How to Sell at Overseas Exhibitions: Guide for Indonesian Businesses

December 27, 2023

In this guide for Indonesian merchants, learn how to sell at overseas pop-up fairs and exhibitions in markets such as Malaysia and Singapore. Read on!

Indonesia's products stand out in the international market due to their uniqueness and quality. Items such as spices, batik, coffee, textiles, and distinctive foods like krupuk and sambal are a huge hit with customers around the world. Not only are Indonesian products of high quality, but they also reflect a unique cultural heritage that appeals to the international market.

The presence of the HitPay payment gateway facilitates international transactions for small and medium-sized enterprises (UMKM), so you can access global customers more easily.

In this article, we will provide a guide on how to sell at overseas pop-up fairs and exhibitions in markets such as Malaysia and Singapore. Read on!

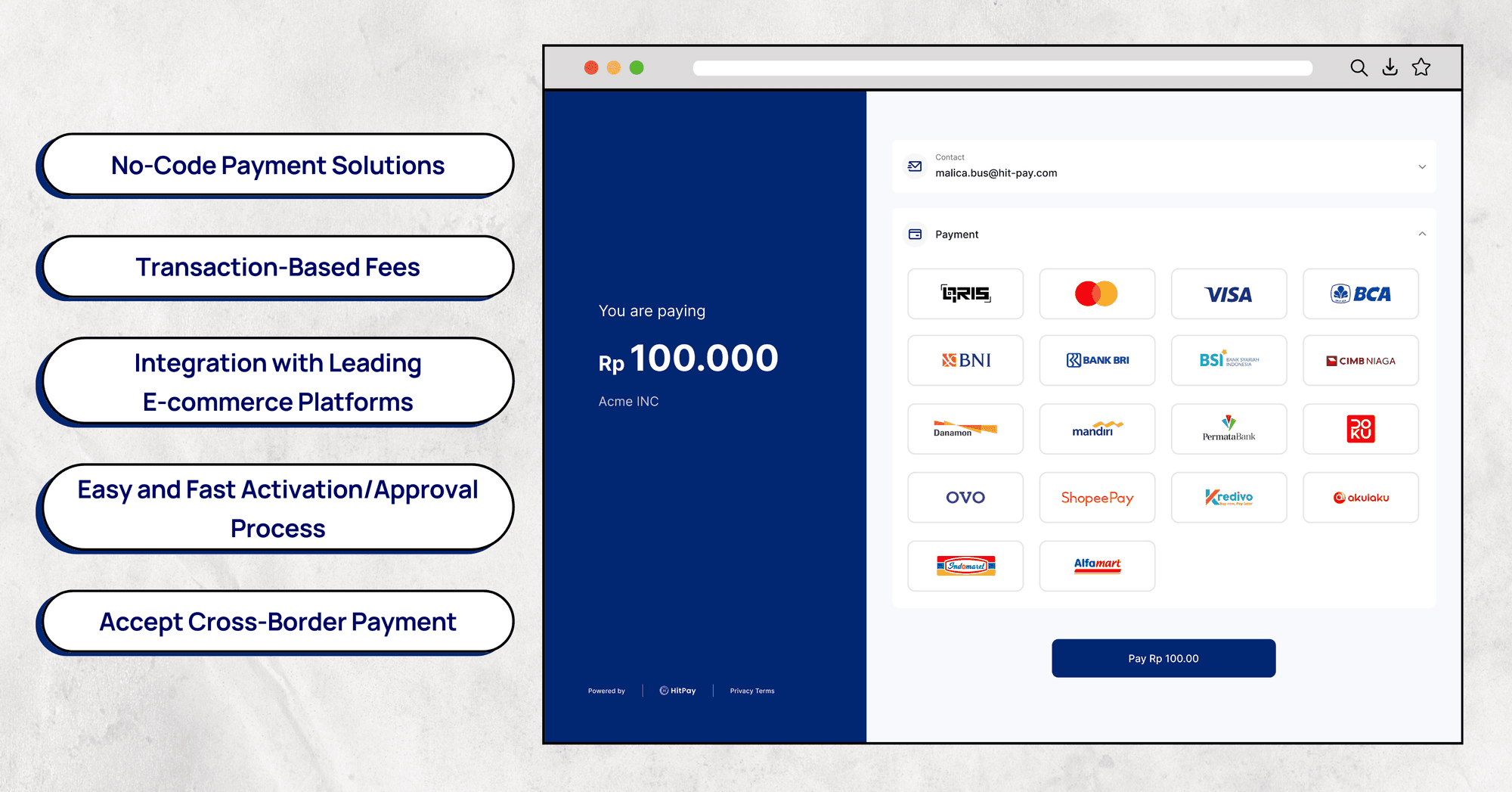

HitPay: Payment Gateway for International Transaction

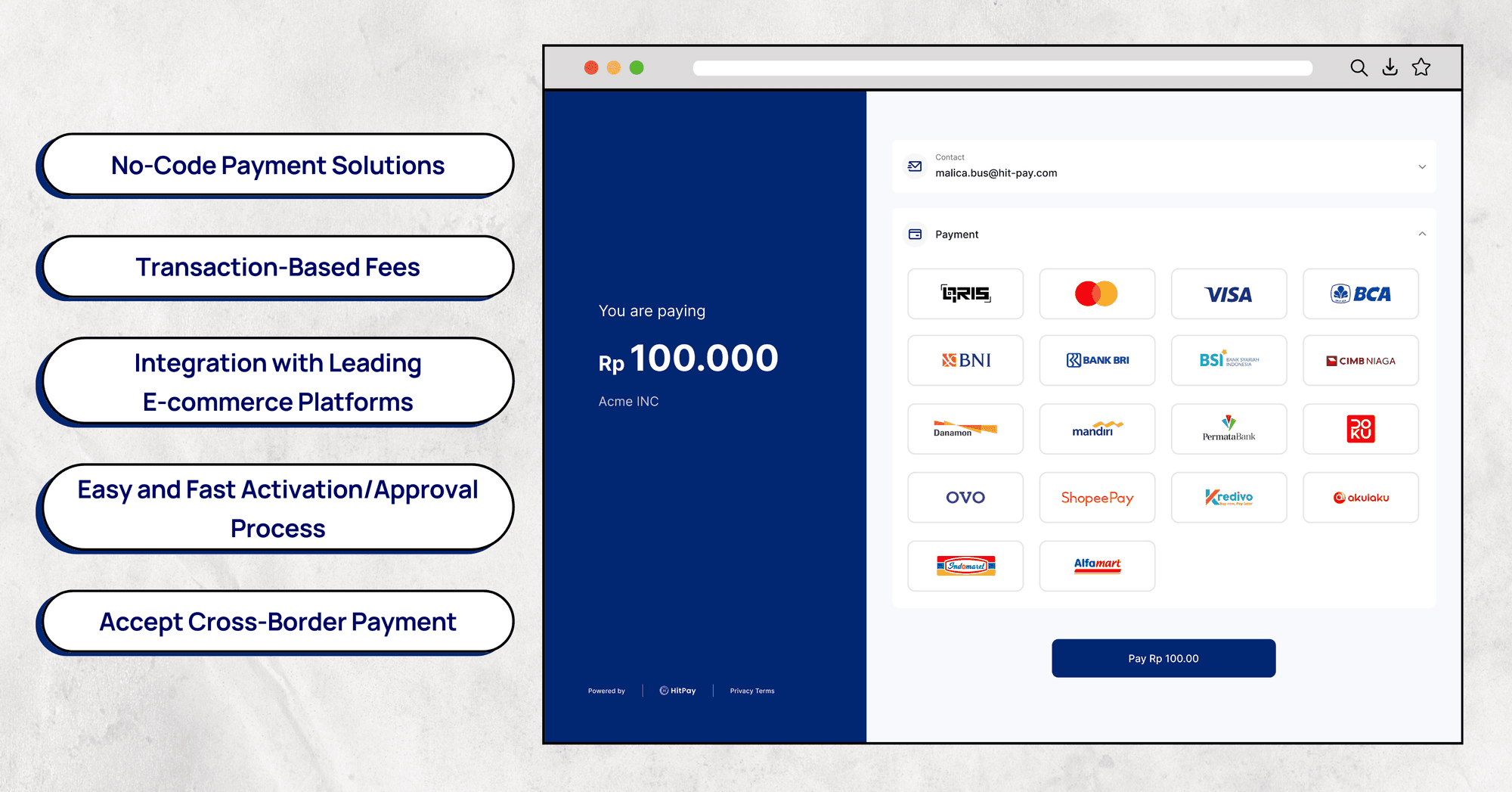

Compared to other payment platforms in Indonesia, HitPay offers several advantages:

No-Code Payment Solutions. HitPay provides payment solutions without the need for coding. This user-friendly feature simplifies the payment process for merchants.

