Is Square Down? Try the Best Square Alternative That's Free

October 2, 2023

Square, the popular payment processing service, has recently experienced outages that left small businesses struggling to process payments. If Square is down and you need to process payments, try the best free Square alternative for small businesses and SMBs.

Read on to learn more about HitPay vs. Square so you can make the right choice for your payment processing needs.

Do I need a Square alternative?

Square's recent outages have caused significant disruptions for small businesses. Just this September, a Square outage left sellers unable to access their accounts or process credit card payments for a day. This incident highlights the challenges faced by small businesses that rely on Square for their payment processing needs.

Moreover, as businesses grow, Square's limitations become apparent. For instance, Square does not integrate seamlessly with certain e-commerce platforms, such as Shopify. Additionally, features like custom domains and PayPal acceptance come with extra fees. Furthermore, Square has a complicated pricing structure, with multiple subscription tiers that can be confusing for business owners. These factors can create hurdles for growing businesses looking for a reliable payment processing solution.

Why Choose HitPay Over Square?

Choosing HitPay as a Square alternative offers several advantages for businesses.

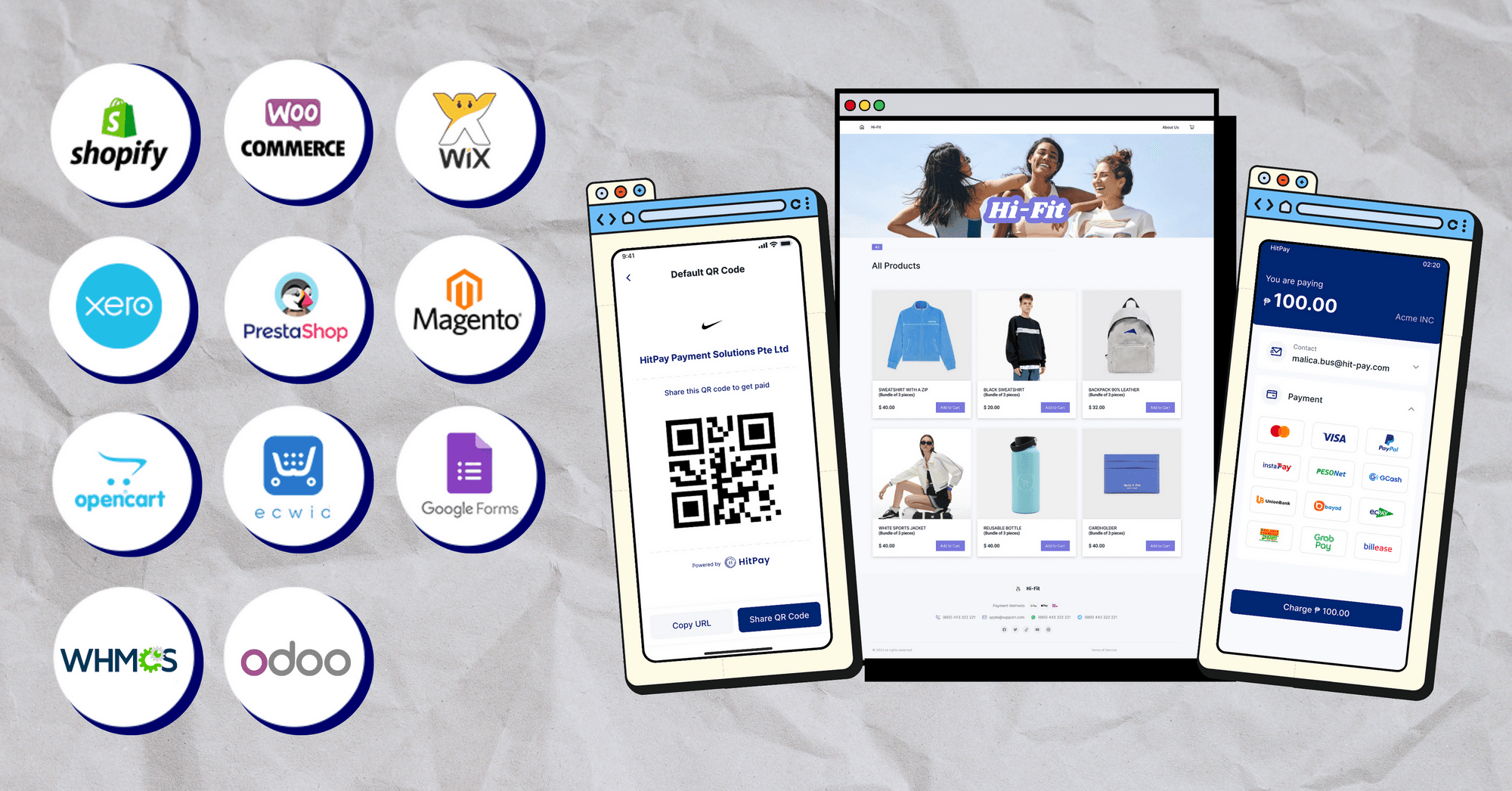

Firstly, HitPay provides the widest range of no-code integrations with various e-commerce platforms and sales channels. These include Shopify, WooCommerce, Wix, Xero, Google Forms, and more. See HitPay's supported sales channels here. This helps you sync online and offline sales in one place, without needing to build your own integrations.

