Solusi pembayaran untuk bisnis yang berkembang di APAC

Solusi pembayaran untuk bisnis yang berkembang di APAC

Solusi pembayaran untuk bisnis yang berkembang di APAC

Tingkatkan pertumbuhan Anda dengan alat pemrosesan pembayaran yang kuat dan mudah digunakan. HitPay menyatukan pembayaran online, titik penjualan, dan B2B ke dalam satu platform. Sempurna untuk bisnis yang siap berkembang.

Tingkatkan pertumbuhan Anda dengan alat pemrosesan pembayaran yang kuat dan mudah digunakan. HitPay menyatukan pembayaran online, titik penjualan, dan B2B ke dalam satu platform. Sempurna untuk bisnis yang siap berkembang.

Tingkatkan pertumbuhan Anda dengan alat pemrosesan pembayaran yang kuat dan mudah digunakan. HitPay menyatukan pembayaran online, titik penjualan, dan B2B ke dalam satu platform. Sempurna untuk bisnis yang siap berkembang.

Payments

Point of Sales

Online Store

H

Shenzhen Huaju..

Overview

Transaction Volume

This year

1.5K

1.0K

0.5K

0

Jan’23

FEB’23

Mar’23

APR’23

MAy’23

JUN’23

JUL’23

AUG’23

SEP’23

oct’23

nov’23

dec’23

Growth

Today

SGD 570.00

11%

This week

SGD 21,472.34

17%

This month

SGD 72,473.12

8%

Collected at

Sept 17, 2024

11:03AM

Sept 17, 2024

11:03AM

Sept 12, 2024

10:23AM

Sept 10, 2024

08:22PM

Aug, 31 2024

11:03AM

Payment

Amount

SGD 870.34

SGD 109.21

SGD 400.10

SGD 1,870.00

SGD 1,171.24

Recent transactions

Payment by Channel

This month

Others

Payment by Channel

This month

Others

This month

SGD 72,473.12

8%

Today

SGD 570.00

11%

This week

SGD 21,472.34

17%

Headphone

3 Variants

Sunglasses

$120.00

Heel Beauty

$200.00

Snake Plant

$10.00

Location

City Square Mall

Terminal

WisePad3

Total visitors

2.0K

1.5K

1.0K

0.5K

MON

TUE

WED

THU

FRI

SAt

SUN

TOtal revenue

SGD 101,870.00

Pending shipping

18

Received orders

201

Pending pickup

73

Payments

Point of Sales

Online Store

H

Shenzhen Huaju..

Overview

Transaction Volume

This year

1.5K

1.0K

0.5K

0

Jan’23

FEB’23

Mar’23

APR’23

MAy’23

JUN’23

JUL’23

AUG’23

SEP’23

oct’23

nov’23

dec’23

Growth

Today

SGD 570.00

11%

This week

SGD 21,472.34

17%

This month

SGD 72,473.12

8%

Collected at

Sept 17, 2024

11:03AM

Sept 17, 2024

11:03AM

Sept 12, 2024

10:23AM

Sept 10, 2024

08:22PM

Aug, 31 2024

11:03AM

Payment

Amount

SGD 870.34

SGD 109.21

SGD 400.10

SGD 1,870.00

SGD 1,171.24

Recent transactions

Payment by Channel

This month

Others

Payment by Channel

This month

Others

This month

SGD 72,473.12

8%

Today

SGD 570.00

11%

This week

SGD 21,472.34

17%

Headphone

3 Variants

Sunglasses

$120.00

Heel Beauty

$200.00

Snake Plant

$10.00

Location

City Square Mall

Terminal

WisePad3

Total visitors

2.0K

1.5K

1.0K

0.5K

MON

TUE

WED

THU

FRI

SAt

SUN

TOtal revenue

SGD 101,870.00

Pending shipping

18

Received orders

201

Pending pickup

73

Payments

Point of Sales

Online Store

H

Shenzhen Huaju..

