If you are planning to start a business in Indonesia, consider using MidTrans as a payment gateway, which might be the right choice. Apart from that, we will review other alternatives, such as HitPay, which is popular among business people in Indonesia.

The fast growth of technology has led to a huge rise in the use of payment gateways in Indonesia. This can be seen by the growing number of Indonesians preferring to buy things online through e-commerce sites.

To put it simply, payment gateways make it easier for customers to pay for products or services online and offline. In other words, it's essential to have a payment gateway to run your business in Indonesia.

There are several well-known payment gateways in Indonesia right now, with Midtrans being one of the most popular. Before deciding to choose Midtrans as your payment gateway, it is recommended to consider other suitable alternatives. This article explores a more affordable Midtrans payment gateway alternative that may better suit your business needs.

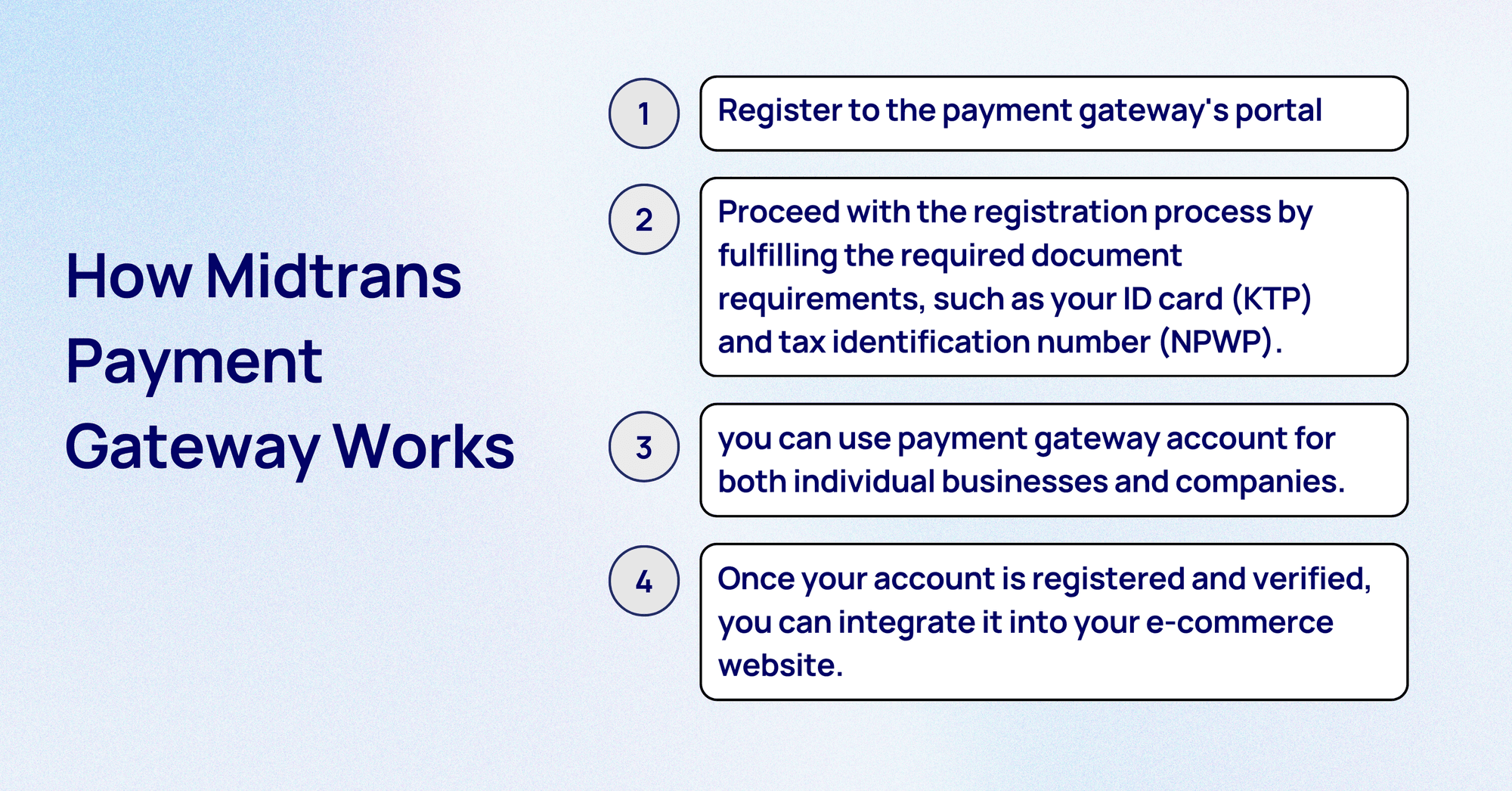

How Midtrans Payment Gateway Works

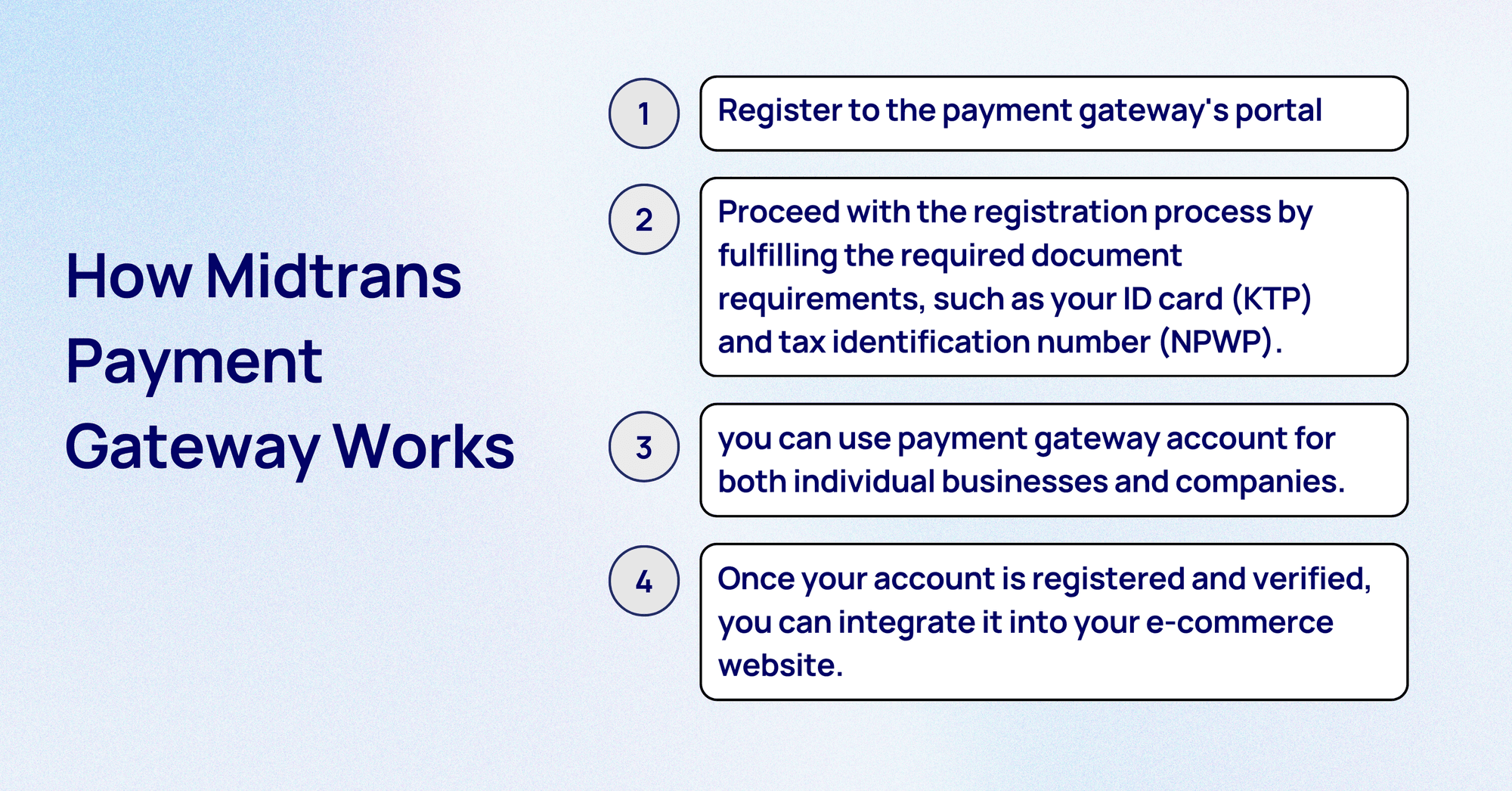

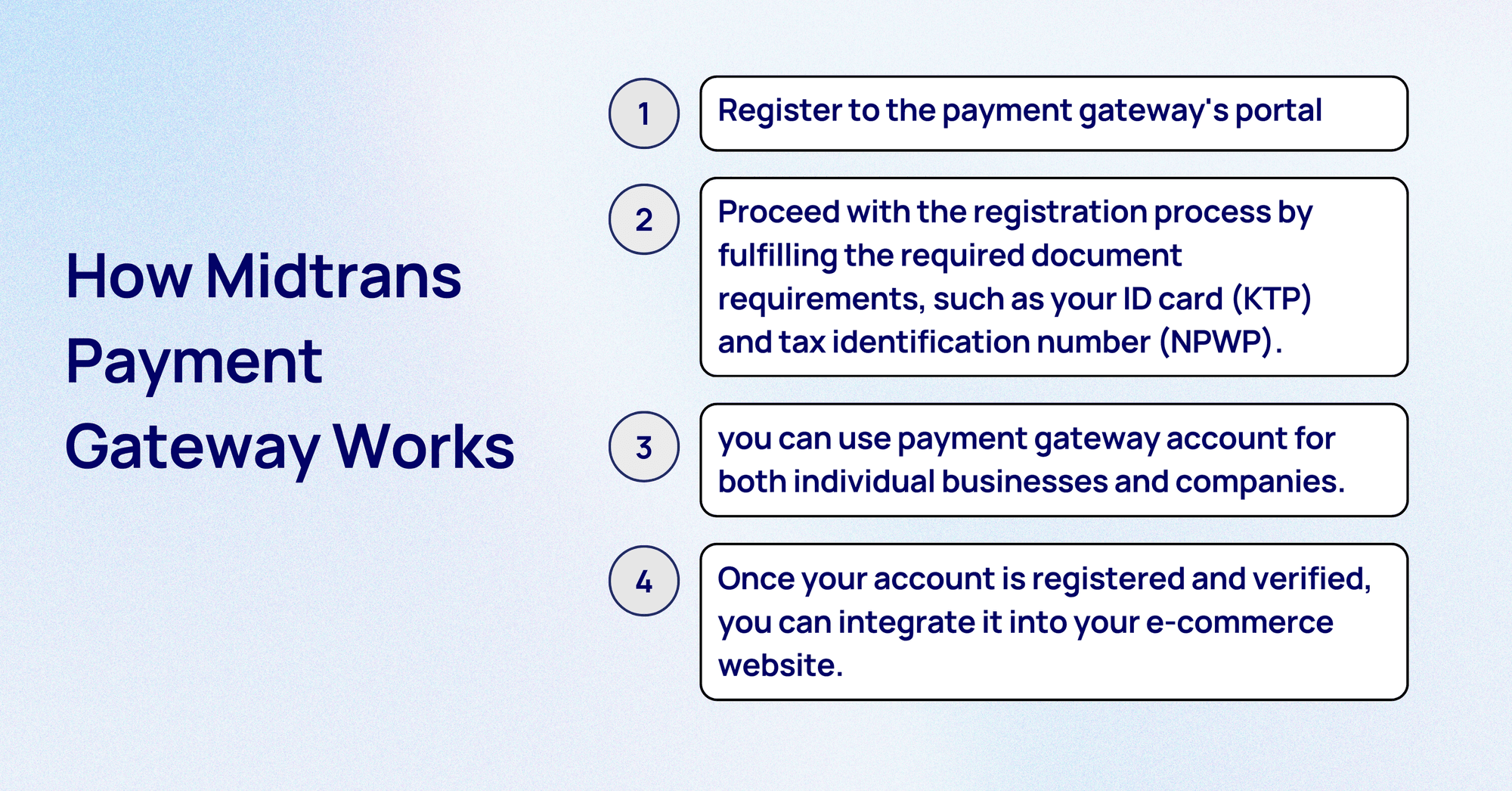

In general, here is how a payment gateway works:

Register to the payment gateway's portal. During this stage, you can make various settings without any commitment or payment.

Next, proceed with the registration process by fulfilling the required document requirements, such as your ID card (KTP) and tax identification number (NPWP). These documents will go through a verification process by the payment gateway provider.

It's worth noting that you can use payment gateway account for both individual businesses and companies.

Once your account is registered and verified, you can integrate it into your e-commerce website. This integration streamlines the checkout process for your customers, enhancing convenience and transaction efficiency.

What is Midtrans Payment Gateway and its advantages?

Midtrans is one of the most popular digital payment platforms in Indonesia and is a subsidiary of GoTo Financial. With support for more than 25 local payment methods and a comprehensive set of features, Midtrans is considered a suitable choice for small and medium-sized businesses (UMKM) in Indonesia. However, it's important to note that Midtrans is not available for all online stores; it is only integrated with a few e-commerce plugins and is not integrated with additional accounting systems or business software.

