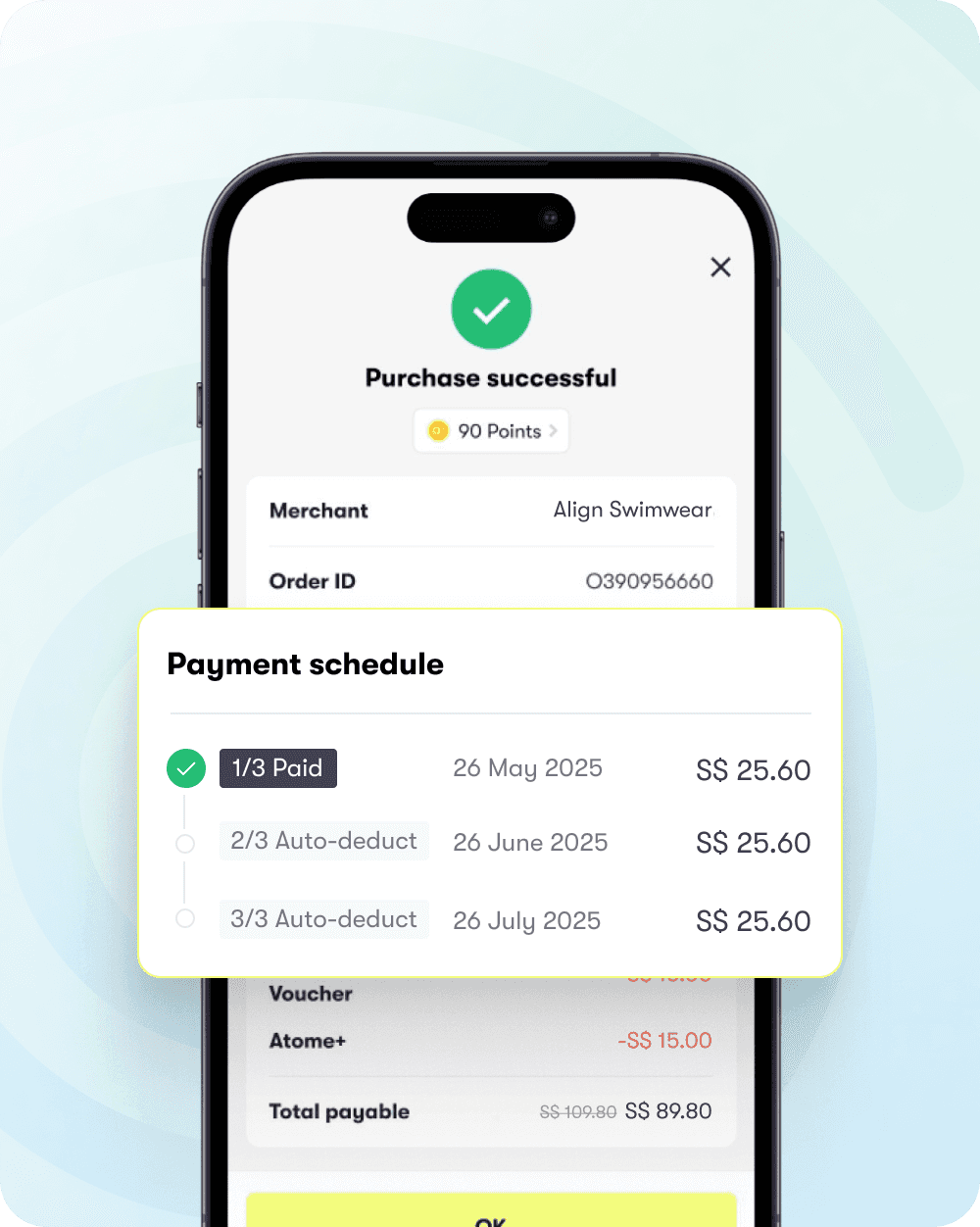

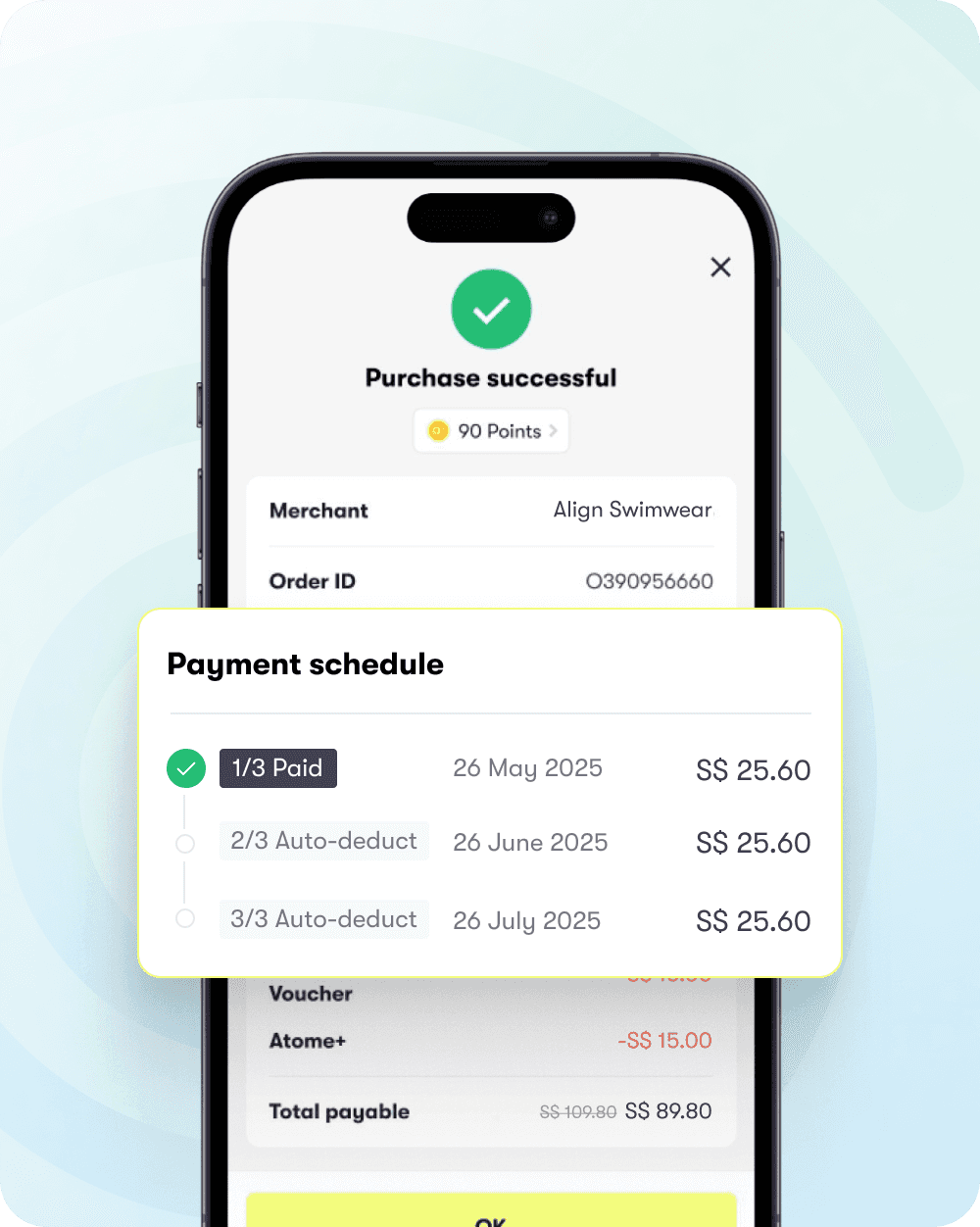

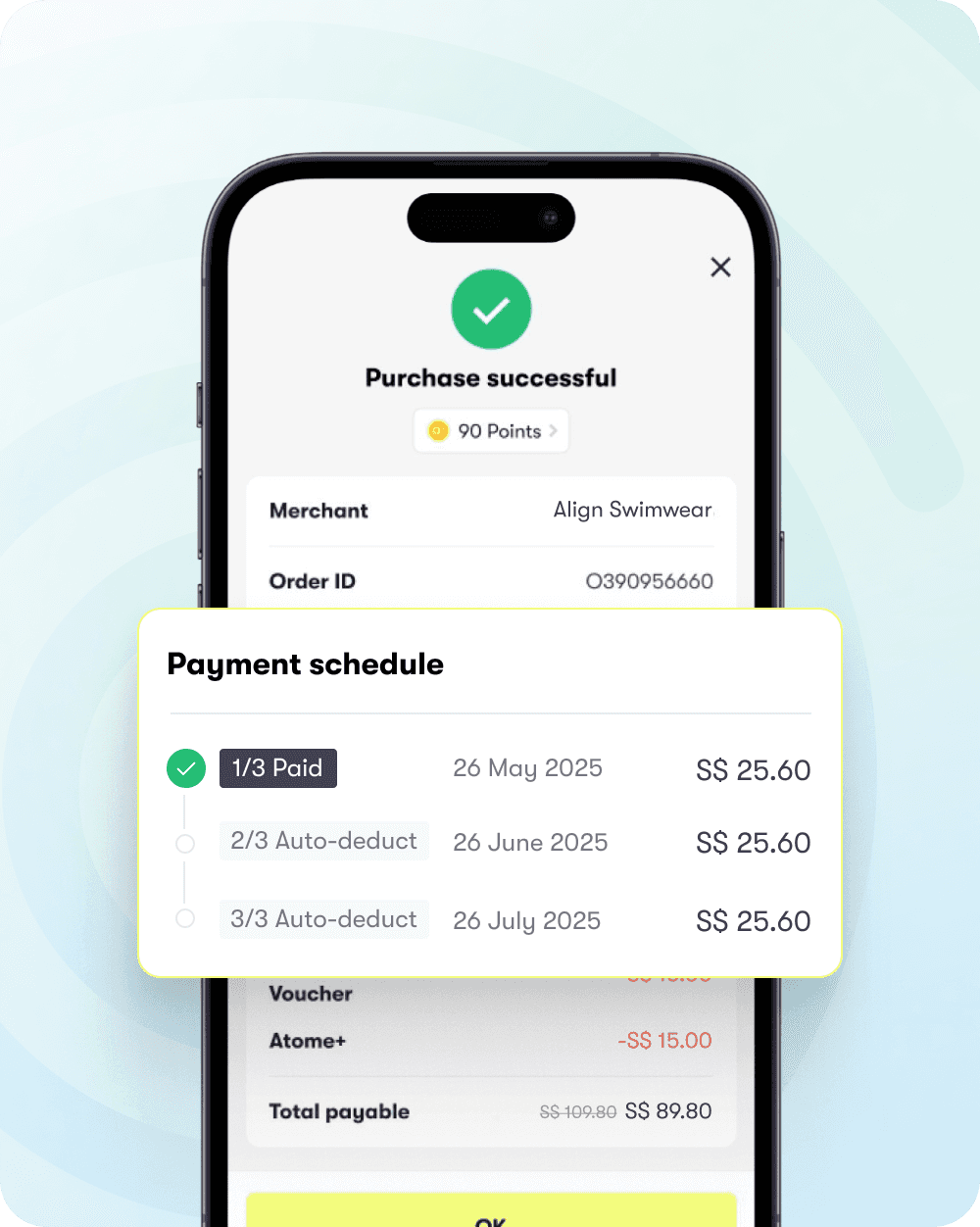

Buy Now Pay Later (BNPL) is a payment method that allows customers to split their purchase into smaller, manageable payments — often interest-free. In the Philippines, itʼs growing fast among Gen Z and millennial online shoppers.

Buy Now Pay Later (BNPL) is a payment method that allows customers to split their purchase into smaller, manageable payments — often interest-free. In the Philippines, itʼs growing fast among Gen Z and millennial online shoppers.

Buy Now Pay Later (BNPL) is a payment method that allows customers to split their purchase into smaller, manageable payments — often interest-free. In the Philippines, itʼs growing fast among Gen Z and millennial online shoppers.

As a merchant, BNPL allows you to increase customer loyalty, reduce checkout abandonment, and boost average order value without taking on any payment risk.

As a merchant, BNPL allows you to increase customer loyalty, reduce checkout abandonment, and boost average order value without taking on any payment risk.

As a merchant, BNPL allows you to increase customer loyalty, reduce checkout abandonment, and boost average order value without taking on any payment risk.

With HitPay + BillEase, you can easily tap into this growing demand for BNPL in the Philippines.

With HitPay + BillEase, you can easily tap into this growing demand for BNPL in the Philippines.

With HitPay + BillEase, you can easily tap into this growing demand for BNPL in the Philippines.

