Credit card machines are crucial for efficient payment processing and enhancing customer experience. Discover the benefits of different types of machines and terminals, and choose the right one for your business needs.

Credit card terminals are an essential tool for businesses of all sizes, but they can be expensive, especially for small businesses. If you're looking for an affordable credit card terminal, there are a few things you need to keep in mind.

In this article, we'll discuss the different types of credit card terminals available, the features to look for, and why they are important for small businesses.

We'll also provide a review of the HitPay Credit Card Terminal, one of the most popular affordable credit card terminals on the market.

What are Credit Card Terminals?

A credit card terminal is a device that allows businesses to accept credit card payments. It is a point-of-sale (POS) system that connects to a merchant's bank account to process transactions.

Credit card terminals typically have a keypad where customers can enter their PIN, a card slot where they can swipe their card, and a screen where they can review the transaction before finalising it.

Credit card terminals are essential for businesses of all sizes. They allow businesses to accept payments from a wider range of customers, and they can help to streamline the checkout process.

Credit card terminals also offer a number of security features to protect both businesses and customers from fraud.

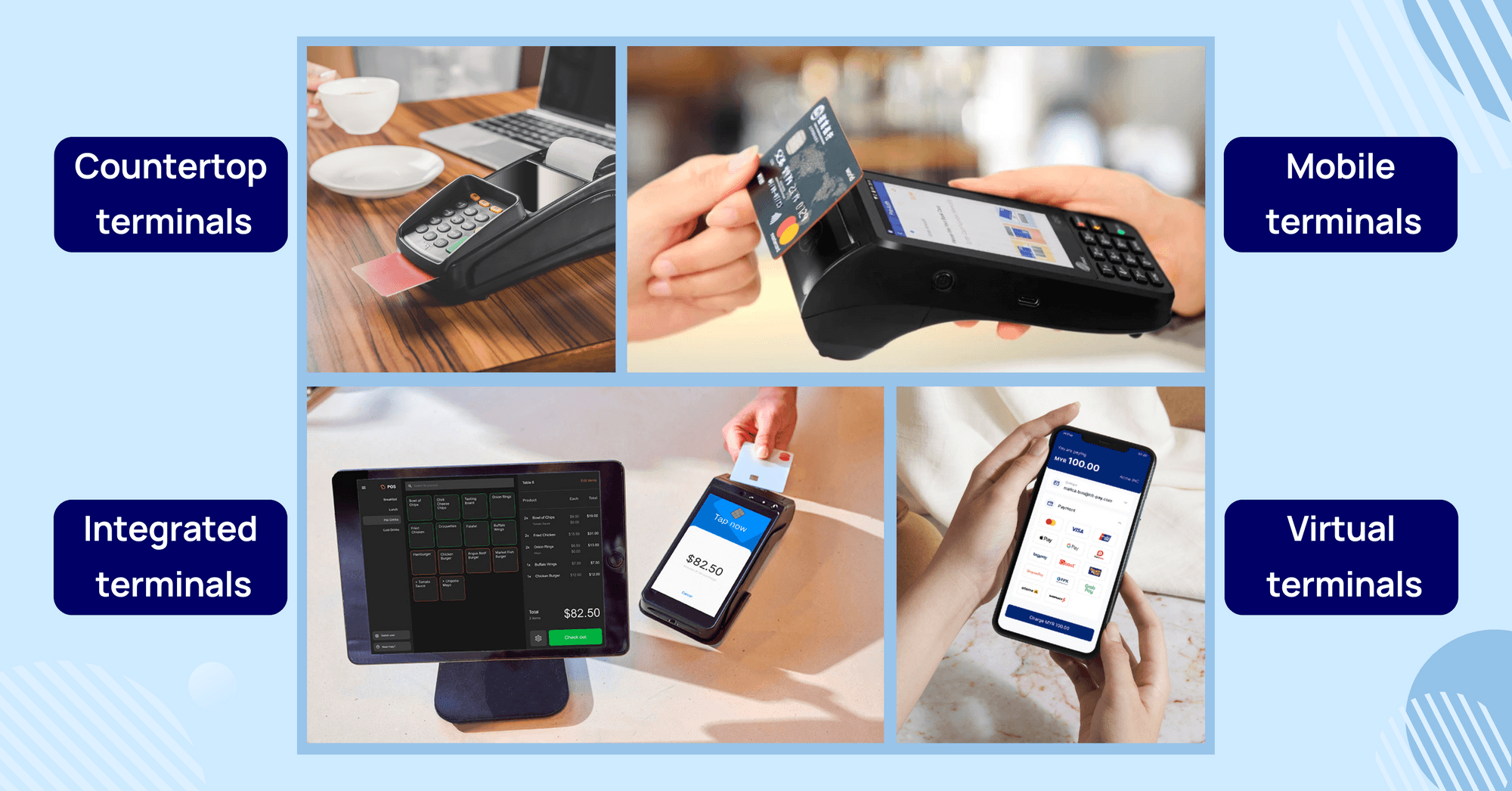

Types of Credit Card Terminals

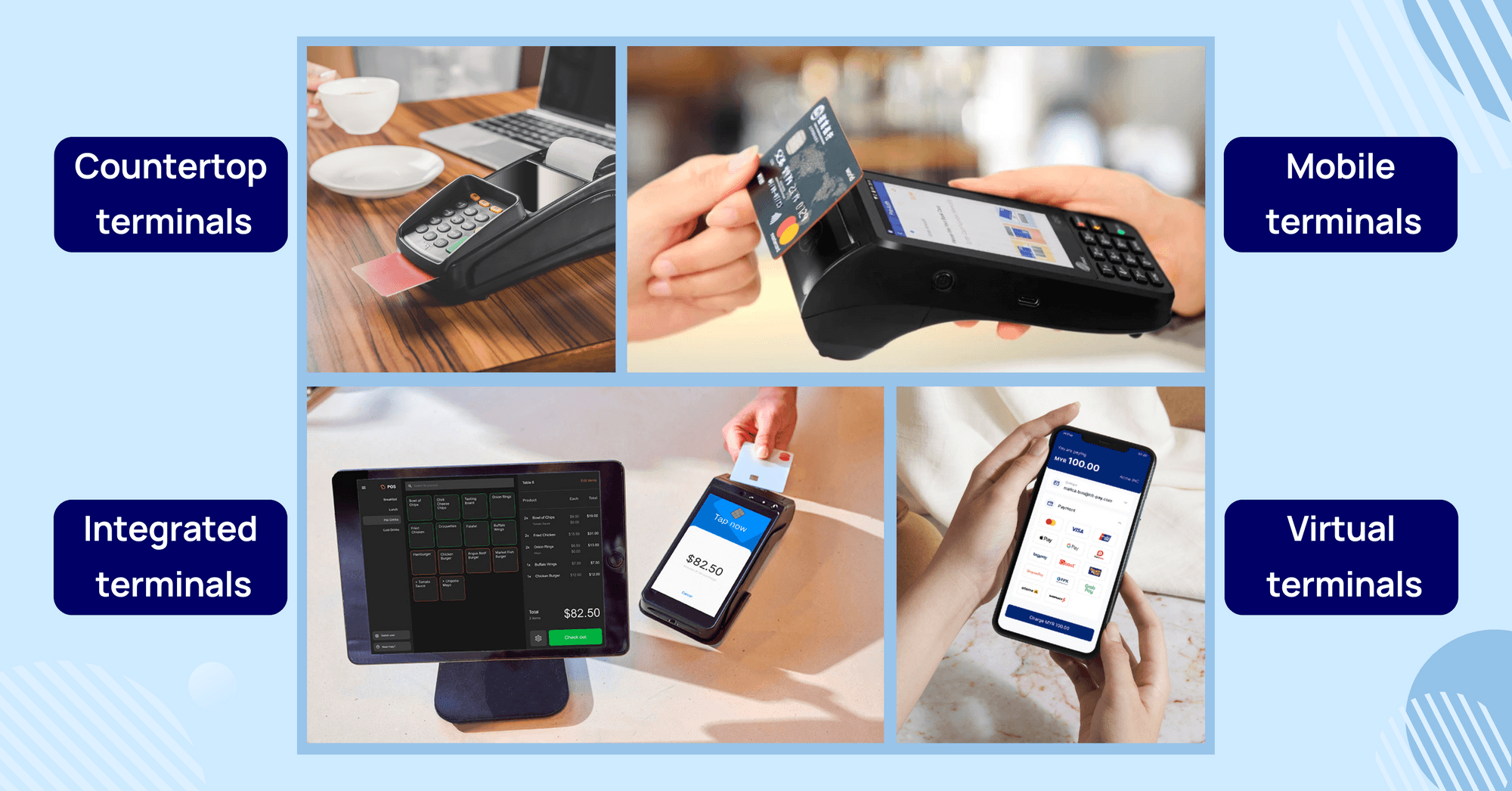

There are many different types of credit card terminals available, each with its own unique features and benefits. The best type of terminal for your business will depend on your specific needs and requirements.

