PayNow QR API and Payment Gateway Integration - HitPay

January 28, 2021

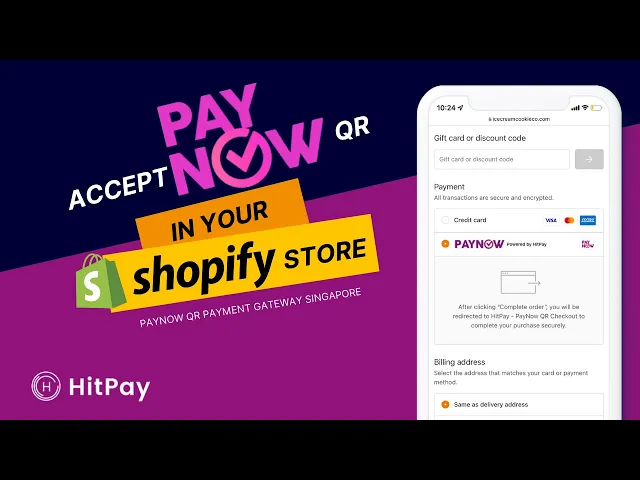

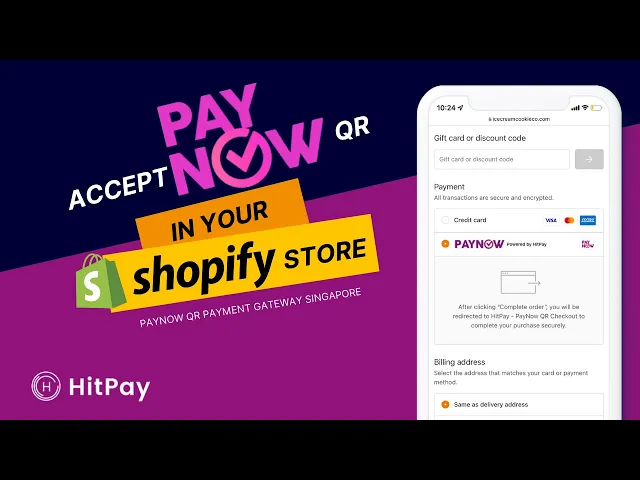

Get onboard with HitPay’s PayNow QR payment gateway with developer APIs and supported plugins like Shopify, Wix, EasyStore, Shopcada, WooCommerce, Prestashop, and Magento

It has been 6 months since HitPay launched PayNow QR checkouts for e-commerce merchants in Singapore and this 👇 is what we have learned:

PayNow is now a ubiquitous payment method in Singapore

PayNow is available on every Singapore banking user’s mobile device and is only a couple of taps away with over 9 banks supporting PayNow QR transactions in addition to DBS PayLah! and Google Pay Singapore. As of September 2019, 2.8m PayNow user registrations were recorded with this number poised to grow post-COVID 19.

