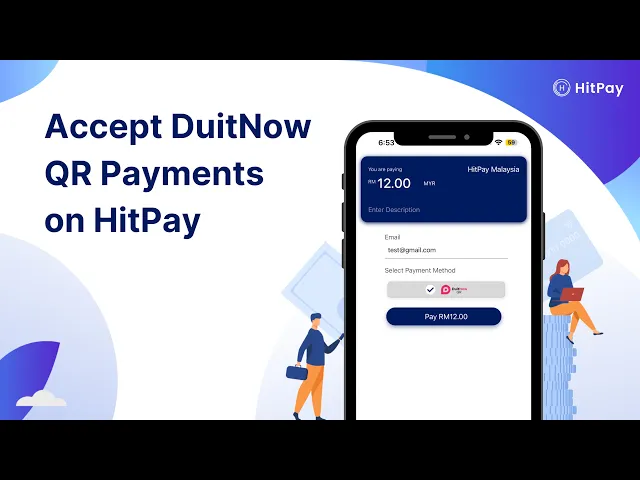

How to Accept DuitNow QR Payments Online — DuitNow Payment Gateway for Shopify, WooCommerce, Xero, and More

April 6, 2023

With a DuitNow payment gateway integration, you can save on payment fees and access millions of DuitNow users in Malaysia.

Start accepting DuitNow QR with the best payment gateway in Malaysia.

Businesses in Malaysia can now accept DuitNow QR customer payments with HitPay, the all-in-one payments platforms for SMEs. With a DuitNow payment gateway integration, you can save on payment fees and access millions of DuitNow users in Malaysia.

Why integrate a DuitNow payment gateway?

A DuitNow payment gateway comes with major benefits for your business:

🛍 Attract more shoppers: DuitNow is a highly popular payment method in Malaysia as it's free to set up, and only requires a local bank account and mobile number. This makes DuitNow much more accessible for Malaysian consumers than other payment methods such as credit cards.

DuitNow supports transfers between over 40 participating banks and e-wallets, including CIMB Bank, Maybank, Hong Leong Bank, RHB Bank, and Public Bank.

By integrating a DuitNow payment gateway on your POS system and online sales channels, you can connect with millions of DuitNow users in Malaysia.

💳 Save on payment fees: DuitNow transaction fees are the most affordable among all digital payment methods in Malaysia.

