Indonesia Payment Gateway Comparison [2023]: Xendit vs Midtrans, Doku, and HitPay Indonesia

February 13, 2023

In this Indonesia payment gateway comparison, we look at what to consider when choosing a payment gateway in Indonesia.

Choosing a payment gateway for your small business in Indonesia?

In this Indonesia payment gateway comparison, we look at what to consider when choosing a payment gateway and compare the pros and cons of the best payment gateways in Indonesia — Xendit, Midtrans, Doku, and HitPay.

5 important factors when choosing an Indonesian payment gateway

1) Pricing

Indonesian payment gateways take a percentage of your total revenue in transaction fees. These fees are often based on your customer's payment method.

If you want to reduce the amount of fees you pay, choose a payment gateway that lets you share or pass transaction fees to your customers.

2) Settlement time

How fast does your payment gateway take to transfer money to your account?

Payment gateways hold money for a few days before transferring it to your account. These settlement times can affect how you manage your cash flow.

3) Supported payment methods and currencies

Customers in Indonesia use various payment methods from cash, bank transfers, e-wallets and QRIS — Indonesia’s national payment transfer system.

Make sure you’re aware of the payment preferences of your target audience so you can offer them on your e-commerce platform and sales channels. Multiple currency support also comes in handy if you’re doing business in multiple markets beyond Indonesia.

4) Online integrations

Payment gateways should integrate with other tools or include the tools you need if you want to sell online efficiently.

Some useful online integrations for any e-commerce seller:

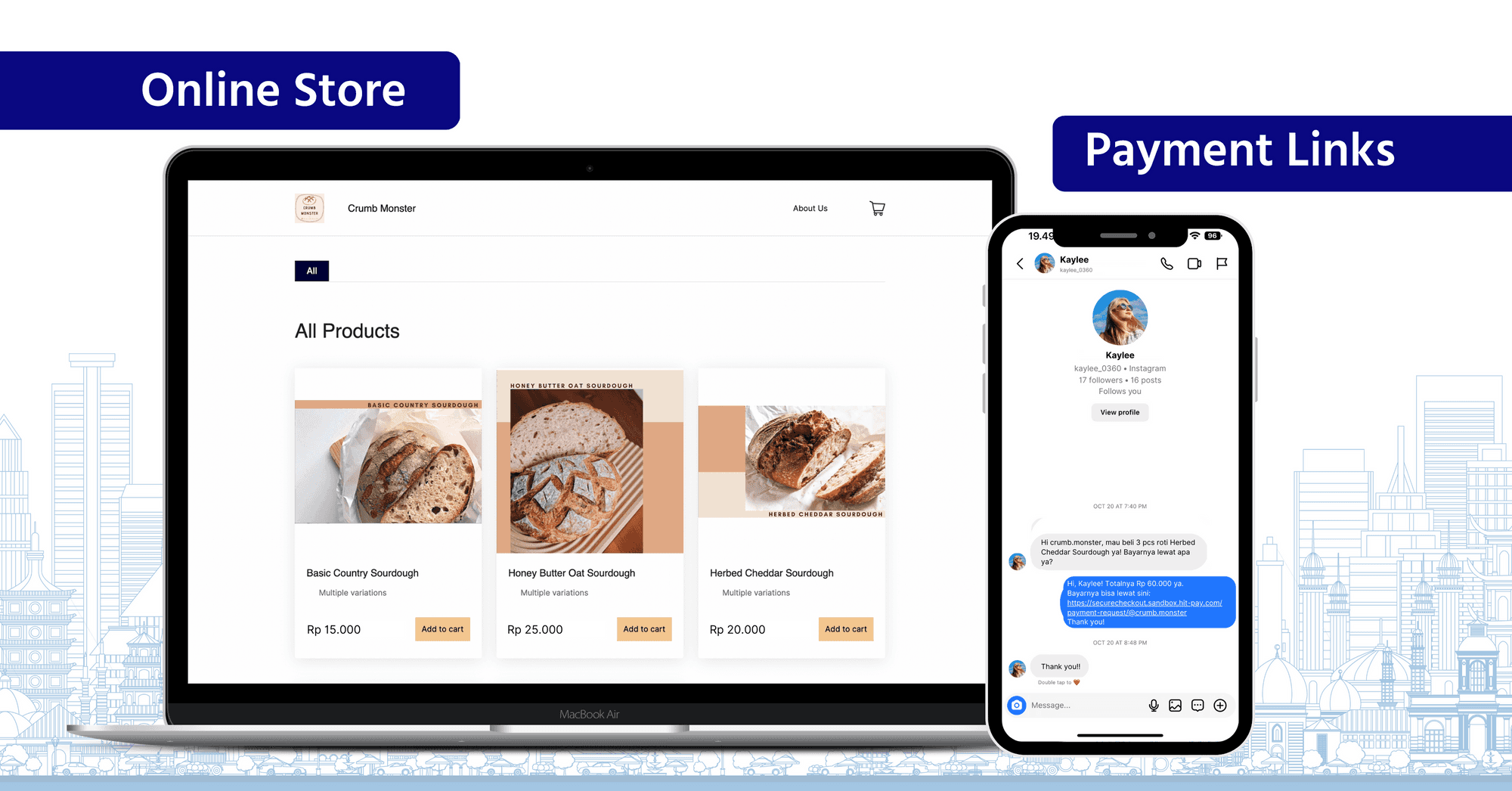

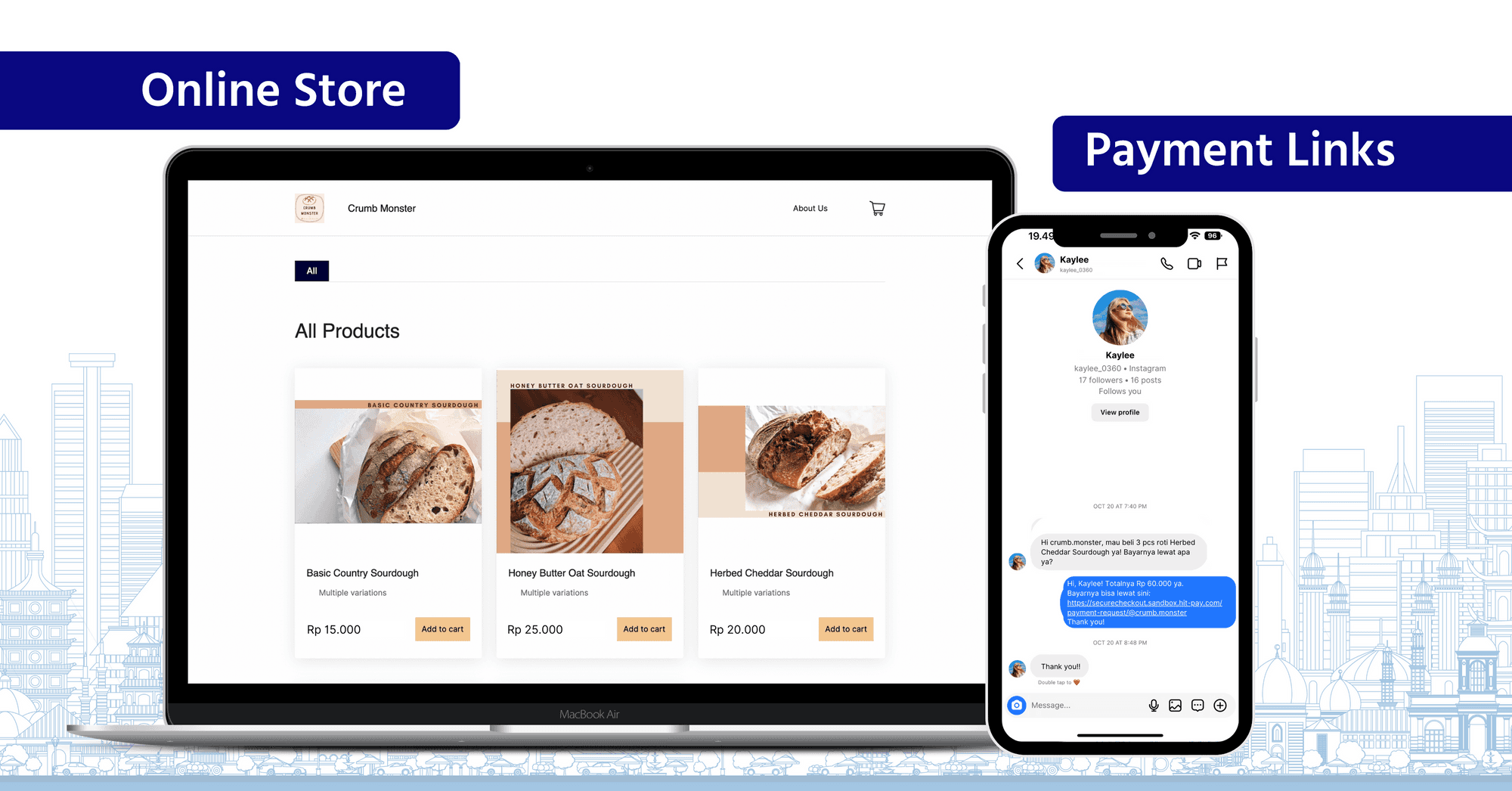

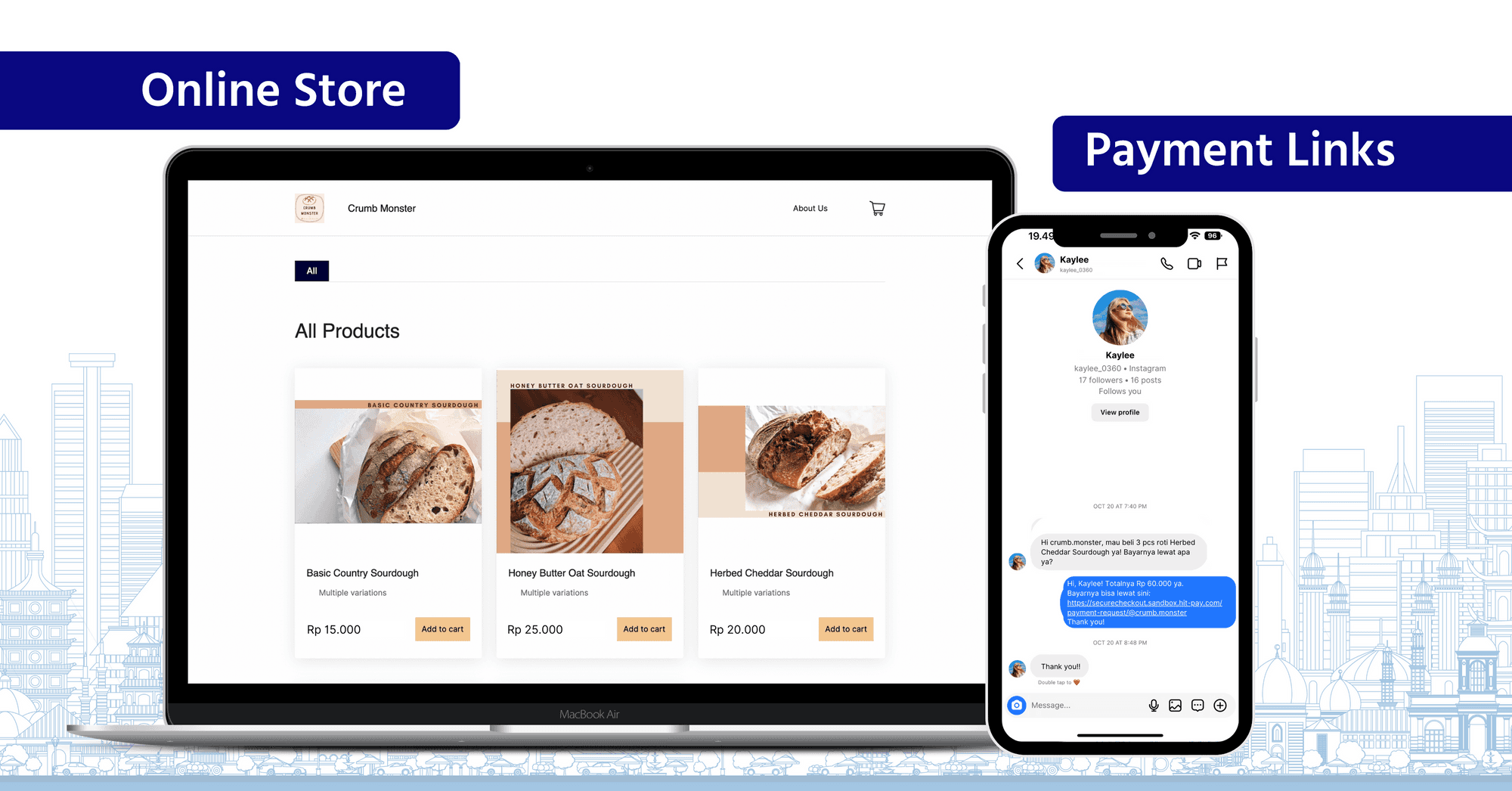

Free online store: There aren't many payment gateways that come with an online store, so you'll either need one with one built-in or one that integrates with your chosen e-commerce platform

Payment links: Accept online payments over social media or messaging apps with payment links

Invoice generator: Instantly create invoices to send to your customers

Accounting software integrations: Skip the hassle of manual bookkeeping with automatic transaction updates

Read also: 7 must-have small business software that are completely free

5) POS integrations

Accepting payments in-person? A good payment gateway goes beyond processing payments to help you save time and reduce costs.

Here are useful POS software your payment gateway should have.

Easy in-person payments: Tools like Scan To Pay helps you accept POS payments in seconds, all from your mobile phone.

Inventory management: Help track inventory and alert you when you need to restock across your online and offline channels

Business tools: Includes invoicing, customising receipts and invoices, and receipt printer integrations.

Location and staff management: Easily sell across multiple locations with tools to track sales, add/remove staff members, and more.

Best payment gateways in Indonesia — 2023 comparison

Xendit

Founded in 2015, Xendit is a reliable choice in Indonesia as it supports a wide range of local payment methods. However, it doesn't offer online store features, so you’ll need to add an external e-commerce platform to sell online.

Pros

✅ No setup or annual fees. Only pay per transaction

✅ Easy setup with no technical knowledge needed

✅ Has advanced payment features such as invoicing, 24/7 automated payouts and payment facilitation across sub-merchants or partners

Cons

❌ No additional business software included. If you need to manage inventory and or create an e-commerce store, you'll need another platform.

Midtrans

Part of the GoTo Financial platform, Midtrans is a good payment gateway for small businesses in Indonesia thanks to its 25+ local payment methods and order management features. However, you may want to look elsewhere if you’re not on Shopify or WooCommerce.

Pros:

✅ No setup or annual fees. Only pay per transaction

✅ 25+ payment methods and order management features

Cons:

❌ Limited 3rd party e-commerce platform integrations. Not all online stores are supported

❌ No accounting integrations or additional business software included

Doku

Doku’s payment gateway comes with e-Katalog (its no-code online store) but lacks essential features like accounting software integrations and e-commerce integrations.

Pros:

✅ No setup or annual fees. Only pay per transaction.