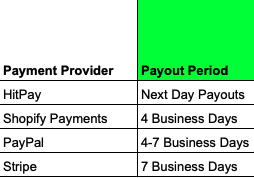

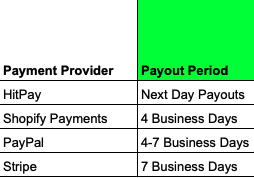

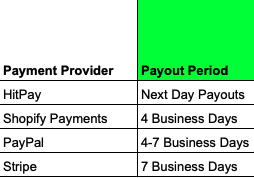

Comparison of payout schedules

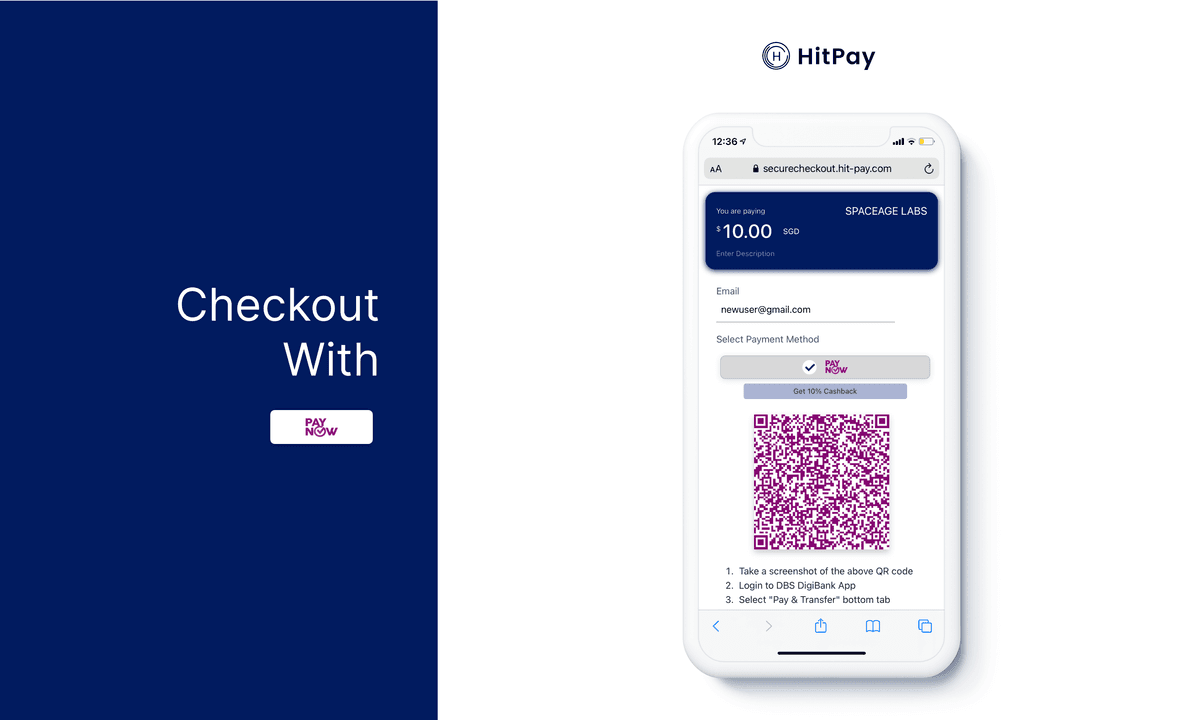

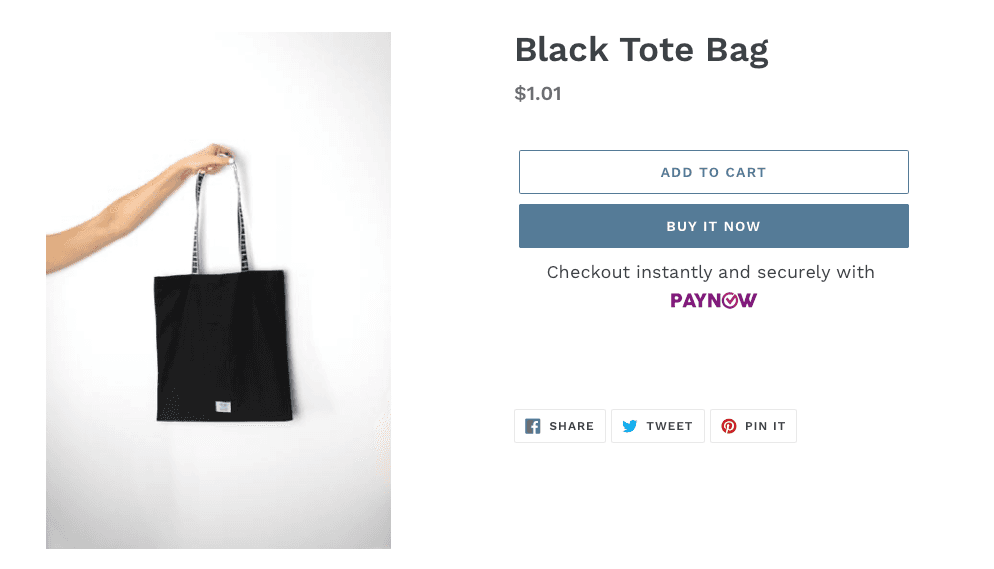

