What is a Cashless Payment? A Simple Guide

October 20, 2023

Cashless payments are transforming the way businesses and consumers handle transactions in Malaysia. With their convenience, speed, and security, cashless payments are becoming increasingly popular. In this article, we explore why.

Cashless payments represent monetary transactions without the exchange of physical cash, transforming the way businesses and consumers handle transactions.

Cashless payments in Malaysia are expected to grow by 20.8% to reach MYR371.8bn ($84.5bn) in 2023. The increased adoption of cashless payments can be attributed to their convenience, speed, and security.

Payment processing platforms like HitPay play a crucial role in facilitating cashless transactions for small and medium-sized enterprises (SMEs).

How do Cashless Payments Work?

Cashless payments are any type of payment that does not involve the exchange of physical cash.

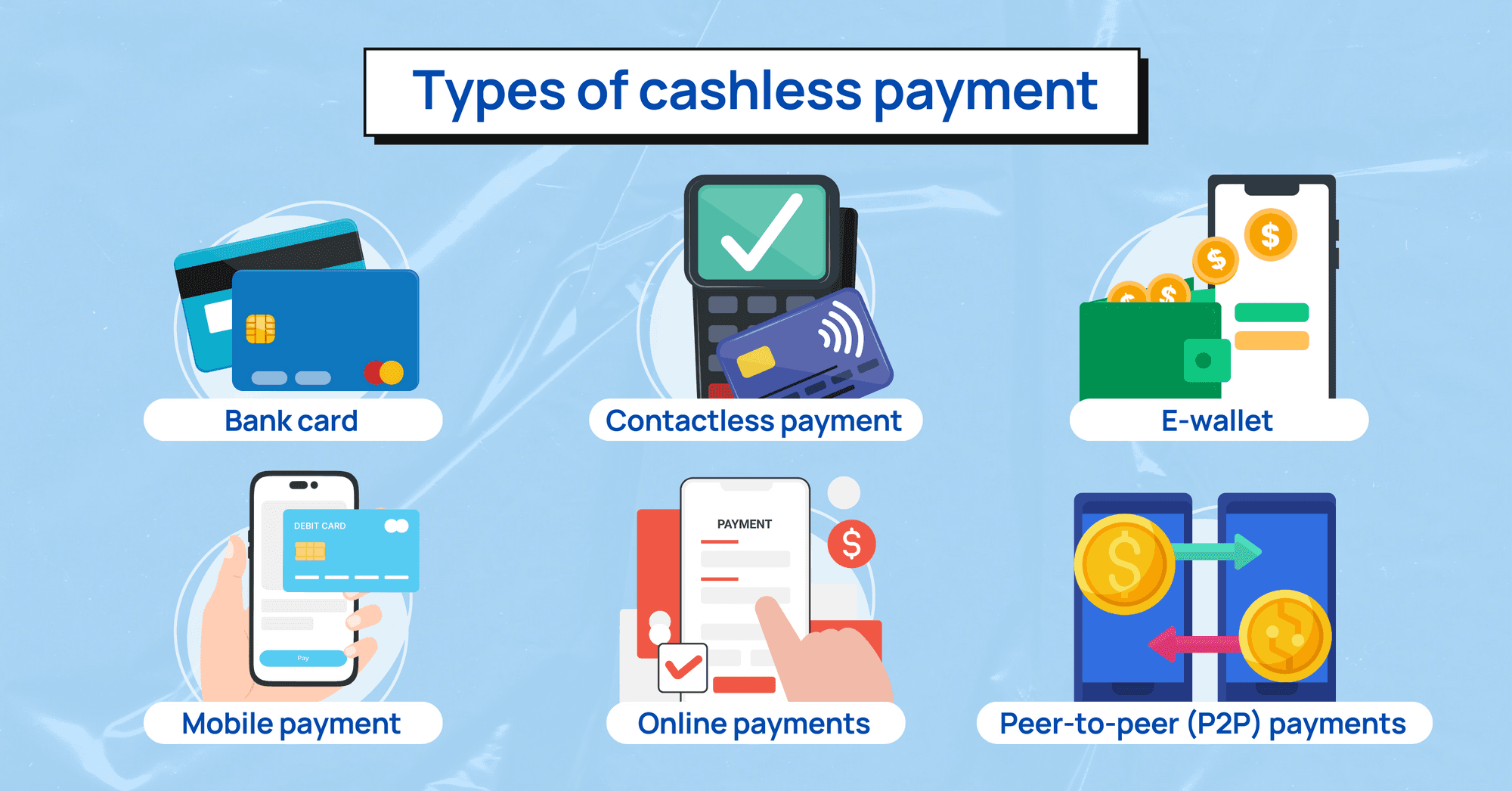

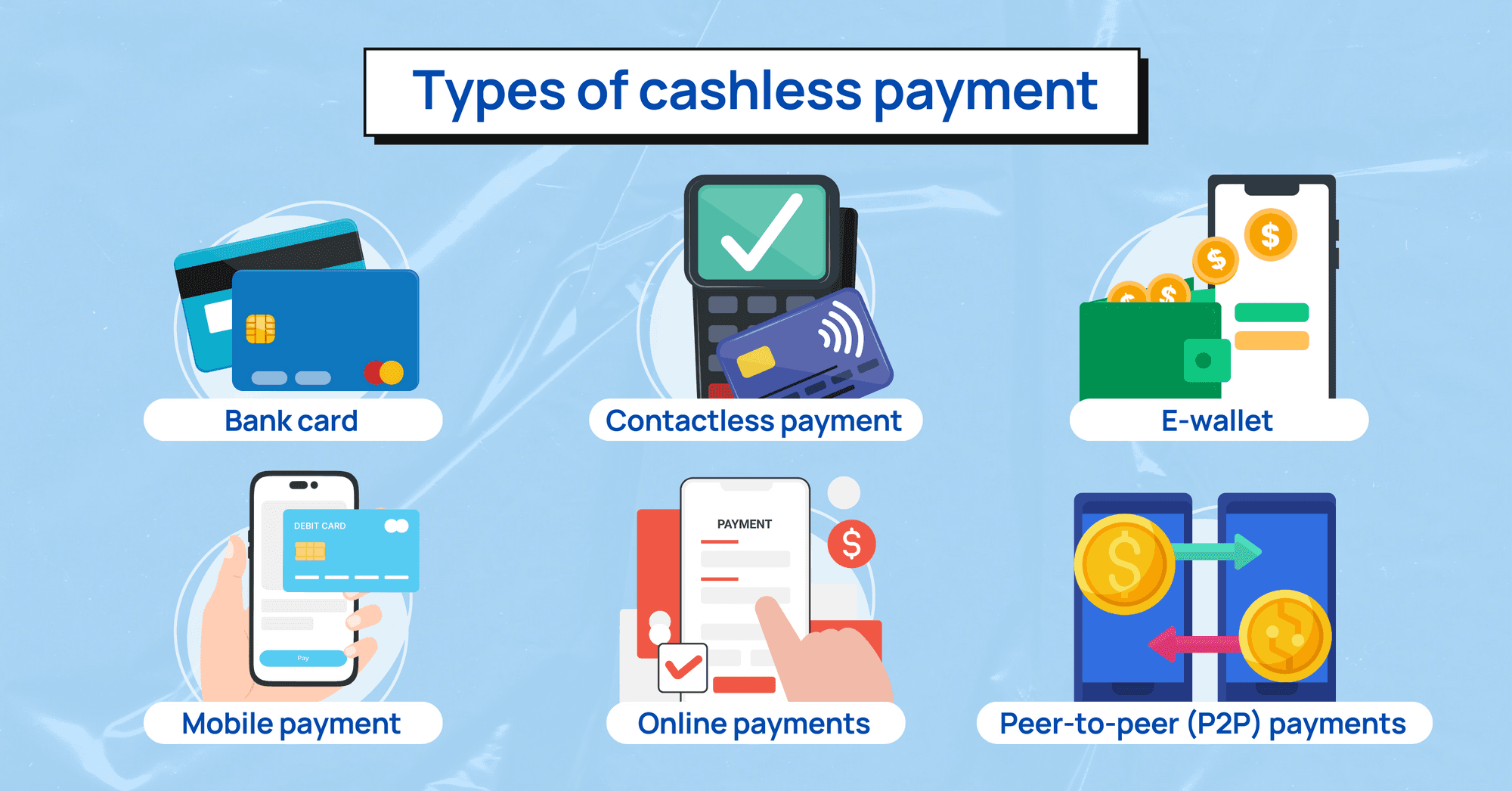

There are many different types of cashless payments, but they all work by transferring money from the payer's account to the recipient's account electronically. Let's explore the different types.

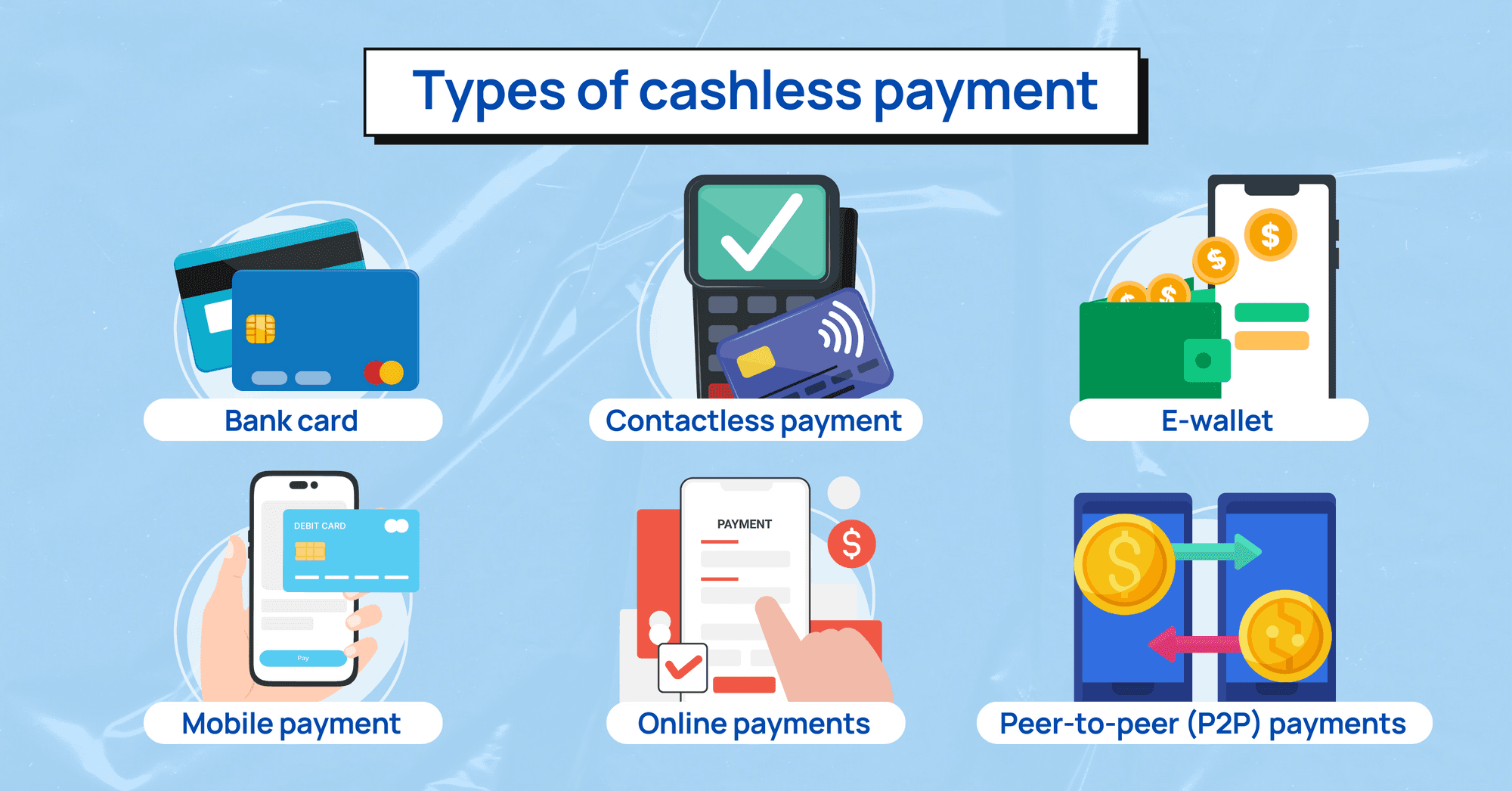

Bank Card

Bank cards are one of the most popular types of cashless payments. They can be used to make purchases in stores, online, and over the phone.

Bank cards can be either debit cards or credit cards. Debit cards are linked to your bank account and withdraw money directly from your account when you make a purchase.

