Midtrans Payment Gateway Reviews in Indonesia: User Reviews & Alternatives

December 27, 2023

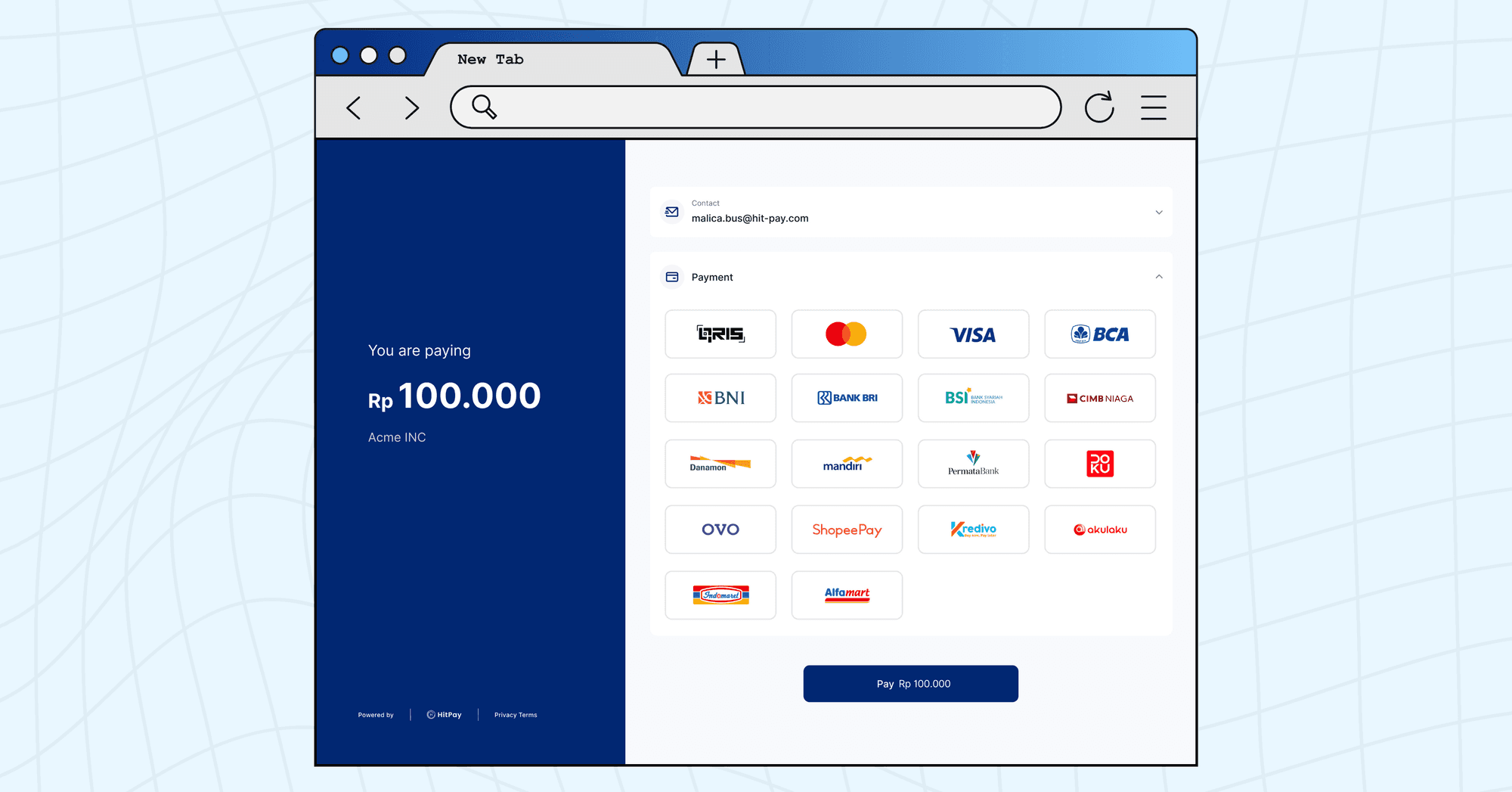

HitPay emerges as the top alternative payment gateway in Indonesia, rivalling Midtrans. However, if you are in search of a comprehensive payment platform, HitPay Indonesia might be a more fitting choice.