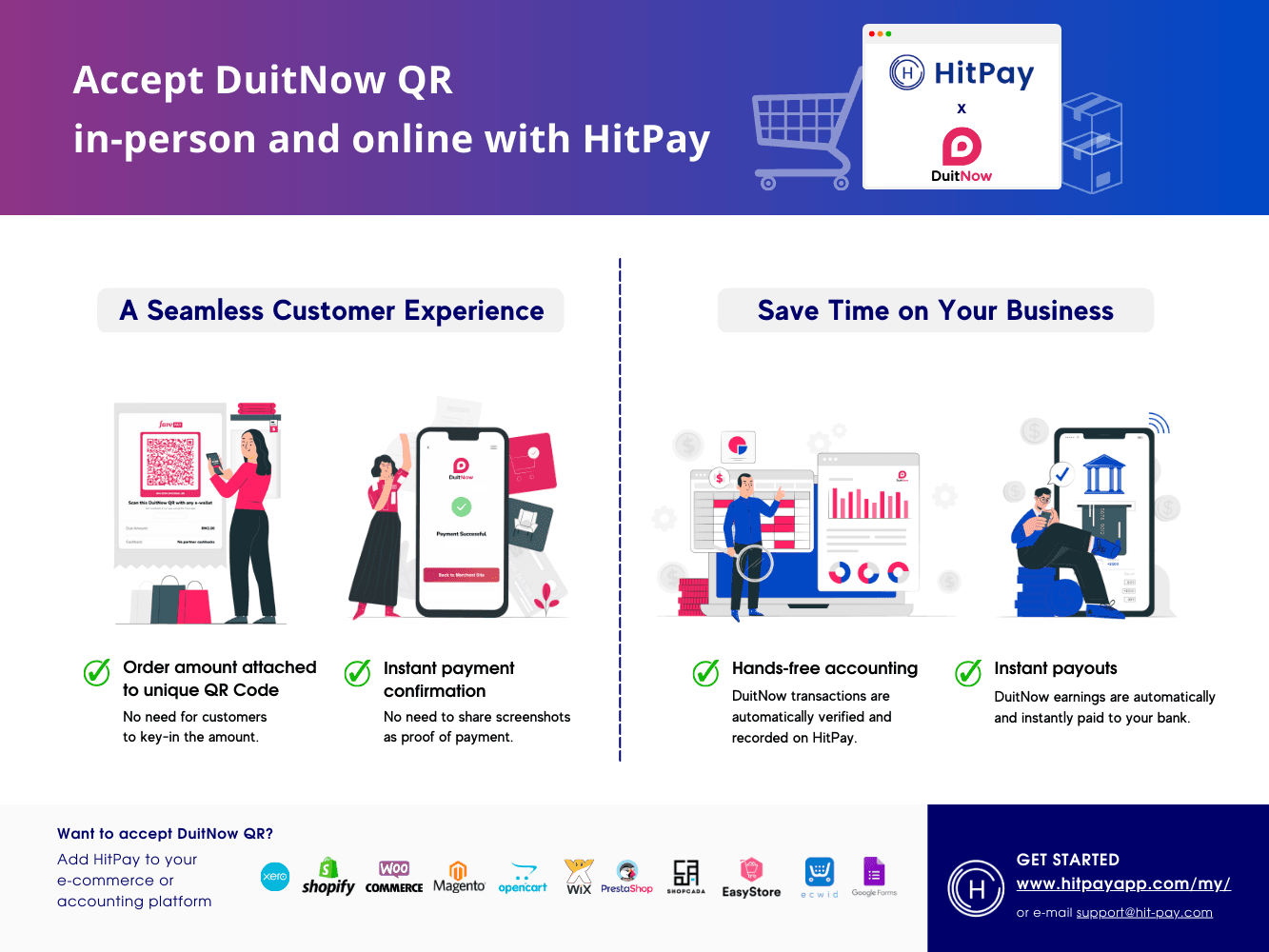

💰 Instant payouts: DuitNow earnings are automatically and instantly paid out to you.

🌏 Reach more customers across the region: DuitNow makes cross-border transactions easy by linking with QRIS (Indonesia), NETS (Singapore), and PromptPay (Thailand).

Travellers from Indonesia, Singapore, and Thailand can easily shop at your business by scanning the DuitNow QR code and paying with their mobile banking or e-wallet app.

How do I accept DuitNow QR customer payments?

DuitNow transactions are fully automated from start to end — no need to manually confirm payments or manually reconcile orders.

