Best POS Systems Costs for Small Businesses

September 7, 2024

Learn about the costs of POS systems for small businesses, including hardware and software expenses, essential features, and factors to consider when choosing the right system to match your business needs.

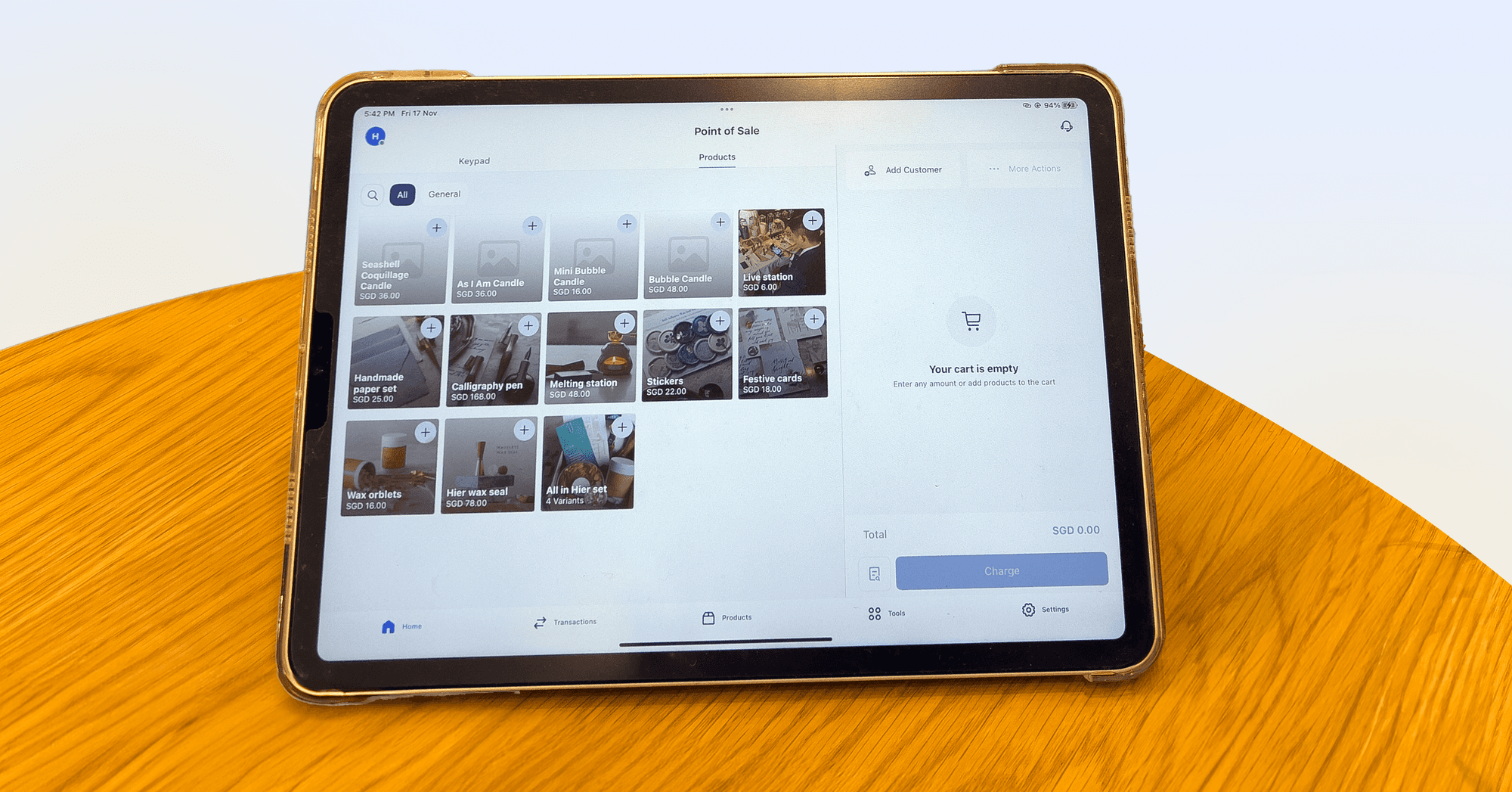

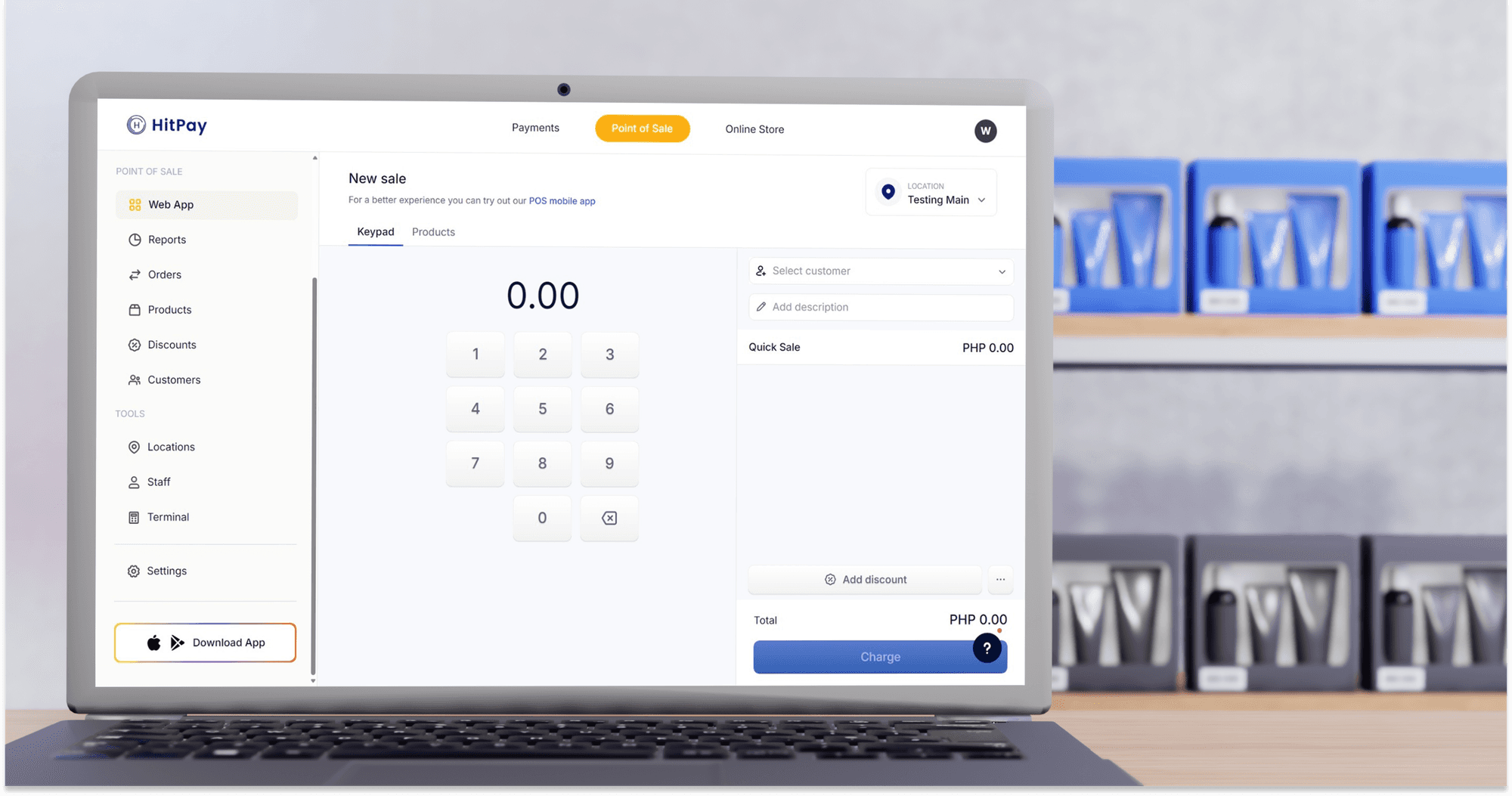

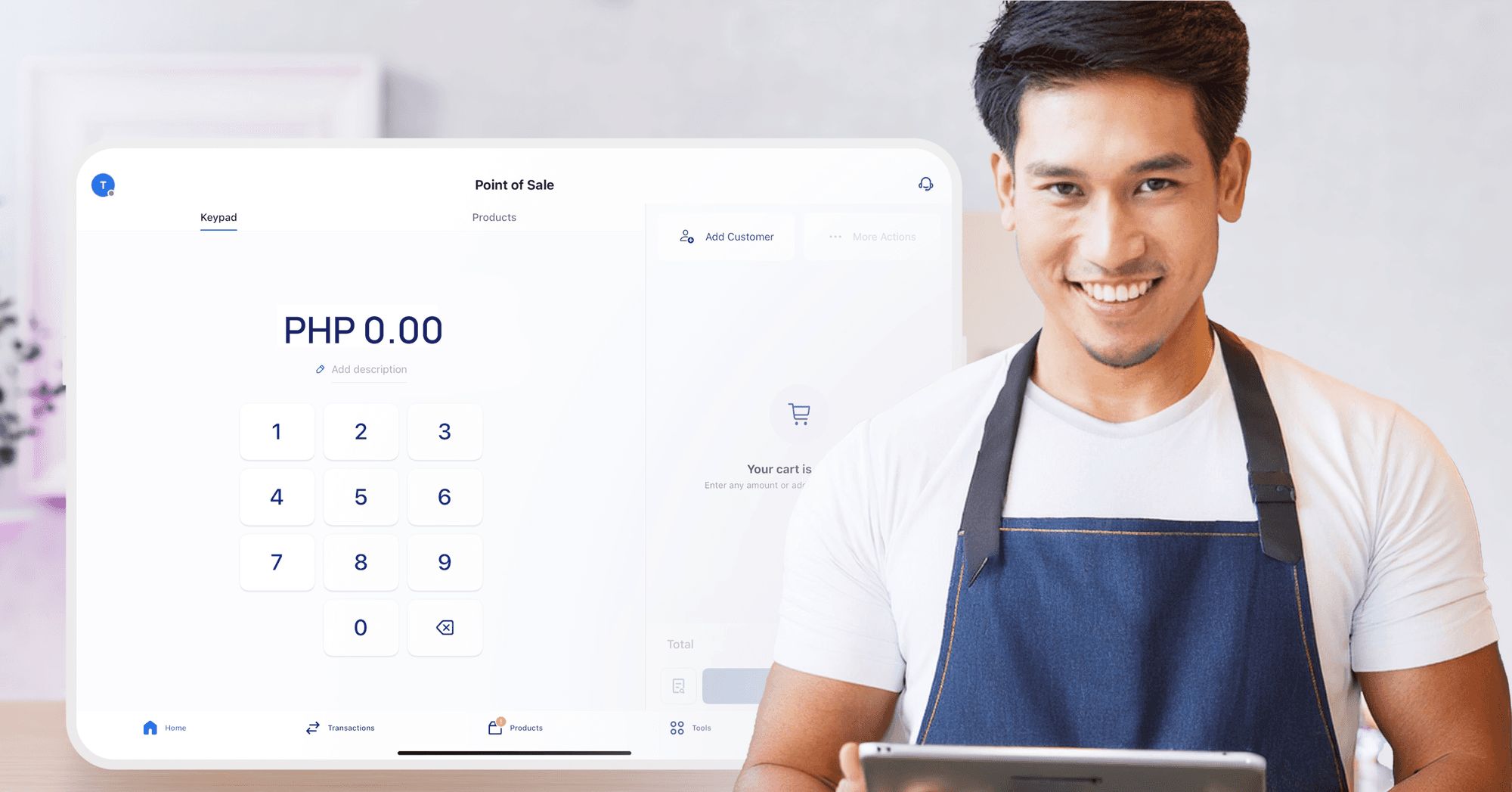

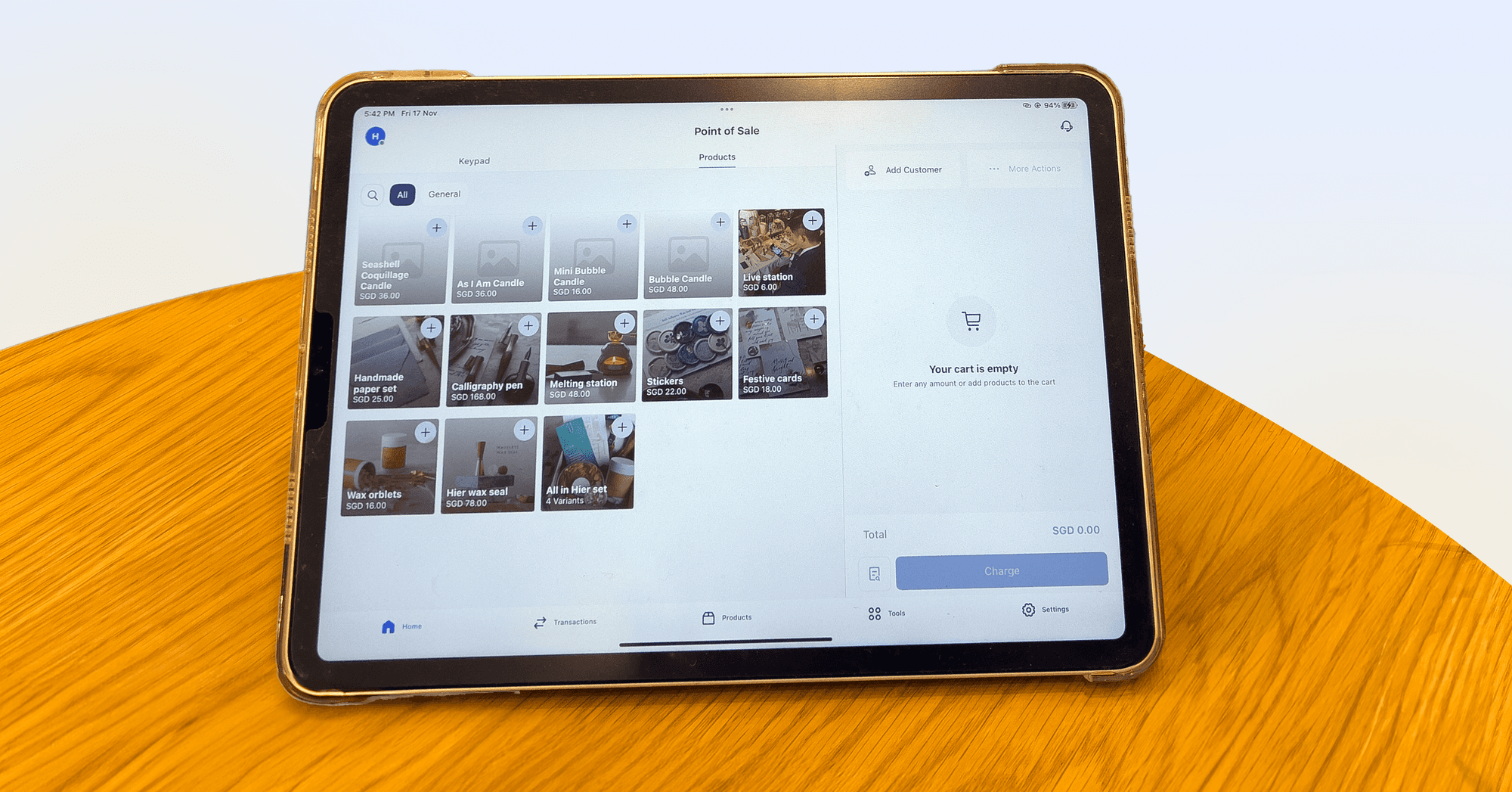

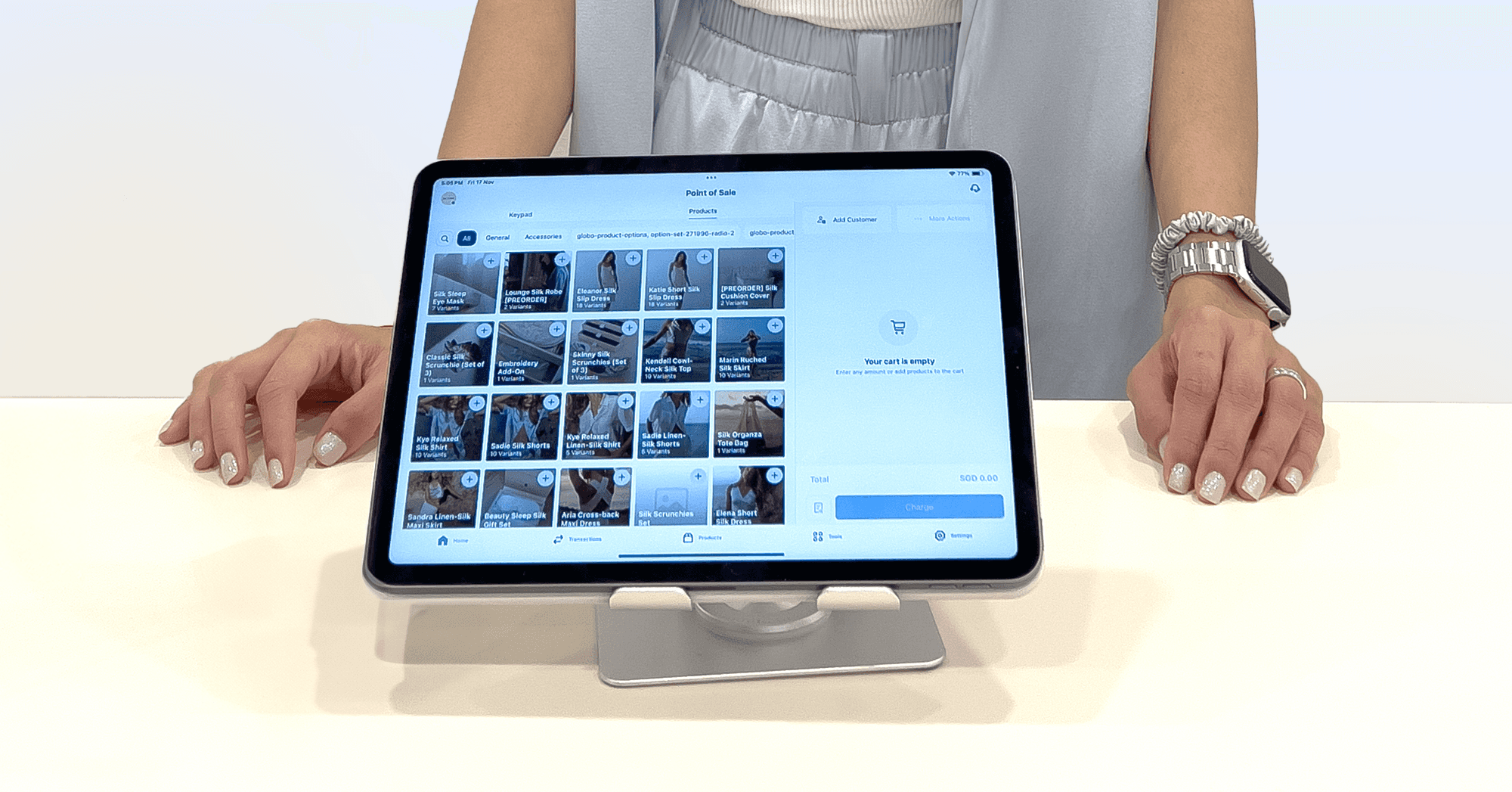

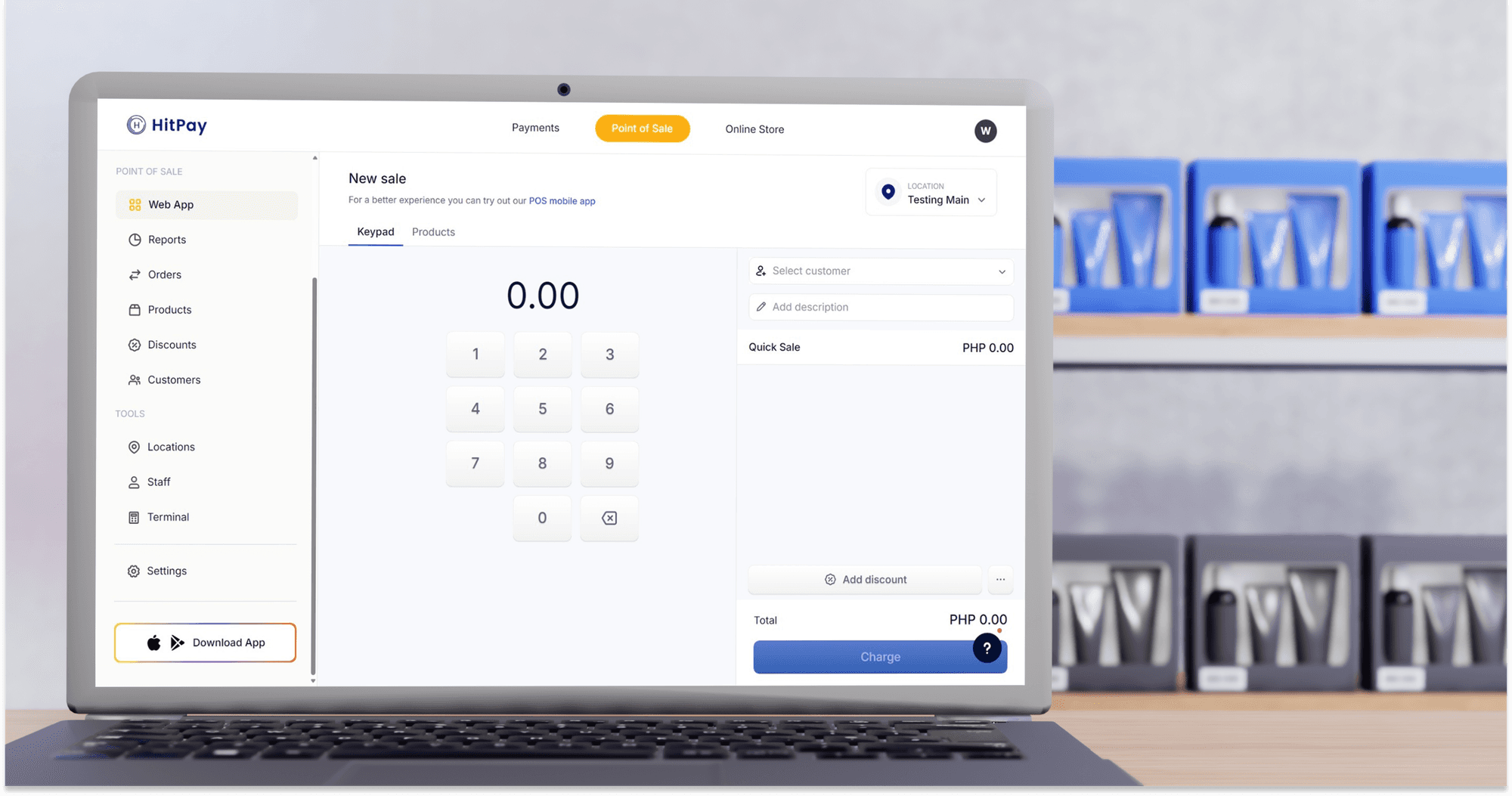

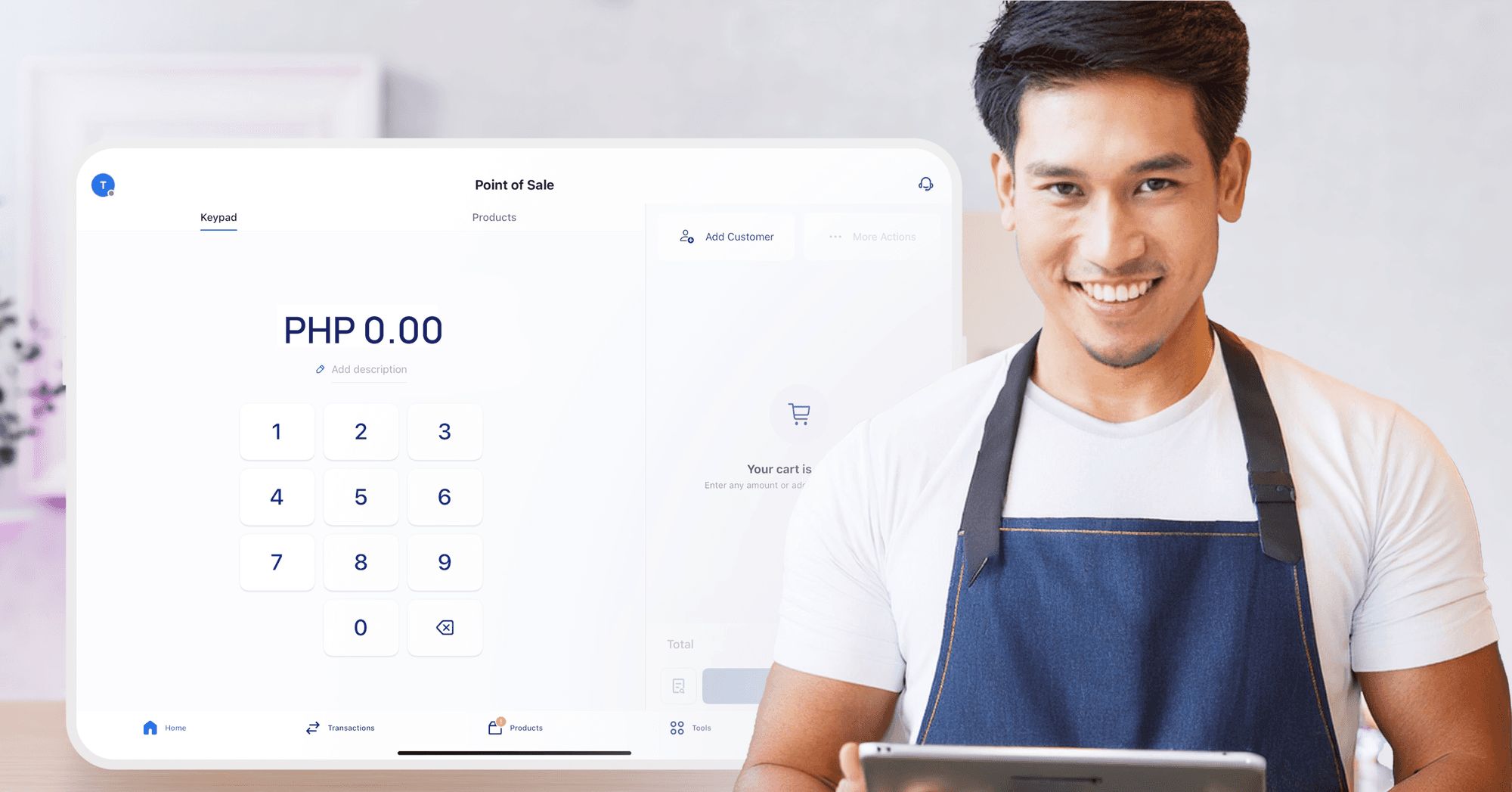

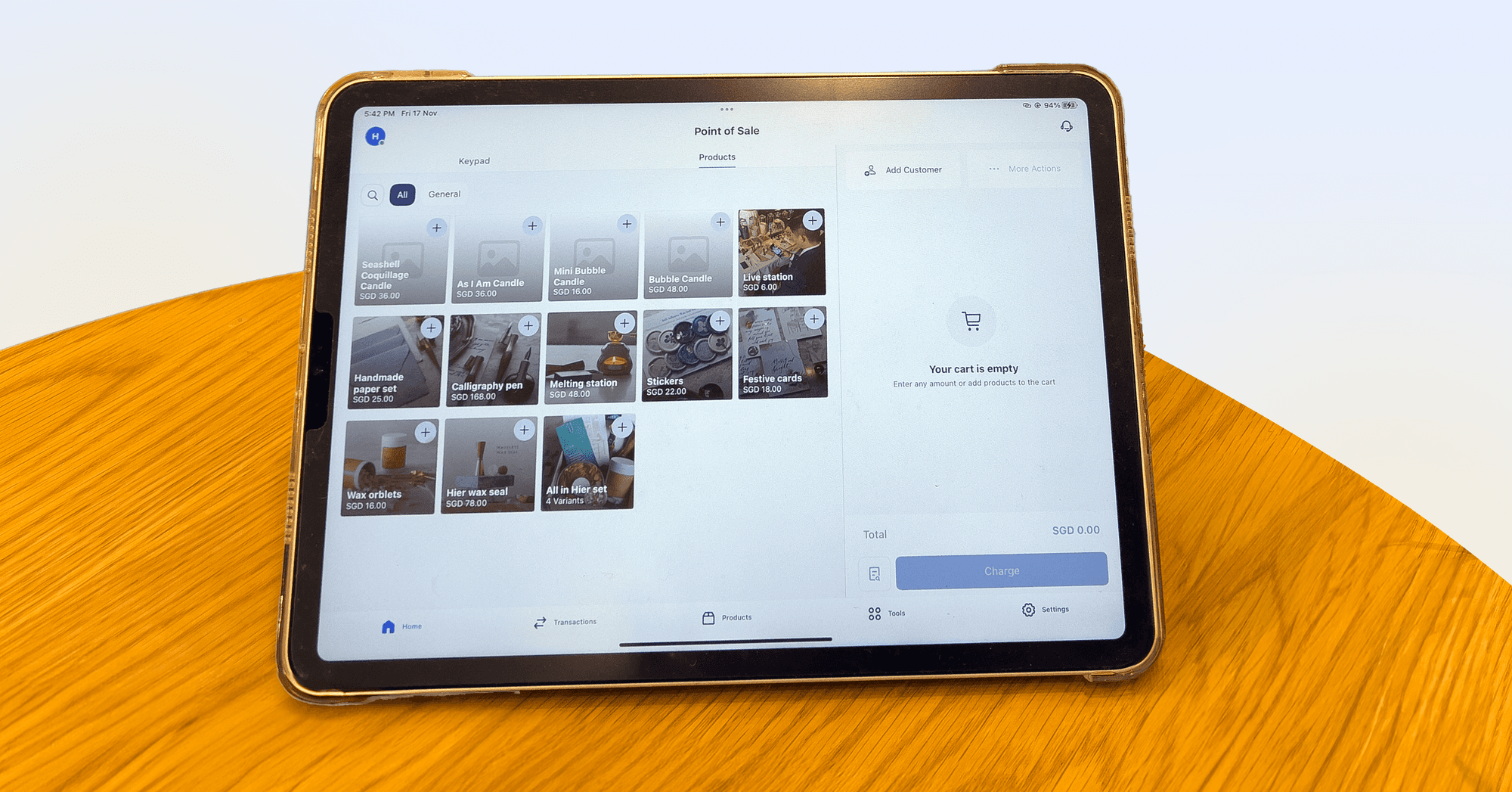

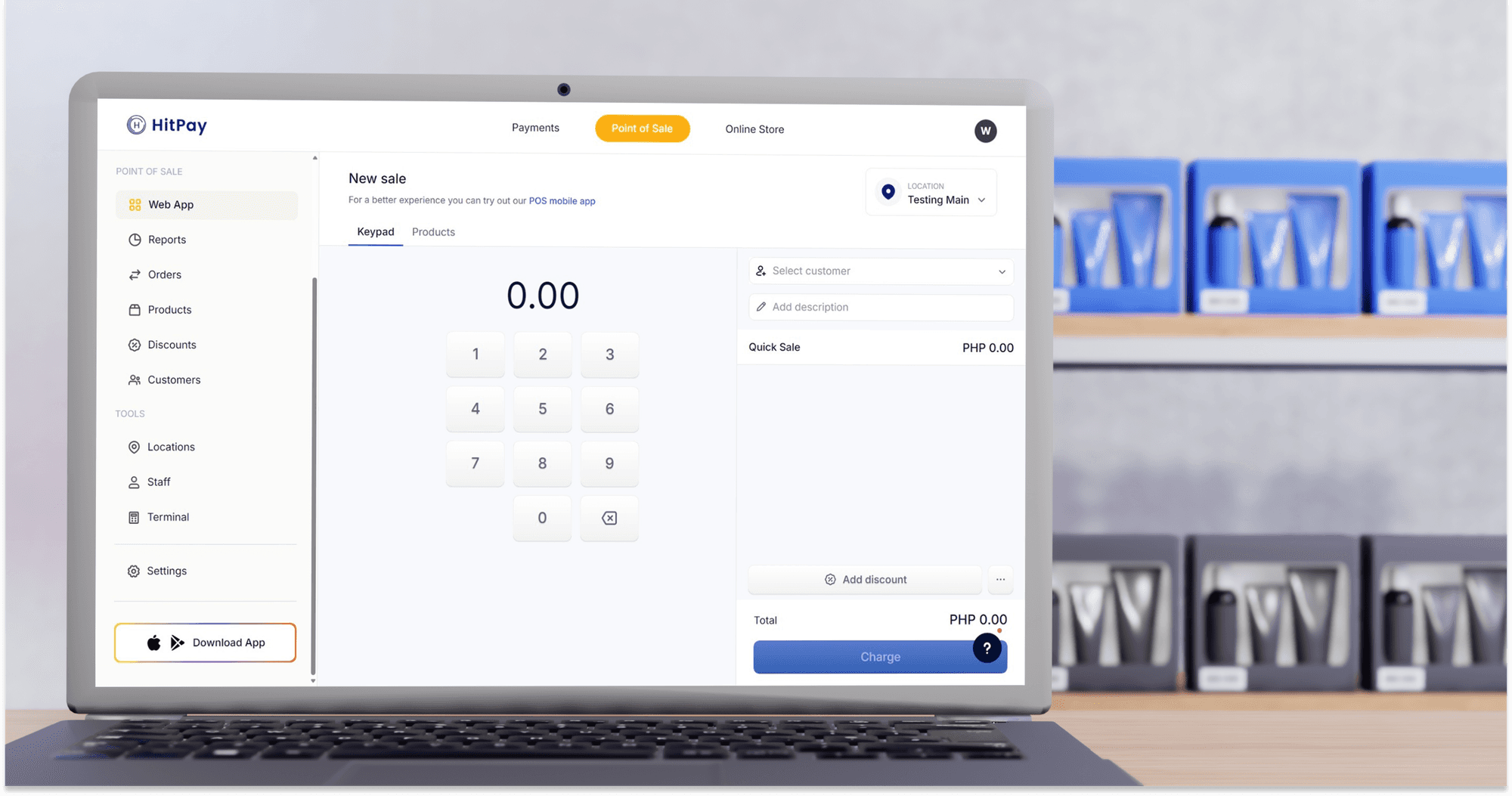

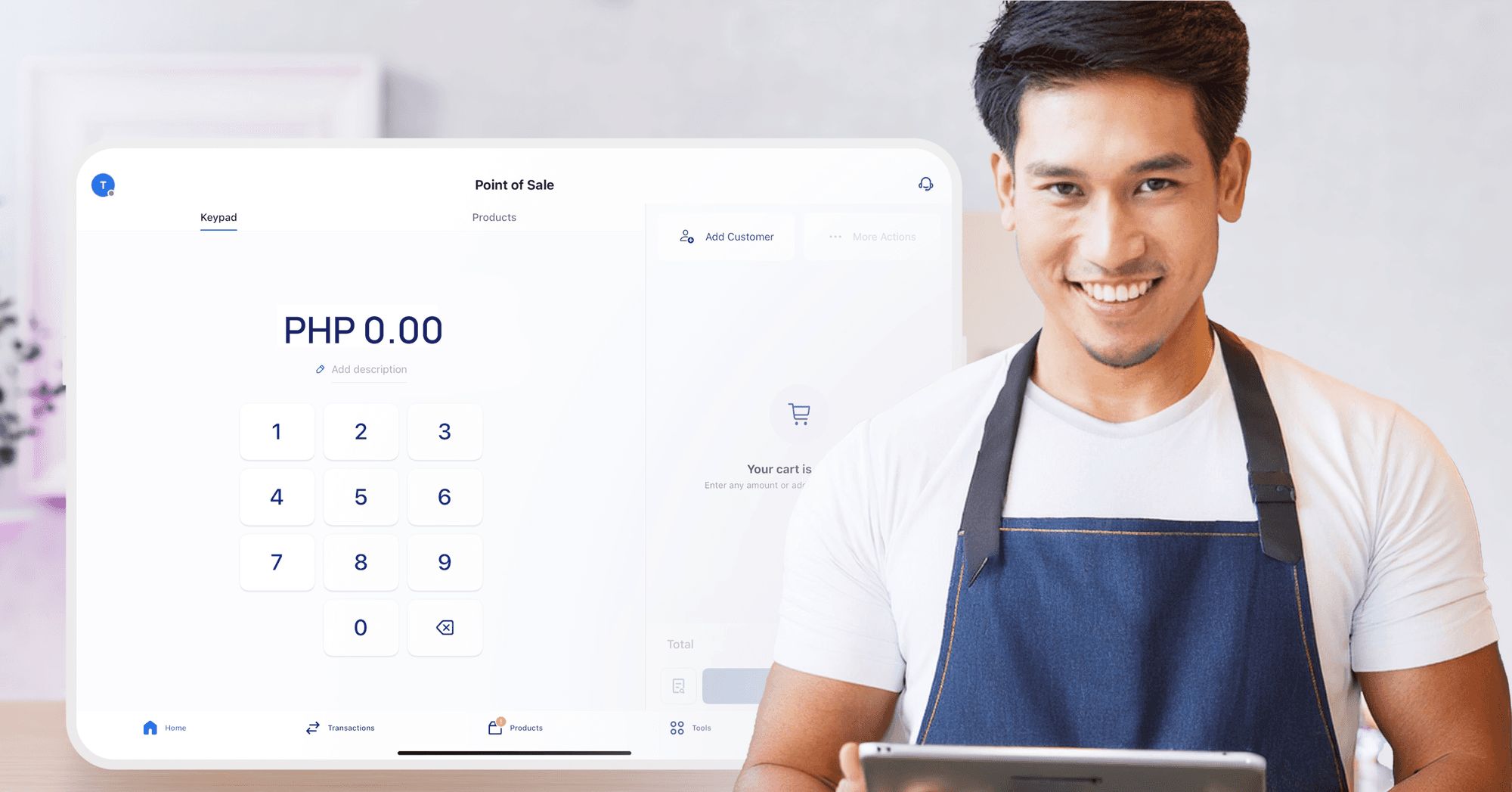

A Point of Sale (POS) system is essential for businesses to manage sales, process payments, and track inventory. It’s more than just a tool for transactions—modern POS systems combine both hardware and software to help streamline operations, improve customer experience, and boost business efficiency.

For small and medium-sized enterprises (SMEs), choosing the right POS system is critical to their growth and success. HitPay, a trusted payment platform serving over 15,000 businesses globally, offers a comprehensive, all-in-one solution that integrates online payments, in-store transactions, and B2B payments into a single system.

In this guide, we’ll break down what a POS system is, the essential features to look for, and what you can expect to pay in 2024.

Key Takeaways

It's essential to evaluate the different features each POS system offers to match your business needs.

Regular payment processing fees are typically unavoidable and should be factored into your overall budget.

Researching various providers and their plans is crucial to finding the most cost-effective solution for your small business.

What Is the Average POS System Cost for Small Businesses?

When looking at the cost of a POS system for small businesses, it’s important to think about both the hardware and software costs. These expenses can be different depending on what your business needs.

Monthly software fees can range from free options to higher-priced plans that offer more advanced features. Hardware costs also vary, from basic tools to more advanced equipment that can be expensive.

Understanding the Cost of Your POS System

The cost of a POS system can change significantly based on your business’s size and specific needs. Smaller businesses may only require basic features, which keep costs lower, while larger businesses might need more advanced functions like detailed analytics, multi-location support, and integration with other systems, which can increase the cost.

Understanding these potential expenses is key to planning a realistic budget and ensuring you invest in a system that meets your business needs without unnecessary extras. With many POS providers, the costs can quickly add up due to software subscriptions, additional hardware, and potential hidden fees.