Here is an overview of some of the most common types of credit card terminals:

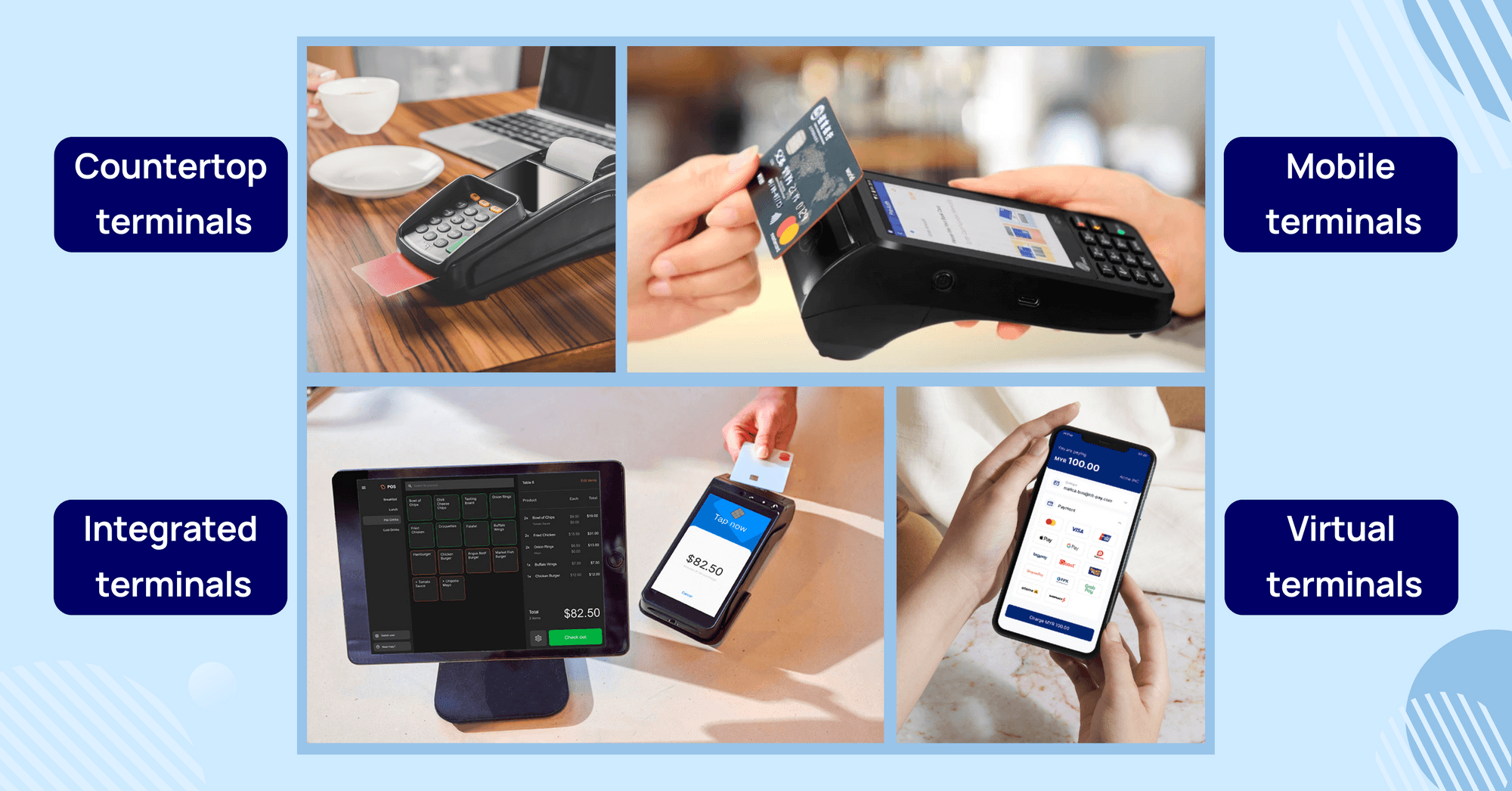

Countertop terminals: Countertop terminals are the most common type of credit card terminal. They are typically placed on the counter at a checkout station. Countertop terminals are available in a variety of sizes and shapes, and they can be either wired or wireless.

Mobile terminals: Mobile terminals are portable credit card terminals that can be used anywhere. They are ideal for businesses that need to accept payments on the go, such as food trucks, taxi cabs, and trade shows. Mobile terminals are typically powered by batteries or rechargeable batteries.

Integrated terminals: Integrated terminals are combined with point-of-sale (POS) systems. This allows businesses to process payments and manage their inventory and customer data all from one place. Integrated terminals are typically more expensive than other types of terminals, but they can save businesses time and money in the long run.

Virtual terminals: Virtual terminals are software-based terminals that allow businesses to accept credit card payments over the phone or through their website. Virtual terminals are a good option for businesses that do not need a physical terminal, such as mail order and telephone order businesses.

In addition to these basic types, there are also a number of specialised credit card terminals available. For example, there are terminals that are specifically designed for restaurants, hotels, and retail stores. There are also terminals that support contactless payments and loyalty programs.

