Singapore Company Registration: A Step-by-Step Guide For Entrepreneurs

March 21, 2024

Thinking of incorporating a business in Singapore? Learn why Singapore’s an excellent place for entrepreneurs and how to register a company in Singapore

Are you considering registering a business in Singapore or bringing your online business internationally?

Here’s our guide to incorporating a business in Singapore and how HitPay’s payment solution can help simplify registering a company for your budding SME.

5 reasons you should register a company in Singapore

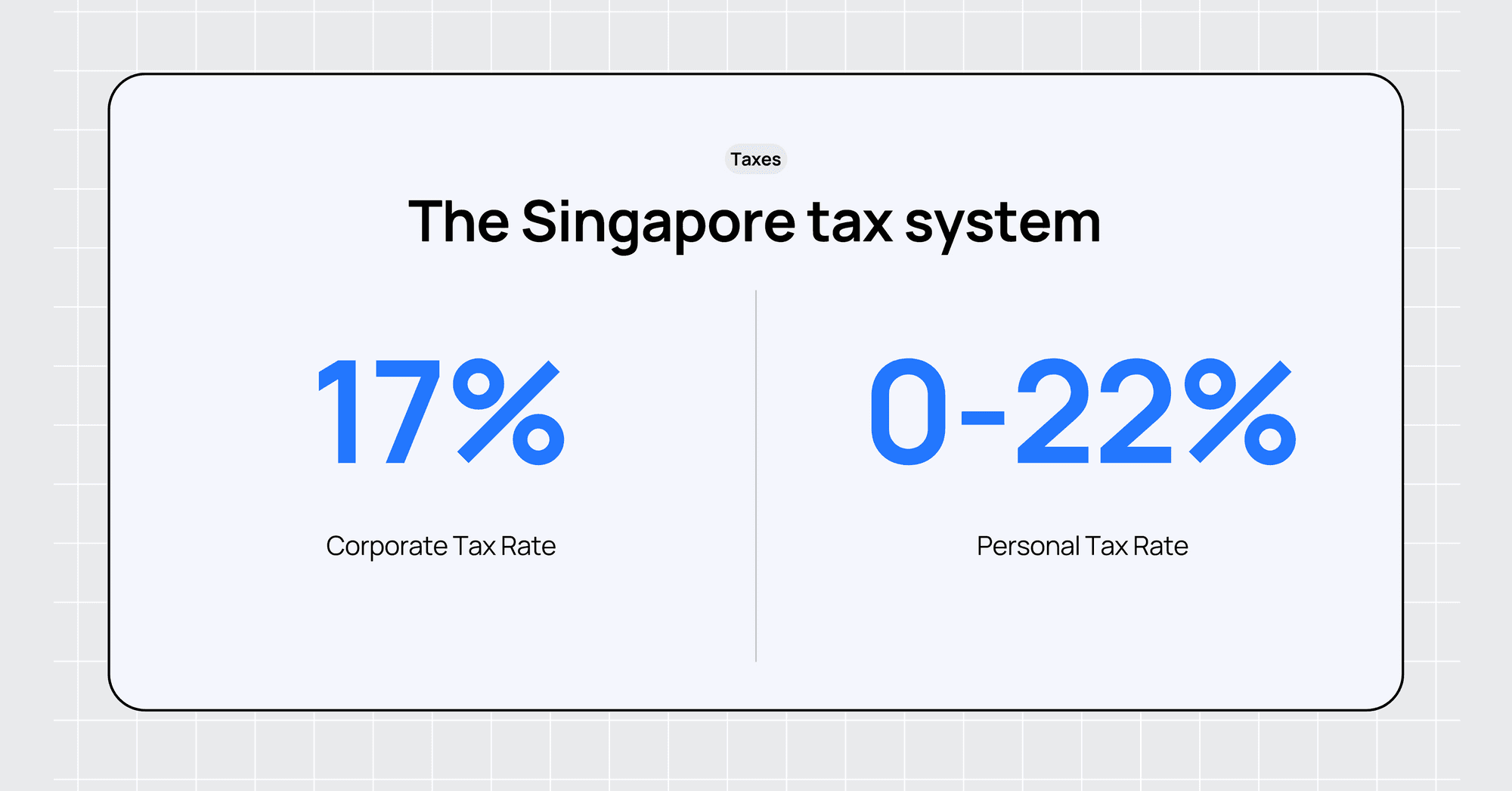

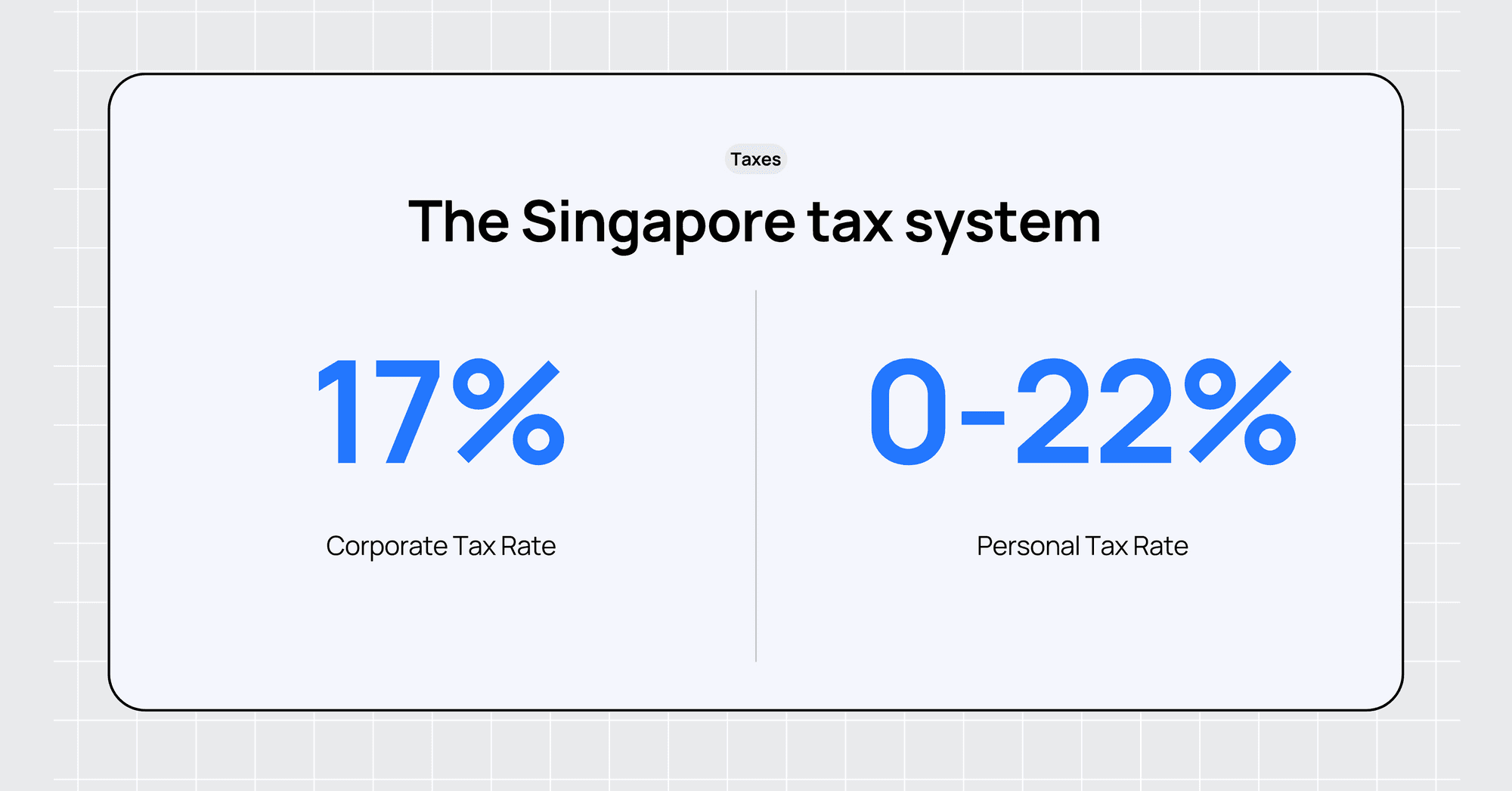

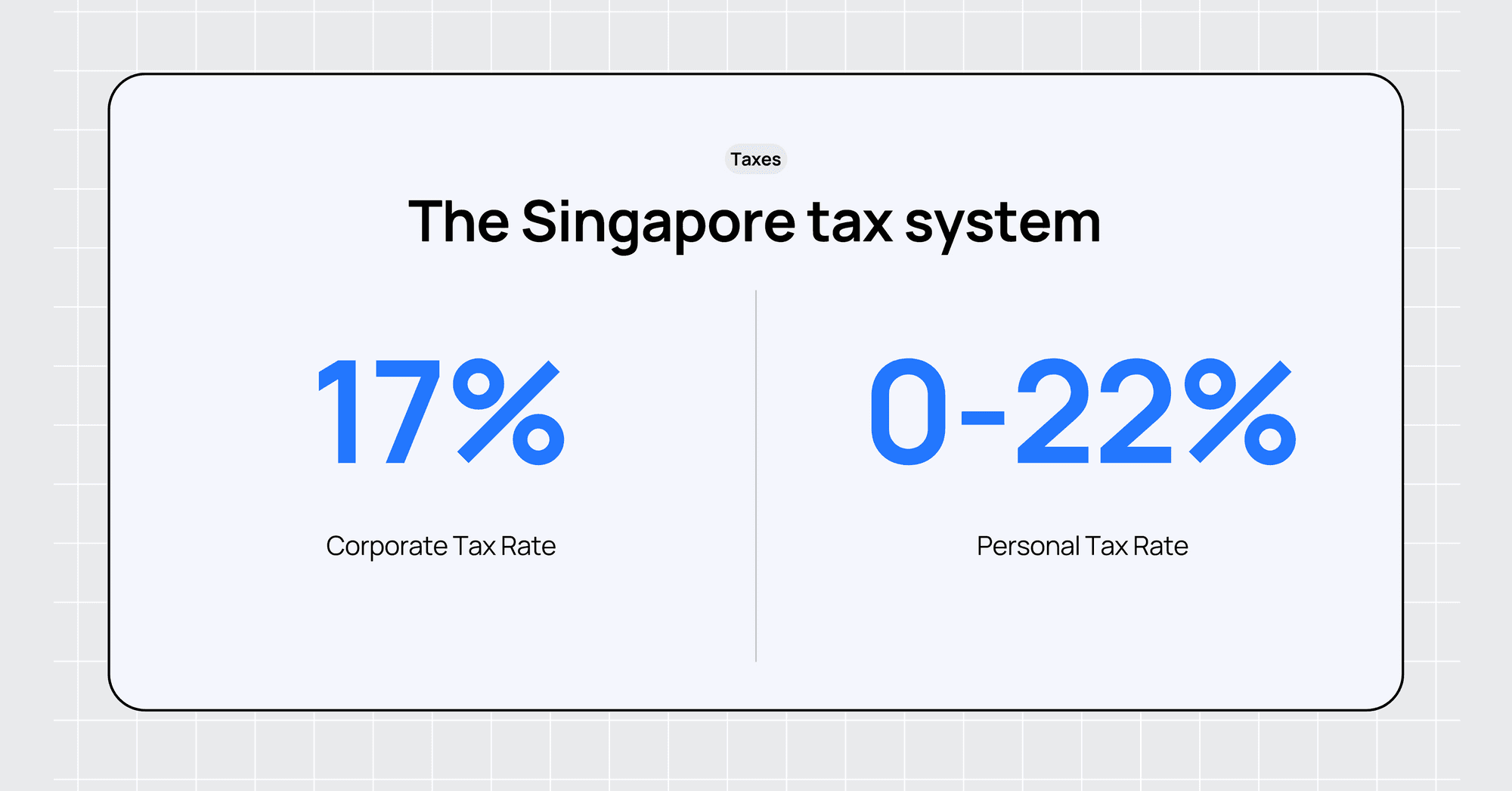

1. Singapore’s attractive tax system

Taxes affect your business costs, so it’s understandable you’re looking for a tax regime appropriate for a new business.

Singapore’s corporate tax rate is a flat 17% on taxable income, with a 75% tax exemption available for new companies for their first three years of operation.

For example, here’s how Singapore’s corporate tax rate compares with other countries and regions.

Singapore’s flat 17% tax rate on taxable income is lower than Asia’s average corporate tax rate of 19.80%

It’s also lower than the worldwide average tax rate of 23.45%

Singapore has the lowest corporate tax rate in ASEAN

Corporate Tax Rate (2023) | Country in ASEAN |

Singapore | 17% |

Malaysia | 24% |

Thailand | 20% |

Indonesia | 22% |

Brunei | 18.5% |

Laos | 20% |

Vietnam | 20% |

Myanmar | 22% |

Cambodia | 20% |

Corporate tax rate data from PwC

2. Many SME grants and initiatives to support your business

Besides a friendly tax environment, the Singapore government supports small and medium-sized businesses with many grants and initiatives.

Some examples of startup and online business-friendly grants

Startup SG Founder: Provides mentorship and startup capital grant of S$50,000 to first-time entrepreneurs with innovative business ideas

Productivity Solutions Grant (PSG): Receive up to 50% funding support for eligible productivity solutions

See the complete list of grants available to Singapore-based businesses here.

3. Stable currency and environment

