Unlock Seamless Transactions with FPX Payment in Malaysia Using HitPay

October 20, 2023

HitPay, an all-in-one payment platform, and FPX, Malaysia's leading online payment method, offer businesses a seamless payment solution to enhance customer experience and streamline operations.

Are you tired of slow and tedious payment processes when shopping online or paying bills in Malaysia? FPX Payment could be the solution you've been looking for.

FPX Payment is a secure and convenient payment solution that enables seamless transactions, enhancing your online shopping experience and streamlining your bill payments.

What is FPX?

Financial Process Exchange (FPX) is a widely used online payment method in Malaysia, offering convenience and security to both businesses and customers.

It is an online banking service that enables real-time debiting and direct crediting for seamless transactions. Bank Negara Malaysia, the Central Bank of Malaysia along with 11 other major Malaysian financial institutions, form the PayNet Group, which operates FPX.

Nearly 90 million transactions were made using FPX in Malaysia in 2018, making it one of the most popular online payment methods in the country.

By integrating HitPay, an all-in-one payment platform that supports FPX payments, businesses can leverage the advantages of this popular payment method to ensure a seamless and secure transaction experience for their customers.

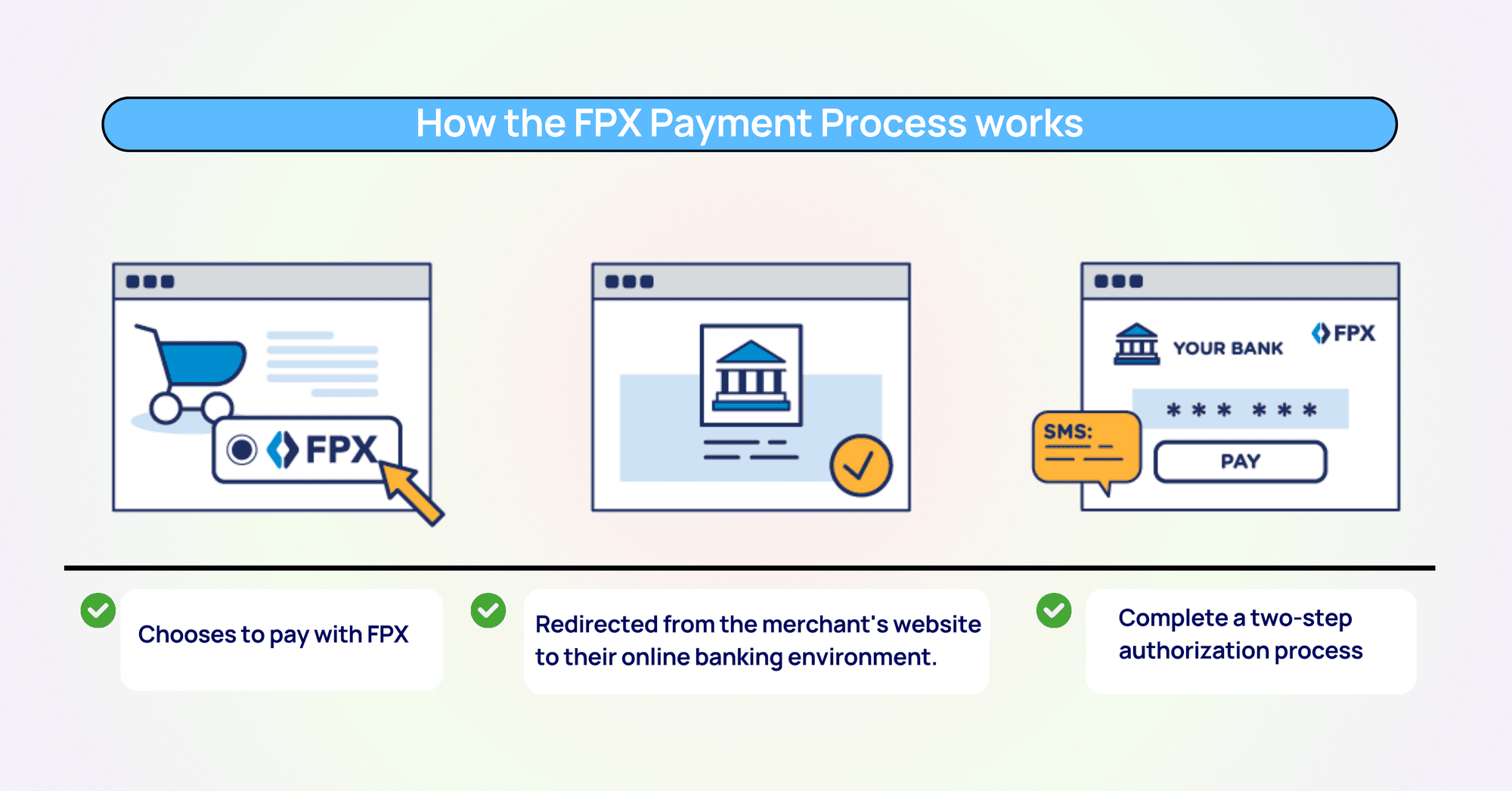

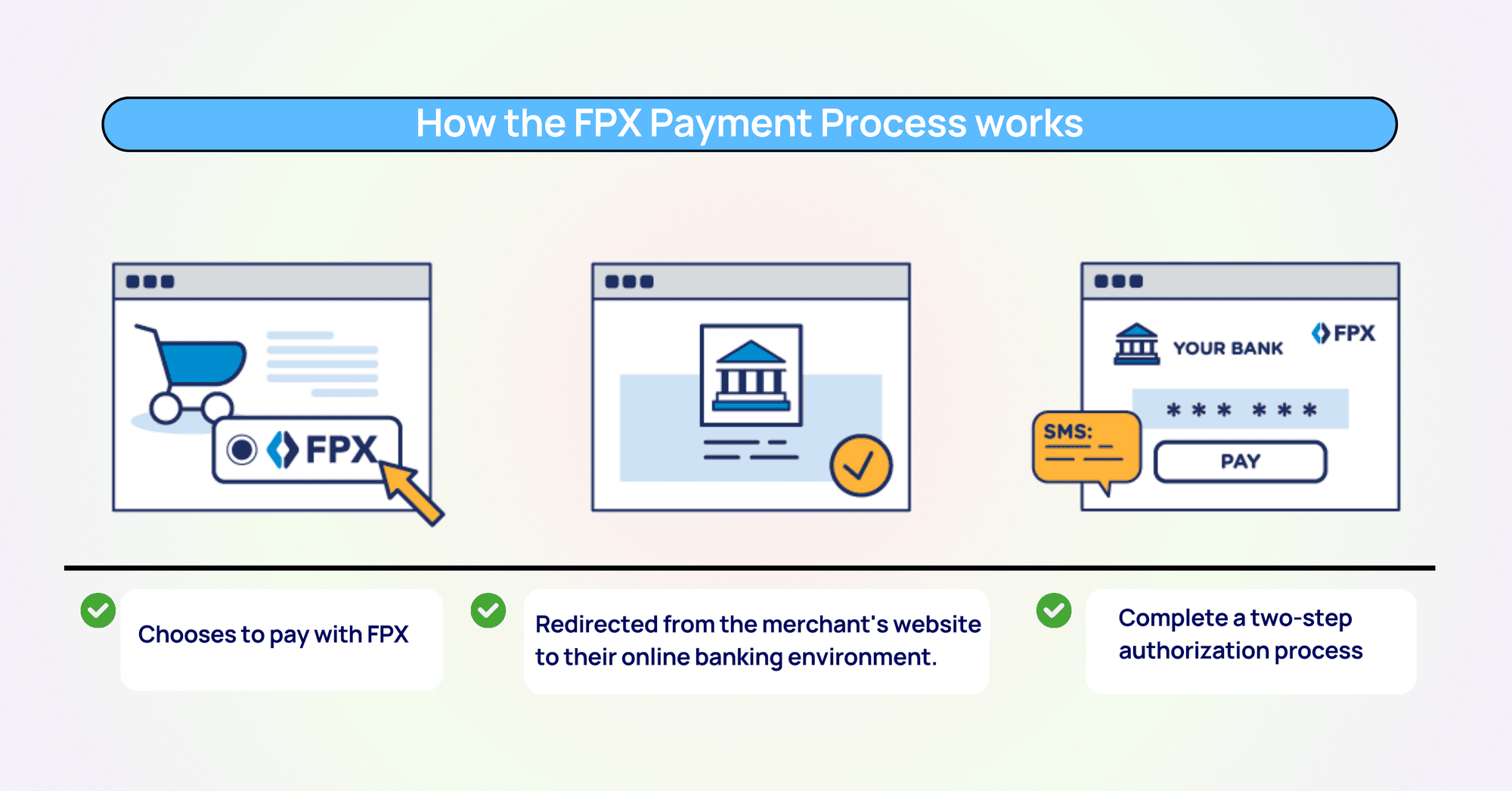

Understanding the FPX Payment Process

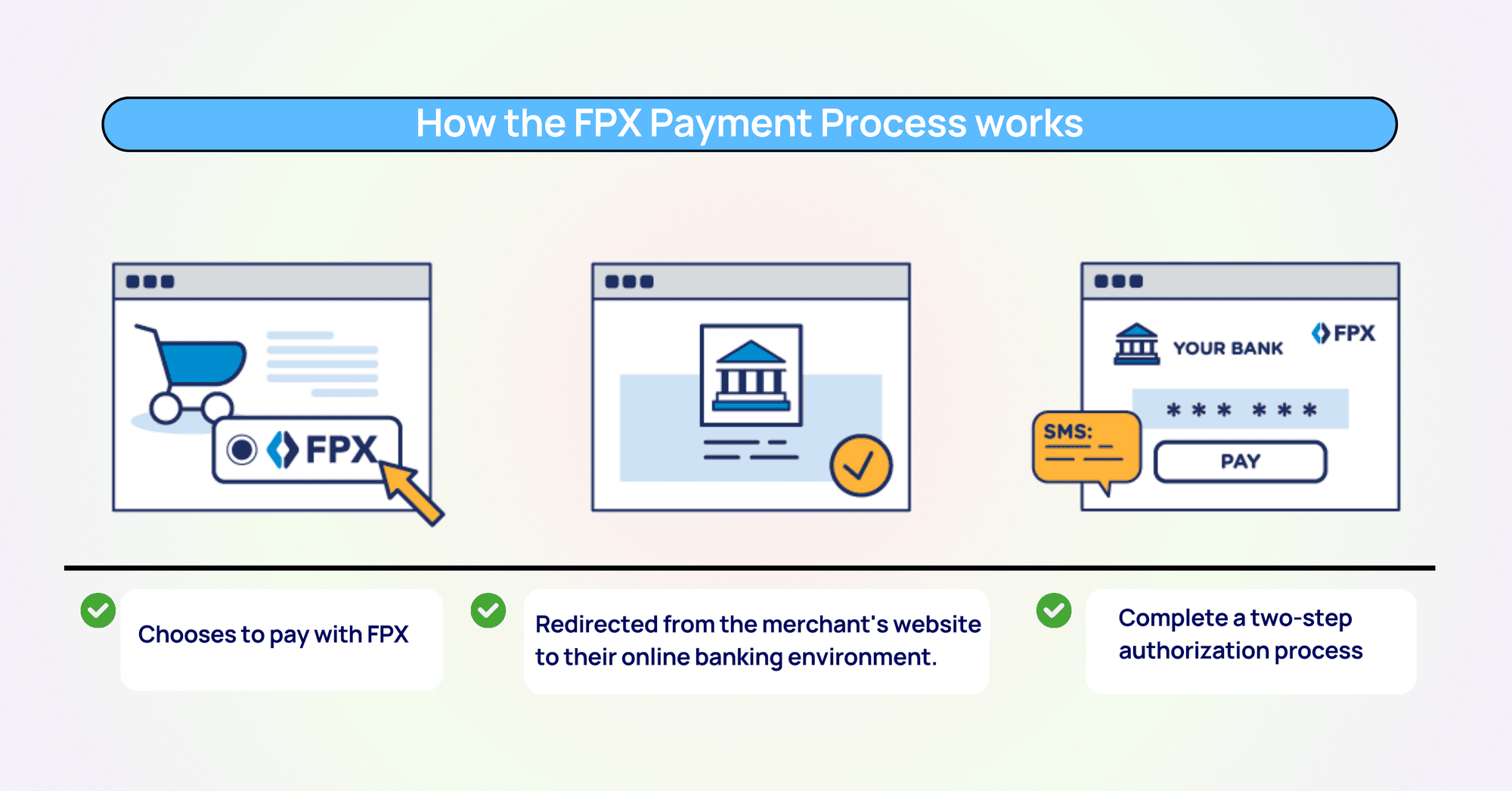

The FPX payment process is designed with customer convenience and security in mind. When a customer chooses to pay with FPX, they are redirected from the merchant's website to their online banking environment.

Here, they complete a two-step authorization process, confirming the transaction with their bank credentials. This level of authentication not only ensures a secure payment experience for customers but also significantly reduces the risk of fraud or unrecognized payments.

As a trusted and widely used payment method in Malaysia, FPX provides businesses and customers alike with a reliable and efficient payment solution.

By incorporating FPX payments into their payment processing systems, businesses can offer their customers a familiar, secure, and user-friendly payment experience.

