Google Forms Payment Plugin

Transform online forms into a powerful payment tool with the Google Forms Payment Plugin. Set up in minutes with customizable options and automated payment collection.

Google Forms

Payment Plugin

Transform online forms into a powerful payment tool with the Google Forms Payment Plugin. Set up in minutes with customizable options and automated payment collection.

Google Forms Payment Plugin

Transform online forms into a powerful payment tool with the Google Forms Payment Plugin. Set up in minutes with customizable options and automated payment collection.

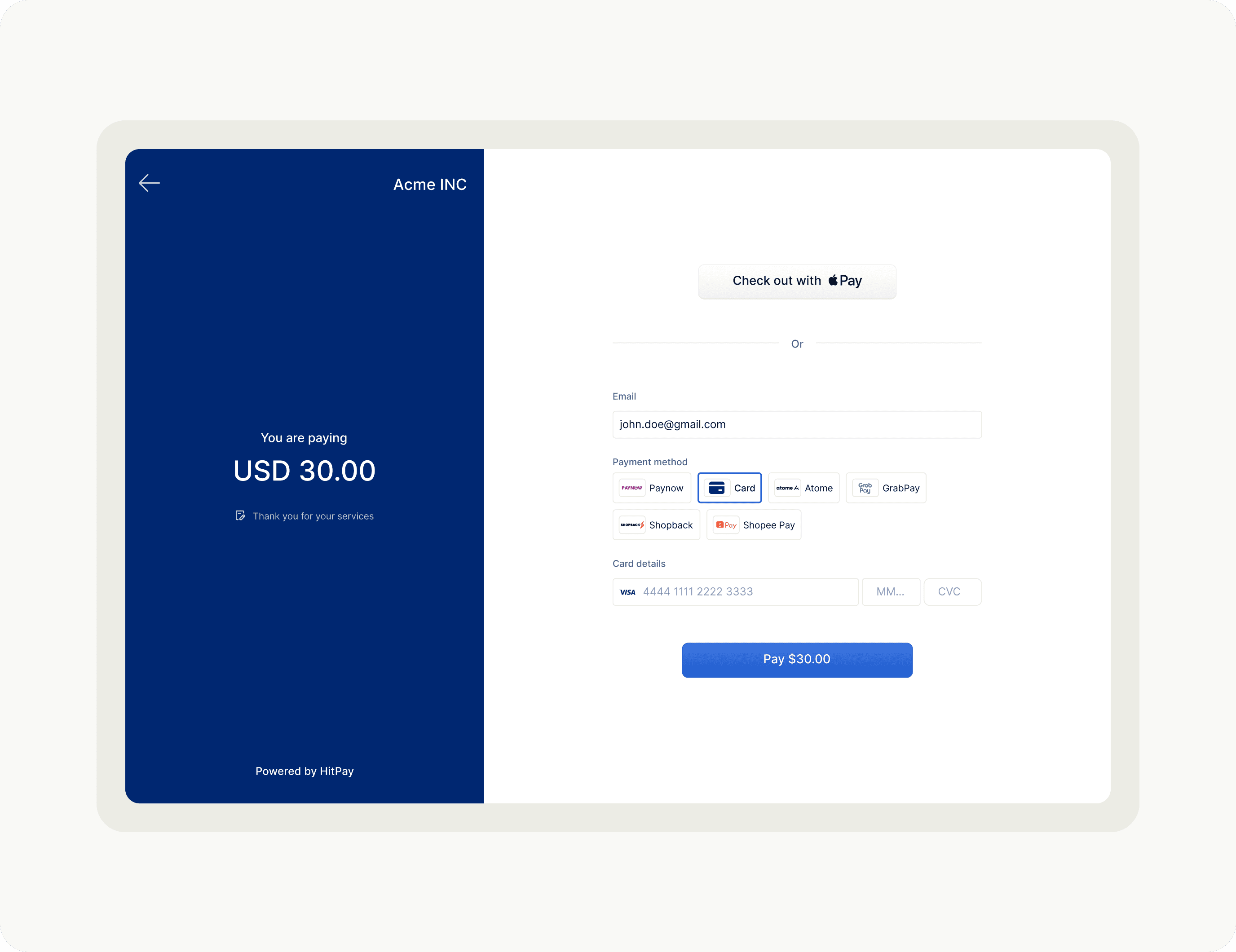

Inbuilt payment methods

Accept popular payment options with one simple Google Forms payment integration

Inbuilt payment methods

Accept popular payment options with one simple Google Forms payment integration

Inbuilt payment methods

Accept popular payment options with one simple Google Forms payment integration

No coding required

Just install the HitPay plugin and start collecting Google Forms responses

No coding required

Just install the HitPay plugin and start collecting Google Forms responses

No coding required

Just install the HitPay plugin and start collecting Google Forms responses

Customisable payments

Set fixed or dynamic charges, calculated from your customer’s Google Form answers

Customisable payments

Set fixed or dynamic charges, calculated from your customer’s Google Form answers

Customisable payments

Set fixed or dynamic charges, calculated from your customer’s Google Form answers