Credit cards allow you to borrow money from the bank to make purchases. You repay the borrowed money plus interest over time.

Contactless Payment

Contactless payments are a type of bank card payment that allows you to pay for goods and services by tapping your card or phone on the merchant's terminal.

Contactless payments are typically faster and more convenient than traditional bank card payments, and they are also more secure.

E-Wallet

E-wallets are digital wallets that store your money electronically. E-wallets can be used to make payments online, in stores, and even to send and receive money from other people.

To use an e-wallet, you will typically need to create an account and then load money into your wallet from your bank account.

Once you have money in your e-wallet, you can use it to make payments by scanning the merchant's QR code or by entering your e-wallet credentials.

Mobile payments

Mobile payments allow you to use your phone to make payments.

This can be done using a variety of methods, such as mobile wallets, QR codes, and near-field communication (NFC). Mobile payments are becoming increasingly popular, as they are convenient and secure.

Online payments

Online payments allow you to make purchases on the internet using a variety of methods, such as credit cards, debit cards, and PayPal.

Online payments are essential for e-commerce, and they are becoming increasingly popular for other types of transactions, such as paying bills and sending money to friends and family.

Peer-to-peer (P2P) payments

P2P payments allow you to send and receive money from other people using a variety of apps and services.

This is a convenient way to split bills with friends or send money to family members.