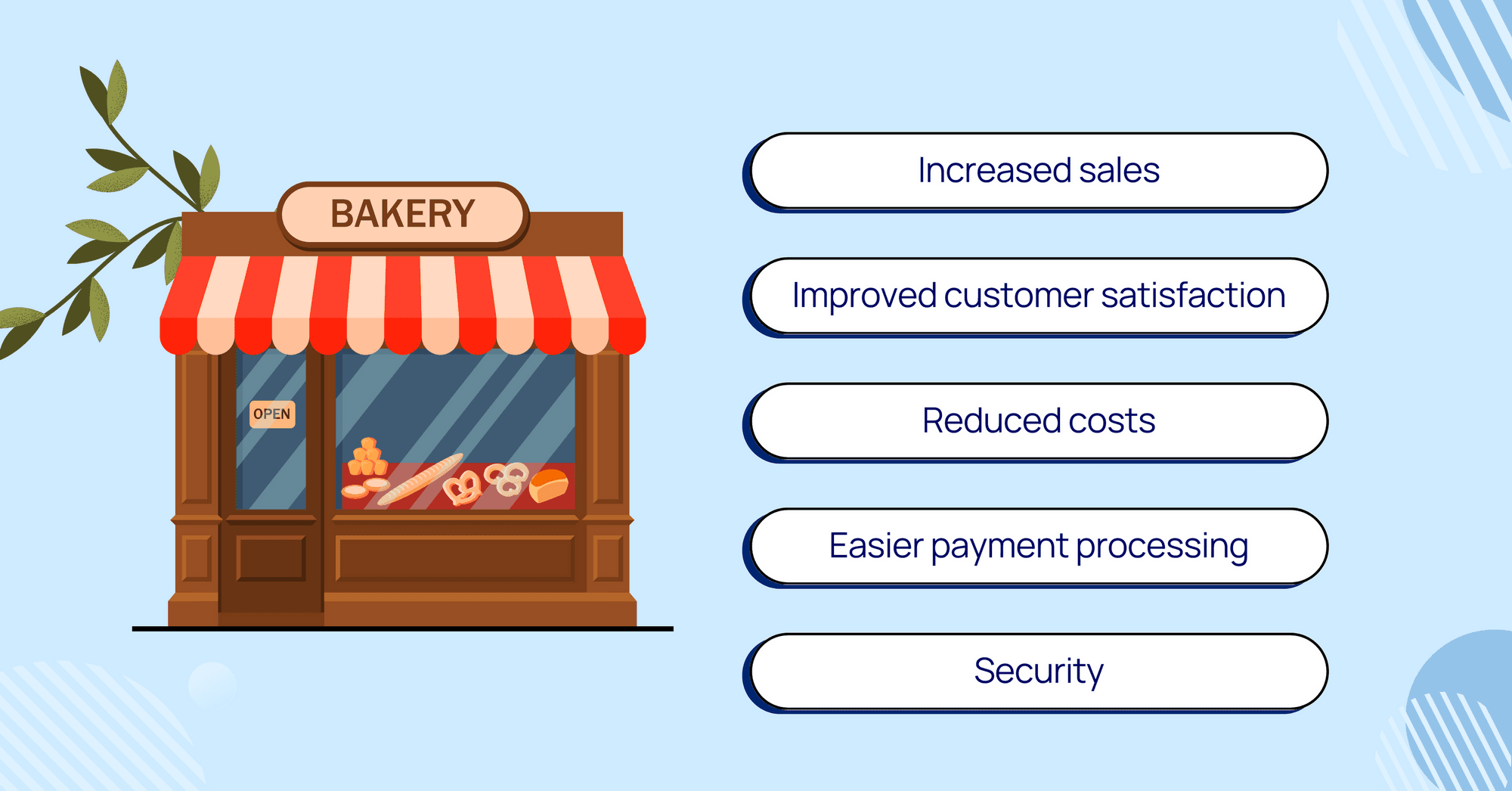

Why are Credit Card Terminals Important for Small Businesses?

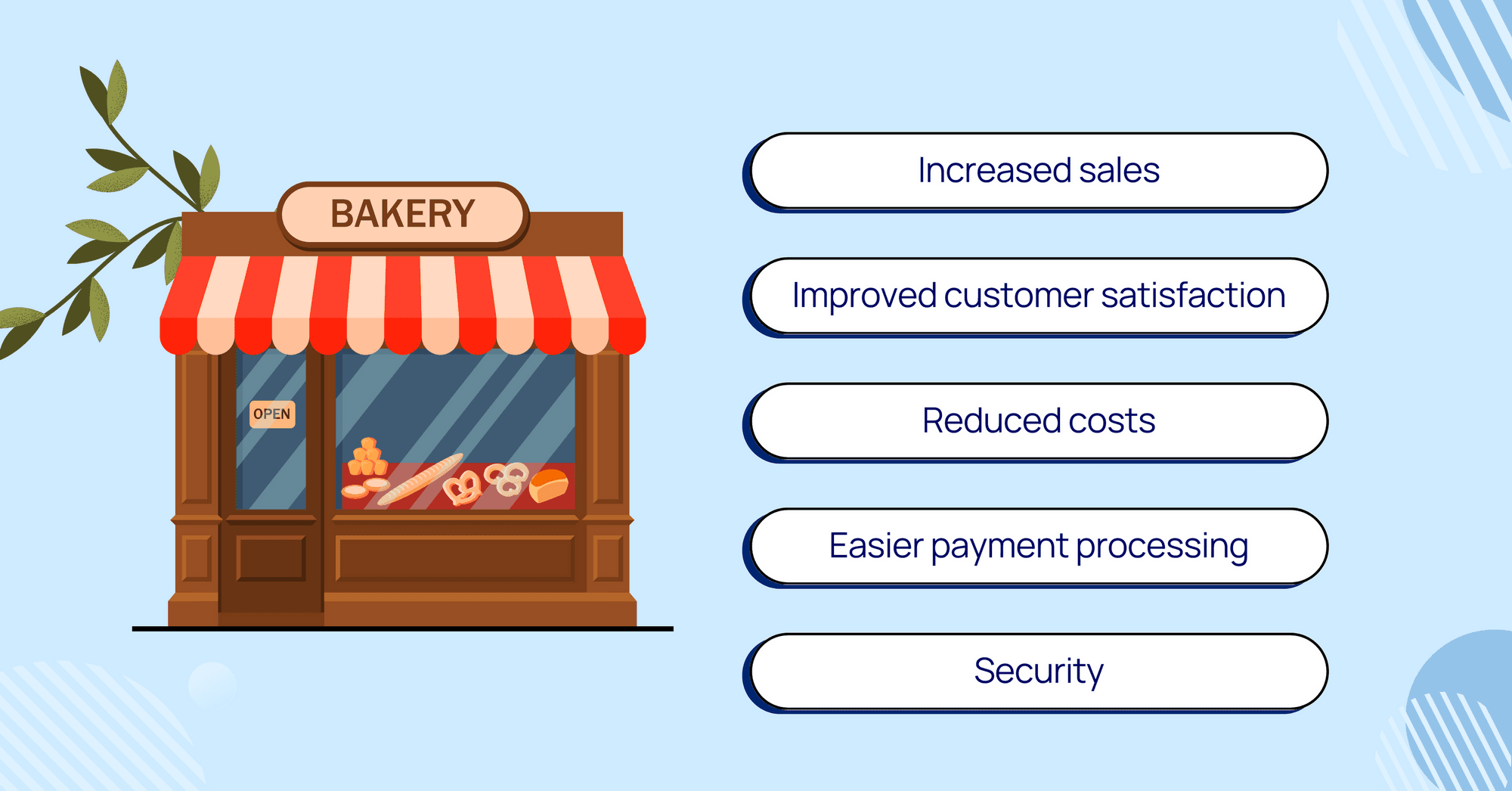

Credit card terminals are essential for small businesses that want to thrive in today's economy. They offer a number of benefits that can help businesses to increase sales, improve customer satisfaction, reduce costs, and streamline operations.

Here are some of the key benefits of using a credit card terminal for your small business:

Increased sales: Credit card terminals allow businesses to accept payments from a wider range of customers, including those who do not carry cash.

Improved customer satisfaction: Credit card terminals make it easy for customers to pay for goods and services. This can lead to improved customer satisfaction as consumers are increasingly favouring electronic payments (card payments in Malaysia is expected to grow by 20.8% to reach MYR371.8bn ($84.5bn) in 2023).

Reduced costs: Credit card terminals can help to reduce the costs associated with cash handling, such as the cost of counting and transporting cash.

Easier payment processing: Credit card terminals automate the payment processing process, making it easier and more efficient for businesses.

Security: Credit card terminals offer a number of security features to protect both businesses and customers from fraud. Some of the security features include:

Encryption: Scrambles credit card data so it cannot be read by unauthorised individuals.

Tokenisation: Replaces credit card numbers with unique tokens.

Fraud detection: Uses a variety of methods to detect fraudulent transactions.

Password protection: Prevents unauthorised individuals from accessing the terminal.

In addition to these benefits, credit card terminals can also help small businesses to grow and expand. For example, businesses that accept credit cards can more easily sell their products and services online and to customers from outside of their local area.

If you are a small business owner who does not currently accept credit cards, you should consider getting a credit card terminal from a provider such as HitPay. It is a small investment that can pay off in many ways.

What to Look For In an Affordable Credit Card Terminal?

When choosing an affordable credit card terminal, it's important to consider the following factors:

Price: The price of a credit card terminal can vary depending on the features it offers and the brand. The costs associated with a credit card terminal are as follows:

Monthly fees: Some processors charge a monthly fee, with or without hardware rental.

Hardware costs: Varies depending on features and brand; some processors rent terminals, while others require purchase.

Transaction fees: Typically a percentage of the transaction amount plus a fixed fee.

Other fees: Some processors charge additional fees for services such as chargeback protection and fraud detection.

Features: Some credit card terminals offer basic features like swiping and chip reading, while others offer more advanced features like contactless payments, loyalty programs, and inventory management. Consider the features that are important to your business when choosing a terminal.

Compatibility: Make sure that the credit card terminal you choose is compatible with your payment processor. This will ensure that you can accept payments from all of your customers.

Security: Credit card terminals should offer a number of security features mentioned in the previous section to protect both businesses and customers from fraud.

Customer support: It is important to choose a credit card terminal from a company that offers good customer support. This is important in case you have any problems with your terminal after you purchase it.

In addition to these factors, you may also want to consider the following when choosing an affordable credit card terminal:

Size and portability: If you need a credit card terminal that you can take with you on the go, you will need to choose a portable terminal.

Ease of use: Credit card terminals should be easy to use for both businesses and customers. Look for a terminal with a clear and concise display and easy-to-use buttons.

Warranty: Most credit card terminals come with a warranty. This warranty will protect you in case your terminal malfunctions or is damaged.