Choosing the right payment gateway for your business in Indonesia requires careful consideration before making a decision. One important aspect is reviewing feedback from other users, comparing the strengths and weaknesses of different payment gateway platforms, and exploring alternative payment gateway options available in Indonesia.

What is Midtrans Payment Gateway

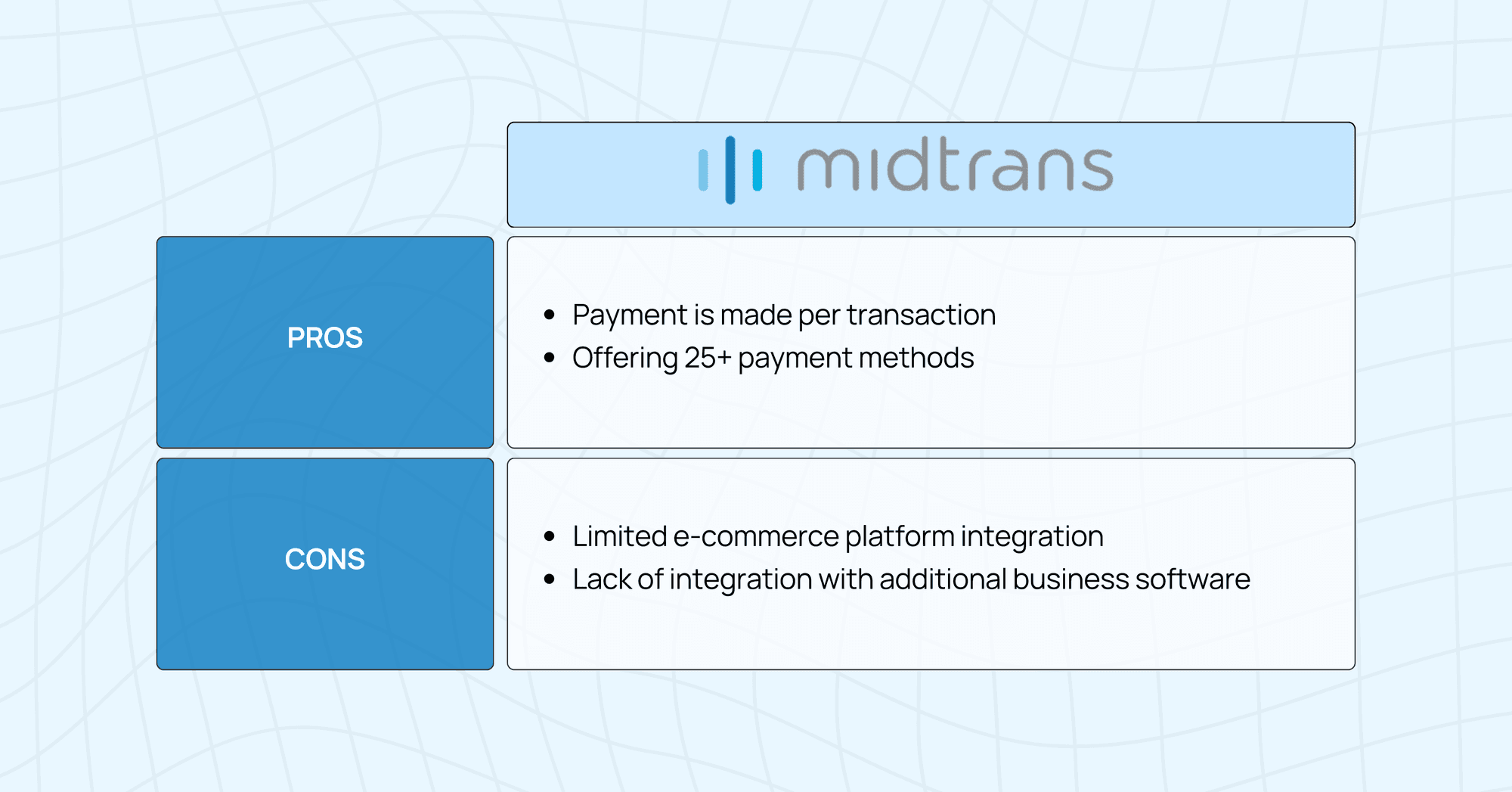

Midtrans is a digital payment platform affiliated with GoTo Financial. Offering more than 25 local payment methods, it presents a robust set of features, making it the preferred option for SMEs in Indonesia. Nevertheless, it's worth noting that Midtrans may not be accessible on all online stores and has limited integration with certain e-commerce plugins. Additionally, Midtrans isn't connected to accounting systems and doesn't feature supplementary business software.