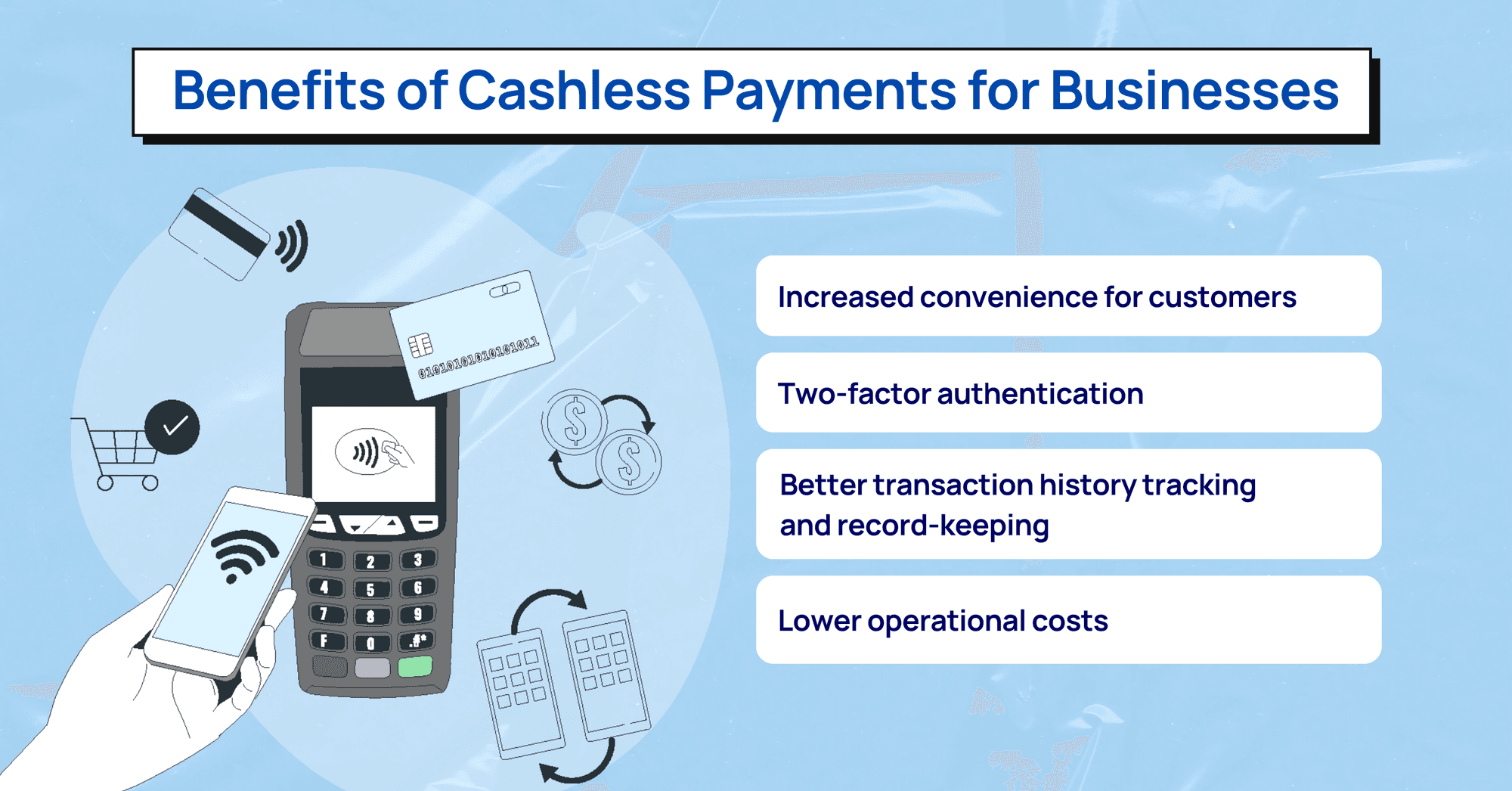

Benefits of Cashless Payments for Businesses

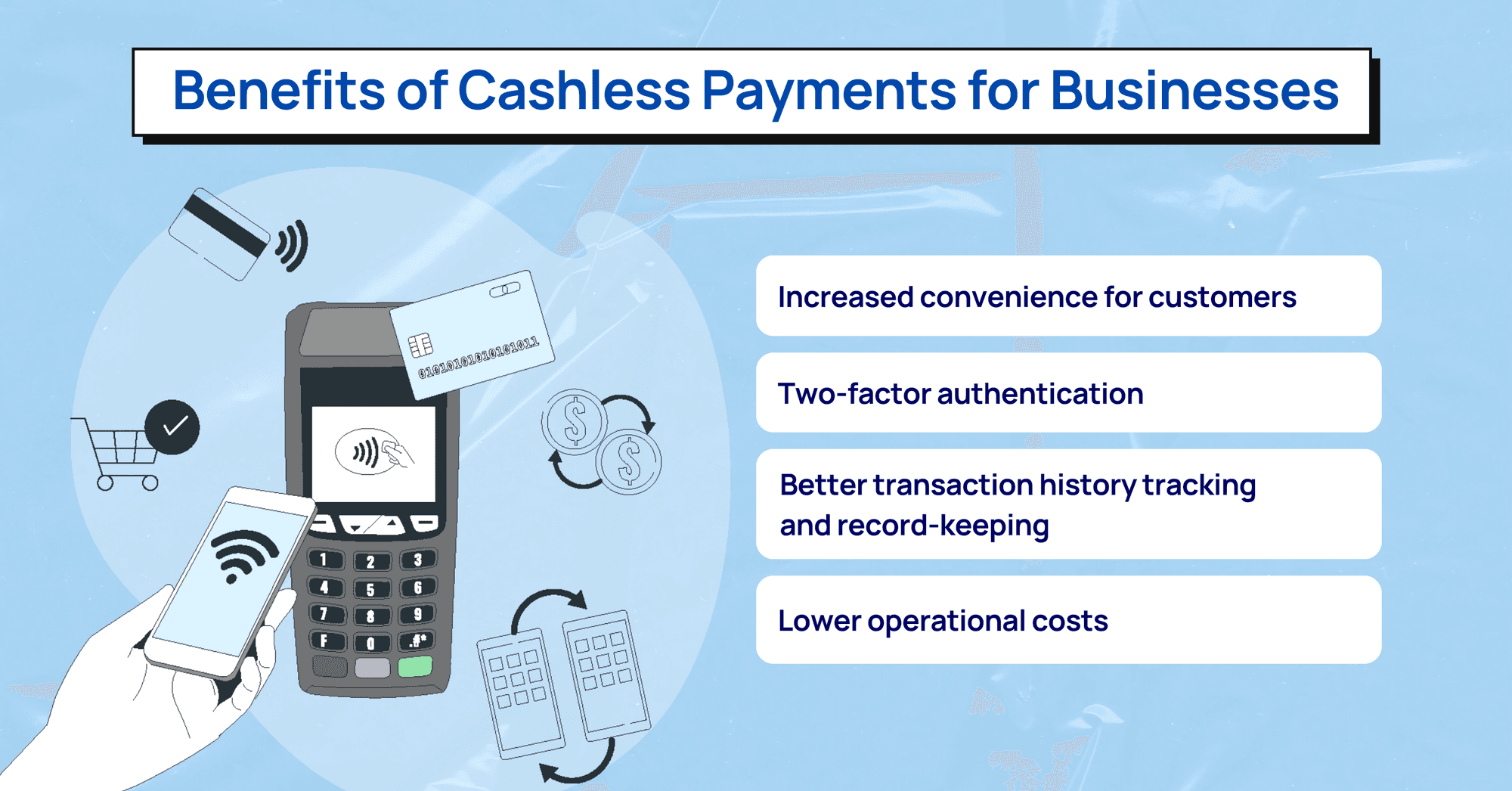

Adopting cashless payment methods offers numerous advantages for businesses, starting with increased convenience for customers. Time-saving and flexible payment options cater to the growing preferences of consumers, ultimately driving sales and increasing customer satisfaction.

Security is another benefit, as cashless payment methods use encryption and authentication measures to protect transaction data. Added security features, such as two-factor authentication, provide an extra layer of protection for customers and businesses alike.

Better transaction history tracking and record-keeping allow businesses to gain valuable insights into customer behaviour, helping them make data-driven decisions and tailor their offerings.

Additionally, cashless payments can lower operational costs for businesses by reducing the need for cash handling and streamlining payment processing.

Overall, the adoption of cashless payment methods can boost customer satisfaction and sales, while providing businesses with valuable data and a more efficient payment processing system.