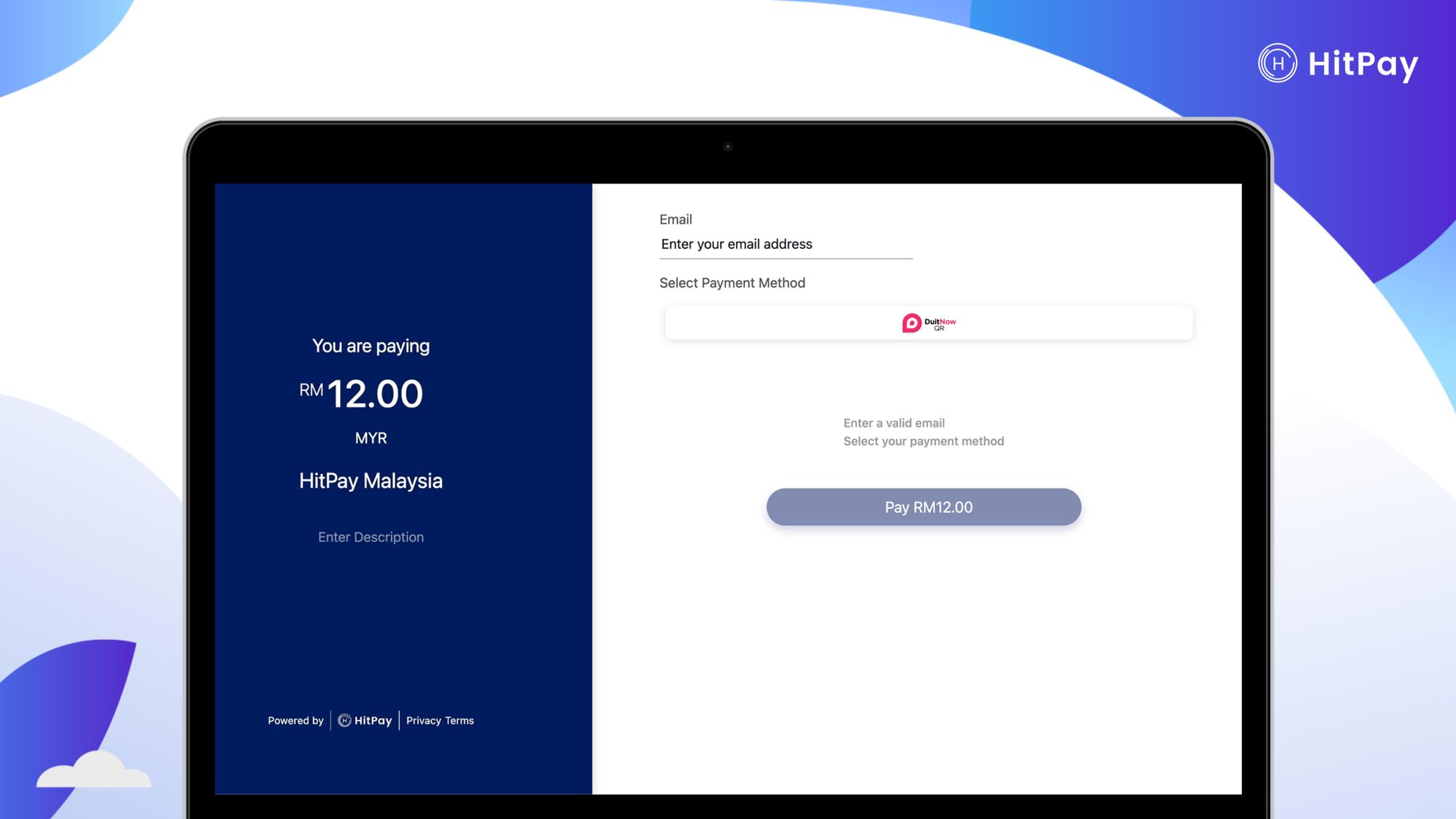

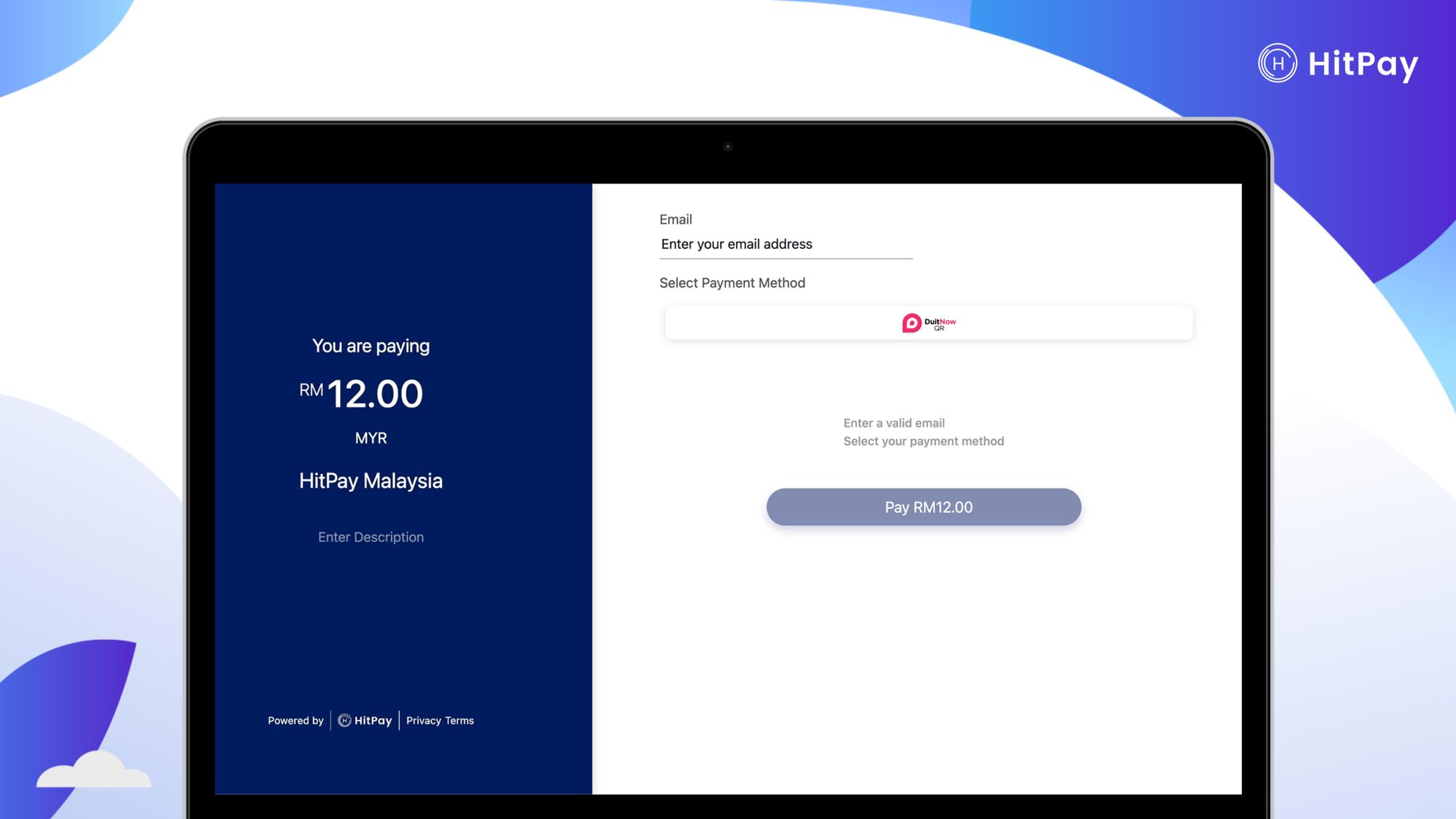

1) Customer launches their mobile banking or e-wallet app

2) Customer scans your DuitNow QR code online or in-store