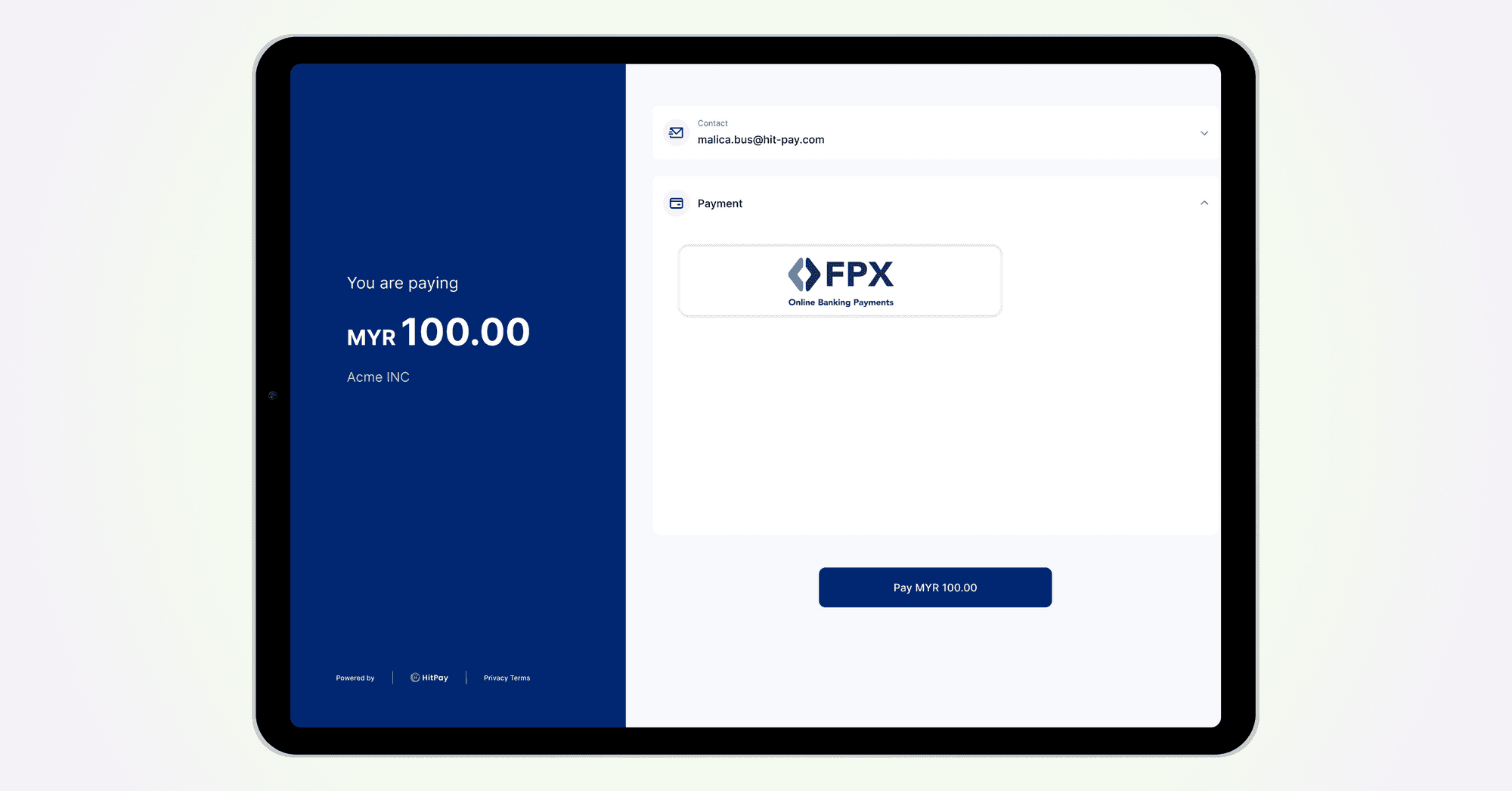

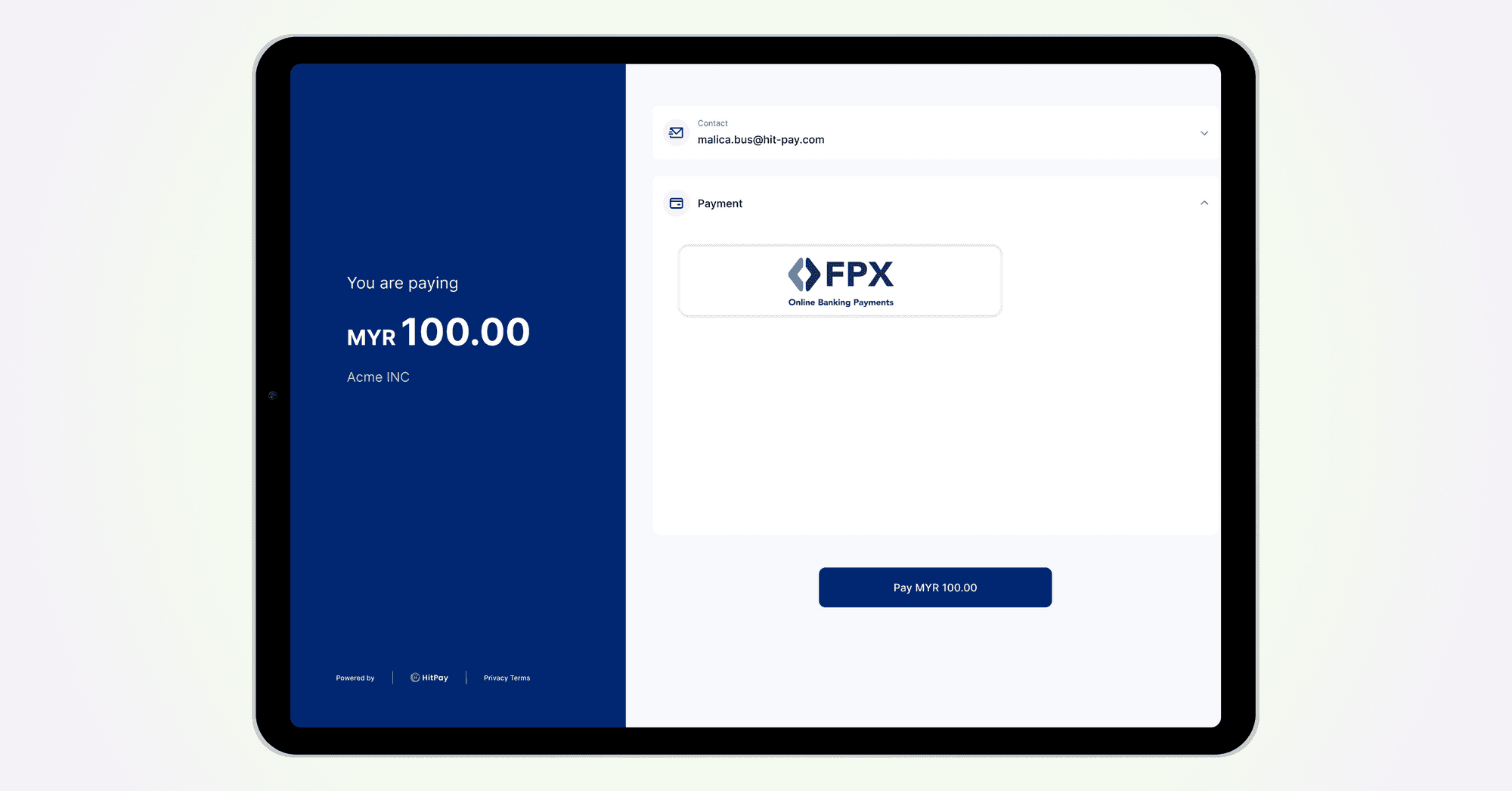

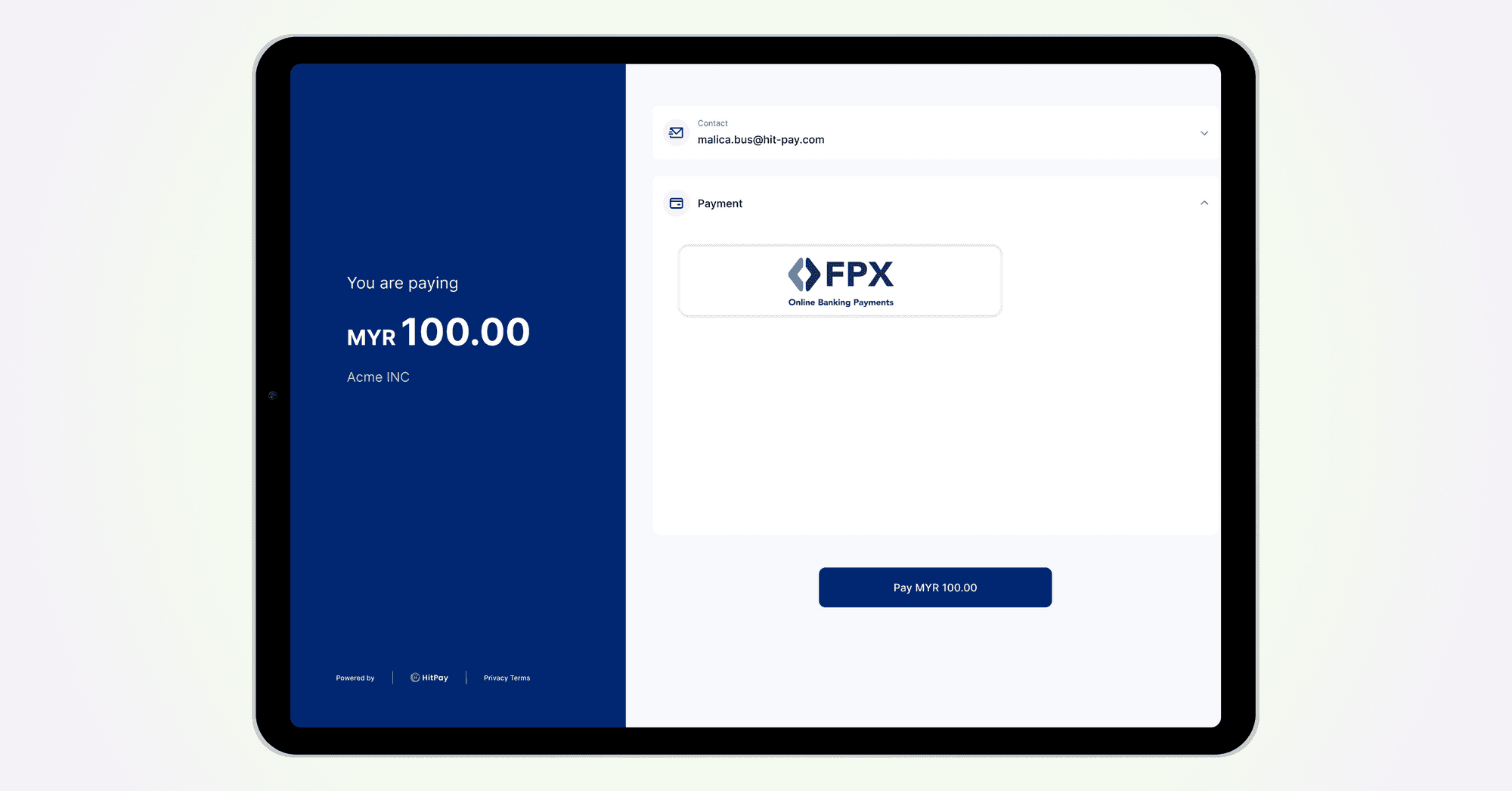

Streamlining FPX Payments with HitPay

HitPay simplifies the process of accepting FPX payments for small and medium-sized enterprises (SMEs) by offering an all-in-one payment platform that caters to the diverse needs of businesses.

To enable FPX as a payment method, merchants can effortlessly integrate HitPay's versatile payment processing features into their existing systems.

With a range of integration options, including e-commerce plugins, no-code tools, and APIs, HitPay ensures businesses have the flexibility to seamlessly incorporate FPX payments into their operations.

By utilizing HitPay's comprehensive payment solution, SMEs can focus on providing their customers with a secure, convenient, and user-friendly payment experience, ultimately driving growth and success in the Malaysian market.

Reaping the Benefits of FPX Payments for Businesses

FPX payments offer a multitude of advantages for businesses, including real-time payment processing and immediate debiting from customers' bank accounts. This streamlined process ensures businesses can efficiently manage their transactions and maintain a healthy cash flow.

Secondly, by offering FPX as a payment method, businesses can tap into the vast Malaysian market and cater to the preferences of a wider customer base.

FPX transactions are also highly convenient, as customers from multiple banks can access FPX.

Ultimately, the integration of FPX payments into a business's payment processing system can contribute to increased customer satisfaction, loyalty, and revenue generation in the competitive Malaysian market.