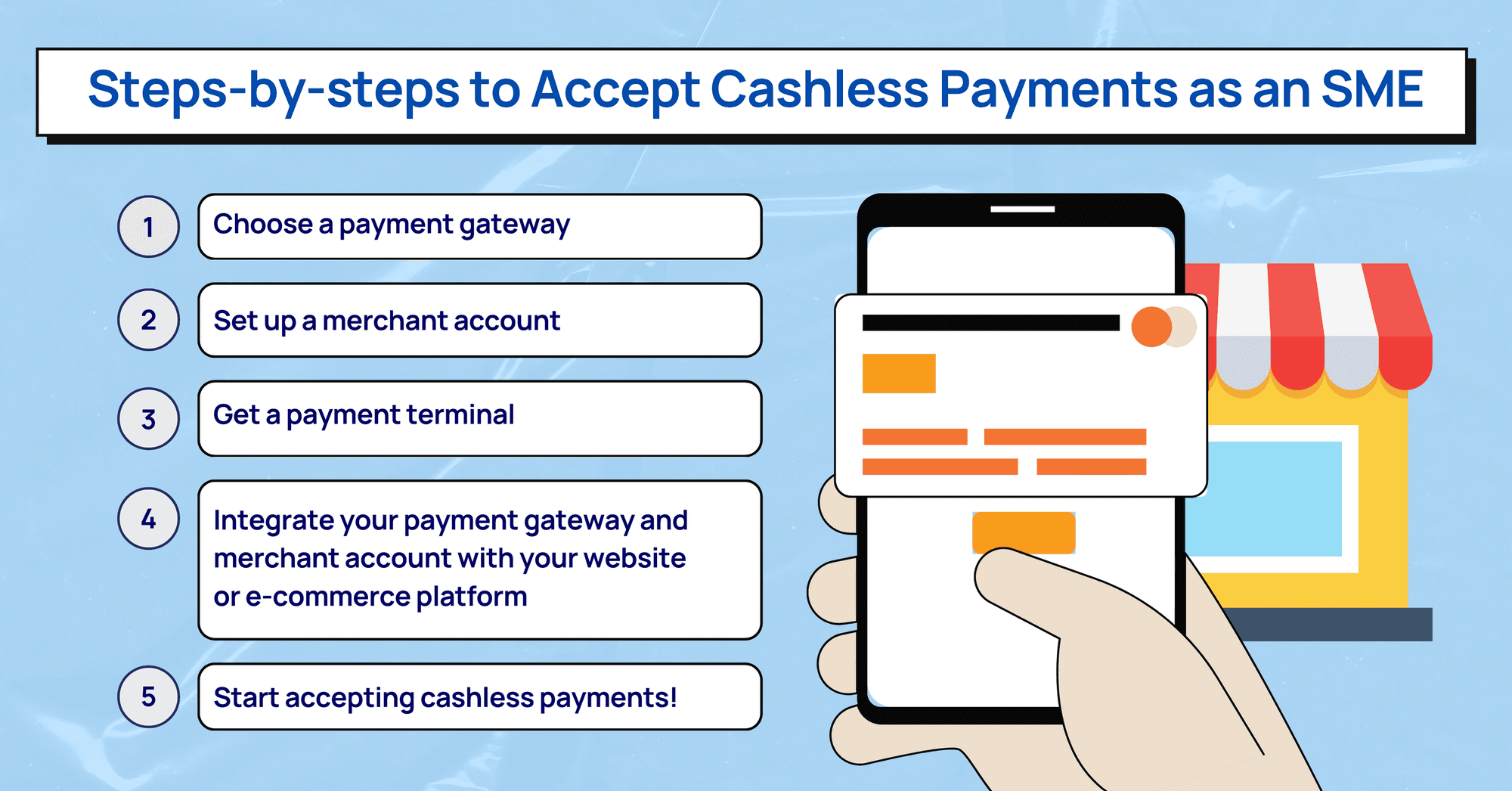

How to Accept Cashless Payments as an SME

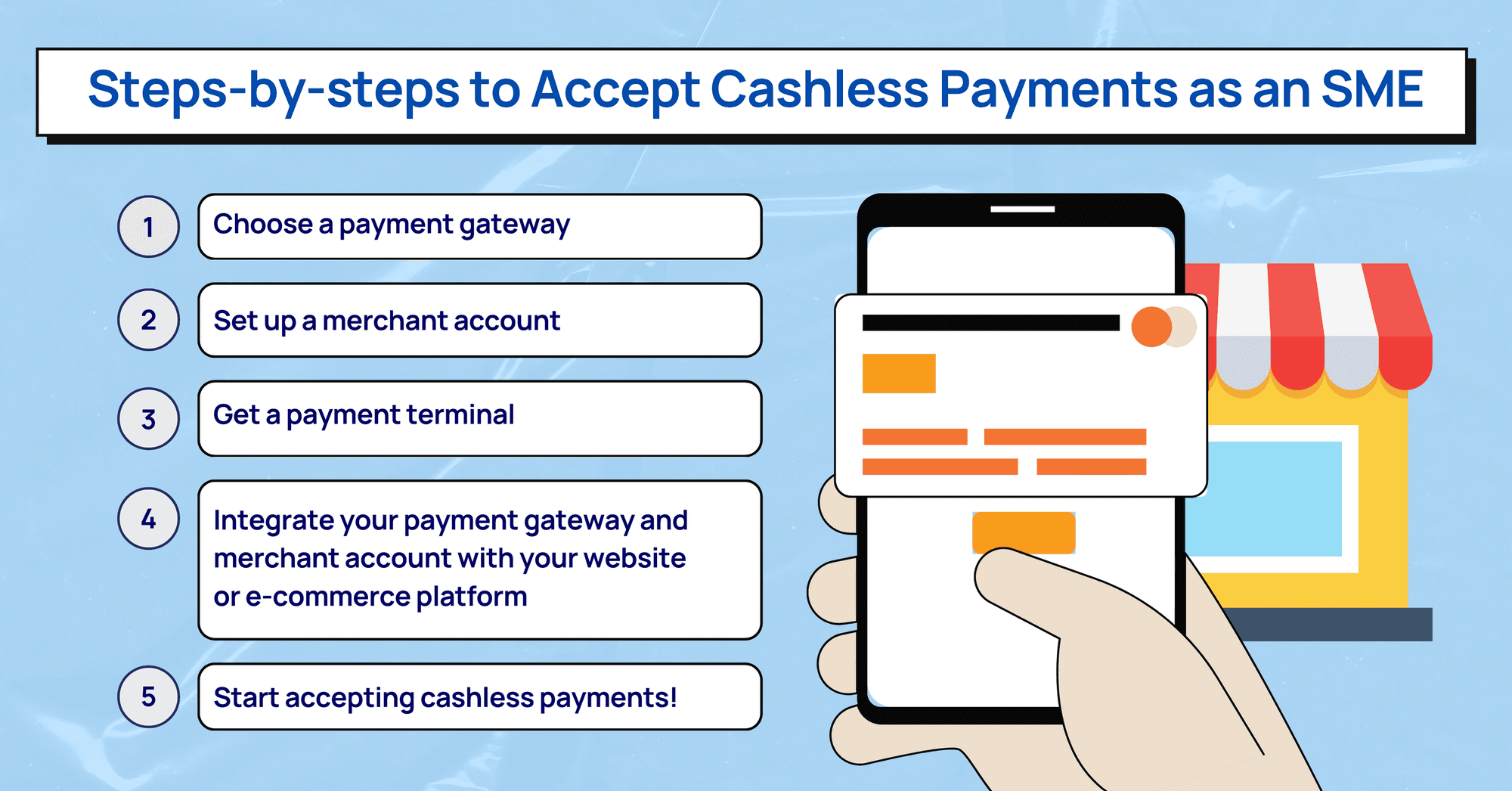

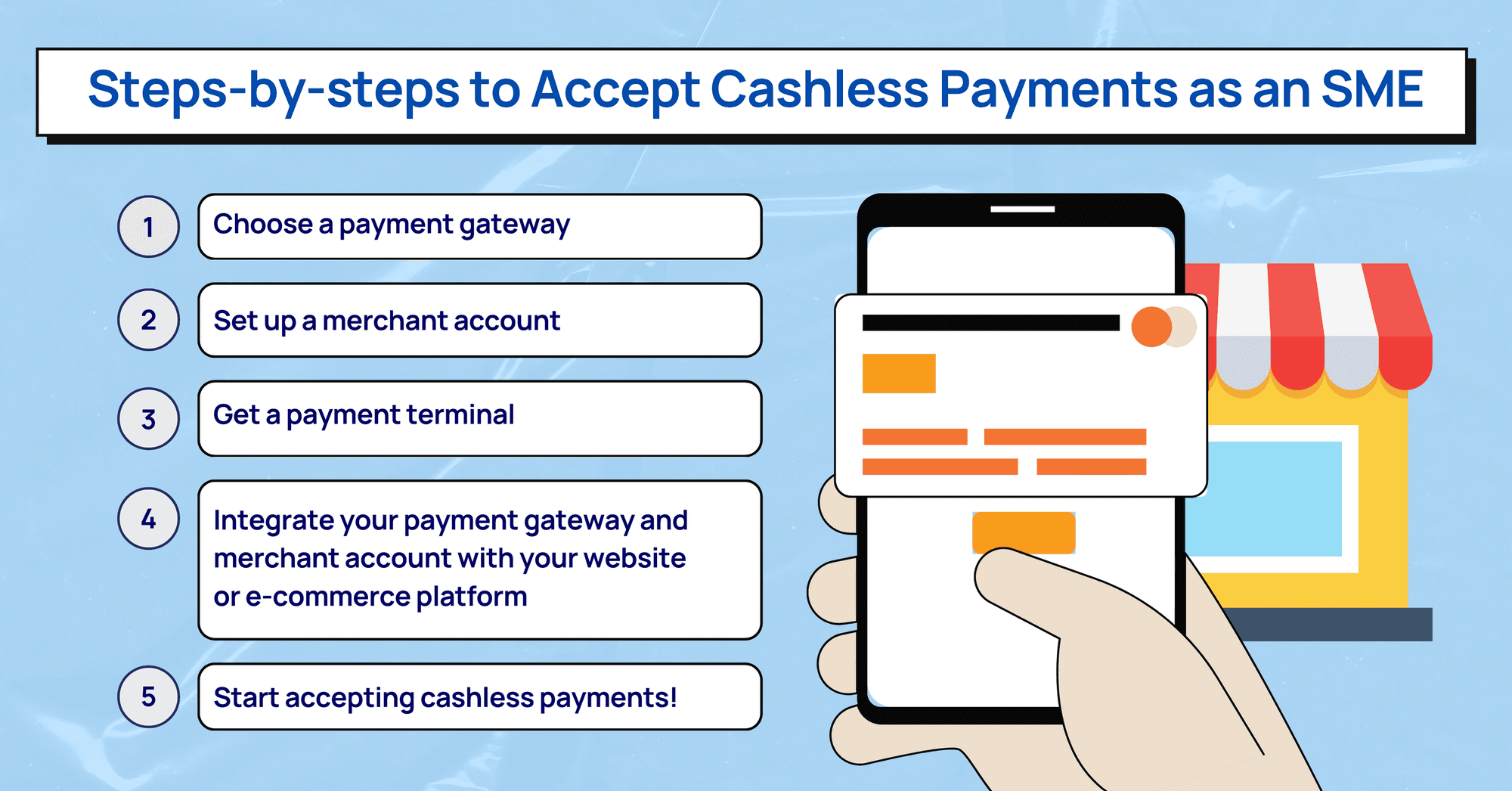

It's never been easier to accept card payments, with a wide range of payment gateways and terminals available for businesses of all sizes.

In just a few simple steps, you can start accepting card payments in your store or online, and give your customers the convenience and security they expect.

Choose a payment gateway. A payment gateway is a service that processes payments from customers and transfers the money to your merchant account. There are many different payment gateways available, so you can choose one that best meets your needs and budget. HitPay is a great option for small businesses that are looking for a cheap and reliable payment gateway. It offers a wide range of features, including support for multiple payment methods, recurring billing, and fraud protection. HitPay is also easy to use and integrates with popular e-commerce platforms.

Set up a merchant account. A merchant account is a special type of bank account that allows you to accept payments from customers. You can apply for a merchant account from a variety of banks and financial institutions.

Get a payment terminal. A payment terminal is a device that allows customers to make cashless payments. Payment terminals can be either countertop or mobile.

Integrate your payment gateway and merchant account with your website or e-commerce platform. This process can be done by following the instructions provided by your merchant account provider and payment gateway provider.

Start accepting cashless payments! Once you have everything set up, you will be able to accept cashless payments from customers. When a customer makes a cashless payment, the payment gateway will process the payment and transfer the money to your merchant account. You will then be able to withdraw the money from your merchant account to your regular bank account.

Conclusion

The use of cashless payments is changing the way businesses and consumers handle transactions in Malaysia. Cashless payments offer a variety of benefits for both businesses and consumers, including convenience, speed, security, and insights.

Businesses that adopt cashless payment methods can benefit from increased customer satisfaction, enhanced security, better insights, and reduced operational costs. Consumers can benefit from time-saving and flexible payment options, a more secure payment experience, and the convenience of being able to make payments without having to carry cash.