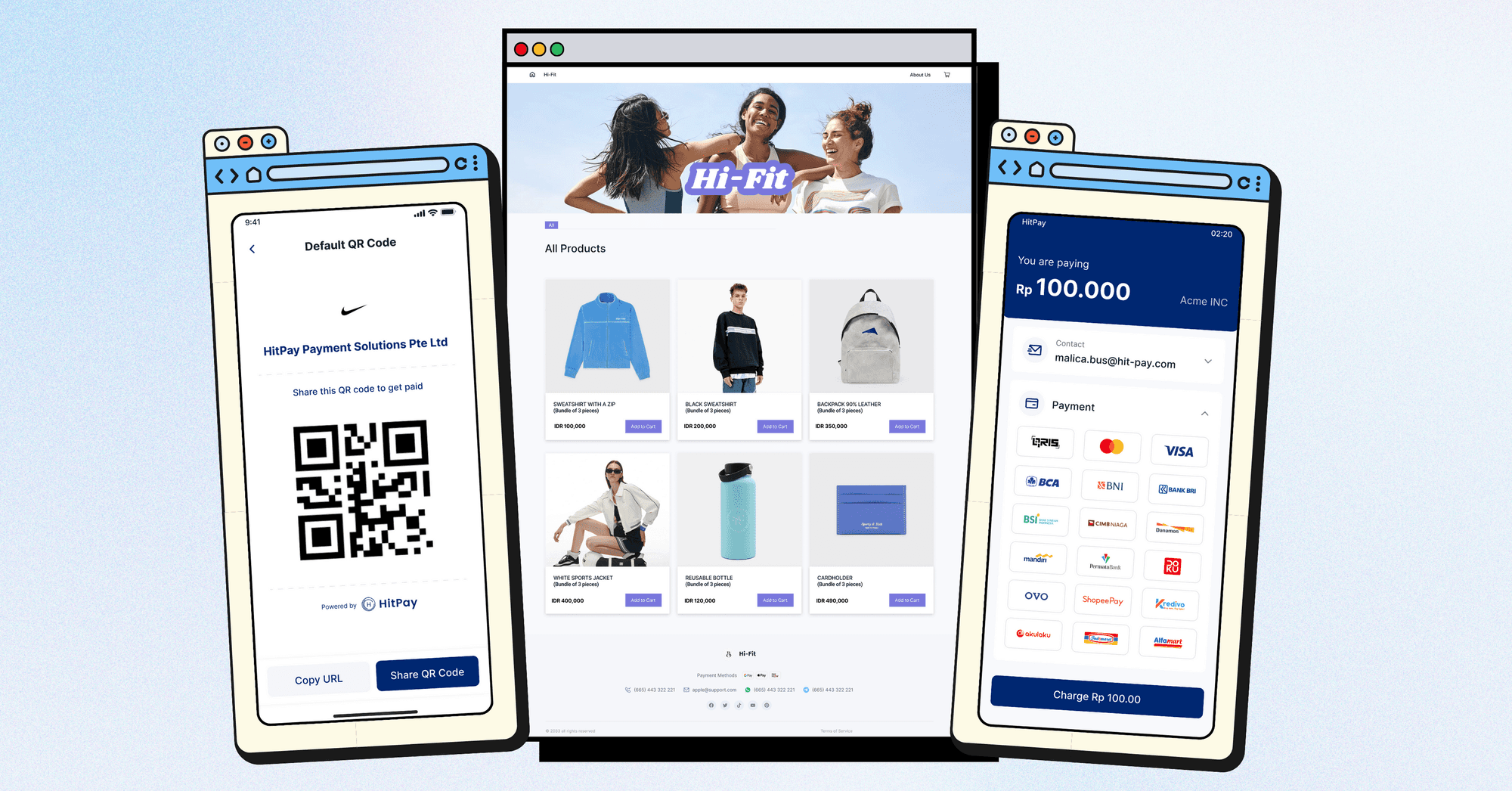

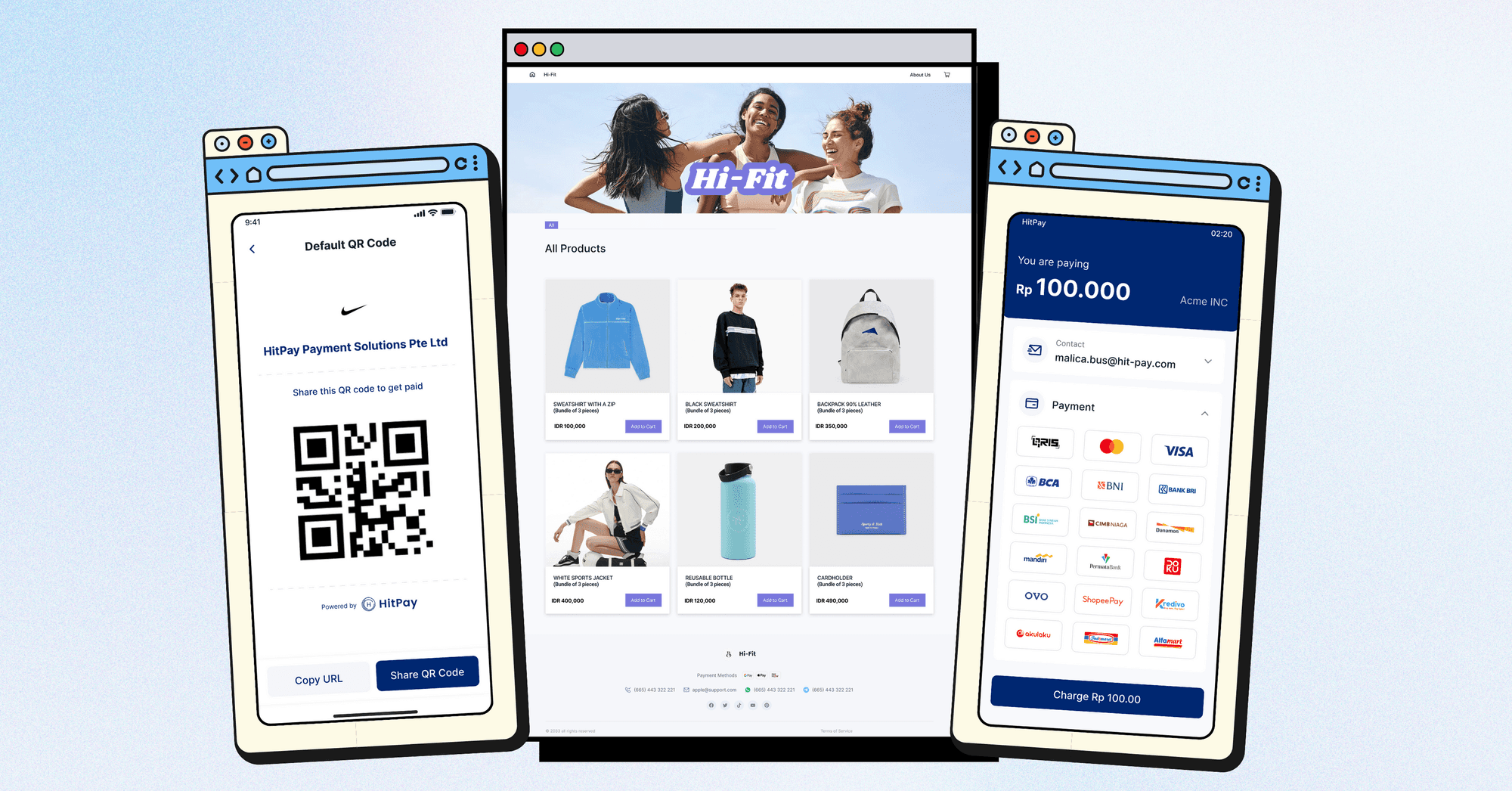

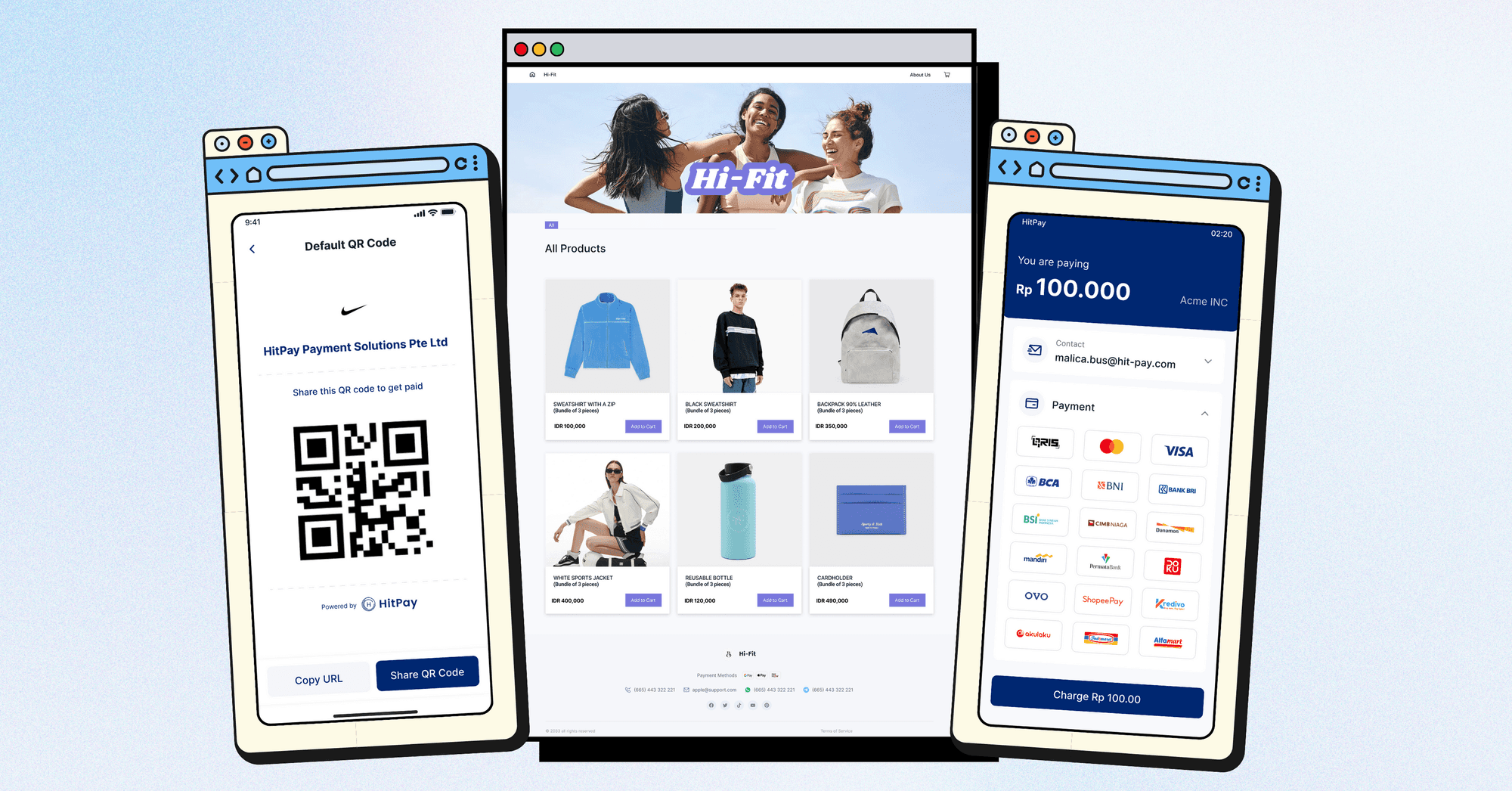

For a more comprehensive solution, HitPay is a highly recommended alternative. HitPay has the advantage of accepting international transactions and can receive payments from customers worldwide in over 100 different currencies. Additionally, HitPay offers seamless integrations with various leading e-commerce plugins such as Shopify, WooCommerce, EasyStore, Prestashop, Magento, OpenCart, Shopcada, Ecwid, Wix, and many more.

Furthermore, HitPay also provides various business software for free, including automatic invoicing and website building tools.