For the past 15 consecutive years, the EIU has ranked Singapore as the world’s most efficient and open economy, scoring well on business-friendly regulation, foreign trade, and technological readiness.

Singapore is a country where you can focus on starting and growing your new online business rather than worrying if political and economic instability will affect your company.

4. Easy to do business

Singapore ranks second in the most recent World Bank rankings for ease of business, behind New Zealand. For instance, you can get your business registration approved with the Singapore Accounting and Corporate Regulatory Authority (ACRA) within an hour if no other requirements or licenses are needed.

5. English-speaking workforce and business environment

While Singapore is a multi-lingual country, it conducts business in English, making it easy for international entrepreneurs to focus on building their new business.

How to register your company in Singapore - A step-by-step guide for SMEs

Step 1: Choose a company name

First, choose a company name and submit a business name application through BizFile+.

Your company name and registration number (UEN) appear on all business correspondence, including business letters, statements of accounts, invoices, and official notices. Therefore, it’s essential to use a name that is professional, easy to spell, and represents your business well.

Consider these tips when choosing a company name in Singapore

Avoid generic or geographically linked names if you plan to expand to other countries

Avoid obscene, vulgar, or offensive names

Avoid choosing names similar to other companies, reserved company names or government-linked (e.g., Temasek)

Check that the company name isn't associated with anything unsavory or unrelated to your business

Search ACRA BizFile+ and Google to check that your chosen name isn’t already reserved or in use

More guidelines on choosing a company name are here.

Once approved, ACRA will reserve your business name for four months. Make sure you register your business during this time.

Step 2: Meet the company registration requirements in Singapore

Before registering your company in Singapore, you’ll need:

An approved company name.

An appointed company director.

An appointed company secretary within 6 months of business incorporation in Singapore. This must be a qualified Singapore resident, defined as a Singapore Citizen or Permanent Resident. Foreigners holding a Singapore work visa like an EntrePass or Employment Pass also qualify.

A minimum of S$1 in paid-up capital

A registered address for the company. This must be a local physical Singapore address.

Step 3: Prepare your Singapore business incorporation documents

Besides your company name, you also need to prepare incorporation documents to register your company in Singapore, such as:

A description and classification of your business activities

The Singapore Standard Industrial Classification Code (SSIC) code that best matches your business activities

Company shareholder details

Company directors details

A registered Singaporean business address

Share capital information

Information on the company’s constitution

Check out ACRA's guide to business incorporation in Singapore for more details.

Step 4: Register your company with ACRA

Once you’ve got your documents, head to the ACRA website to register your company.

Once you’ve registered successfully, you will receive a Certificate of Incorporation and a business file (‘Bizfile’) from ACRA. This is the official certificate of business incorporation in Singapore, and it's also required to open a Singapore corporate bank account.

You’ll also need to register for Singapore’s Goods and Services Tax (GST) if you expect your company’s annual turnover to exceed S$1 million. Check out Singapore’s guide on whether your business needs to register for GST.

Step 5: Obtain any necessary licenses and permits

Depending on what you plan to sell, you might need other licenses to do business.

Read more: Check out the Singapore Government’s guide to business licenses here.

Step 6: Set up a corporate bank account to manage your business finances

Setting up a corporate bank account keeps your business transactions separate from your personal finances. This is handy for declaring income tax, managing cash flow, and receiving customer payments.