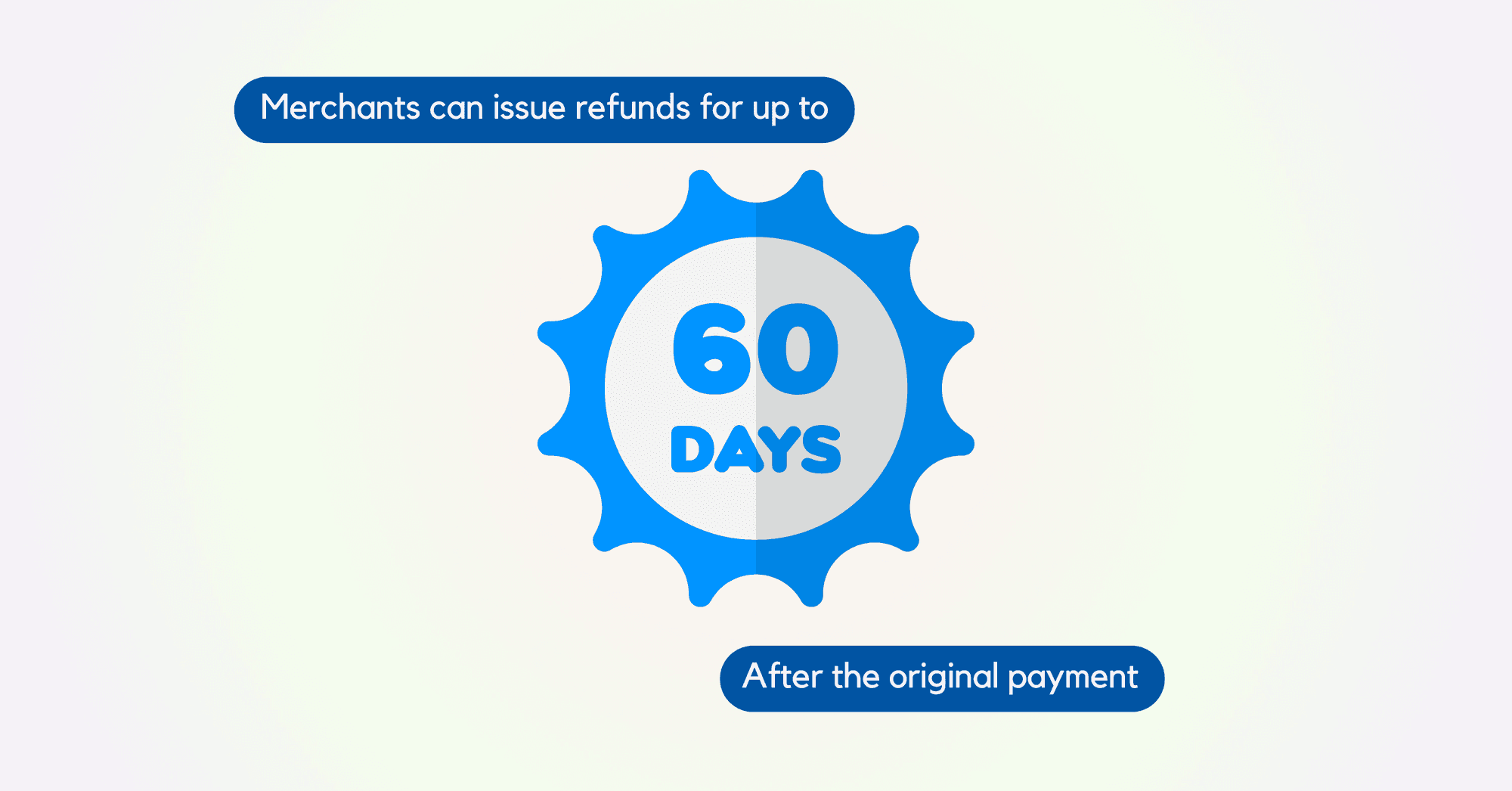

Handling Refunds and Disputes with FPX Payments

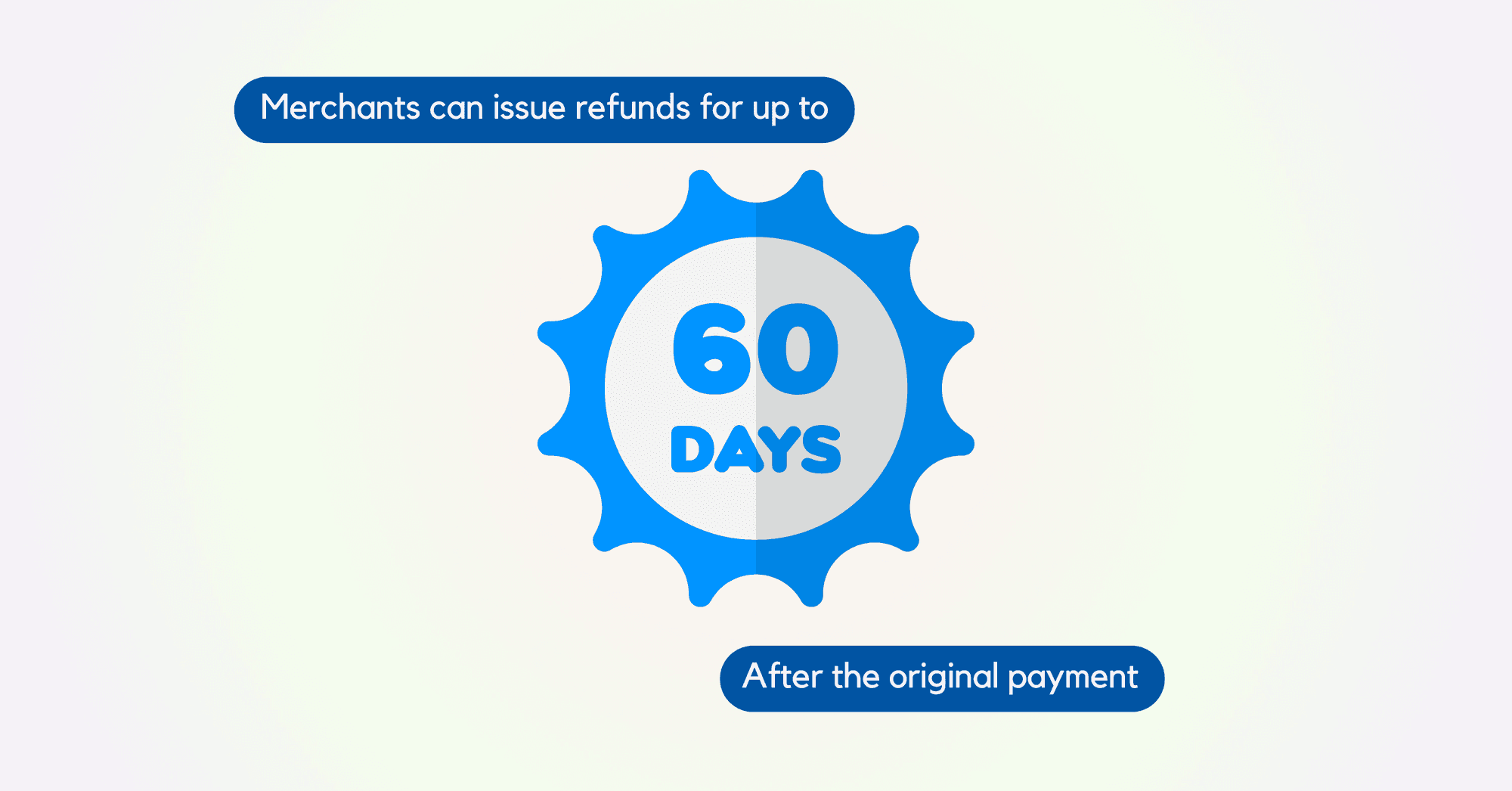

With FPX payments, the refund process is straightforward. There is no dispute process for FPX payments, as customers authenticate the transaction with their bank. This authentication process ensures a secure payment experience, reducing the likelihood of disputes arising in the first place.