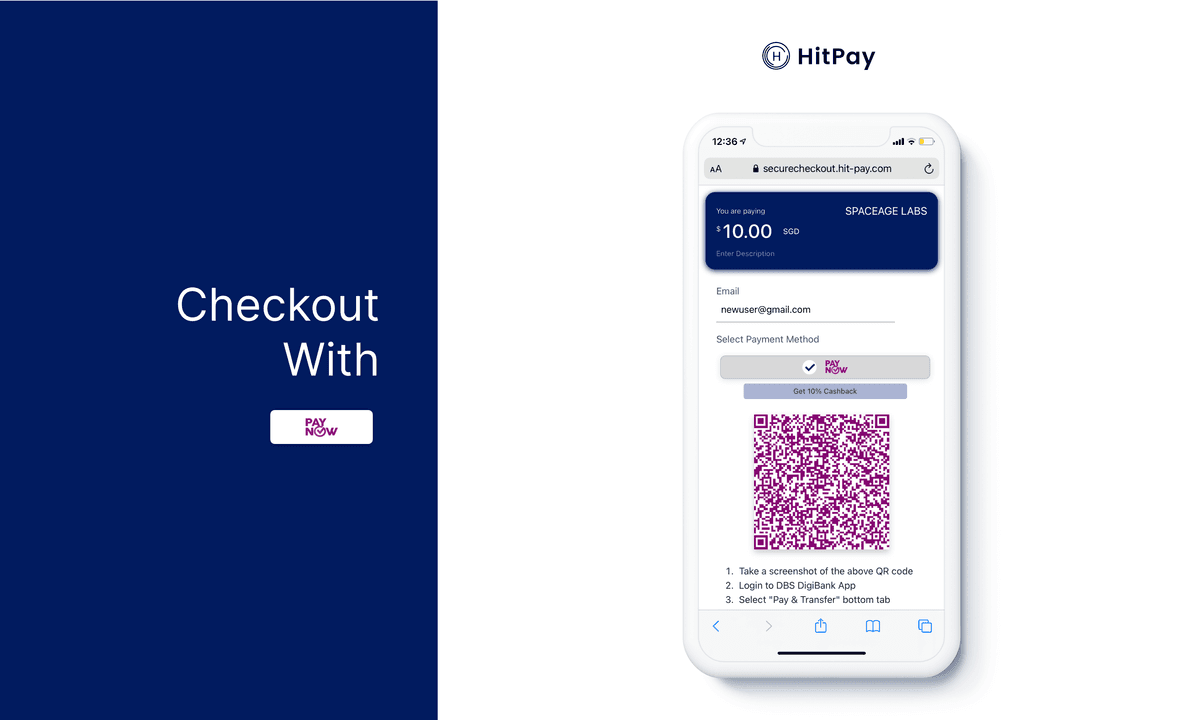

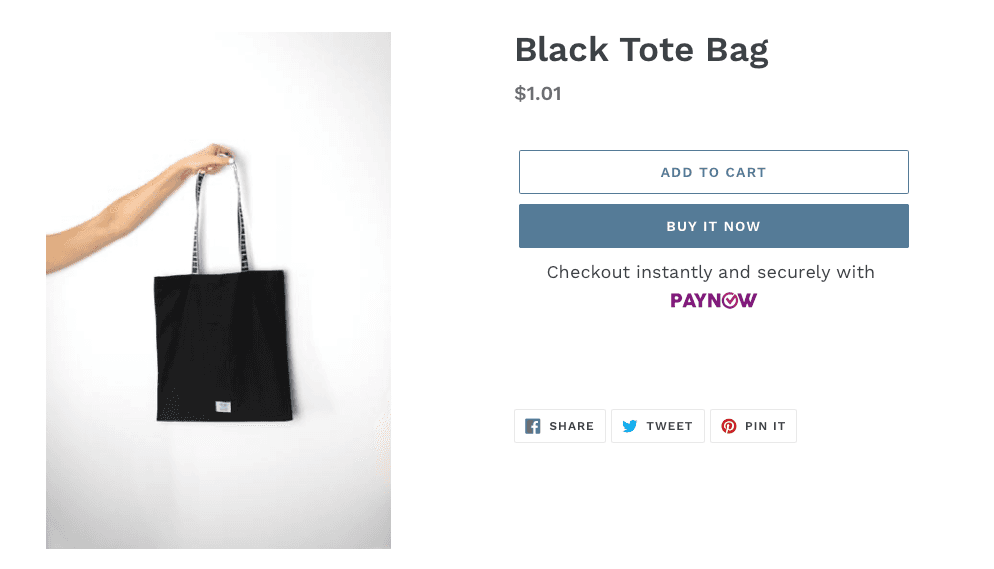

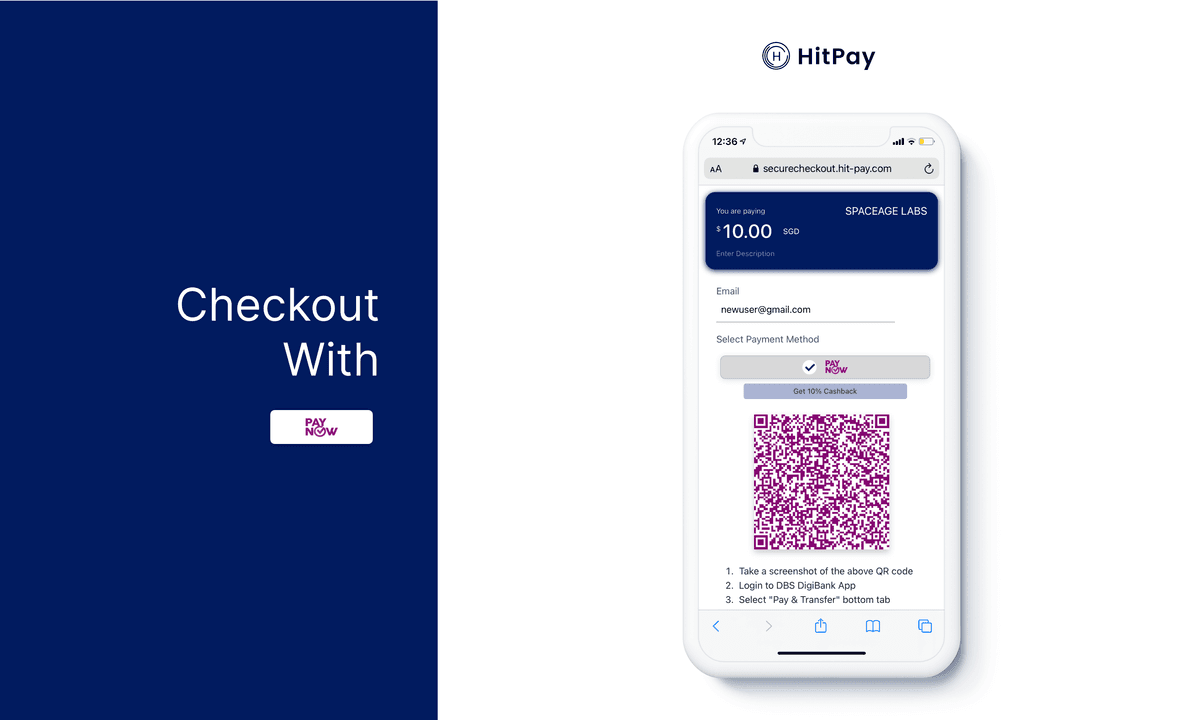

Customers LOVE paying with their mobile phones

As opposed to credit card checkouts on e-commerce platforms, PayNow QR checkouts require customers to use their mobile phone to checkout on an e-commerce merchant website. This is a safer and more convenient way for customers to pay and HitPay merchants have observed a 50% decrease in cart abandonment rates after adding PayNow checkouts to their e-commerce store.