How the Google Forms Payment Plugin works

How the Google Forms Payment Plugin works

How the Google Forms Payment Plugin works

01

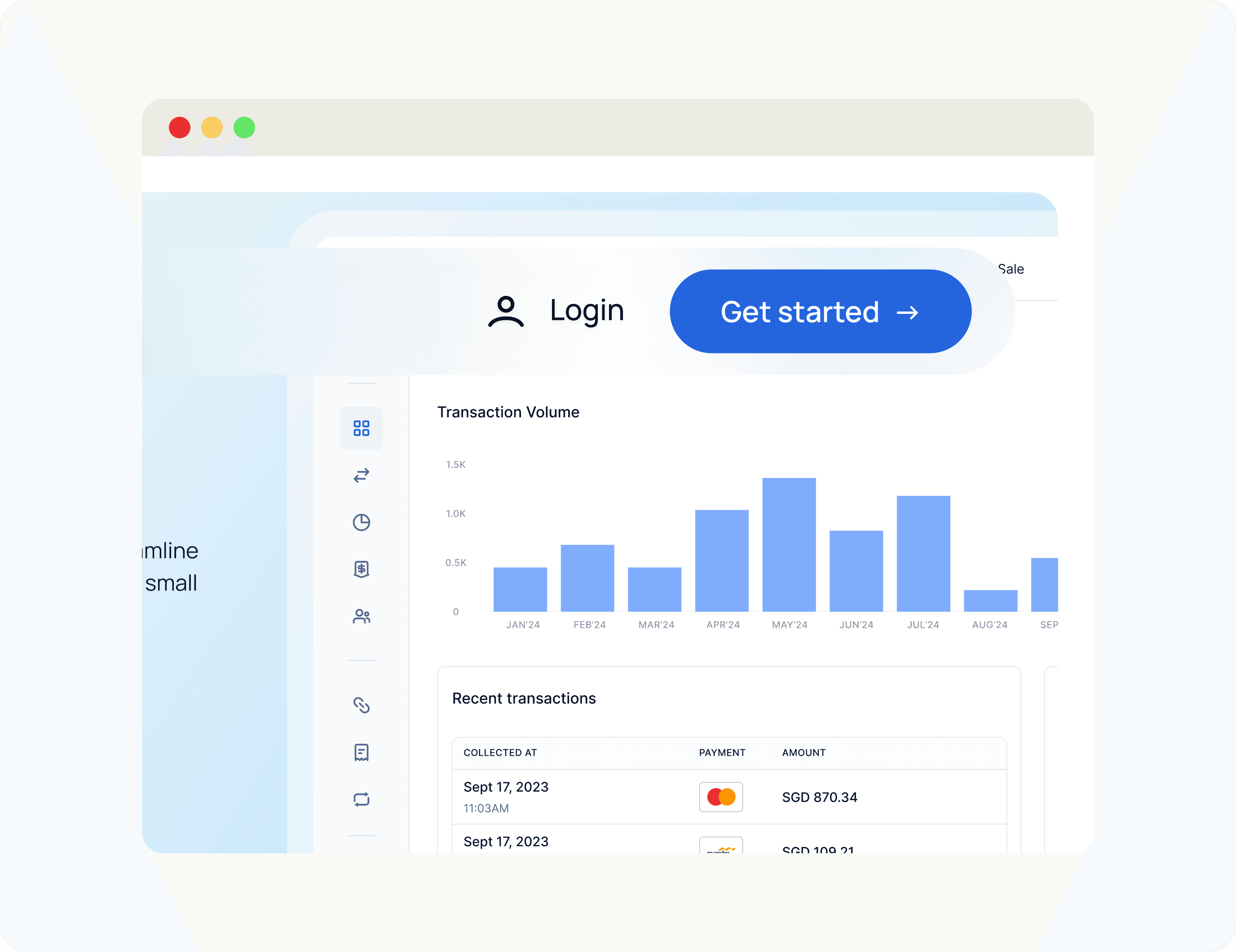

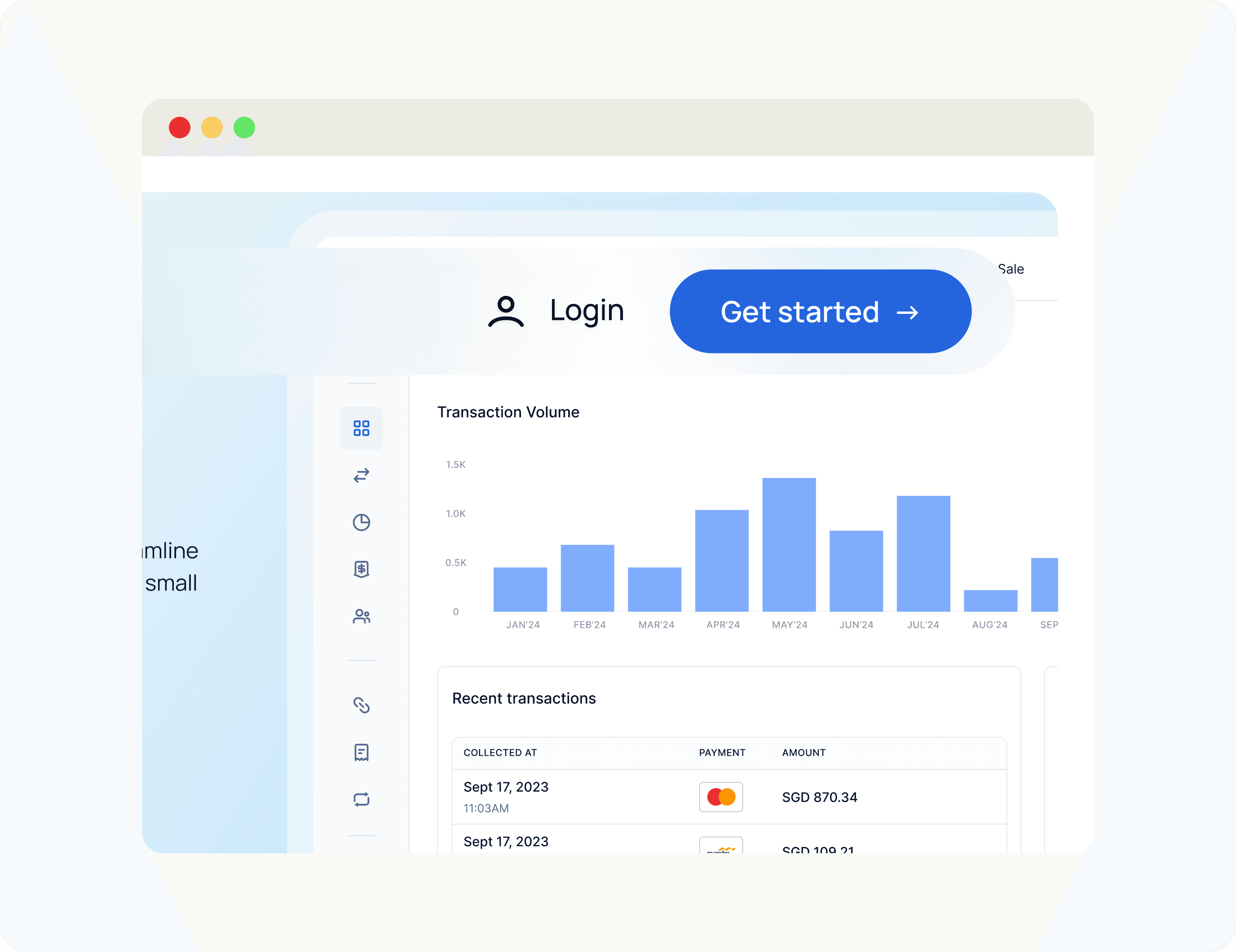

Create your HitPay account

Set up your free account on HitPay and activate your preferred local and international payment methods from the dashboard. Contact our Sales team to get started with your HitPay account.