Suggested options for corporate banks in Singapore

DBS Entrepreneur Account for Start-ups

OCBC Business Growth Account

UOB eBusiness Account

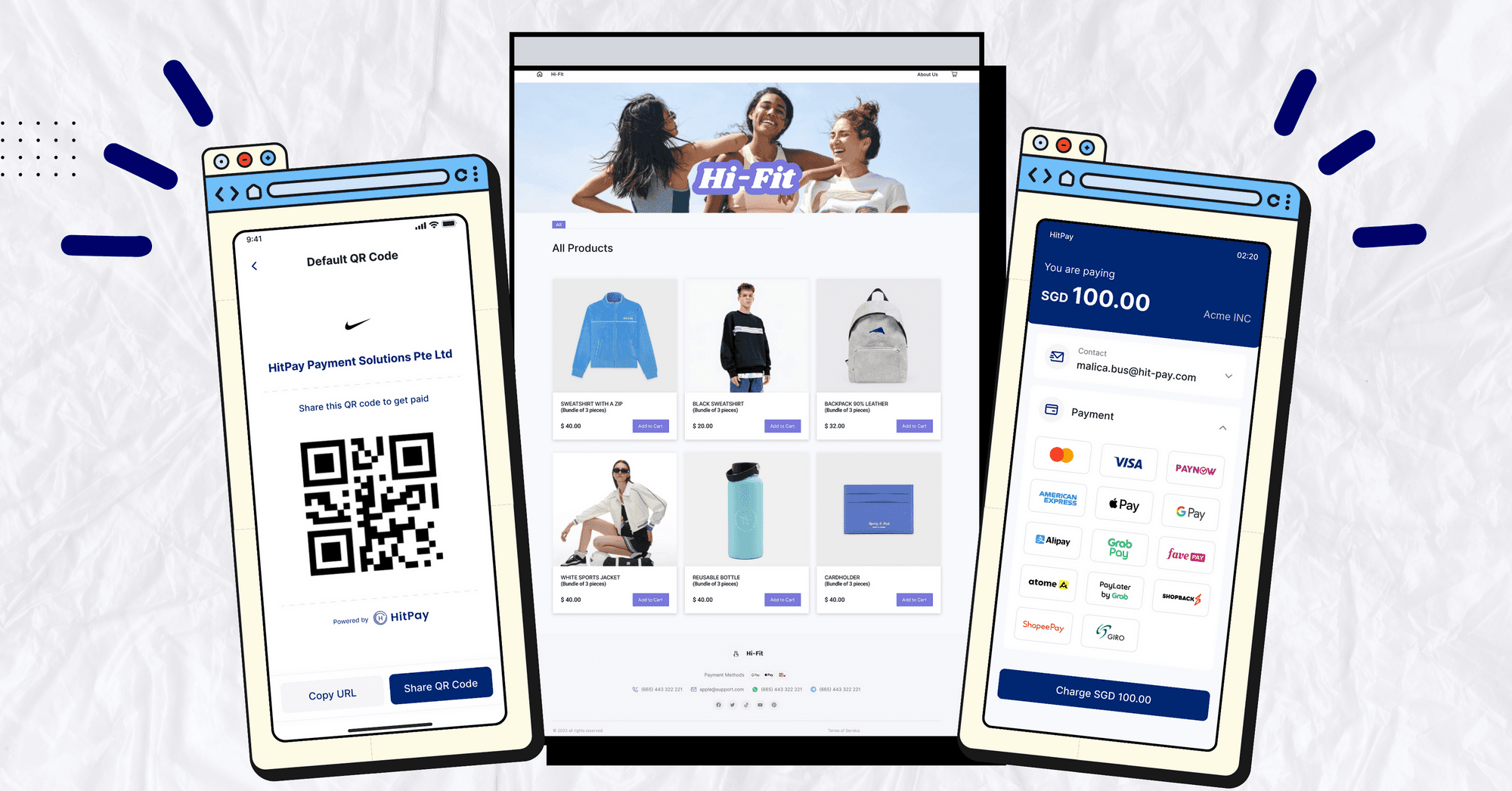

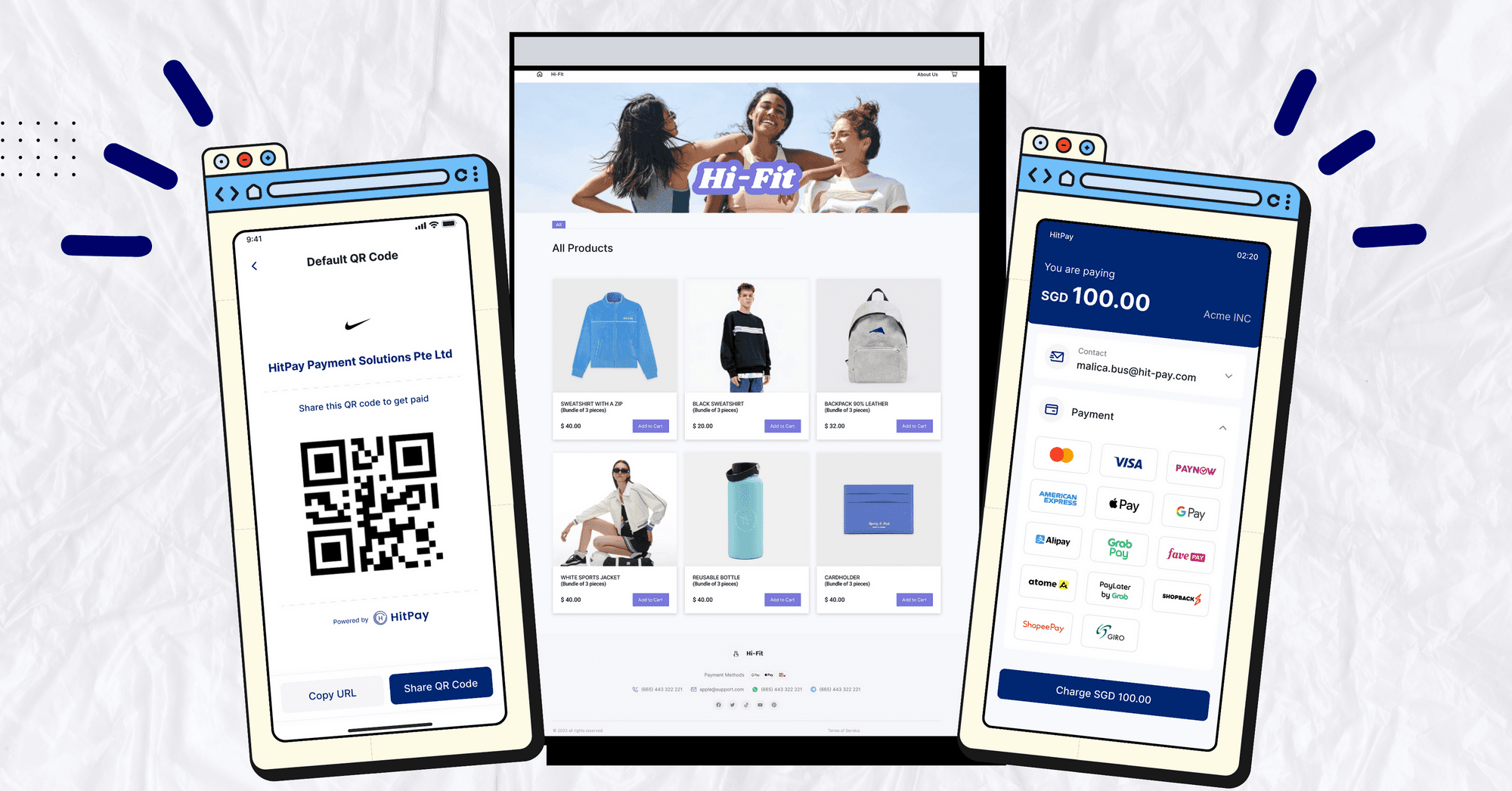

Step 7: Select a payment platform for payment processing

To do business online, you need a payment platform to receive payments from your customers and a website to serve as your digital home for your business.