💡Simple Pricing Did you know that with HitPay, you can access advanced POS software features with no subscription fees? It’s an ideal solution for businesses looking to manage costs without compromising on essential tools.

What Is the Average POS System Cost for Small Businesses?

The cost of a Point of Sale (POS) system for small businesses can vary widely depending on several factors. Understanding these costs is crucial for making an informed decision that aligns with your business needs and budget.

Factors Influencing POS System Cost

Several key factors can impact the overall cost of your POS system:

Hardware requirements: The number and type of terminals, card readers, receipt printers, and other hardware components needed.

Software features: Advanced features like inventory management, customer relationship management (CRM), or multi-location support often come at a premium.

Business size and transaction volume: Larger businesses with higher transaction volumes may require more robust systems, which can increase costs.

Integration needs: Compatibility with existing systems (e.g., accounting software, e-commerce platforms) may affect pricing.

Industry-specific requirements: Certain industries, such as restaurants or retail, may need specialized features that can impact cost.

Support and training: The level of customer support and training provided can influence ongoing costs.

Payment processing fees: While not directly part of the POS system cost, these fees are an important consideration in the overall expense.

By carefully evaluating these factors and your business's specific needs, you can better estimate the total cost of implementing a POS system and choose a solution that offers the best value for your small business.

💡Advanced POS Software Features Choosing a POS system depends on your business’s needs. With HitPay, you can enjoy features like inventory management, customer insights, and seamless receipt printing, all without any additional charges—perfect for small businesses seeking comprehensive solutions.

Comparing Paid POS Systems vs. Free Options

When choosing a POS system, it’s crucial to weigh the differences between free and paid options. Free POS systems might seem like a cost-effective choice initially but can end up costing more in the long run due to higher transaction fees and limited functionality.

On the other hand, paid POS systems typically offer more robust features, lower transaction fees, and better scalability, making them a better fit for growing businesses.

HitPay offers a unique solution by combining the advantages of both free and paid systems. With no subscription fees, and with access to advanced features like payment processing and inventory management, HitPay gives businesses the tools they need without the high costs typically associated with paid systems.