Offer BNPL in the Philippines with BillEase

Offer BNPL in the Philippines with BillEase

Offer BNPL in the Philippines with BillEase

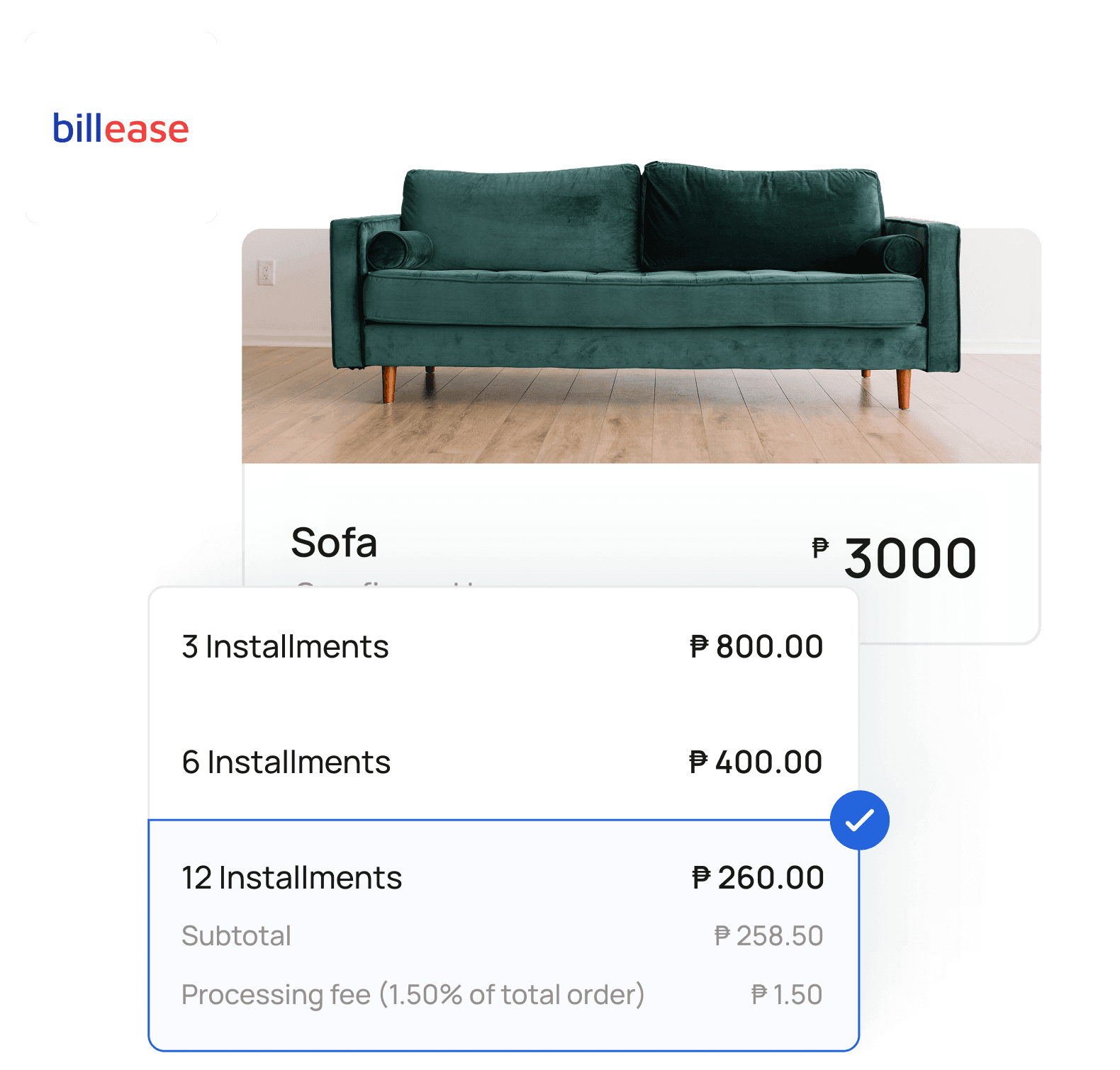

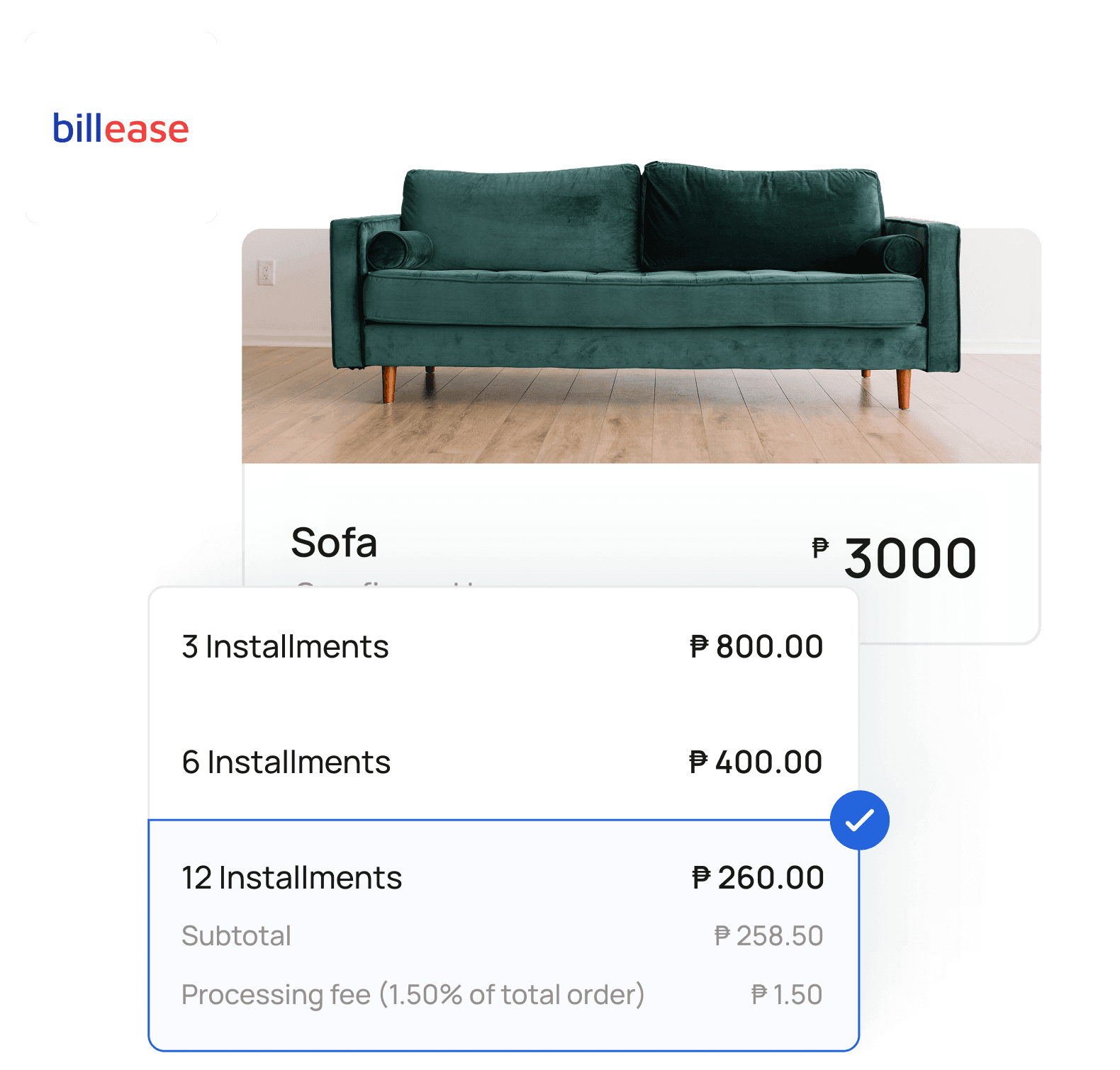

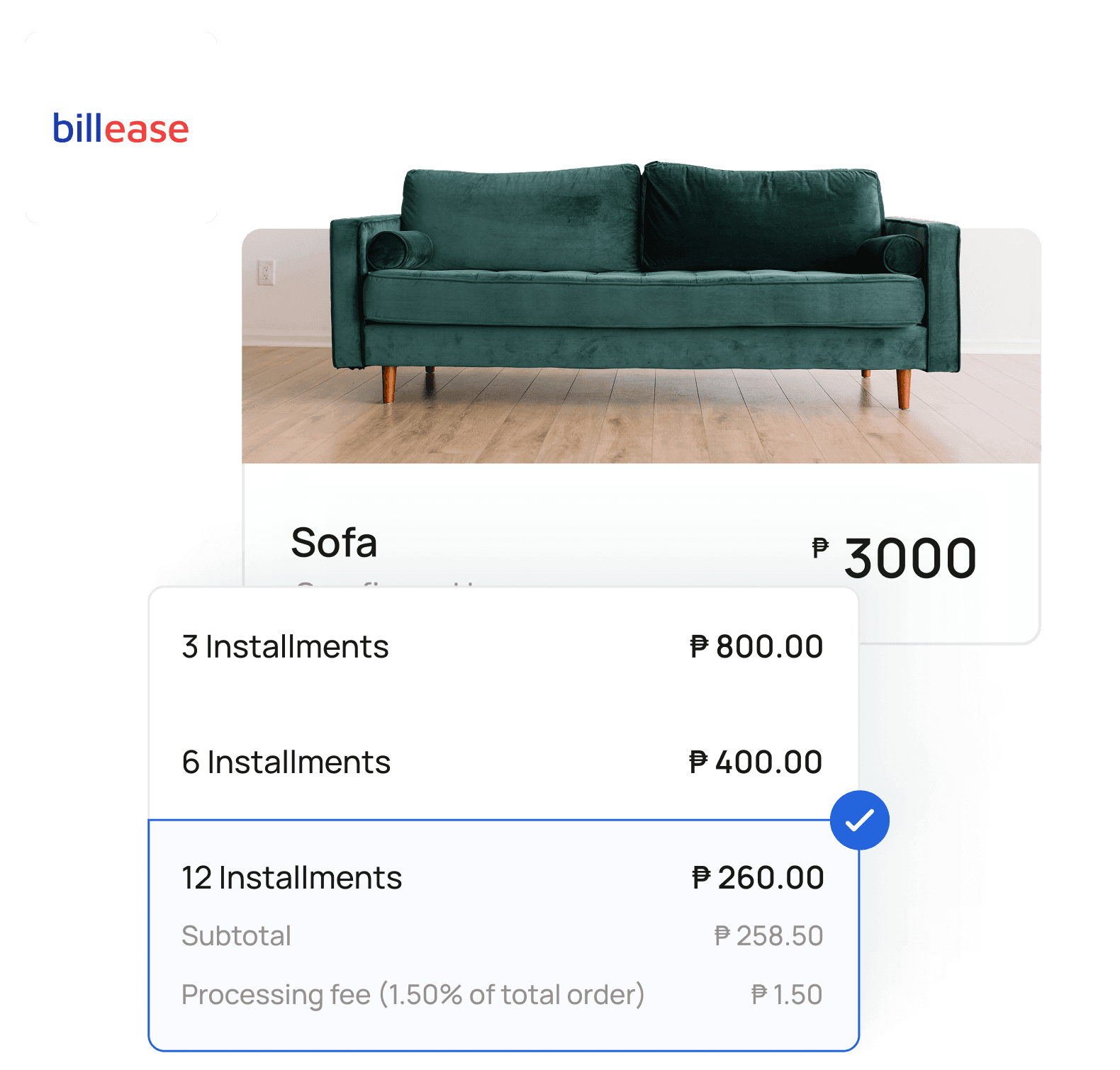