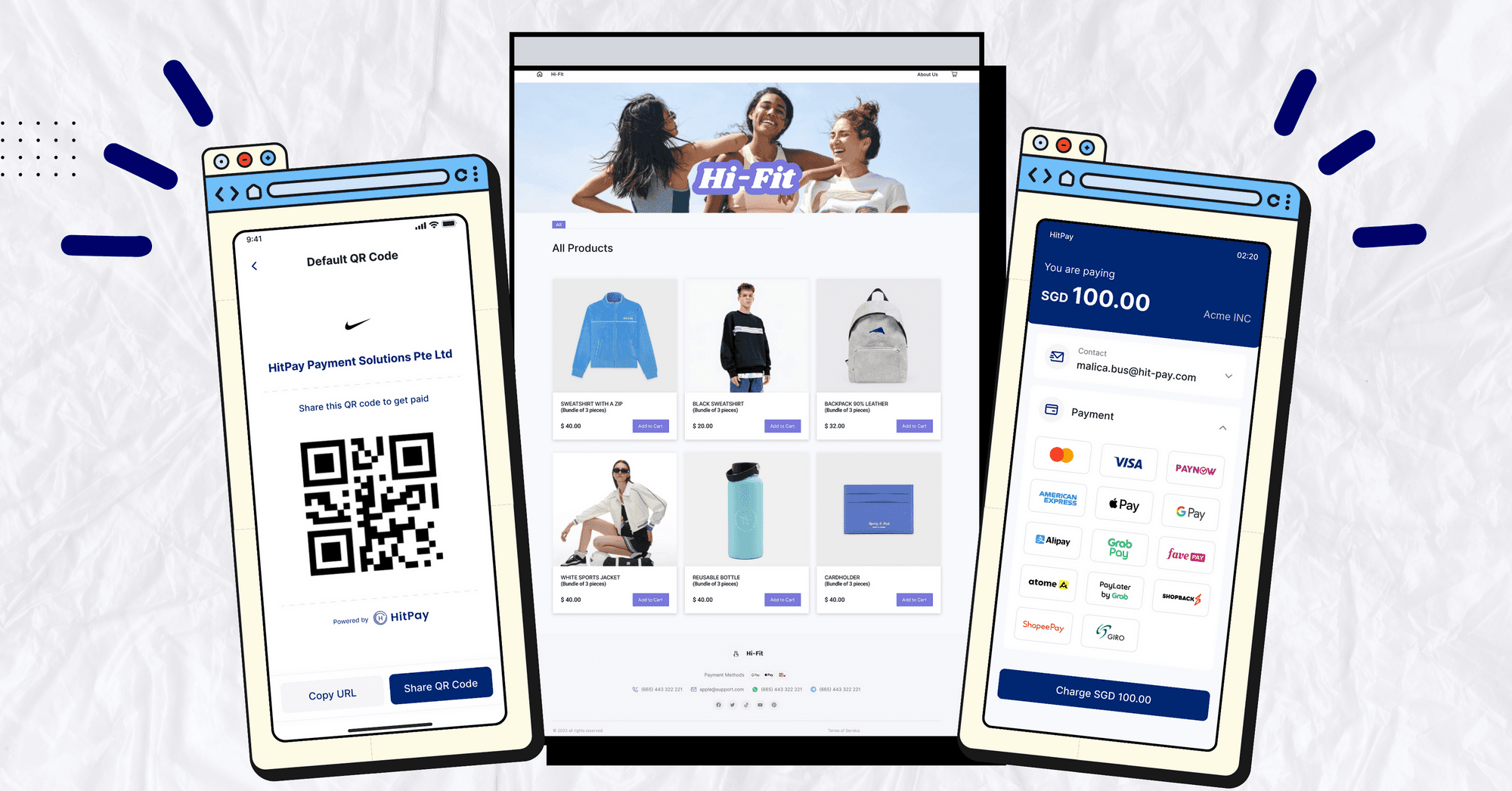

Usually, you’d handle these two aspects separately. But tools like HitPay enable you to manage a website and payments in one platform. Here’s how

Why use HitPay to handle payments for your Singapore online business?

Reason 1: All-in-one payments platform for SMEs

The HitPay payment gateway enables businesses to accept popular local and international payment methods, such as:

Credit and debit cards

Digital wallets like Apple Pay and Google Pay

Buy Now Pay Later (BNPL) solutions like Atome

Offering multiple payment methods makes it easier for customers to use their preferred payment method at checkout, reducing cart abandonment and encouraging more sales.

Reason 2: Includes free business tools to support your business growth

Running a business is more than making sales and taking payments, and HitPay includes the tools you need to run your new Singapore-registered company.

HitPay’s all-in-one e-commerce tool includes:

A free online store for a website to sell online

E-commerce plugins to link HitPay’s payment gateway to an existing e-commerce store on popular e-commerce platforms like Shopify, EasyStore, Ecwid, OpenCart, Prestashop, Wix, Shopcada

Link in bio page for easy selling and branding on social media

Support for payment links and recurring billing to get paid easily

Virtual point of sale system with HitPay’s mobile app to accept payments in person

Reason 3: No subscription or contract lock-in

As a new business, it’s prudent to use every dollar wisely.

Opening a HitPay account is free, with no set-up fees, ongoing subscriptions or contracts to sign. Depending on your payment method and channel, you’ll only pay per transaction when you make a sale. See HitPay’s pricing here.

Start your Singapore online business today with HitPay and Osome

HitPay partners with Osome to provide incorporation and bookkeeping services. If you’re keen on starting a business in Singapore but need help handling all the paperwork and processes, get in touch here.

Singapore Company Registration: A Step-by-Step Guide For Entrepreneurs

March 21, 2024

Thinking of incorporating a business in Singapore? Learn why Singapore’s an excellent place for entrepreneurs and how to register a company in Singapore

Are you considering registering a business in Singapore or bringing your online business internationally?

Here’s our guide to incorporating a business in Singapore and how HitPay’s payment solution can help simplify registering a company for your budding SME.

5 reasons you should register a company in Singapore

1. Singapore’s attractive tax system

Taxes affect your business costs, so it’s understandable you’re looking for a tax regime appropriate for a new business.

