The Easiest Way to Manage B2B Multi-Currency Payments in Singapore

September 15, 2023

In today's globalized business environment, efficient B2B payments are crucial for smooth operations. However, small and medium-sized enterprises (SMEs) often face challenges in managing multi-currency transactions, such as high fees and complex processes. The HitPay Multi-currency Account offers a solution tailored for businesses in Singapore, providing a seamless, cost-effective, and secure platform for international B2B payments.

Benefits of Using HitPay for B2B Multi-Currency Payments

The HitPay Multi-currency Account offers numerous advantages for businesses looking to streamline their international B2B payment processes. By choosing HitPay, businesses can enjoy lower costs, enhanced security, easy integration with existing systems, and a platform specifically designed for SMEs.

One of the primary benefits of using HitPay is the potential for significant cost savings. Unlike traditional banks, HitPay does not charge transaction fees or subscription fees, making it an attractive alternative for businesses engaged in frequent international transactions. See HitPay pricing here.

In addition to lower costs, HitPay prioritizes the security and protection of its users. The platform utilizes robust technology designed by banking professionals and undergoes rigorous testing by external cybersecurity agencies. This ensures that users can have peace of mind when managing their multi-currency payments.

HitPay also offers easy integration with existing systems, providing businesses with no-code tools for e-commerce plugins, payment links, invoicing software, and more.

Finally, HitPay is specifically built for SMEs, offering a user-friendly platform without contracts or lock-in periods. The easy setup and customization options make it an ideal choice for small and medium-sized enterprises looking for an efficient and cost-effective solution to manage their international B2B payments.