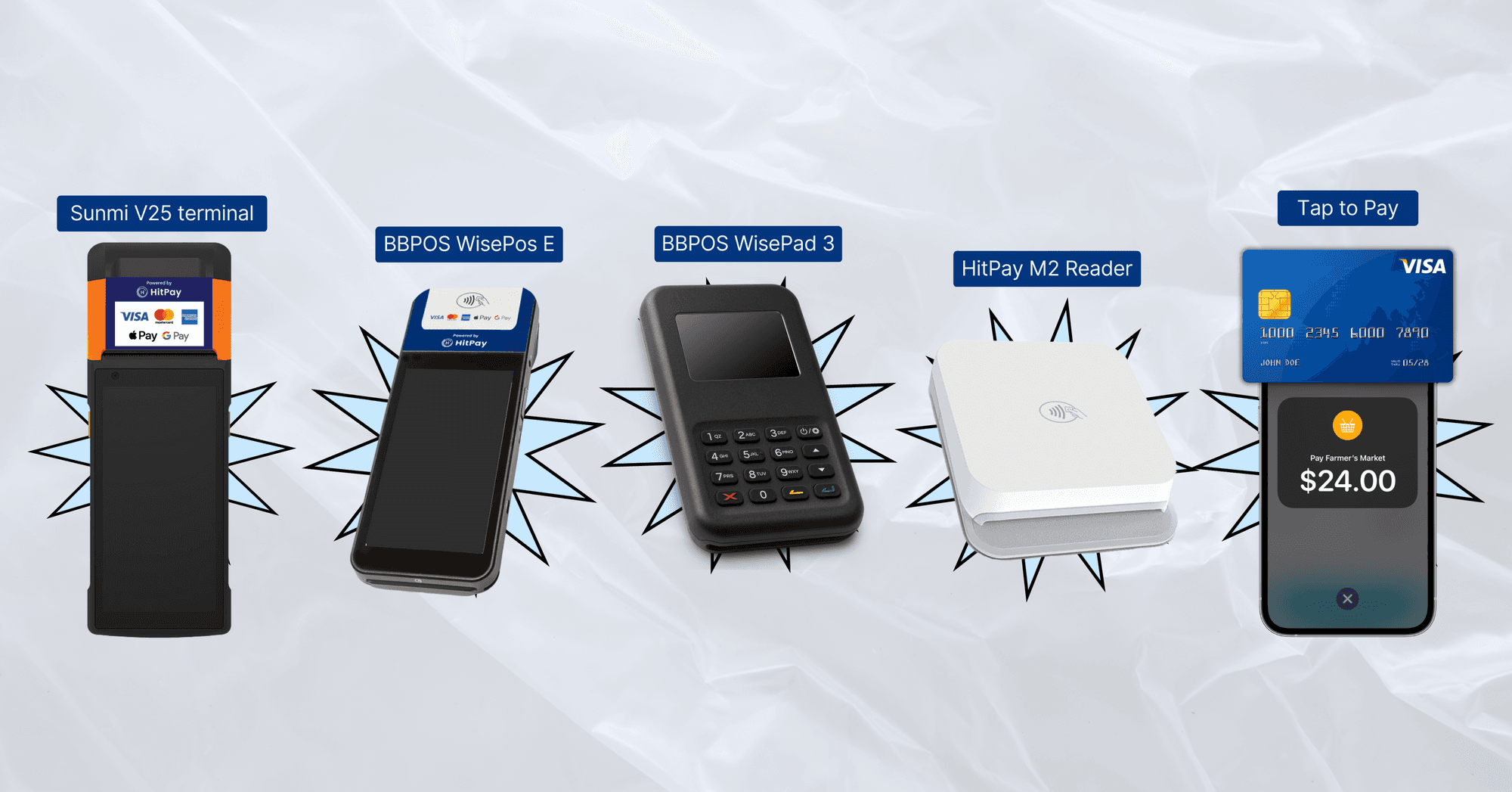

HitPay Credit Card Terminals

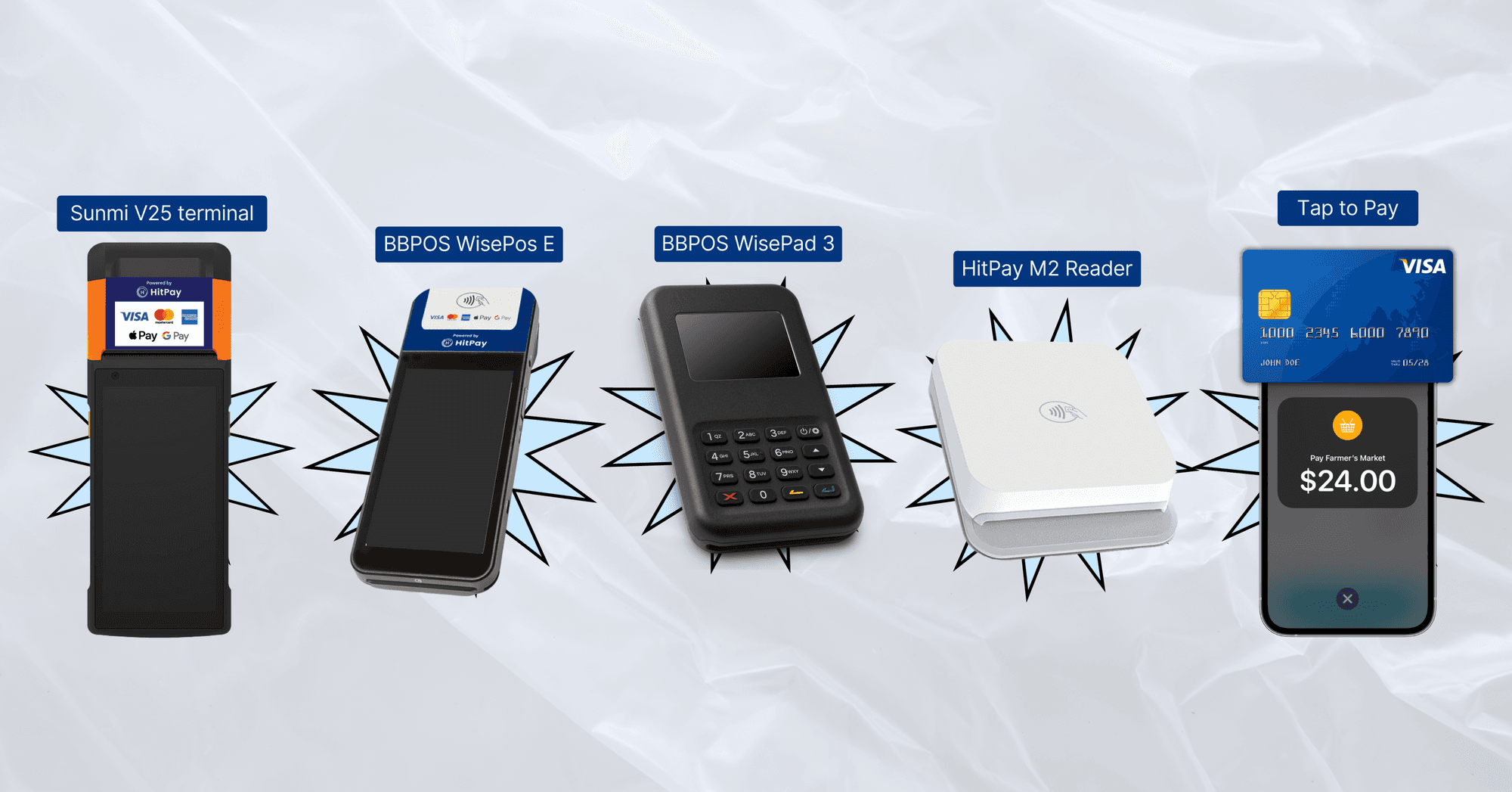

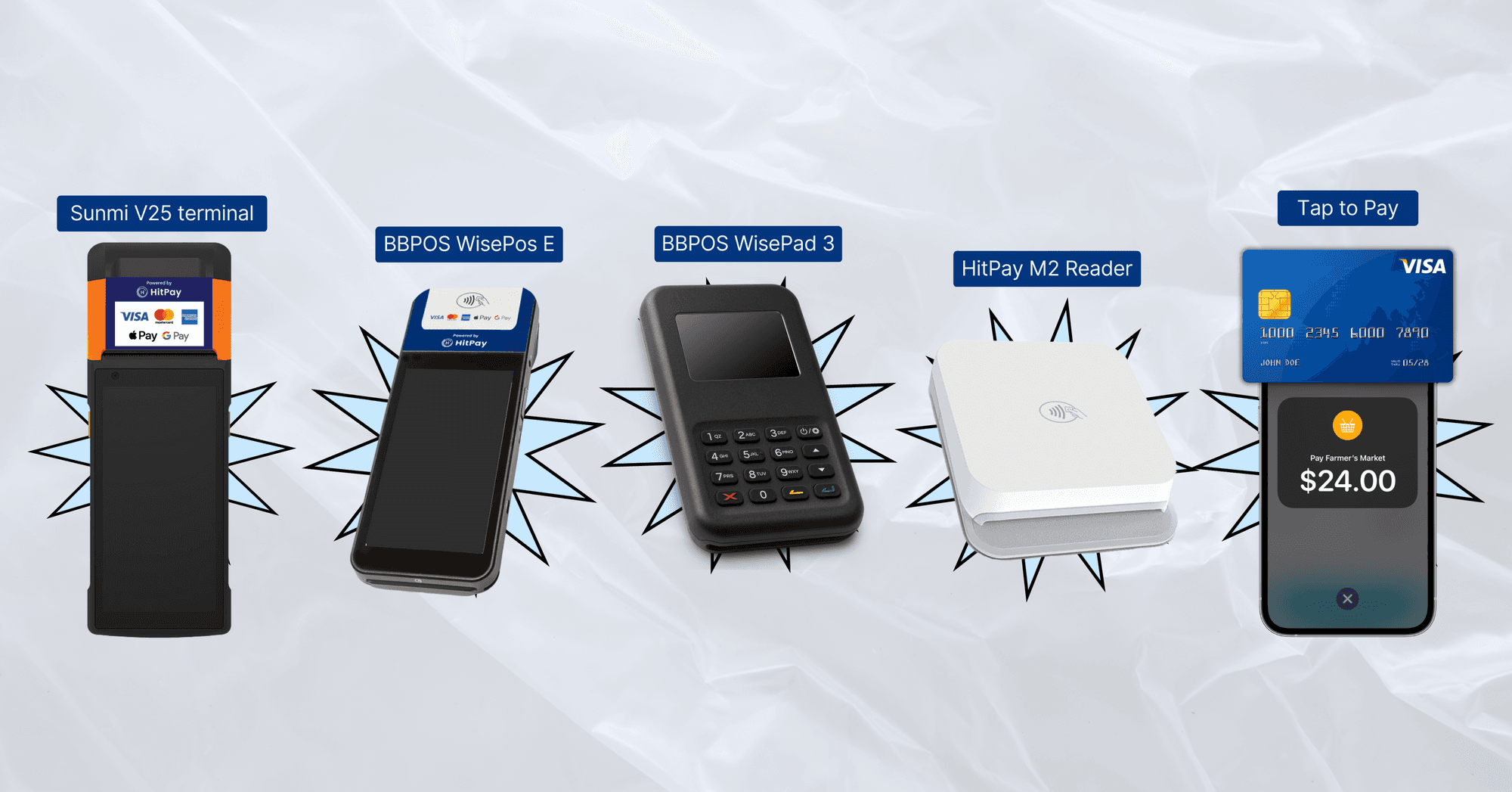

HitPay offers a wide range of credit card terminals to suit the needs of businesses of all sizes. Whether you need a standalone or mobile terminal, or a terminal that can accept swiped, chip, and contactless payments, HitPay has a terminal for you.

HitPay credit card terminals in Malaysia include:

Sunmi V25

BBPOS WisePos E

BBPOS WisePad 3

HitPay M2 Reader

Tap to Pay

For a more detailed view and side by side comparison of the credit card terminals, click here.

Advantages Of HitPay's Credit Card Terminals

HitPay credit card terminals are reliable, secure, and easy to use. They are also backed by HitPay's excellent customer support, so you can be sure that you will get the help you need if you have any problems. Other benefits include:

Fast and Secure Transactions: HitPay Credit Card Terminals offer fast and secure transactions, so you can keep your customers happy and your business moving forward. They support contactless payments, including Visa, Mastercard, Apple Pay, and Google Pay, so customers can pay the way they prefer.

Cost-effective solution: Traditional POS systems can be expensive to rent and maintain, with high rental and account maintenance fees. HitPay offers a more cost-effective solution with no rental fees. Businesses only pay per transaction, which makes it easier to manage expenses and allocate resources more efficiently. HitPay is a great option for businesses of all sizes, especially those that are looking for a cost-effective and user-friendly POS system.

No minimum term contracts: HitPay offers flexible payment processing options without long-term contracts. This gives businesses the freedom to change their payment processor or pricing plan at any time, without having to worry about fees or penalties. This is especially beneficial for businesses that need to adapt quickly to changes in market conditions or customer demands.

Free POS Software: HitPay Credit Card Terminals come integrated with free HitPay POS software, which offers a variety of features to help you manage your business, such as product syncing, location management, and automation.

Fast Onboarding and Delivery: HitPay does not slow you down with long waiting times for onboarding and delivery. You can set up a free HitPay account and order your Credit Card Terminal, and be up and running within the week.

Lightweight and Portable: HitPay credit card terminals are designed to be portable, allowing businesses to take their business anywhere. Whether at a trade show, a pop-up event, or offering services on-the-go, HitPay terminals help businesses accept payments wherever they grow.

Customisable Branding: Businesses can personalise the customer experience by customising receipts with their business logo and contact information. This small touch reinforces brand identity and makes a lasting impression on customers.

