HitPay launches Payment Gateway in Malaysia with one-stop payment solutions

March 14, 2022

Grow your business with the best payment gateway in Malaysia for SMEs.

We’re excited to announce that HitPay Malaysia is officially live! Starting today, businesses in Malaysia can easily accept customer payments with HitPay’s wide range of online and offline payment solutions.

Introducing HitPay Malaysia

HitPay Malaysia is a one-stop commerce platform that empowers SMEs with no-code payment gateway solutions. Thousands of merchants have grown with HitPay's products, helping them receive POS and e-commerce payments with ease.

How does HitPay Malaysia help SMEs grow their business?

All the payment methods you need, on a single account

HitPay supports a wide range of online payment methods in Malaysia:

Visa

Mastercard

UnionPay

Apple Pay

Google Pay

FPX

GrabPay

You can easily choose which payment methods to display on each of your sales channels. HitPay payment options take just 1 day to set up (instead of the usual 2 - 3 weeks from other payment providers).

Free business management tools

Photo credit: @sejadisruptivo

HitPay’s one-stop platform includes essential tools to manage your business:

Online Store Platform — List and sell products directly through our site. Includes inbuilt inventory management.

E-commerce Plugins — Integrate HitPay payments on your existing online store. No coding required.

Payment Links — Create unique links to collect payments on the go.

Recurring Billing — Manage customer subscriptions and payment plans.

Automated Invoicing — Save time by creating and sending professional invoices with our invoice generator.

Virtual POS Terminal — Accept in-person payments directly on your phone or tablet. No credit card reader required.

While other companies charge for these tools (or only offer a free trial), HitPay's small business software is free, with no subscription or setup fees. Users can access every single feature, and we're always launching new features to stay ahead of the trend.

Express onboarding and payouts

After you register for an account (with all necessary documents), your HitPay Malaysia account will be approved in just 3 business days or less.

You'll also receive payouts in just T+1 business days, much faster than other payment providers in Malaysia.

No setup, subscription, or hidden fees

HitPay Malaysia pricing is low-cost and transparent to suit the needs of growing businesses. Signing up for our payment gateway is free, with no upfront costs or minimum-term contracts. Only pay per transaction, and always know exactly what you’ll pay. See HitPay pricing here.

Easy-to-use payments platform

We offer instant onboarding without any waiting time. Simply set up a HitPay account and start accepting payments within 20 minutes.

HitPay's no-code payment solutions can be set up by anyone in your team, without any technical knowledge. We also provide step-by-step help guides and WhatsApp Support to assist with any query.