Overview

Transaction Volume

This year

1.5K

1.0K

0.5K

0

Jan’23

FEB’23

Mar’23

APR’23

MAy’23

JUN’23

JUL’23

AUG’23

SEP’23

oct’23

nov’23

dec’23

Growth

Today

SGD 570.00

11%

This week

SGD 21,472.34

17%

This month

SGD 72,473.12

8%

Collected at

Sept 17, 2024

11:03AM

Sept 17, 2024

11:03AM

Sept 12, 2024

10:23AM

Sept 10, 2024

08:22PM

Aug, 31 2024

11:03AM

Payment

Amount

SGD 870.34

SGD 109.21

SGD 400.10

SGD 1,870.00

SGD 1,171.24

Recent transactions

Payment by Channel

This month

Others

Payment by Channel

This month

Others

This month

SGD 72,473.12

8%

Today

SGD 570.00

11%

This week

SGD 21,472.34

17%

Headphone

3 Variants

Sunglasses

$120.00

Heel Beauty

$200.00

Snake Plant

$10.00

Location

City Square Mall

Terminal

WisePad3

Total visitors

2.0K

1.5K

1.0K

0.5K

MON

TUE

WED

THU

FRI

SAt

SUN

TOtal revenue

SGD 101,870.00

Pending shipping

18

Received orders

201

Pending pickup

73

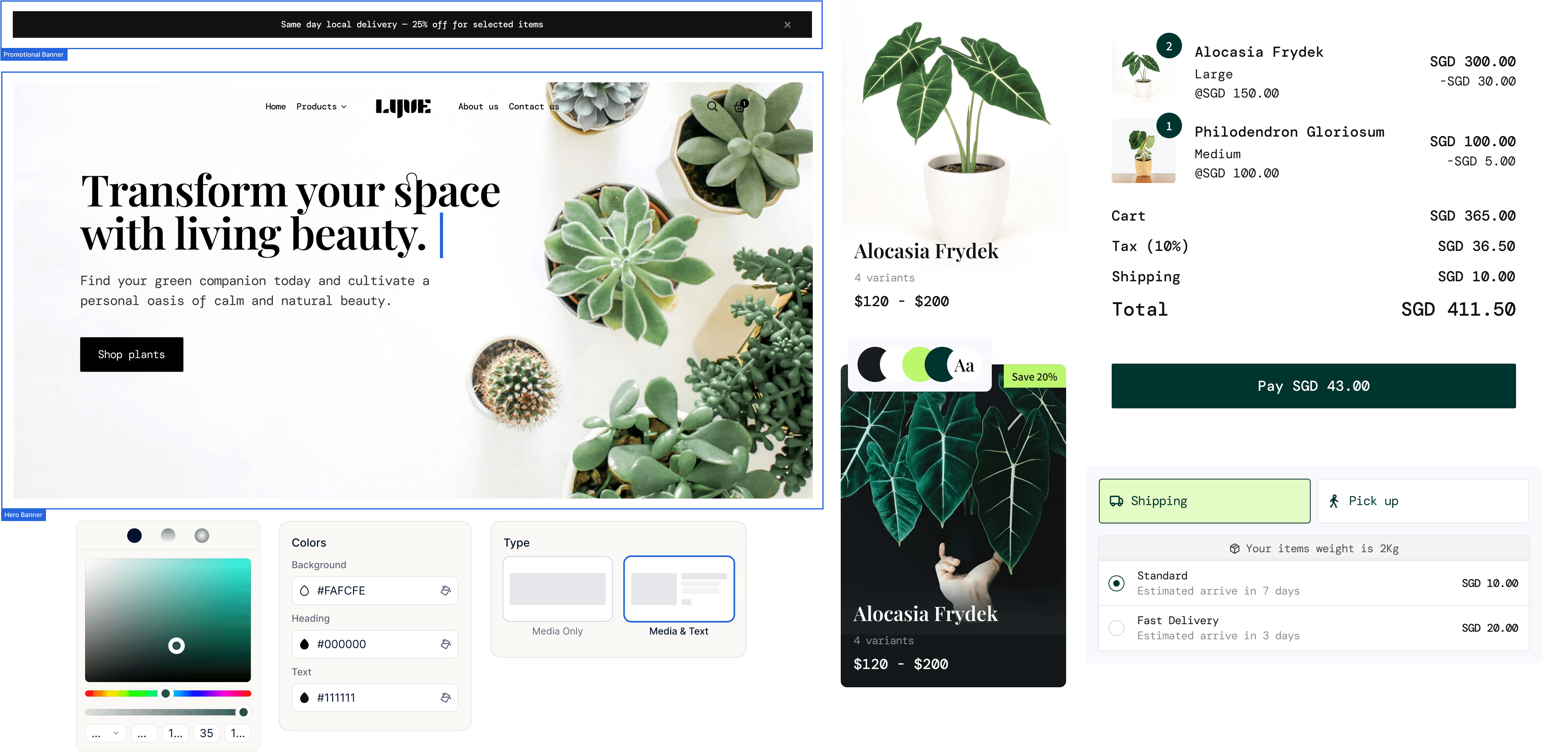

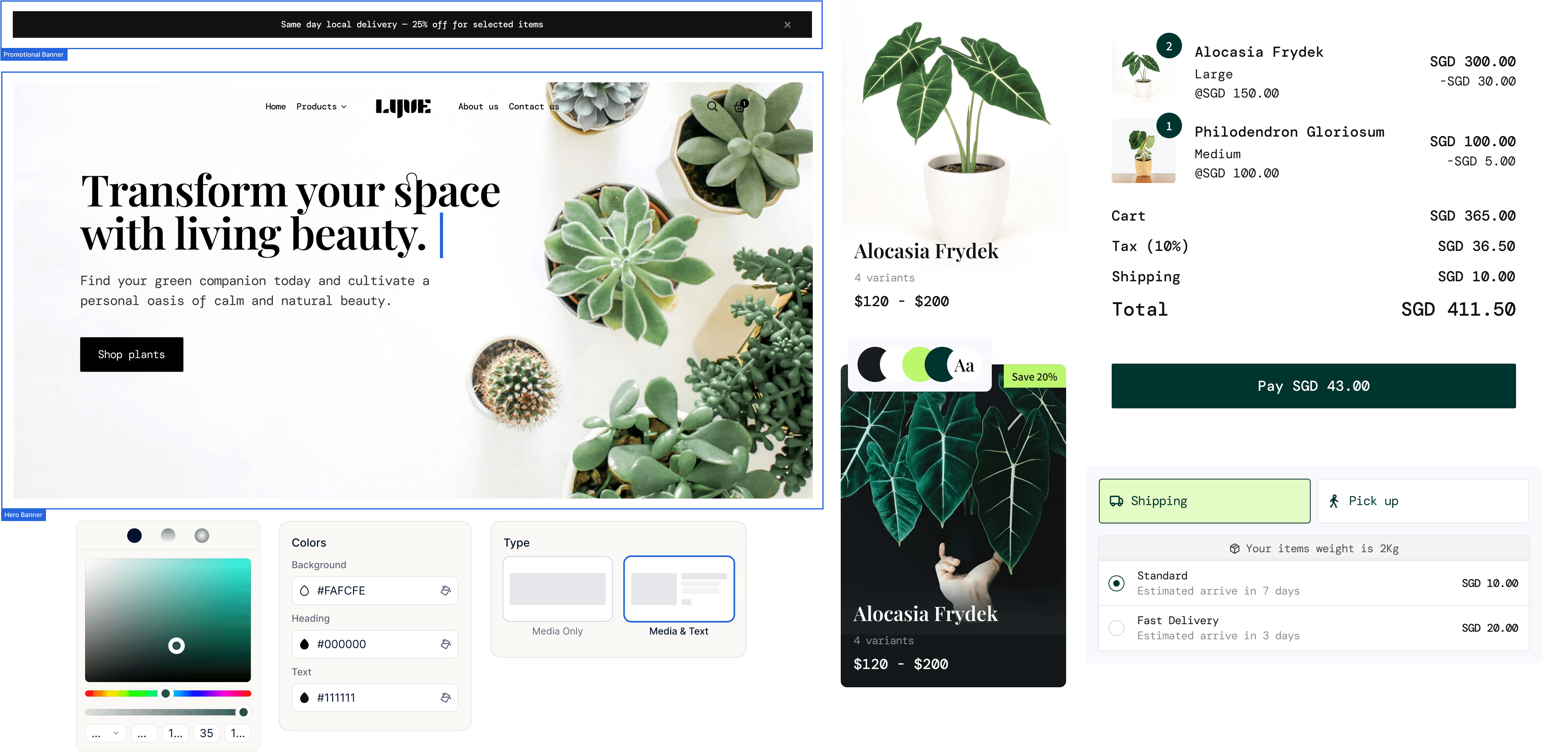

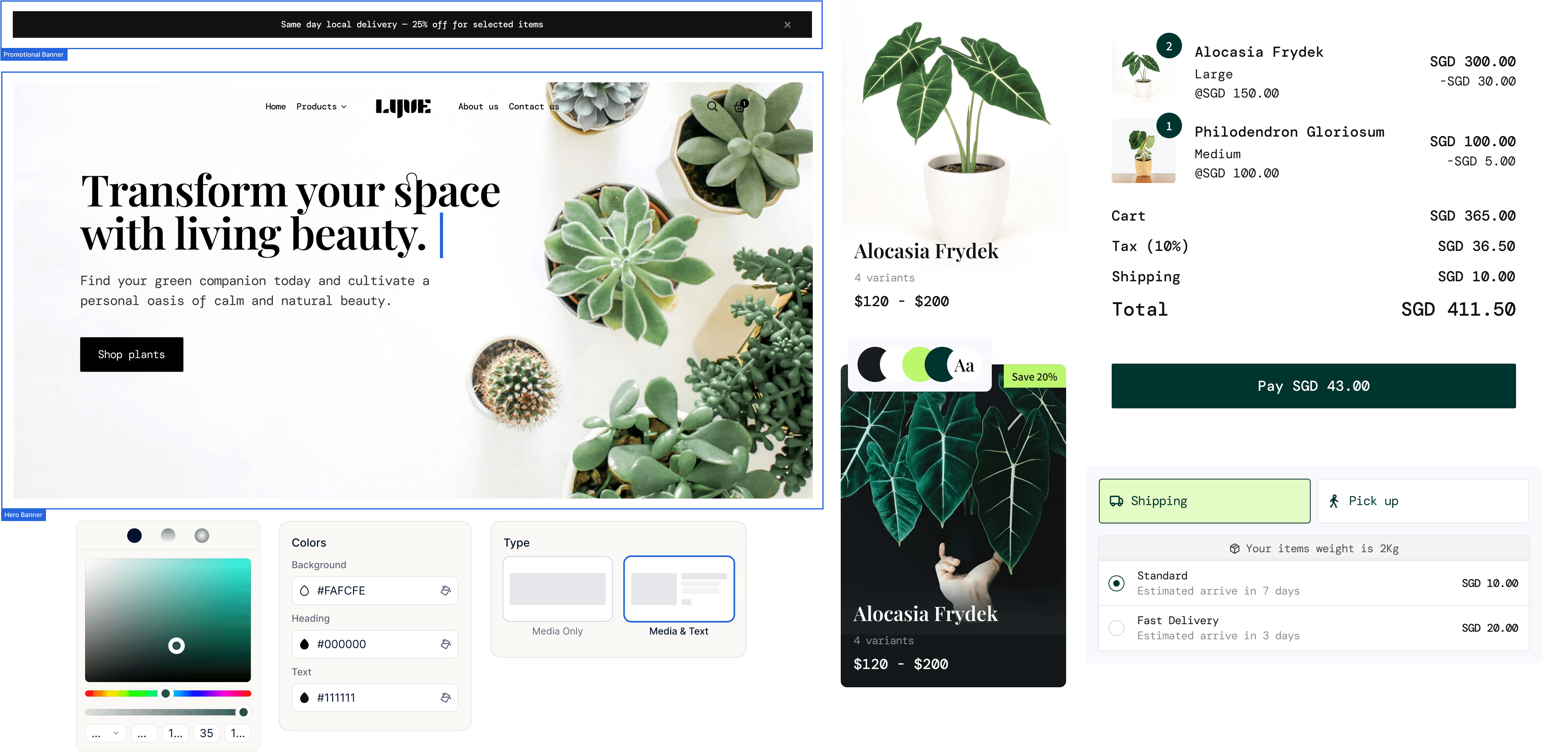

Wujudkan ide besarmu dengan pembuat toko online gratis dari HitPay. Tambahkan produk, sesuaikan desain, dan kelola pesanan dengan mudah.

Wujudkan ide besarmu dengan pembuat toko online gratis dari HitPay. Tambahkan produk, sesuaikan desain, dan kelola pesanan dengan mudah.

Wujudkan ide besarmu dengan pembuat toko online gratis dari HitPay. Tambahkan produk, sesuaikan desain, dan kelola pesanan dengan mudah.

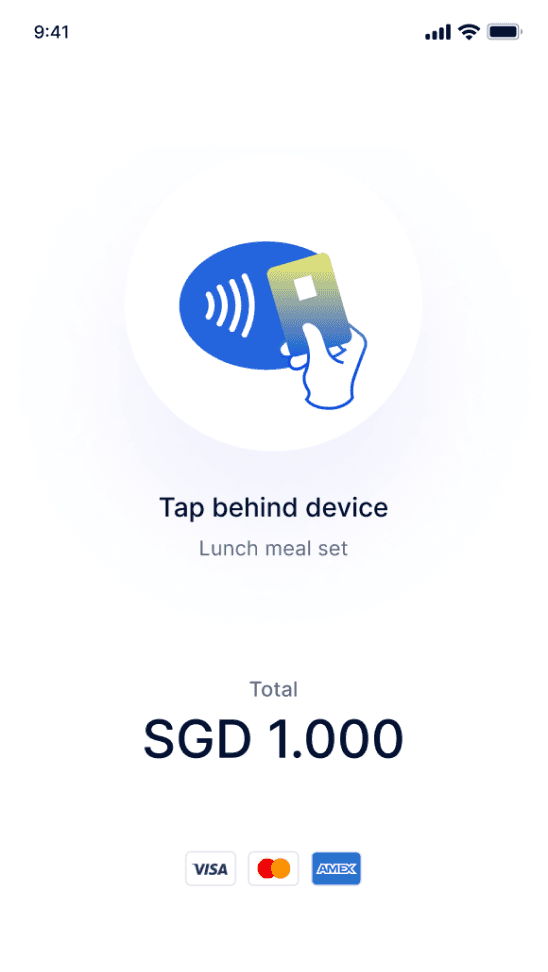

Ambil pembayarancara yang Anda inginkan

Ambil pembayarancara yang Anda inginkan

Ambil pembayarancara yang Anda inginkan

Optimalkan pembayaran Anda dengan fitur-fitur penting. Sesuaikan antarmuka checkout, proses pembayaran yang aman, dan dapatkan wawasan penjualan — semua dirancang untuk meningkatkan kinerja bisnis Anda.