01

Create your HitPay account

Set up your free account on HitPay and activate your preferred local and international payment methods from the dashboard. Contact our Sales team to get started with your HitPay account.

01

Create your HitPay account

Set up your free account on HitPay and activate your preferred local and international payment methods from the dashboard. Contact our Sales team to get started with your HitPay account.

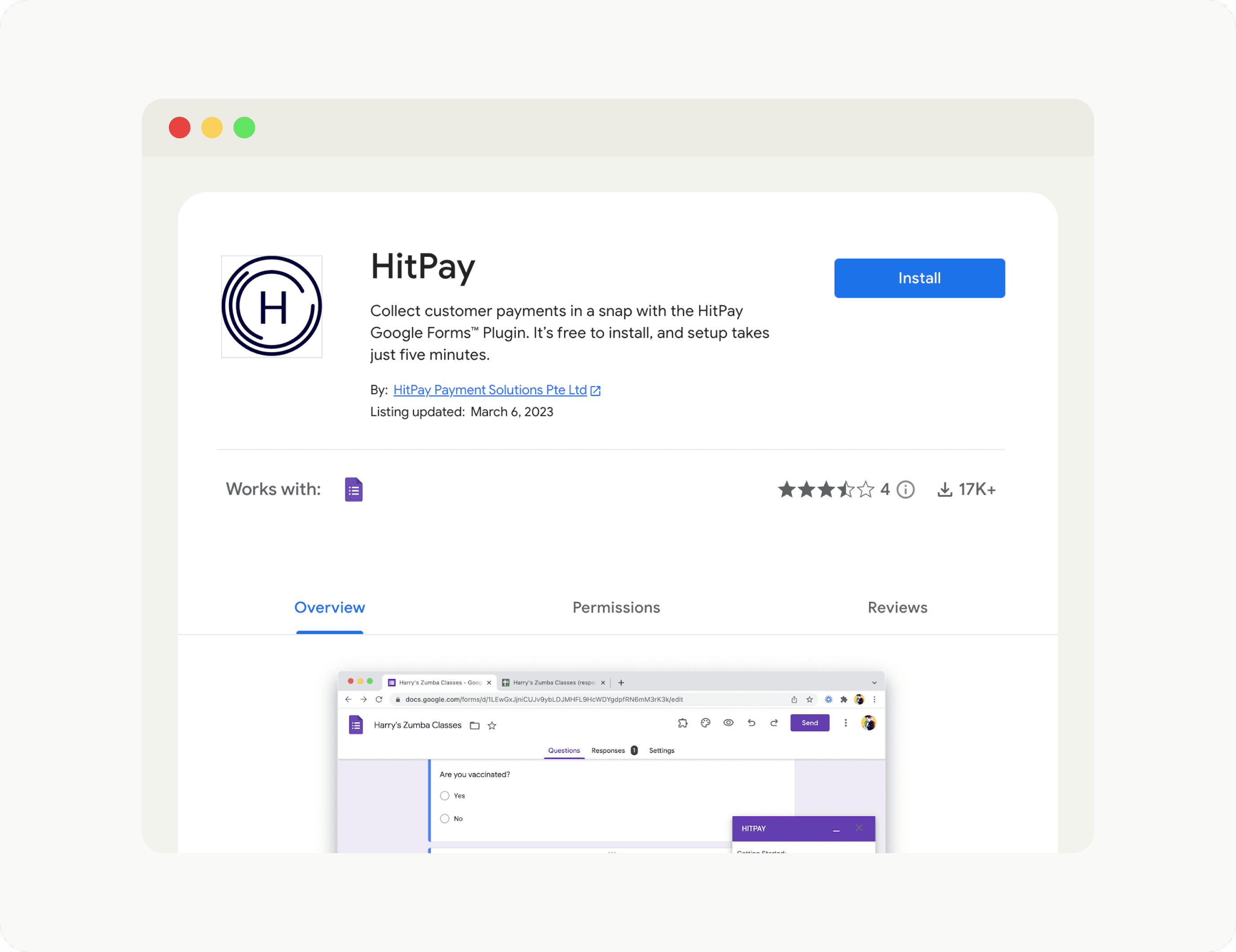

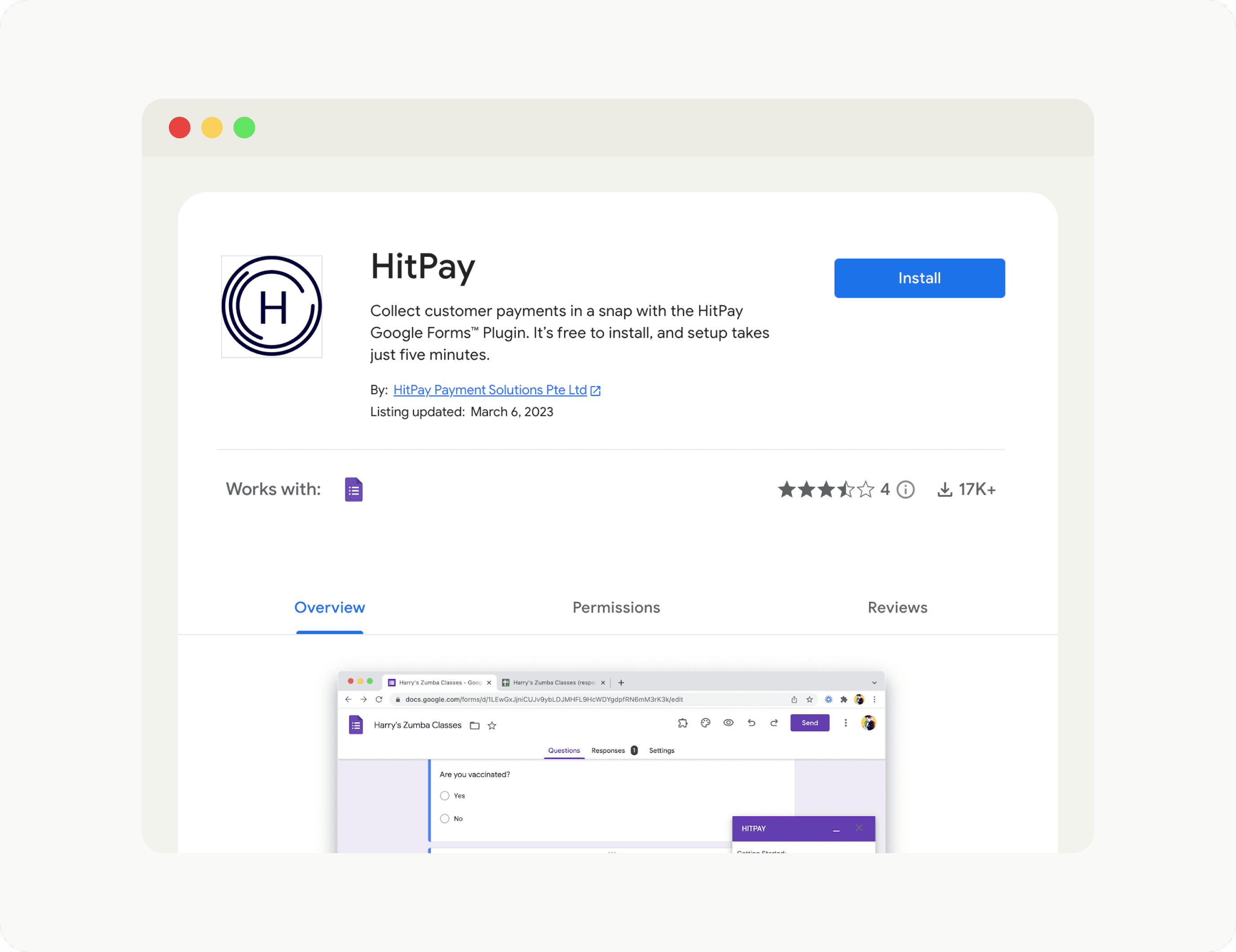

02

Install the HitPay Google Forms

Payment Plugin

Install the HitPay Google Forms Payment Plugin

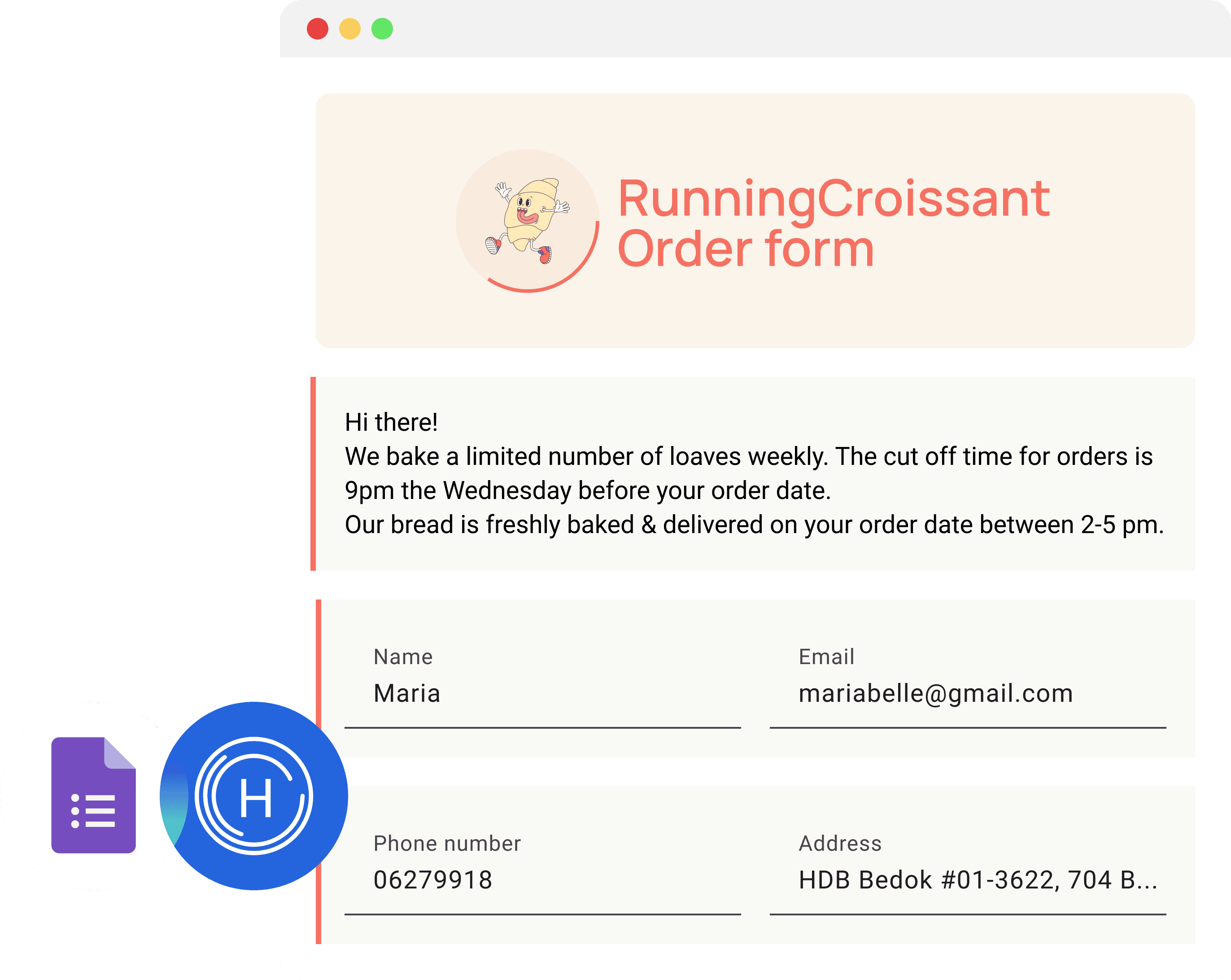

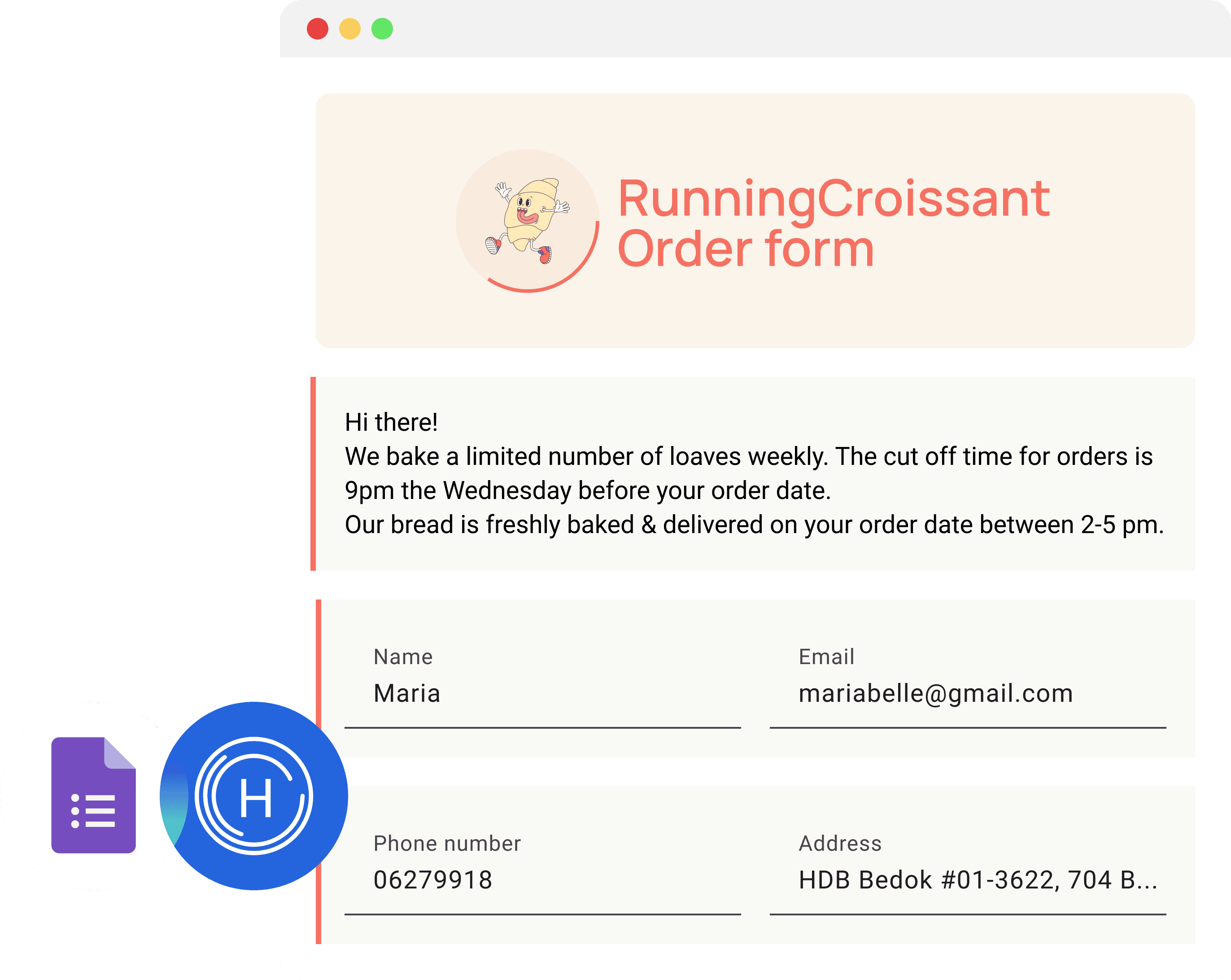