Transaction-Based Fees. Enjoy the benefit of transaction-based fees with HitPay. There are no setup fees, subscription costs, or minimum monthly transaction requirements. HitPay also provides the option to reduce partner costs by shifting transaction fees to customers. All e-commerce and payment features are included for free.

Integration with Leading E-commerce Platforms. We offer a variety of plugin options without coding for leading e-commerce platforms such as Shopify, WooCommerce, Shopcada, Magento, Prestashop, and more. Seamless integration ensures a smooth experience for merchants on these platforms.

Easy and Fast Activation/Approval Process. Getting started with HitPay is quick and straightforward. You can begin accepting payments through HitPay in just 3 business days, a faster turnaround compared to other payment gateway providers.

Accept Cross-Border Payment. HitPay enables you to accept payments cross-border, allowing you to reach customers globally in line with the growth of your business.

If you encounter any issues while making payments using HitPay, don't worry! Just contact the HitPay team promptly, and they will assist promptly.

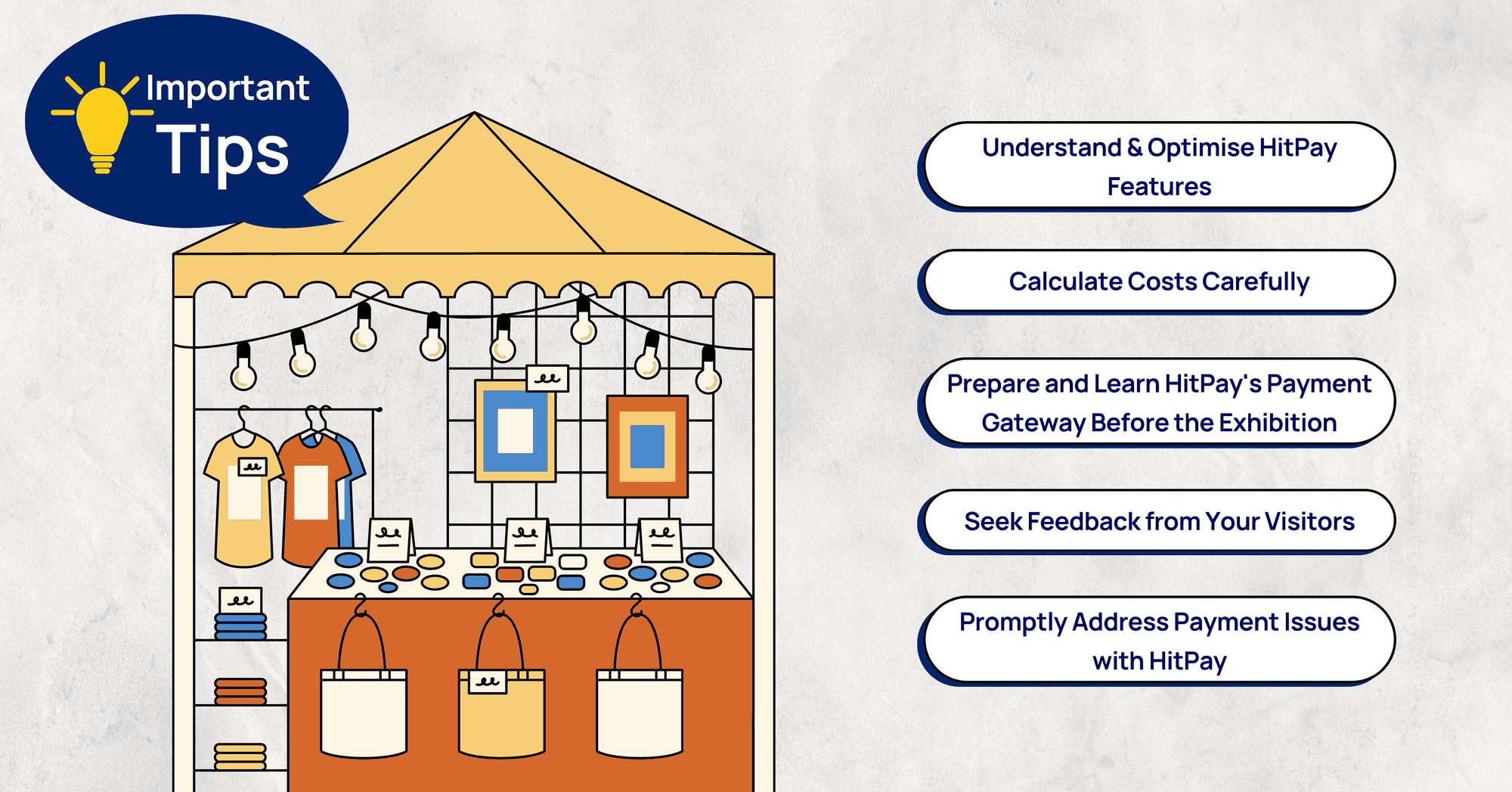

Selling Tips at International Exhibitions

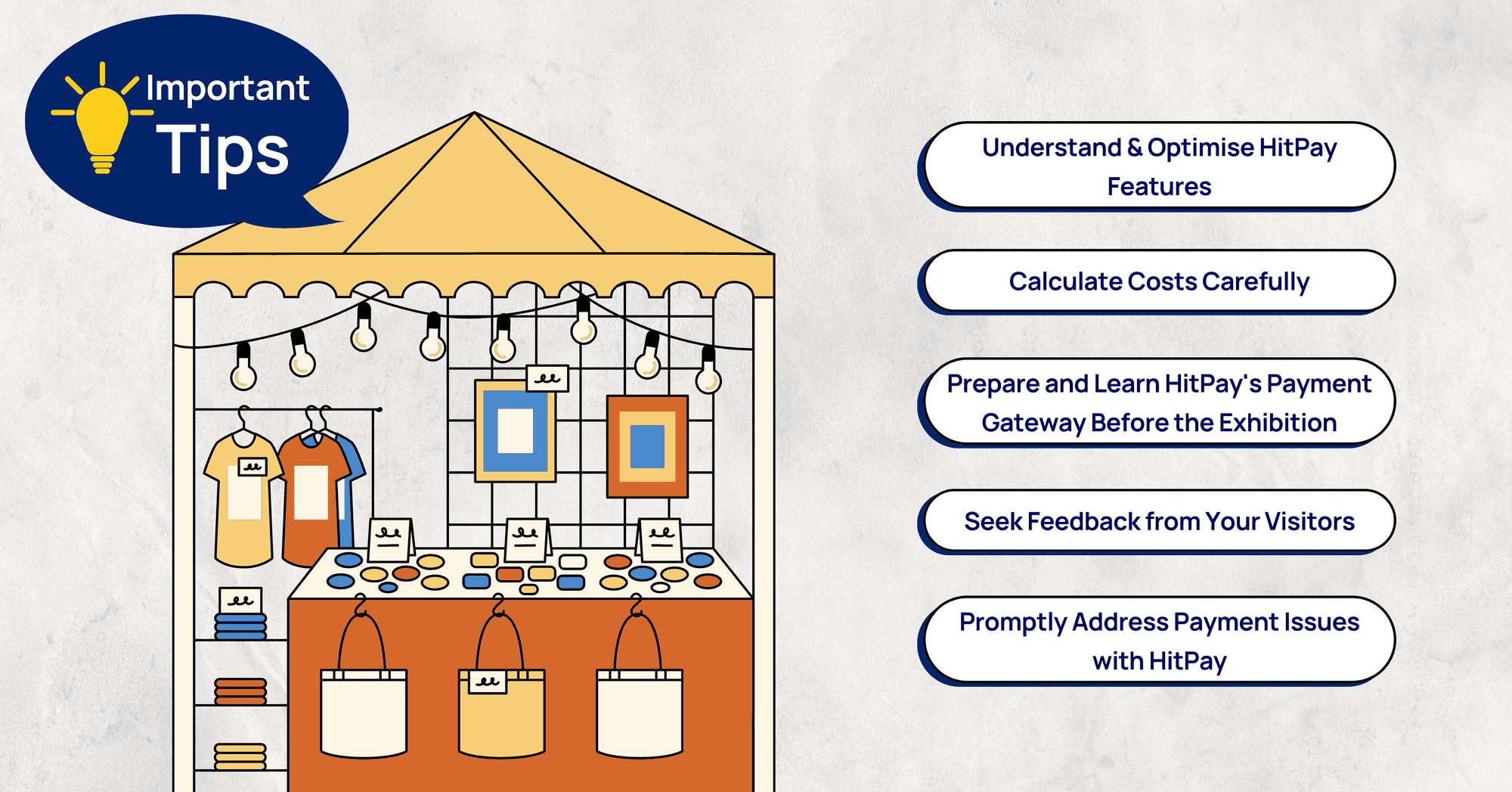

Important tips to sell at overseas and Singapore events with HitPay