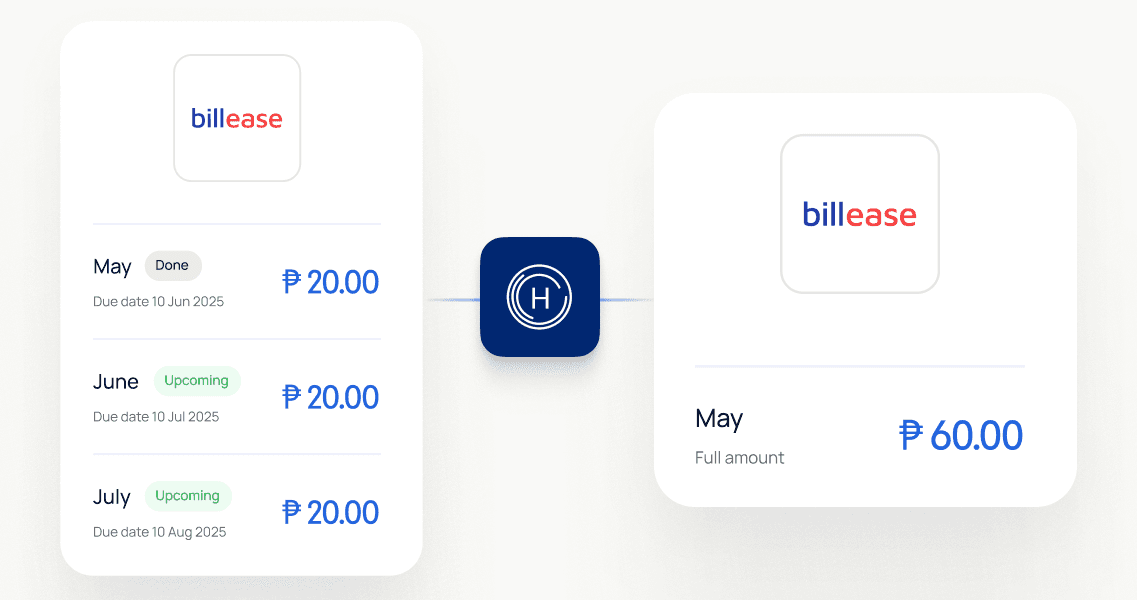

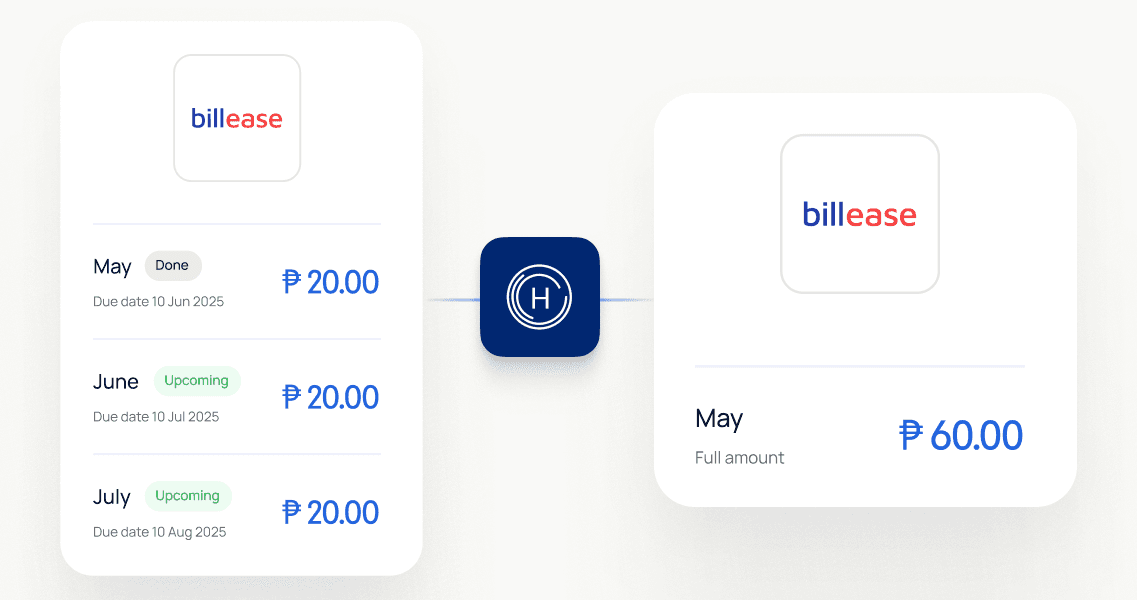

BillEase is one of the most trusted BNPL platforms in the Philippines, offering flexible payment plans for Filipino shoppers.

BillEase is one of the most trusted BNPL platforms in the Philippines, offering flexible payment plans for Filipino shoppers.

BillEase is one of the most trusted BNPL platforms in the Philippines, offering flexible payment plans for Filipino shoppers.

