Best Credit Card Machine for Small Businesses in the Philippines

September 7, 2023

In today's fast-paced business environment, having a reliable payment processing system is crucial for small businesses. Traditional point of sale (POS) systems often pose challenges for small businesses, such as high rental fees, inflexible contracts, and complex inventory management.

But we have a solution for you — HitPay's affordable Credit Card Terminals and Tap to Pay, which provide fast and secure payment processing for small businesses in the Philippines.

Why Choose HitPay Credit Card Terminals in the Philippines

When considering affordable credit card machines for small businesses in the Philippines, it is essential to compare the available options to make the best decision for your business. HitPay Credit Card Terminals stand out among competitors such as PayMaya Credit Card terminal, GCash POS terminal, and POS machine BDO, with our merchant-focused approach and exclusive features.

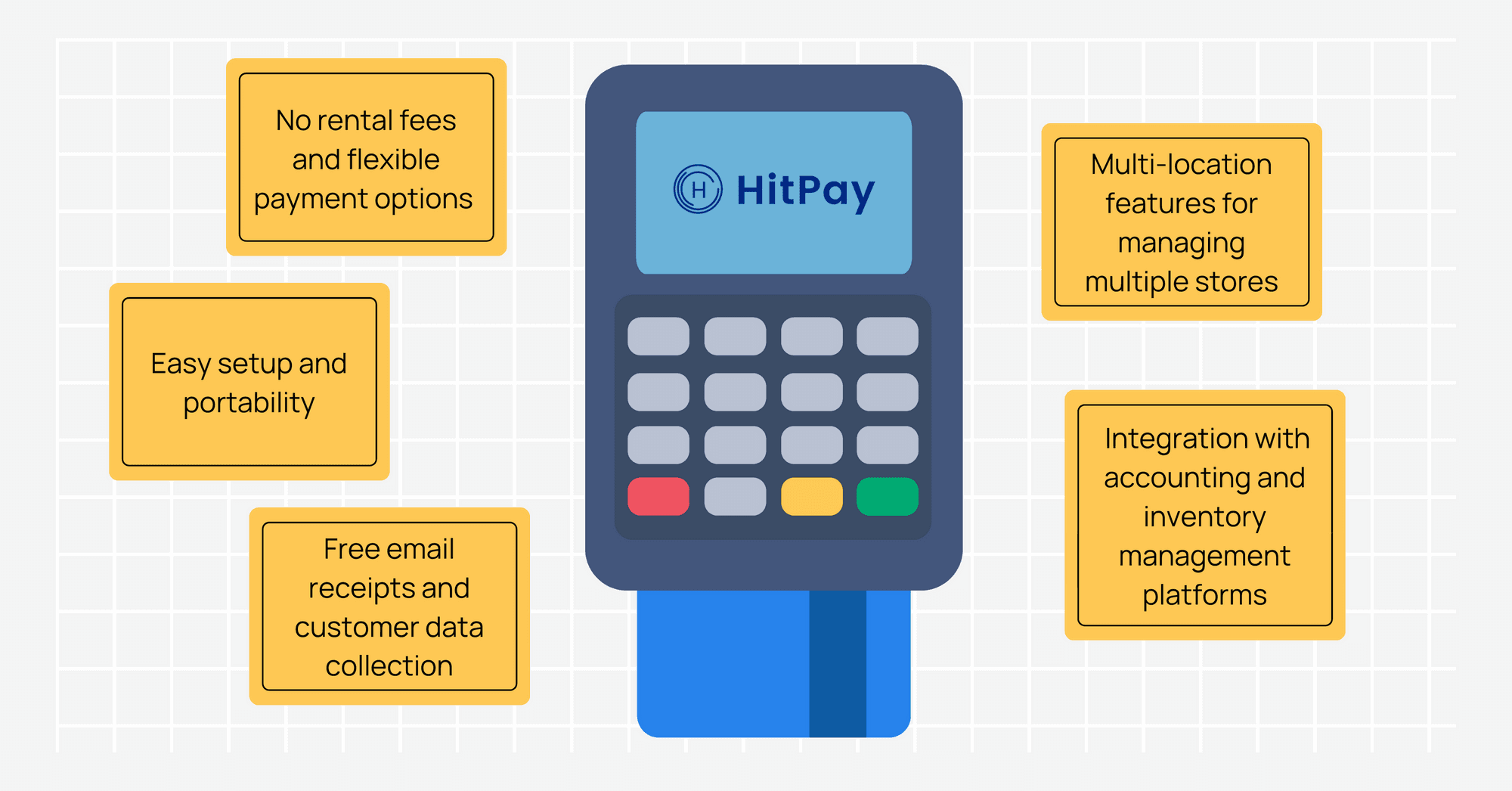

There are several key benefits to choosing HitPay Credit Card Terminal for your small business:

No rental fees and flexible payment options make it more cost-effective for small businesses.