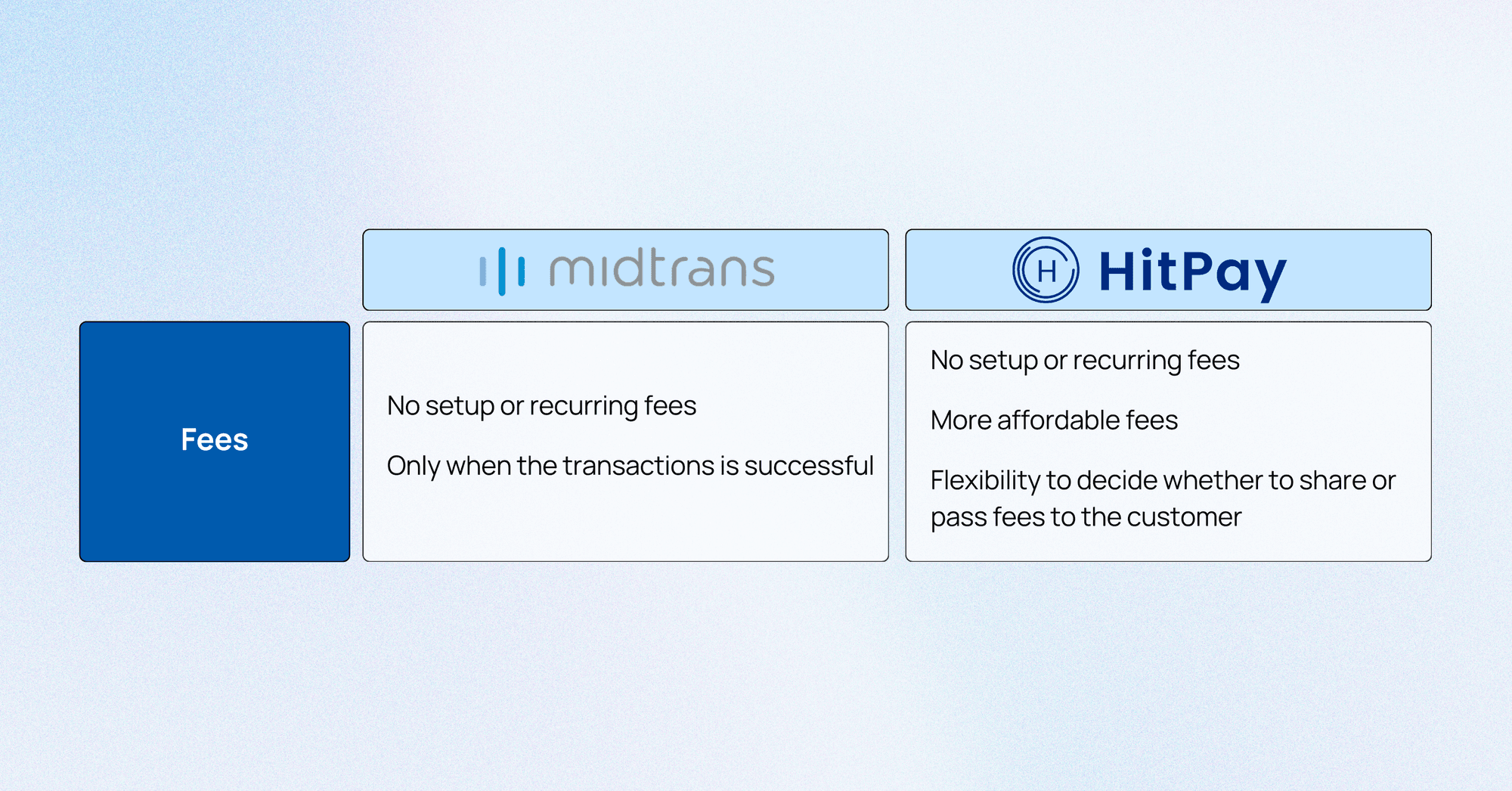

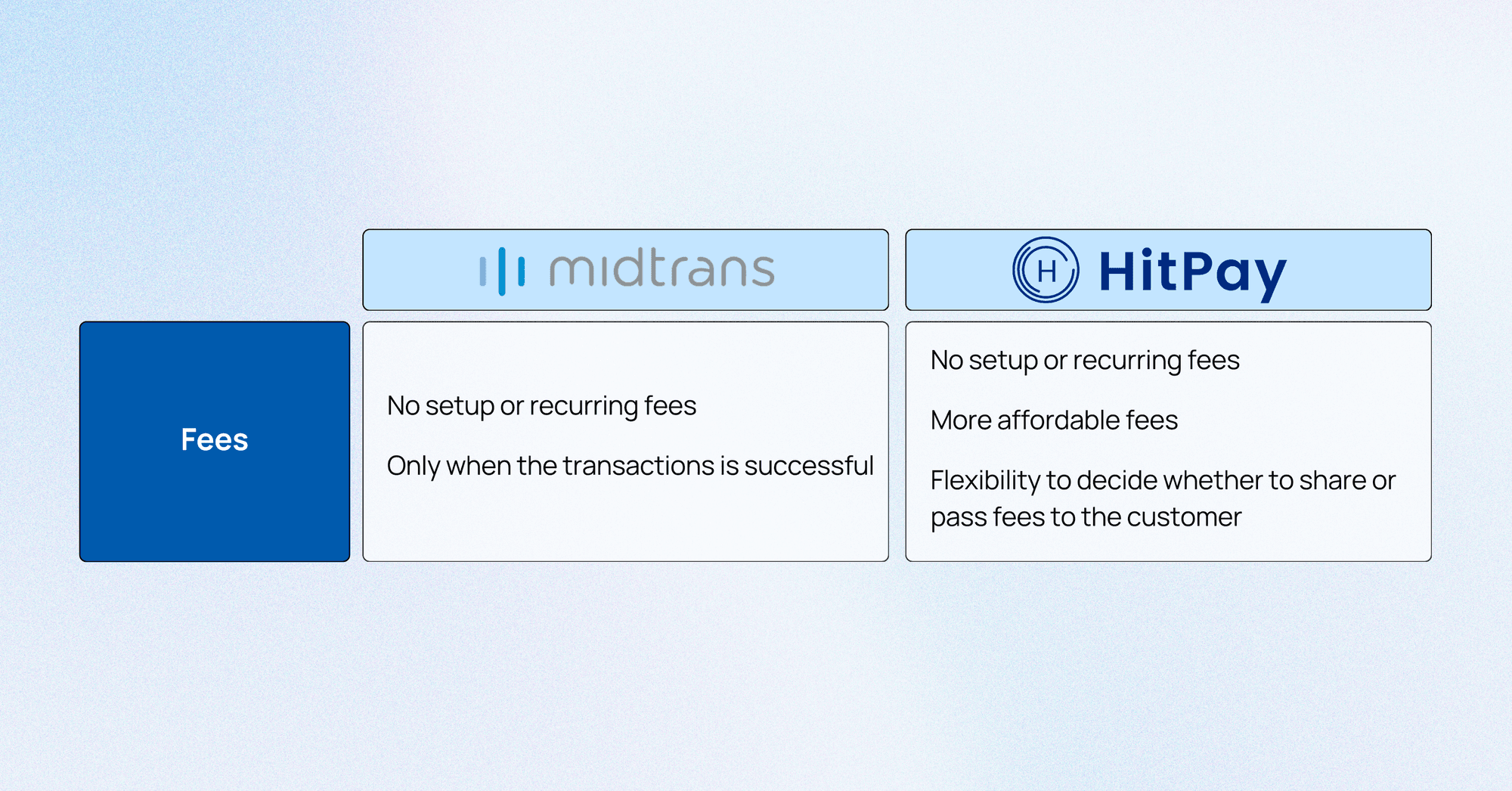

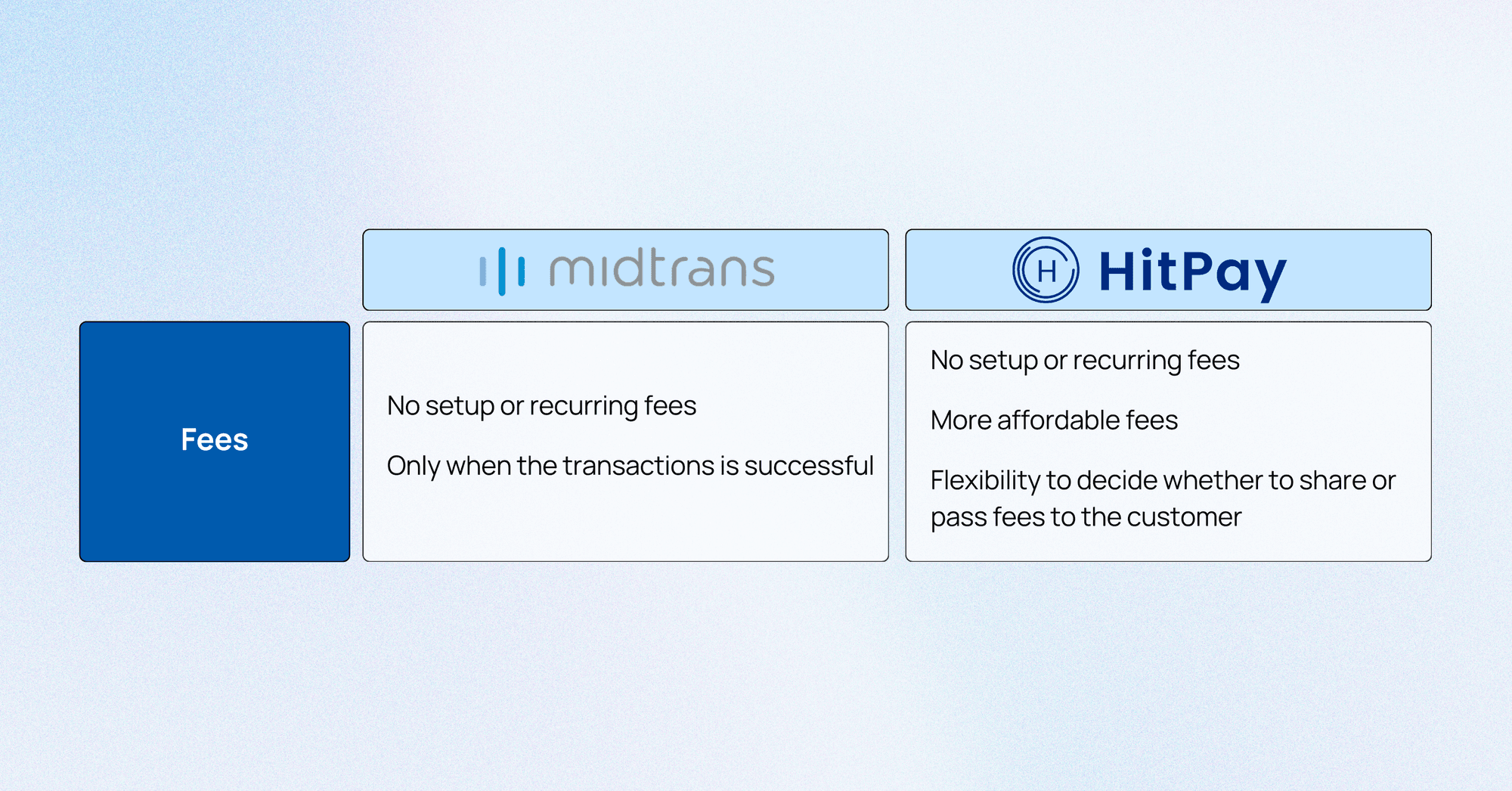

Comparing Midtrans fees and HitPay fees

The payment fees between Midtrans and HitPay are not significantly different, as both do not charge setup or recurring fees. Instead, fees will be charged to users when a transaction is successful, including fees from banks and fraud detection systems.

Overall, HitPay offers more affordable fees compared to Midtrans, and you have the flexibility to decide whether to share or pass fees to the customer. This advantage is significant in reducing your operational costs and providing benefits to the buyers.

Compare the pricing of payment gateway services from HitPay and the pricing offered by Midtrans.

Why should you consider HitPay as an alternative to Midtrans?

Choosing HitPay as an alternative payment gateway to Midtrans can offer several advantages for your business.

Integrations with No Coding Needed: HitPay provides the widest range of no-coding integrations with Shopify, WooCommerce, and other e-commerce platformss. You can easily synchronize your online and offline sales in one place without the need to build your own integrations. This will save you time. See the supported sales channels by HitPay here.

Free Business Software: HitPay offers free business software, including recurring billing management, invoice generation, and online website creation. This will help businesses save on operational costs, and, importantly, HitPay does not charge subscription fees for this software. You only pay per transaction, making this solution cost-effective.

