Products

->

In-person payment

Products

->

In-person payment

Products

->

In-person payment

Take payments the way you want to

Take payments the way you want to

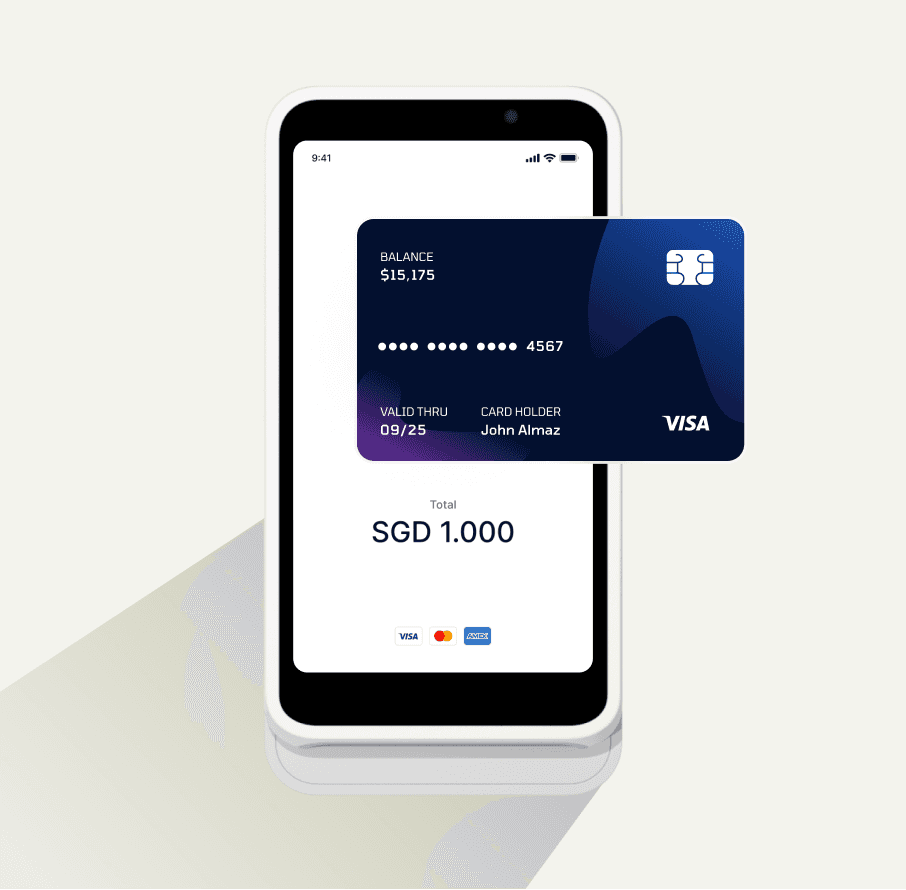

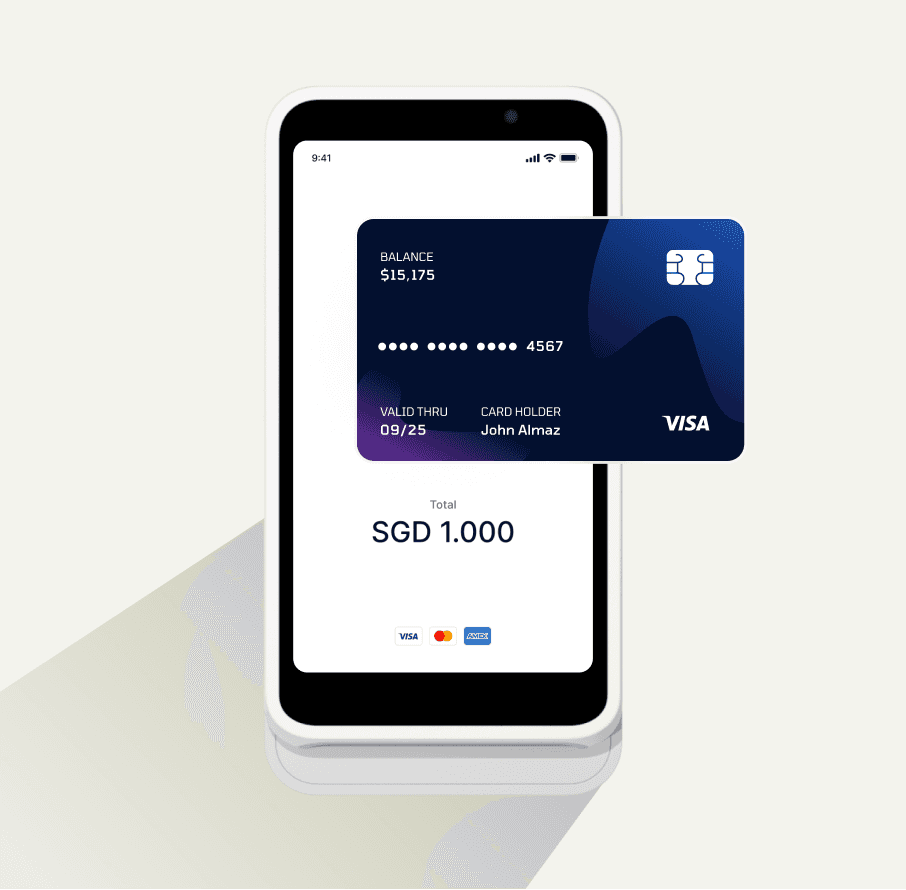

Take payments the way you want to

Accept all types of in-store payments with straightforward pricing. No set-up fees, only pay per transaction

Accept all types of in-store payments with straightforward pricing. No set-up fees, only pay per transaction

Accept all types of in-store payments with straightforward pricing. No set-up fees, only pay per transaction

Fast setup

Start selling within the week. Signing up is free and can be done in minutes.