Its easy setup and portability enable businesses to accept payments in various locations and during events such as pop-up stores or trade shows.

HitPay Credit Card Terminals offer integration with accounting and inventory management platforms, ensuring streamlined business operations and accurate record-keeping.

With multi-location features for managing multiple stores, it is suitable for businesses that operate in different locations.

Free email receipts and customer data collection allow businesses to build a valuable customer database for marketing and promotions.

These benefits make HitPay Credit Card Terminal an excellent payment processing choice for small businesses in the Philippines.

HitPay Credit Card Terminals Overview

HitPay offers a variety of affordable credit card terminals to cater to the diverse needs of small businesses in the Philippines. In this section, we will provide an overview of the different HitPay Credit Card terminals, including Sunmi V25, BBPOS WisePos E, BBPOS WisePad 3, and Tap to Pay. We will also discuss their features, connectivity, warranty, and supported transactions to help you make an informed decision.

The Sunmi V25 terminal is a versatile option that supports both SIM card and Wi-Fi connections. With a one-year warranty, this terminal supports Tap and Pay or PayWave transactions and QR code payments.

With the BBPOS WisePos E, you get a Wi-Fi-only terminal that also comes with a one-year warranty. It supports a wide range of card transactions, including Tap and Pay or PayWave, inserting a card, and swiping a card. QR code payments are supported both on the device and when paired with the HitPay Mobile app and HitPay Web POS app. This terminal can be used as a standalone device or paired with a smartphone, tablet, or desktop/laptop.

The BBPOS WisePad 3 is a Bluetooth-enabled terminal that connects to internet data on a smartphone or tablet. It comes with a one-year warranty and supports Tap and Pay or PayWave and card insert transactions. QR code payments are supported when paired with the HitPay Mobile app. This terminal is ideal for being paired with a smartphone or tablet.

In addition to the HitPay Credit Card Terminal, HitPay also offers a Tap to Pay solution for small businesses. This innovative payment option allows businesses to accept payments directly on their mobile devices without the need for a separate card reader. There are several benefits of using HitPay Tap to Pay for small businesses, such as no card reader required, making it an affordable and convenient option for businesses just starting out or with limited resources. Secure transactions through the HitPay app ensure that both businesses and customers can have peace of mind when making payments, and compatibility with both Android and iOS devices makes it accessible to a wide range of users and businesses.

Benefits of Choosing HitPay Credit Card Terminals for Small Businesses

When selecting an affordable credit card terminal for your small business, it is essential to consider the benefits and advantages that come with the chosen solution. HitPay Credit Card terminals offer a wide range of benefits for small businesses in the Philippines, making them the ideal choice to support your business growth and success.

One of the most significant benefits of HitPay Credit Card terminals is their ease of use and fast setup process. This enables businesses to start accepting payments quickly, minimizing downtime and ensuring a smooth transition to the new system.

Additionally, HitPay Credit Card terminals come integrated with free HitPay POS software, providing seamless business management capabilities. This all-in-one tool allows you to manage your inventory, sales channels, and locations with ease while also automating various operations, saving you time and effort.

Security and efficiency are at the core of HitPay Credit Card terminals, ensuring that transactions are processed quickly and safely. This focus on security not only provides peace of mind for business owners but also builds trust with customers, leading to increased loyalty and satisfaction.

HitPay Credit Card terminals also offer simple and transparent pricing with no hidden fees. This straightforward approach to pricing ensures that you know exactly what you're paying for, allowing you to budget effectively and avoid unexpected costs.

Lastly, HitPay Credit Card terminals have received numerous positive customer testimonials, highlighting their reliability, ease of use, and overall value for small businesses. These testimonials serve as a testament to the quality and effectiveness of HitPay Credit Card terminals, making them a top choice for small businesses in the Philippines.