Incorporating FPX payments into your business's payment processing system not only provides convenience and security for your customers but also simplifies the handling of refunds and disputes, saving time and resources for your business.

Growing Your Business with HitPay and FPX Payments

By integrating HitPay and FPX payments, businesses can expand their reach across Southeast Asia and beyond. HitPay has already supported over 15,000 businesses globally, providing a comprehensive payment solution tailored to the needs of small and medium-sized enterprises.

HitPay's unique selling points, such as no-code tools, competitive pricing, and additional business software without monthly subscription fees, make it an attractive option for businesses seeking a powerful payment processing platform.

HitPay and FPX payments are well-suited to a wide range of industries, including e-commerce, retail, hospitality, service providers, and nonprofits.

By offering FPX as a payment method and leveraging the robust features of HitPay, businesses can cater to the preferences of a diverse customer base, driving growth and success in the competitive Malaysian market and beyond.

Expand Your Business Horizons

Targeting the Malaysian market is crucial for businesses seeking growth, and incorporating FPX payments can significantly contribute to that goal.

By using HitPay as an all-in-one payment platform that supports FPX payments, businesses can offer a seamless, secure, and user-friendly payment experience to their customers.

HitPay caters to a wide range of industries, providing versatile payment processing and integration options.

Have questions about HitPay?

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

Unlock Seamless Transactions with FPX Payment in Malaysia Using HitPay

October 20, 2023

HitPay, an all-in-one payment platform, and FPX, Malaysia's leading online payment method, offer businesses a seamless payment solution to enhance customer experience and streamline operations.

Are you tired of slow and tedious payment processes when shopping online or paying bills in Malaysia? FPX Payment could be the solution you've been looking for.

FPX Payment is a secure and convenient payment solution that enables seamless transactions, enhancing your online shopping experience and streamlining your bill payments.

What is FPX?

Financial Process Exchange (FPX) is a widely used online payment method in Malaysia, offering convenience and security to both businesses and customers.

It is an online banking service that enables real-time debiting and direct crediting for seamless transactions. Bank Negara Malaysia, the Central Bank of Malaysia along with 11 other major Malaysian financial institutions, form the PayNet Group, which operates FPX.

Nearly 90 million transactions were made using FPX in Malaysia in 2018, making it one of the most popular online payment methods in the country.

By integrating HitPay, an all-in-one payment platform that supports FPX payments, businesses can leverage the advantages of this popular payment method to ensure a seamless and secure transaction experience for their customers.

Understanding the FPX Payment Process

The FPX payment process is designed with customer convenience and security in mind. When a customer chooses to pay with FPX, they are redirected from the merchant's website to their online banking environment.

Here, they complete a two-step authorization process, confirming the transaction with their bank credentials. This level of authentication not only ensures a secure payment experience for customers but also significantly reduces the risk of fraud or unrecognized payments.

As a trusted and widely used payment method in Malaysia, FPX provides businesses and customers alike with a reliable and efficient payment solution.

By incorporating FPX payments into their payment processing systems, businesses can offer their customers a familiar, secure, and user-friendly payment experience.

Streamlining FPX Payments with HitPay

HitPay simplifies the process of accepting FPX payments for small and medium-sized enterprises (SMEs) by offering an all-in-one payment platform that caters to the diverse needs of businesses.

To enable FPX as a payment method, merchants can effortlessly integrate HitPay's versatile payment processing features into their existing systems.

With a range of integration options, including e-commerce plugins, no-code tools, and APIs, HitPay ensures businesses have the flexibility to seamlessly incorporate FPX payments into their operations.

By utilizing HitPay's comprehensive payment solution, SMEs can focus on providing their customers with a secure, convenient, and user-friendly payment experience, ultimately driving growth and success in the Malaysian market.

Reaping the Benefits of FPX Payments for Businesses

FPX payments offer a multitude of advantages for businesses, including real-time payment processing and immediate debiting from customers' bank accounts. This streamlined process ensures businesses can efficiently manage their transactions and maintain a healthy cash flow.

Secondly, by offering FPX as a payment method, businesses can tap into the vast Malaysian market and cater to the preferences of a wider customer base.

FPX transactions are also highly convenient, as customers from multiple banks can access FPX.

Ultimately, the integration of FPX payments into a business's payment processing system can contribute to increased customer satisfaction, loyalty, and revenue generation in the competitive Malaysian market.

Handling Refunds and Disputes with FPX Payments

With FPX payments, the refund process is straightforward. There is no dispute process for FPX payments, as customers authenticate the transaction with their bank. This authentication process ensures a secure payment experience, reducing the likelihood of disputes arising in the first place.

Incorporating FPX payments into your business's payment processing system not only provides convenience and security for your customers but also simplifies the handling of refunds and disputes, saving time and resources for your business.