Optimalkan pembayaran Anda dengan fitur-fitur penting. Sesuaikan antarmuka checkout, proses pembayaran yang aman, dan dapatkan wawasan penjualan — semua dirancang untuk meningkatkan kinerja bisnis Anda.

Optimalkan pembayaran Anda dengan fitur-fitur penting. Sesuaikan antarmuka checkout, proses pembayaran yang aman, dan dapatkan wawasan penjualan — semua dirancang untuk meningkatkan kinerja bisnis Anda.

Optimalkan pembayaran dengan fitur penting yang dirancang untuk meningkatkan kinerja bisnis Anda. Sesuaikan antarmuka checkout, proses pembayaran yang aman, dan dapatkan wawasan penjualan — semuanya dalam satu platform.

Terima semua metode pembayaran populer

Ambil berbagai macam metode pembayaran dan terima pembayaran langsung ke rekening bank bisnis Anda.

Terima semua metode pembayaran populer

Ambil berbagai macam metode pembayaran dan terima pembayaran langsung ke rekening bank bisnis Anda.

Terima semua metode pembayaran populer

Ambil berbagai macam metode pembayaran dan terima pembayaran langsung ke rekening bank bisnis Anda.

Sesuaikan halaman checkout Anda agar sesuai dengan merek Anda

Tawarkan halaman checkout yang dapat disesuaikan untuk mencocokkan identitas merek Anda dan menyederhanakan proses pembayaran Anda.

Didukung oleh HitPay

Anda sedang membayar

Sekitar

~

USD 30.00

Setara dengan

IDR 459,924

USD 1 = IDR 15,330.80

Thank you for your services

Acme INC

Checkout dengan

Or

john.doe@gmail.com

Payment method

Paynow

Card

Atome

GrabPay

Shopback

Shopee Pay

Detail Kartu

4444 1111 2222 3333

MM/YY

CVC

Bayar $30,00

Bayar $30,00

Acme INC

Anda sedang membayar

Sekitar

~

USD 30.00

Setara dengan

IDR 459,924

USD 1 = IDR 15,330.80

Anda akan dikenakan biaya dalam Rupiah Indonesia (IDR) pada laporan kartu Anda

Detail

Checkout dengan

john.doe@gmail.com

Metode pembayaran

Paynow

Cards

Shopback

Atome

GrabPay

Shopee Pay

Card details

4444 1111 2222 3333

MM/YY

CVC

Sesuaikan halaman checkout Anda agar sesuai dengan merek Anda

Tawarkan halaman checkout yang dapat disesuaikan untuk mencocokkan identitas merek Anda dan menyederhanakan proses pembayaran Anda.

Didukung oleh HitPay

Anda sedang membayar

Sekitar

~

USD 30.00

Setara dengan

IDR 459,924

USD 1 = IDR 15,330.80

Thank you for your services

Acme INC

Checkout dengan

Or

john.doe@gmail.com

Payment method

Paynow

Card

Atome

GrabPay

Shopback

Shopee Pay

Detail Kartu

4444 1111 2222 3333

MM/YY

CVC

Bayar $30,00

Bayar $30,00

Acme INC

Anda sedang membayar

Sekitar

~

USD 30.00

Setara dengan

IDR 459,924

USD 1 = IDR 15,330.80

Anda akan dikenakan biaya dalam Rupiah Indonesia (IDR) pada laporan kartu Anda

Detail

Checkout dengan

john.doe@gmail.com

Metode pembayaran

Paynow

Cards

Shopback

Atome

GrabPay

Shopee Pay

Card details

4444 1111 2222 3333

MM/YY

CVC

Sesuaikan halaman checkout Anda agar sesuai dengan merek Anda

Tawarkan halaman checkout yang dapat disesuaikan untuk mencocokkan identitas merek Anda dan menyederhanakan proses pembayaran Anda.

Didukung oleh HitPay

Anda sedang membayar

Sekitar

~

USD 30.00

Setara dengan

IDR 459,924

USD 1 = IDR 15,330.80

Thank you for your services

Acme INC

Checkout dengan

Or

john.doe@gmail.com

Payment method

Paynow

Card

Atome

GrabPay

Shopback

Shopee Pay

Detail Kartu

4444 1111 2222 3333

MM/YY

CVC

Bayar $30,00

Bayar $30,00

Acme INC

Anda sedang membayar

Sekitar

~

USD 30.00

Setara dengan

IDR 459,924

USD 1 = IDR 15,330.80

Anda akan dikenakan biaya dalam Rupiah Indonesia (IDR) pada laporan kartu Anda

Detail

Checkout dengan

john.doe@gmail.com

Metode pembayaran

Paynow

Cards

Shopback

Atome

GrabPay

Shopee Pay

Card details

4444 1111 2222 3333

MM/YY

CVC

Ambil pembayaran di Shopify, WooCommerce, dan lainnya

HitPay terintegrasi dengan lancar dengan situs web eCommerce pilihan Anda.

Integrasi

Ambil pembayaran di Shopify, WooCommerce, dan lainnya

HitPay terintegrasi dengan lancar dengan situs web eCommerce pilihan Anda.

Integrasi

Ambil pembayaran di Shopify, WooCommerce, dan lainnya

HitPay terintegrasi dengan lancar dengan situs web eCommerce pilihan Anda.