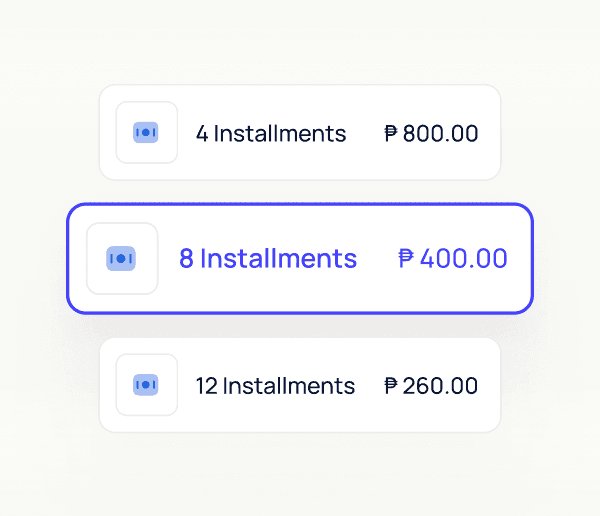

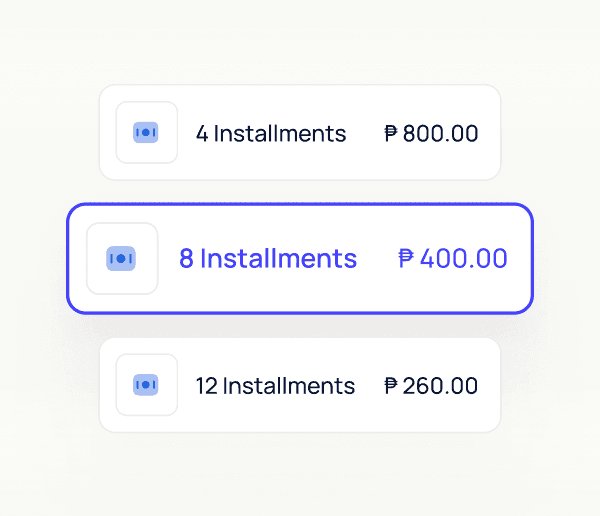

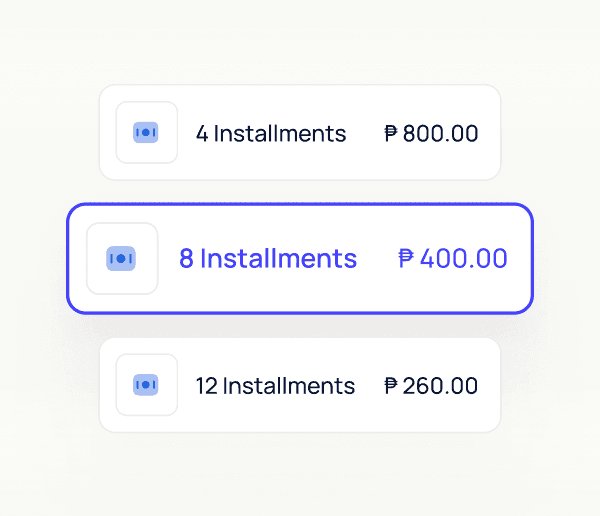

Flexible Installment Terms

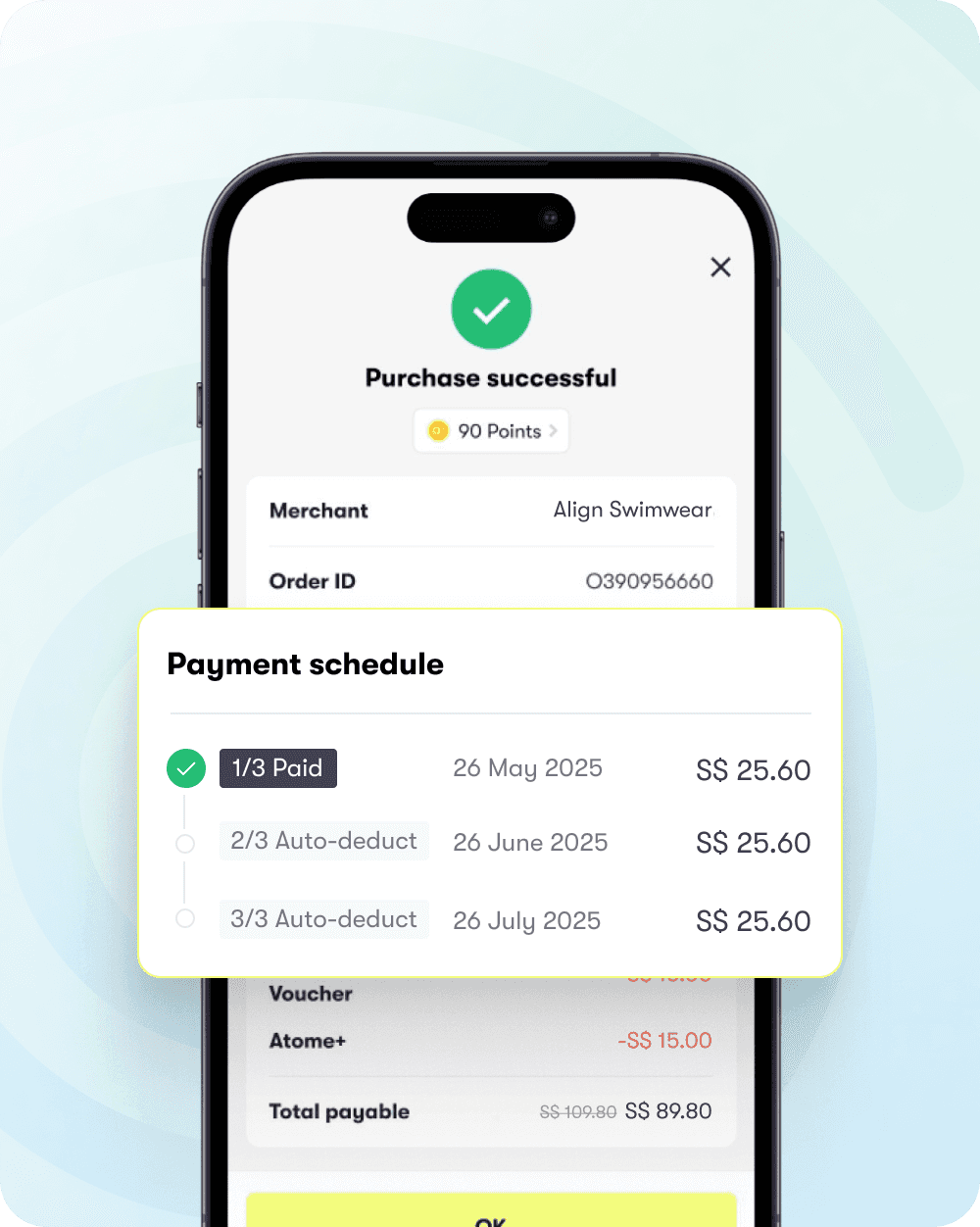

Customers can pay in 3, 6, 9, or 12 monthly installments — interest-free for select merchants.

Real-Time Credit Decision

BillEase provides on-the-spot approval so customers can complete checkout without delays.

Merchant Payout

You receive the full order value immediately.

Supported Platforms

Works on Shopify, WooCommerce, Wix, and via API or payment links

How to apply for BillEase BNPL

Create your free HitPay account

Activate BillEase as a payment method from your dashboard

Connect your store or platform - Shopify, WooCommerce, or APIs

Customer selects BillEase at checkout and applies for payment terms

You get paid in full immediately — no follow-up needed

How to apply for BillEase BNPL

Create your free HitPay account

Activate BillEase as a payment method from your dashboard

Connect your store or platform - Shopify, WooCommerce, or APIs

Customer selects BillEase at checkout and applies for payment terms

You get paid in full immediately — no follow-up needed

How to apply for BillEase BNPL

Create your free HitPay account

Activate BillEase as a payment method from your dashboard

Connect your store or platform - Shopify, WooCommerce, or APIs

Customer selects BillEase at checkout and applies for payment terms

You get paid in full immediately — no follow-up needed

How to apply for BillEase BNPL

Create your free HitPay account

Activate BillEase as a payment method from your dashboard

Connect your store or platform - Shopify, WooCommerce, or APIs

Customer selects BillEase at checkout and applies for payment terms

You get paid in full immediately — no follow-up needed

Why use HitPay for BNPL in the Philippines?

Why use HitPay for BNPL in the Philippines?

Get started with BNPL on HitPay

Trusted & Compliant

Trusted & Compliant

HitPay is BSP-registered and trusted by thousands of businesses in the Philippines and across APAC

Transparent pricing

Transparent pricing

Only pay per successful transaction. No monthly fees

Works Across Channels

Works Across Channels

Accept BNPL via online checkout, invoices, payment links, or APIs — all from a single dashboard

Frequently Asked Questions

Frequently Asked Questions