What Are the Components of a POS System?

A POS system has many key parts that work together well. They help improve how your business runs and how you deal with customers. Knowing about these parts helps you pick the right system for your needs.

Essential POS Hardware for Your Business

The hardware is a big part of a POS system. It connects your business to your customers. Important POS hardware includes:

Central Processing Unit (CPU): The main terminal for processing transactions.

Touch-Screen Monitors: These may eliminate the need for a separate mouse in some systems, making for a more user-friendly experience.

Card Readers: EMV-compliant credit card readers ensure security and accuracy during transactions.

Barcode Scanners: Especially popular in retail, these devices allow for quick and accurate data entry that helps manage inventory effectively.

Cash Drawers: Designed to withstand frequent opening while protecting cash and other valuables.

Receipt Printers: Thermal printers are generally more cost-effective in the long run and can significantly impact revenue.

Types of POS Software Available

The software is also key. There are different types for different business needs:

Cloud-Based Solutions: Ideal for large online merchants, these reduce upfront costs and enhance scalability.

On-Premises Solutions: More traditional, these are often preferred by businesses requiring control over their systems.

Integrated Inventory Management: Software that helps track items in real time, providing insights into stock levels.

Sales Reporting and Analytics: This enables you to review sales patterns and make data-driven decisions.

Additional Features in Popular POS Systems

Today's POS systems have more features that make things better for customers and your business. Some of these features include:

Sales Reporting: Provides insights into performance, allowing for strategic adjustments.

Customer Management: Helps keep track of customer data and preferences.

Loyalty Programs: Encourages repeat purchases and customer engagement, with 79% of consumers more likely to buy from a brand that offers a loyalty program.

Integrated Payment Processing: This ensures accuracy and security during payment transactions.

The POS market is rapidly expanding, with the transaction value in the Mobile POS Payments market projected to reach US$3.76 trillion in 2024. As businesses grow, it’s important to invest in systems that effectively combine both hardware and software.

Retailers can benefit from networked devices that track sales and inventory in real-time, leading to more efficient operations and improved decision-making.

How to Choose the Best POS System for Small Businesses?