3) Customer confirms details and makes payment

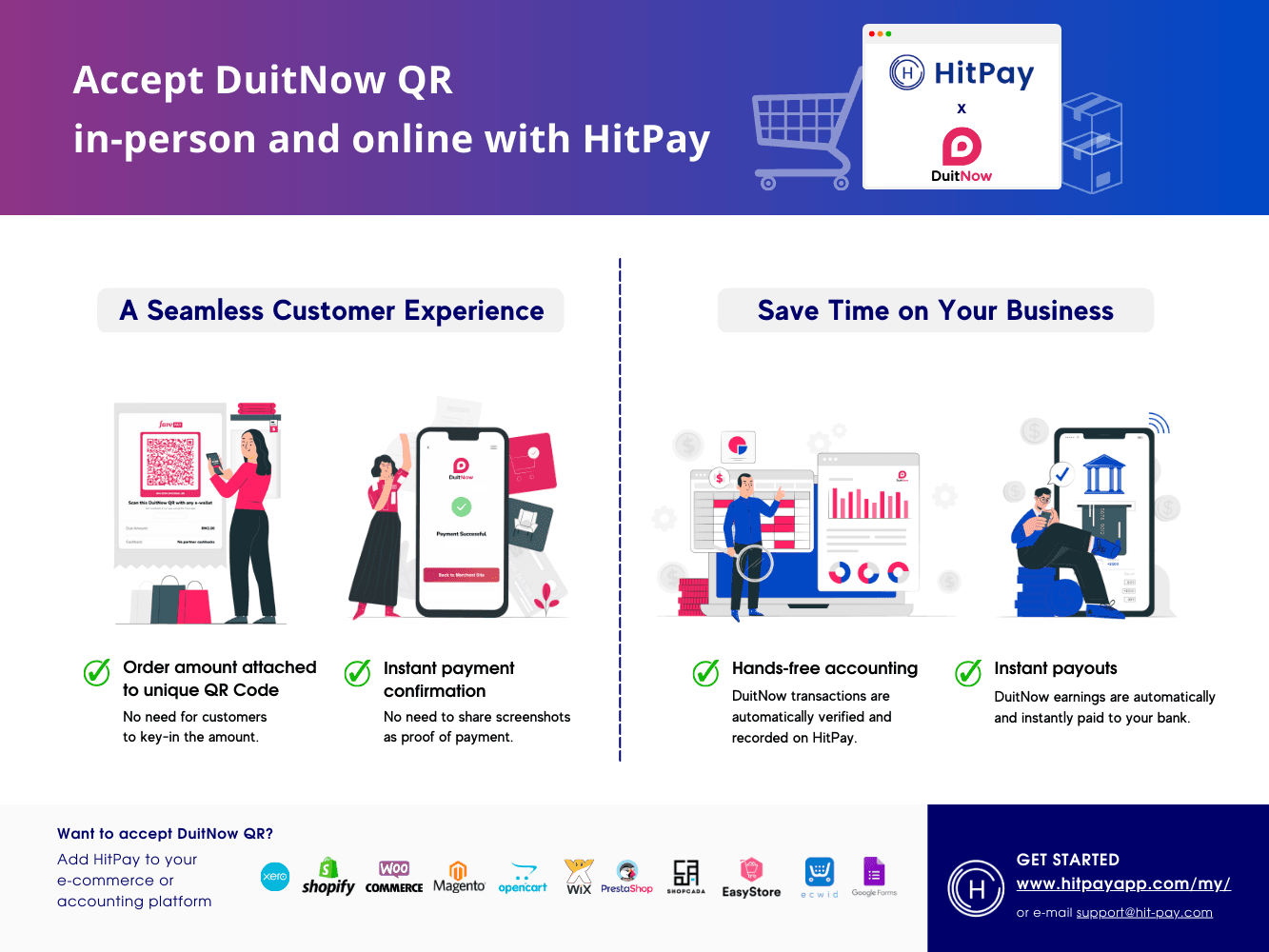

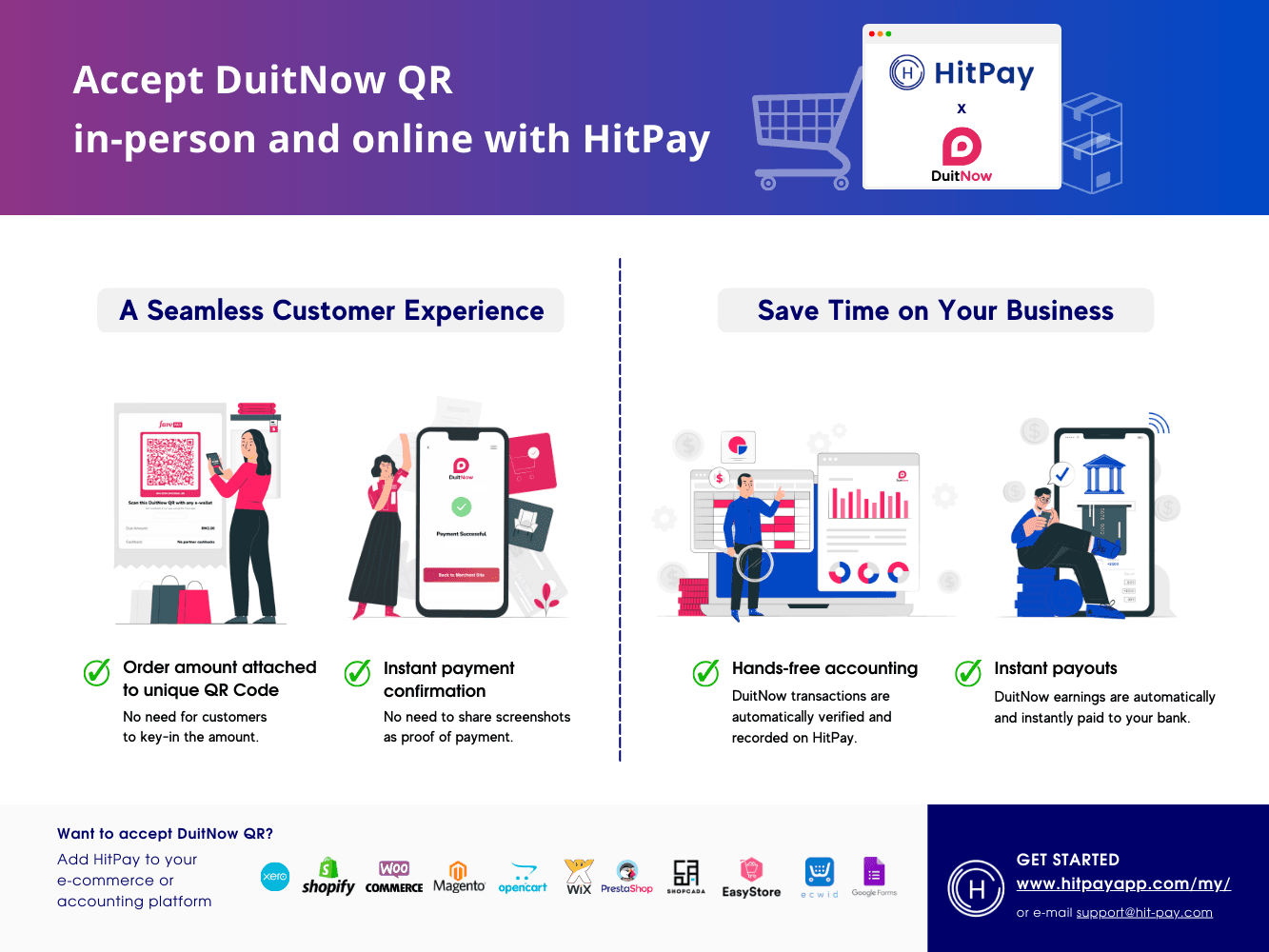

DuitNow offers a seamless customer experience as customers do not need to key in the amount to pay.

4) You receive automatic payment confirmation

Your customer doesn't need to share screenshots as proof of payment.

Transactions with DuitNow QR are automatically verified and recorded on your HitPay account.

How do I set up a DuitNow payment gateway for my business?

1) Sign up for a HitPay account

HitPay is free to set up, with no recurring or hidden fees. Only pay per transaction, with no minimum monthly transaction amounts.