Start selling within the week. Register your interest with HitPay and get your free account set up with ease.

Transparent pricing

No hidden fees -- ever. Purchase the terminal once, then only per transaction.

No hidden fees, Purchase the terminal once, then only per transaction.

Cross-channel syncing

Sync with other HitPay tools to streamline your business operations

Sync with other HitPay tools to streamline your business operations.

In-store payments designed to fit your needs

In-store payments designed to fit your needs

Quick and secure payments, all on one HitPay device.

Availability of features varies by market.

Availability of features varies by market.

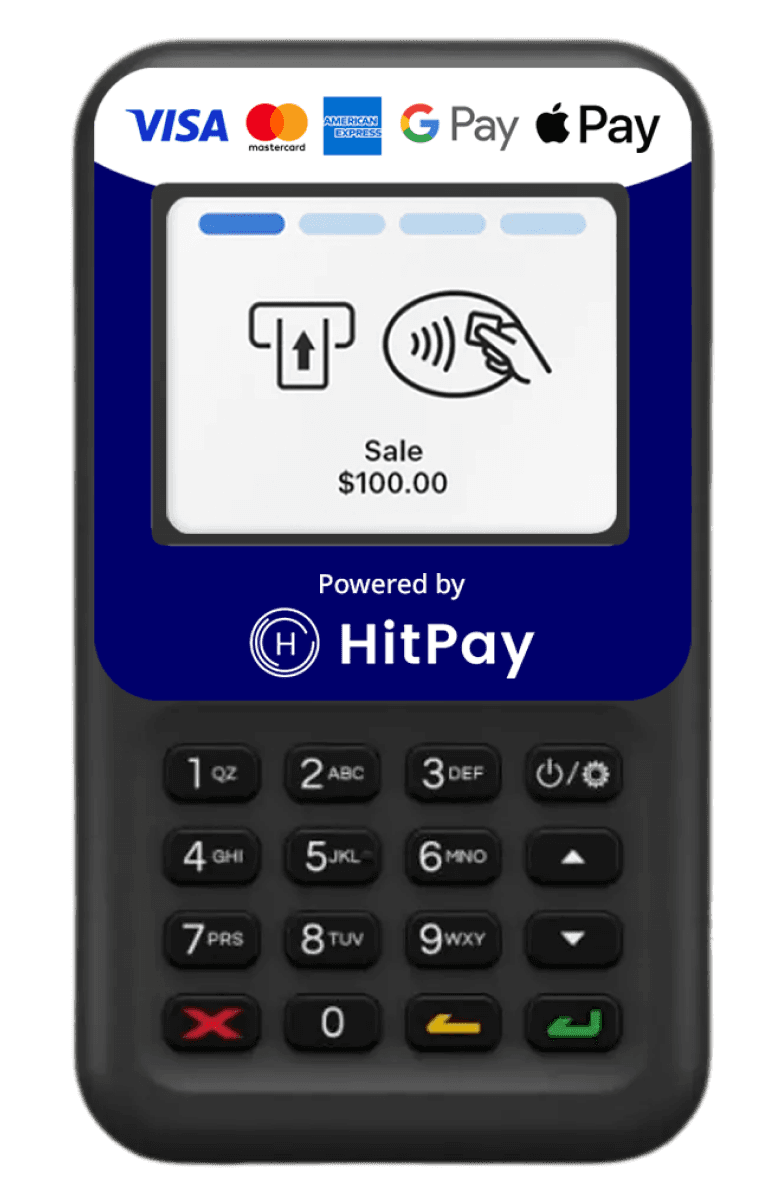

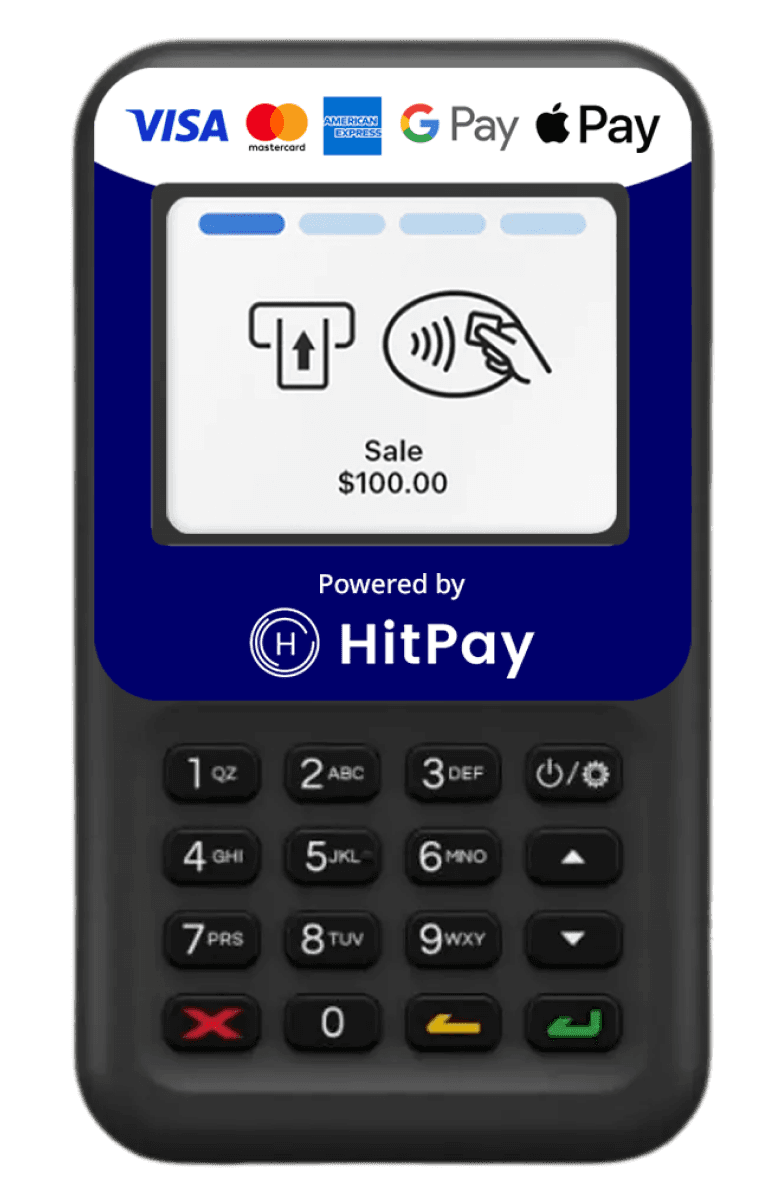

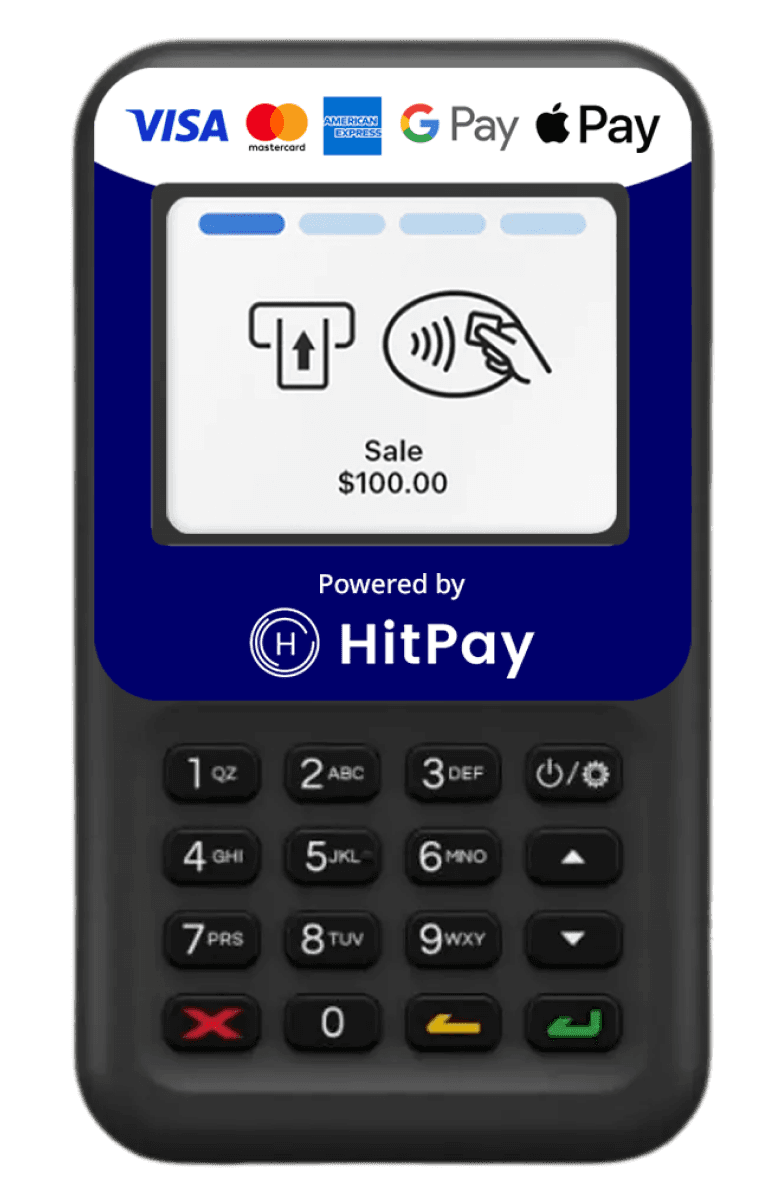

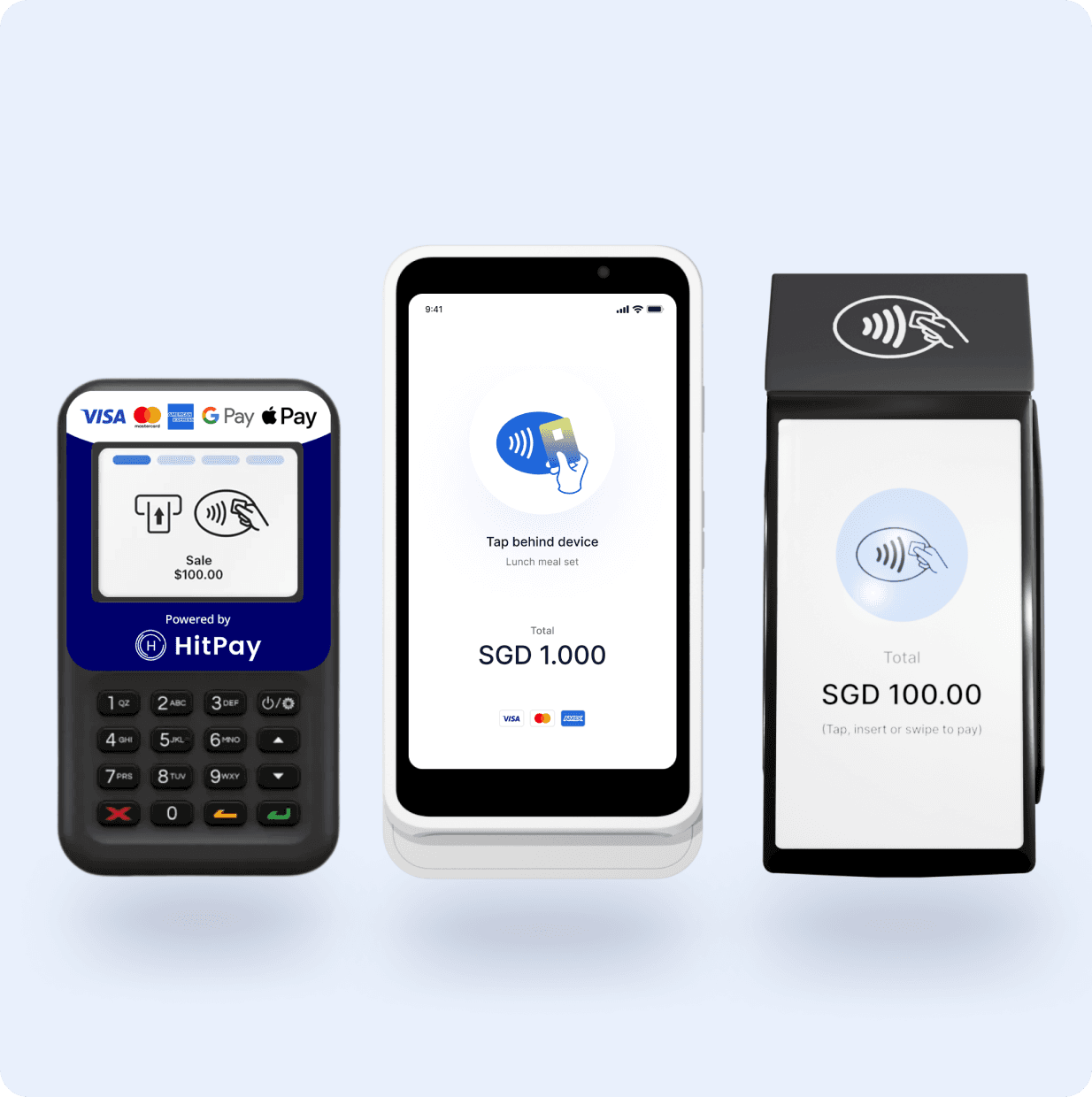

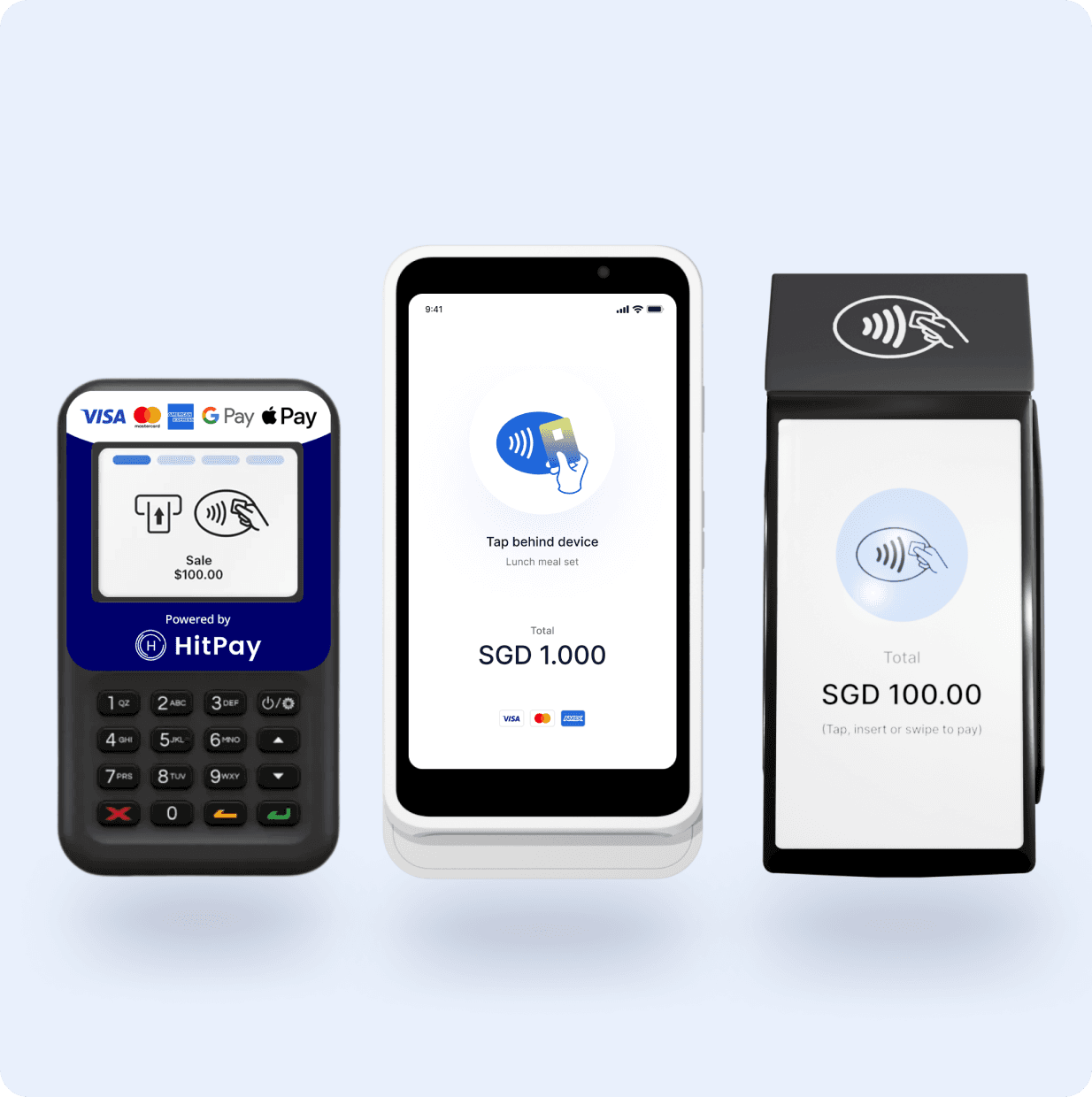

Card terminals

Collect payments on-the-go or in-store with card terminals built to match your business needs.