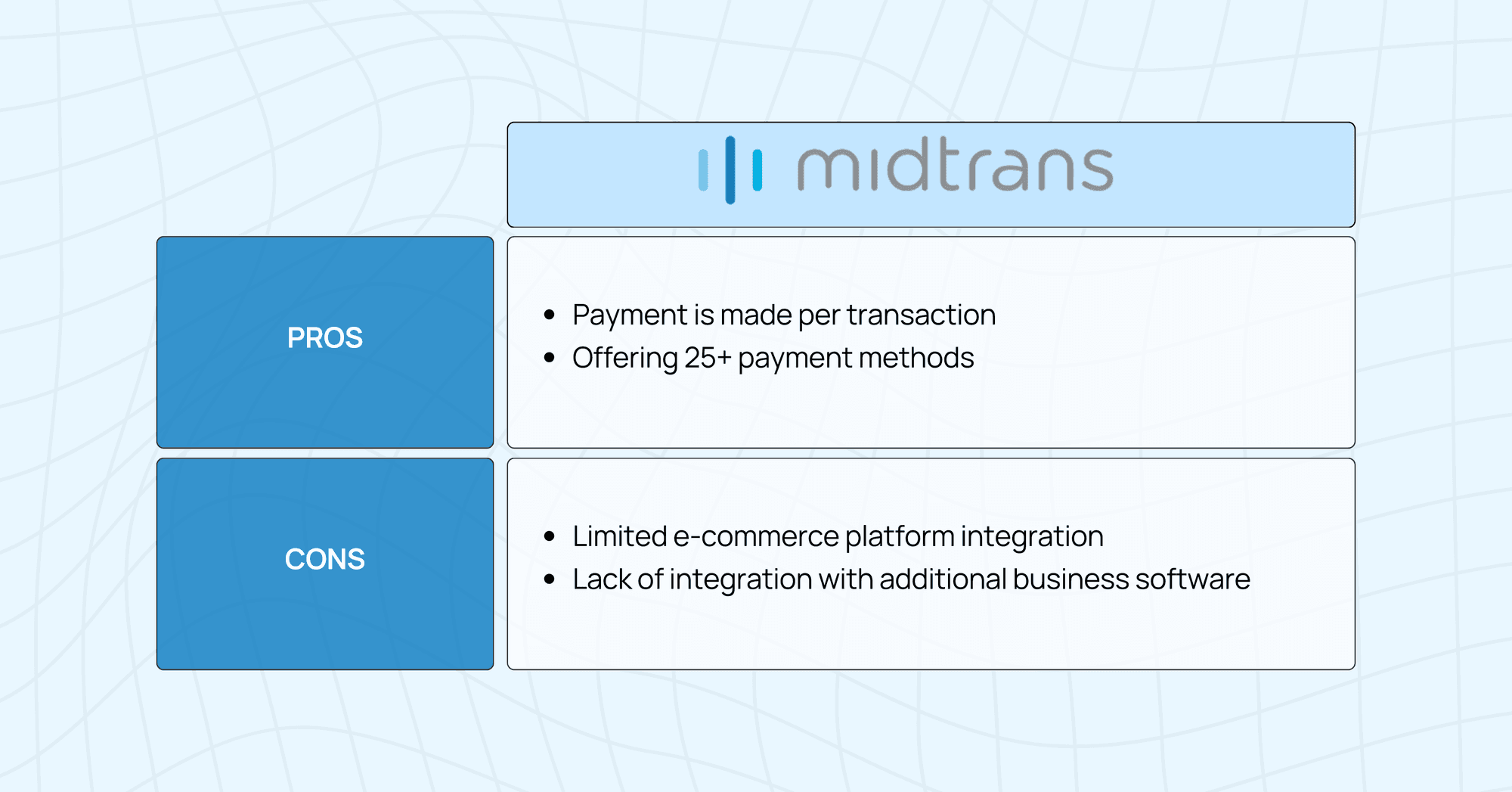

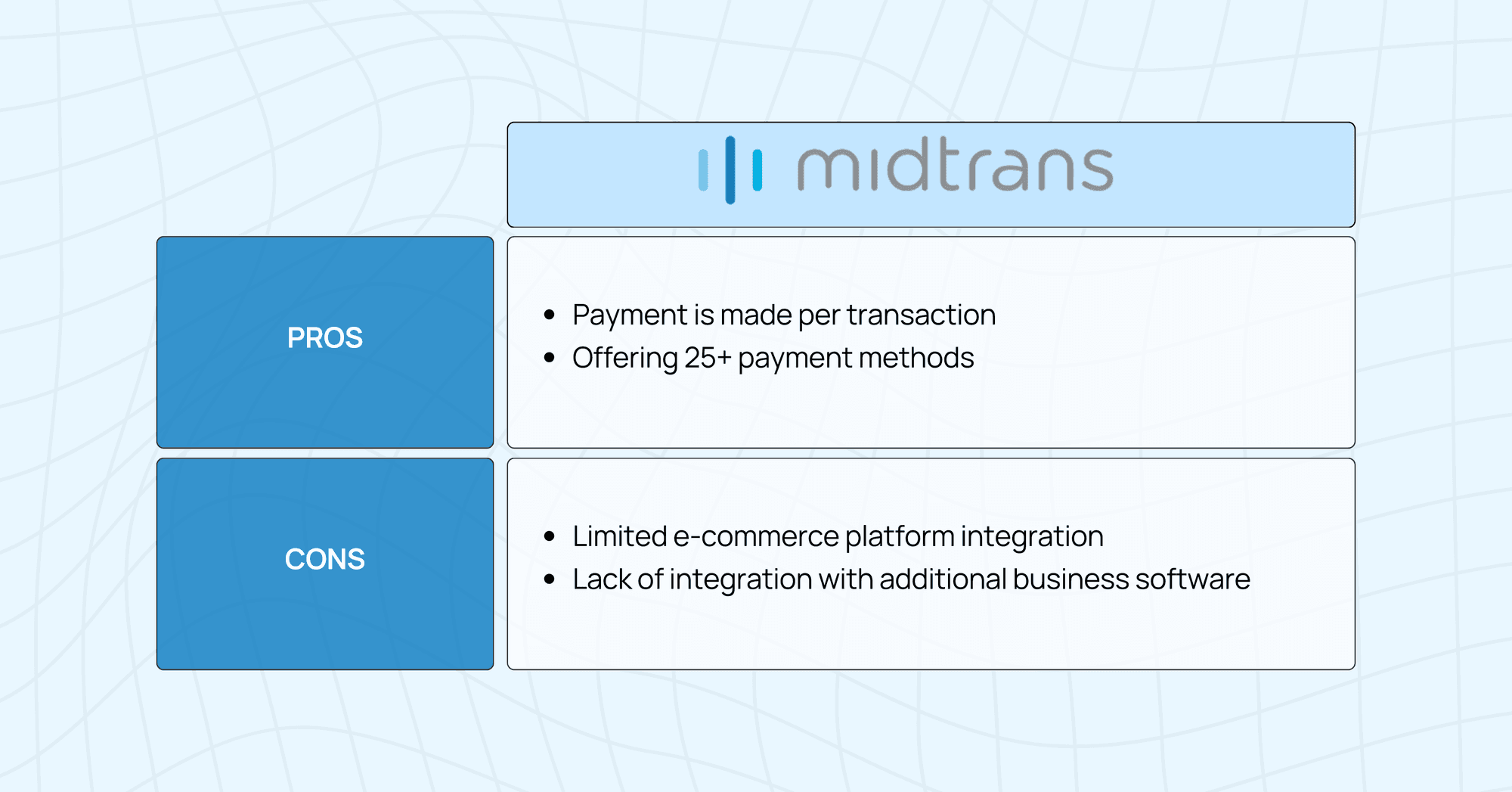

Pros and Cons of Midtrans

Review Midtrans Payment Gateway

User feedback on Midtrans indicates negative experiences with this payment gateway in Indonesia. Some users initially signed up with hopes of streamlining their business transactions through Midtrans. However, they regretted their choice due to various issues, including fund withholding by Midtrans, slow customer service responses, and prolonged response times of up to a week, leading to frustration and disappointment among users.

In response to these issues, several Xendit users have chosen to transition to alternative payment gateways like HitPay. HitPay is recognized for delivering prompt, friendly, and efficient service, a distinction evident in customer service reviews comparing HitPay and Midtrans. HitPay received a higher score, specifically 4.7 out of 257 reviewers on Trustpilot, while Xendit attained a score of 3.6 out of 134 reviewers on Google Review.