Participating in an exhibition provides a unique opportunity for SMEs to enhance brand awareness and boost sales conversion, especially when the exhibition is held in Singapore. However, successful involvement in such an event requires thorough preparation and strategic planning.

Here are some practical tips that Indonesian SMEs can follow when participating in exhibitions in Singapore:

Understand & Optimise HitPay Features:

Ensure you make the most of assistance that supports SMEs when selling products internationally. These features can simplify transaction processes and broaden your market reach.Calculate Costs Carefully:

Before determining product prices, meticulously study all the costs involved, including shipping and other expenses related to selling in Singapore. Make sure to incorporate these costs into the product price to ensure a suitable profit margin.Prepare and Learn HitPay's Payment Gateway Before the Exhibition:

Don't let technical matters hinder your sales success in Singapore. Before participating in an exhibition or any other event, prepare yourself by familiarizing yourself with HitPay's payment gateway. Learn about the registration process, integration, and other technical aspects to ensure smooth transactions.Seek Feedback from Your Visitors:

Build a positive reputation by seeking testimonials and feedback from visitors. Establish good relationships with customers. Positive testimonials not only enhance the trust of potential customers but also serve as assets for expanding your business in Singapore.Promptly Address Payment Issues with HitPay:

If you encounter problems while making payments using HitPay, don't worry! Contact the HitPay team promptly, and they will assist without delay.

By following these tips, UMKM from Indonesia can maximize its presence and success at Singaporean exhibitions.

Curious to learn more about HitPay Indonesia? Schedule a free demo and contact us now!

How to Sell at Overseas Exhibitions: Guide for Indonesian Businesses

December 27, 2023

In this guide for Indonesian merchants, learn how to sell at overseas pop-up fairs and exhibitions in markets such as Malaysia and Singapore. Read on!

Indonesia's products stand out in the international market due to their uniqueness and quality. Items such as spices, batik, coffee, textiles, and distinctive foods like krupuk and sambal are a huge hit with customers around the world. Not only are Indonesian products of high quality, but they also reflect a unique cultural heritage that appeals to the international market.

The presence of the HitPay payment gateway facilitates international transactions for small and medium-sized enterprises (UMKM), so you can access global customers more easily.

In this article, we will provide a guide on how to sell at overseas pop-up fairs and exhibitions in markets such as Malaysia and Singapore. Read on!