Countertop payments

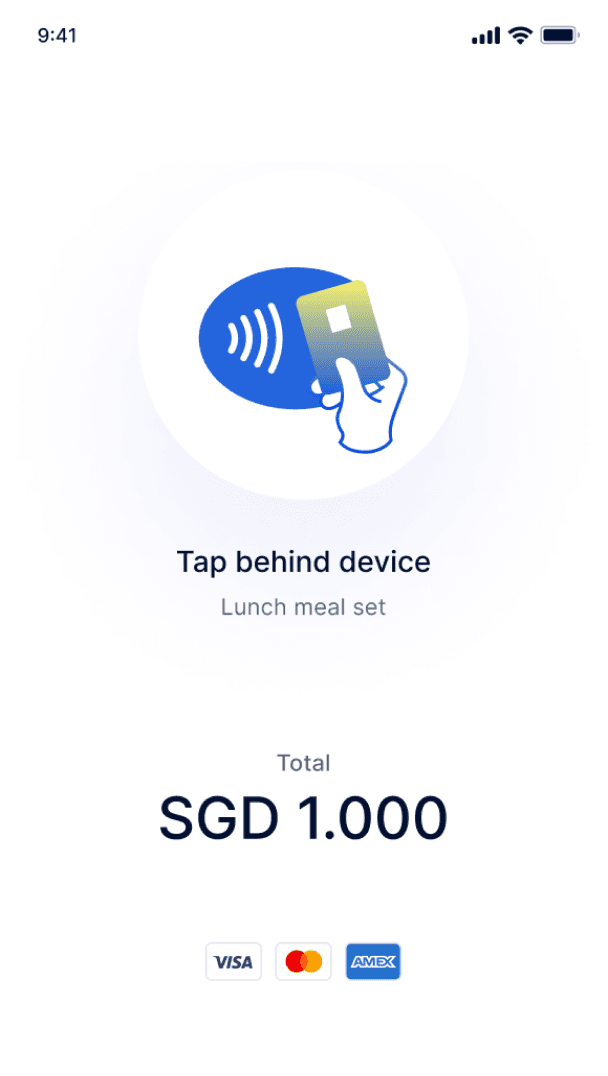