Singapore’s corporate tax rate is a flat 17% on taxable income, with a 75% tax exemption available for new companies for their first three years of operation.

For example, here’s how Singapore’s corporate tax rate compares with other countries and regions.

Singapore’s flat 17% tax rate on taxable income is lower than Asia’s average corporate tax rate of 19.80%

It’s also lower than the worldwide average tax rate of 23.45%

Singapore has the lowest corporate tax rate in ASEAN

Corporate Tax Rate (2023) | Country in ASEAN |

Singapore | 17% |

Malaysia | 24% |

Thailand | 20% |

Indonesia | 22% |

Brunei | 18.5% |

Laos | 20% |

Vietnam | 20% |

Myanmar | 22% |

Cambodia | 20% |

Corporate tax rate data from PwC

2. Many SME grants and initiatives to support your business

Besides a friendly tax environment, the Singapore government supports small and medium-sized businesses with many grants and initiatives.

Some examples of startup and online business-friendly grants

Startup SG Founder: Provides mentorship and startup capital grant of S$50,000 to first-time entrepreneurs with innovative business ideas

Productivity Solutions Grant (PSG): Receive up to 50% funding support for eligible productivity solutions

See the complete list of grants available to Singapore-based businesses here.

3. Stable currency and environment

For the past 15 consecutive years, the EIU has ranked Singapore as the world’s most efficient and open economy, scoring well on business-friendly regulation, foreign trade, and technological readiness.

Singapore is a country where you can focus on starting and growing your new online business rather than worrying if political and economic instability will affect your company.

4. Easy to do business

Singapore ranks second in the most recent World Bank rankings for ease of business, behind New Zealand. For instance, you can get your business registration approved with the Singapore Accounting and Corporate Regulatory Authority (ACRA) within an hour if no other requirements or licenses are needed.

5. English-speaking workforce and business environment

While Singapore is a multi-lingual country, it conducts business in English, making it easy for international entrepreneurs to focus on building their new business.

How to register your company in Singapore - A step-by-step guide for SMEs

Step 1: Choose a company name

First, choose a company name and submit a business name application through BizFile+.

Your company name and registration number (UEN) appear on all business correspondence, including business letters, statements of accounts, invoices, and official notices. Therefore, it’s essential to use a name that is professional, easy to spell, and represents your business well.