Growing Your Business with HitPay and FPX Payments

By integrating HitPay and FPX payments, businesses can expand their reach across Southeast Asia and beyond. HitPay has already supported over 15,000 businesses globally, providing a comprehensive payment solution tailored to the needs of small and medium-sized enterprises.

HitPay's unique selling points, such as no-code tools, competitive pricing, and additional business software without monthly subscription fees, make it an attractive option for businesses seeking a powerful payment processing platform.

HitPay and FPX payments are well-suited to a wide range of industries, including e-commerce, retail, hospitality, service providers, and nonprofits.

By offering FPX as a payment method and leveraging the robust features of HitPay, businesses can cater to the preferences of a diverse customer base, driving growth and success in the competitive Malaysian market and beyond.

Expand Your Business Horizons

Targeting the Malaysian market is crucial for businesses seeking growth, and incorporating FPX payments can significantly contribute to that goal.

By using HitPay as an all-in-one payment platform that supports FPX payments, businesses can offer a seamless, secure, and user-friendly payment experience to their customers.

HitPay caters to a wide range of industries, providing versatile payment processing and integration options.

Have questions about HitPay?

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

Unlock Seamless Transactions with FPX Payment in Malaysia Using HitPay

October 20, 2023

HitPay, an all-in-one payment platform, and FPX, Malaysia's leading online payment method, offer businesses a seamless payment solution to enhance customer experience and streamline operations.

Are you tired of slow and tedious payment processes when shopping online or paying bills in Malaysia? FPX Payment could be the solution you've been looking for.

FPX Payment is a secure and convenient payment solution that enables seamless transactions, enhancing your online shopping experience and streamlining your bill payments.

What is FPX?

Financial Process Exchange (FPX) is a widely used online payment method in Malaysia, offering convenience and security to both businesses and customers.

It is an online banking service that enables real-time debiting and direct crediting for seamless transactions. Bank Negara Malaysia, the Central Bank of Malaysia along with 11 other major Malaysian financial institutions, form the PayNet Group, which operates FPX.

Nearly 90 million transactions were made using FPX in Malaysia in 2018, making it one of the most popular online payment methods in the country.

By integrating HitPay, an all-in-one payment platform that supports FPX payments, businesses can leverage the advantages of this popular payment method to ensure a seamless and secure transaction experience for their customers.

Understanding the FPX Payment Process

The FPX payment process is designed with customer convenience and security in mind. When a customer chooses to pay with FPX, they are redirected from the merchant's website to their online banking environment.

Here, they complete a two-step authorization process, confirming the transaction with their bank credentials. This level of authentication not only ensures a secure payment experience for customers but also significantly reduces the risk of fraud or unrecognized payments.

As a trusted and widely used payment method in Malaysia, FPX provides businesses and customers alike with a reliable and efficient payment solution.

By incorporating FPX payments into their payment processing systems, businesses can offer their customers a familiar, secure, and user-friendly payment experience.

Streamlining FPX Payments with HitPay

HitPay simplifies the process of accepting FPX payments for small and medium-sized enterprises (SMEs) by offering an all-in-one payment platform that caters to the diverse needs of businesses.

To enable FPX as a payment method, merchants can effortlessly integrate HitPay's versatile payment processing features into their existing systems.

With a range of integration options, including e-commerce plugins, no-code tools, and APIs, HitPay ensures businesses have the flexibility to seamlessly incorporate FPX payments into their operations.

By utilizing HitPay's comprehensive payment solution, SMEs can focus on providing their customers with a secure, convenient, and user-friendly payment experience, ultimately driving growth and success in the Malaysian market.

Reaping the Benefits of FPX Payments for Businesses

FPX payments offer a multitude of advantages for businesses, including real-time payment processing and immediate debiting from customers' bank accounts. This streamlined process ensures businesses can efficiently manage their transactions and maintain a healthy cash flow.

Secondly, by offering FPX as a payment method, businesses can tap into the vast Malaysian market and cater to the preferences of a wider customer base.

FPX transactions are also highly convenient, as customers from multiple banks can access FPX.

Ultimately, the integration of FPX payments into a business's payment processing system can contribute to increased customer satisfaction, loyalty, and revenue generation in the competitive Malaysian market.

Handling Refunds and Disputes with FPX Payments

With FPX payments, the refund process is straightforward. There is no dispute process for FPX payments, as customers authenticate the transaction with their bank. This authentication process ensures a secure payment experience, reducing the likelihood of disputes arising in the first place.

Incorporating FPX payments into your business's payment processing system not only provides convenience and security for your customers but also simplifies the handling of refunds and disputes, saving time and resources for your business.

Growing Your Business with HitPay and FPX Payments

By integrating HitPay and FPX payments, businesses can expand their reach across Southeast Asia and beyond. HitPay has already supported over 15,000 businesses globally, providing a comprehensive payment solution tailored to the needs of small and medium-sized enterprises.

HitPay's unique selling points, such as no-code tools, competitive pricing, and additional business software without monthly subscription fees, make it an attractive option for businesses seeking a powerful payment processing platform.

HitPay and FPX payments are well-suited to a wide range of industries, including e-commerce, retail, hospitality, service providers, and nonprofits.

By offering FPX as a payment method and leveraging the robust features of HitPay, businesses can cater to the preferences of a diverse customer base, driving growth and success in the competitive Malaysian market and beyond.

Expand Your Business Horizons

Targeting the Malaysian market is crucial for businesses seeking growth, and incorporating FPX payments can significantly contribute to that goal.

By using HitPay as an all-in-one payment platform that supports FPX payments, businesses can offer a seamless, secure, and user-friendly payment experience to their customers.

HitPay caters to a wide range of industries, providing versatile payment processing and integration options.

Have questions about HitPay?

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.