Real Time Transaction Monitoring: HitPay provides a user-friendly dashboard and mobile app that allows businesses to stay in control of their transactions. Businesses can monitor sales, view transaction history, and gain insights into their financial performance in real-time.

Which HitPay Credit Card Terminal is Right for You?

The best HitPay Credit Card Terminal for you will depend on your specific needs and requirements.

If you have a physical storefront, the countertop terminal is a good option. If you need to accept payments on the move, the mobile terminal is a good option.

If you are not sure which HitPay Credit Card Terminal is right for you, you can contact HitPay customer support for assistance. We will be happy to help you choose the right terminal for your business.

How do HitPays Credit Card Terminals Work?

HitPay credit card terminals offer a user-friendly and efficient payment experience for small businesses in Malaysia. Here's a summary:

Easy setup: HitPay terminals are compatible with both iOS and Android devices, and they can be set up quickly and easily. This means that businesses can start accepting payments right away.

Secure transactions: All transactions made through HitPay terminals are secure and encrypted, protecting both businesses and their customers. This helps to maintain trust and confidence in the payment process.

Device compatibility: HitPay terminals are compatible with a wide range of devices, so businesses can find the perfect solution for their needs. This versatility also ensures that businesses can continue to use HitPay terminals as they grow and their requirements change.

Comprehensive guides: Step-by-step guides are available for both desktop and mobile use, providing clear instructions on how to use HitPay terminals effectively. This makes the payment process as smooth as possible for businesses and their customers.

Tap to Pay: One of the standout features of HitPay terminals is the Tap to Pay functionality, which allows businesses to accept contactless payments directly on their mobile devices. This eliminates the need for additional hardware and simplifies the payment process, making it even more convenient for businesses and their customers.

Overall, HitPay credit card terminals offer a number of benefits for small businesses in Malaysia, including easy setup, secure transactions, device compatibility, comprehensive guides, and Tap to Pay functionality

Have questions about HitPay?

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

คุณอาจชอบโพสต์เหล่านี้

Understanding the POS System: What Is a Point of Sale System and How Does It Work?

HitPay Philippines

โพสต์

9 กันยายน 2567

Understanding the Different Types of POS Systems and Their Benefits in Various Industries

HitPay Philippines

โพสต์

8 กันยายน 2567

The Essential Retail POS System: Why Retailers Need a Point of Sale Solution

HitPay Philippines

โพสต์

8 กันยายน 2567

Credit card machines are crucial for efficient payment processing and enhancing customer experience. Discover the benefits of different types of machines and terminals, and choose the right one for your business needs.