Consider these tips when choosing a company name in Singapore

Avoid generic or geographically linked names if you plan to expand to other countries

Avoid obscene, vulgar, or offensive names

Avoid choosing names similar to other companies, reserved company names or government-linked (e.g., Temasek)

Check that the company name isn't associated with anything unsavory or unrelated to your business

Search ACRA BizFile+ and Google to check that your chosen name isn’t already reserved or in use

More guidelines on choosing a company name are here.

Once approved, ACRA will reserve your business name for four months. Make sure you register your business during this time.

Step 2: Meet the company registration requirements in Singapore

Before registering your company in Singapore, you’ll need:

An approved company name.

An appointed company director.

An appointed company secretary within 6 months of business incorporation in Singapore. This must be a qualified Singapore resident, defined as a Singapore Citizen or Permanent Resident. Foreigners holding a Singapore work visa like an EntrePass or Employment Pass also qualify.

A minimum of S$1 in paid-up capital

A registered address for the company. This must be a local physical Singapore address.

Step 3: Prepare your Singapore business incorporation documents

Besides your company name, you also need to prepare incorporation documents to register your company in Singapore, such as:

A description and classification of your business activities

The Singapore Standard Industrial Classification Code (SSIC) code that best matches your business activities

Company shareholder details

Company directors details

A registered Singaporean business address

Share capital information

Information on the company’s constitution

Check out ACRA's guide to business incorporation in Singapore for more details.

Step 4: Register your company with ACRA

Once you’ve got your documents, head to the ACRA website to register your company.

Once you’ve registered successfully, you will receive a Certificate of Incorporation and a business file (‘Bizfile’) from ACRA. This is the official certificate of business incorporation in Singapore, and it's also required to open a Singapore corporate bank account.

You’ll also need to register for Singapore’s Goods and Services Tax (GST) if you expect your company’s annual turnover to exceed S$1 million. Check out Singapore’s guide on whether your business needs to register for GST.

Step 5: Obtain any necessary licenses and permits

Depending on what you plan to sell, you might need other licenses to do business.

Read more: Check out the Singapore Government’s guide to business licenses here.

Step 6: Set up a corporate bank account to manage your business finances

Setting up a corporate bank account keeps your business transactions separate from your personal finances. This is handy for declaring income tax, managing cash flow, and receiving customer payments.

Suggested options for corporate banks in Singapore

DBS Entrepreneur Account for Start-ups

OCBC Business Growth Account

UOB eBusiness Account

Step 7: Select a payment platform for payment processing

To do business online, you need a payment platform to receive payments from your customers and a website to serve as your digital home for your business.

Usually, you’d handle these two aspects separately. But tools like HitPay enable you to manage a website and payments in one platform. Here’s how

Why use HitPay to handle payments for your Singapore online business?

Reason 1: All-in-one payments platform for SMEs

The HitPay payment gateway enables businesses to accept popular local and international payment methods, such as:

Credit and debit cards

Digital wallets like Apple Pay and Google Pay

Buy Now Pay Later (BNPL) solutions like Atome

Offering multiple payment methods makes it easier for customers to use their preferred payment method at checkout, reducing cart abandonment and encouraging more sales.

Reason 2: Includes free business tools to support your business growth

Running a business is more than making sales and taking payments, and HitPay includes the tools you need to run your new Singapore-registered company.

HitPay’s all-in-one e-commerce tool includes:

A free online store for a website to sell online

E-commerce plugins to link HitPay’s payment gateway to an existing e-commerce store on popular e-commerce platforms like Shopify, EasyStore, Ecwid, OpenCart, Prestashop, Wix, Shopcada

Link in bio page for easy selling and branding on social media

Support for payment links and recurring billing to get paid easily

Virtual point of sale system with HitPay’s mobile app to accept payments in person

Reason 3: No subscription or contract lock-in

As a new business, it’s prudent to use every dollar wisely.

Opening a HitPay account is free, with no set-up fees, ongoing subscriptions or contracts to sign. Depending on your payment method and channel, you’ll only pay per transaction when you make a sale. See HitPay’s pricing here.

Start your Singapore online business today with HitPay and Osome

HitPay partners with Osome to provide incorporation and bookkeeping services. If you’re keen on starting a business in Singapore but need help handling all the paperwork and processes, get in touch here.

Singapore Company Registration: A Step-by-Step Guide For Entrepreneurs

March 21, 2024

Thinking of incorporating a business in Singapore? Learn why Singapore’s an excellent place for entrepreneurs and how to register a company in Singapore

Are you considering registering a business in Singapore or bringing your online business internationally?

Here’s our guide to incorporating a business in Singapore and how HitPay’s payment solution can help simplify registering a company for your budding SME.

5 reasons you should register a company in Singapore

1. Singapore’s attractive tax system

Taxes affect your business costs, so it’s understandable you’re looking for a tax regime appropriate for a new business.

Singapore’s corporate tax rate is a flat 17% on taxable income, with a 75% tax exemption available for new companies for their first three years of operation.

For example, here’s how Singapore’s corporate tax rate compares with other countries and regions.

Singapore’s flat 17% tax rate on taxable income is lower than Asia’s average corporate tax rate of 19.80%

It’s also lower than the worldwide average tax rate of 23.45%

Singapore has the lowest corporate tax rate in ASEAN

Corporate Tax Rate (2023) | Country in ASEAN |

Singapore | 17% |

Malaysia | 24% |

Thailand | 20% |

Indonesia | 22% |

Brunei | 18.5% |

Laos | 20% |

Vietnam | 20% |

Myanmar | 22% |

Cambodia | 20% |

Corporate tax rate data from PwC

2. Many SME grants and initiatives to support your business

Besides a friendly tax environment, the Singapore government supports small and medium-sized businesses with many grants and initiatives.