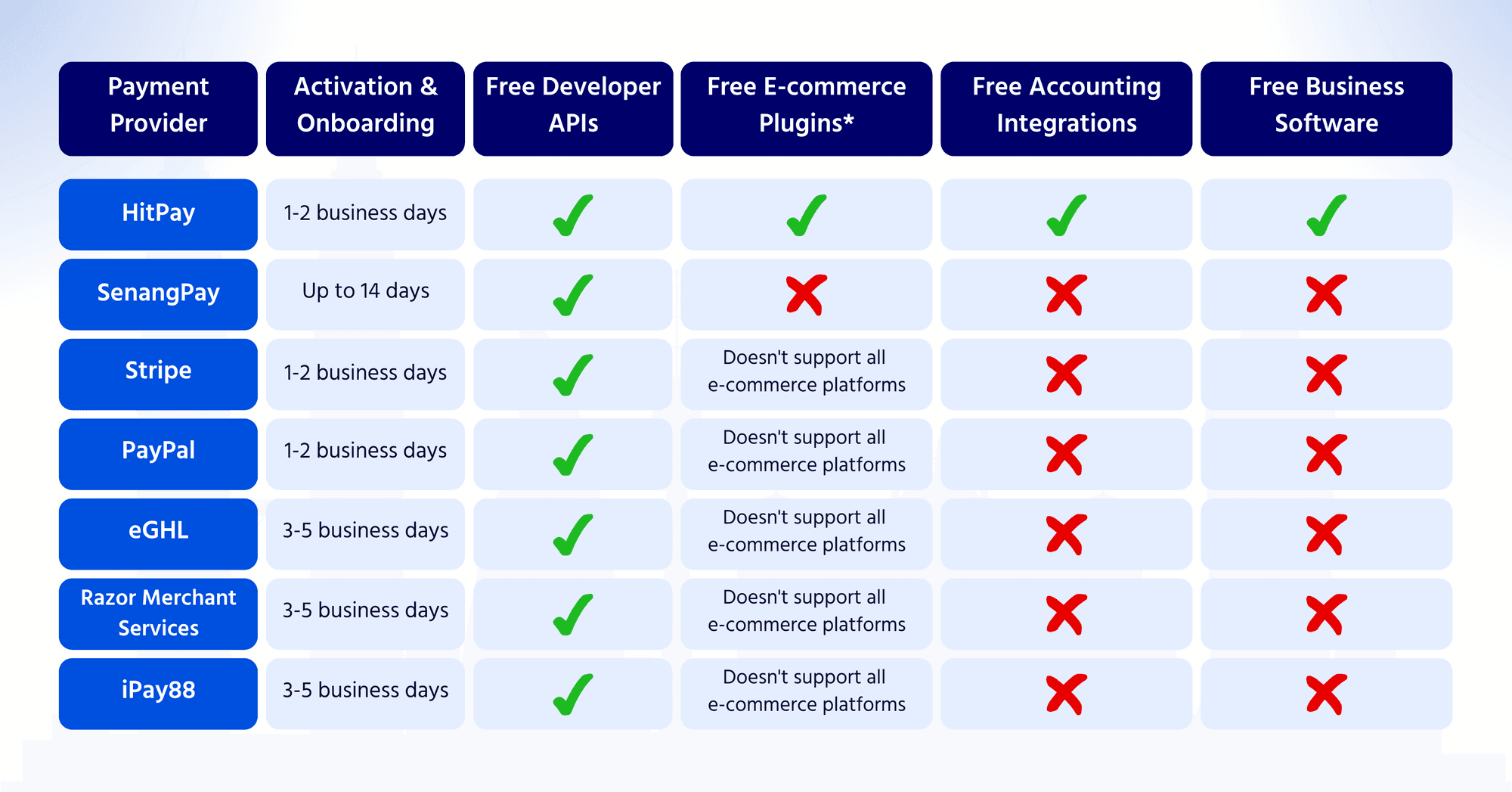

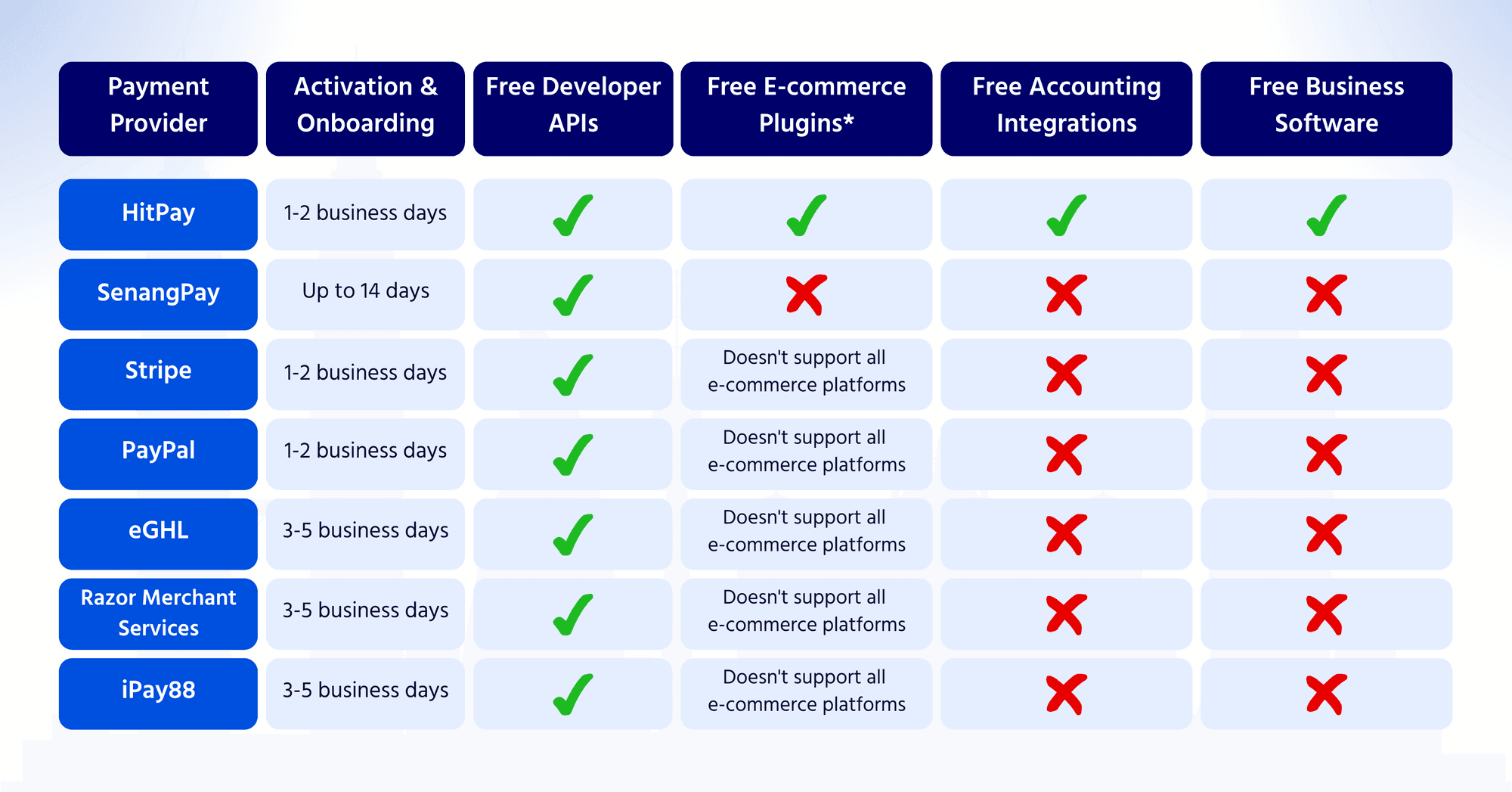

How HitPay compares with other payment gateway providers in Malaysia

Compared to other payment gateway platforms in Malaysia, HitPay offers:

No monthly or annual fees

Free business tools. All features are completely free to use.

Instant onboarding. Set up an account and start accepting payments in just 20 minutes.

Cross-border payment acceptance. This lets you reach global customers as you scale.

Read also: Malaysia Payment Gateway Comparison — HitPay vs. SenangPay and other top payment platforms

What solutions does HitPay Malaysia provide?

The HitPay payment gateway is easy to use on any sales channel — from social media, custom-built websites, and every major e-commerce platform. We have easy e-commerce integrations for Shopify, WooCommerce, Magento, Prestashop, Opencart, EasyStore, Google Plugins, and more.

Unlike most other platforms, we don’t charge a subscription fee. Activate our free payment solutions in minutes:

Accounting Integrations with Xero and QuickBooks

Developer APIs including payment gateway APIs and POS SDKs

HitPay also provides easy payment customisation. Enjoy smart checkout features that let you pass credit card transaction fees to customers, display payment methods based on total order amount, and more.

Try the best payment gateway in Malaysia for growing businesses

Ready to save costs and scale your business with HitPay?

Click here to set up your HitPay Malaysia payment gateway now.

HitPay launches Payment Gateway in Malaysia with one-stop payment solutions

March 14, 2022

Grow your business with the best payment gateway in Malaysia for SMEs.

We’re excited to announce that HitPay Malaysia is officially live! Starting today, businesses in Malaysia can easily accept customer payments with HitPay’s wide range of online and offline payment solutions.

Introducing HitPay Malaysia

HitPay Malaysia is a one-stop commerce platform that empowers SMEs with no-code payment gateway solutions. Thousands of merchants have grown with HitPay's products, helping them receive POS and e-commerce payments with ease.