Integrasi

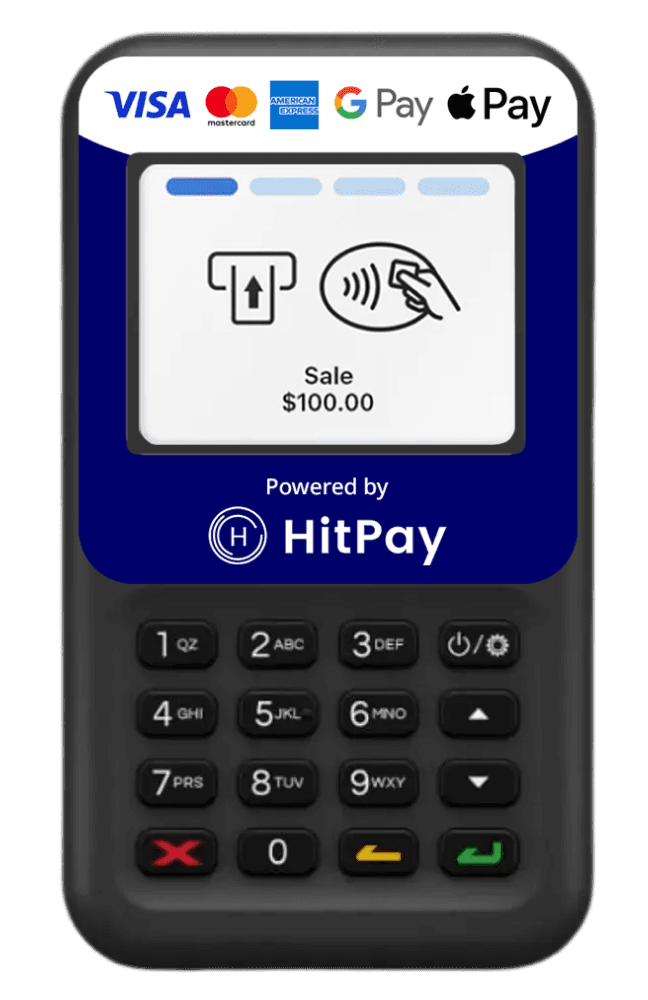

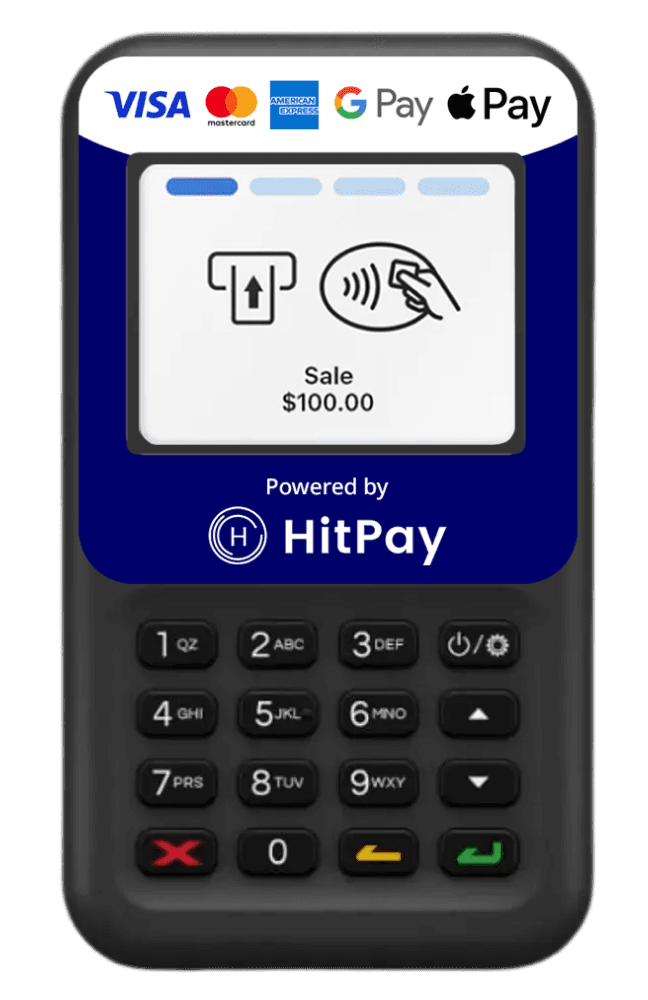

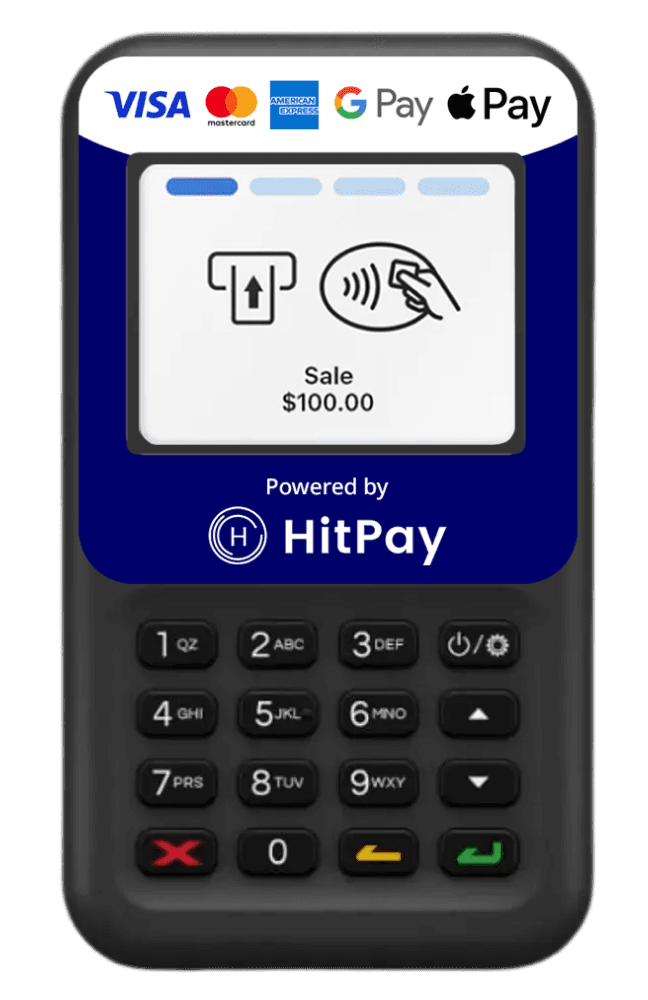

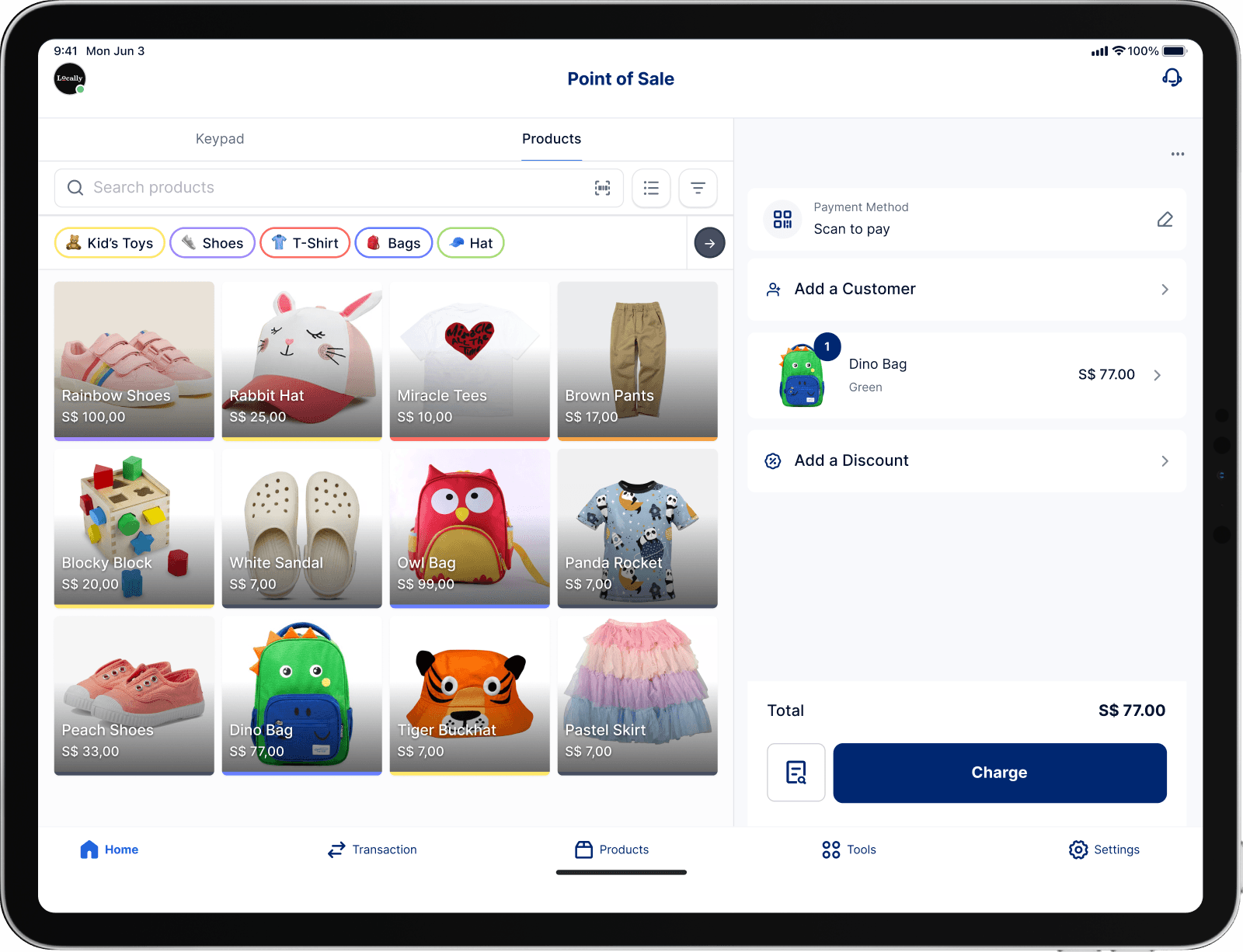

Ambil pembayaran di toko

Terminal HitPay menawarkan solusi pembayaran all-in-one, dengan fitur POS terintegrasi termasuk manajemen inventaris dan pelacakan penjualan secara real-time.

Ambil pembayaran di toko

Terminal HitPay menawarkan solusi pembayaran all-in-one, dengan fitur POS terintegrasi termasuk manajemen inventaris dan pelacakan penjualan secara real-time.

Ambil pembayaran di toko

Terminal HitPay menawarkan solusi pembayaran all-in-one, dengan fitur POS terintegrasi termasuk manajemen inventaris dan pelacakan penjualan secara real-time.