HitPay Credit Card Terminals are made for growing businesses, with a one-time purchase fee and no rental or subscription fees. Your credit card terminal comes integrated with free POS software — with features that help you manage unlimited locations, automate operations, and more. Plus, you can order and start accepting payments on your card terminal within a week!

Additionally, HitPay offers free business software, including recurring billing management, an invoice generator, and an online website builder, helping businesses save on costs. Unlike Square, HitPay doesn't charge subscription fees for these tools — only pay-per-transaction.

In terms of pricing, HitPay has simple pay-per-transaction pricing, with no hidden fees or surprises. This straightforward approach allows growing businesses to plan their expenses effectively.

Try the best Square alternative that's free

If you're facing issues with Square outages, you may want to try HitPay as a free Square alternative for payment processing.

HitPay is an all-in-one payment platform built especially for small businesses and merchants — with online and in-person payment options, and the widest range of integrations and no-code tools.

Ready to explore HitPay's features for yourself?

Set up an account for free or find out more with a 1-on-1 demo.

Is Square Down? Try the Best Square Alternative That's Free

October 2, 2023

Square, the popular payment processing service, has recently experienced outages that left small businesses struggling to process payments. If Square is down and you need to process payments, try the best free Square alternative for small businesses and SMBs.

Read on to learn more about HitPay vs. Square so you can make the right choice for your payment processing needs.

Do I need a Square alternative?

Square's recent outages have caused significant disruptions for small businesses. Just this September, a Square outage left sellers unable to access their accounts or process credit card payments for a day. This incident highlights the challenges faced by small businesses that rely on Square for their payment processing needs.

Moreover, as businesses grow, Square's limitations become apparent. For instance, Square does not integrate seamlessly with certain e-commerce platforms, such as Shopify. Additionally, features like custom domains and PayPal acceptance come with extra fees. Furthermore, Square has a complicated pricing structure, with multiple subscription tiers that can be confusing for business owners. These factors can create hurdles for growing businesses looking for a reliable payment processing solution.

Why Choose HitPay Over Square?

Choosing HitPay as a Square alternative offers several advantages for businesses.