Choosing a POS system is a big decision. You need to think about your business's needs, like how many sales you have, how you connect with customers, and what your industry requires.

Consider whether you need specific features like mobile payments, loyalty programs, or integration with e-commerce platforms. Additionally, think about scalability—choosing a system that can grow with your business ensures you won’t outgrow it as your operations expand.

Evaluating Your Business Needs

First, look at what your business needs now and in the future. Think about what tasks you want to automate, like managing inventory and scheduling. With 64% of businesses believing that artificial intelligence and automation can boost overall productivity, integrating AI-powered features in your POS system can be a strategic move. Knowing what you need will help you pick the right POS system for your business.

Also, consider the volume of transactions you handle daily and any industry-specific requirements, such as tracking perishable goods in a restaurant or handling online orders in retail. By thoroughly evaluating these needs, you can choose a POS system that not only meets current demands but also supports your growth plans.

Key Features to Look for in a POS System

When choosing a POS system, it’s important to focus on the features that match your business needs so your operations run smoothly and your business can grow.

Inventory management to keep track of stock levels

Sales reporting capabilities for performance insights

Customer relationship management tools to enhance engagement

Support for various payment methods, including mobile wallets and credit cards.

Security features to protect sensitive transaction data.

Also, think about monthly fees and transaction costs, which can change a lot between providers. Some systems charge extra for things like detailed reports, managing multiple locations, and more users.

Top POS Providers to Consider

Here’s a comparison of some leading POS providers, highlighting their key features and which types of businesses they’re best suited for:

POS Provider

Key Features

- No monthly fees, only charges when processing payments

- Supports various payment methods

- Easy to set up and use

- Extensive range of payment options to cater to diverse customer preferences

Square

- No monthly fees

- Only charges when processing payments

Clover

- Flexible plans for different business needs

- Customisable hardware options

Lightspeed

- Advanced reporting and analytics

- Excellent for tracking detailed sales data

When choosing a POS system, consider whether it will support your business growth. Selecting a trusted vendor like HitPay ensures your system can scale with your business while keeping pricing transparent without hidden fees.

💡Payment Support and Inventory Syncing HitPay stands out with its seamless integration of both online and in-store payments. It also syncs inventory across platforms like Shopify and WooCommerce, giving businesses the flexibility to manage both offline and online sales from one system.

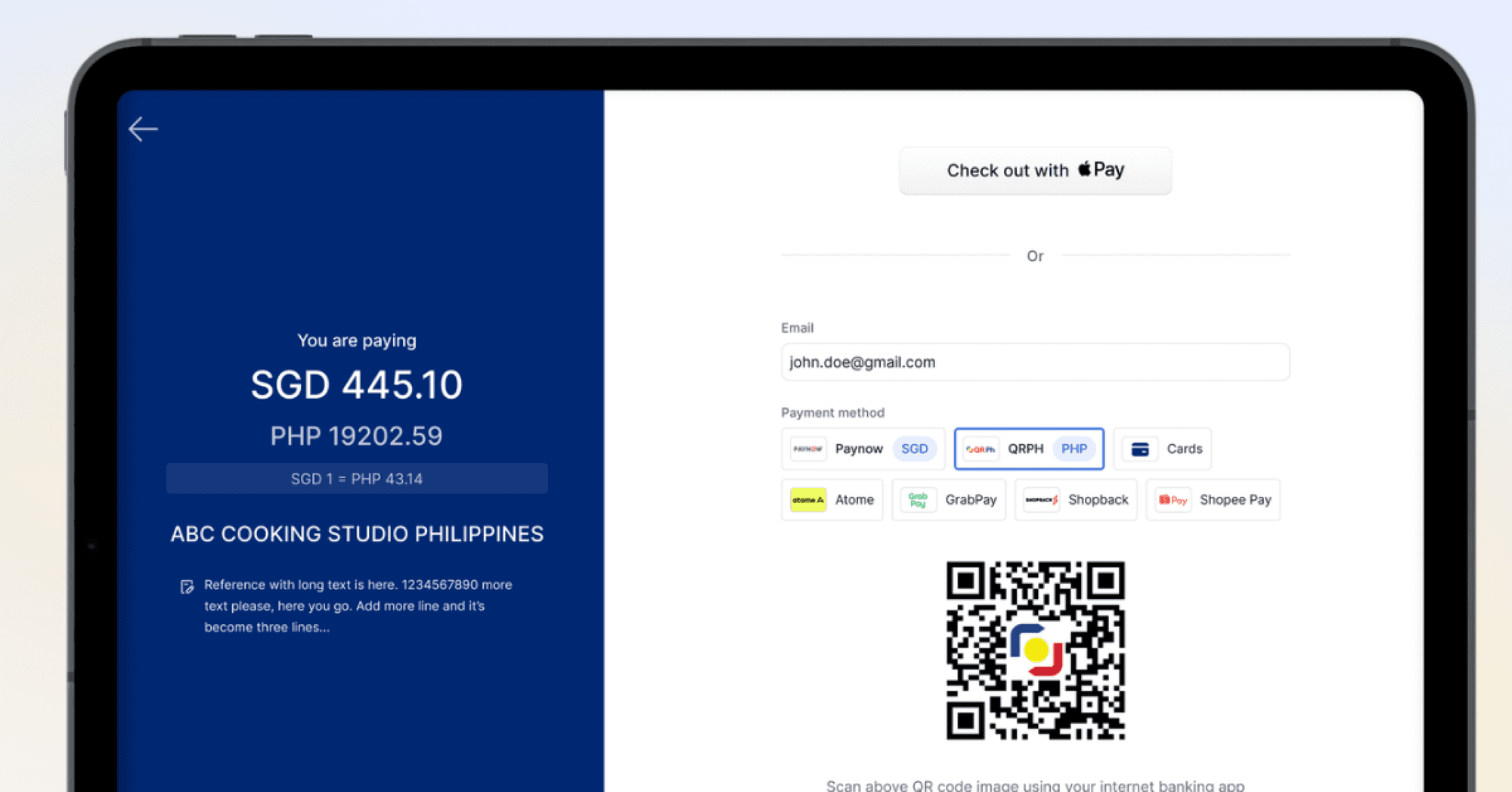

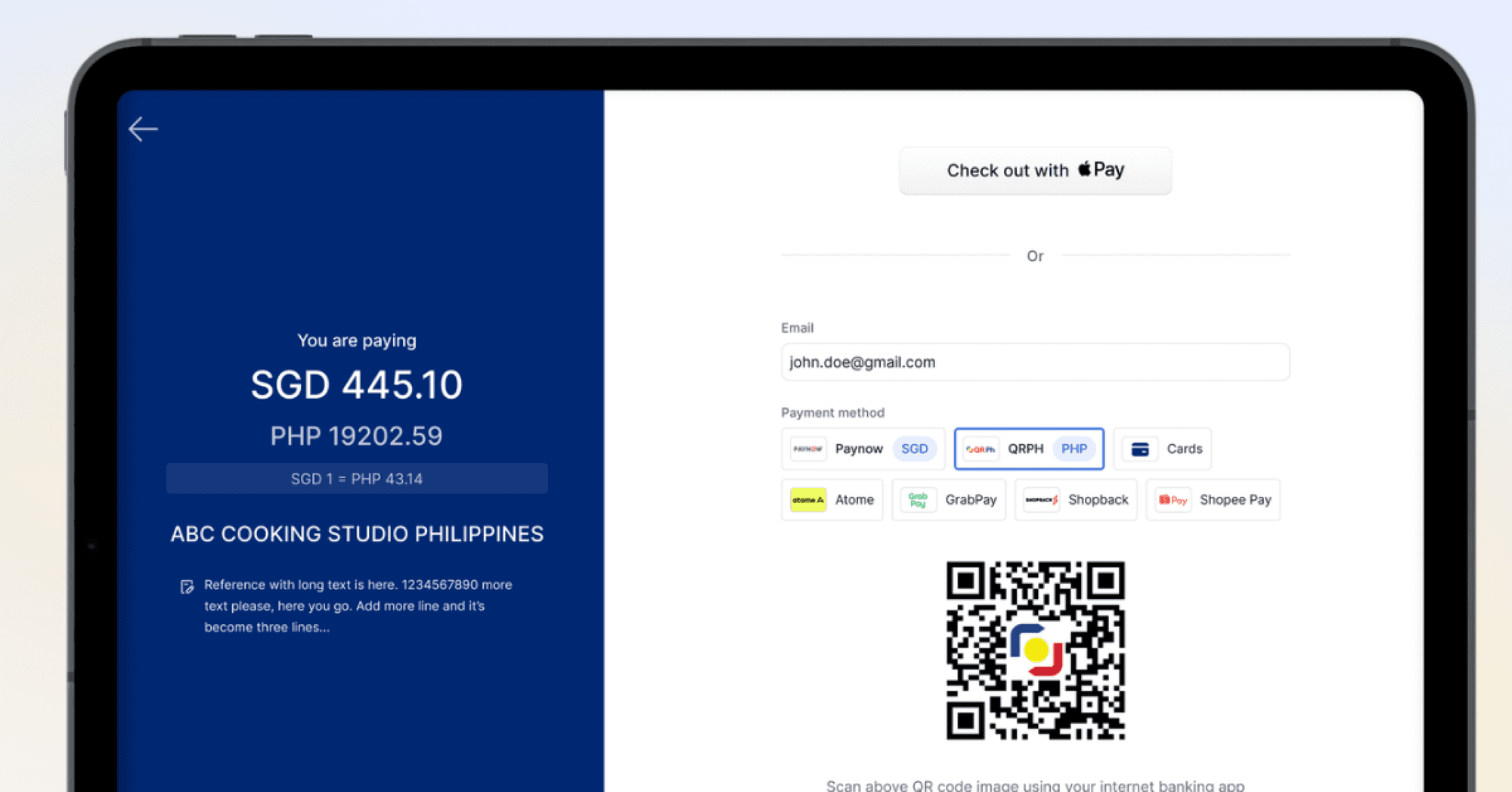

What Are Typical POS Fees and Credit Card Processing Fees?

When choosing a POS system, it's important to understand the different fees you might encounter. The cost of a POS system is more than just paying for the hardware or software. Here are some common fees to consider:

Monthly Subscription Fees: Many POS systems charge a monthly fee for access to their software. The cost depends on the plan and features included.

Transaction Fees: These are fees taken from each sale. They usually include a percentage of the sale plus a small fixed amount.

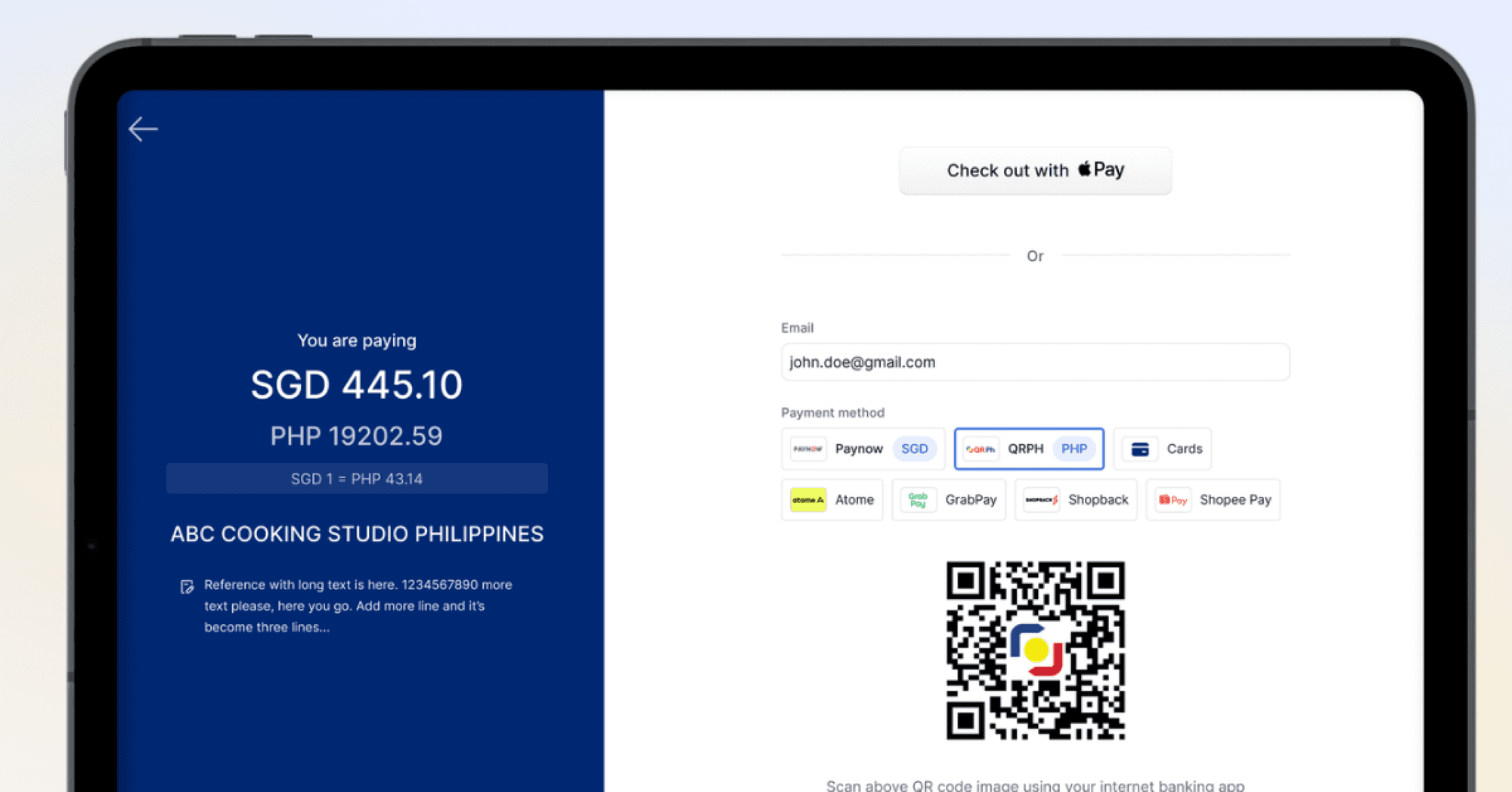

Credit Card Processing Fees: If your customers pay with credit or debit cards, you'll need to cover processing fees. These fees vary by provider and can include extra charges for different payment types, like online payments.

Hardware Costs: Depending on your business, you may need card readers, receipt printers, and cash registers. These can add to your overall expenses.

Additional Feature Costs: Some systems charge extra for features like advanced reporting, multi-location management, or more users.

Understanding these fees in advance can help you choose a POS system that fits your budget and avoids unexpected costs.

💡HitPay offers easy QR code and credit card payment options that enhance customer convenience while keeping transaction costs low.