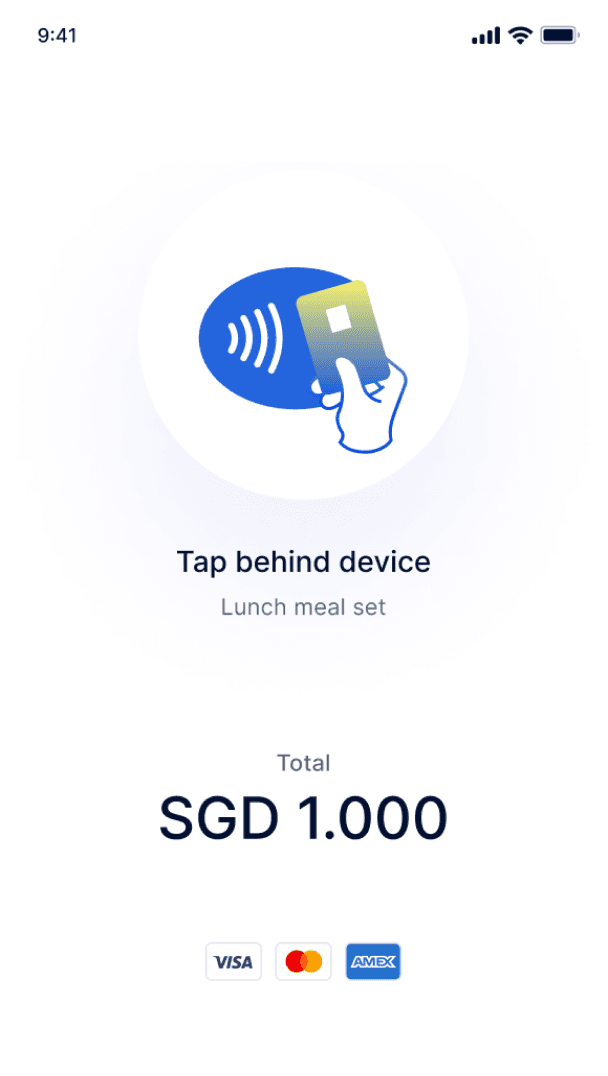

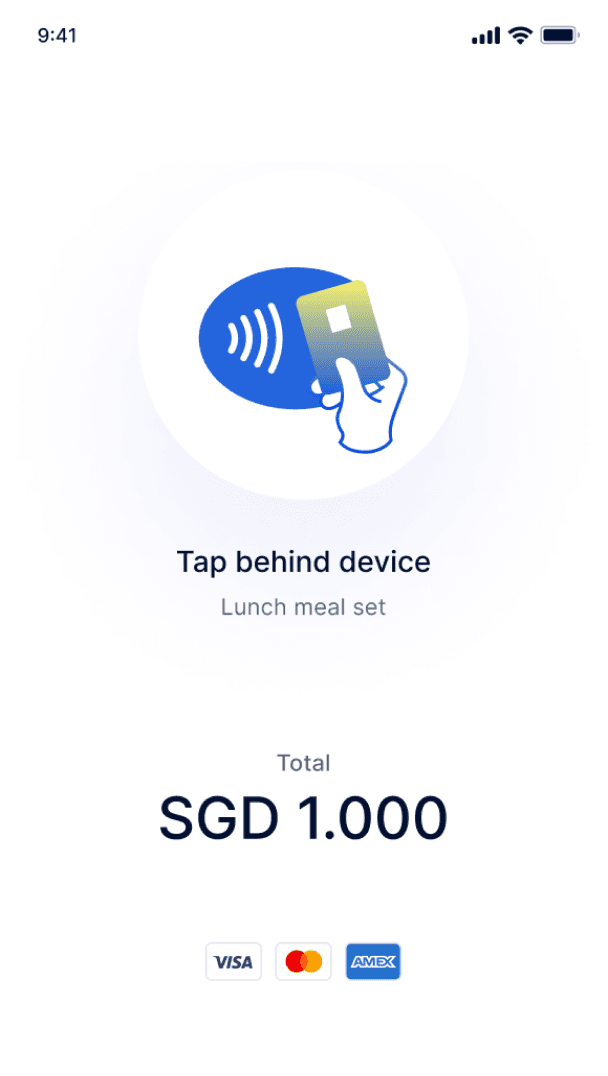