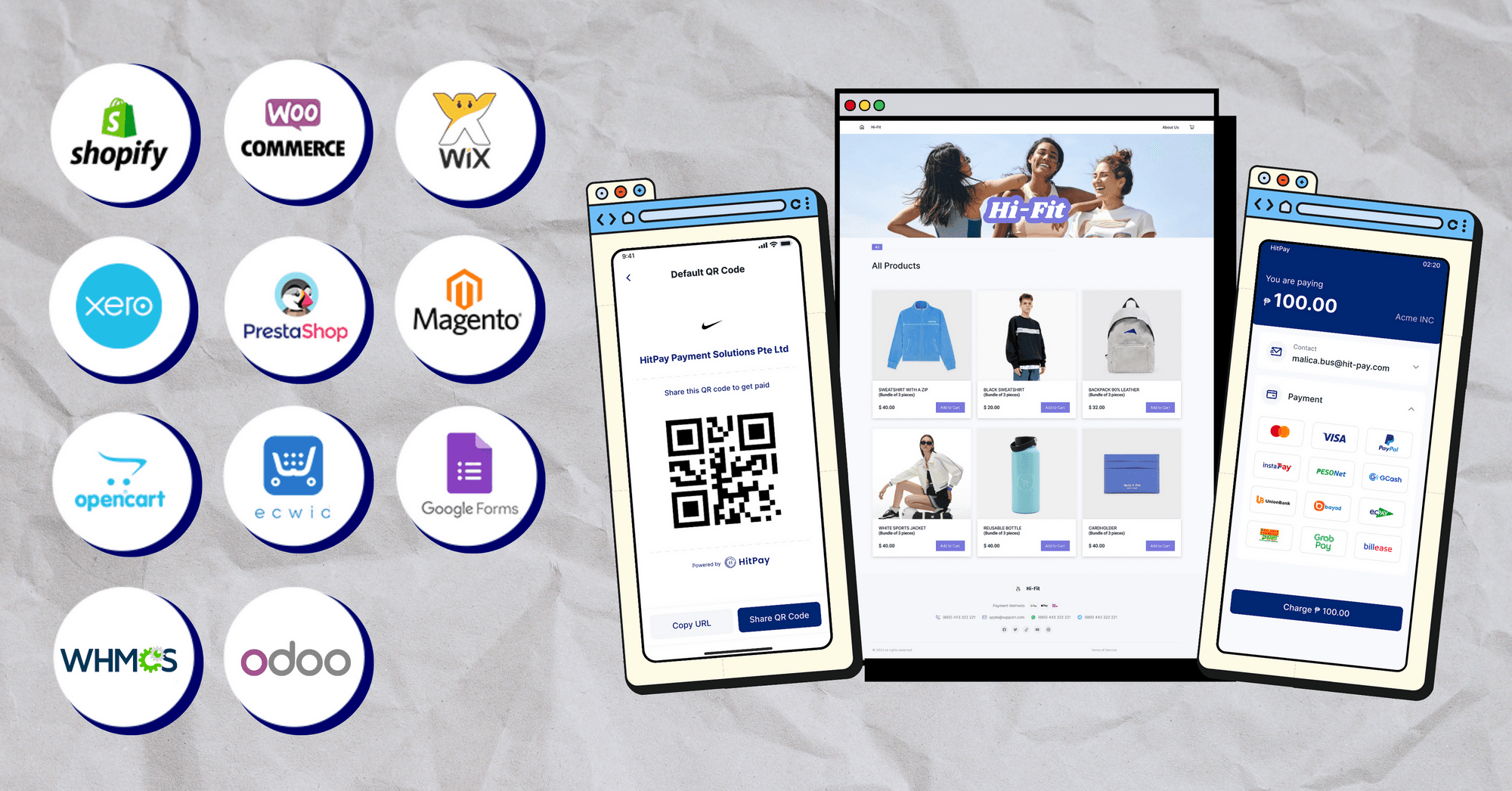

Firstly, HitPay provides the widest range of no-code integrations with various e-commerce platforms and sales channels. These include Shopify, WooCommerce, Wix, Xero, Google Forms, and more. See HitPay's supported sales channels here. This helps you sync online and offline sales in one place, without needing to build your own integrations.

HitPay Credit Card Terminals are made for growing businesses, with a one-time purchase fee and no rental or subscription fees. Your credit card terminal comes integrated with free POS software — with features that help you manage unlimited locations, automate operations, and more. Plus, you can order and start accepting payments on your card terminal within a week!

Additionally, HitPay offers free business software, including recurring billing management, an invoice generator, and an online website builder, helping businesses save on costs. Unlike Square, HitPay doesn't charge subscription fees for these tools — only pay-per-transaction.

In terms of pricing, HitPay has simple pay-per-transaction pricing, with no hidden fees or surprises. This straightforward approach allows growing businesses to plan their expenses effectively.

Try the best Square alternative that's free

If you're facing issues with Square outages, you may want to try HitPay as a free Square alternative for payment processing.

HitPay is an all-in-one payment platform built especially for small businesses and merchants — with online and in-person payment options, and the widest range of integrations and no-code tools.

Ready to explore HitPay's features for yourself?

Set up an account for free or find out more with a 1-on-1 demo.

Is Square Down? Try the Best Square Alternative That's Free

October 2, 2023

Square, the popular payment processing service, has recently experienced outages that left small businesses struggling to process payments. If Square is down and you need to process payments, try the best free Square alternative for small businesses and SMBs.

Read on to learn more about HitPay vs. Square so you can make the right choice for your payment processing needs.

Do I need a Square alternative?

Square's recent outages have caused significant disruptions for small businesses. Just this September, a Square outage left sellers unable to access their accounts or process credit card payments for a day. This incident highlights the challenges faced by small businesses that rely on Square for their payment processing needs.

Moreover, as businesses grow, Square's limitations become apparent. For instance, Square does not integrate seamlessly with certain e-commerce platforms, such as Shopify. Additionally, features like custom domains and PayPal acceptance come with extra fees. Furthermore, Square has a complicated pricing structure, with multiple subscription tiers that can be confusing for business owners. These factors can create hurdles for growing businesses looking for a reliable payment processing solution.

Why Choose HitPay Over Square?

Choosing HitPay as a Square alternative offers several advantages for businesses.