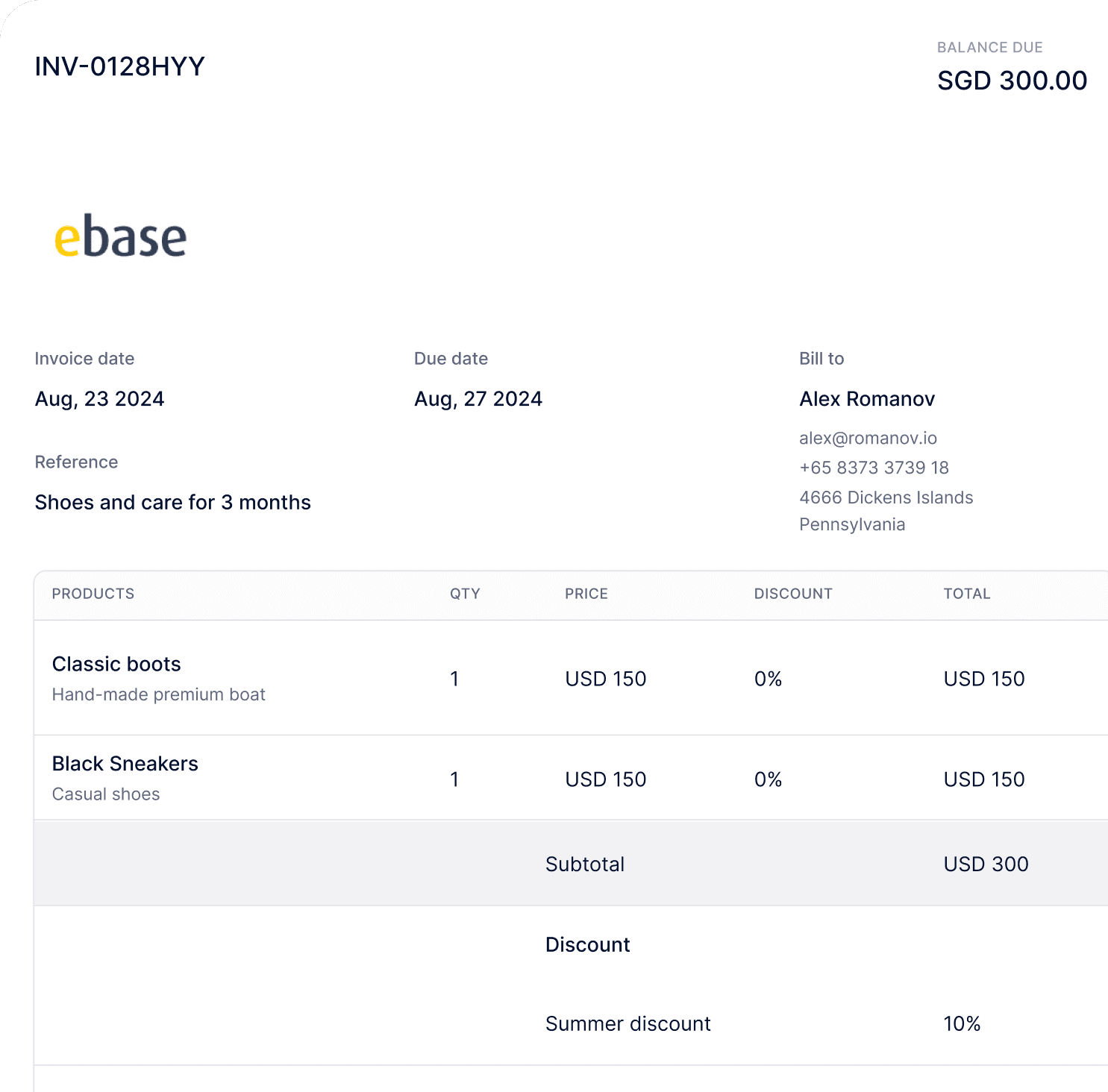

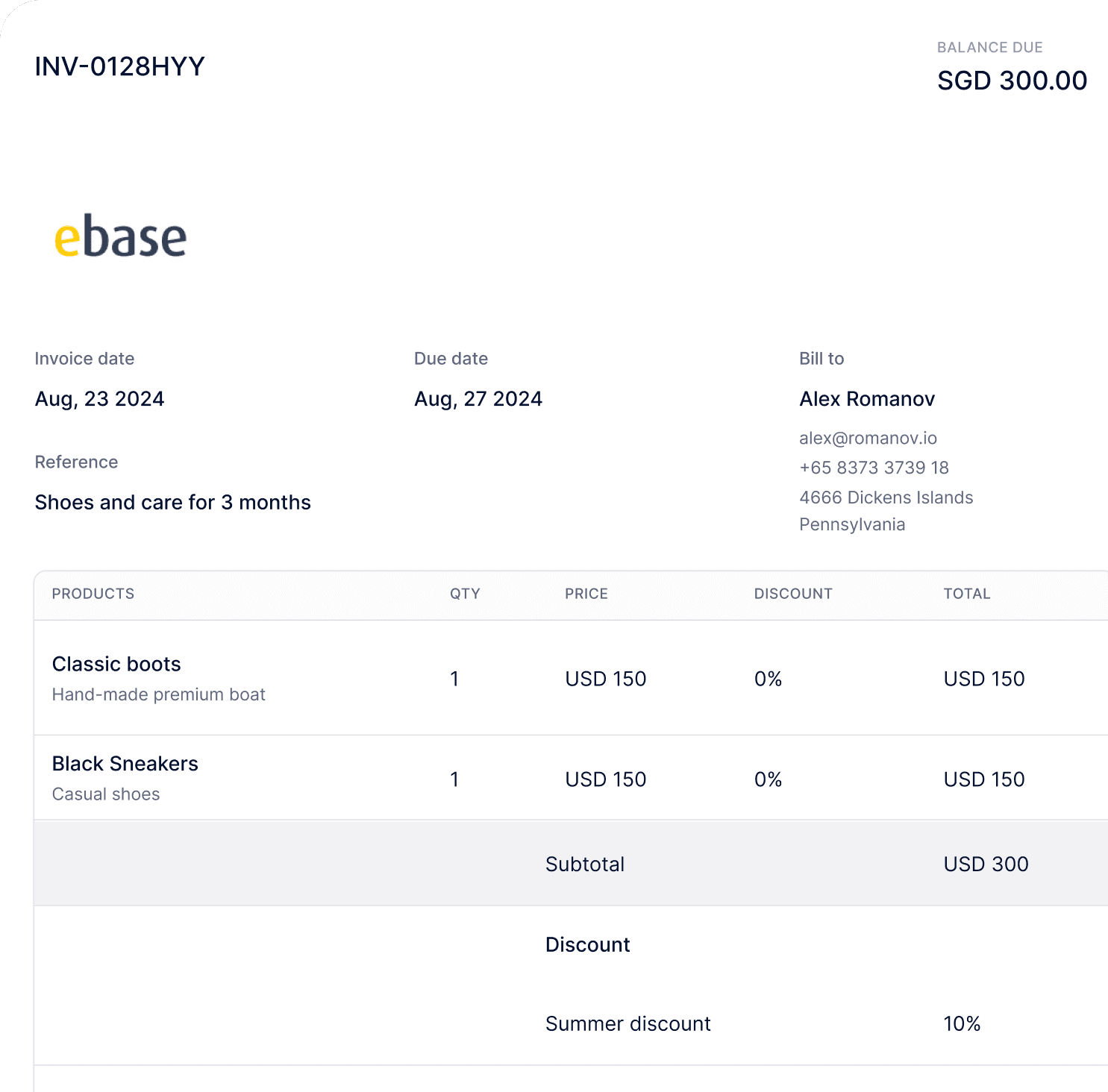

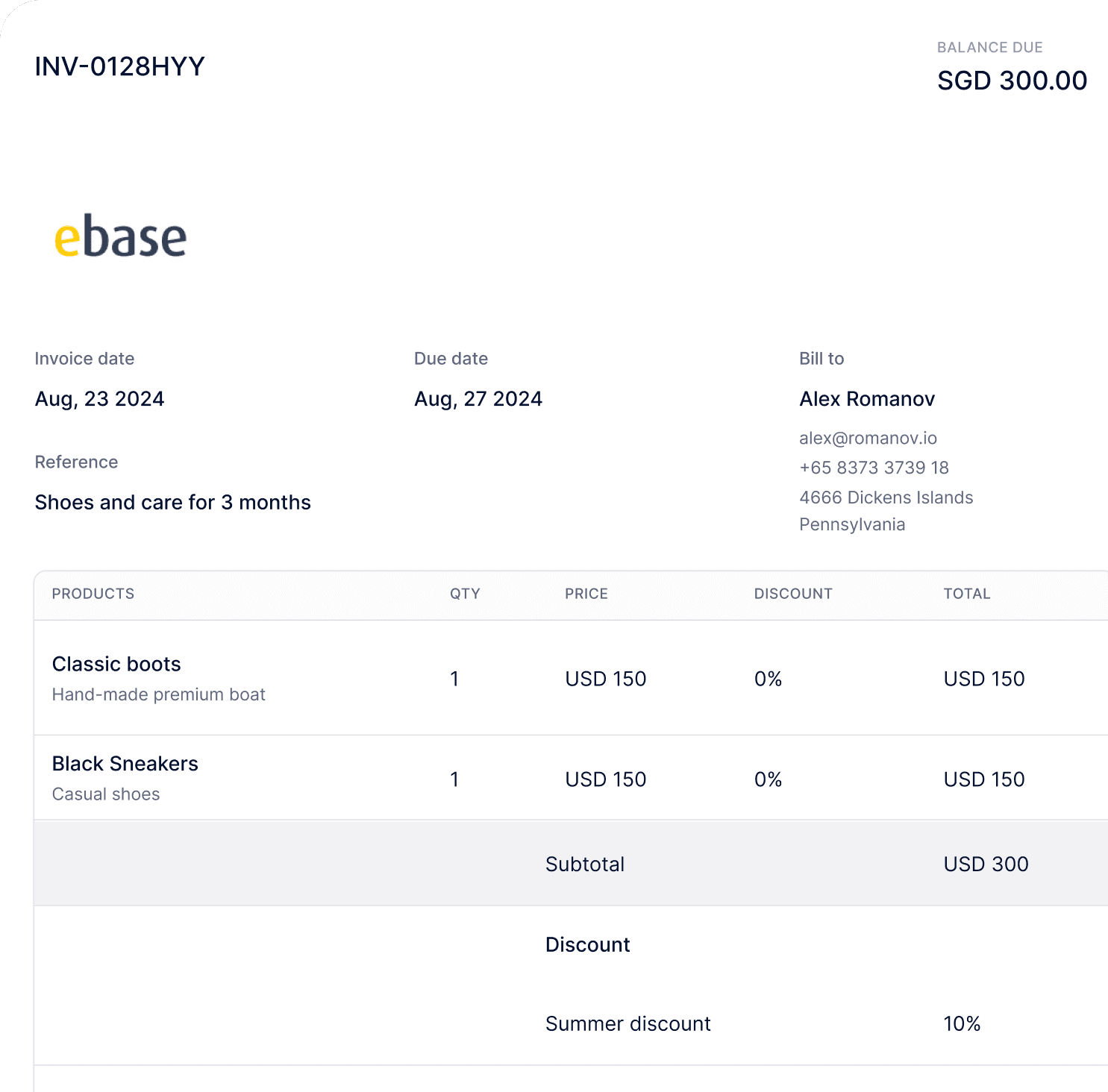

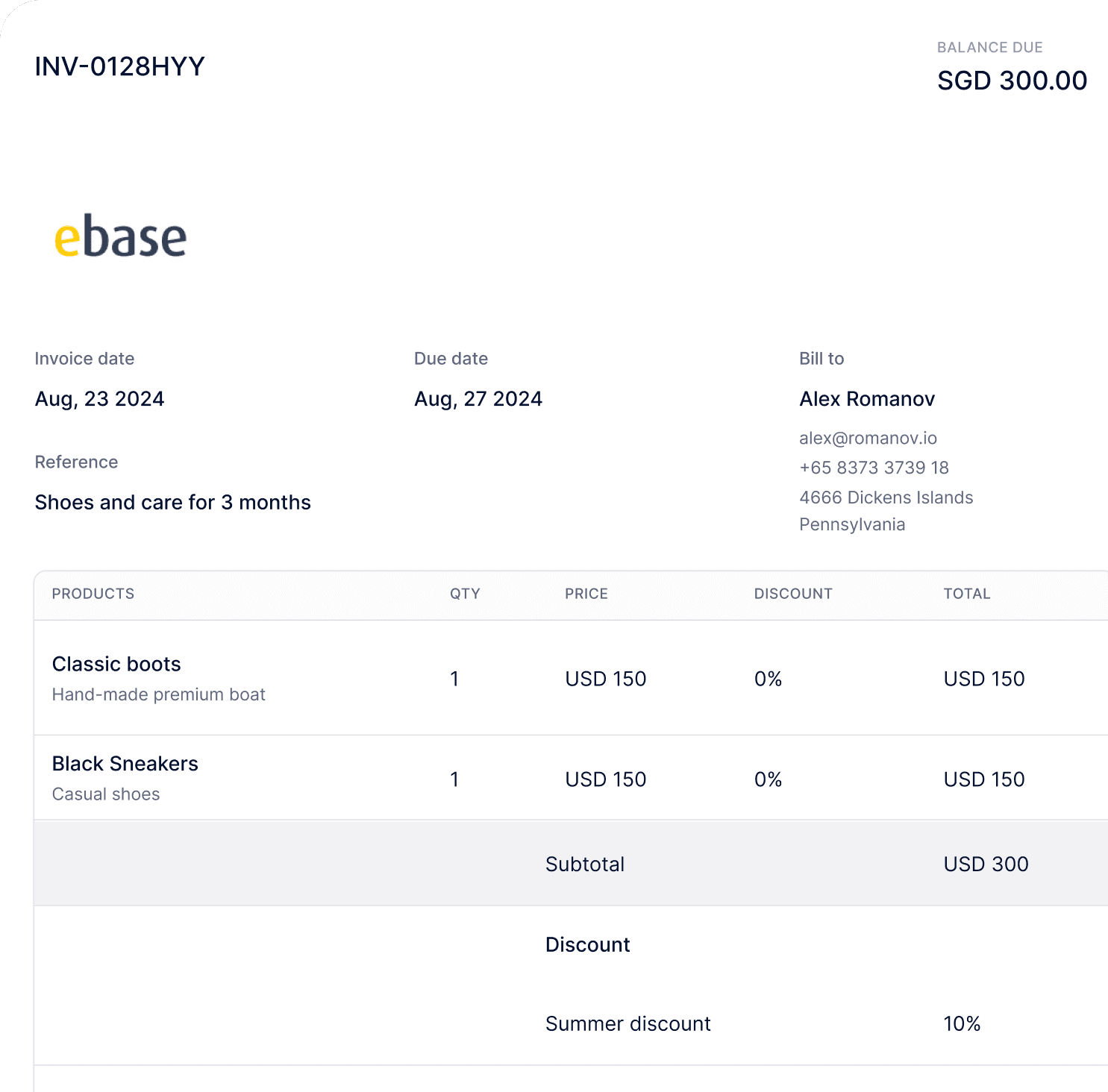

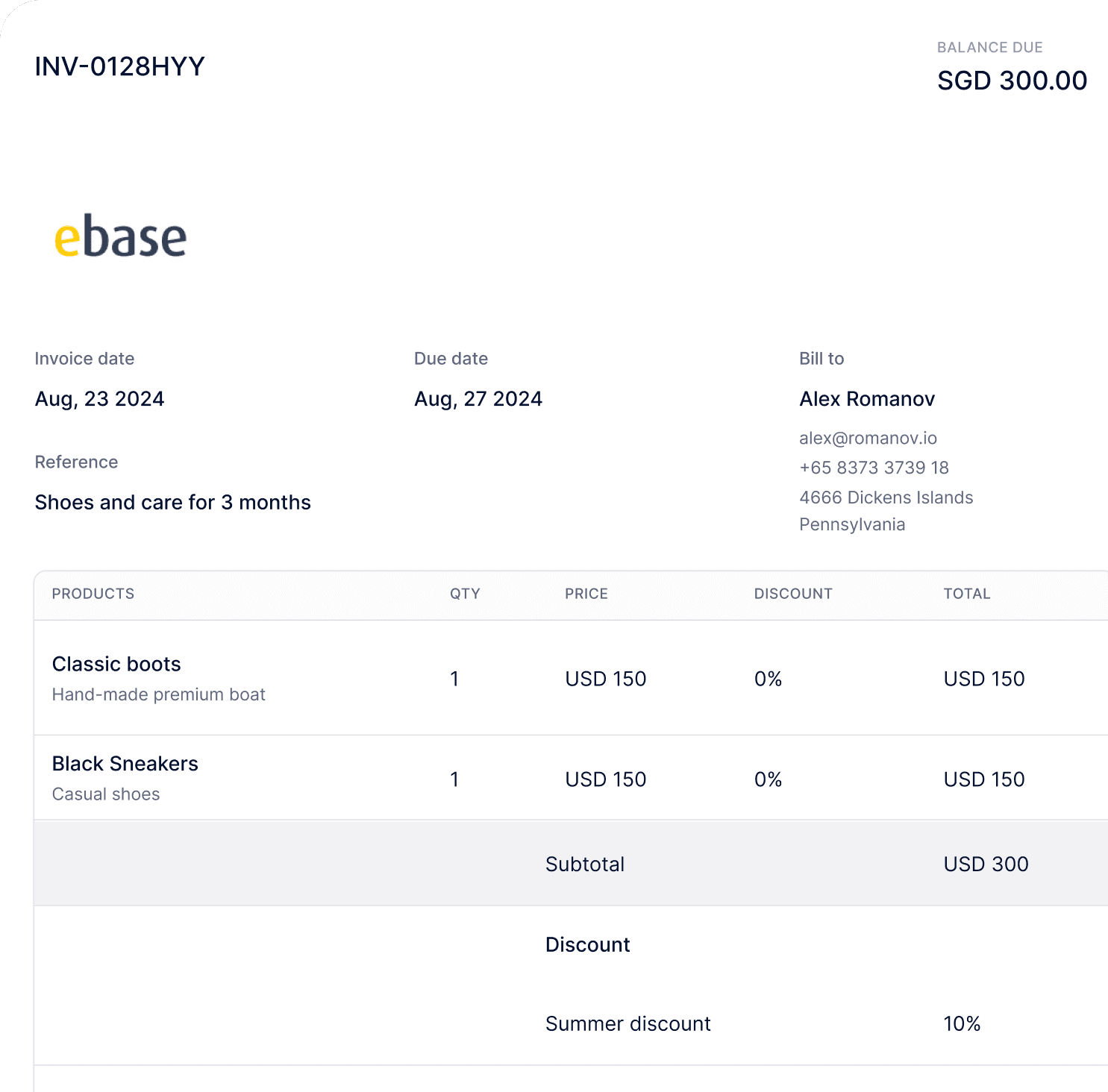

Sederhanakan pembayaran dengan alat penagihan cerdas HitPay

Sederhanakan pembayaran dengan alat penagihan cerdas HitPay

Sederhanakan pembayaran dengan alat penagihan cerdas HitPay

Akun Anda dilengkapi dengan fitur penagihan yang ramah pengguna, penagihan berulang, dan tautan pembayaran untuk memastikan Anda dibayar tepat waktu, setiap kali.

Akun Anda dilengkapi dengan fitur penagihan yang ramah pengguna, penagihan berulang, dan tautan pembayaran untuk memastikan Anda dibayar tepat waktu, setiap kali.

Akun Anda dilengkapi dengan fitur penagihan yang ramah pengguna, penagihan berulang, dan tautan pembayaran untuk memastikan Anda dibayar tepat waktu, setiap kali.

Hari ini 08:12AM

Hai Alex, saya ingin memesan 5 Roti Sourdough.

Tentu! Berikut adalah tautan pembayaran untuk pesanan Anda.

Toko Roti Alex

securecheckout.hit-pay.com

Terima kasih!

john.doe@gmail.com

Metode pembayaran

Paynow

Cards

Shopback

Atome

GrabPay