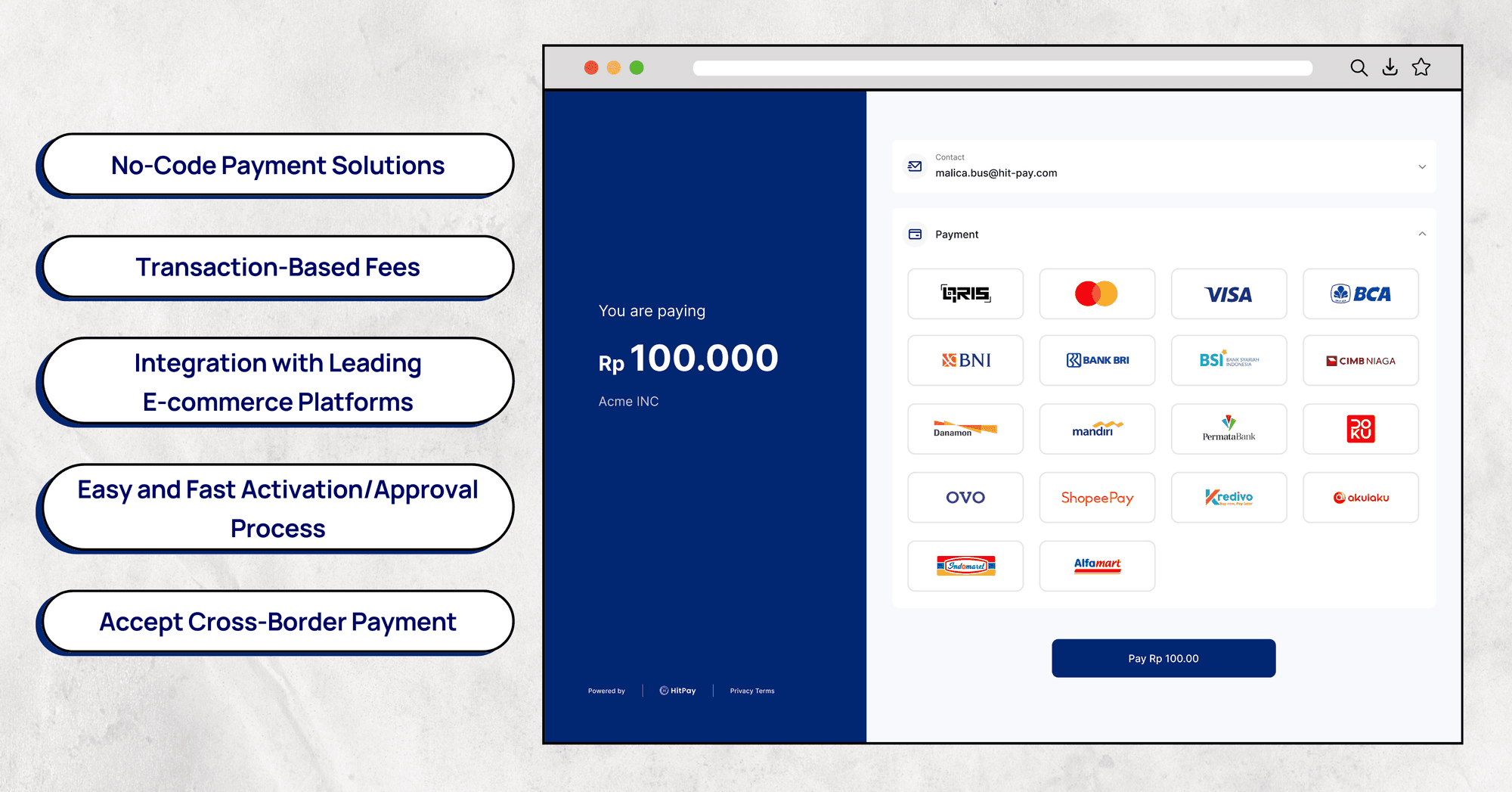

HitPay: Payment Gateway for International Transaction

Compared to other payment platforms in Indonesia, HitPay offers several advantages:

No-Code Payment Solutions. HitPay provides payment solutions without the need for coding. This user-friendly feature simplifies the payment process for merchants.

Transaction-Based Fees. Enjoy the benefit of transaction-based fees with HitPay. There are no setup fees, subscription costs, or minimum monthly transaction requirements. HitPay also provides the option to reduce partner costs by shifting transaction fees to customers. All e-commerce and payment features are included for free.

Integration with Leading E-commerce Platforms. We offer a variety of plugin options without coding for leading e-commerce platforms such as Shopify, WooCommerce, Shopcada, Magento, Prestashop, and more. Seamless integration ensures a smooth experience for merchants on these platforms.

Easy and Fast Activation/Approval Process. Getting started with HitPay is quick and straightforward. You can begin accepting payments through HitPay in just 3 business days, a faster turnaround compared to other payment gateway providers.

Accept Cross-Border Payment. HitPay enables you to accept payments cross-border, allowing you to reach customers globally in line with the growth of your business.

If you encounter any issues while making payments using HitPay, don't worry! Just contact the HitPay team promptly, and they will assist promptly.