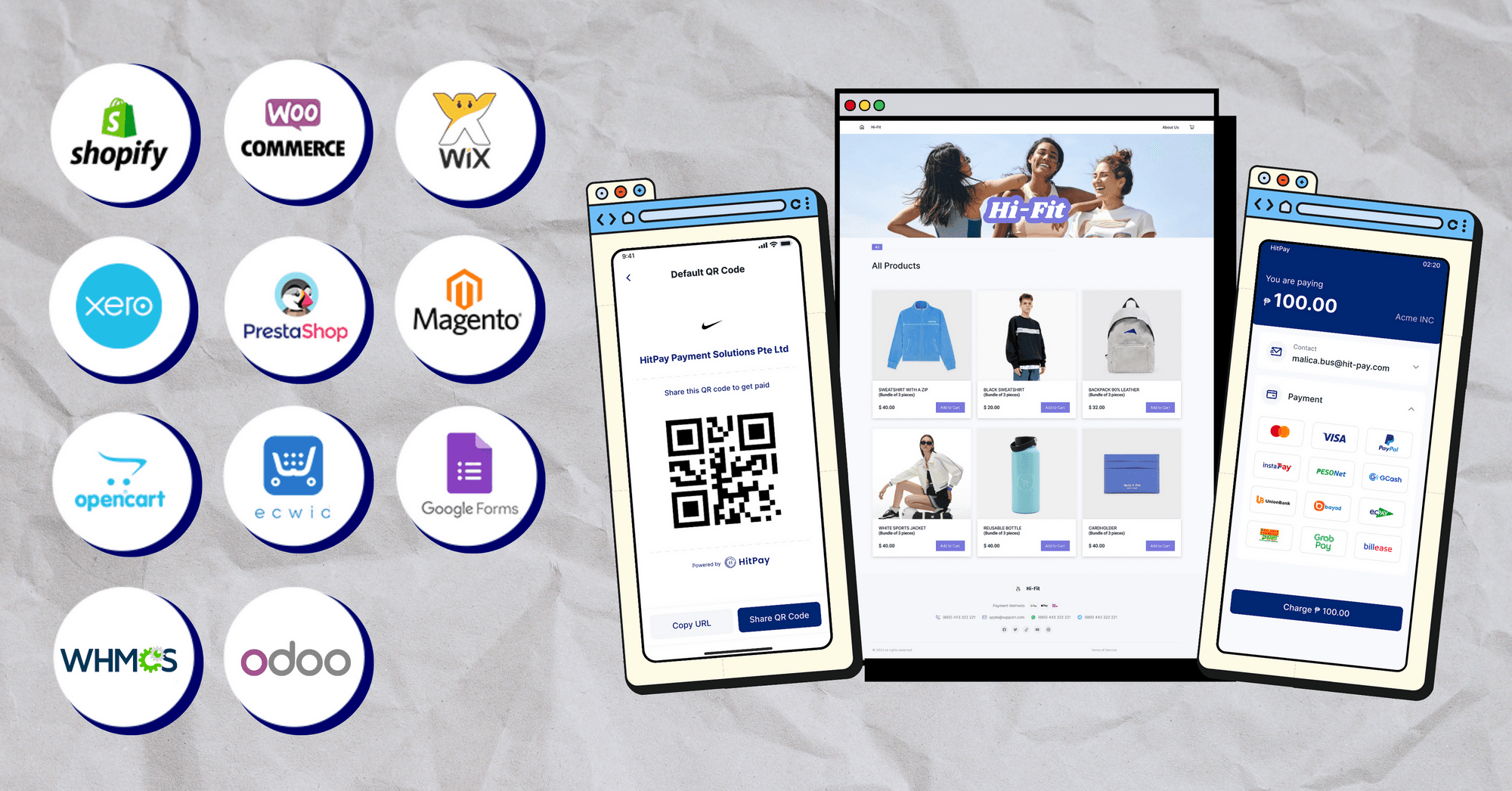

Firstly, HitPay provides the widest range of no-code integrations with various e-commerce platforms and sales channels. These include Shopify, WooCommerce, Wix, Xero, Google Forms, and more. See HitPay's supported sales channels here. This helps you sync online and offline sales in one place, without needing to build your own integrations.

HitPay Credit Card Terminals are made for growing businesses, with a one-time purchase fee and no rental or subscription fees. Your credit card terminal comes integrated with free POS software — with features that help you manage unlimited locations, automate operations, and more. Plus, you can order and start accepting payments on your card terminal within a week!

Additionally, HitPay offers free business software, including recurring billing management, an invoice generator, and an online website builder, helping businesses save on costs. Unlike Square, HitPay doesn't charge subscription fees for these tools — only pay-per-transaction.

In terms of pricing, HitPay has simple pay-per-transaction pricing, with no hidden fees or surprises. This straightforward approach allows growing businesses to plan their expenses effectively.

Try the best Square alternative that's free

If you're facing issues with Square outages, you may want to try HitPay as a free Square alternative for payment processing.

HitPay is an all-in-one payment platform built especially for small businesses and merchants — with online and in-person payment options, and the widest range of integrations and no-code tools.

Ready to explore HitPay's features for yourself?

Set up an account for free or find out more with a 1-on-1 demo.