Credit card terminals are an essential tool for businesses of all sizes, but they can be expensive, especially for small businesses. If you're looking for an affordable credit card terminal, there are a few things you need to keep in mind.

In this article, we'll discuss the different types of credit card terminals available, the features to look for, and why they are important for small businesses.

We'll also provide a review of the HitPay Credit Card Terminal, one of the most popular affordable credit card terminals on the market.

What are Credit Card Terminals?

A credit card terminal is a device that allows businesses to accept credit card payments. It is a point-of-sale (POS) system that connects to a merchant's bank account to process transactions.

Credit card terminals typically have a keypad where customers can enter their PIN, a card slot where they can swipe their card, and a screen where they can review the transaction before finalising it.

Credit card terminals are essential for businesses of all sizes. They allow businesses to accept payments from a wider range of customers, and they can help to streamline the checkout process.

Credit card terminals also offer a number of security features to protect both businesses and customers from fraud.

Types of Credit Card Terminals

There are many different types of credit card terminals available, each with its own unique features and benefits. The best type of terminal for your business will depend on your specific needs and requirements.

Here is an overview of some of the most common types of credit card terminals:

Countertop terminals: Countertop terminals are the most common type of credit card terminal. They are typically placed on the counter at a checkout station. Countertop terminals are available in a variety of sizes and shapes, and they can be either wired or wireless.

Mobile terminals: Mobile terminals are portable credit card terminals that can be used anywhere. They are ideal for businesses that need to accept payments on the go, such as food trucks, taxi cabs, and trade shows. Mobile terminals are typically powered by batteries or rechargeable batteries.

Integrated terminals: Integrated terminals are combined with point-of-sale (POS) systems. This allows businesses to process payments and manage their inventory and customer data all from one place. Integrated terminals are typically more expensive than other types of terminals, but they can save businesses time and money in the long run.

Virtual terminals: Virtual terminals are software-based terminals that allow businesses to accept credit card payments over the phone or through their website. Virtual terminals are a good option for businesses that do not need a physical terminal, such as mail order and telephone order businesses.

In addition to these basic types, there are also a number of specialised credit card terminals available. For example, there are terminals that are specifically designed for restaurants, hotels, and retail stores. There are also terminals that support contactless payments and loyalty programs.

Why are Credit Card Terminals Important for Small Businesses?

Credit card terminals are essential for small businesses that want to thrive in today's economy. They offer a number of benefits that can help businesses to increase sales, improve customer satisfaction, reduce costs, and streamline operations.

Here are some of the key benefits of using a credit card terminal for your small business:

Increased sales: Credit card terminals allow businesses to accept payments from a wider range of customers, including those who do not carry cash.

Improved customer satisfaction: Credit card terminals make it easy for customers to pay for goods and services. This can lead to improved customer satisfaction as consumers are increasingly favouring electronic payments (card payments in Malaysia is expected to grow by 20.8% to reach MYR371.8bn ($84.5bn) in 2023).

Reduced costs: Credit card terminals can help to reduce the costs associated with cash handling, such as the cost of counting and transporting cash.

Easier payment processing: Credit card terminals automate the payment processing process, making it easier and more efficient for businesses.

Security: Credit card terminals offer a number of security features to protect both businesses and customers from fraud. Some of the security features include:

Encryption: Scrambles credit card data so it cannot be read by unauthorised individuals.

Tokenisation: Replaces credit card numbers with unique tokens.

Fraud detection: Uses a variety of methods to detect fraudulent transactions.

Password protection: Prevents unauthorised individuals from accessing the terminal.

In addition to these benefits, credit card terminals can also help small businesses to grow and expand. For example, businesses that accept credit cards can more easily sell their products and services online and to customers from outside of their local area.

If you are a small business owner who does not currently accept credit cards, you should consider getting a credit card terminal from a provider such as HitPay. It is a small investment that can pay off in many ways.

What to Look For In an Affordable Credit Card Terminal?

When choosing an affordable credit card terminal, it's important to consider the following factors:

Price: The price of a credit card terminal can vary depending on the features it offers and the brand. The costs associated with a credit card terminal are as follows:

Monthly fees: Some processors charge a monthly fee, with or without hardware rental.

Hardware costs: Varies depending on features and brand; some processors rent terminals, while others require purchase.

Transaction fees: Typically a percentage of the transaction amount plus a fixed fee.

Other fees: Some processors charge additional fees for services such as chargeback protection and fraud detection.

Features: Some credit card terminals offer basic features like swiping and chip reading, while others offer more advanced features like contactless payments, loyalty programs, and inventory management. Consider the features that are important to your business when choosing a terminal.

Compatibility: Make sure that the credit card terminal you choose is compatible with your payment processor. This will ensure that you can accept payments from all of your customers.

Security: Credit card terminals should offer a number of security features mentioned in the previous section to protect both businesses and customers from fraud.

Customer support: It is important to choose a credit card terminal from a company that offers good customer support. This is important in case you have any problems with your terminal after you purchase it.

In addition to these factors, you may also want to consider the following when choosing an affordable credit card terminal:

Size and portability: If you need a credit card terminal that you can take with you on the go, you will need to choose a portable terminal.

Ease of use: Credit card terminals should be easy to use for both businesses and customers. Look for a terminal with a clear and concise display and easy-to-use buttons.

Warranty: Most credit card terminals come with a warranty. This warranty will protect you in case your terminal malfunctions or is damaged.

HitPay Credit Card Terminals

HitPay offers a wide range of credit card terminals to suit the needs of businesses of all sizes. Whether you need a standalone or mobile terminal, or a terminal that can accept swiped, chip, and contactless payments, HitPay has a terminal for you.

HitPay credit card terminals in Malaysia include:

Sunmi V25

BBPOS WisePos E

BBPOS WisePad 3

HitPay M2 Reader

Tap to Pay

For a more detailed view and side by side comparison of the credit card terminals, click here.

Advantages Of HitPay's Credit Card Terminals

HitPay credit card terminals are reliable, secure, and easy to use. They are also backed by HitPay's excellent customer support, so you can be sure that you will get the help you need if you have any problems. Other benefits include:

Fast and Secure Transactions: HitPay Credit Card Terminals offer fast and secure transactions, so you can keep your customers happy and your business moving forward. They support contactless payments, including Visa, Mastercard, Apple Pay, and Google Pay, so customers can pay the way they prefer.

Cost-effective solution: Traditional POS systems can be expensive to rent and maintain, with high rental and account maintenance fees. HitPay offers a more cost-effective solution with no rental fees. Businesses only pay per transaction, which makes it easier to manage expenses and allocate resources more efficiently. HitPay is a great option for businesses of all sizes, especially those that are looking for a cost-effective and user-friendly POS system.

No minimum term contracts: HitPay offers flexible payment processing options without long-term contracts. This gives businesses the freedom to change their payment processor or pricing plan at any time, without having to worry about fees or penalties. This is especially beneficial for businesses that need to adapt quickly to changes in market conditions or customer demands.

Free POS Software: HitPay Credit Card Terminals come integrated with free HitPay POS software, which offers a variety of features to help you manage your business, such as product syncing, location management, and automation.

Fast Onboarding and Delivery: HitPay does not slow you down with long waiting times for onboarding and delivery. You can set up a free HitPay account and order your Credit Card Terminal, and be up and running within the week.

Lightweight and Portable: HitPay credit card terminals are designed to be portable, allowing businesses to take their business anywhere. Whether at a trade show, a pop-up event, or offering services on-the-go, HitPay terminals help businesses accept payments wherever they grow.

Customisable Branding: Businesses can personalise the customer experience by customising receipts with their business logo and contact information. This small touch reinforces brand identity and makes a lasting impression on customers.

Real Time Transaction Monitoring: HitPay provides a user-friendly dashboard and mobile app that allows businesses to stay in control of their transactions. Businesses can monitor sales, view transaction history, and gain insights into their financial performance in real-time.

Which HitPay Credit Card Terminal is Right for You?

The best HitPay Credit Card Terminal for you will depend on your specific needs and requirements.

If you have a physical storefront, the countertop terminal is a good option. If you need to accept payments on the move, the mobile terminal is a good option.

If you are not sure which HitPay Credit Card Terminal is right for you, you can contact HitPay customer support for assistance. We will be happy to help you choose the right terminal for your business.

How do HitPays Credit Card Terminals Work?