Affordable and Flexible Fees: HitPay adopts a straightforward pricing approach, with transparent per-transaction fees and no hidden costs. This direct approach allows growing businesses to plan their expenses effectively without worrying about additional fees or unwanted surprises.

If you're interested in using HitPay to grow your business, contact us now for a free demo with our team.

You might also like these posts

If you are planning to start a business in Indonesia, consider using MidTrans as a payment gateway, which might be the right choice. Apart from that, we will review other alternatives, such as HitPay, which is popular among business people in Indonesia.

The fast growth of technology has led to a huge rise in the use of payment gateways in Indonesia. This can be seen by the growing number of Indonesians preferring to buy things online through e-commerce sites.

To put it simply, payment gateways make it easier for customers to pay for products or services online and offline. In other words, it's essential to have a payment gateway to run your business in Indonesia.

There are several well-known payment gateways in Indonesia right now, with Midtrans being one of the most popular. Before deciding to choose Midtrans as your payment gateway, it is recommended to consider other suitable alternatives. This article explores a more affordable Midtrans payment gateway alternative that may better suit your business needs.

How Midtrans Payment Gateway Works

In general, here is how a payment gateway works:

Register to the payment gateway's portal. During this stage, you can make various settings without any commitment or payment.

Next, proceed with the registration process by fulfilling the required document requirements, such as your ID card (KTP) and tax identification number (NPWP). These documents will go through a verification process by the payment gateway provider.

It's worth noting that you can use payment gateway account for both individual businesses and companies.

Once your account is registered and verified, you can integrate it into your e-commerce website. This integration streamlines the checkout process for your customers, enhancing convenience and transaction efficiency.

What is Midtrans Payment Gateway and its advantages?

Midtrans is one of the most popular digital payment platforms in Indonesia and is a subsidiary of GoTo Financial. With support for more than 25 local payment methods and a comprehensive set of features, Midtrans is considered a suitable choice for small and medium-sized businesses (UMKM) in Indonesia. However, it's important to note that Midtrans is not available for all online stores; it is only integrated with a few e-commerce plugins and is not integrated with additional accounting systems or business software.

For a more comprehensive solution, HitPay is a highly recommended alternative. HitPay has the advantage of accepting international transactions and can receive payments from customers worldwide in over 100 different currencies. Additionally, HitPay offers seamless integrations with various leading e-commerce plugins such as Shopify, WooCommerce, EasyStore, Prestashop, Magento, OpenCart, Shopcada, Ecwid, Wix, and many more.