2) Activate DuitNow on HitPay

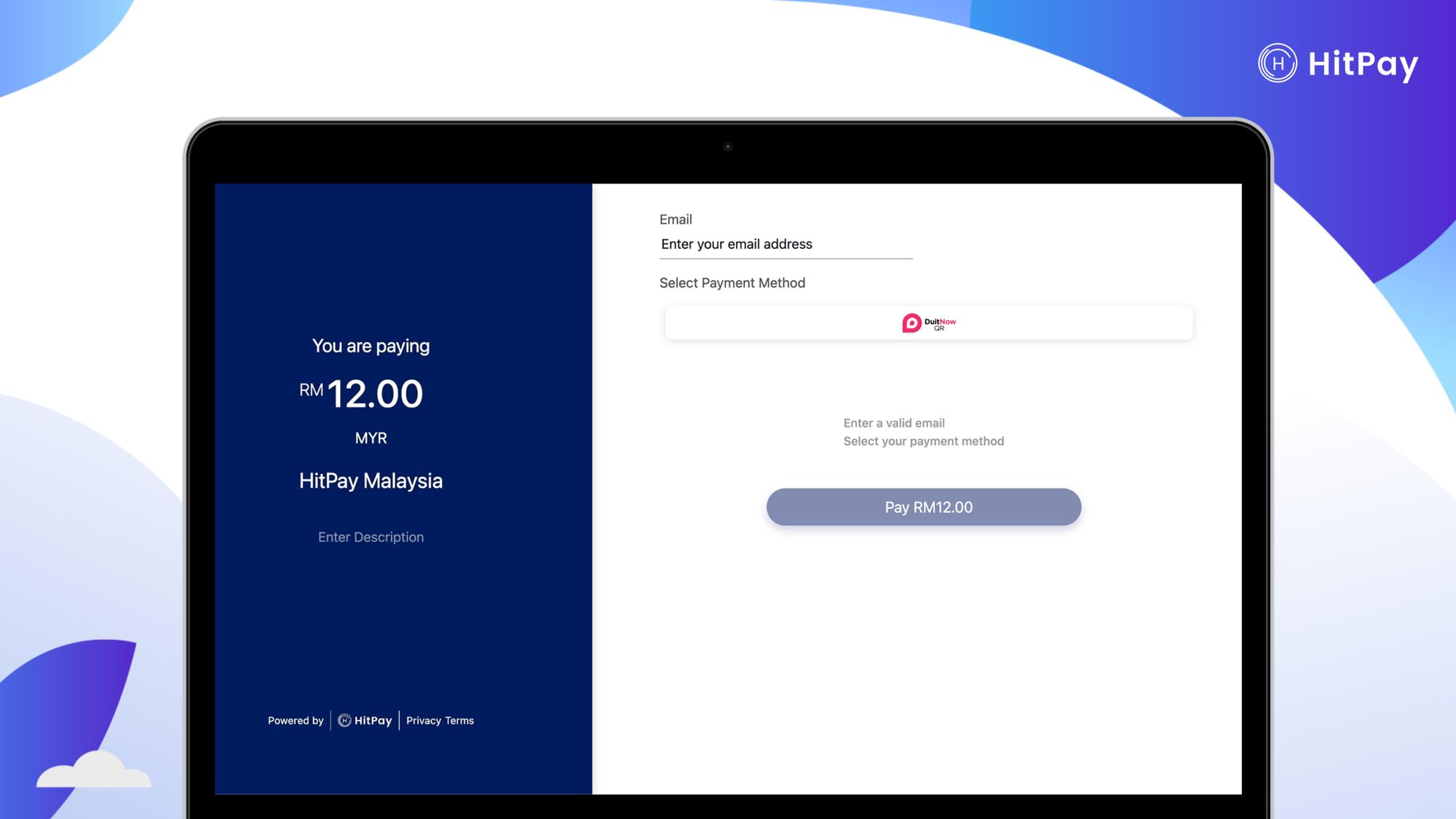

With just one HitPay account, you can accept DuitNow QR on Shopify, WooCommerce, and all online and offline sales channels.

Here's where HitPay helps you integrate your DuitNow payment gateway:

- E-commerce stores including Shopify

- POS system

- Social media and messaging apps (using DuitNow payment links)

- Xero and DuitNow accounting integrations

HitPay DuitNow integrations have no coding required, so you can set it up in just minutes.

3) Integrate DuitNow with Xero Accounting

Save time by connecting your DuitNow payment gateway with Xero:

Automatically create invoices in Xero for DuitNow sales and payment fees

Automatically reconcile between HitPay sales records and your bank account

Start accepting DuitNow QR payments with Malaysia's best DuitNow payment gateway

DuitNow is an essential addition to the all-in-one payment methods on HitPay in Malaysia, including FPX, credit cards, BNPL, and e-wallets.

Sign up for your free HitPay account here.

How to Accept DuitNow QR Payments Online — DuitNow Payment Gateway for Shopify, WooCommerce, Xero, and More

April 6, 2023

With a DuitNow payment gateway integration, you can save on payment fees and access millions of DuitNow users in Malaysia.

Start accepting DuitNow QR with the best payment gateway in Malaysia.

Businesses in Malaysia can now accept DuitNow QR customer payments with HitPay, the all-in-one payments platforms for SMEs. With a DuitNow payment gateway integration, you can save on payment fees and access millions of DuitNow users in Malaysia.

Why integrate a DuitNow payment gateway?

A DuitNow payment gateway comes with major benefits for your business:

🛍 Attract more shoppers: DuitNow is a highly popular payment method in Malaysia as it's free to set up, and only requires a local bank account and mobile number. This makes DuitNow much more accessible for Malaysian consumers than other payment methods such as credit cards.

DuitNow supports transfers between over 40 participating banks and e-wallets, including CIMB Bank, Maybank, Hong Leong Bank, RHB Bank, and Public Bank.

By integrating a DuitNow payment gateway on your POS system and online sales channels, you can connect with millions of DuitNow users in Malaysia.

💳 Save on payment fees: DuitNow transaction fees are the most affordable among all digital payment methods in Malaysia.

💰 Instant payouts: DuitNow earnings are automatically and instantly paid out to you.

🌏 Reach more customers across the region: DuitNow makes cross-border transactions easy by linking with QRIS (Indonesia), NETS (Singapore), and PromptPay (Thailand).

Travellers from Indonesia, Singapore, and Thailand can easily shop at your business by scanning the DuitNow QR code and paying with their mobile banking or e-wallet app.

How do I accept DuitNow QR customer payments?

DuitNow transactions are fully automated from start to end — no need to manually confirm payments or manually reconcile orders.

1) Customer launches their mobile banking or e-wallet app

2) Customer scans your DuitNow QR code online or in-store

3) Customer confirms details and makes payment

DuitNow offers a seamless customer experience as customers do not need to key in the amount to pay.

4) You receive automatic payment confirmation

Your customer doesn't need to share screenshots as proof of payment.

Transactions with DuitNow QR are automatically verified and recorded on your HitPay account.

How do I set up a DuitNow payment gateway for my business?

1) Sign up for a HitPay account

HitPay is free to set up, with no recurring or hidden fees. Only pay per transaction, with no minimum monthly transaction amounts.