What is Buy Now Pay Later in the Philippines?

BNPL is a payment method that lets customers buy now and pay later through fixed monthly installments. In the Philippines, BillEase is a popular and trusted option.

How do I accept BillEase through HitPay?

Just sign up for HitPay, activate BillEase from your dashboard, and choose your preferred online payment setup (e.g. e-commerce stores like Shopify, payment links, and more).

Is BillEase only for e-commerce stores?

No. You can also use BillEase for invoicing, payment links, and custom API setups — ideal for service businesses and freelancers

Do I need a separate BillEase account?

No. HitPay manages the BNPL onboarding and integration for you. Activate BillEase from within your HitPay account.

What is Buy Now Pay Later in the Philippines?

BNPL is a payment method that lets customers buy now and pay later through fixed monthly installments. In the Philippines, BillEase is a popular and trusted option.

How do I accept BillEase through HitPay?

Just sign up for HitPay, activate BillEase from your dashboard, and choose your preferred online payment setup (e.g. e-commerce stores like Shopify, payment links, and more).

Is BillEase only for e-commerce stores?

No. You can also use BillEase for invoicing, payment links, and custom API setups — ideal for service businesses and freelancers

Do I need a separate BillEase account?

No. HitPay manages the BNPL onboarding and integration for you. Activate BillEase from within your HitPay account.

What is Buy Now Pay Later in the Philippines?

BNPL is a payment method that lets customers buy now and pay later through fixed monthly installments. In the Philippines, BillEase is a popular and trusted option.

How do I accept BillEase through HitPay?

Just sign up for HitPay, activate BillEase from your dashboard, and choose your preferred online payment setup (e.g. e-commerce stores like Shopify, payment links, and more).

Is BillEase only for e-commerce stores?

No. You can also use BillEase for invoicing, payment links, and custom API setups — ideal for service businesses and freelancers

Do I need a separate BillEase account?

No. HitPay manages the BNPL onboarding and integration for you. Activate BillEase from within your HitPay account.

Still have questions?

Contact our team.

Still have questions?

Contact our team.

Still have questions?

Contact our team.