HitPay credit card terminals offer a user-friendly and efficient payment experience for small businesses in Malaysia. Here's a summary:

Easy setup: HitPay terminals are compatible with both iOS and Android devices, and they can be set up quickly and easily. This means that businesses can start accepting payments right away.

Secure transactions: All transactions made through HitPay terminals are secure and encrypted, protecting both businesses and their customers. This helps to maintain trust and confidence in the payment process.

Device compatibility: HitPay terminals are compatible with a wide range of devices, so businesses can find the perfect solution for their needs. This versatility also ensures that businesses can continue to use HitPay terminals as they grow and their requirements change.

Comprehensive guides: Step-by-step guides are available for both desktop and mobile use, providing clear instructions on how to use HitPay terminals effectively. This makes the payment process as smooth as possible for businesses and their customers.

Tap to Pay: One of the standout features of HitPay terminals is the Tap to Pay functionality, which allows businesses to accept contactless payments directly on their mobile devices. This eliminates the need for additional hardware and simplifies the payment process, making it even more convenient for businesses and their customers.

Overall, HitPay credit card terminals offer a number of benefits for small businesses in Malaysia, including easy setup, secure transactions, device compatibility, comprehensive guides, and Tap to Pay functionality

Have questions about HitPay?

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

คุณอาจชอบโพสต์เหล่านี้

Understanding the POS System: What Is a Point of Sale System and How Does It Work?

HitPay Philippines

โพสต์

9 กันยายน 2567

Understanding the Different Types of POS Systems and Their Benefits in Various Industries

HitPay Philippines

โพสต์

8 กันยายน 2567

The Essential Retail POS System: Why Retailers Need a Point of Sale Solution

HitPay Philippines

โพสต์

8 กันยายน 2567

Credit card machines are crucial for efficient payment processing and enhancing customer experience. Discover the benefits of different types of machines and terminals, and choose the right one for your business needs.

Credit card terminals are an essential tool for businesses of all sizes, but they can be expensive, especially for small businesses. If you're looking for an affordable credit card terminal, there are a few things you need to keep in mind.

In this article, we'll discuss the different types of credit card terminals available, the features to look for, and why they are important for small businesses.

We'll also provide a review of the HitPay Credit Card Terminal, one of the most popular affordable credit card terminals on the market.

What are Credit Card Terminals?

A credit card terminal is a device that allows businesses to accept credit card payments. It is a point-of-sale (POS) system that connects to a merchant's bank account to process transactions.

Credit card terminals typically have a keypad where customers can enter their PIN, a card slot where they can swipe their card, and a screen where they can review the transaction before finalising it.

Credit card terminals are essential for businesses of all sizes. They allow businesses to accept payments from a wider range of customers, and they can help to streamline the checkout process.

Credit card terminals also offer a number of security features to protect both businesses and customers from fraud.

Types of Credit Card Terminals

There are many different types of credit card terminals available, each with its own unique features and benefits. The best type of terminal for your business will depend on your specific needs and requirements.

Here is an overview of some of the most common types of credit card terminals:

Countertop terminals: Countertop terminals are the most common type of credit card terminal. They are typically placed on the counter at a checkout station. Countertop terminals are available in a variety of sizes and shapes, and they can be either wired or wireless.

Mobile terminals: Mobile terminals are portable credit card terminals that can be used anywhere. They are ideal for businesses that need to accept payments on the go, such as food trucks, taxi cabs, and trade shows. Mobile terminals are typically powered by batteries or rechargeable batteries.

Integrated terminals: Integrated terminals are combined with point-of-sale (POS) systems. This allows businesses to process payments and manage their inventory and customer data all from one place. Integrated terminals are typically more expensive than other types of terminals, but they can save businesses time and money in the long run.

Virtual terminals: Virtual terminals are software-based terminals that allow businesses to accept credit card payments over the phone or through their website. Virtual terminals are a good option for businesses that do not need a physical terminal, such as mail order and telephone order businesses.

In addition to these basic types, there are also a number of specialised credit card terminals available. For example, there are terminals that are specifically designed for restaurants, hotels, and retail stores. There are also terminals that support contactless payments and loyalty programs.

Why are Credit Card Terminals Important for Small Businesses?

Credit card terminals are essential for small businesses that want to thrive in today's economy. They offer a number of benefits that can help businesses to increase sales, improve customer satisfaction, reduce costs, and streamline operations.

Here are some of the key benefits of using a credit card terminal for your small business:

Increased sales: Credit card terminals allow businesses to accept payments from a wider range of customers, including those who do not carry cash.

Improved customer satisfaction: Credit card terminals make it easy for customers to pay for goods and services. This can lead to improved customer satisfaction as consumers are increasingly favouring electronic payments (card payments in Malaysia is expected to grow by 20.8% to reach MYR371.8bn ($84.5bn) in 2023).

Reduced costs: Credit card terminals can help to reduce the costs associated with cash handling, such as the cost of counting and transporting cash.

Easier payment processing: Credit card terminals automate the payment processing process, making it easier and more efficient for businesses.

Security: Credit card terminals offer a number of security features to protect both businesses and customers from fraud. Some of the security features include:

Encryption: Scrambles credit card data so it cannot be read by unauthorised individuals.

Tokenisation: Replaces credit card numbers with unique tokens.

Fraud detection: Uses a variety of methods to detect fraudulent transactions.

Password protection: Prevents unauthorised individuals from accessing the terminal.

In addition to these benefits, credit card terminals can also help small businesses to grow and expand. For example, businesses that accept credit cards can more easily sell their products and services online and to customers from outside of their local area.

If you are a small business owner who does not currently accept credit cards, you should consider getting a credit card terminal from a provider such as HitPay. It is a small investment that can pay off in many ways.

What to Look For In an Affordable Credit Card Terminal?

When choosing an affordable credit card terminal, it's important to consider the following factors:

Price: The price of a credit card terminal can vary depending on the features it offers and the brand. The costs associated with a credit card terminal are as follows:

Monthly fees: Some processors charge a monthly fee, with or without hardware rental.

Hardware costs: Varies depending on features and brand; some processors rent terminals, while others require purchase.

Transaction fees: Typically a percentage of the transaction amount plus a fixed fee.

Other fees: Some processors charge additional fees for services such as chargeback protection and fraud detection.

Features: Some credit card terminals offer basic features like swiping and chip reading, while others offer more advanced features like contactless payments, loyalty programs, and inventory management. Consider the features that are important to your business when choosing a terminal.

Compatibility: Make sure that the credit card terminal you choose is compatible with your payment processor. This will ensure that you can accept payments from all of your customers.

Security: Credit card terminals should offer a number of security features mentioned in the previous section to protect both businesses and customers from fraud.

Customer support: It is important to choose a credit card terminal from a company that offers good customer support. This is important in case you have any problems with your terminal after you purchase it.

In addition to these factors, you may also want to consider the following when choosing an affordable credit card terminal:

Size and portability: If you need a credit card terminal that you can take with you on the go, you will need to choose a portable terminal.

Ease of use: Credit card terminals should be easy to use for both businesses and customers. Look for a terminal with a clear and concise display and easy-to-use buttons.

Warranty: Most credit card terminals come with a warranty. This warranty will protect you in case your terminal malfunctions or is damaged.

HitPay Credit Card Terminals

HitPay offers a wide range of credit card terminals to suit the needs of businesses of all sizes. Whether you need a standalone or mobile terminal, or a terminal that can accept swiped, chip, and contactless payments, HitPay has a terminal for you.

HitPay credit card terminals in Malaysia include:

Sunmi V25

BBPOS WisePos E

BBPOS WisePad 3

HitPay M2 Reader

Tap to Pay

For a more detailed view and side by side comparison of the credit card terminals, click here.

Advantages Of HitPay's Credit Card Terminals

HitPay credit card terminals are reliable, secure, and easy to use. They are also backed by HitPay's excellent customer support, so you can be sure that you will get the help you need if you have any problems. Other benefits include:

Fast and Secure Transactions: HitPay Credit Card Terminals offer fast and secure transactions, so you can keep your customers happy and your business moving forward. They support contactless payments, including Visa, Mastercard, Apple Pay, and Google Pay, so customers can pay the way they prefer.