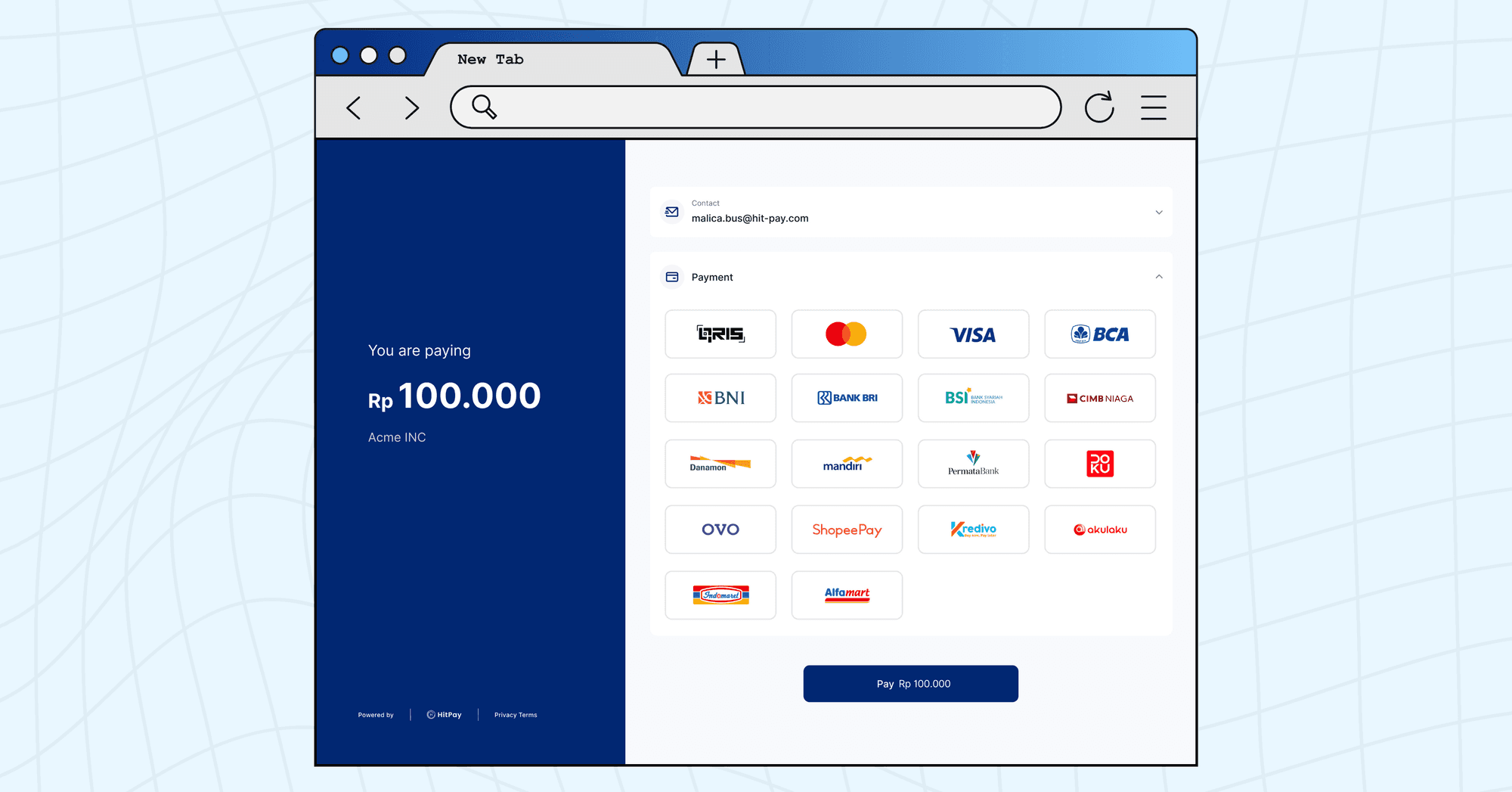

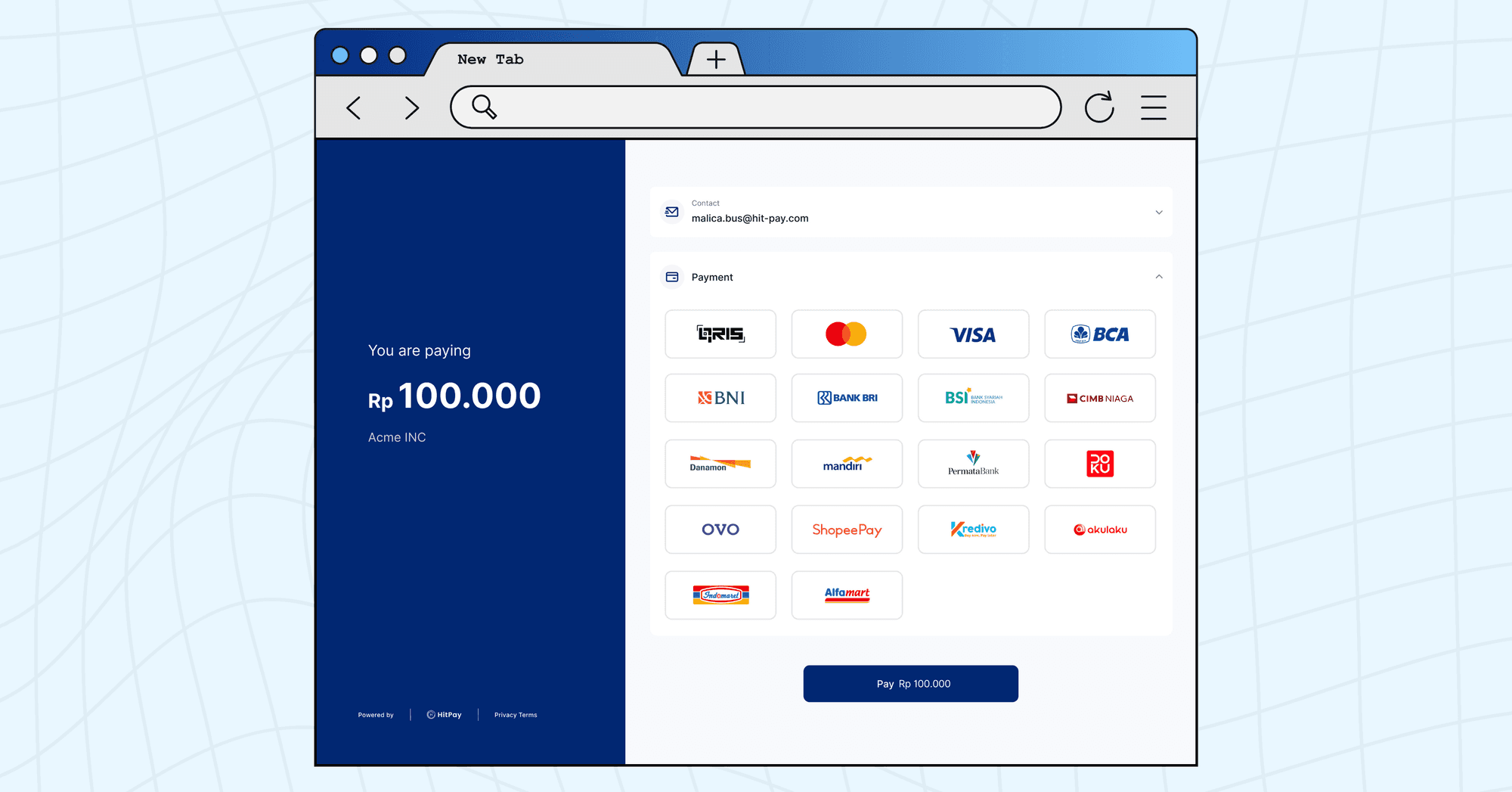

Hitpay Payment Gateway: An Alternative to Midtrans Payment Gateway

Choosing HitPay as an alternative to Midtrans can provide several significant advantages for your business.

Easy Integration Without Coding: HitPay offers extensive integration without requiring specialized programming or coding, supporting various e-commerce platforms and sales channels. Additionally, you can easily synchronize your online and offline sales in one location.

Free Business Software: HitPay provides business software for free, including an invoice generator and store builder. More importantly, HitPay does not charge a subscription fee for the use of this software.

Affordable and Flexible Fees: HitPay adopts a simple pricing approach, with clear per-transaction fees and no hidden charges. This transparent approach allows businesses in the growth phase to effectively plan their expenses without worrying about additional costs or surprises.

If you are considering HitPay to expand your business in Indonesia, contact us now to get a free demo from our team.