How to Get Started with the HitPay Credit Card Machine in the Philippines

Choosing the best credit card machine for your small business is crucial for efficient payment processing and overall business success. HitPay's credit card terminals stand out as the top choice for small businesses in the Philippines, offering a range of features, seamless integration, and competitive pricing tailored to meet the unique needs of SMEs.

By choosing HitPay as your payment solution provider, you will benefit from a user-friendly, efficient, and secure platform designed specifically to help small businesses thrive in the competitive market. Don't miss the opportunity to enhance your business operations and provide a seamless payment experience for your customers with HitPay credit card terminals.

Interested in a HitPay Credit Card Machine in the Philippines?

While HitPay credit card terminals are not yet available in the Philippines, they will be coming soon to support businesses in the region.

Selecting a reliable and affordable credit card machine is essential for small businesses to ensure efficient payment processing and overall success. HitPay's credit card terminals emerge as the top choice for small businesses in the Philippines, offering user-friendly features, seamless integration, and competitive pricing tailored to meet the unique needs of SMEs. By choosing HitPay as your payment solution provider, you'll be better equipped to enhance business growth and provide a seamless payment experience for your customers. Don't miss the opportunity to support your business operations and stay ahead of the competition with HitPay Credit Card terminals.

To register your interest in HitPay's credit card terminals, contact us now.

Best Credit Card Machine for Small Businesses in the Philippines

September 7, 2023

In today's fast-paced business environment, having a reliable payment processing system is crucial for small businesses. Traditional point of sale (POS) systems often pose challenges for small businesses, such as high rental fees, inflexible contracts, and complex inventory management.

But we have a solution for you — HitPay's affordable Credit Card Terminals and Tap to Pay, which provide fast and secure payment processing for small businesses in the Philippines.

Why Choose HitPay Credit Card Terminals in the Philippines

When considering affordable credit card machines for small businesses in the Philippines, it is essential to compare the available options to make the best decision for your business. HitPay Credit Card Terminals stand out among competitors such as PayMaya Credit Card terminal, GCash POS terminal, and POS machine BDO, with our merchant-focused approach and exclusive features.

There are several key benefits to choosing HitPay Credit Card Terminal for your small business:

No rental fees and flexible payment options make it more cost-effective for small businesses.

Its easy setup and portability enable businesses to accept payments in various locations and during events such as pop-up stores or trade shows.

HitPay Credit Card Terminals offer integration with accounting and inventory management platforms, ensuring streamlined business operations and accurate record-keeping.

With multi-location features for managing multiple stores, it is suitable for businesses that operate in different locations.

Free email receipts and customer data collection allow businesses to build a valuable customer database for marketing and promotions.

These benefits make HitPay Credit Card Terminal an excellent payment processing choice for small businesses in the Philippines.

HitPay Credit Card Terminals Overview

HitPay offers a variety of affordable credit card terminals to cater to the diverse needs of small businesses in the Philippines. In this section, we will provide an overview of the different HitPay Credit Card terminals, including Sunmi V25, BBPOS WisePos E, BBPOS WisePad 3, and Tap to Pay. We will also discuss their features, connectivity, warranty, and supported transactions to help you make an informed decision.

The Sunmi V25 terminal is a versatile option that supports both SIM card and Wi-Fi connections. With a one-year warranty, this terminal supports Tap and Pay or PayWave transactions and QR code payments.

With the BBPOS WisePos E, you get a Wi-Fi-only terminal that also comes with a one-year warranty. It supports a wide range of card transactions, including Tap and Pay or PayWave, inserting a card, and swiping a card. QR code payments are supported both on the device and when paired with the HitPay Mobile app and HitPay Web POS app. This terminal can be used as a standalone device or paired with a smartphone, tablet, or desktop/laptop.

The BBPOS WisePad 3 is a Bluetooth-enabled terminal that connects to internet data on a smartphone or tablet. It comes with a one-year warranty and supports Tap and Pay or PayWave and card insert transactions. QR code payments are supported when paired with the HitPay Mobile app. This terminal is ideal for being paired with a smartphone or tablet.

In addition to the HitPay Credit Card Terminal, HitPay also offers a Tap to Pay solution for small businesses. This innovative payment option allows businesses to accept payments directly on their mobile devices without the need for a separate card reader. There are several benefits of using HitPay Tap to Pay for small businesses, such as no card reader required, making it an affordable and convenient option for businesses just starting out or with limited resources. Secure transactions through the HitPay app ensure that both businesses and customers can have peace of mind when making payments, and compatibility with both Android and iOS devices makes it accessible to a wide range of users and businesses.