How the HitPay Multi-Currency Account Works

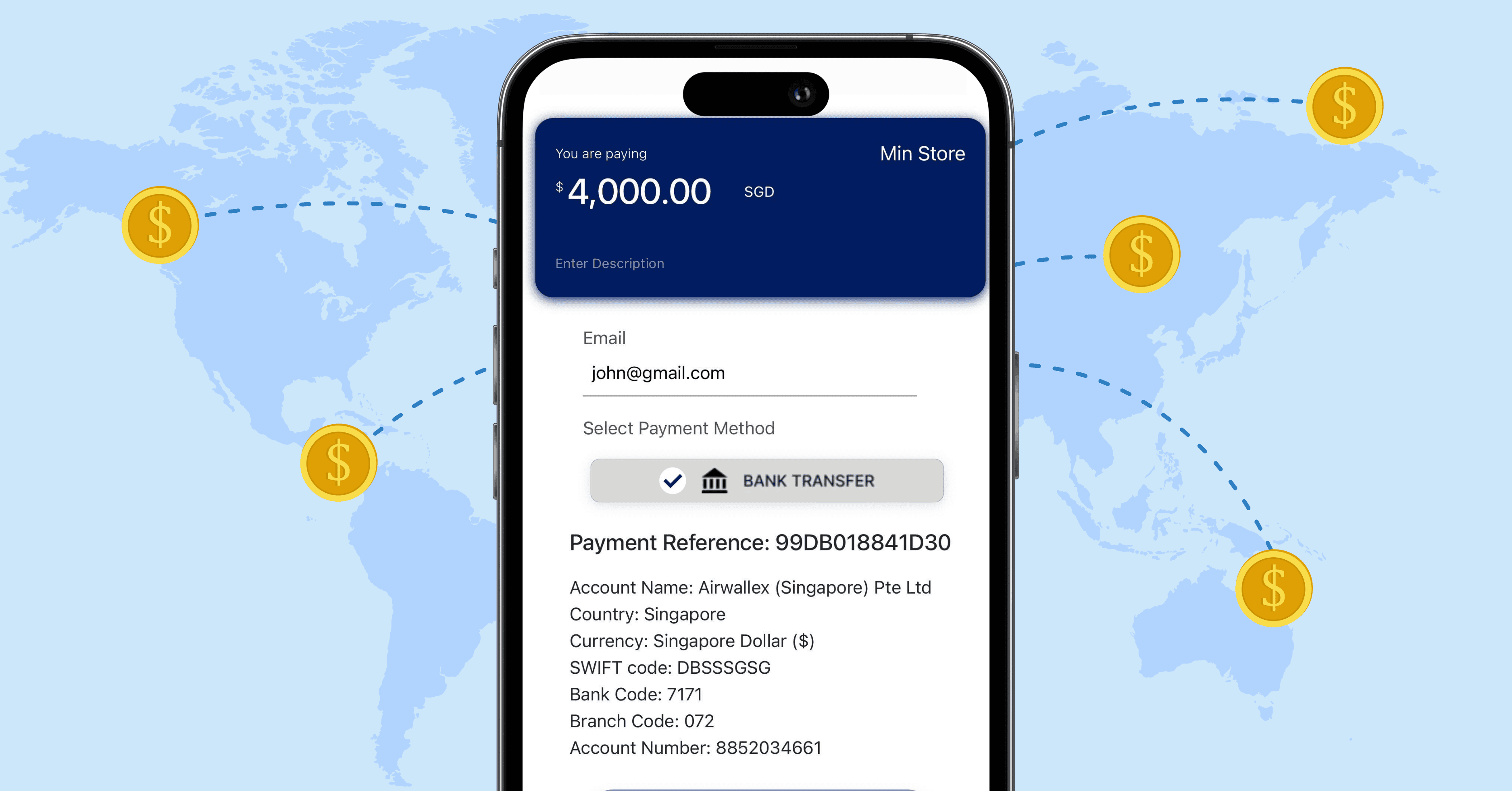

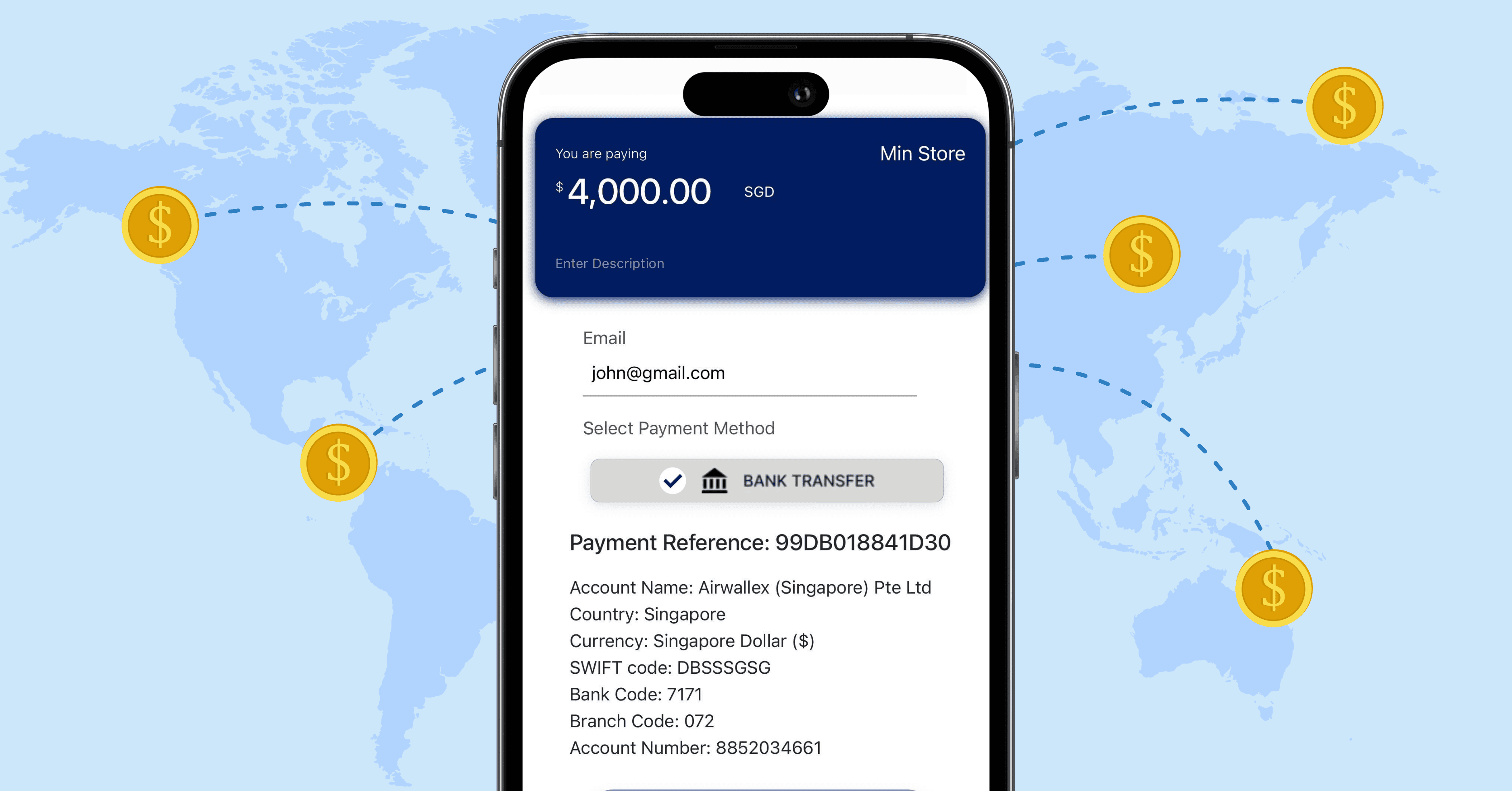

The HitPay Multi-currency Account simplifies the process of managing international B2B payments by offering a user-friendly platform for accepting payments from customers and suppliers, paying suppliers, vendors, contractors, and employees, and managing your account with ease.

With HitPay, businesses can accept payments from customers and suppliers in multiple currencies and from various countries. The platform supports a wide range of currencies, ensuring that users can effectively manage their global transactions.

The platform also provides tools for tracking and managing payment statuses, ensuring that businesses have complete visibility and control over their international payments. Users have access to a comprehensive dashboard and reporting features, making it easy to monitor and analyze their multi-currency transactions.

Additionally, HitPay offers help guides and live chat support to help you navigate any challenges that may arise when managing international B2B payments.

How to Get Started with B2B Multi-Currency Payments

Getting started with HitPay Multi-currency Payments is a straightforward process involving registering for an account and integrating the platform with your existing systems.

The HitPay Multi-currency Account offers a range of benefits for businesses in Singapore looking to manage their B2B multi-currency payments more efficiently. With lower costs, enhanced security, easy integration, and a platform designed specifically for SMEs, HitPay presents a reliable and cost-effective solution for international B2B transactions.

To get started, contact the HitPay team now.

Read also: Free Business Registration in Singapore

The Easiest Way to Manage B2B Multi-Currency Payments in Singapore

September 15, 2023