✅ Offers no-code invoicing, online store builder and payment link tools

Cons:

❌ No accounting integrations included

❌ Limited 3rd party e-commerce platform integrations. Only supports Magento, PrestaShop, Shopify and WooCommerce.

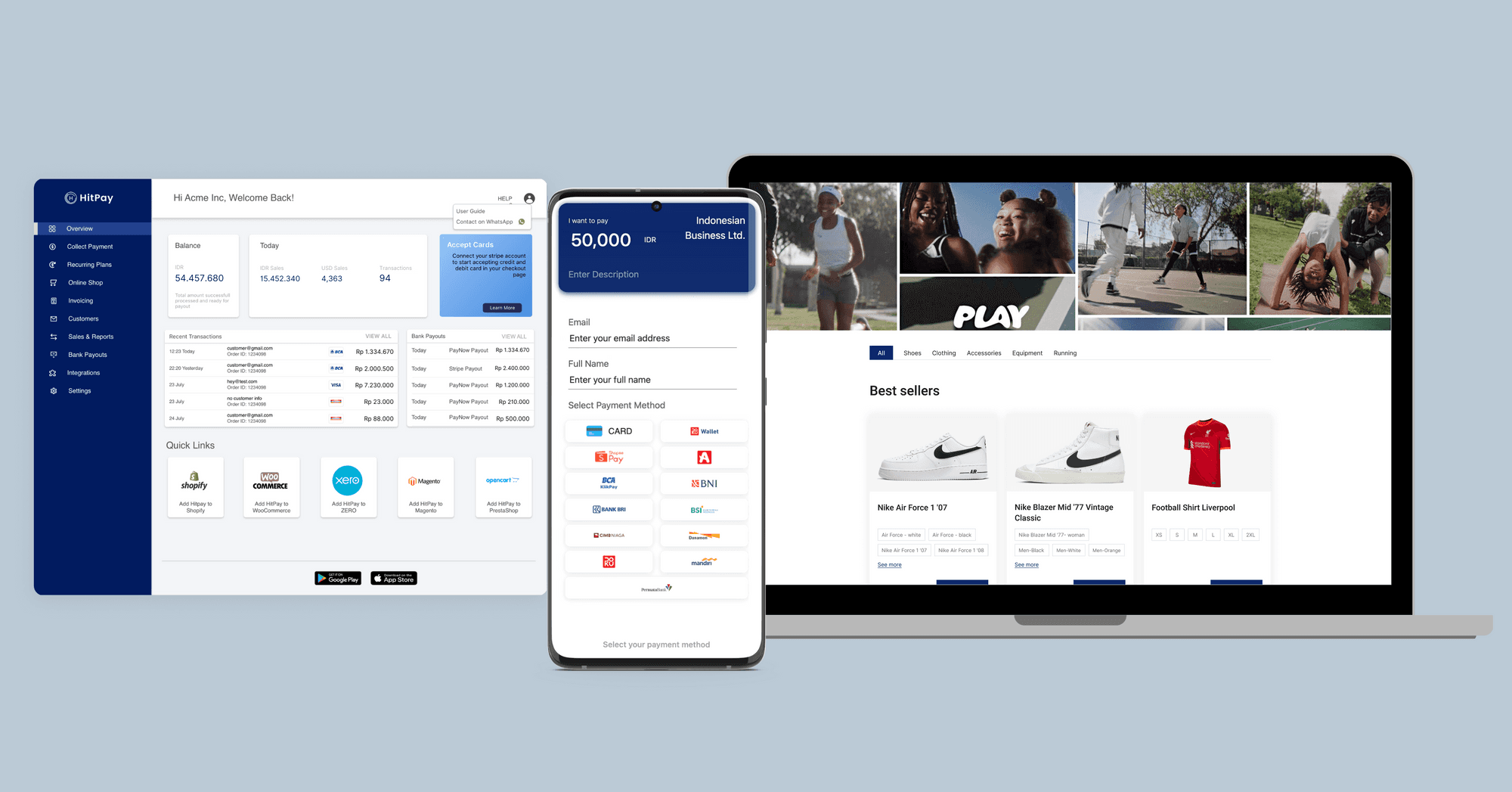

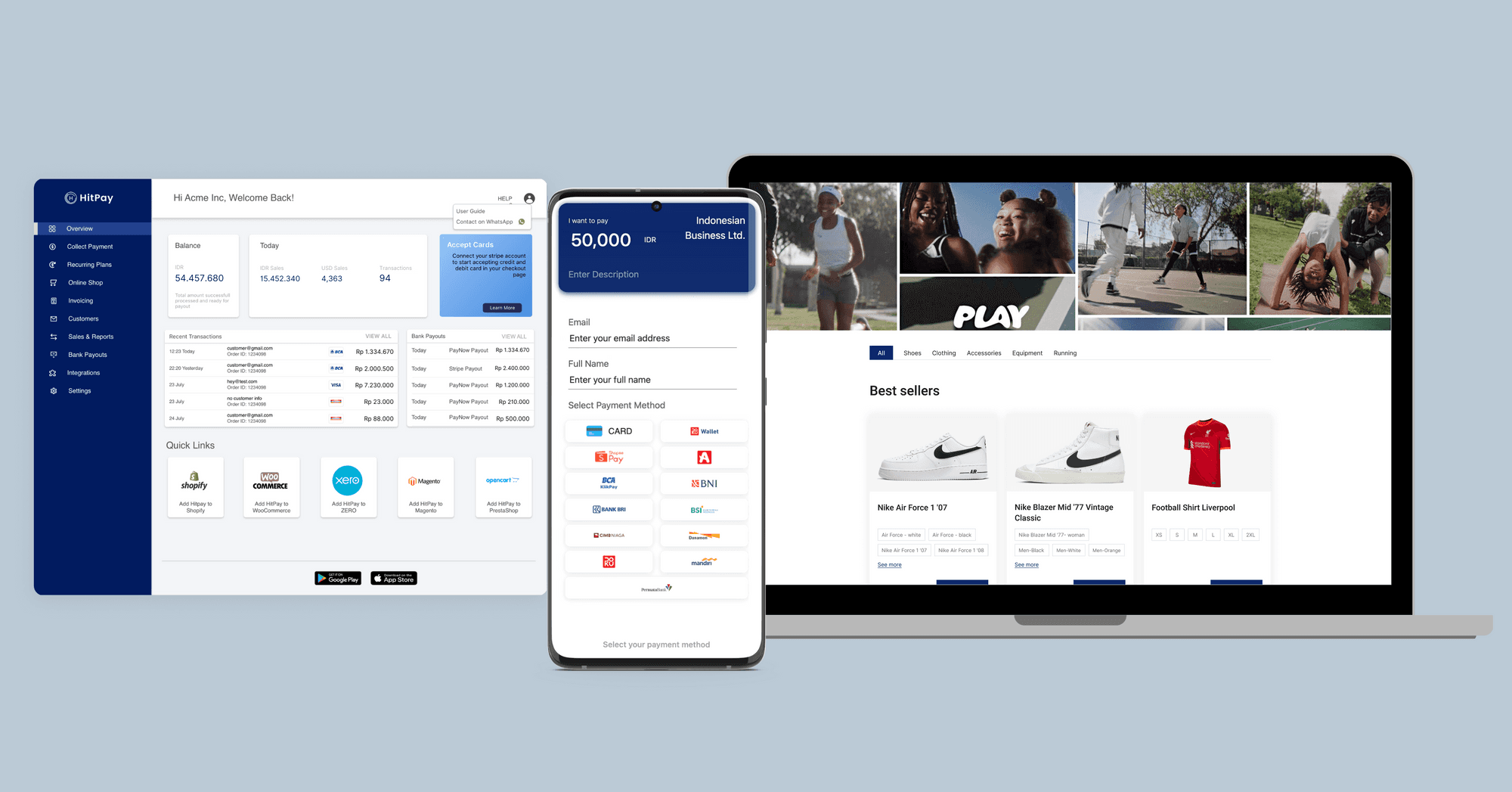

HitPay Indonesia

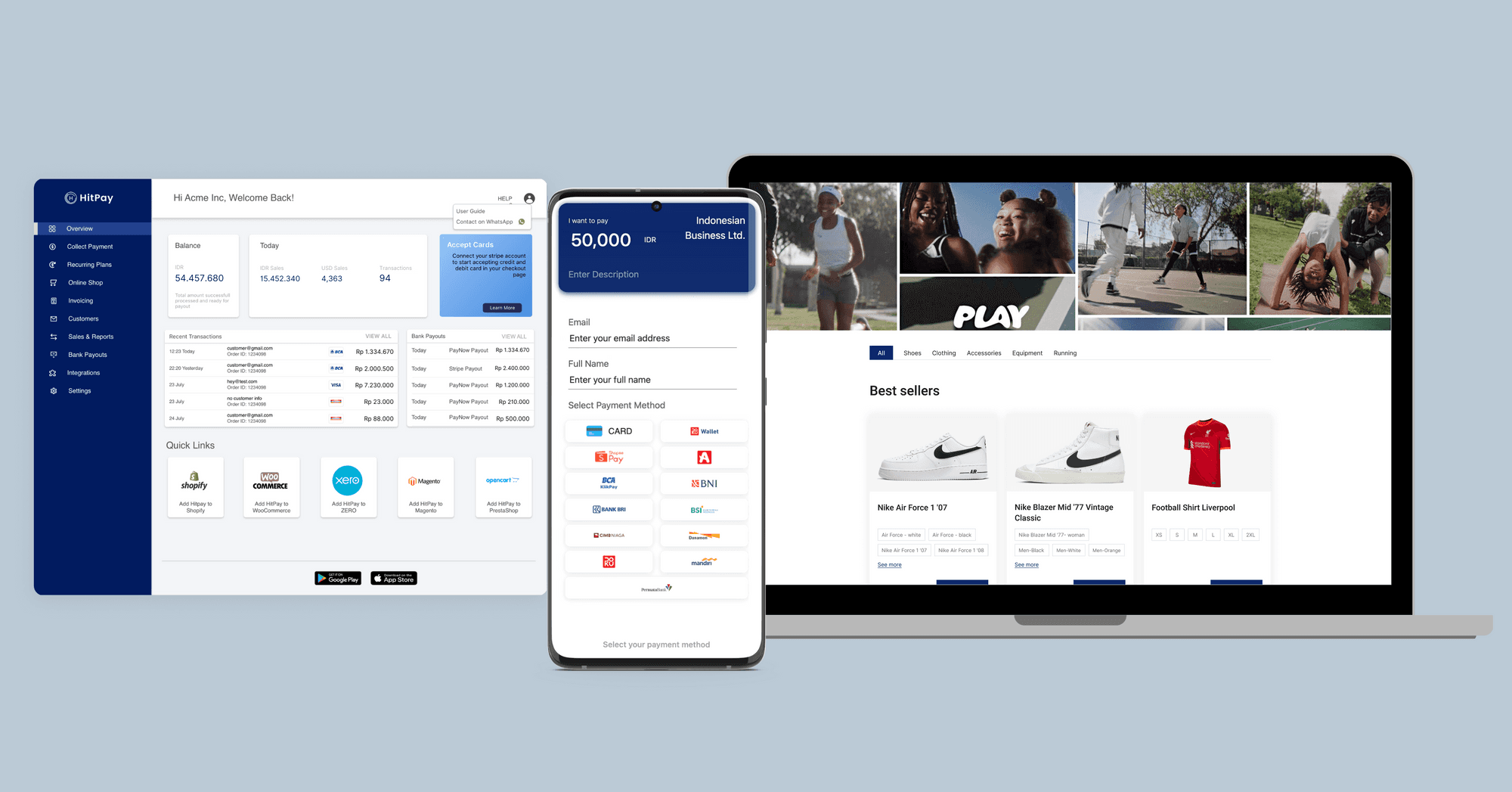

HitPay is a one-stop, online-and-offline payments platform built for small businesses and SMEs. Founded in Singapore, HitPay has just launched in Indonesia.

Pros:

✅ No setup, annual fees or minimum monthly transactions. Only pay per transaction (or pass all merchant fees to customers)

✅ Supports major e-commerce platforms including Shopify, WooCommerce, EasyStore, Prestashop, Magento, OpenCart, Shopcada, Ecwid, Wix, and Google Forms

✅ All business software you need included for free (invoice generator, website builder, and more)

✅ Integrated POS system to automatically sync online and offline sales

✅ Accounting integrations with Xero and Quickbooks

Cons:

❌ Credit card terminals not available on launch, but coming soon

See HitPay pricing and payment methods here.