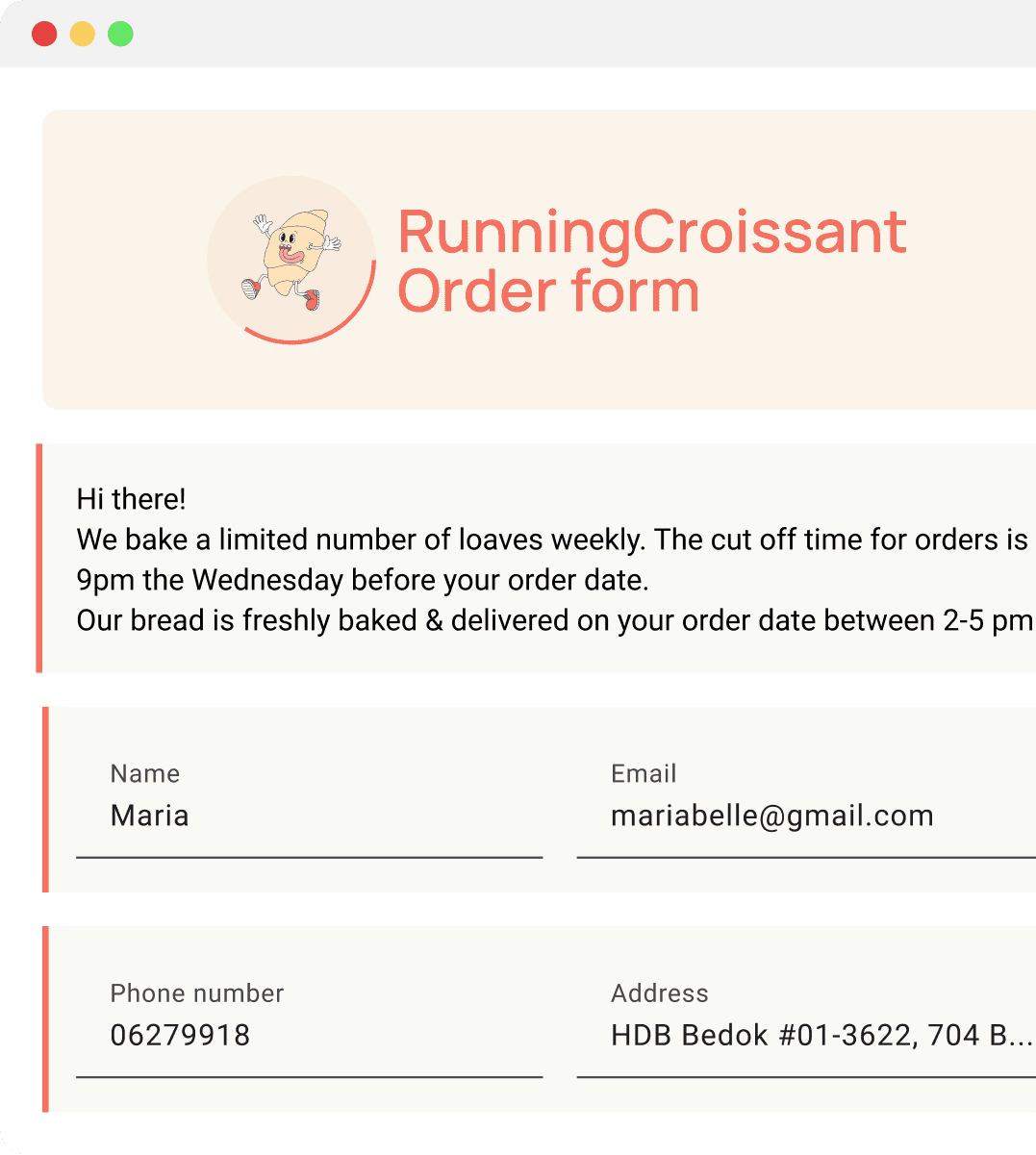

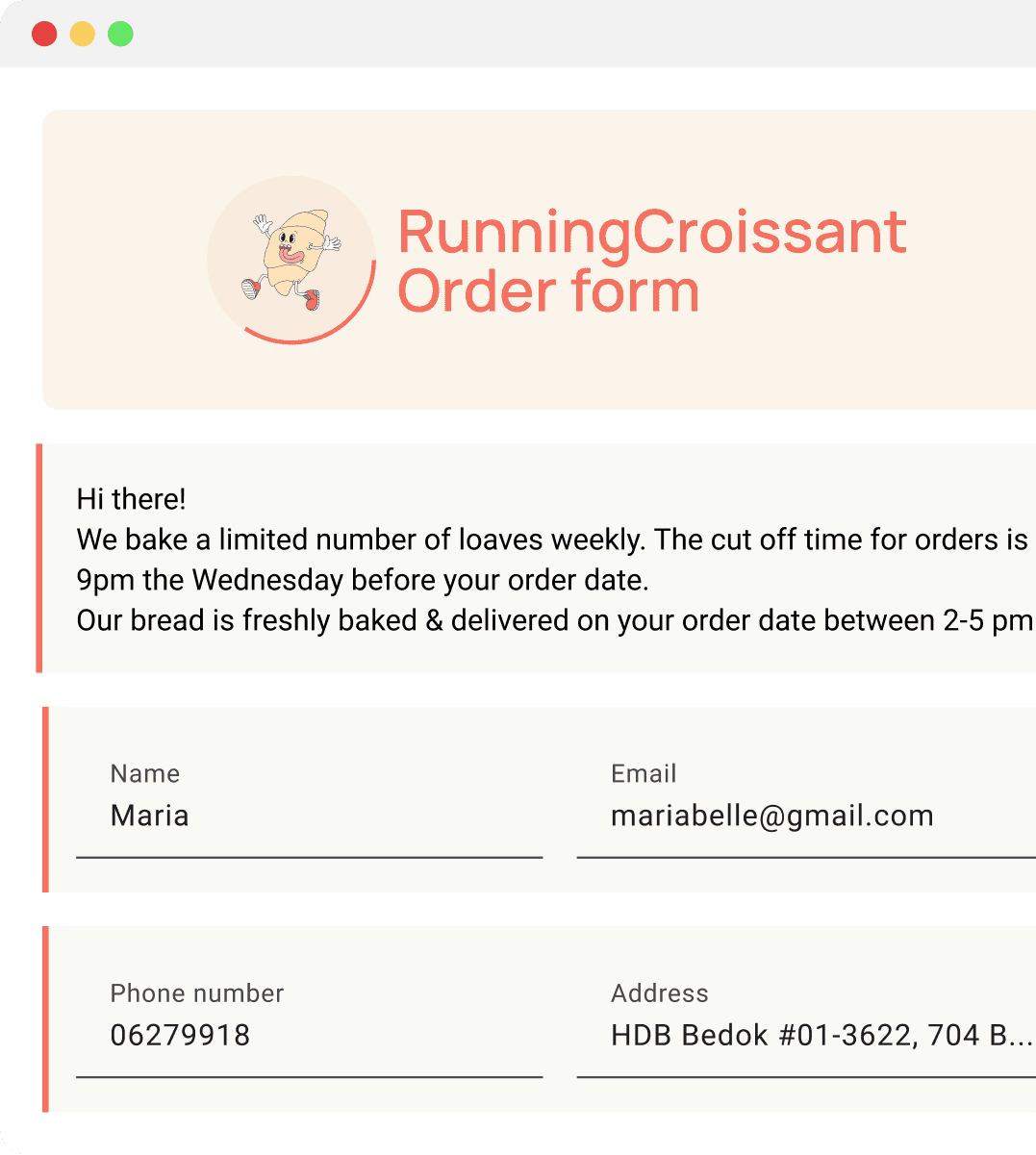

Create your Google Form, install the HitPay plugin, and customise your payment options. Setup is simple with no coding required, and takes only a few minutes.

02

Install the HitPay Google Forms

Payment Plugin

Create your Google Form, install the HitPay plugin, and customise your payment options. Setup is simple with no coding required, and takes only a few minutes.

02

Install the HitPay Google Forms

Payment Plugin

Create your Google Form, install the HitPay plugin, and customise your payment options. Setup is simple with no coding required, and takes only a few minutes.