Some examples of startup and online business-friendly grants

Startup SG Founder: Provides mentorship and startup capital grant of S$50,000 to first-time entrepreneurs with innovative business ideas

Productivity Solutions Grant (PSG): Receive up to 50% funding support for eligible productivity solutions

See the complete list of grants available to Singapore-based businesses here.

3. Stable currency and environment

For the past 15 consecutive years, the EIU has ranked Singapore as the world’s most efficient and open economy, scoring well on business-friendly regulation, foreign trade, and technological readiness.

Singapore is a country where you can focus on starting and growing your new online business rather than worrying if political and economic instability will affect your company.

4. Easy to do business

Singapore ranks second in the most recent World Bank rankings for ease of business, behind New Zealand. For instance, you can get your business registration approved with the Singapore Accounting and Corporate Regulatory Authority (ACRA) within an hour if no other requirements or licenses are needed.

5. English-speaking workforce and business environment

While Singapore is a multi-lingual country, it conducts business in English, making it easy for international entrepreneurs to focus on building their new business.

How to register your company in Singapore - A step-by-step guide for SMEs

Step 1: Choose a company name

First, choose a company name and submit a business name application through BizFile+.

Your company name and registration number (UEN) appear on all business correspondence, including business letters, statements of accounts, invoices, and official notices. Therefore, it’s essential to use a name that is professional, easy to spell, and represents your business well.

Consider these tips when choosing a company name in Singapore

Avoid generic or geographically linked names if you plan to expand to other countries

Avoid obscene, vulgar, or offensive names

Avoid choosing names similar to other companies, reserved company names or government-linked (e.g., Temasek)

Check that the company name isn't associated with anything unsavory or unrelated to your business

Search ACRA BizFile+ and Google to check that your chosen name isn’t already reserved or in use

More guidelines on choosing a company name are here.

Once approved, ACRA will reserve your business name for four months. Make sure you register your business during this time.

Step 2: Meet the company registration requirements in Singapore

Before registering your company in Singapore, you’ll need:

An approved company name.

An appointed company director.

An appointed company secretary within 6 months of business incorporation in Singapore. This must be a qualified Singapore resident, defined as a Singapore Citizen or Permanent Resident. Foreigners holding a Singapore work visa like an EntrePass or Employment Pass also qualify.

A minimum of S$1 in paid-up capital

A registered address for the company. This must be a local physical Singapore address.

Step 3: Prepare your Singapore business incorporation documents

Besides your company name, you also need to prepare incorporation documents to register your company in Singapore, such as:

A description and classification of your business activities

The Singapore Standard Industrial Classification Code (SSIC) code that best matches your business activities

Company shareholder details

Company directors details

A registered Singaporean business address

Share capital information

Information on the company’s constitution

Check out ACRA's guide to business incorporation in Singapore for more details.

Step 4: Register your company with ACRA

Once you’ve got your documents, head to the ACRA website to register your company.

Once you’ve registered successfully, you will receive a Certificate of Incorporation and a business file (‘Bizfile’) from ACRA. This is the official certificate of business incorporation in Singapore, and it's also required to open a Singapore corporate bank account.

You’ll also need to register for Singapore’s Goods and Services Tax (GST) if you expect your company’s annual turnover to exceed S$1 million. Check out Singapore’s guide on whether your business needs to register for GST.

Step 5: Obtain any necessary licenses and permits

Depending on what you plan to sell, you might need other licenses to do business.

Read more: Check out the Singapore Government’s guide to business licenses here.

Step 6: Set up a corporate bank account to manage your business finances

Setting up a corporate bank account keeps your business transactions separate from your personal finances. This is handy for declaring income tax, managing cash flow, and receiving customer payments.

Suggested options for corporate banks in Singapore

DBS Entrepreneur Account for Start-ups

OCBC Business Growth Account

UOB eBusiness Account

Step 7: Select a payment platform for payment processing

To do business online, you need a payment platform to receive payments from your customers and a website to serve as your digital home for your business.

Usually, you’d handle these two aspects separately. But tools like HitPay enable you to manage a website and payments in one platform. Here’s how

Why use HitPay to handle payments for your Singapore online business?

Reason 1: All-in-one payments platform for SMEs

The HitPay payment gateway enables businesses to accept popular local and international payment methods, such as:

Credit and debit cards

Digital wallets like Apple Pay and Google Pay

Buy Now Pay Later (BNPL) solutions like Atome

Offering multiple payment methods makes it easier for customers to use their preferred payment method at checkout, reducing cart abandonment and encouraging more sales.

Reason 2: Includes free business tools to support your business growth

Running a business is more than making sales and taking payments, and HitPay includes the tools you need to run your new Singapore-registered company.

HitPay’s all-in-one e-commerce tool includes:

A free online store for a website to sell online

E-commerce plugins to link HitPay’s payment gateway to an existing e-commerce store on popular e-commerce platforms like Shopify, EasyStore, Ecwid, OpenCart, Prestashop, Wix, Shopcada

Link in bio page for easy selling and branding on social media

Support for payment links and recurring billing to get paid easily

Virtual point of sale system with HitPay’s mobile app to accept payments in person

Reason 3: No subscription or contract lock-in

As a new business, it’s prudent to use every dollar wisely.

Opening a HitPay account is free, with no set-up fees, ongoing subscriptions or contracts to sign. Depending on your payment method and channel, you’ll only pay per transaction when you make a sale. See HitPay’s pricing here.

Start your Singapore online business today with HitPay and Osome

HitPay partners with Osome to provide incorporation and bookkeeping services. If you’re keen on starting a business in Singapore but need help handling all the paperwork and processes, get in touch here.