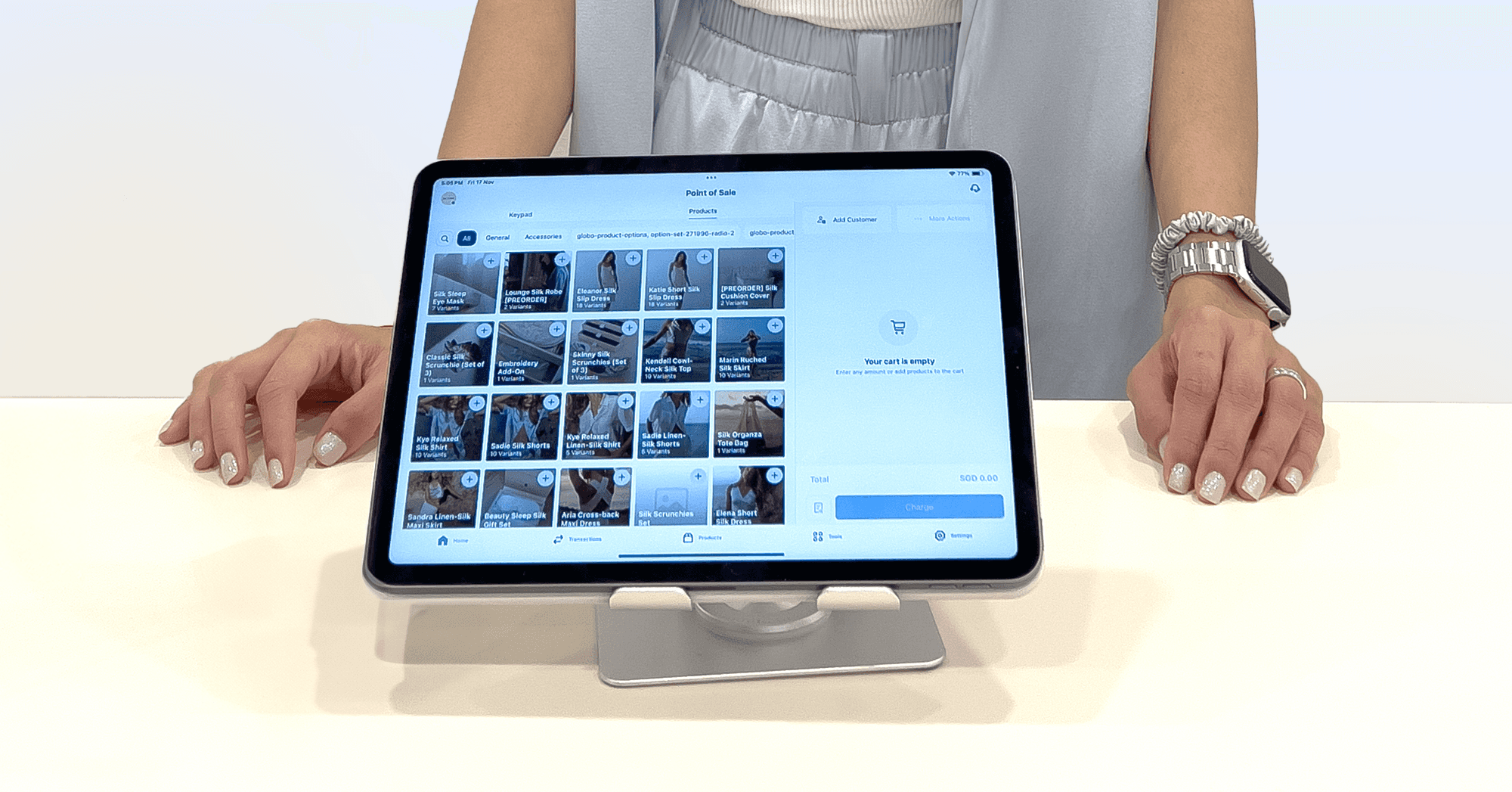

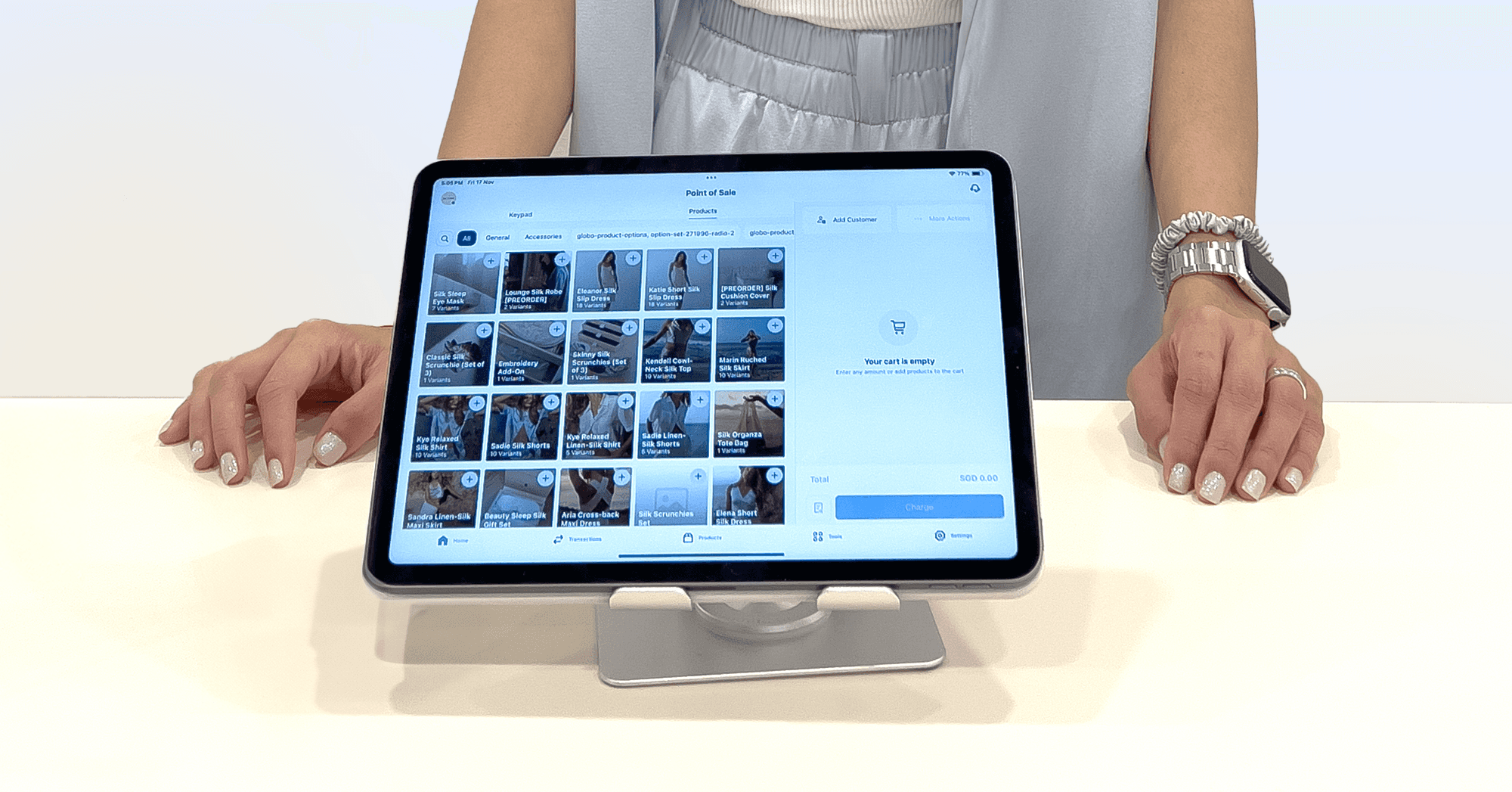

Are There Specific POS Systems for Retail and Restaurants?

Different types of businesses require different POS systems. Retail stores often need systems that help manage inventory and monitor sales, while restaurants benefit from systems designed for order management and table tracking.

Selecting the right POS system is crucial for ensuring smooth operations and enhancing customer satisfaction.

Best Retail POS Systems for Small Businesses

Retail shops benefit from POS systems that can do more than just process payments.

These systems should offer detailed sales reports that show which products are selling the most and when. This helps store owners make better decisions about what to restock and when to run promotions.

Additionally, good retail POS systems include inventory management features that automatically update stock levels when items are sold. This reduces errors and helps keep the right amount of products in stock. Some systems even send alerts when stock is low, making it easier to manage inventory efficiently.

💡Retail businesses thrive with accurate inventory management. HitPay integrates with platforms like Shopify and WooCommerce, keeping your inventory synced and updated across all channels for smoother operations.

What to Expect in Terms of POS System Pricing?

POS system pricing involves both upfront and ongoing costs. Upfront, you'll need to budget for hardware like cash drawers, receipt printers, and barcode scanners. Ongoing expenses include monthly software subscriptions and transaction fees, which can vary based on your business needs and sales volume.

Budgeting for a POS System in the Philippines

When selecting a POS system in the Philippines, it’s important to find one that balances affordability, local payment support, and ease of use. Considering both initial setup costs and ongoing fees is key to making a choice that suits your budget.

Some systems are particularly popular in the Philippines for their flexibility and local market focus, making them strong options for businesses looking to manage costs while maintaining efficiency.

Get Started With HitPay’s Secure POS System Software

Selecting the right POS system is crucial for your business’s success. In 2024, small businesses should focus on finding a system that balances cost with the features they need, such as inventory management, sales reporting, and customer engagement.

Understanding both initial and ongoing costs, along with transaction fees, helps in making a smart choice. Whether you run a retail store or a restaurant, choose a POS system that fits your needs, scales as you grow, and offers clear, transparent pricing.

With the right solution, you can streamline operations, improve customer satisfaction, and support your business’s growth.

Experience the simplicity and efficiency of HitPay's POS software with no subscription fees. Take advantage of our advanced features at no cost, and streamline your business operations effortlessly.

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Frequently Asked Questions About POS Systems

What is a POS system and how does it work for a small business?

A POS system (Point of Sale system) is a combination of hardware and software that allows small businesses to process sales transactions. The POS software manages sales, inventory, and customer data, while the POS hardware includes devices like cash registers, barcode scanners, and card readers.

What should I consider when choosing the best POS system for my small business?

Evaluate the POS system cost, including pos software pricing, pos hardware costs, and any ongoing fees associated with the POS provider. It's also wise to look for a free POS system or a free plan that allows you to test features before committing.

What are the typical costs associated with a POS system?

The cost of a POS system can vary widely based on various factors, including the type of POS system you choose. Generally, you can expect to pay for the POS software (which can be a one-time fee or a monthly subscription), POS hardware (like terminals, printers, and scanners), and any additional transaction fees charged by the POS provider.

Are there any free POS systems available for small businesses?

Yes, there are several free POS systems available that can be a great starting point for small businesses. These systems typically offer basic functionality suitable for startups or low-volume retailers. However, it's important to evaluate whether the features provided meet your business needs and if there are any hidden fees or limitations.