Midtrans Payment Gateway Reviews in Indonesia: User Reviews & Alternatives

December 27, 2023

HitPay emerges as the top alternative payment gateway in Indonesia, rivalling Midtrans. However, if you are in search of a comprehensive payment platform, HitPay Indonesia might be a more fitting choice.

Choosing the right payment gateway for your business in Indonesia requires careful consideration before making a decision. One important aspect is reviewing feedback from other users, comparing the strengths and weaknesses of different payment gateway platforms, and exploring alternative payment gateway options available in Indonesia.

What is Midtrans Payment Gateway

Midtrans is a digital payment platform affiliated with GoTo Financial. Offering more than 25 local payment methods, it presents a robust set of features, making it the preferred option for SMEs in Indonesia. Nevertheless, it's worth noting that Midtrans may not be accessible on all online stores and has limited integration with certain e-commerce plugins. Additionally, Midtrans isn't connected to accounting systems and doesn't feature supplementary business software.

Pros and Cons of Midtrans

Review Midtrans Payment Gateway

User feedback on Midtrans indicates negative experiences with this payment gateway in Indonesia. Some users initially signed up with hopes of streamlining their business transactions through Midtrans. However, they regretted their choice due to various issues, including fund withholding by Midtrans, slow customer service responses, and prolonged response times of up to a week, leading to frustration and disappointment among users.

In response to these issues, several Xendit users have chosen to transition to alternative payment gateways like HitPay. HitPay is recognized for delivering prompt, friendly, and efficient service, a distinction evident in customer service reviews comparing HitPay and Midtrans. HitPay received a higher score, specifically 4.7 out of 257 reviewers on Trustpilot, while Xendit attained a score of 3.6 out of 134 reviewers on Google Review.

Hitpay Payment Gateway: An Alternative to Midtrans Payment Gateway

Choosing HitPay as an alternative to Midtrans can provide several significant advantages for your business.