Cost-effective solution: Traditional POS systems can be expensive to rent and maintain, with high rental and account maintenance fees. HitPay offers a more cost-effective solution with no rental fees. Businesses only pay per transaction, which makes it easier to manage expenses and allocate resources more efficiently. HitPay is a great option for businesses of all sizes, especially those that are looking for a cost-effective and user-friendly POS system.

No minimum term contracts: HitPay offers flexible payment processing options without long-term contracts. This gives businesses the freedom to change their payment processor or pricing plan at any time, without having to worry about fees or penalties. This is especially beneficial for businesses that need to adapt quickly to changes in market conditions or customer demands.

Free POS Software: HitPay Credit Card Terminals come integrated with free HitPay POS software, which offers a variety of features to help you manage your business, such as product syncing, location management, and automation.

Fast Onboarding and Delivery: HitPay does not slow you down with long waiting times for onboarding and delivery. You can set up a free HitPay account and order your Credit Card Terminal, and be up and running within the week.

Lightweight and Portable: HitPay credit card terminals are designed to be portable, allowing businesses to take their business anywhere. Whether at a trade show, a pop-up event, or offering services on-the-go, HitPay terminals help businesses accept payments wherever they grow.

Customisable Branding: Businesses can personalise the customer experience by customising receipts with their business logo and contact information. This small touch reinforces brand identity and makes a lasting impression on customers.

Real Time Transaction Monitoring: HitPay provides a user-friendly dashboard and mobile app that allows businesses to stay in control of their transactions. Businesses can monitor sales, view transaction history, and gain insights into their financial performance in real-time.

Which HitPay Credit Card Terminal is Right for You?

The best HitPay Credit Card Terminal for you will depend on your specific needs and requirements.

If you have a physical storefront, the countertop terminal is a good option. If you need to accept payments on the move, the mobile terminal is a good option.

If you are not sure which HitPay Credit Card Terminal is right for you, you can contact HitPay customer support for assistance. We will be happy to help you choose the right terminal for your business.

How do HitPays Credit Card Terminals Work?

HitPay credit card terminals offer a user-friendly and efficient payment experience for small businesses in Malaysia. Here's a summary:

Easy setup: HitPay terminals are compatible with both iOS and Android devices, and they can be set up quickly and easily. This means that businesses can start accepting payments right away.

Secure transactions: All transactions made through HitPay terminals are secure and encrypted, protecting both businesses and their customers. This helps to maintain trust and confidence in the payment process.

Device compatibility: HitPay terminals are compatible with a wide range of devices, so businesses can find the perfect solution for their needs. This versatility also ensures that businesses can continue to use HitPay terminals as they grow and their requirements change.

Comprehensive guides: Step-by-step guides are available for both desktop and mobile use, providing clear instructions on how to use HitPay terminals effectively. This makes the payment process as smooth as possible for businesses and their customers.

Tap to Pay: One of the standout features of HitPay terminals is the Tap to Pay functionality, which allows businesses to accept contactless payments directly on their mobile devices. This eliminates the need for additional hardware and simplifies the payment process, making it even more convenient for businesses and their customers.

Overall, HitPay credit card terminals offer a number of benefits for small businesses in Malaysia, including easy setup, secure transactions, device compatibility, comprehensive guides, and Tap to Pay functionality

Have questions about HitPay?

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

คุณอาจชอบโพสต์เหล่านี้

Understanding the POS System: What Is a Point of Sale System and How Does It Work?

HitPay Philippines

โพสต์

9 กันยายน 2567

Understanding the Different Types of POS Systems and Their Benefits in Various Industries

HitPay Philippines

โพสต์

8 กันยายน 2567

The Essential Retail POS System: Why Retailers Need a Point of Sale Solution

HitPay Philippines

โพสต์

8 กันยายน 2567

มาทำให้คุณตั้งค่ากันเถอะ

สร้างบัญชีทันทีหรือติดต่อเราเพื่อสร้างแพ็คเกจที่กำหนดเองสำหรับธุรกิจของคุณ.

ซอฟต์แวร์ธุรกิจ

บริษัท

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

ประเทศอื่น ๆ ทั้งหมด

บริษัท HitPay Payment Solutions Pte Ltd ("HitPay") ได้รับอนุญาตเป็นสถาบันการชำระเงินขนาดใหญ่ (PS20200643) ภายใต้พระราชบัญญัติการบริการการชำระเงินของสิงคโปร์สำหรับการให้บริการการโอนเงินภายในประเทศ, การโอนเงินข้ามพรมแดน และบริการการจัดหาผู้ค้า ซึ่งสามารถยืนยันได้ในไดเรกทอรีสถาบันการเงินของ MAS ที่นี่. HitPay ยังสามารถให้บริการเหล่านี้ร่วมกับพันธมิตรอื่น ๆ ที่ได้รับอนุญาตหรือยกเว้นโดย MAS.

บริษัท HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, สิงคโปร์ 089109

มาทำให้คุณตั้งค่ากันเถอะ

สร้างบัญชีทันทีเพื่อเริ่มต้นหรือติดต่อเรา

เพื่อออกแบบแพ็คเกจที่กำหนดเองสำหรับธุรกิจของคุณ.

ซอฟต์แวร์ธุรกิจ

บริษัท

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

ประเทศอื่น ๆ ทั้งหมด

บริษัท HitPay Payment Solutions Pte Ltd ("HitPay") ได้รับอนุญาตเป็นสถาบันการชำระเงินขนาดใหญ่ (PS20200643) ภายใต้พระราชบัญญัติการบริการการชำระเงินของสิงคโปร์สำหรับการให้บริการการโอนเงินภายในประเทศ, การโอนเงินข้ามพรมแดน และบริการการจัดหาผู้ค้า ซึ่งสามารถยืนยันได้ในไดเรกทอรีสถาบันการเงินของ MAS ที่นี่. HitPay ยังสามารถให้บริการเหล่านี้ร่วมกับพันธมิตรอื่น ๆ ที่ได้รับอนุญาตหรือยกเว้นโดย MAS.

บริษัท HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, สิงคโปร์ 089109

มาทำให้คุณตั้งค่ากันเถอะ

สร้างบัญชีทันทีเพื่อเริ่มต้นหรือติดต่อเราเพื่อออกแบบ

แพ็คเกจที่กำหนดเองสำหรับธุรกิจของคุณ.

ซอฟต์แวร์ธุรกิจ

บริษัท

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

ประเทศอื่น ๆ ทั้งหมด

บริษัท HitPay Payment Solutions Pte Ltd ("HitPay") ได้รับอนุญาตเป็นสถาบันการชำระเงินขนาดใหญ่ (PS20200643) ภายใต้พระราชบัญญัติการบริการการชำระเงินของสิงคโปร์สำหรับการให้บริการการโอนเงินภายในประเทศ, การโอนเงินข้ามพรมแดน และบริการการจัดหาผู้ค้า ซึ่งสามารถยืนยันได้ในไดเรกทอรีสถาบันการเงินของ MAS ที่นี่. HitPay ยังสามารถให้บริการเหล่านี้ร่วมกับพันธมิตรอื่น ๆ ที่ได้รับอนุญาตหรือยกเว้นโดย MAS.

บริษัท HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, สิงคโปร์ 089109

มาทำให้คุณตั้งค่ากันเถอะ

สร้างบัญชีทันทีเพื่อเริ่มต้นหรือ ติดต่อเราสำหรับการออกแบบแพ็คเกจที่กำหนดเอง

สำหรับธุรกิจของคุณ.

ซอฟต์แวร์ธุรกิจ

บริษัท

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

ประเทศอื่น ๆ ทั้งหมด

HitPay Payment Solutions Pte Ltd ("HitPay") ได้รับใบอนุญาตเป็นสถาบันการชำระเงินที่สำคัญ (PS20200643) ภายใต้พระราชบัญญัติการชำระเงินของสิงคโปร์ สำหรับการให้บริการโอนเงินภายในประเทศ, การโอนเงินข้ามพรมแดน และบริการการจัดหาค่าใช้จ่ายให้กับพ่อค้า ซึ่งสามารถยืนยันได้ในไดเรกทอรีสถาบันการเงิน MAS ที่นี่. HitPay อาจให้บริการเหล่านี้ในความร่วมมือกับพันธมิตรที่ได้รับใบอนุญาตหรือได้รับการยกเว้นจาก MAS อื่น ๆ

HitPay Payment Solutions Pte Ltd

1 ถนนเคียงไทร, สิงคโปร์ 089109