Shopee Pay

Bayar Rp. 100.000,00

Tautan Pembayaran

Kumpulkan pembayaran melalui email atau obrolan online

Minta pembayaran melalui email, obrolan, atau media sosial -- tanpa perlu situs web atau coding.

Hari ini 08:12AM

Hai Alex, saya ingin memesan 5 Roti Sourdough.

Tentu! Berikut adalah tautan pembayaran untuk pesanan Anda.

Toko Roti Alex

securecheckout.hit-pay.com

Terima kasih!

john.doe@gmail.com

Metode pembayaran

Paynow

Cards

Shopback

Atome

GrabPay

Shopee Pay

Bayar Rp. 100.000,00

Tautan Pembayaran

Kumpulkan pembayaran melalui email atau obrolan online

Minta pembayaran melalui email, obrolan, atau media sosial -- tanpa perlu situs web atau coding.

Hari ini 08:12AM

Hai Alex, saya ingin memesan 5 Roti Sourdough.

Tentu! Berikut adalah tautan pembayaran untuk pesanan Anda.

Toko Roti Alex

securecheckout.hit-pay.com

Terima kasih!

john.doe@gmail.com

Metode pembayaran

Paynow

Cards

Shopback

Atome

GrabPay

Shopee Pay

Bayar Rp. 100.000,00

Tautan Pembayaran

Kumpulkan pembayaran melalui email atau obrolan online

Minta pembayaran melalui email, obrolan, atau media sosial -- tanpa perlu situs web atau coding.