Payment processing platforms like HitPay play a crucial role in facilitating cashless transactions for SMEs. HitPay is a cheap and reliable payment gateway that offers a wide range of features, making it a great option for SMEs looking to accept cashless payments.

If you are a business owner, consider adopting cashless payment methods to offer your customers the convenience and security they demand.

Have questions about HitPay?

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

What is a Cashless Payment? A Simple Guide

October 20, 2023

Cashless payments are transforming the way businesses and consumers handle transactions in Malaysia. With their convenience, speed, and security, cashless payments are becoming increasingly popular. In this article, we explore why.

Cashless payments represent monetary transactions without the exchange of physical cash, transforming the way businesses and consumers handle transactions.

Cashless payments in Malaysia are expected to grow by 20.8% to reach MYR371.8bn ($84.5bn) in 2023. The increased adoption of cashless payments can be attributed to their convenience, speed, and security.

Payment processing platforms like HitPay play a crucial role in facilitating cashless transactions for small and medium-sized enterprises (SMEs).

How do Cashless Payments Work?

Cashless payments are any type of payment that does not involve the exchange of physical cash.

There are many different types of cashless payments, but they all work by transferring money from the payer's account to the recipient's account electronically. Let's explore the different types.

Bank Card

Bank cards are one of the most popular types of cashless payments. They can be used to make purchases in stores, online, and over the phone.

Bank cards can be either debit cards or credit cards. Debit cards are linked to your bank account and withdraw money directly from your account when you make a purchase.

Credit cards allow you to borrow money from the bank to make purchases. You repay the borrowed money plus interest over time.

Contactless Payment

Contactless payments are a type of bank card payment that allows you to pay for goods and services by tapping your card or phone on the merchant's terminal.

Contactless payments are typically faster and more convenient than traditional bank card payments, and they are also more secure.

E-Wallet

E-wallets are digital wallets that store your money electronically. E-wallets can be used to make payments online, in stores, and even to send and receive money from other people.

To use an e-wallet, you will typically need to create an account and then load money into your wallet from your bank account.

Once you have money in your e-wallet, you can use it to make payments by scanning the merchant's QR code or by entering your e-wallet credentials.