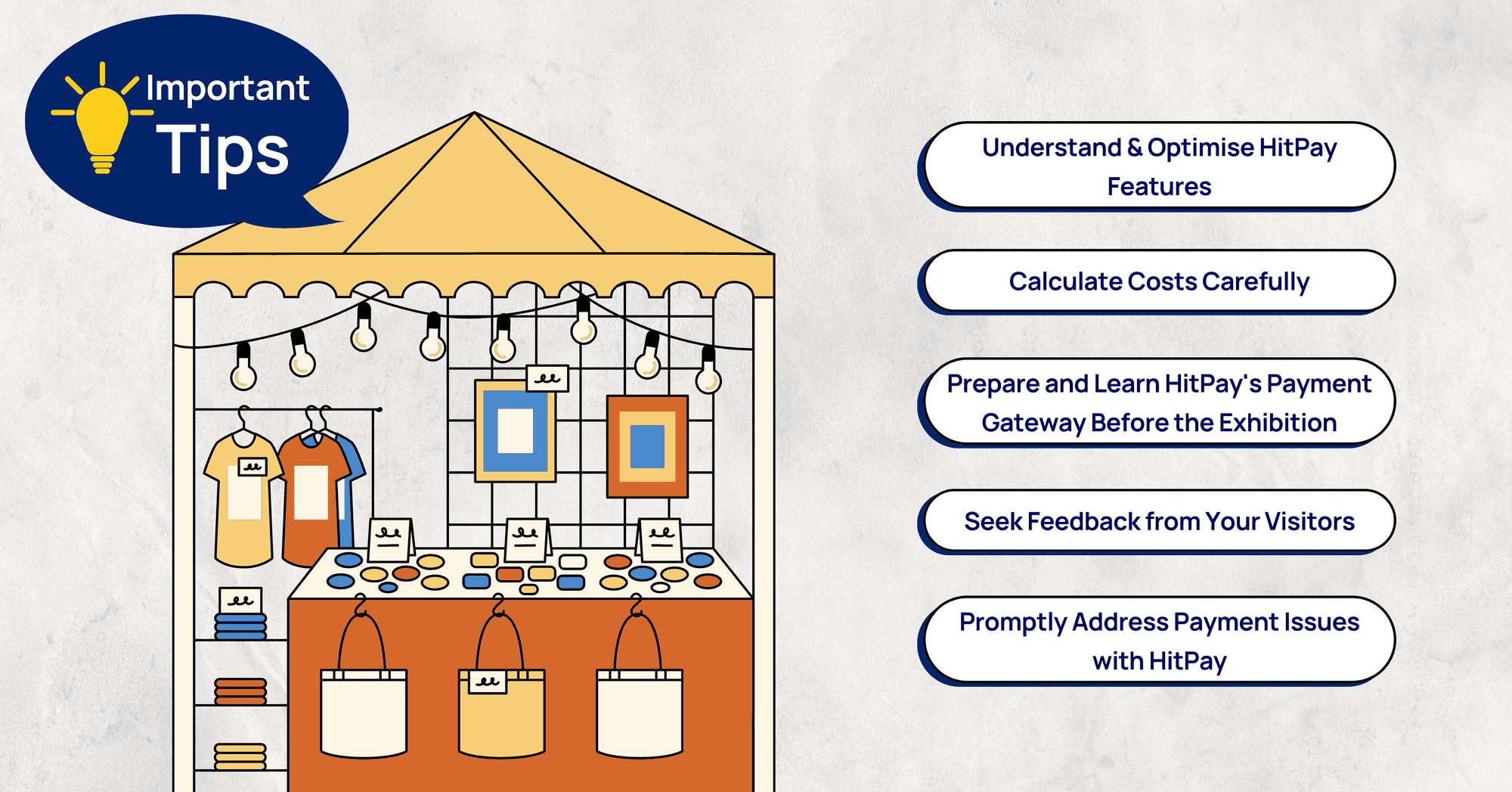

Selling Tips at International Exhibitions

Important tips to sell at overseas and Singapore events with HitPay

Participating in an exhibition provides a unique opportunity for SMEs to enhance brand awareness and boost sales conversion, especially when the exhibition is held in Singapore. However, successful involvement in such an event requires thorough preparation and strategic planning.

Here are some practical tips that Indonesian SMEs can follow when participating in exhibitions in Singapore:

Understand & Optimise HitPay Features:

Ensure you make the most of assistance that supports SMEs when selling products internationally. These features can simplify transaction processes and broaden your market reach.Calculate Costs Carefully:

Before determining product prices, meticulously study all the costs involved, including shipping and other expenses related to selling in Singapore. Make sure to incorporate these costs into the product price to ensure a suitable profit margin.Prepare and Learn HitPay's Payment Gateway Before the Exhibition:

Don't let technical matters hinder your sales success in Singapore. Before participating in an exhibition or any other event, prepare yourself by familiarizing yourself with HitPay's payment gateway. Learn about the registration process, integration, and other technical aspects to ensure smooth transactions.Seek Feedback from Your Visitors:

Build a positive reputation by seeking testimonials and feedback from visitors. Establish good relationships with customers. Positive testimonials not only enhance the trust of potential customers but also serve as assets for expanding your business in Singapore.Promptly Address Payment Issues with HitPay:

If you encounter problems while making payments using HitPay, don't worry! Contact the HitPay team promptly, and they will assist without delay.