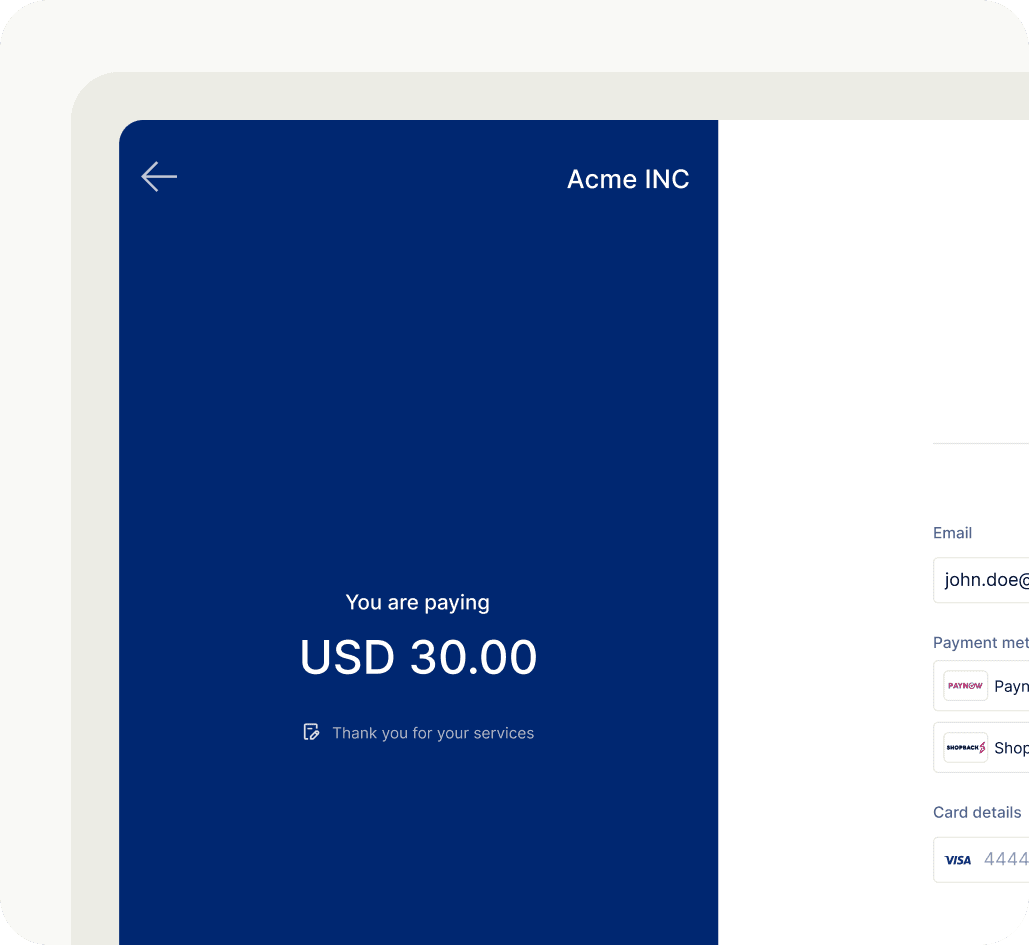

03

Automate payment collection

After your customers fill in the form, you don’t have to do a thing. HitPay sends a secure payment link to their email, letting your customers pay with their preferred credit card, banking app, or digital wallet.

03

Automate payment collection

After your customers fill in the form, you don’t have to do a thing. HitPay sends a secure payment link to their email, letting your customers pay with their preferred credit card, banking app, or digital wallet.

03

Automate payment collection

After your customers fill in the form, you don’t have to do a thing. HitPay sends a secure payment link to their email, letting your customers pay with their preferred credit card, banking app, or digital wallet.