Tagihan Dibayar Bulan Ini

Rp. 8.772.912,00

Faktur yang menunggu

Rp. 22.177.713,80

Mengulangi faktur

20

Penagihan

Buat faktur bermerek dalam hitungan menit

Hemat waktu dalam penagihan dengan perangkat lunak faktur gratis kami. Buat faktur profesional dalam hitungan menit dan otomatisasi pengumpulan pembayaran.

Tagihan Dibayar Bulan Ini

Rp. 8.772.912,00

Faktur yang menunggu

Rp. 22.177.713,80

Mengulangi faktur

20

Penagihan

Buat faktur bermerek dalam hitungan menit

Hemat waktu dalam penagihan dengan perangkat lunak faktur gratis kami. Buat faktur profesional dalam hitungan menit dan otomatisasi pengumpulan pembayaran.

Tagihan Dibayar Bulan Ini

Rp. 8.772.912,00

Faktur yang menunggu

Rp. 22.177.713,80

Mengulangi faktur

20

Penagihan

Buat faktur bermerek dalam hitungan menit

Hemat waktu dalam penagihan dengan perangkat lunak faktur gratis kami. Buat faktur profesional dalam hitungan menit dan otomatisasi pengumpulan pembayaran.

Locally

Paket Emas

Cocok untuk usia 30 - 56

Rp. 300.000,00

Per bulan

Paket Silver

Cocok untuk usia 20 - 29

Rp. 120.000,00

Per minggu

Rencana Perunggu

Cocok untuk usia 7-19 tahun

Rp. 220.000,00

2 minggu pada 14

Penagihan Berulang

Penagihan berulang dibuat mudah

Atur siklus penagihan otomatis dan kelola rencana langganan hanya dalam beberapa klik.

Locally

Paket Emas

Cocok untuk usia 30 - 56

Rp. 300.000,00

Per bulan

Paket Silver

Cocok untuk usia 20 - 29

Rp. 120.000,00

Per minggu

Rencana Perunggu

Cocok untuk usia 7-19 tahun

Rp. 220.000,00

2 minggu pada 14

Penagihan Berulang

Penagihan berulang dibuat mudah

Atur siklus penagihan otomatis dan kelola rencana langganan hanya dalam beberapa klik.

Locally

Paket Emas

Cocok untuk usia 30 - 56

Rp. 300.000,00

Per bulan

Paket Silver

Cocok untuk usia 20 - 29

Rp. 120.000,00

Per minggu

Rencana Perunggu

Cocok untuk usia 7-19 tahun

Rp. 220.000,00

2 minggu pada 14

Penagihan Berulang

Penagihan berulang dibuat mudah

Atur siklus penagihan otomatis dan kelola rencana langganan hanya dalam beberapa klik.

Hari ini 08:12AM

Hai Alex, saya ingin memesan 5 Roti Sourdough.

Tentu! Berikut adalah tautan pembayaran untuk pesanan Anda.

Toko Roti Alex

securecheckout.hit-pay.com

Terima kasih!

john.doe@gmail.com

Metode pembayaran

Paynow

Cards

Shopback

Atome

GrabPay

Shopee Pay

Bayar Rp. 100.000,00

Tautan Pembayaran

Kumpulkan pembayaran melalui email atau obrolan online

Minta pembayaran melalui email, obrolan, atau media sosial -- tanpa perlu situs web atau coding.

Hari ini 08:12AM

Hai Alex, saya ingin memesan 5 Roti Sourdough.

Tentu! Berikut adalah tautan pembayaran untuk pesanan Anda.

Toko Roti Alex

securecheckout.hit-pay.com

Terima kasih!

john.doe@gmail.com

Metode pembayaran

Paynow

Cards

Shopback

Atome

GrabPay

Shopee Pay

Bayar Rp. 100.000,00

Tautan Pembayaran

Kumpulkan pembayaran melalui email atau obrolan online

Minta pembayaran melalui email, obrolan, atau media sosial -- tanpa perlu situs web atau coding.

Tagihan Dibayar Bulan Ini

Rp. 8.772.912,00

Faktur yang menunggu

Rp. 22.177.713,80

Mengulangi faktur

20

Penagihan

Buat faktur bermerek dalam hitungan menit

Hemat waktu dalam penagihan dengan perangkat lunak faktur gratis kami. Buat faktur profesional dalam hitungan menit dan otomatisasi pengumpulan pembayaran.

Tagihan Dibayar Bulan Ini

Rp. 8.772.912,00

Faktur yang menunggu

Rp. 22.177.713,80

Mengulangi faktur

20

Penagihan

Buat faktur bermerek dalam hitungan menit

Hemat waktu dalam penagihan dengan perangkat lunak faktur gratis kami. Buat faktur profesional dalam hitungan menit dan otomatisasi pengumpulan pembayaran.

Locally

Paket Emas

Cocok untuk usia 30 - 56

Rp. 300.000,00

Per bulan

Paket Silver

Cocok untuk usia 20 - 29

Rp. 120.000,00

Per minggu

Rencana Perunggu

Cocok untuk usia 7-19 tahun

Rp. 220.000,00

2 minggu pada 14

Penagihan Berulang

Penagihan berulang dibuat mudah

Atur siklus penagihan otomatis dan kelola rencana langganan hanya dalam beberapa klik.

Locally

Paket Emas

Cocok untuk usia 30 - 56

Rp. 300.000,00

Per bulan

Paket Silver

Cocok untuk usia 20 - 29

Rp. 120.000,00

Per minggu

Rencana Perunggu

Cocok untuk usia 7-19 tahun

Rp. 220.000,00

2 minggu pada 14

Penagihan Berulang

Penagihan berulang dibuat mudah

Atur siklus penagihan otomatis dan kelola rencana langganan hanya dalam beberapa klik.

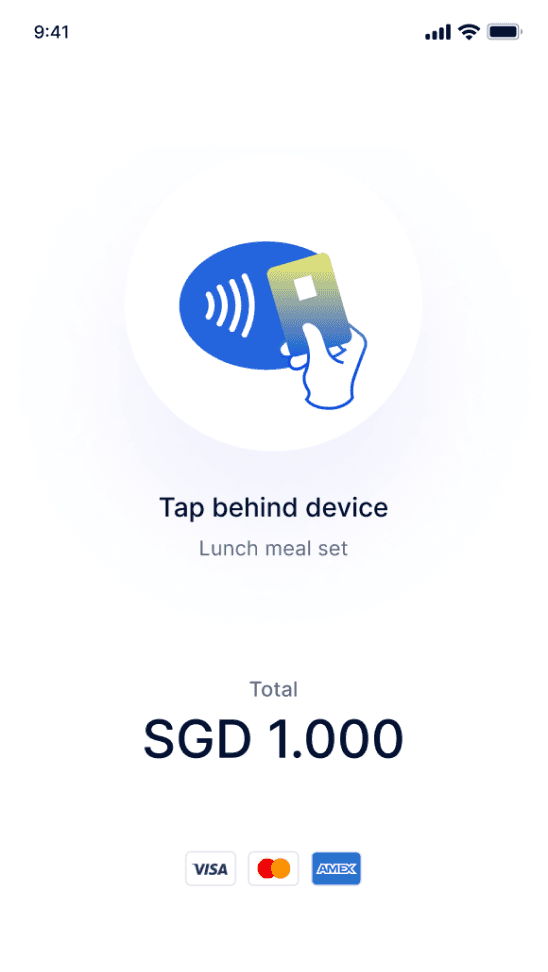

Titik Penjualan

Sinkronkan penjualan online dan offline dengan perangkat lunak gratis kami

Sinkronkan penjualan online dan offline dengan perangkat lunak gratis kami

Sinkronkan penjualan online dan offline dengan perangkat lunak gratis kami

HitPay POS menyediakan pemrosesan transaksi yang efisien, manajemen inventaris yang kokoh, dan analitik mendalam — semuanya dalam antarmuka ramah pengguna tanpa perlu kode. Mulailah secara gratis dengan harga sederhana per transaksi.

HitPay POS menyediakan pemrosesan transaksi yang efisien, manajemen inventaris yang kokoh, dan analitik mendalam — semuanya dalam antarmuka ramah pengguna tanpa perlu kode. Mulailah secara gratis dengan harga sederhana per transaksi.

HitPay POS menyediakan pemrosesan transaksi yang efisien, manajemen inventaris yang kokoh, dan analitik mendalam — semuanya dalam antarmuka ramah pengguna tanpa perlu kode. Mulailah secara gratis dengan harga sederhana per transaksi.

Toko Online

Bangun toko online Anda

dengan mudah

Bangun toko online Anda

dengan mudah

Bangun toko online Anda

dengan mudah

Bangun toko online Anda

dengan mudah

Wujudkan ide besarmu dengan pembuat toko online gratis dari HitPay. Tambahkan produk, sesuaikan desain, dan kelola pesanan dengan mudah.

Wujudkan ide besarmu dengan pembuat toko online gratis dari HitPay. Tambahkan produk, sesuaikan desain, dan kelola pesanan dengan mudah.

Wujudkan ide besarmu dengan pembuat toko online gratis dari HitPay. Tambahkan produk, sesuaikan desain, dan kelola pesanan dengan mudah.

PENGEMBANG

Jelajahi API pembayaran kami

Jelajahi API pembayaran kami

Jelajahi API pembayaran kami

Akses API pembayaran yang kuat dan ramah pengembang yang terintegrasi dengan mulus di berbagai platform. Dengan hanya satu integrasi yang mudah, API HitPay memungkinkan bisnis Anda untuk membuka pembayaran dan penarikan di seluruh pasar global.