Mobile payments

Mobile payments allow you to use your phone to make payments.

This can be done using a variety of methods, such as mobile wallets, QR codes, and near-field communication (NFC). Mobile payments are becoming increasingly popular, as they are convenient and secure.

Online payments

Online payments allow you to make purchases on the internet using a variety of methods, such as credit cards, debit cards, and PayPal.

Online payments are essential for e-commerce, and they are becoming increasingly popular for other types of transactions, such as paying bills and sending money to friends and family.

Peer-to-peer (P2P) payments

P2P payments allow you to send and receive money from other people using a variety of apps and services.

This is a convenient way to split bills with friends or send money to family members.

Benefits of Cashless Payments for Businesses

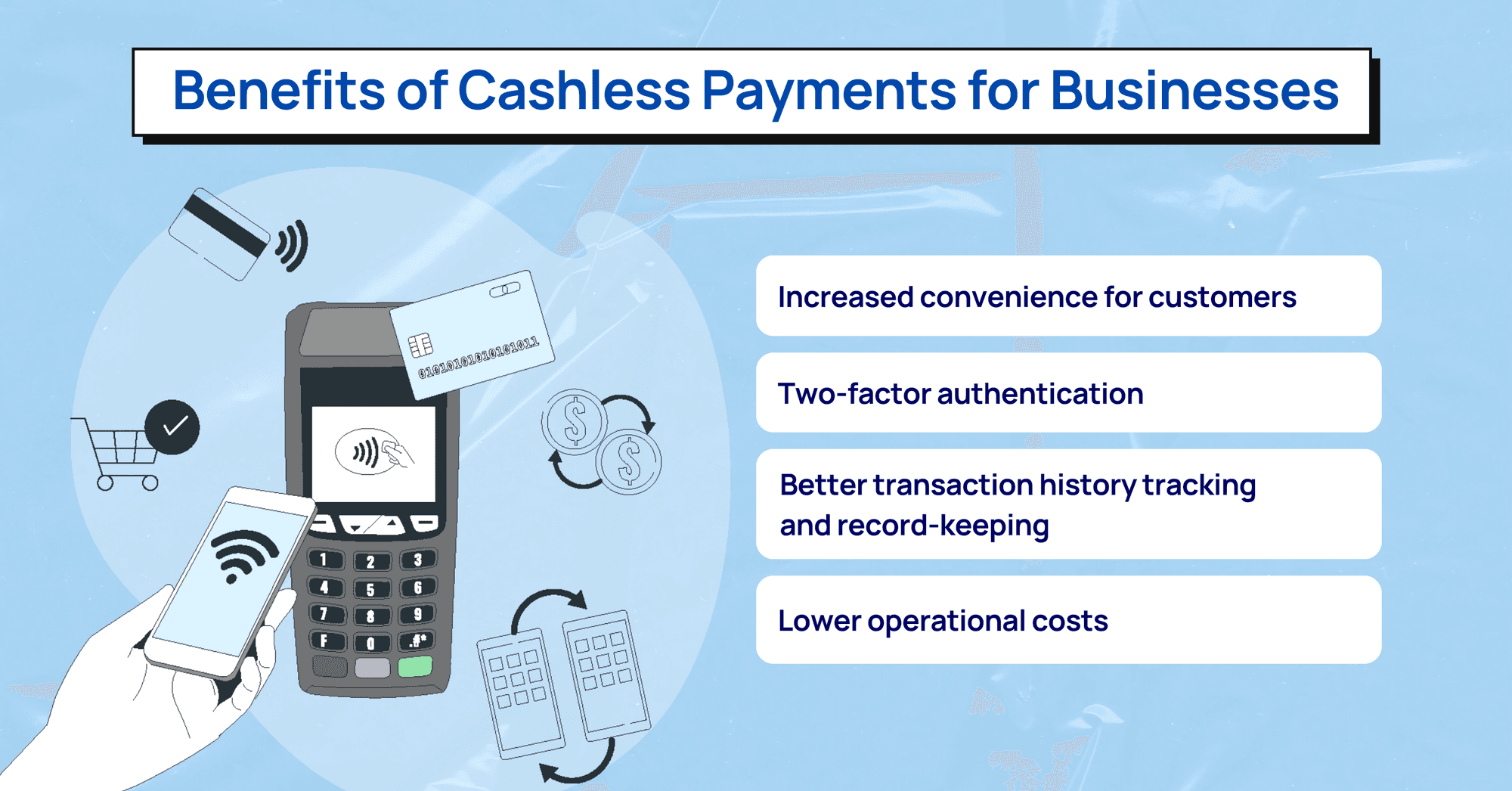

Adopting cashless payment methods offers numerous advantages for businesses, starting with increased convenience for customers. Time-saving and flexible payment options cater to the growing preferences of consumers, ultimately driving sales and increasing customer satisfaction.

Security is another benefit, as cashless payment methods use encryption and authentication measures to protect transaction data. Added security features, such as two-factor authentication, provide an extra layer of protection for customers and businesses alike.

Better transaction history tracking and record-keeping allow businesses to gain valuable insights into customer behaviour, helping them make data-driven decisions and tailor their offerings.

Additionally, cashless payments can lower operational costs for businesses by reducing the need for cash handling and streamlining payment processing.

Overall, the adoption of cashless payment methods can boost customer satisfaction and sales, while providing businesses with valuable data and a more efficient payment processing system.

How to Accept Cashless Payments as an SME

It's never been easier to accept card payments, with a wide range of payment gateways and terminals available for businesses of all sizes.

In just a few simple steps, you can start accepting card payments in your store or online, and give your customers the convenience and security they expect.

Choose a payment gateway. A payment gateway is a service that processes payments from customers and transfers the money to your merchant account. There are many different payment gateways available, so you can choose one that best meets your needs and budget. HitPay is a great option for small businesses that are looking for a cheap and reliable payment gateway. It offers a wide range of features, including support for multiple payment methods, recurring billing, and fraud protection. HitPay is also easy to use and integrates with popular e-commerce platforms.

Set up a merchant account. A merchant account is a special type of bank account that allows you to accept payments from customers. You can apply for a merchant account from a variety of banks and financial institutions.

Get a payment terminal. A payment terminal is a device that allows customers to make cashless payments. Payment terminals can be either countertop or mobile.

Integrate your payment gateway and merchant account with your website or e-commerce platform. This process can be done by following the instructions provided by your merchant account provider and payment gateway provider.