In today's globalized business environment, efficient B2B payments are crucial for smooth operations. However, small and medium-sized enterprises (SMEs) often face challenges in managing multi-currency transactions, such as high fees and complex processes. The HitPay Multi-currency Account offers a solution tailored for businesses in Singapore, providing a seamless, cost-effective, and secure platform for international B2B payments.

Benefits of Using HitPay for B2B Multi-Currency Payments

The HitPay Multi-currency Account offers numerous advantages for businesses looking to streamline their international B2B payment processes. By choosing HitPay, businesses can enjoy lower costs, enhanced security, easy integration with existing systems, and a platform specifically designed for SMEs.

One of the primary benefits of using HitPay is the potential for significant cost savings. Unlike traditional banks, HitPay does not charge transaction fees or subscription fees, making it an attractive alternative for businesses engaged in frequent international transactions. See HitPay pricing here.

In addition to lower costs, HitPay prioritizes the security and protection of its users. The platform utilizes robust technology designed by banking professionals and undergoes rigorous testing by external cybersecurity agencies. This ensures that users can have peace of mind when managing their multi-currency payments.

HitPay also offers easy integration with existing systems, providing businesses with no-code tools for e-commerce plugins, payment links, invoicing software, and more.

Finally, HitPay is specifically built for SMEs, offering a user-friendly platform without contracts or lock-in periods. The easy setup and customization options make it an ideal choice for small and medium-sized enterprises looking for an efficient and cost-effective solution to manage their international B2B payments.