By following these tips, UMKM from Indonesia can maximize its presence and success at Singaporean exhibitions.

Curious to learn more about HitPay Indonesia? Schedule a free demo and contact us now!

How to Sell at Overseas Exhibitions: Guide for Indonesian Businesses

December 27, 2023

In this guide for Indonesian merchants, learn how to sell at overseas pop-up fairs and exhibitions in markets such as Malaysia and Singapore. Read on!

Indonesia's products stand out in the international market due to their uniqueness and quality. Items such as spices, batik, coffee, textiles, and distinctive foods like krupuk and sambal are a huge hit with customers around the world. Not only are Indonesian products of high quality, but they also reflect a unique cultural heritage that appeals to the international market.

The presence of the HitPay payment gateway facilitates international transactions for small and medium-sized enterprises (UMKM), so you can access global customers more easily.

In this article, we will provide a guide on how to sell at overseas pop-up fairs and exhibitions in markets such as Malaysia and Singapore. Read on!

HitPay: Payment Gateway for International Transaction

Compared to other payment platforms in Indonesia, HitPay offers several advantages:

No-Code Payment Solutions. HitPay provides payment solutions without the need for coding. This user-friendly feature simplifies the payment process for merchants.

Transaction-Based Fees. Enjoy the benefit of transaction-based fees with HitPay. There are no setup fees, subscription costs, or minimum monthly transaction requirements. HitPay also provides the option to reduce partner costs by shifting transaction fees to customers. All e-commerce and payment features are included for free.

Integration with Leading E-commerce Platforms. We offer a variety of plugin options without coding for leading e-commerce platforms such as Shopify, WooCommerce, Shopcada, Magento, Prestashop, and more. Seamless integration ensures a smooth experience for merchants on these platforms.

Easy and Fast Activation/Approval Process. Getting started with HitPay is quick and straightforward. You can begin accepting payments through HitPay in just 3 business days, a faster turnaround compared to other payment gateway providers.

Accept Cross-Border Payment. HitPay enables you to accept payments cross-border, allowing you to reach customers globally in line with the growth of your business.

If you encounter any issues while making payments using HitPay, don't worry! Just contact the HitPay team promptly, and they will assist promptly.

Selling Tips at International Exhibitions

Important tips to sell at overseas and Singapore events with HitPay

Participating in an exhibition provides a unique opportunity for SMEs to enhance brand awareness and boost sales conversion, especially when the exhibition is held in Singapore. However, successful involvement in such an event requires thorough preparation and strategic planning.

Here are some practical tips that Indonesian SMEs can follow when participating in exhibitions in Singapore:

Understand & Optimise HitPay Features:

Ensure you make the most of assistance that supports SMEs when selling products internationally. These features can simplify transaction processes and broaden your market reach.Calculate Costs Carefully:

Before determining product prices, meticulously study all the costs involved, including shipping and other expenses related to selling in Singapore. Make sure to incorporate these costs into the product price to ensure a suitable profit margin.Prepare and Learn HitPay's Payment Gateway Before the Exhibition:

Don't let technical matters hinder your sales success in Singapore. Before participating in an exhibition or any other event, prepare yourself by familiarizing yourself with HitPay's payment gateway. Learn about the registration process, integration, and other technical aspects to ensure smooth transactions.Seek Feedback from Your Visitors:

Build a positive reputation by seeking testimonials and feedback from visitors. Establish good relationships with customers. Positive testimonials not only enhance the trust of potential customers but also serve as assets for expanding your business in Singapore.Promptly Address Payment Issues with HitPay:

If you encounter problems while making payments using HitPay, don't worry! Contact the HitPay team promptly, and they will assist without delay.

By following these tips, UMKM from Indonesia can maximize its presence and success at Singaporean exhibitions.