Start accepting cashless payments! Once you have everything set up, you will be able to accept cashless payments from customers. When a customer makes a cashless payment, the payment gateway will process the payment and transfer the money to your merchant account. You will then be able to withdraw the money from your merchant account to your regular bank account.

Conclusion

The use of cashless payments is changing the way businesses and consumers handle transactions in Malaysia. Cashless payments offer a variety of benefits for both businesses and consumers, including convenience, speed, security, and insights.

Businesses that adopt cashless payment methods can benefit from increased customer satisfaction, enhanced security, better insights, and reduced operational costs. Consumers can benefit from time-saving and flexible payment options, a more secure payment experience, and the convenience of being able to make payments without having to carry cash.

Payment processing platforms like HitPay play a crucial role in facilitating cashless transactions for SMEs. HitPay is a cheap and reliable payment gateway that offers a wide range of features, making it a great option for SMEs looking to accept cashless payments.

If you are a business owner, consider adopting cashless payment methods to offer your customers the convenience and security they demand.

Have questions about HitPay?

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

What is a Cashless Payment? A Simple Guide

October 20, 2023

Cashless payments are transforming the way businesses and consumers handle transactions in Malaysia. With their convenience, speed, and security, cashless payments are becoming increasingly popular. In this article, we explore why.

Cashless payments represent monetary transactions without the exchange of physical cash, transforming the way businesses and consumers handle transactions.

Cashless payments in Malaysia are expected to grow by 20.8% to reach MYR371.8bn ($84.5bn) in 2023. The increased adoption of cashless payments can be attributed to their convenience, speed, and security.

Payment processing platforms like HitPay play a crucial role in facilitating cashless transactions for small and medium-sized enterprises (SMEs).

How do Cashless Payments Work?

Cashless payments are any type of payment that does not involve the exchange of physical cash.

There are many different types of cashless payments, but they all work by transferring money from the payer's account to the recipient's account electronically. Let's explore the different types.

Bank Card

Bank cards are one of the most popular types of cashless payments. They can be used to make purchases in stores, online, and over the phone.

Bank cards can be either debit cards or credit cards. Debit cards are linked to your bank account and withdraw money directly from your account when you make a purchase.

Credit cards allow you to borrow money from the bank to make purchases. You repay the borrowed money plus interest over time.

Contactless Payment

Contactless payments are a type of bank card payment that allows you to pay for goods and services by tapping your card or phone on the merchant's terminal.

Contactless payments are typically faster and more convenient than traditional bank card payments, and they are also more secure.

E-Wallet

E-wallets are digital wallets that store your money electronically. E-wallets can be used to make payments online, in stores, and even to send and receive money from other people.

To use an e-wallet, you will typically need to create an account and then load money into your wallet from your bank account.

Once you have money in your e-wallet, you can use it to make payments by scanning the merchant's QR code or by entering your e-wallet credentials.

Mobile payments

Mobile payments allow you to use your phone to make payments.

This can be done using a variety of methods, such as mobile wallets, QR codes, and near-field communication (NFC). Mobile payments are becoming increasingly popular, as they are convenient and secure.

Online payments

Online payments allow you to make purchases on the internet using a variety of methods, such as credit cards, debit cards, and PayPal.

Online payments are essential for e-commerce, and they are becoming increasingly popular for other types of transactions, such as paying bills and sending money to friends and family.

Peer-to-peer (P2P) payments

P2P payments allow you to send and receive money from other people using a variety of apps and services.

This is a convenient way to split bills with friends or send money to family members.

Benefits of Cashless Payments for Businesses

Adopting cashless payment methods offers numerous advantages for businesses, starting with increased convenience for customers. Time-saving and flexible payment options cater to the growing preferences of consumers, ultimately driving sales and increasing customer satisfaction.

Security is another benefit, as cashless payment methods use encryption and authentication measures to protect transaction data. Added security features, such as two-factor authentication, provide an extra layer of protection for customers and businesses alike.

Better transaction history tracking and record-keeping allow businesses to gain valuable insights into customer behaviour, helping them make data-driven decisions and tailor their offerings.

Additionally, cashless payments can lower operational costs for businesses by reducing the need for cash handling and streamlining payment processing.

Overall, the adoption of cashless payment methods can boost customer satisfaction and sales, while providing businesses with valuable data and a more efficient payment processing system.

How to Accept Cashless Payments as an SME

It's never been easier to accept card payments, with a wide range of payment gateways and terminals available for businesses of all sizes.

In just a few simple steps, you can start accepting card payments in your store or online, and give your customers the convenience and security they expect.

Choose a payment gateway. A payment gateway is a service that processes payments from customers and transfers the money to your merchant account. There are many different payment gateways available, so you can choose one that best meets your needs and budget. HitPay is a great option for small businesses that are looking for a cheap and reliable payment gateway. It offers a wide range of features, including support for multiple payment methods, recurring billing, and fraud protection. HitPay is also easy to use and integrates with popular e-commerce platforms.

Set up a merchant account. A merchant account is a special type of bank account that allows you to accept payments from customers. You can apply for a merchant account from a variety of banks and financial institutions.

Get a payment terminal. A payment terminal is a device that allows customers to make cashless payments. Payment terminals can be either countertop or mobile.

Integrate your payment gateway and merchant account with your website or e-commerce platform. This process can be done by following the instructions provided by your merchant account provider and payment gateway provider.

Start accepting cashless payments! Once you have everything set up, you will be able to accept cashless payments from customers. When a customer makes a cashless payment, the payment gateway will process the payment and transfer the money to your merchant account. You will then be able to withdraw the money from your merchant account to your regular bank account.

Conclusion

The use of cashless payments is changing the way businesses and consumers handle transactions in Malaysia. Cashless payments offer a variety of benefits for both businesses and consumers, including convenience, speed, security, and insights.

Businesses that adopt cashless payment methods can benefit from increased customer satisfaction, enhanced security, better insights, and reduced operational costs. Consumers can benefit from time-saving and flexible payment options, a more secure payment experience, and the convenience of being able to make payments without having to carry cash.

Payment processing platforms like HitPay play a crucial role in facilitating cashless transactions for SMEs. HitPay is a cheap and reliable payment gateway that offers a wide range of features, making it a great option for SMEs looking to accept cashless payments.

If you are a business owner, consider adopting cashless payment methods to offer your customers the convenience and security they demand.

Have questions about HitPay?

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.