How the HitPay Multi-Currency Account Works

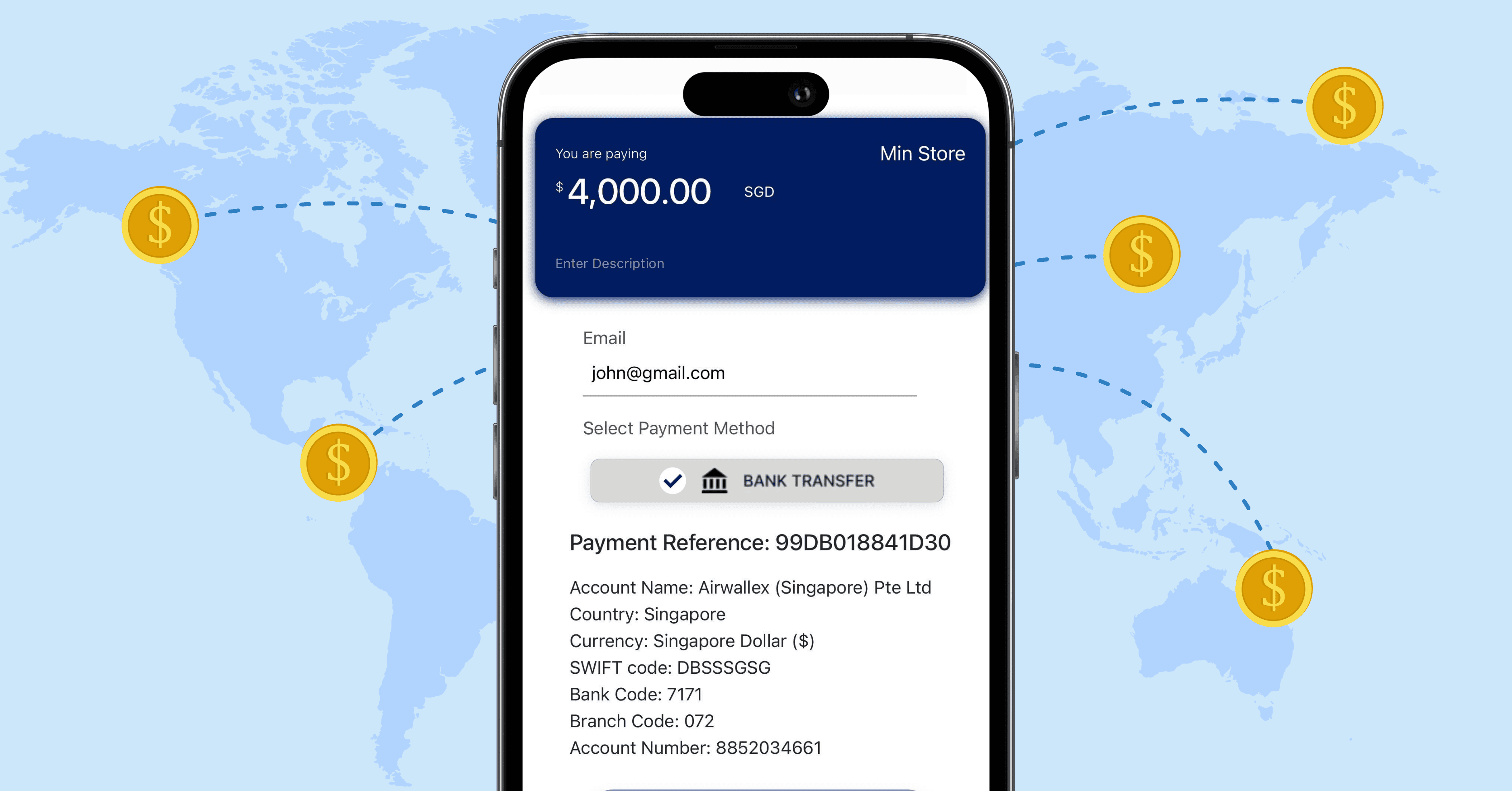

The HitPay Multi-currency Account simplifies the process of managing international B2B payments by offering a user-friendly platform for accepting payments from customers and suppliers, paying suppliers, vendors, contractors, and employees, and managing your account with ease.