Benefits of Choosing HitPay Credit Card Terminals for Small Businesses

When selecting an affordable credit card terminal for your small business, it is essential to consider the benefits and advantages that come with the chosen solution. HitPay Credit Card terminals offer a wide range of benefits for small businesses in the Philippines, making them the ideal choice to support your business growth and success.

One of the most significant benefits of HitPay Credit Card terminals is their ease of use and fast setup process. This enables businesses to start accepting payments quickly, minimizing downtime and ensuring a smooth transition to the new system.

Additionally, HitPay Credit Card terminals come integrated with free HitPay POS software, providing seamless business management capabilities. This all-in-one tool allows you to manage your inventory, sales channels, and locations with ease while also automating various operations, saving you time and effort.

Security and efficiency are at the core of HitPay Credit Card terminals, ensuring that transactions are processed quickly and safely. This focus on security not only provides peace of mind for business owners but also builds trust with customers, leading to increased loyalty and satisfaction.

HitPay Credit Card terminals also offer simple and transparent pricing with no hidden fees. This straightforward approach to pricing ensures that you know exactly what you're paying for, allowing you to budget effectively and avoid unexpected costs.

Lastly, HitPay Credit Card terminals have received numerous positive customer testimonials, highlighting their reliability, ease of use, and overall value for small businesses. These testimonials serve as a testament to the quality and effectiveness of HitPay Credit Card terminals, making them a top choice for small businesses in the Philippines.

How to Get Started with the HitPay Credit Card Machine in the Philippines

Choosing the best credit card machine for your small business is crucial for efficient payment processing and overall business success. HitPay's credit card terminals stand out as the top choice for small businesses in the Philippines, offering a range of features, seamless integration, and competitive pricing tailored to meet the unique needs of SMEs.

By choosing HitPay as your payment solution provider, you will benefit from a user-friendly, efficient, and secure platform designed specifically to help small businesses thrive in the competitive market. Don't miss the opportunity to enhance your business operations and provide a seamless payment experience for your customers with HitPay credit card terminals.

Interested in a HitPay Credit Card Machine in the Philippines?

While HitPay credit card terminals are not yet available in the Philippines, they will be coming soon to support businesses in the region.

Selecting a reliable and affordable credit card machine is essential for small businesses to ensure efficient payment processing and overall success. HitPay's credit card terminals emerge as the top choice for small businesses in the Philippines, offering user-friendly features, seamless integration, and competitive pricing tailored to meet the unique needs of SMEs. By choosing HitPay as your payment solution provider, you'll be better equipped to enhance business growth and provide a seamless payment experience for your customers. Don't miss the opportunity to support your business operations and stay ahead of the competition with HitPay Credit Card terminals.

To register your interest in HitPay's credit card terminals, contact us now.

Best Credit Card Machine for Small Businesses in the Philippines

September 7, 2023

In today's fast-paced business environment, having a reliable payment processing system is crucial for small businesses. Traditional point of sale (POS) systems often pose challenges for small businesses, such as high rental fees, inflexible contracts, and complex inventory management.

But we have a solution for you — HitPay's affordable Credit Card Terminals and Tap to Pay, which provide fast and secure payment processing for small businesses in the Philippines.

Why Choose HitPay Credit Card Terminals in the Philippines

When considering affordable credit card machines for small businesses in the Philippines, it is essential to compare the available options to make the best decision for your business. HitPay Credit Card Terminals stand out among competitors such as PayMaya Credit Card terminal, GCash POS terminal, and POS machine BDO, with our merchant-focused approach and exclusive features.

There are several key benefits to choosing HitPay Credit Card Terminal for your small business:

No rental fees and flexible payment options make it more cost-effective for small businesses.

Its easy setup and portability enable businesses to accept payments in various locations and during events such as pop-up stores or trade shows.

HitPay Credit Card Terminals offer integration with accounting and inventory management platforms, ensuring streamlined business operations and accurate record-keeping.

With multi-location features for managing multiple stores, it is suitable for businesses that operate in different locations.

Free email receipts and customer data collection allow businesses to build a valuable customer database for marketing and promotions.

These benefits make HitPay Credit Card Terminal an excellent payment processing choice for small businesses in the Philippines.