Easy Integration Without Coding: HitPay offers extensive integration without requiring specialized programming or coding, supporting various e-commerce platforms and sales channels. Additionally, you can easily synchronize your online and offline sales in one location.

Free Business Software: HitPay provides business software for free, including an invoice generator and store builder. More importantly, HitPay does not charge a subscription fee for the use of this software.

Affordable and Flexible Fees: HitPay adopts a simple pricing approach, with clear per-transaction fees and no hidden charges. This transparent approach allows businesses in the growth phase to effectively plan their expenses without worrying about additional costs or surprises.

If you are considering HitPay to expand your business in Indonesia, contact us now to get a free demo from our team.

Midtrans Payment Gateway Reviews in Indonesia: User Reviews & Alternatives

December 27, 2023

HitPay emerges as the top alternative payment gateway in Indonesia, rivalling Midtrans. However, if you are in search of a comprehensive payment platform, HitPay Indonesia might be a more fitting choice.

Choosing the right payment gateway for your business in Indonesia requires careful consideration before making a decision. One important aspect is reviewing feedback from other users, comparing the strengths and weaknesses of different payment gateway platforms, and exploring alternative payment gateway options available in Indonesia.

What is Midtrans Payment Gateway

Midtrans is a digital payment platform affiliated with GoTo Financial. Offering more than 25 local payment methods, it presents a robust set of features, making it the preferred option for SMEs in Indonesia. Nevertheless, it's worth noting that Midtrans may not be accessible on all online stores and has limited integration with certain e-commerce plugins. Additionally, Midtrans isn't connected to accounting systems and doesn't feature supplementary business software.

Pros and Cons of Midtrans

Review Midtrans Payment Gateway

User feedback on Midtrans indicates negative experiences with this payment gateway in Indonesia. Some users initially signed up with hopes of streamlining their business transactions through Midtrans. However, they regretted their choice due to various issues, including fund withholding by Midtrans, slow customer service responses, and prolonged response times of up to a week, leading to frustration and disappointment among users.

In response to these issues, several Xendit users have chosen to transition to alternative payment gateways like HitPay. HitPay is recognized for delivering prompt, friendly, and efficient service, a distinction evident in customer service reviews comparing HitPay and Midtrans. HitPay received a higher score, specifically 4.7 out of 257 reviewers on Trustpilot, while Xendit attained a score of 3.6 out of 134 reviewers on Google Review.

Hitpay Payment Gateway: An Alternative to Midtrans Payment Gateway

Choosing HitPay as an alternative to Midtrans can provide several significant advantages for your business.

Easy Integration Without Coding: HitPay offers extensive integration without requiring specialized programming or coding, supporting various e-commerce platforms and sales channels. Additionally, you can easily synchronize your online and offline sales in one location.

Free Business Software: HitPay provides business software for free, including an invoice generator and store builder. More importantly, HitPay does not charge a subscription fee for the use of this software.

Affordable and Flexible Fees: HitPay adopts a simple pricing approach, with clear per-transaction fees and no hidden charges. This transparent approach allows businesses in the growth phase to effectively plan their expenses without worrying about additional costs or surprises.

If you are considering HitPay to expand your business in Indonesia, contact us now to get a free demo from our team.

Let's get you set up

Create an account instantly or contact us to create a custom package for your business.

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

United Kingdom

Hong Kong

Sweden

United States

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

88 Market Street Level #40-01, CapitaSpring, Singapore 048948.

Let's get you set up

Create an account instantly or contact us to create a custom package for your business.

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

United Kingdom

Hong Kong

Sweden

United States

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

88 Market Street Level #40-01, CapitaSpring, Singapore 048948.

Let's get you set up

Create an account instantly or contact us to create a custom package for your business.

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

United Kingdom

Hong Kong

Sweden

United States

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

88 Market Street Level #40-01, CapitaSpring, Singapore 048948.

Let's get you set up

Create an account instantly or contact us to create a custom package for your business.

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

United Kingdom

Hong Kong

Sweden

United States

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

88 Market Street Level #40-01, CapitaSpring, Singapore 048948.