How does HitPay Malaysia help SMEs grow their business?

All the payment methods you need, on a single account

HitPay supports a wide range of online payment methods in Malaysia:

Visa

Mastercard

UnionPay

Apple Pay

Google Pay

FPX

GrabPay

You can easily choose which payment methods to display on each of your sales channels. HitPay payment options take just 1 day to set up (instead of the usual 2 - 3 weeks from other payment providers).

Free business management tools

Photo credit: @sejadisruptivo

HitPay’s one-stop platform includes essential tools to manage your business:

Online Store Platform — List and sell products directly through our site. Includes inbuilt inventory management.

E-commerce Plugins — Integrate HitPay payments on your existing online store. No coding required.

Payment Links — Create unique links to collect payments on the go.

Recurring Billing — Manage customer subscriptions and payment plans.

Automated Invoicing — Save time by creating and sending professional invoices with our invoice generator.

Virtual POS Terminal — Accept in-person payments directly on your phone or tablet. No credit card reader required.

While other companies charge for these tools (or only offer a free trial), HitPay's small business software is free, with no subscription or setup fees. Users can access every single feature, and we're always launching new features to stay ahead of the trend.

Express onboarding and payouts

After you register for an account (with all necessary documents), your HitPay Malaysia account will be approved in just 3 business days or less.

You'll also receive payouts in just T+1 business days, much faster than other payment providers in Malaysia.

No setup, subscription, or hidden fees

HitPay Malaysia pricing is low-cost and transparent to suit the needs of growing businesses. Signing up for our payment gateway is free, with no upfront costs or minimum-term contracts. Only pay per transaction, and always know exactly what you’ll pay. See HitPay pricing here.