2) Activate DuitNow on HitPay

With just one HitPay account, you can accept DuitNow QR on Shopify, WooCommerce, and all online and offline sales channels.

Here's where HitPay helps you integrate your DuitNow payment gateway:

- E-commerce stores including Shopify

- POS system

- Social media and messaging apps (using DuitNow payment links)

- Xero and DuitNow accounting integrations

HitPay DuitNow integrations have no coding required, so you can set it up in just minutes.

3) Integrate DuitNow with Xero Accounting

Save time by connecting your DuitNow payment gateway with Xero:

Automatically create invoices in Xero for DuitNow sales and payment fees

Automatically reconcile between HitPay sales records and your bank account

Start accepting DuitNow QR payments with Malaysia's best DuitNow payment gateway

DuitNow is an essential addition to the all-in-one payment methods on HitPay in Malaysia, including FPX, credit cards, BNPL, and e-wallets.

Sign up for your free HitPay account here.

How to Accept DuitNow QR Payments Online — DuitNow Payment Gateway for Shopify, WooCommerce, Xero, and More

April 6, 2023

With a DuitNow payment gateway integration, you can save on payment fees and access millions of DuitNow users in Malaysia.

Start accepting DuitNow QR with the best payment gateway in Malaysia.

Businesses in Malaysia can now accept DuitNow QR customer payments with HitPay, the all-in-one payments platforms for SMEs. With a DuitNow payment gateway integration, you can save on payment fees and access millions of DuitNow users in Malaysia.

Why integrate a DuitNow payment gateway?

A DuitNow payment gateway comes with major benefits for your business:

🛍 Attract more shoppers: DuitNow is a highly popular payment method in Malaysia as it's free to set up, and only requires a local bank account and mobile number. This makes DuitNow much more accessible for Malaysian consumers than other payment methods such as credit cards.

DuitNow supports transfers between over 40 participating banks and e-wallets, including CIMB Bank, Maybank, Hong Leong Bank, RHB Bank, and Public Bank.

By integrating a DuitNow payment gateway on your POS system and online sales channels, you can connect with millions of DuitNow users in Malaysia.

💳 Save on payment fees: DuitNow transaction fees are the most affordable among all digital payment methods in Malaysia.

💰 Instant payouts: DuitNow earnings are automatically and instantly paid out to you.

🌏 Reach more customers across the region: DuitNow makes cross-border transactions easy by linking with QRIS (Indonesia), NETS (Singapore), and PromptPay (Thailand).

Travellers from Indonesia, Singapore, and Thailand can easily shop at your business by scanning the DuitNow QR code and paying with their mobile banking or e-wallet app.

How do I accept DuitNow QR customer payments?

DuitNow transactions are fully automated from start to end — no need to manually confirm payments or manually reconcile orders.

1) Customer launches their mobile banking or e-wallet app

2) Customer scans your DuitNow QR code online or in-store

3) Customer confirms details and makes payment

DuitNow offers a seamless customer experience as customers do not need to key in the amount to pay.

4) You receive automatic payment confirmation

Your customer doesn't need to share screenshots as proof of payment.

Transactions with DuitNow QR are automatically verified and recorded on your HitPay account.

How do I set up a DuitNow payment gateway for my business?

1) Sign up for a HitPay account

HitPay is free to set up, with no recurring or hidden fees. Only pay per transaction, with no minimum monthly transaction amounts.

2) Activate DuitNow on HitPay

With just one HitPay account, you can accept DuitNow QR on Shopify, WooCommerce, and all online and offline sales channels.

Here's where HitPay helps you integrate your DuitNow payment gateway:

- E-commerce stores including Shopify

- POS system

- Social media and messaging apps (using DuitNow payment links)

- Xero and DuitNow accounting integrations

HitPay DuitNow integrations have no coding required, so you can set it up in just minutes.

3) Integrate DuitNow with Xero Accounting

Save time by connecting your DuitNow payment gateway with Xero:

Automatically create invoices in Xero for DuitNow sales and payment fees

Automatically reconcile between HitPay sales records and your bank account

Start accepting DuitNow QR payments with Malaysia's best DuitNow payment gateway

DuitNow is an essential addition to the all-in-one payment methods on HitPay in Malaysia, including FPX, credit cards, BNPL, and e-wallets.

Sign up for your free HitPay account here.