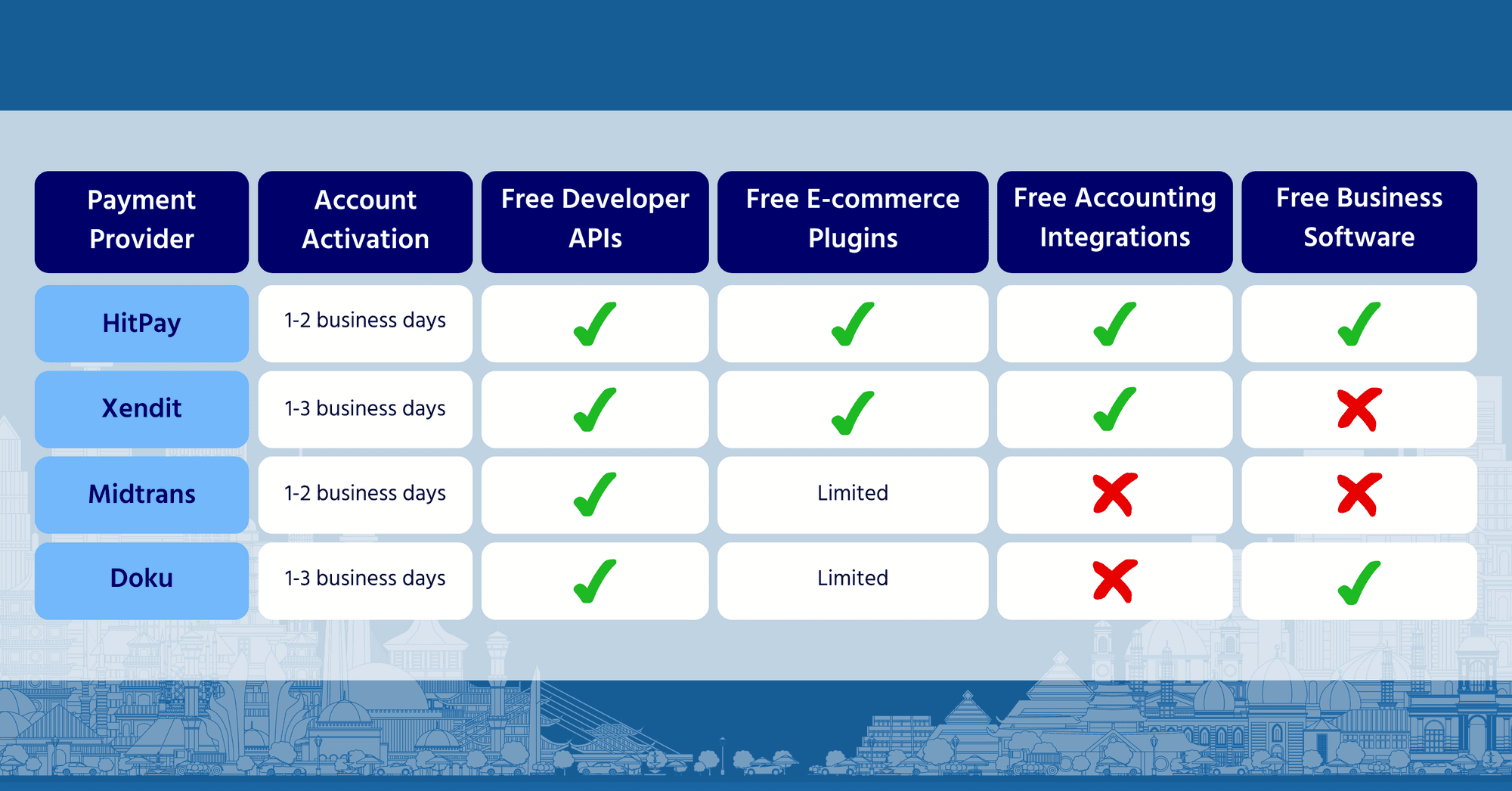

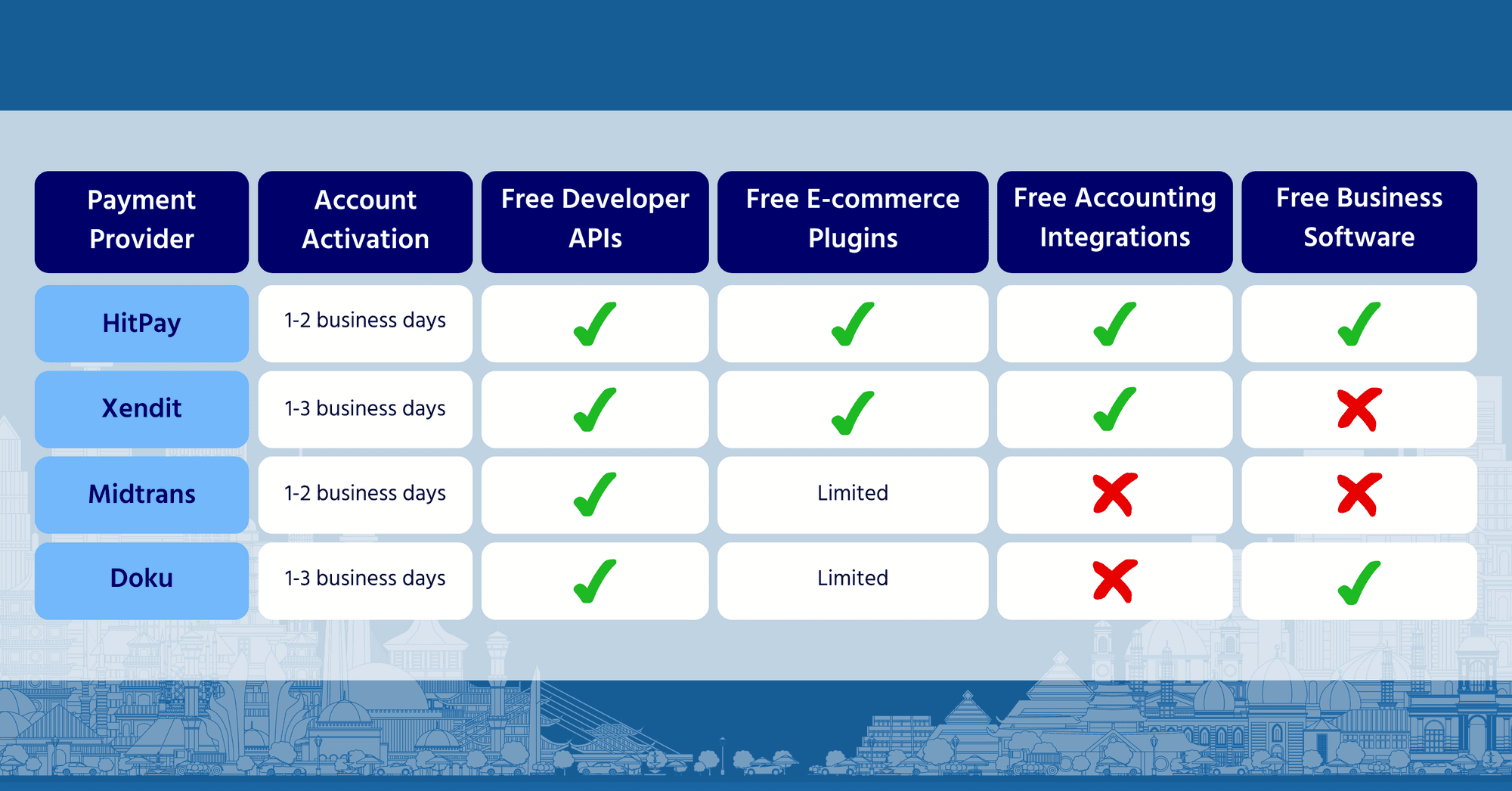

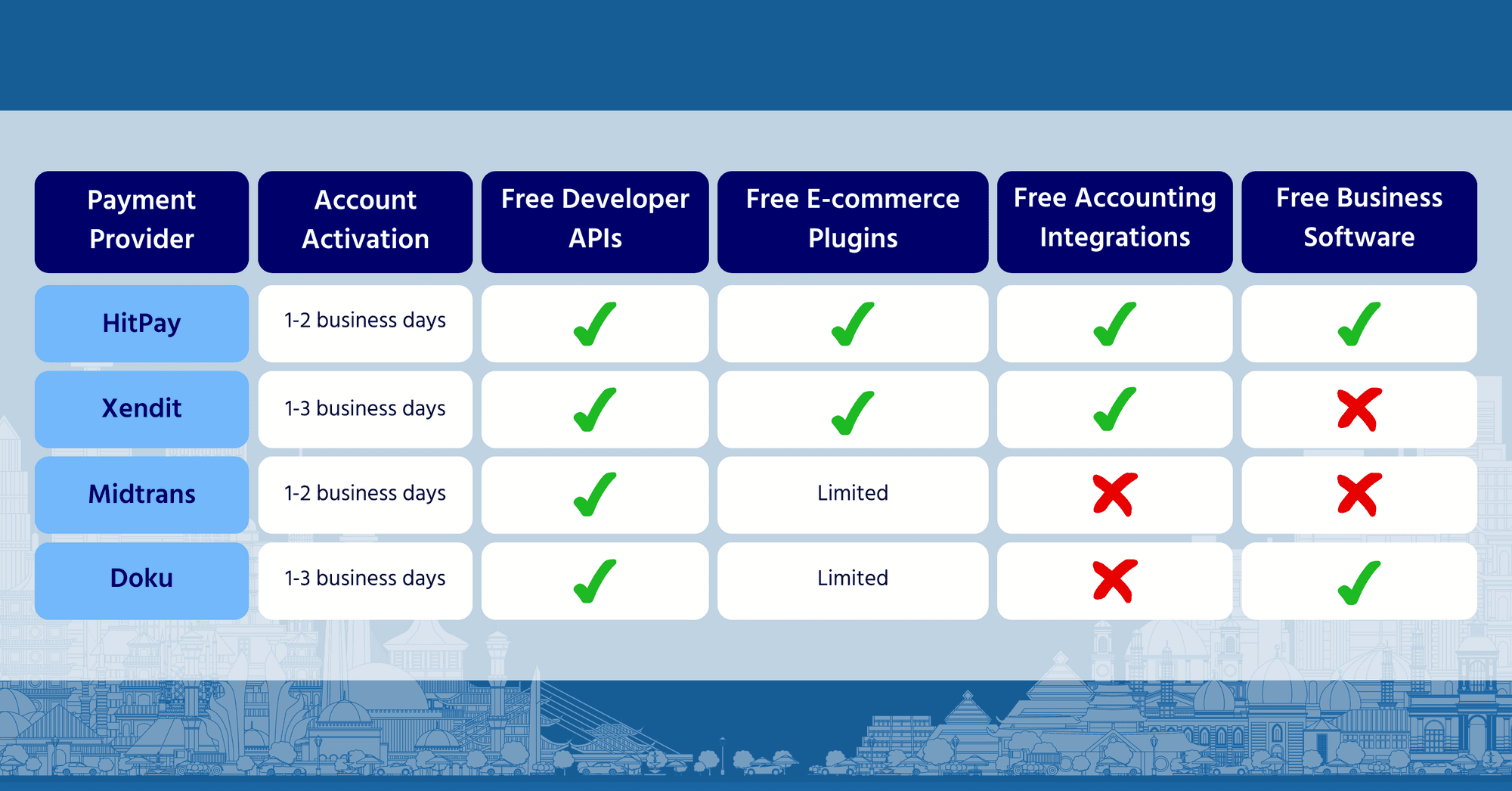

Indonesia Payment Gateway Comparison

Payment Gateway Features

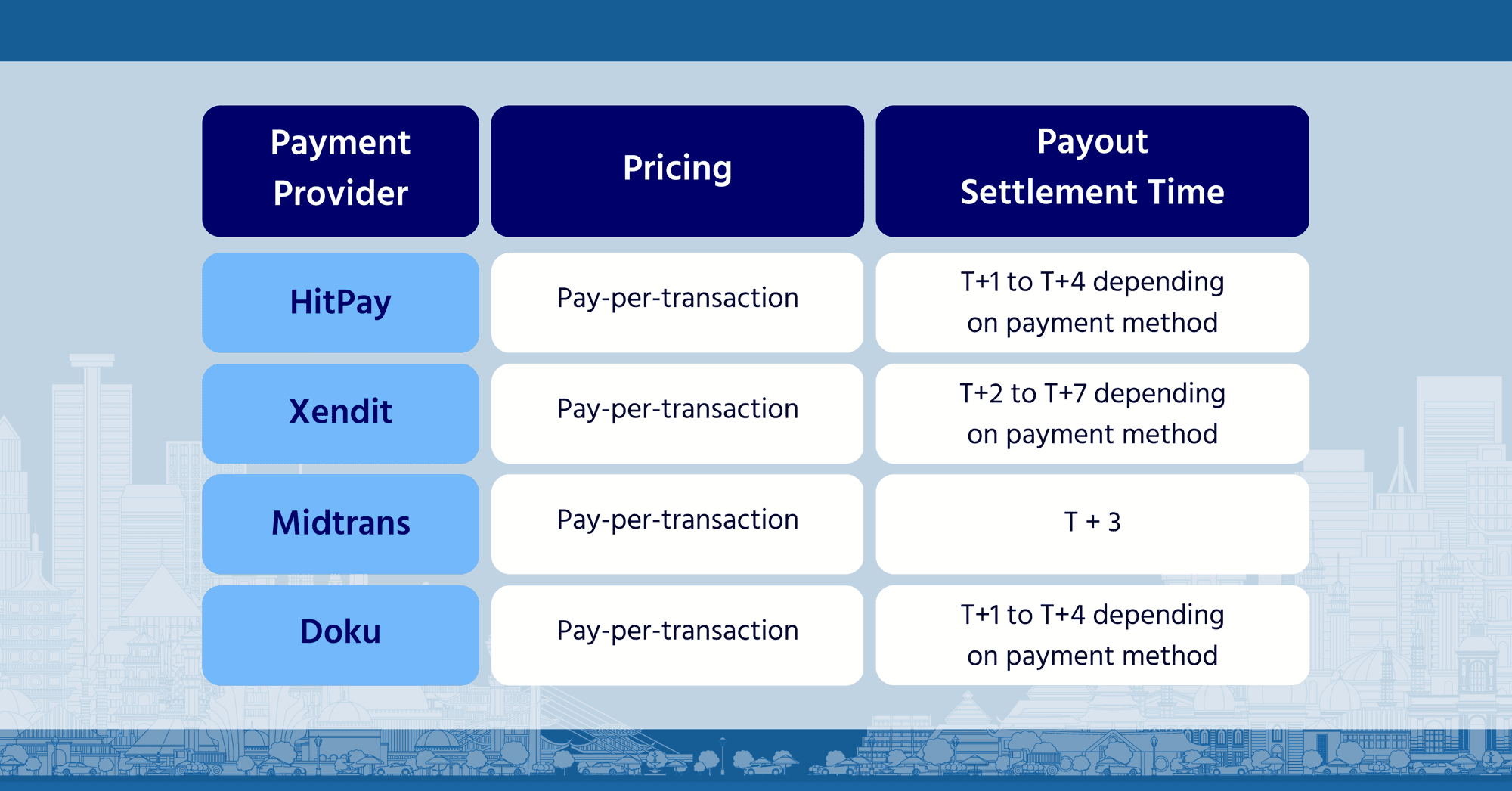

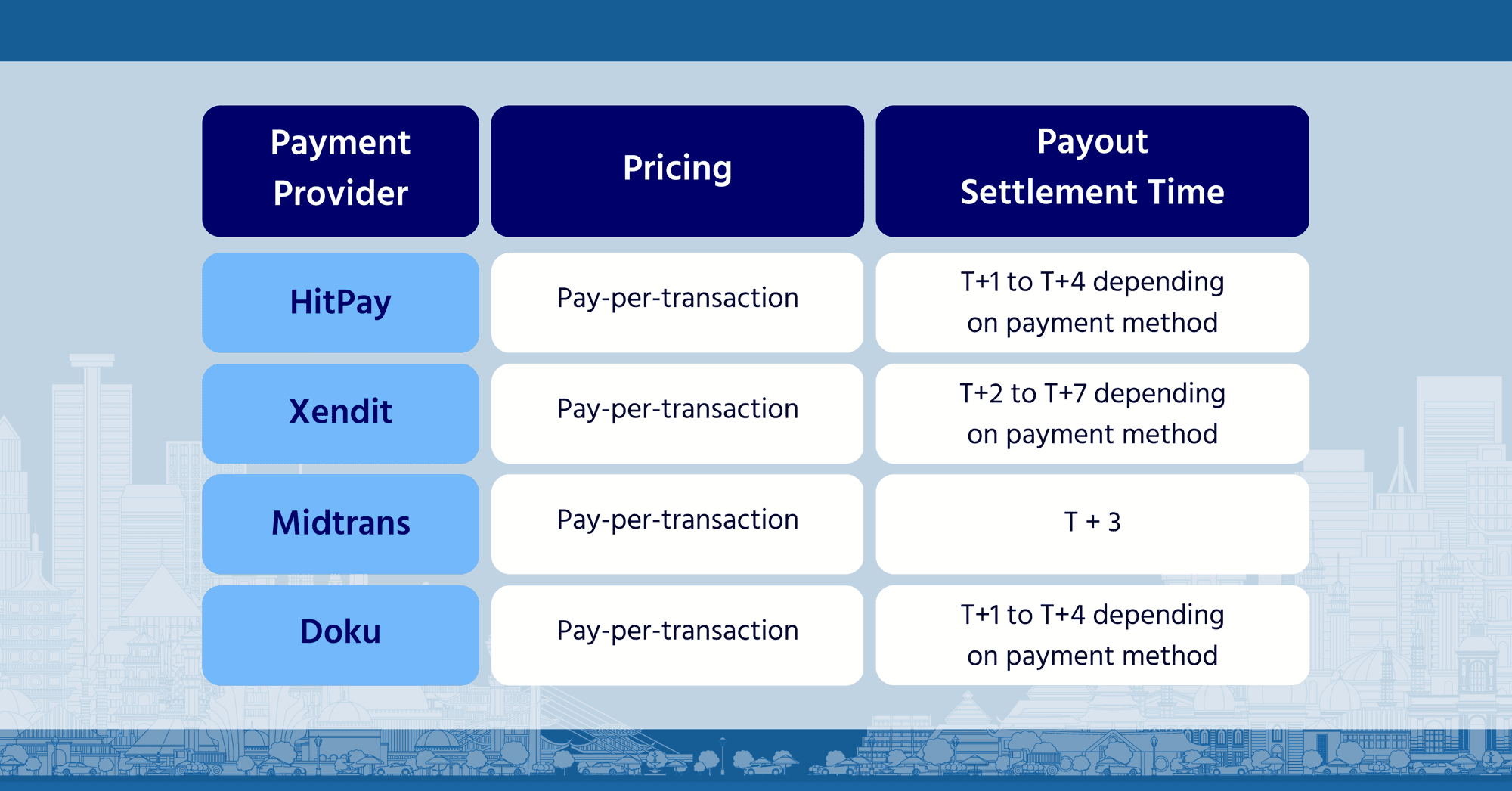

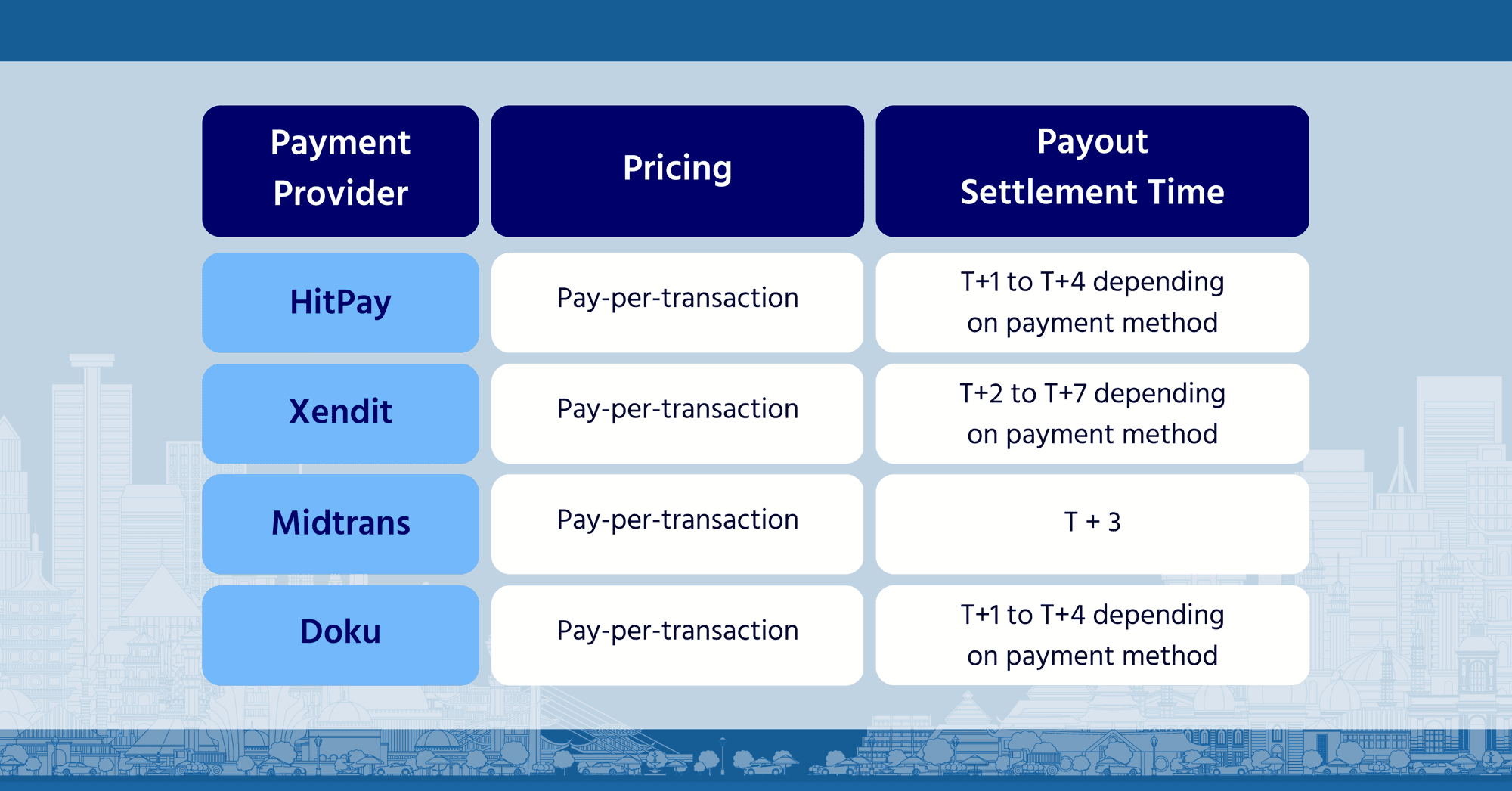

Pricing and Settlement Time

Best online payment gateway in Indonesia

If you want an all-in-one payment platform to grow your business, HitPay Indonesia may be the right fit for you.

Want to see how HitPay Indonesia works?

Contact us for a free demo!

Indonesia Payment Gateway Comparison [2023]: Xendit vs Midtrans, Doku, and HitPay Indonesia

February 13, 2023

In this Indonesia payment gateway comparison, we look at what to consider when choosing a payment gateway in Indonesia.

Choosing a payment gateway for your small business in Indonesia?

In this Indonesia payment gateway comparison, we look at what to consider when choosing a payment gateway and compare the pros and cons of the best payment gateways in Indonesia — Xendit, Midtrans, Doku, and HitPay.