Tap to pay

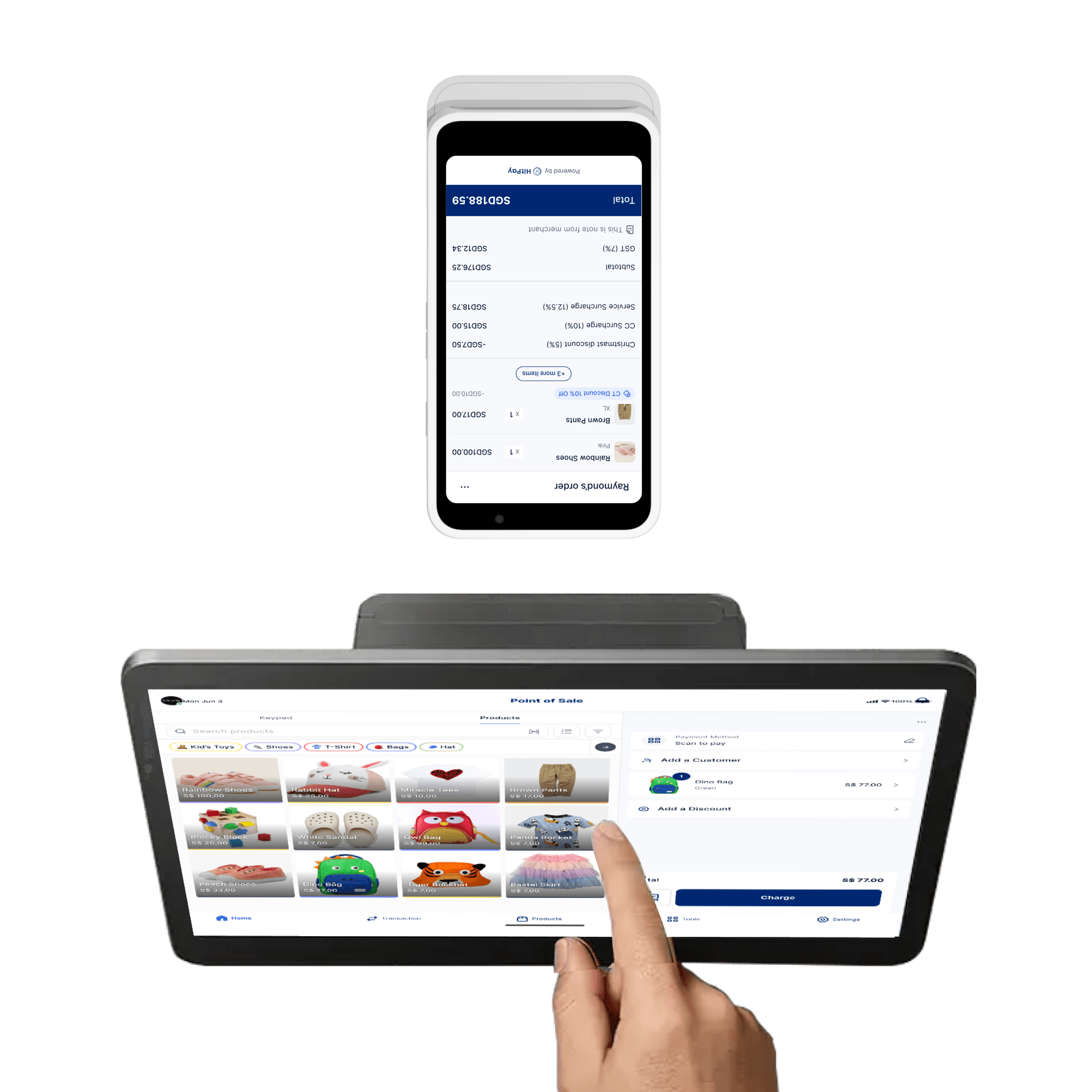