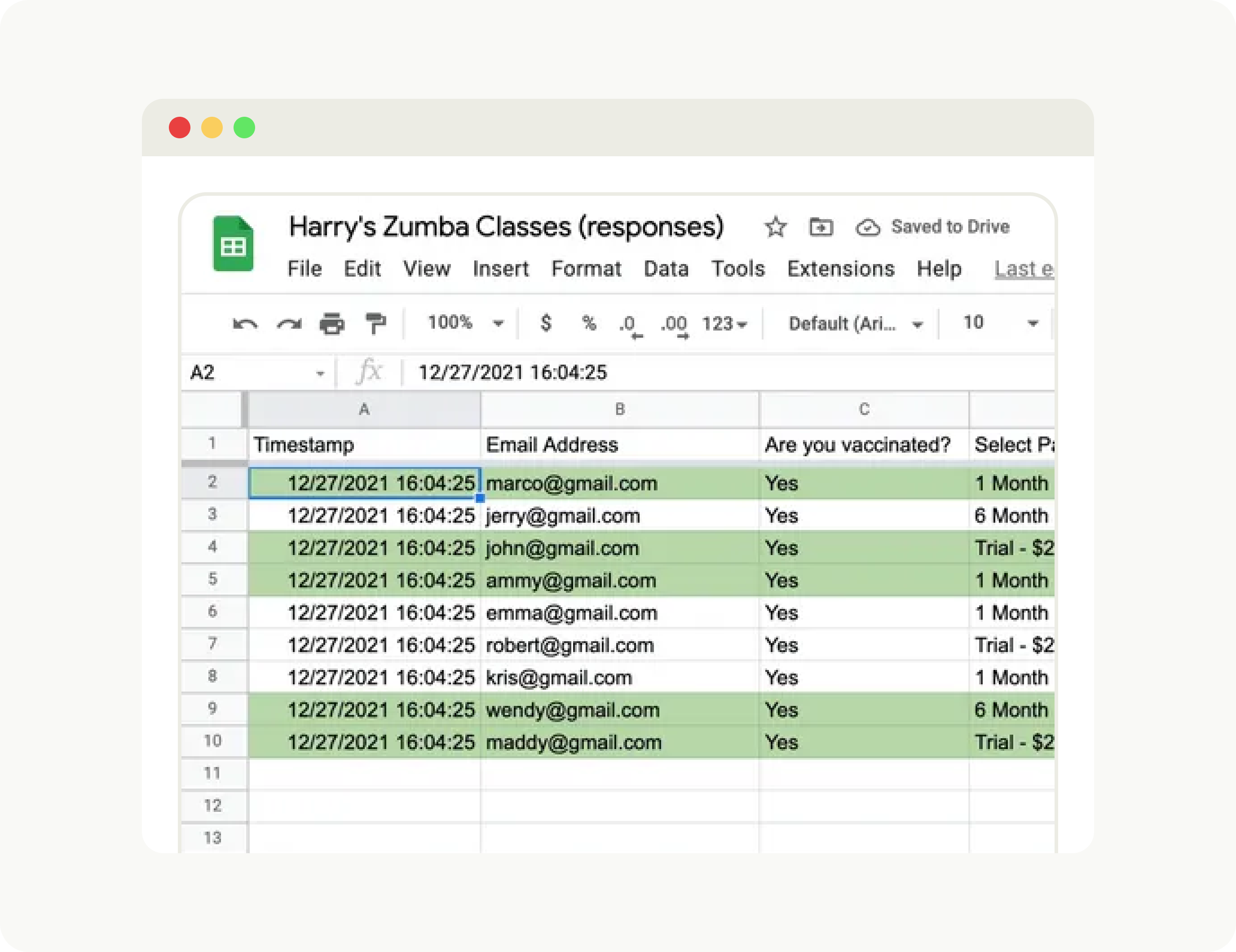

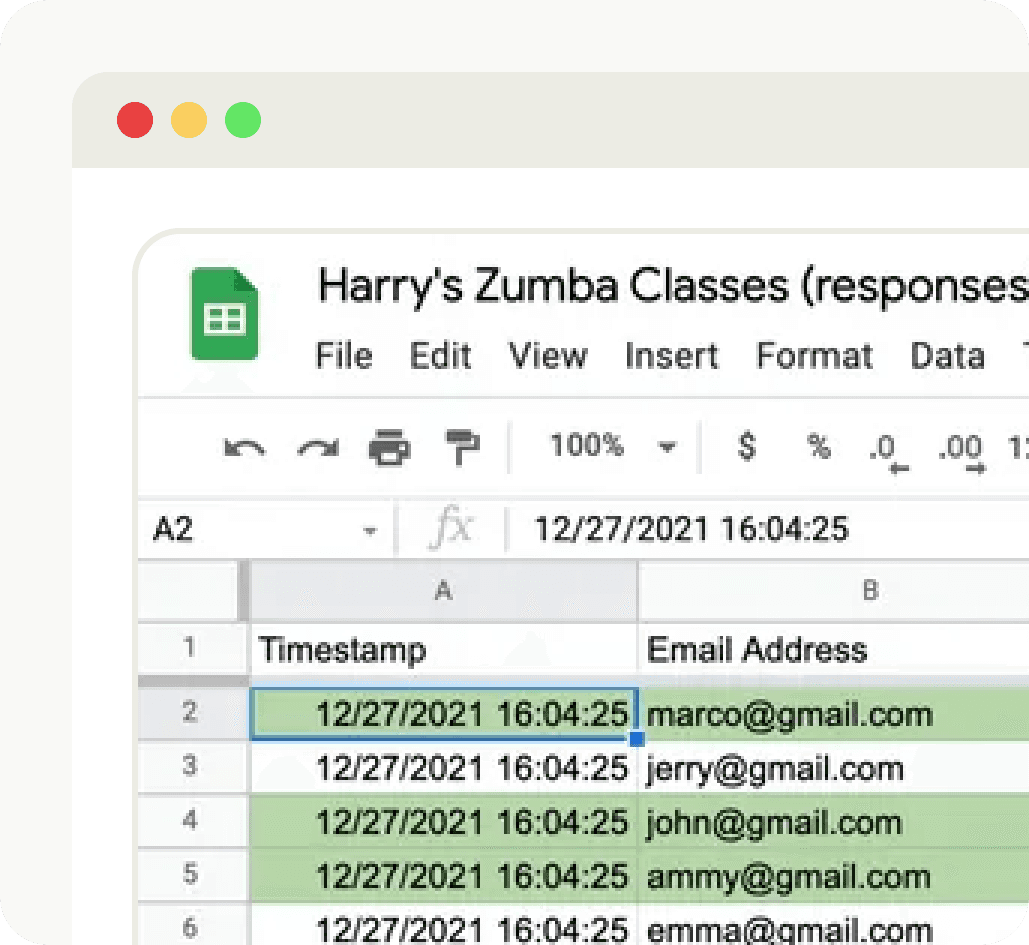

04

Track payments with ease

HitPay automatically updates the status of each form submission once payment is made — just refer to the linked Google Sheet.

04

Track payments with ease

HitPay automatically updates the status of each form submission once payment is made — just refer to the linked Google Sheet.

04

Track payments with ease

HitPay automatically updates the status of each form submission once payment is made — just refer to the linked Google Sheet.

Frequently Asked Questions

What is the HitPay Google Forms Payment Plugin?

The HitPay Google Forms Payment Plugin allows you to collect payments directly from Google Forms submissions. It integrates payment options into your form, enabling your customers to pay via credit cards, debit cards, bank transfers, and digital wallets.

Who can use the Google Forms Payment Plugin?

What payment methods are supported by the Google Forms Payment Plugin?

Do I need coding skills to set up the HitPay Google Forms Payment Plugin?

Can I customize payment fields in my form?

How long does it take to set up?

Is the HitPay Google Forms Payment Plugin free?

How do I receive the funds collected?

Have questions?

Frequently Asked Questions

What is the HitPay Google Forms Payment Plugin?

The HitPay Google Forms Payment Plugin allows you to collect payments directly from Google Forms submissions. It integrates payment options into your form, enabling your customers to pay via credit cards, debit cards, bank transfers, and digital wallets.

Who can use the Google Forms Payment Plugin?

What payment methods are supported by the Google Forms Payment Plugin?

Do I need coding skills to set up the HitPay Google Forms Payment Plugin?

Can I customize payment fields in my form?

How long does it take to set up?

Is the HitPay Google Forms Payment Plugin free?

How do I receive the funds collected?

Have questions?

Frequently Asked Questions

What is the HitPay Google Forms Payment Plugin?

The HitPay Google Forms Payment Plugin allows you to collect payments directly from Google Forms submissions. It integrates payment options into your form, enabling your customers to pay via credit cards, debit cards, bank transfers, and digital wallets.

Who can use the Google Forms Payment Plugin?

What payment methods are supported by the Google Forms Payment Plugin?

Do I need coding skills to set up the HitPay Google Forms Payment Plugin?

Can I customize payment fields in my form?

How long does it take to set up?

Is the HitPay Google Forms Payment Plugin free?

How do I receive the funds collected?

Have questions?

Let's get you set up

Create an account instantly or contact us to create a custom package for your business.

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapore 089109

Let's get you set up

Create an account instantly to get started or contact us

to design a custom package for your business.

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapore 089109

Let's get you set up

Create an account instantly to get started or contact us to design

a custom package for your business.

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapore 089109

Let's get you set up

Create an account instantly to get started or contact us to design a custom package

for your business.

business software

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapore 089109