5 important factors when choosing an Indonesian payment gateway

1) Pricing

Indonesian payment gateways take a percentage of your total revenue in transaction fees. These fees are often based on your customer's payment method.

If you want to reduce the amount of fees you pay, choose a payment gateway that lets you share or pass transaction fees to your customers.

2) Settlement time

How fast does your payment gateway take to transfer money to your account?

Payment gateways hold money for a few days before transferring it to your account. These settlement times can affect how you manage your cash flow.

3) Supported payment methods and currencies

Customers in Indonesia use various payment methods from cash, bank transfers, e-wallets and QRIS — Indonesia’s national payment transfer system.

Make sure you’re aware of the payment preferences of your target audience so you can offer them on your e-commerce platform and sales channels. Multiple currency support also comes in handy if you’re doing business in multiple markets beyond Indonesia.

4) Online integrations

Payment gateways should integrate with other tools or include the tools you need if you want to sell online efficiently.

Some useful online integrations for any e-commerce seller:

Free online store: There aren't many payment gateways that come with an online store, so you'll either need one with one built-in or one that integrates with your chosen e-commerce platform

Payment links: Accept online payments over social media or messaging apps with payment links

Invoice generator: Instantly create invoices to send to your customers

Accounting software integrations: Skip the hassle of manual bookkeeping with automatic transaction updates

Read also: 7 must-have small business software that are completely free

5) POS integrations

Accepting payments in-person? A good payment gateway goes beyond processing payments to help you save time and reduce costs.

Here are useful POS software your payment gateway should have.

Easy in-person payments: Tools like Scan To Pay helps you accept POS payments in seconds, all from your mobile phone.