You might also like these posts

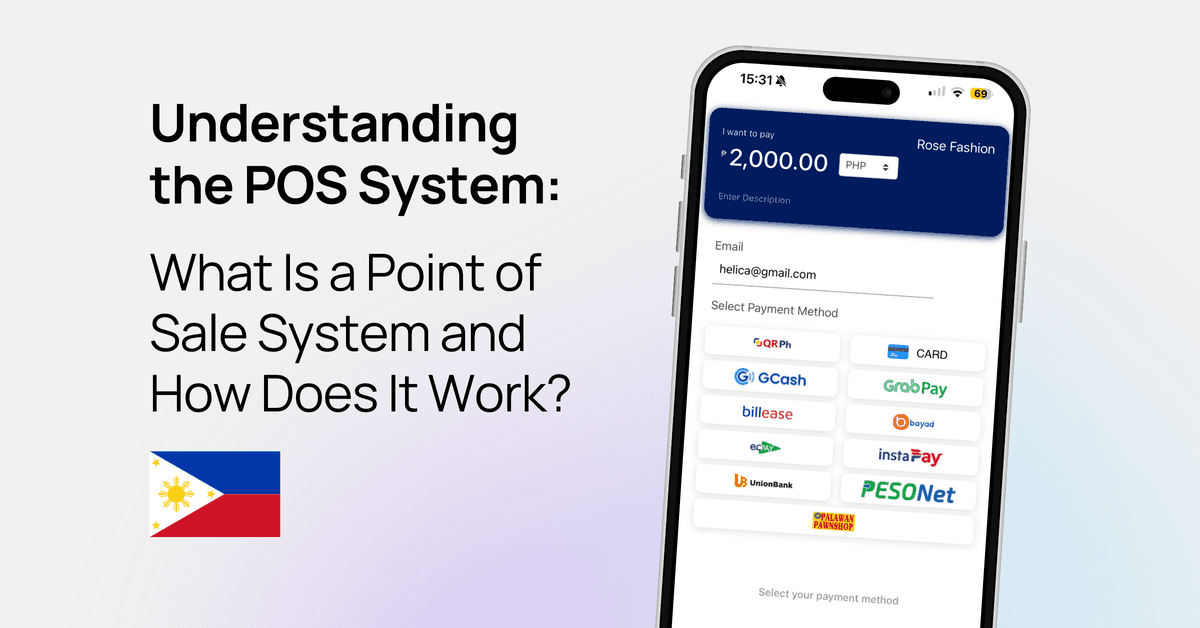

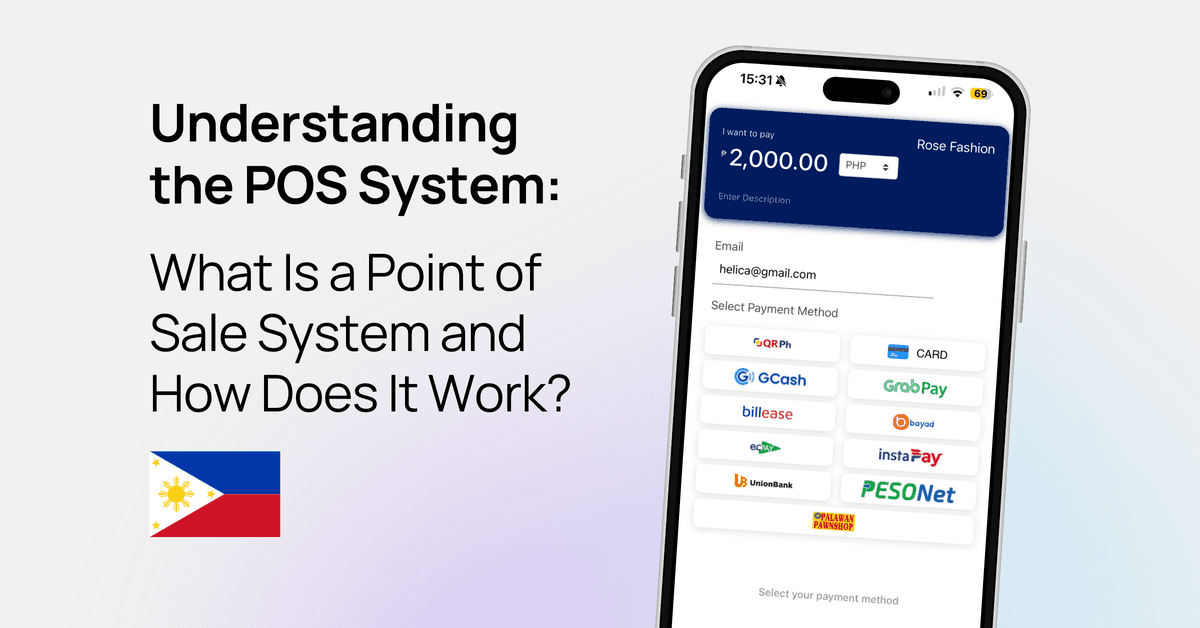

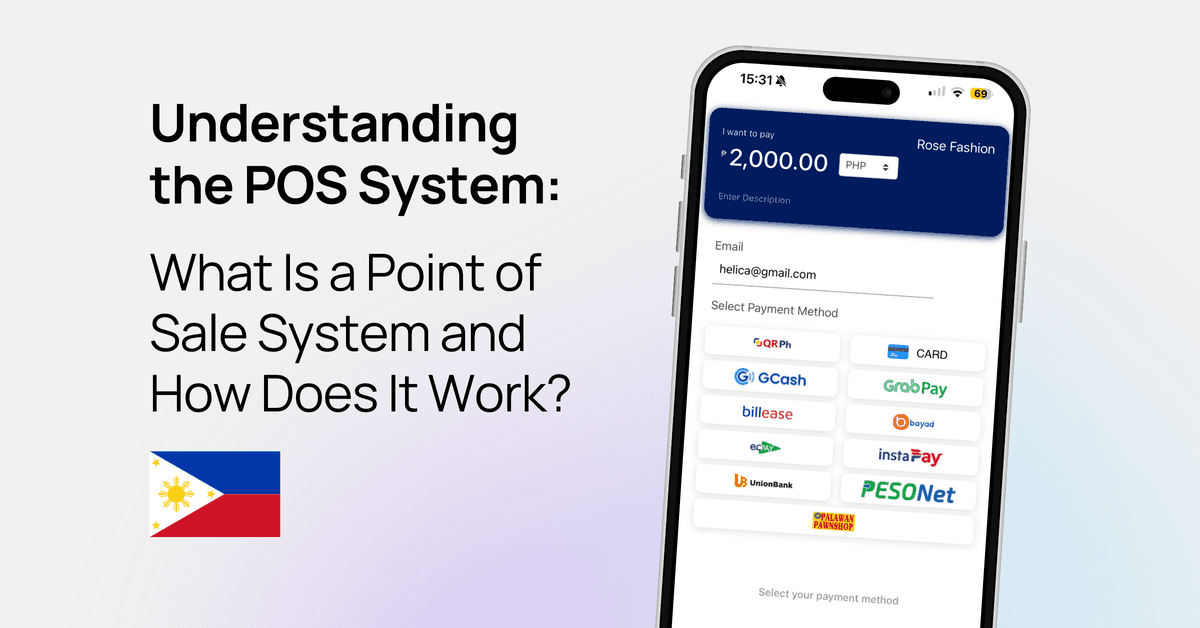

Understanding the POS System: What Is a Point of Sale System and How Does It Work?

HitPay Philippines

POS

September 9, 2024

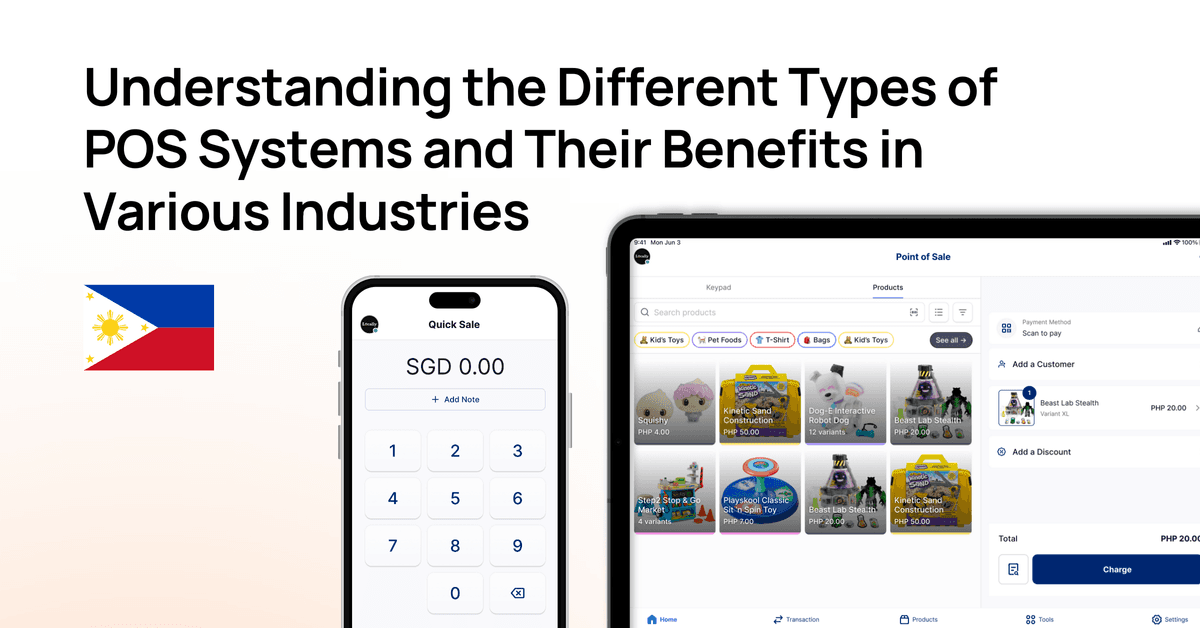

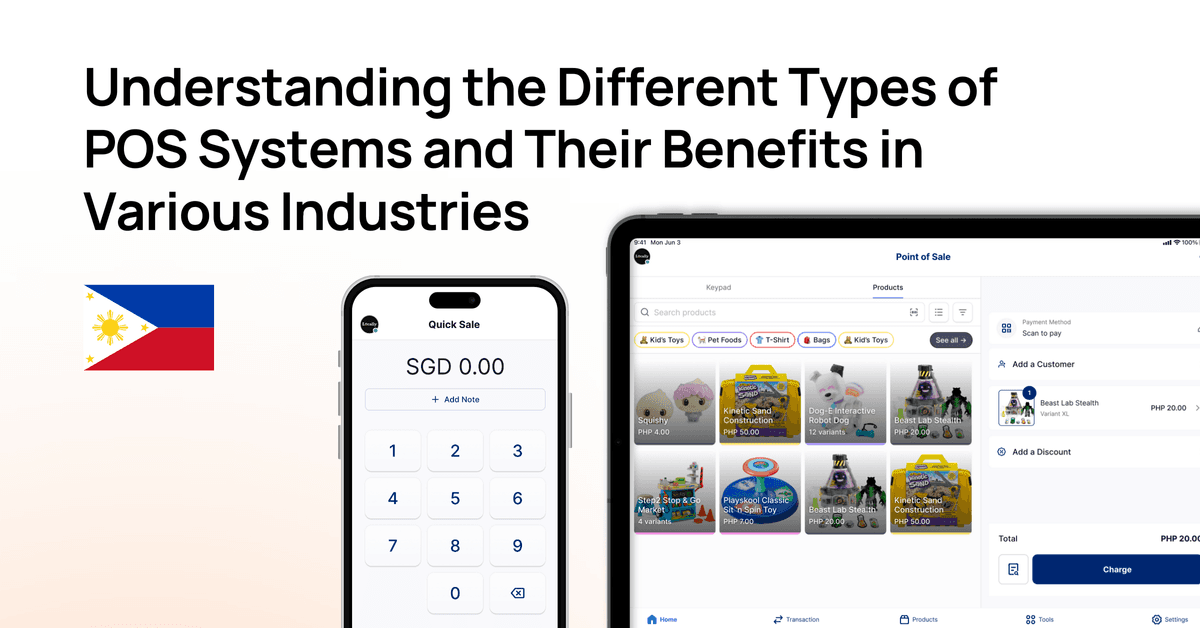

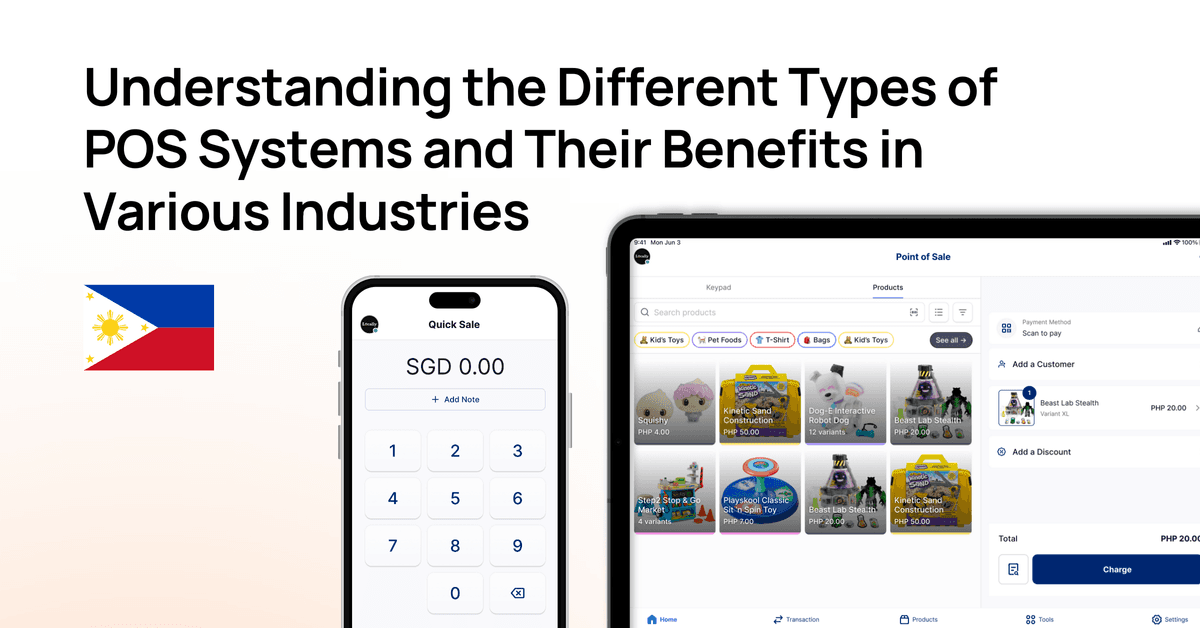

Understanding the Different Types of POS Systems and Their Benefits in Various Industries