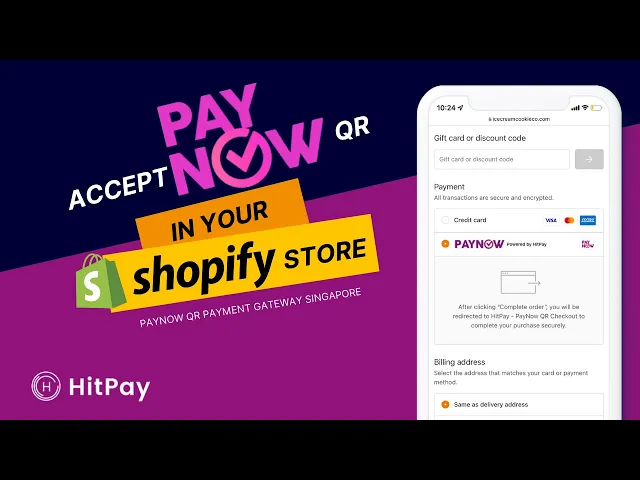

Click on the video below to view the HitPay PayNow QR checkout demo

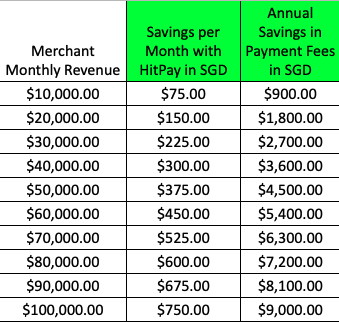

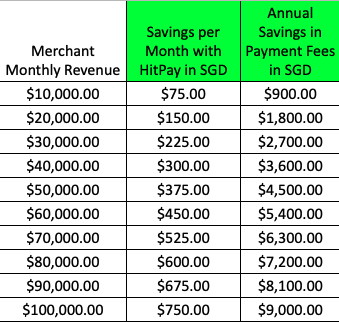

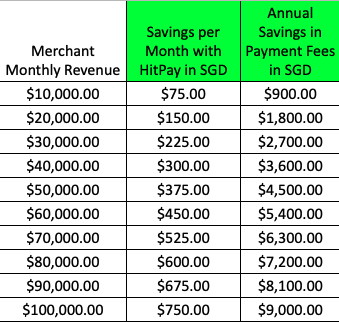

Merchants are saving an average of S$500 per month on payment processing fees

When e-commerce merchants use HitPay for PayNow QR payment acceptance, merchants are potentially saving upto S$10,000 in payment fees on an annual basis. PayNow QR acceptance provides upto 70% savings in payment processing fees compared to credit card payment processing. HitPay charges 0.8%+30c per transaction, without any setup, monthly or annual fees.

Savings with HitPay PayNow QR payment gateway

HitPay has dramatically improved cashflow management for e-commerce merchants

With next-day payouts for PayNow e-commerce checkouts, HitPay has improved access to cashflows by over 80%. The standard payout period for online credit card payment acceptance is 4–7 business days and HitPay automatically pays out to the merchant, the next day (even on weekends!)

Comparison of payout schedules

To find out more about HitPay, please visit our website or contact us on WhatsApp

PayNow QR API and Payment Gateway Integration - HitPay

January 28, 2021

Get onboard with HitPay’s PayNow QR payment gateway with developer APIs and supported plugins like Shopify, Wix, EasyStore, Shopcada, WooCommerce, Prestashop, and Magento

It has been 6 months since HitPay launched PayNow QR checkouts for e-commerce merchants in Singapore and this 👇 is what we have learned:

PayNow is now a ubiquitous payment method in Singapore

PayNow is available on every Singapore banking user’s mobile device and is only a couple of taps away with over 9 banks supporting PayNow QR transactions in addition to DBS PayLah! and Google Pay Singapore. As of September 2019, 2.8m PayNow user registrations were recorded with this number poised to grow post-COVID 19.