Easy-to-use payments platform

We offer instant onboarding without any waiting time. Simply set up a HitPay account and start accepting payments within 20 minutes.

HitPay's no-code payment solutions can be set up by anyone in your team, without any technical knowledge. We also provide step-by-step help guides and WhatsApp Support to assist with any query.

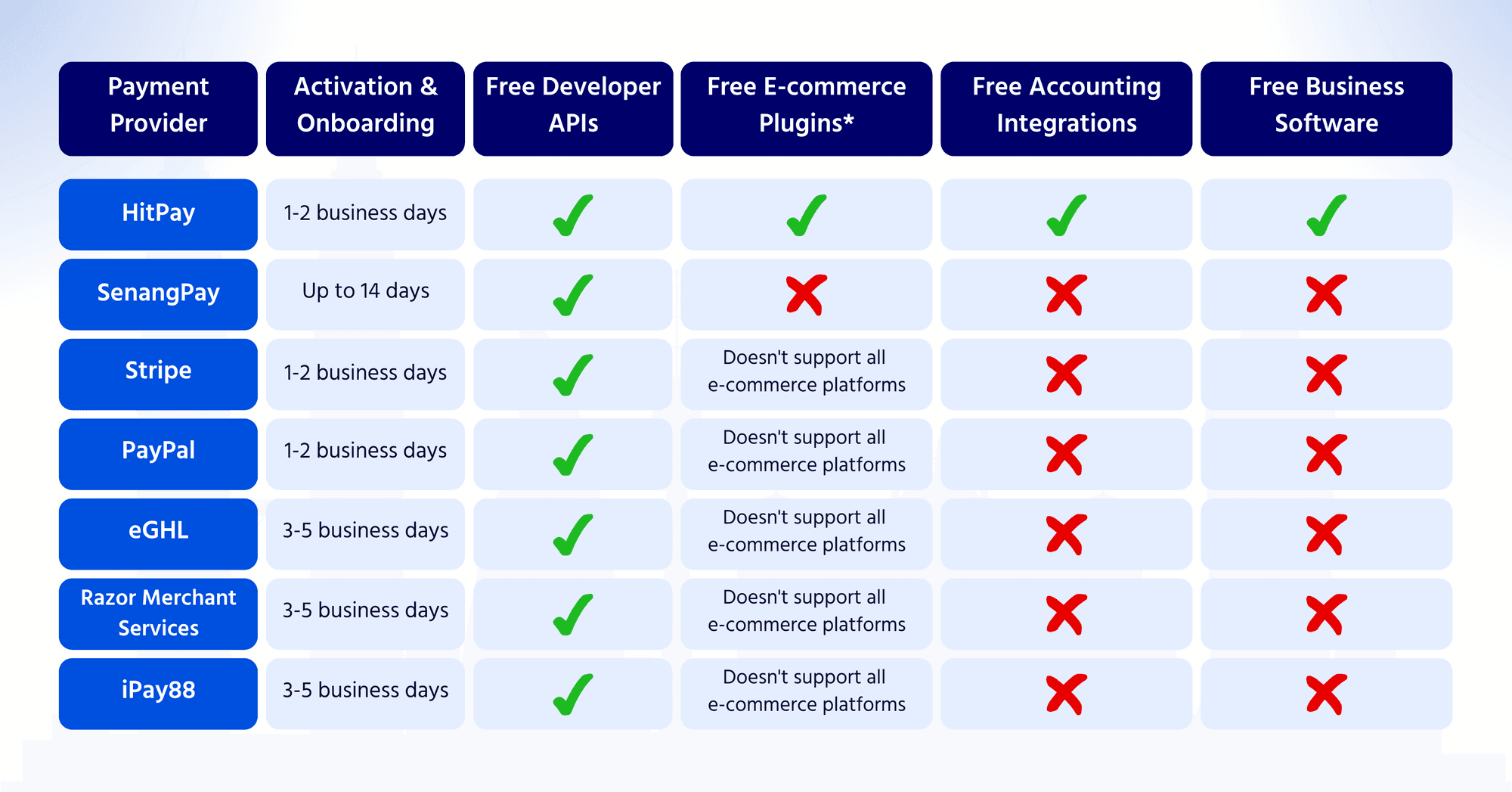

How HitPay compares with other payment gateway providers in Malaysia

Compared to other payment gateway platforms in Malaysia, HitPay offers:

No monthly or annual fees

Free business tools. All features are completely free to use.

Instant onboarding. Set up an account and start accepting payments in just 20 minutes.

Cross-border payment acceptance. This lets you reach global customers as you scale.