HitPay Philippines

POS

September 8, 2024

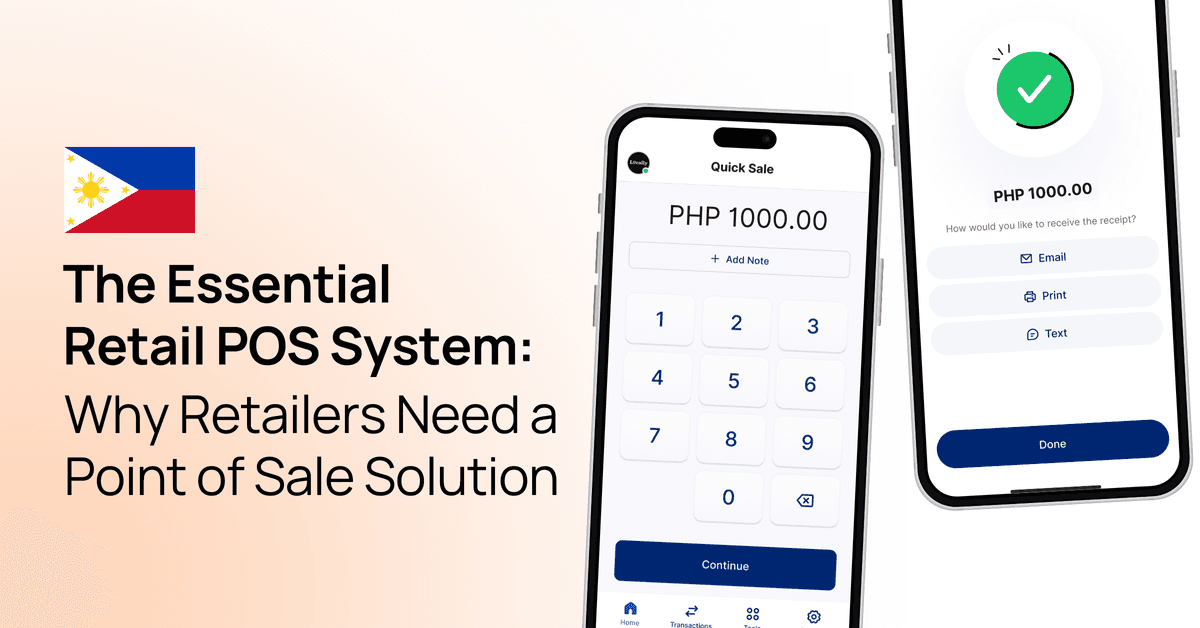

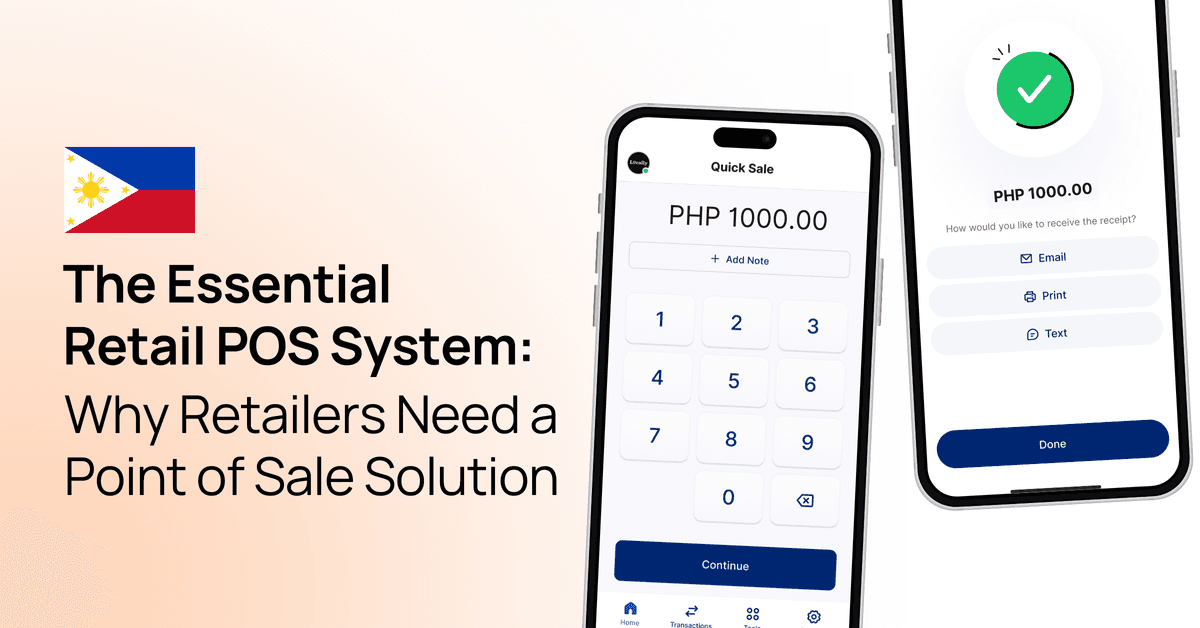

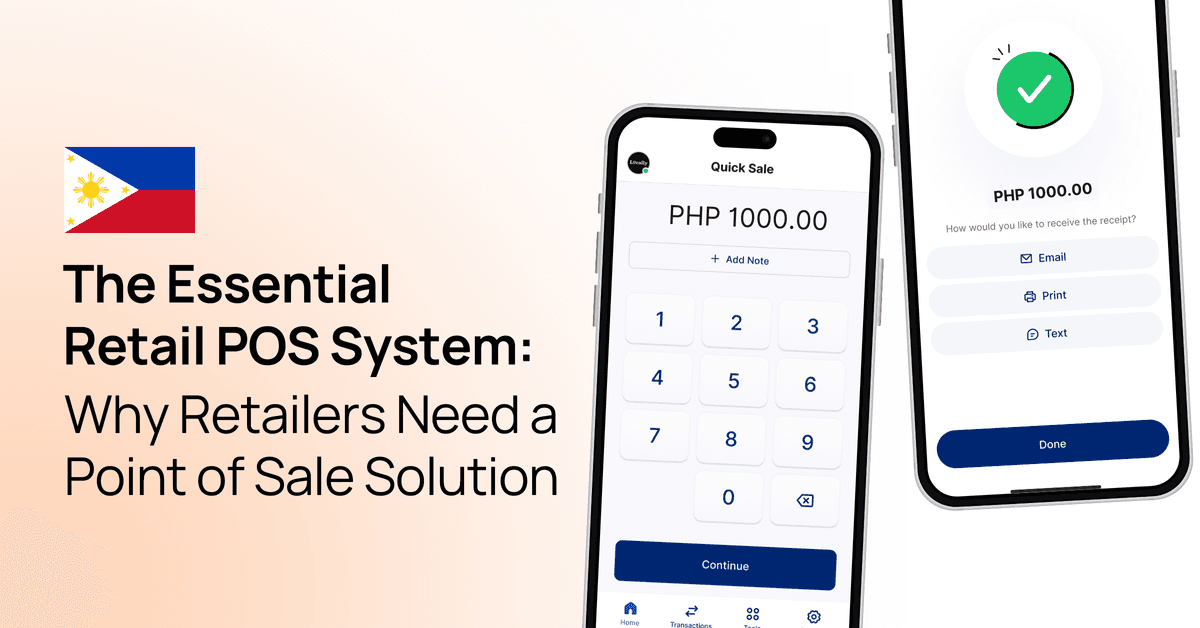

The Essential Retail POS System: Why Retailers Need a Point of Sale Solution

HitPay Philippines

POS

September 8, 2024

Best POS Systems Costs for Small Businesses

September 7, 2024

Learn about the costs of POS systems for small businesses, including hardware and software expenses, essential features, and factors to consider when choosing the right system to match your business needs.

A Point of Sale (POS) system is essential for businesses to manage sales, process payments, and track inventory. It’s more than just a tool for transactions—modern POS systems combine both hardware and software to help streamline operations, improve customer experience, and boost business efficiency.

For small and medium-sized enterprises (SMEs), choosing the right POS system is critical to their growth and success. HitPay, a trusted payment platform serving over 15,000 businesses globally, offers a comprehensive, all-in-one solution that integrates online payments, in-store transactions, and B2B payments into a single system.

In this guide, we’ll break down what a POS system is, the essential features to look for, and what you can expect to pay in 2024.

Key Takeaways

It's essential to evaluate the different features each POS system offers to match your business needs.

Regular payment processing fees are typically unavoidable and should be factored into your overall budget.

Researching various providers and their plans is crucial to finding the most cost-effective solution for your small business.

What Is the Average POS System Cost for Small Businesses?

When looking at the cost of a POS system for small businesses, it’s important to think about both the hardware and software costs. These expenses can be different depending on what your business needs.

Monthly software fees can range from free options to higher-priced plans that offer more advanced features. Hardware costs also vary, from basic tools to more advanced equipment that can be expensive.

Understanding the Cost of Your POS System

The cost of a POS system can change significantly based on your business’s size and specific needs. Smaller businesses may only require basic features, which keep costs lower, while larger businesses might need more advanced functions like detailed analytics, multi-location support, and integration with other systems, which can increase the cost.

Understanding these potential expenses is key to planning a realistic budget and ensuring you invest in a system that meets your business needs without unnecessary extras. With many POS providers, the costs can quickly add up due to software subscriptions, additional hardware, and potential hidden fees.

💡Simple Pricing Did you know that with HitPay, you can access advanced POS software features with no subscription fees? It’s an ideal solution for businesses looking to manage costs without compromising on essential tools.

What Is the Average POS System Cost for Small Businesses?

The cost of a Point of Sale (POS) system for small businesses can vary widely depending on several factors. Understanding these costs is crucial for making an informed decision that aligns with your business needs and budget.

Factors Influencing POS System Cost

Several key factors can impact the overall cost of your POS system:

Hardware requirements: The number and type of terminals, card readers, receipt printers, and other hardware components needed.

Software features: Advanced features like inventory management, customer relationship management (CRM), or multi-location support often come at a premium.

Business size and transaction volume: Larger businesses with higher transaction volumes may require more robust systems, which can increase costs.

Integration needs: Compatibility with existing systems (e.g., accounting software, e-commerce platforms) may affect pricing.

Industry-specific requirements: Certain industries, such as restaurants or retail, may need specialized features that can impact cost.

Support and training: The level of customer support and training provided can influence ongoing costs.

Payment processing fees: While not directly part of the POS system cost, these fees are an important consideration in the overall expense.

By carefully evaluating these factors and your business's specific needs, you can better estimate the total cost of implementing a POS system and choose a solution that offers the best value for your small business.

💡Advanced POS Software Features Choosing a POS system depends on your business’s needs. With HitPay, you can enjoy features like inventory management, customer insights, and seamless receipt printing, all without any additional charges—perfect for small businesses seeking comprehensive solutions.

Comparing Paid POS Systems vs. Free Options

When choosing a POS system, it’s crucial to weigh the differences between free and paid options. Free POS systems might seem like a cost-effective choice initially but can end up costing more in the long run due to higher transaction fees and limited functionality.

On the other hand, paid POS systems typically offer more robust features, lower transaction fees, and better scalability, making them a better fit for growing businesses.

HitPay offers a unique solution by combining the advantages of both free and paid systems. With no subscription fees, and with access to advanced features like payment processing and inventory management, HitPay gives businesses the tools they need without the high costs typically associated with paid systems.

What Are the Components of a POS System?

A POS system has many key parts that work together well. They help improve how your business runs and how you deal with customers. Knowing about these parts helps you pick the right system for your needs.

Essential POS Hardware for Your Business

The hardware is a big part of a POS system. It connects your business to your customers. Important POS hardware includes:

Central Processing Unit (CPU): The main terminal for processing transactions.

Touch-Screen Monitors: These may eliminate the need for a separate mouse in some systems, making for a more user-friendly experience.

Card Readers: EMV-compliant credit card readers ensure security and accuracy during transactions.

Barcode Scanners: Especially popular in retail, these devices allow for quick and accurate data entry that helps manage inventory effectively.

Cash Drawers: Designed to withstand frequent opening while protecting cash and other valuables.

Receipt Printers: Thermal printers are generally more cost-effective in the long run and can significantly impact revenue.

Types of POS Software Available

The software is also key. There are different types for different business needs:

Cloud-Based Solutions: Ideal for large online merchants, these reduce upfront costs and enhance scalability.

On-Premises Solutions: More traditional, these are often preferred by businesses requiring control over their systems.

Integrated Inventory Management: Software that helps track items in real time, providing insights into stock levels.

Sales Reporting and Analytics: This enables you to review sales patterns and make data-driven decisions.

Additional Features in Popular POS Systems

Today's POS systems have more features that make things better for customers and your business. Some of these features include:

Sales Reporting: Provides insights into performance, allowing for strategic adjustments.

Customer Management: Helps keep track of customer data and preferences.

Loyalty Programs: Encourages repeat purchases and customer engagement, with 79% of consumers more likely to buy from a brand that offers a loyalty program.

Integrated Payment Processing: This ensures accuracy and security during payment transactions.

The POS market is rapidly expanding, with the transaction value in the Mobile POS Payments market projected to reach US$3.76 trillion in 2024. As businesses grow, it’s important to invest in systems that effectively combine both hardware and software.

Retailers can benefit from networked devices that track sales and inventory in real-time, leading to more efficient operations and improved decision-making.

How to Choose the Best POS System for Small Businesses?

Choosing a POS system is a big decision. You need to think about your business's needs, like how many sales you have, how you connect with customers, and what your industry requires.

Consider whether you need specific features like mobile payments, loyalty programs, or integration with e-commerce platforms. Additionally, think about scalability—choosing a system that can grow with your business ensures you won’t outgrow it as your operations expand.

Evaluating Your Business Needs

First, look at what your business needs now and in the future. Think about what tasks you want to automate, like managing inventory and scheduling. With 64% of businesses believing that artificial intelligence and automation can boost overall productivity, integrating AI-powered features in your POS system can be a strategic move. Knowing what you need will help you pick the right POS system for your business.

Also, consider the volume of transactions you handle daily and any industry-specific requirements, such as tracking perishable goods in a restaurant or handling online orders in retail. By thoroughly evaluating these needs, you can choose a POS system that not only meets current demands but also supports your growth plans.

Key Features to Look for in a POS System

When choosing a POS system, it’s important to focus on the features that match your business needs so your operations run smoothly and your business can grow.

Inventory management to keep track of stock levels

Sales reporting capabilities for performance insights

Customer relationship management tools to enhance engagement

Support for various payment methods, including mobile wallets and credit cards.

Security features to protect sensitive transaction data.

Also, think about monthly fees and transaction costs, which can change a lot between providers. Some systems charge extra for things like detailed reports, managing multiple locations, and more users.

Top POS Providers to Consider

Here’s a comparison of some leading POS providers, highlighting their key features and which types of businesses they’re best suited for:

POS Provider

Key Features

- No monthly fees, only charges when processing payments

- Supports various payment methods

- Easy to set up and use

- Extensive range of payment options to cater to diverse customer preferences

Square

- No monthly fees

- Only charges when processing payments

Clover

- Flexible plans for different business needs

- Customisable hardware options

Lightspeed

- Advanced reporting and analytics

- Excellent for tracking detailed sales data

When choosing a POS system, consider whether it will support your business growth. Selecting a trusted vendor like HitPay ensures your system can scale with your business while keeping pricing transparent without hidden fees.

💡Payment Support and Inventory Syncing HitPay stands out with its seamless integration of both online and in-store payments. It also syncs inventory across platforms like Shopify and WooCommerce, giving businesses the flexibility to manage both offline and online sales from one system.

What Are Typical POS Fees and Credit Card Processing Fees?

When choosing a POS system, it's important to understand the different fees you might encounter. The cost of a POS system is more than just paying for the hardware or software. Here are some common fees to consider:

Monthly Subscription Fees: Many POS systems charge a monthly fee for access to their software. The cost depends on the plan and features included.

Transaction Fees: These are fees taken from each sale. They usually include a percentage of the sale plus a small fixed amount.

Credit Card Processing Fees: If your customers pay with credit or debit cards, you'll need to cover processing fees. These fees vary by provider and can include extra charges for different payment types, like online payments.

Hardware Costs: Depending on your business, you may need card readers, receipt printers, and cash registers. These can add to your overall expenses.

Additional Feature Costs: Some systems charge extra for features like advanced reporting, multi-location management, or more users.

Understanding these fees in advance can help you choose a POS system that fits your budget and avoids unexpected costs.

💡HitPay offers easy QR code and credit card payment options that enhance customer convenience while keeping transaction costs low.

Are There Specific POS Systems for Retail and Restaurants?

Different types of businesses require different POS systems. Retail stores often need systems that help manage inventory and monitor sales, while restaurants benefit from systems designed for order management and table tracking.

Selecting the right POS system is crucial for ensuring smooth operations and enhancing customer satisfaction.

Best Retail POS Systems for Small Businesses

Retail shops benefit from POS systems that can do more than just process payments.

These systems should offer detailed sales reports that show which products are selling the most and when. This helps store owners make better decisions about what to restock and when to run promotions.

Additionally, good retail POS systems include inventory management features that automatically update stock levels when items are sold. This reduces errors and helps keep the right amount of products in stock. Some systems even send alerts when stock is low, making it easier to manage inventory efficiently.

💡Retail businesses thrive with accurate inventory management. HitPay integrates with platforms like Shopify and WooCommerce, keeping your inventory synced and updated across all channels for smoother operations.

What to Expect in Terms of POS System Pricing?

POS system pricing involves both upfront and ongoing costs. Upfront, you'll need to budget for hardware like cash drawers, receipt printers, and barcode scanners. Ongoing expenses include monthly software subscriptions and transaction fees, which can vary based on your business needs and sales volume.

Budgeting for a POS System in the Philippines

When selecting a POS system in the Philippines, it’s important to find one that balances affordability, local payment support, and ease of use. Considering both initial setup costs and ongoing fees is key to making a choice that suits your budget.

Some systems are particularly popular in the Philippines for their flexibility and local market focus, making them strong options for businesses looking to manage costs while maintaining efficiency.

Get Started With HitPay’s Secure POS System Software

Selecting the right POS system is crucial for your business’s success. In 2024, small businesses should focus on finding a system that balances cost with the features they need, such as inventory management, sales reporting, and customer engagement.

Understanding both initial and ongoing costs, along with transaction fees, helps in making a smart choice. Whether you run a retail store or a restaurant, choose a POS system that fits your needs, scales as you grow, and offers clear, transparent pricing.

With the right solution, you can streamline operations, improve customer satisfaction, and support your business’s growth.