Akses API pembayaran yang kuat dan ramah pengembang yang terintegrasi dengan mulus di berbagai platform. Dengan hanya satu integrasi yang mudah, API HitPay memungkinkan bisnis Anda untuk membuka pembayaran dan penarikan di seluruh pasar global.

Akses API pembayaran yang kuat dan ramah pengembang yang terintegrasi dengan mulus di berbagai platform. Dengan hanya satu integrasi yang mudah, API HitPay memungkinkan bisnis Anda untuk membuka pembayaran dan penarikan di seluruh pasar global.

Node.js

Ruby

Python

Go

PHP

Java

.NET

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

const hitpay = require("hitpay")("hp_test_BQokikJOvBiI2HlWgH4olfQ2");

// Create a payment intent to start a purchase flow

let paymentIntent = await hitpay.paymentIntents.create({

amount: 2000,

currency: "usd",

description: "My first payment",

});

// Complete the payment using a test card.

await hitpay.paymentIntents.confirm(paymentIntent.id, {

payment_method: "pm_card_mastercard",

});

Node.js

Ruby

Python

Go

PHP

Java

.NET

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

const hitpay = require("hitpay")("hp_test_BQokikJOvBiI2HlWgH4olfQ2");

// Create a payment intent to start a purchase flow

let paymentIntent = await hitpay.paymentIntents.create({

amount: 2000,

currency: "usd",

description: "My first payment",

});

// Complete the payment using a test card.

await hitpay.paymentIntents.confirm(paymentIntent.id, {

payment_method: "pm_card_mastercard",

});

Node.js

Ruby

Python

Go

PHP

Java

.NET

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

const hitpay = require("hitpay")("hp_test_BQokikJOvBiI2HlWgH4olfQ2");

// Create a payment intent to start a purchase flow

let paymentIntent = await hitpay.paymentIntents.create({

amount: 2000,

currency: "usd",

description: "My first payment",

});

// Complete the payment using a test card.

await hitpay.paymentIntents.confirm(paymentIntent.id, {

payment_method: "pm_card_mastercard",

});

Node.js

Ruby

Python

Go

PHP

Java

.NET

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

const hitpay = require("hitpay")("hp_test_BQokikJOvBiI2HlWgH4olfQ2");

// Create a payment intent to start a purchase flow

let paymentIntent = await hitpay.paymentIntents.create({

amount: 2000,

currency: "usd",

description: "My first payment",

});

// Complete the payment using a test card.

await hitpay.paymentIntents.confirm(paymentIntent.id, {

payment_method: "pm_card_mastercard",

});

Wujudkan ide besarmu dengan pembuat toko online gratis dari HitPay. Tambahkan produk, sesuaikan desain, dan kelola pesanan dengan mudah.

Wujudkan ide besarmu dengan pembuat toko online gratis dari HitPay. Tambahkan produk, sesuaikan desain, dan kelola pesanan dengan mudah.

Pertanyaan yang Sering Ditanyakan

Pertanyaan yang Sering Ditanyakan

Bagaimana cara saya memulai dengan HitPay?

Untuk memulai dengan HitPay, silakan daftarkan minat Anda kepada tim kami. Setelah bisnis Anda disetujui dan akun gratis Anda dibuat, Anda dapat mengakses seluruh rangkaian alat pemrosesan pembayaran HitPay.

Bagaimana cara saya memulai dengan HitPay?

Untuk memulai dengan HitPay, silakan daftarkan minat Anda kepada tim kami. Setelah bisnis Anda disetujui dan akun gratis Anda dibuat, Anda dapat mengakses seluruh rangkaian alat pemrosesan pembayaran HitPay.

Bagaimana cara saya memulai dengan HitPay?

Untuk memulai dengan HitPay, silakan daftarkan minat Anda kepada tim kami. Setelah bisnis Anda disetujui dan akun gratis Anda dibuat, Anda dapat mengakses seluruh rangkaian alat pemrosesan pembayaran HitPay.

Bagaimana cara saya memulai dengan HitPay?

Untuk memulai dengan HitPay, silakan daftarkan minat Anda kepada tim kami. Setelah bisnis Anda disetujui dan akun gratis Anda dibuat, Anda dapat mengakses seluruh rangkaian alat pemrosesan pembayaran HitPay.

Jenis bisnis apa yang dapat memanfaatkan HitPay?

Jenis bisnis apa yang dapat memanfaatkan HitPay?

Jenis bisnis apa yang dapat memanfaatkan HitPay?

Jenis bisnis apa yang dapat memanfaatkan HitPay?

Apakah HitPay aman?

Apakah HitPay aman?

Apakah HitPay aman?

Apakah HitPay aman?

Metode pembayaran apa yang bisa saya terima dengan HitPay?

Metode pembayaran apa yang bisa saya terima dengan HitPay?

Metode pembayaran apa yang bisa saya terima dengan HitPay?

Metode pembayaran apa yang bisa saya terima dengan HitPay?

Bisakah saya menggunakan HitPay untuk pembayaran online dan tatap muka?

Bisakah saya menggunakan HitPay untuk pembayaran online dan tatap muka?

Bisakah saya menggunakan HitPay untuk pembayaran online dan tatap muka?

Bisakah saya menggunakan HitPay untuk pembayaran online dan tatap muka?

Bagaimana cara saya mengintegrasikan HitPay dengan situs web atau aplikasi saya?

Bagaimana cara saya mengintegrasikan HitPay dengan situs web atau aplikasi saya?

Bagaimana cara saya mengintegrasikan HitPay dengan situs web atau aplikasi saya?

Bagaimana cara saya mengintegrasikan HitPay dengan situs web atau aplikasi saya?

Apakah ada biaya pendaftaran untuk menggunakan HitPay?

Apakah ada biaya pendaftaran untuk menggunakan HitPay?

Apakah ada biaya pendaftaran untuk menggunakan HitPay?

Apakah ada biaya pendaftaran untuk menggunakan HitPay?

Ada pertanyaan?

Mari kita siapkan Anda

Buat akun secara instan atau hubungi kami untuk membuat paket khusus untuk bisnis Anda.

perangkat lunak bisnis

Perusahaan

Singapura

Filipina

Malaysia

Indonesia

Thailand

Australia & Selandia Baru

Semua negara lain

HitPay Payment Solutions Pte Ltd ("HitPay") memiliki lisensi sebagai Institusi Pembayaran Utama (PS20200643) di bawah Undang-Undang Layanan Pembayaran Singapura untuk penyediaan Layanan Transfer Uang Domestik, Layanan Transfer Uang Lintas Batas, dan Layanan Akuisisi Merchant. Ini dapat dikonfirmasi di Direktori Institusi Keuangan MAS di sini. HitPay juga dapat menyediakan layanan ini bersama dengan mitra lain yang memiliki lisensi atau pengecualian dari MAS.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapura 089109

Mari kita siapkan Anda

Buat akun secara instan atau hubungi kami untuk membuat paket khusus untuk bisnis Anda.

perangkat lunak bisnis

Perusahaan

Singapura

Filipina

Malaysia

Indonesia

Thailand

Australia & Selandia Baru

Semua negara lain

HitPay Payment Solutions Pte Ltd ("HitPay") memiliki lisensi sebagai Institusi Pembayaran Utama (PS20200643) di bawah Undang-Undang Layanan Pembayaran Singapura untuk penyediaan Layanan Transfer Uang Domestik, Layanan Transfer Uang Lintas Batas, dan Layanan Akuisisi Merchant. Ini dapat dikonfirmasi di Direktori Institusi Keuangan MAS di sini. HitPay juga dapat menyediakan layanan ini bersama dengan mitra lain yang memiliki lisensi atau pengecualian dari MAS.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapura 089109

Mari kita siapkan Anda

Buat akun secara instan atau hubungi kami untuk membuat paket khusus untuk bisnis Anda.

perangkat lunak bisnis

Perusahaan

Singapura

Filipina

Malaysia

Indonesia

Thailand

Australia & Selandia Baru

Semua negara lain

HitPay Payment Solutions Pte Ltd ("HitPay") memiliki lisensi sebagai Institusi Pembayaran Utama (PS20200643) di bawah Undang-Undang Layanan Pembayaran Singapura untuk penyediaan Layanan Transfer Uang Domestik, Layanan Transfer Uang Lintas Batas, dan Layanan Akuisisi Pedagang. Ini dapat dikonfirmasi di Direktori Institusi Keuangan MAS di sini. HitPay juga dapat menyediakan layanan ini bersama dengan mitra lain yang dilisensikan oleh MAS atau yang dibebaskan.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapura 089109

Mari kita siapkan Anda

Buat akun secara instan atau hubungi kami untuk membuat paket khusus untuk bisnis Anda.

perangkat lunak bisnis

Perusahaan

Singapura

Filipina

Malaysia

Indonesia

Thailand

Australia & Selandia Baru

Semua negara lain

HitPay Payment Solutions Pte Ltd ("HitPay") memiliki lisensi sebagai Institusi Pembayaran Utama (PS20200643) di bawah Undang-Undang Layanan Pembayaran Singapura untuk penyediaan Layanan Transfer Uang Domestik, Layanan Transfer Uang Lintas Batas, dan Layanan Akuisisi Merchant. Ini dapat dikonfirmasi di Direktori Institusi Keuangan MAS di sini. HitPay juga dapat menyediakan layanan ini bersama dengan mitra lain yang memiliki lisensi atau pengecualian dari MAS.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapura 089109