HitPay Credit Card Terminals Overview

HitPay offers a variety of affordable credit card terminals to cater to the diverse needs of small businesses in the Philippines. In this section, we will provide an overview of the different HitPay Credit Card terminals, including Sunmi V25, BBPOS WisePos E, BBPOS WisePad 3, and Tap to Pay. We will also discuss their features, connectivity, warranty, and supported transactions to help you make an informed decision.

The Sunmi V25 terminal is a versatile option that supports both SIM card and Wi-Fi connections. With a one-year warranty, this terminal supports Tap and Pay or PayWave transactions and QR code payments.

With the BBPOS WisePos E, you get a Wi-Fi-only terminal that also comes with a one-year warranty. It supports a wide range of card transactions, including Tap and Pay or PayWave, inserting a card, and swiping a card. QR code payments are supported both on the device and when paired with the HitPay Mobile app and HitPay Web POS app. This terminal can be used as a standalone device or paired with a smartphone, tablet, or desktop/laptop.

The BBPOS WisePad 3 is a Bluetooth-enabled terminal that connects to internet data on a smartphone or tablet. It comes with a one-year warranty and supports Tap and Pay or PayWave and card insert transactions. QR code payments are supported when paired with the HitPay Mobile app. This terminal is ideal for being paired with a smartphone or tablet.

In addition to the HitPay Credit Card Terminal, HitPay also offers a Tap to Pay solution for small businesses. This innovative payment option allows businesses to accept payments directly on their mobile devices without the need for a separate card reader. There are several benefits of using HitPay Tap to Pay for small businesses, such as no card reader required, making it an affordable and convenient option for businesses just starting out or with limited resources. Secure transactions through the HitPay app ensure that both businesses and customers can have peace of mind when making payments, and compatibility with both Android and iOS devices makes it accessible to a wide range of users and businesses.

Benefits of Choosing HitPay Credit Card Terminals for Small Businesses

When selecting an affordable credit card terminal for your small business, it is essential to consider the benefits and advantages that come with the chosen solution. HitPay Credit Card terminals offer a wide range of benefits for small businesses in the Philippines, making them the ideal choice to support your business growth and success.

One of the most significant benefits of HitPay Credit Card terminals is their ease of use and fast setup process. This enables businesses to start accepting payments quickly, minimizing downtime and ensuring a smooth transition to the new system.

Additionally, HitPay Credit Card terminals come integrated with free HitPay POS software, providing seamless business management capabilities. This all-in-one tool allows you to manage your inventory, sales channels, and locations with ease while also automating various operations, saving you time and effort.

Security and efficiency are at the core of HitPay Credit Card terminals, ensuring that transactions are processed quickly and safely. This focus on security not only provides peace of mind for business owners but also builds trust with customers, leading to increased loyalty and satisfaction.

HitPay Credit Card terminals also offer simple and transparent pricing with no hidden fees. This straightforward approach to pricing ensures that you know exactly what you're paying for, allowing you to budget effectively and avoid unexpected costs.

Lastly, HitPay Credit Card terminals have received numerous positive customer testimonials, highlighting their reliability, ease of use, and overall value for small businesses. These testimonials serve as a testament to the quality and effectiveness of HitPay Credit Card terminals, making them a top choice for small businesses in the Philippines.

How to Get Started with the HitPay Credit Card Machine in the Philippines

Choosing the best credit card machine for your small business is crucial for efficient payment processing and overall business success. HitPay's credit card terminals stand out as the top choice for small businesses in the Philippines, offering a range of features, seamless integration, and competitive pricing tailored to meet the unique needs of SMEs.

By choosing HitPay as your payment solution provider, you will benefit from a user-friendly, efficient, and secure platform designed specifically to help small businesses thrive in the competitive market. Don't miss the opportunity to enhance your business operations and provide a seamless payment experience for your customers with HitPay credit card terminals.

Interested in a HitPay Credit Card Machine in the Philippines?

While HitPay credit card terminals are not yet available in the Philippines, they will be coming soon to support businesses in the region.

Selecting a reliable and affordable credit card machine is essential for small businesses to ensure efficient payment processing and overall success. HitPay's credit card terminals emerge as the top choice for small businesses in the Philippines, offering user-friendly features, seamless integration, and competitive pricing tailored to meet the unique needs of SMEs. By choosing HitPay as your payment solution provider, you'll be better equipped to enhance business growth and provide a seamless payment experience for your customers. Don't miss the opportunity to support your business operations and stay ahead of the competition with HitPay Credit Card terminals.