Experience the simplicity and efficiency of HitPay's POS software with no subscription fees. Take advantage of our advanced features at no cost, and streamline your business operations effortlessly.

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Frequently Asked Questions About POS Systems

What is a POS system and how does it work for a small business?

A POS system (Point of Sale system) is a combination of hardware and software that allows small businesses to process sales transactions. The POS software manages sales, inventory, and customer data, while the POS hardware includes devices like cash registers, barcode scanners, and card readers.

What should I consider when choosing the best POS system for my small business?

Evaluate the POS system cost, including pos software pricing, pos hardware costs, and any ongoing fees associated with the POS provider. It's also wise to look for a free POS system or a free plan that allows you to test features before committing.

What are the typical costs associated with a POS system?

The cost of a POS system can vary widely based on various factors, including the type of POS system you choose. Generally, you can expect to pay for the POS software (which can be a one-time fee or a monthly subscription), POS hardware (like terminals, printers, and scanners), and any additional transaction fees charged by the POS provider.

Are there any free POS systems available for small businesses?

Yes, there are several free POS systems available that can be a great starting point for small businesses. These systems typically offer basic functionality suitable for startups or low-volume retailers. However, it's important to evaluate whether the features provided meet your business needs and if there are any hidden fees or limitations.

You might also like these posts

Understanding the POS System: What Is a Point of Sale System and How Does It Work?

HitPay Philippines

POS

September 9, 2024

Understanding the Different Types of POS Systems and Their Benefits in Various Industries

HitPay Philippines

POS

September 8, 2024

The Essential Retail POS System: Why Retailers Need a Point of Sale Solution

HitPay Philippines

POS

September 8, 2024

Best POS Systems Costs for Small Businesses

September 7, 2024

Learn about the costs of POS systems for small businesses, including hardware and software expenses, essential features, and factors to consider when choosing the right system to match your business needs.

A Point of Sale (POS) system is essential for businesses to manage sales, process payments, and track inventory. It’s more than just a tool for transactions—modern POS systems combine both hardware and software to help streamline operations, improve customer experience, and boost business efficiency.

For small and medium-sized enterprises (SMEs), choosing the right POS system is critical to their growth and success. HitPay, a trusted payment platform serving over 15,000 businesses globally, offers a comprehensive, all-in-one solution that integrates online payments, in-store transactions, and B2B payments into a single system.

In this guide, we’ll break down what a POS system is, the essential features to look for, and what you can expect to pay in 2024.

Key Takeaways

It's essential to evaluate the different features each POS system offers to match your business needs.

Regular payment processing fees are typically unavoidable and should be factored into your overall budget.

Researching various providers and their plans is crucial to finding the most cost-effective solution for your small business.

What Is the Average POS System Cost for Small Businesses?

When looking at the cost of a POS system for small businesses, it’s important to think about both the hardware and software costs. These expenses can be different depending on what your business needs.

Monthly software fees can range from free options to higher-priced plans that offer more advanced features. Hardware costs also vary, from basic tools to more advanced equipment that can be expensive.

Understanding the Cost of Your POS System

The cost of a POS system can change significantly based on your business’s size and specific needs. Smaller businesses may only require basic features, which keep costs lower, while larger businesses might need more advanced functions like detailed analytics, multi-location support, and integration with other systems, which can increase the cost.

Understanding these potential expenses is key to planning a realistic budget and ensuring you invest in a system that meets your business needs without unnecessary extras. With many POS providers, the costs can quickly add up due to software subscriptions, additional hardware, and potential hidden fees.

💡Simple Pricing Did you know that with HitPay, you can access advanced POS software features with no subscription fees? It’s an ideal solution for businesses looking to manage costs without compromising on essential tools.

What Is the Average POS System Cost for Small Businesses?

The cost of a Point of Sale (POS) system for small businesses can vary widely depending on several factors. Understanding these costs is crucial for making an informed decision that aligns with your business needs and budget.

Factors Influencing POS System Cost

Several key factors can impact the overall cost of your POS system:

Hardware requirements: The number and type of terminals, card readers, receipt printers, and other hardware components needed.

Software features: Advanced features like inventory management, customer relationship management (CRM), or multi-location support often come at a premium.

Business size and transaction volume: Larger businesses with higher transaction volumes may require more robust systems, which can increase costs.

Integration needs: Compatibility with existing systems (e.g., accounting software, e-commerce platforms) may affect pricing.

Industry-specific requirements: Certain industries, such as restaurants or retail, may need specialized features that can impact cost.

Support and training: The level of customer support and training provided can influence ongoing costs.

Payment processing fees: While not directly part of the POS system cost, these fees are an important consideration in the overall expense.

By carefully evaluating these factors and your business's specific needs, you can better estimate the total cost of implementing a POS system and choose a solution that offers the best value for your small business.

💡Advanced POS Software Features Choosing a POS system depends on your business’s needs. With HitPay, you can enjoy features like inventory management, customer insights, and seamless receipt printing, all without any additional charges—perfect for small businesses seeking comprehensive solutions.

Comparing Paid POS Systems vs. Free Options

When choosing a POS system, it’s crucial to weigh the differences between free and paid options. Free POS systems might seem like a cost-effective choice initially but can end up costing more in the long run due to higher transaction fees and limited functionality.

On the other hand, paid POS systems typically offer more robust features, lower transaction fees, and better scalability, making them a better fit for growing businesses.

HitPay offers a unique solution by combining the advantages of both free and paid systems. With no subscription fees, and with access to advanced features like payment processing and inventory management, HitPay gives businesses the tools they need without the high costs typically associated with paid systems.

What Are the Components of a POS System?

A POS system has many key parts that work together well. They help improve how your business runs and how you deal with customers. Knowing about these parts helps you pick the right system for your needs.

Essential POS Hardware for Your Business

The hardware is a big part of a POS system. It connects your business to your customers. Important POS hardware includes:

Central Processing Unit (CPU): The main terminal for processing transactions.

Touch-Screen Monitors: These may eliminate the need for a separate mouse in some systems, making for a more user-friendly experience.

Card Readers: EMV-compliant credit card readers ensure security and accuracy during transactions.

Barcode Scanners: Especially popular in retail, these devices allow for quick and accurate data entry that helps manage inventory effectively.

Cash Drawers: Designed to withstand frequent opening while protecting cash and other valuables.

Receipt Printers: Thermal printers are generally more cost-effective in the long run and can significantly impact revenue.

Types of POS Software Available

The software is also key. There are different types for different business needs:

Cloud-Based Solutions: Ideal for large online merchants, these reduce upfront costs and enhance scalability.

On-Premises Solutions: More traditional, these are often preferred by businesses requiring control over their systems.

Integrated Inventory Management: Software that helps track items in real time, providing insights into stock levels.

Sales Reporting and Analytics: This enables you to review sales patterns and make data-driven decisions.

Additional Features in Popular POS Systems

Today's POS systems have more features that make things better for customers and your business. Some of these features include:

Sales Reporting: Provides insights into performance, allowing for strategic adjustments.

Customer Management: Helps keep track of customer data and preferences.

Loyalty Programs: Encourages repeat purchases and customer engagement, with 79% of consumers more likely to buy from a brand that offers a loyalty program.

Integrated Payment Processing: This ensures accuracy and security during payment transactions.

The POS market is rapidly expanding, with the transaction value in the Mobile POS Payments market projected to reach US$3.76 trillion in 2024. As businesses grow, it’s important to invest in systems that effectively combine both hardware and software.

Retailers can benefit from networked devices that track sales and inventory in real-time, leading to more efficient operations and improved decision-making.

How to Choose the Best POS System for Small Businesses?

Choosing a POS system is a big decision. You need to think about your business's needs, like how many sales you have, how you connect with customers, and what your industry requires.

Consider whether you need specific features like mobile payments, loyalty programs, or integration with e-commerce platforms. Additionally, think about scalability—choosing a system that can grow with your business ensures you won’t outgrow it as your operations expand.

Evaluating Your Business Needs

First, look at what your business needs now and in the future. Think about what tasks you want to automate, like managing inventory and scheduling. With 64% of businesses believing that artificial intelligence and automation can boost overall productivity, integrating AI-powered features in your POS system can be a strategic move. Knowing what you need will help you pick the right POS system for your business.

Also, consider the volume of transactions you handle daily and any industry-specific requirements, such as tracking perishable goods in a restaurant or handling online orders in retail. By thoroughly evaluating these needs, you can choose a POS system that not only meets current demands but also supports your growth plans.

Key Features to Look for in a POS System

When choosing a POS system, it’s important to focus on the features that match your business needs so your operations run smoothly and your business can grow.

Inventory management to keep track of stock levels

Sales reporting capabilities for performance insights

Customer relationship management tools to enhance engagement

Support for various payment methods, including mobile wallets and credit cards.

Security features to protect sensitive transaction data.

Also, think about monthly fees and transaction costs, which can change a lot between providers. Some systems charge extra for things like detailed reports, managing multiple locations, and more users.

Top POS Providers to Consider

Here’s a comparison of some leading POS providers, highlighting their key features and which types of businesses they’re best suited for:

POS Provider

Key Features

- No monthly fees, only charges when processing payments

- Supports various payment methods

- Easy to set up and use

- Extensive range of payment options to cater to diverse customer preferences

Square

- No monthly fees

- Only charges when processing payments

Clover

- Flexible plans for different business needs

- Customisable hardware options

Lightspeed

- Advanced reporting and analytics

- Excellent for tracking detailed sales data

When choosing a POS system, consider whether it will support your business growth. Selecting a trusted vendor like HitPay ensures your system can scale with your business while keeping pricing transparent without hidden fees.

💡Payment Support and Inventory Syncing HitPay stands out with its seamless integration of both online and in-store payments. It also syncs inventory across platforms like Shopify and WooCommerce, giving businesses the flexibility to manage both offline and online sales from one system.

What Are Typical POS Fees and Credit Card Processing Fees?

When choosing a POS system, it's important to understand the different fees you might encounter. The cost of a POS system is more than just paying for the hardware or software. Here are some common fees to consider:

Monthly Subscription Fees: Many POS systems charge a monthly fee for access to their software. The cost depends on the plan and features included.

Transaction Fees: These are fees taken from each sale. They usually include a percentage of the sale plus a small fixed amount.

Credit Card Processing Fees: If your customers pay with credit or debit cards, you'll need to cover processing fees. These fees vary by provider and can include extra charges for different payment types, like online payments.

Hardware Costs: Depending on your business, you may need card readers, receipt printers, and cash registers. These can add to your overall expenses.

Additional Feature Costs: Some systems charge extra for features like advanced reporting, multi-location management, or more users.

Understanding these fees in advance can help you choose a POS system that fits your budget and avoids unexpected costs.

💡HitPay offers easy QR code and credit card payment options that enhance customer convenience while keeping transaction costs low.

Are There Specific POS Systems for Retail and Restaurants?

Different types of businesses require different POS systems. Retail stores often need systems that help manage inventory and monitor sales, while restaurants benefit from systems designed for order management and table tracking.

Selecting the right POS system is crucial for ensuring smooth operations and enhancing customer satisfaction.

Best Retail POS Systems for Small Businesses

Retail shops benefit from POS systems that can do more than just process payments.

These systems should offer detailed sales reports that show which products are selling the most and when. This helps store owners make better decisions about what to restock and when to run promotions.

Additionally, good retail POS systems include inventory management features that automatically update stock levels when items are sold. This reduces errors and helps keep the right amount of products in stock. Some systems even send alerts when stock is low, making it easier to manage inventory efficiently.

💡Retail businesses thrive with accurate inventory management. HitPay integrates with platforms like Shopify and WooCommerce, keeping your inventory synced and updated across all channels for smoother operations.

What to Expect in Terms of POS System Pricing?

POS system pricing involves both upfront and ongoing costs. Upfront, you'll need to budget for hardware like cash drawers, receipt printers, and barcode scanners. Ongoing expenses include monthly software subscriptions and transaction fees, which can vary based on your business needs and sales volume.

Budgeting for a POS System in the Philippines

When selecting a POS system in the Philippines, it’s important to find one that balances affordability, local payment support, and ease of use. Considering both initial setup costs and ongoing fees is key to making a choice that suits your budget.

Some systems are particularly popular in the Philippines for their flexibility and local market focus, making them strong options for businesses looking to manage costs while maintaining efficiency.

Get Started With HitPay’s Secure POS System Software

Selecting the right POS system is crucial for your business’s success. In 2024, small businesses should focus on finding a system that balances cost with the features they need, such as inventory management, sales reporting, and customer engagement.

Understanding both initial and ongoing costs, along with transaction fees, helps in making a smart choice. Whether you run a retail store or a restaurant, choose a POS system that fits your needs, scales as you grow, and offers clear, transparent pricing.

With the right solution, you can streamline operations, improve customer satisfaction, and support your business’s growth.

Experience the simplicity and efficiency of HitPay's POS software with no subscription fees. Take advantage of our advanced features at no cost, and streamline your business operations effortlessly.

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Frequently Asked Questions About POS Systems

What is a POS system and how does it work for a small business?

A POS system (Point of Sale system) is a combination of hardware and software that allows small businesses to process sales transactions. The POS software manages sales, inventory, and customer data, while the POS hardware includes devices like cash registers, barcode scanners, and card readers.

What should I consider when choosing the best POS system for my small business?

Evaluate the POS system cost, including pos software pricing, pos hardware costs, and any ongoing fees associated with the POS provider. It's also wise to look for a free POS system or a free plan that allows you to test features before committing.

What are the typical costs associated with a POS system?

The cost of a POS system can vary widely based on various factors, including the type of POS system you choose. Generally, you can expect to pay for the POS software (which can be a one-time fee or a monthly subscription), POS hardware (like terminals, printers, and scanners), and any additional transaction fees charged by the POS provider.

Are there any free POS systems available for small businesses?

Yes, there are several free POS systems available that can be a great starting point for small businesses. These systems typically offer basic functionality suitable for startups or low-volume retailers. However, it's important to evaluate whether the features provided meet your business needs and if there are any hidden fees or limitations.

You might also like these posts

Understanding the POS System: What Is a Point of Sale System and How Does It Work?

HitPay Philippines

POS

September 9, 2024

Understanding the Different Types of POS Systems and Their Benefits in Various Industries

HitPay Philippines

POS

September 8, 2024

The Essential Retail POS System: Why Retailers Need a Point of Sale Solution

HitPay Philippines

POS

September 8, 2024

Let's get you set up

Create an account instantly or contact us to create a custom package for your business.

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapore 089109

Let's get you set up

Create an account instantly to get started or contact us

to design a custom package for your business.

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapore 089109

Let's get you set up

Create an account instantly to get started or contact us to design

a custom package for your business.

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapore 089109

Let's get you set up

Create an account instantly to get started or contact us to design a custom package

for your business.

business software

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapore 089109