Read also: Malaysia Payment Gateway Comparison — HitPay vs. SenangPay and other top payment platforms

What solutions does HitPay Malaysia provide?

The HitPay payment gateway is easy to use on any sales channel — from social media, custom-built websites, and every major e-commerce platform. We have easy e-commerce integrations for Shopify, WooCommerce, Magento, Prestashop, Opencart, EasyStore, Google Plugins, and more.

Unlike most other platforms, we don’t charge a subscription fee. Activate our free payment solutions in minutes:

Accounting Integrations with Xero and QuickBooks

Developer APIs including payment gateway APIs and POS SDKs

HitPay also provides easy payment customisation. Enjoy smart checkout features that let you pass credit card transaction fees to customers, display payment methods based on total order amount, and more.

Try the best payment gateway in Malaysia for growing businesses

Ready to save costs and scale your business with HitPay?

Click here to set up your HitPay Malaysia payment gateway now.

HitPay launches Payment Gateway in Malaysia with one-stop payment solutions

March 14, 2022

Grow your business with the best payment gateway in Malaysia for SMEs.

We’re excited to announce that HitPay Malaysia is officially live! Starting today, businesses in Malaysia can easily accept customer payments with HitPay’s wide range of online and offline payment solutions.

Introducing HitPay Malaysia

HitPay Malaysia is a one-stop commerce platform that empowers SMEs with no-code payment gateway solutions. Thousands of merchants have grown with HitPay's products, helping them receive POS and e-commerce payments with ease.

How does HitPay Malaysia help SMEs grow their business?

All the payment methods you need, on a single account

HitPay supports a wide range of online payment methods in Malaysia:

Visa

Mastercard

UnionPay

Apple Pay

Google Pay

FPX

GrabPay

You can easily choose which payment methods to display on each of your sales channels. HitPay payment options take just 1 day to set up (instead of the usual 2 - 3 weeks from other payment providers).

Free business management tools

Photo credit: @sejadisruptivo

HitPay’s one-stop platform includes essential tools to manage your business:

Online Store Platform — List and sell products directly through our site. Includes inbuilt inventory management.

E-commerce Plugins — Integrate HitPay payments on your existing online store. No coding required.

Payment Links — Create unique links to collect payments on the go.

Recurring Billing — Manage customer subscriptions and payment plans.

Automated Invoicing — Save time by creating and sending professional invoices with our invoice generator.

Virtual POS Terminal — Accept in-person payments directly on your phone or tablet. No credit card reader required.

While other companies charge for these tools (or only offer a free trial), HitPay's small business software is free, with no subscription or setup fees. Users can access every single feature, and we're always launching new features to stay ahead of the trend.

Express onboarding and payouts

After you register for an account (with all necessary documents), your HitPay Malaysia account will be approved in just 3 business days or less.

You'll also receive payouts in just T+1 business days, much faster than other payment providers in Malaysia.

No setup, subscription, or hidden fees

HitPay Malaysia pricing is low-cost and transparent to suit the needs of growing businesses. Signing up for our payment gateway is free, with no upfront costs or minimum-term contracts. Only pay per transaction, and always know exactly what you’ll pay. See HitPay pricing here.

Easy-to-use payments platform

We offer instant onboarding without any waiting time. Simply set up a HitPay account and start accepting payments within 20 minutes.

HitPay's no-code payment solutions can be set up by anyone in your team, without any technical knowledge. We also provide step-by-step help guides and WhatsApp Support to assist with any query.

How HitPay compares with other payment gateway providers in Malaysia

Compared to other payment gateway platforms in Malaysia, HitPay offers:

No monthly or annual fees

Free business tools. All features are completely free to use.

Instant onboarding. Set up an account and start accepting payments in just 20 minutes.

Cross-border payment acceptance. This lets you reach global customers as you scale.

Read also: Malaysia Payment Gateway Comparison — HitPay vs. SenangPay and other top payment platforms

What solutions does HitPay Malaysia provide?

The HitPay payment gateway is easy to use on any sales channel — from social media, custom-built websites, and every major e-commerce platform. We have easy e-commerce integrations for Shopify, WooCommerce, Magento, Prestashop, Opencart, EasyStore, Google Plugins, and more.

Unlike most other platforms, we don’t charge a subscription fee. Activate our free payment solutions in minutes:

Accounting Integrations with Xero and QuickBooks

Developer APIs including payment gateway APIs and POS SDKs

HitPay also provides easy payment customisation. Enjoy smart checkout features that let you pass credit card transaction fees to customers, display payment methods based on total order amount, and more.

Try the best payment gateway in Malaysia for growing businesses

Ready to save costs and scale your business with HitPay?