Comparison of payout schedules

Customers LOVE paying with their mobile phones

As opposed to credit card checkouts on e-commerce platforms, PayNow QR checkouts require customers to use their mobile phone to checkout on an e-commerce merchant website. This is a safer and more convenient way for customers to pay and HitPay merchants have observed a 50% decrease in cart abandonment rates after adding PayNow checkouts to their e-commerce store.

Click on the video below to view the HitPay PayNow QR checkout demo

Merchants are saving an average of S$500 per month on payment processing fees

When e-commerce merchants use HitPay for PayNow QR payment acceptance, merchants are potentially saving upto S$10,000 in payment fees on an annual basis. PayNow QR acceptance provides upto 70% savings in payment processing fees compared to credit card payment processing. HitPay charges 0.8%+30c per transaction, without any setup, monthly or annual fees.

Savings with HitPay PayNow QR payment gateway

HitPay has dramatically improved cashflow management for e-commerce merchants

With next-day payouts for PayNow e-commerce checkouts, HitPay has improved access to cashflows by over 80%. The standard payout period for online credit card payment acceptance is 4–7 business days and HitPay automatically pays out to the merchant, the next day (even on weekends!)

Comparison of payout schedules

To find out more about HitPay, please visit our website or contact us on WhatsApp

PayNow QR API and Payment Gateway Integration - HitPay

January 28, 2021

Get onboard with HitPay’s PayNow QR payment gateway with developer APIs and supported plugins like Shopify, Wix, EasyStore, Shopcada, WooCommerce, Prestashop, and Magento

It has been 6 months since HitPay launched PayNow QR checkouts for e-commerce merchants in Singapore and this 👇 is what we have learned:

PayNow is now a ubiquitous payment method in Singapore

PayNow is available on every Singapore banking user’s mobile device and is only a couple of taps away with over 9 banks supporting PayNow QR transactions in addition to DBS PayLah! and Google Pay Singapore. As of September 2019, 2.8m PayNow user registrations were recorded with this number poised to grow post-COVID 19.

Comparison of payout schedules

Customers LOVE paying with their mobile phones

As opposed to credit card checkouts on e-commerce platforms, PayNow QR checkouts require customers to use their mobile phone to checkout on an e-commerce merchant website. This is a safer and more convenient way for customers to pay and HitPay merchants have observed a 50% decrease in cart abandonment rates after adding PayNow checkouts to their e-commerce store.

Click on the video below to view the HitPay PayNow QR checkout demo

Merchants are saving an average of S$500 per month on payment processing fees

When e-commerce merchants use HitPay for PayNow QR payment acceptance, merchants are potentially saving upto S$10,000 in payment fees on an annual basis. PayNow QR acceptance provides upto 70% savings in payment processing fees compared to credit card payment processing. HitPay charges 0.8%+30c per transaction, without any setup, monthly or annual fees.

Savings with HitPay PayNow QR payment gateway

HitPay has dramatically improved cashflow management for e-commerce merchants

With next-day payouts for PayNow e-commerce checkouts, HitPay has improved access to cashflows by over 80%. The standard payout period for online credit card payment acceptance is 4–7 business days and HitPay automatically pays out to the merchant, the next day (even on weekends!)

Comparison of payout schedules

To find out more about HitPay, please visit our website or contact us on WhatsApp

Let's get you set up

Create an account instantly or contact us to create a custom package for your business.

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

United Kingdom

Hong Kong

Sweden

United States

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

88 Market Street Level #40-01, CapitaSpring, Singapore 048948.

Global

Let's get you set up

Create an account instantly or contact us to create a custom package for your business.

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

United Kingdom

Hong Kong

Sweden

United States

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

88 Market Street Level #40-01, CapitaSpring, Singapore 048948.

Global

Let's get you set up

Create an account instantly or contact us to create a custom package for your business.

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

United Kingdom

Hong Kong

Sweden

United States

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

88 Market Street Level #40-01, CapitaSpring, Singapore 048948.

Global

Let's get you set up

Create an account instantly or contact us to create a custom package for your business.

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

United Kingdom

Hong Kong

Sweden

United States

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

88 Market Street Level #40-01, CapitaSpring, Singapore 048948.

Global