Furthermore, HitPay also provides various business software for free, including automatic invoicing and website building tools.

Comparing Midtrans fees and HitPay fees

The payment fees between Midtrans and HitPay are not significantly different, as both do not charge setup or recurring fees. Instead, fees will be charged to users when a transaction is successful, including fees from banks and fraud detection systems.

Overall, HitPay offers more affordable fees compared to Midtrans, and you have the flexibility to decide whether to share or pass fees to the customer. This advantage is significant in reducing your operational costs and providing benefits to the buyers.

Compare the pricing of payment gateway services from HitPay and the pricing offered by Midtrans.

Why should you consider HitPay as an alternative to Midtrans?

Choosing HitPay as an alternative payment gateway to Midtrans can offer several advantages for your business.

Integrations with No Coding Needed: HitPay provides the widest range of no-coding integrations with Shopify, WooCommerce, and other e-commerce platformss. You can easily synchronize your online and offline sales in one place without the need to build your own integrations. This will save you time. See the supported sales channels by HitPay here.

Free Business Software: HitPay offers free business software, including recurring billing management, invoice generation, and online website creation. This will help businesses save on operational costs, and, importantly, HitPay does not charge subscription fees for this software. You only pay per transaction, making this solution cost-effective.

Affordable and Flexible Fees: HitPay adopts a straightforward pricing approach, with transparent per-transaction fees and no hidden costs. This direct approach allows growing businesses to plan their expenses effectively without worrying about additional fees or unwanted surprises.

If you're interested in using HitPay to grow your business, contact us now for a free demo with our team.

You might also like these posts

If you are planning to start a business in Indonesia, consider using MidTrans as a payment gateway, which might be the right choice. Apart from that, we will review other alternatives, such as HitPay, which is popular among business people in Indonesia.

The fast growth of technology has led to a huge rise in the use of payment gateways in Indonesia. This can be seen by the growing number of Indonesians preferring to buy things online through e-commerce sites.

To put it simply, payment gateways make it easier for customers to pay for products or services online and offline. In other words, it's essential to have a payment gateway to run your business in Indonesia.

There are several well-known payment gateways in Indonesia right now, with Midtrans being one of the most popular. Before deciding to choose Midtrans as your payment gateway, it is recommended to consider other suitable alternatives. This article explores a more affordable Midtrans payment gateway alternative that may better suit your business needs.

How Midtrans Payment Gateway Works

In general, here is how a payment gateway works:

Register to the payment gateway's portal. During this stage, you can make various settings without any commitment or payment.

Next, proceed with the registration process by fulfilling the required document requirements, such as your ID card (KTP) and tax identification number (NPWP). These documents will go through a verification process by the payment gateway provider.

It's worth noting that you can use payment gateway account for both individual businesses and companies.

Once your account is registered and verified, you can integrate it into your e-commerce website. This integration streamlines the checkout process for your customers, enhancing convenience and transaction efficiency.

What is Midtrans Payment Gateway and its advantages?

Midtrans is one of the most popular digital payment platforms in Indonesia and is a subsidiary of GoTo Financial. With support for more than 25 local payment methods and a comprehensive set of features, Midtrans is considered a suitable choice for small and medium-sized businesses (UMKM) in Indonesia. However, it's important to note that Midtrans is not available for all online stores; it is only integrated with a few e-commerce plugins and is not integrated with additional accounting systems or business software.

For a more comprehensive solution, HitPay is a highly recommended alternative. HitPay has the advantage of accepting international transactions and can receive payments from customers worldwide in over 100 different currencies. Additionally, HitPay offers seamless integrations with various leading e-commerce plugins such as Shopify, WooCommerce, EasyStore, Prestashop, Magento, OpenCart, Shopcada, Ecwid, Wix, and many more.

Furthermore, HitPay also provides various business software for free, including automatic invoicing and website building tools.

Comparing Midtrans fees and HitPay fees

The payment fees between Midtrans and HitPay are not significantly different, as both do not charge setup or recurring fees. Instead, fees will be charged to users when a transaction is successful, including fees from banks and fraud detection systems.

Overall, HitPay offers more affordable fees compared to Midtrans, and you have the flexibility to decide whether to share or pass fees to the customer. This advantage is significant in reducing your operational costs and providing benefits to the buyers.

Compare the pricing of payment gateway services from HitPay and the pricing offered by Midtrans.

Why should you consider HitPay as an alternative to Midtrans?

Choosing HitPay as an alternative payment gateway to Midtrans can offer several advantages for your business.

Integrations with No Coding Needed: HitPay provides the widest range of no-coding integrations with Shopify, WooCommerce, and other e-commerce platformss. You can easily synchronize your online and offline sales in one place without the need to build your own integrations. This will save you time. See the supported sales channels by HitPay here.

Free Business Software: HitPay offers free business software, including recurring billing management, invoice generation, and online website creation. This will help businesses save on operational costs, and, importantly, HitPay does not charge subscription fees for this software. You only pay per transaction, making this solution cost-effective.

Affordable and Flexible Fees: HitPay adopts a straightforward pricing approach, with transparent per-transaction fees and no hidden costs. This direct approach allows growing businesses to plan their expenses effectively without worrying about additional fees or unwanted surprises.

If you're interested in using HitPay to grow your business, contact us now for a free demo with our team.

You might also like these posts

Let's get you set up

Create an account instantly or contact us to create a custom package for your business.

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapore 089109

Let's get you set up

Create an account instantly to get started or contact us

to design a custom package for your business.

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapore 089109

Let's get you set up

Create an account instantly to get started or contact us to design

a custom package for your business.

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapore 089109

Let's get you set up

Create an account instantly to get started or contact us to design a custom package

for your business.

business software

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapore 089109