Inventory management: Help track inventory and alert you when you need to restock across your online and offline channels

Business tools: Includes invoicing, customising receipts and invoices, and receipt printer integrations.

Location and staff management: Easily sell across multiple locations with tools to track sales, add/remove staff members, and more.

Best payment gateways in Indonesia — 2023 comparison

Xendit

Founded in 2015, Xendit is a reliable choice in Indonesia as it supports a wide range of local payment methods. However, it doesn't offer online store features, so you’ll need to add an external e-commerce platform to sell online.

Pros

✅ No setup or annual fees. Only pay per transaction

✅ Easy setup with no technical knowledge needed

✅ Has advanced payment features such as invoicing, 24/7 automated payouts and payment facilitation across sub-merchants or partners

Cons

❌ No additional business software included. If you need to manage inventory and or create an e-commerce store, you'll need another platform.

Midtrans

Part of the GoTo Financial platform, Midtrans is a good payment gateway for small businesses in Indonesia thanks to its 25+ local payment methods and order management features. However, you may want to look elsewhere if you’re not on Shopify or WooCommerce.

Pros:

✅ No setup or annual fees. Only pay per transaction

✅ 25+ payment methods and order management features

Cons:

❌ Limited 3rd party e-commerce platform integrations. Not all online stores are supported

❌ No accounting integrations or additional business software included

Doku

Doku’s payment gateway comes with e-Katalog (its no-code online store) but lacks essential features like accounting software integrations and e-commerce integrations.

Pros:

✅ No setup or annual fees. Only pay per transaction.

✅ Offers no-code invoicing, online store builder and payment link tools

Cons:

❌ No accounting integrations included

❌ Limited 3rd party e-commerce platform integrations. Only supports Magento, PrestaShop, Shopify and WooCommerce.

HitPay Indonesia

HitPay is a one-stop, online-and-offline payments platform built for small businesses and SMEs. Founded in Singapore, HitPay has just launched in Indonesia.

Pros:

✅ No setup, annual fees or minimum monthly transactions. Only pay per transaction (or pass all merchant fees to customers)

✅ Supports major e-commerce platforms including Shopify, WooCommerce, EasyStore, Prestashop, Magento, OpenCart, Shopcada, Ecwid, Wix, and Google Forms

✅ All business software you need included for free (invoice generator, website builder, and more)

✅ Integrated POS system to automatically sync online and offline sales

✅ Accounting integrations with Xero and Quickbooks

Cons:

❌ Credit card terminals not available on launch, but coming soon

See HitPay pricing and payment methods here.

Indonesia Payment Gateway Comparison

Payment Gateway Features

Pricing and Settlement Time

Best online payment gateway in Indonesia

If you want an all-in-one payment platform to grow your business, HitPay Indonesia may be the right fit for you.

Want to see how HitPay Indonesia works?

Contact us for a free demo!

Indonesia Payment Gateway Comparison [2023]: Xendit vs Midtrans, Doku, and HitPay Indonesia

February 13, 2023

In this Indonesia payment gateway comparison, we look at what to consider when choosing a payment gateway in Indonesia.

Choosing a payment gateway for your small business in Indonesia?

In this Indonesia payment gateway comparison, we look at what to consider when choosing a payment gateway and compare the pros and cons of the best payment gateways in Indonesia — Xendit, Midtrans, Doku, and HitPay.

5 important factors when choosing an Indonesian payment gateway

1) Pricing

Indonesian payment gateways take a percentage of your total revenue in transaction fees. These fees are often based on your customer's payment method.

If you want to reduce the amount of fees you pay, choose a payment gateway that lets you share or pass transaction fees to your customers.

2) Settlement time

How fast does your payment gateway take to transfer money to your account?

Payment gateways hold money for a few days before transferring it to your account. These settlement times can affect how you manage your cash flow.

3) Supported payment methods and currencies

Customers in Indonesia use various payment methods from cash, bank transfers, e-wallets and QRIS — Indonesia’s national payment transfer system.

Make sure you’re aware of the payment preferences of your target audience so you can offer them on your e-commerce platform and sales channels. Multiple currency support also comes in handy if you’re doing business in multiple markets beyond Indonesia.

4) Online integrations

Payment gateways should integrate with other tools or include the tools you need if you want to sell online efficiently.

Some useful online integrations for any e-commerce seller:

Free online store: There aren't many payment gateways that come with an online store, so you'll either need one with one built-in or one that integrates with your chosen e-commerce platform

Payment links: Accept online payments over social media or messaging apps with payment links

Invoice generator: Instantly create invoices to send to your customers

Accounting software integrations: Skip the hassle of manual bookkeeping with automatic transaction updates

Read also: 7 must-have small business software that are completely free

5) POS integrations

Accepting payments in-person? A good payment gateway goes beyond processing payments to help you save time and reduce costs.

Here are useful POS software your payment gateway should have.

Easy in-person payments: Tools like Scan To Pay helps you accept POS payments in seconds, all from your mobile phone.

Inventory management: Help track inventory and alert you when you need to restock across your online and offline channels

Business tools: Includes invoicing, customising receipts and invoices, and receipt printer integrations.

Location and staff management: Easily sell across multiple locations with tools to track sales, add/remove staff members, and more.

Best payment gateways in Indonesia — 2023 comparison

Xendit

Founded in 2015, Xendit is a reliable choice in Indonesia as it supports a wide range of local payment methods. However, it doesn't offer online store features, so you’ll need to add an external e-commerce platform to sell online.

Pros

✅ No setup or annual fees. Only pay per transaction

✅ Easy setup with no technical knowledge needed

✅ Has advanced payment features such as invoicing, 24/7 automated payouts and payment facilitation across sub-merchants or partners

Cons

❌ No additional business software included. If you need to manage inventory and or create an e-commerce store, you'll need another platform.

Midtrans

Part of the GoTo Financial platform, Midtrans is a good payment gateway for small businesses in Indonesia thanks to its 25+ local payment methods and order management features. However, you may want to look elsewhere if you’re not on Shopify or WooCommerce.

Pros:

✅ No setup or annual fees. Only pay per transaction

✅ 25+ payment methods and order management features

Cons:

❌ Limited 3rd party e-commerce platform integrations. Not all online stores are supported

❌ No accounting integrations or additional business software included

Doku

Doku’s payment gateway comes with e-Katalog (its no-code online store) but lacks essential features like accounting software integrations and e-commerce integrations.

Pros:

✅ No setup or annual fees. Only pay per transaction.

✅ Offers no-code invoicing, online store builder and payment link tools

Cons:

❌ No accounting integrations included

❌ Limited 3rd party e-commerce platform integrations. Only supports Magento, PrestaShop, Shopify and WooCommerce.

HitPay Indonesia

HitPay is a one-stop, online-and-offline payments platform built for small businesses and SMEs. Founded in Singapore, HitPay has just launched in Indonesia.

Pros:

✅ No setup, annual fees or minimum monthly transactions. Only pay per transaction (or pass all merchant fees to customers)

✅ Supports major e-commerce platforms including Shopify, WooCommerce, EasyStore, Prestashop, Magento, OpenCart, Shopcada, Ecwid, Wix, and Google Forms

✅ All business software you need included for free (invoice generator, website builder, and more)

✅ Integrated POS system to automatically sync online and offline sales

✅ Accounting integrations with Xero and Quickbooks

Cons:

❌ Credit card terminals not available on launch, but coming soon

See HitPay pricing and payment methods here.

Indonesia Payment Gateway Comparison

Payment Gateway Features

Pricing and Settlement Time

Best online payment gateway in Indonesia

If you want an all-in-one payment platform to grow your business, HitPay Indonesia may be the right fit for you.