With HitPay, businesses can accept payments from customers and suppliers in multiple currencies and from various countries. The platform supports a wide range of currencies, ensuring that users can effectively manage their global transactions.

The platform also provides tools for tracking and managing payment statuses, ensuring that businesses have complete visibility and control over their international payments. Users have access to a comprehensive dashboard and reporting features, making it easy to monitor and analyze their multi-currency transactions.

Additionally, HitPay offers help guides and live chat support to help you navigate any challenges that may arise when managing international B2B payments.

How to Get Started with B2B Multi-Currency Payments

Getting started with HitPay Multi-currency Payments is a straightforward process involving registering for an account and integrating the platform with your existing systems.

The HitPay Multi-currency Account offers a range of benefits for businesses in Singapore looking to manage their B2B multi-currency payments more efficiently. With lower costs, enhanced security, easy integration, and a platform designed specifically for SMEs, HitPay presents a reliable and cost-effective solution for international B2B transactions.

To get started, contact the HitPay team now.

Read also: Free Business Registration in Singapore

The Easiest Way to Manage B2B Multi-Currency Payments in Singapore

September 15, 2023

In today's globalized business environment, efficient B2B payments are crucial for smooth operations. However, small and medium-sized enterprises (SMEs) often face challenges in managing multi-currency transactions, such as high fees and complex processes. The HitPay Multi-currency Account offers a solution tailored for businesses in Singapore, providing a seamless, cost-effective, and secure platform for international B2B payments.

Benefits of Using HitPay for B2B Multi-Currency Payments

The HitPay Multi-currency Account offers numerous advantages for businesses looking to streamline their international B2B payment processes. By choosing HitPay, businesses can enjoy lower costs, enhanced security, easy integration with existing systems, and a platform specifically designed for SMEs.

One of the primary benefits of using HitPay is the potential for significant cost savings. Unlike traditional banks, HitPay does not charge transaction fees or subscription fees, making it an attractive alternative for businesses engaged in frequent international transactions. See HitPay pricing here.

In addition to lower costs, HitPay prioritizes the security and protection of its users. The platform utilizes robust technology designed by banking professionals and undergoes rigorous testing by external cybersecurity agencies. This ensures that users can have peace of mind when managing their multi-currency payments.

HitPay also offers easy integration with existing systems, providing businesses with no-code tools for e-commerce plugins, payment links, invoicing software, and more.

Finally, HitPay is specifically built for SMEs, offering a user-friendly platform without contracts or lock-in periods. The easy setup and customization options make it an ideal choice for small and medium-sized enterprises looking for an efficient and cost-effective solution to manage their international B2B payments.

How the HitPay Multi-Currency Account Works

The HitPay Multi-currency Account simplifies the process of managing international B2B payments by offering a user-friendly platform for accepting payments from customers and suppliers, paying suppliers, vendors, contractors, and employees, and managing your account with ease.

With HitPay, businesses can accept payments from customers and suppliers in multiple currencies and from various countries. The platform supports a wide range of currencies, ensuring that users can effectively manage their global transactions.

The platform also provides tools for tracking and managing payment statuses, ensuring that businesses have complete visibility and control over their international payments. Users have access to a comprehensive dashboard and reporting features, making it easy to monitor and analyze their multi-currency transactions.

Additionally, HitPay offers help guides and live chat support to help you navigate any challenges that may arise when managing international B2B payments.

How to Get Started with B2B Multi-Currency Payments

Getting started with HitPay Multi-currency Payments is a straightforward process involving registering for an account and integrating the platform with your existing systems.

The HitPay Multi-currency Account offers a range of benefits for businesses in Singapore looking to manage their B2B multi-currency payments more efficiently. With lower costs, enhanced security, easy integration, and a platform designed specifically for SMEs, HitPay presents a reliable and cost-effective solution for international B2B transactions.

To get started, contact the HitPay team now.

Read also: Free Business Registration in Singapore