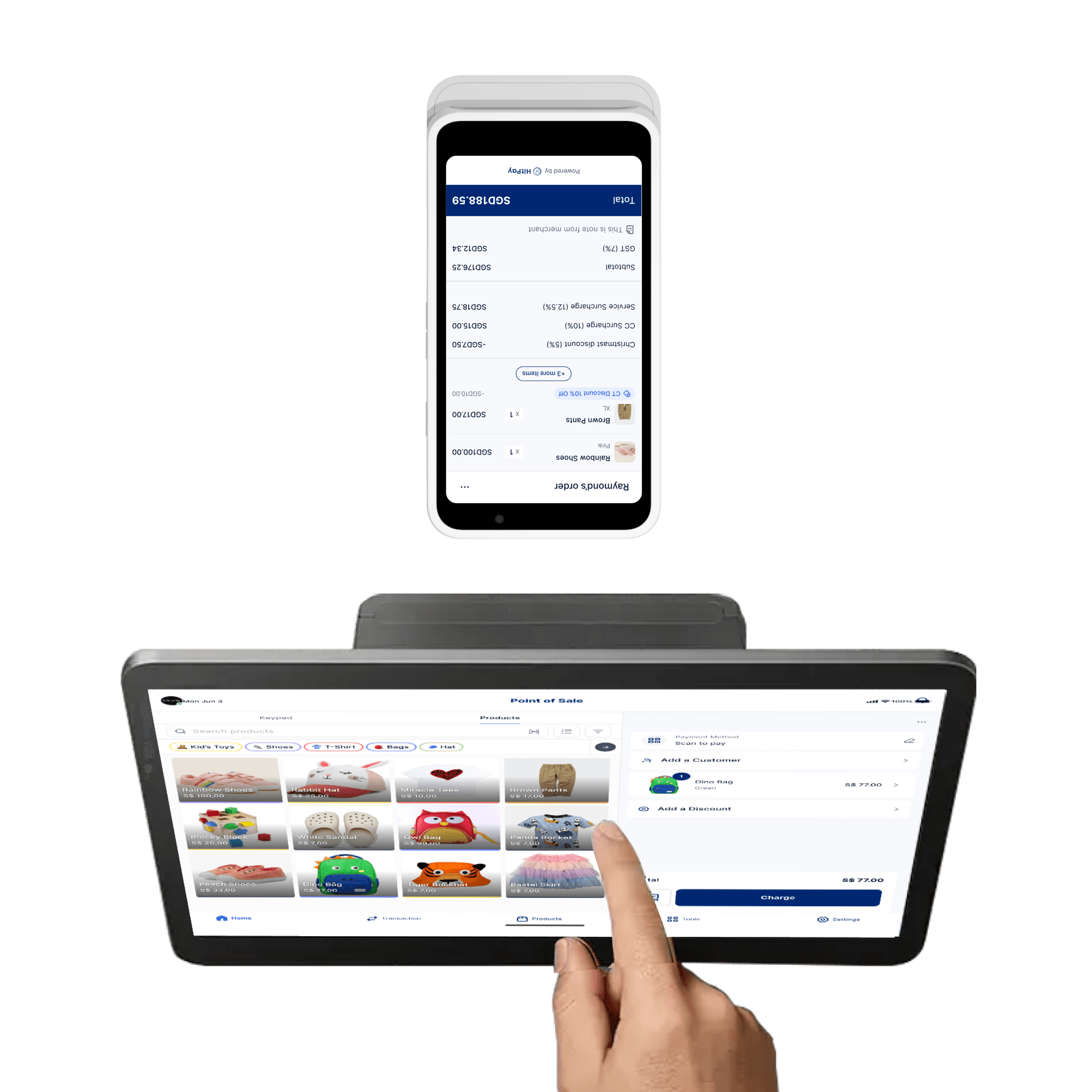

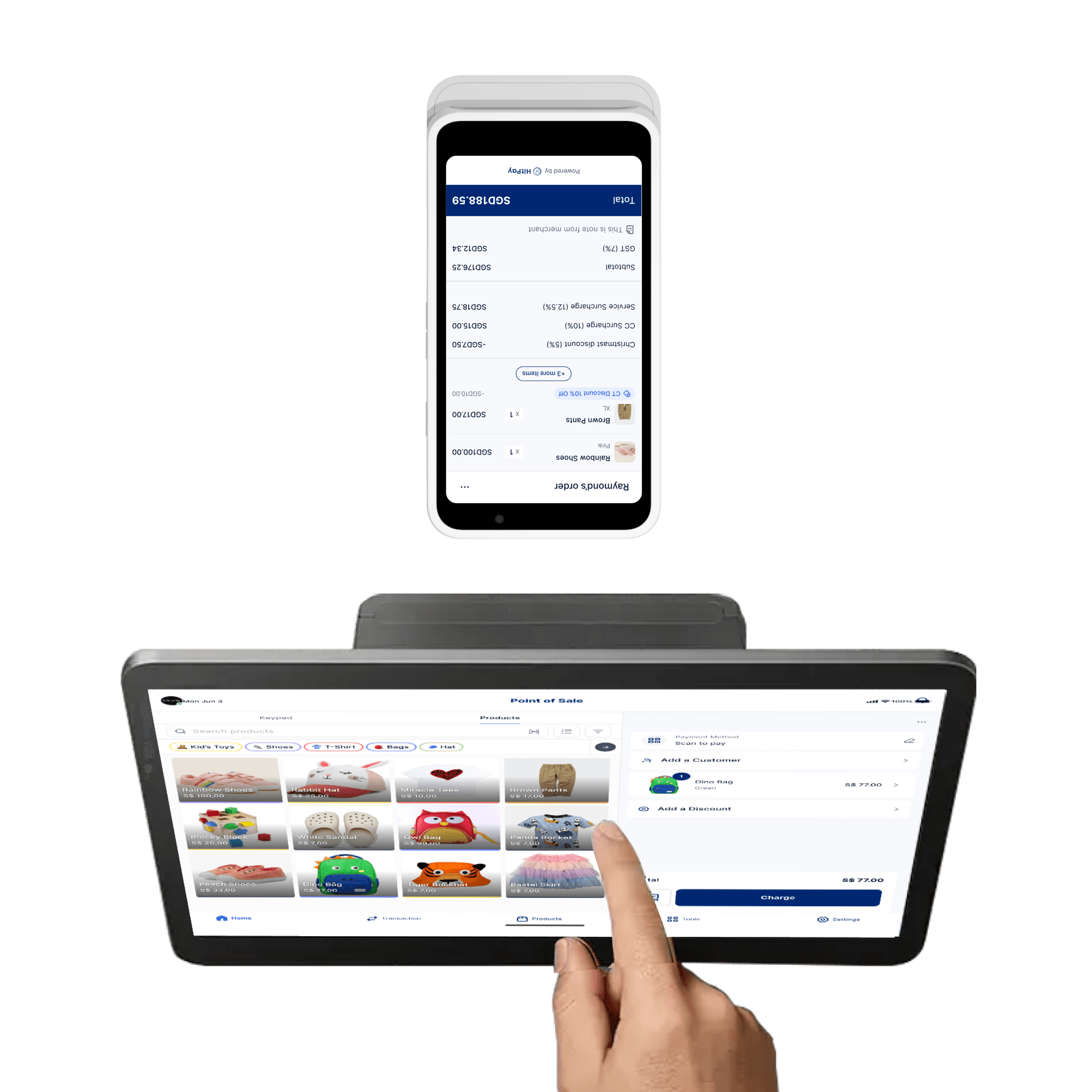

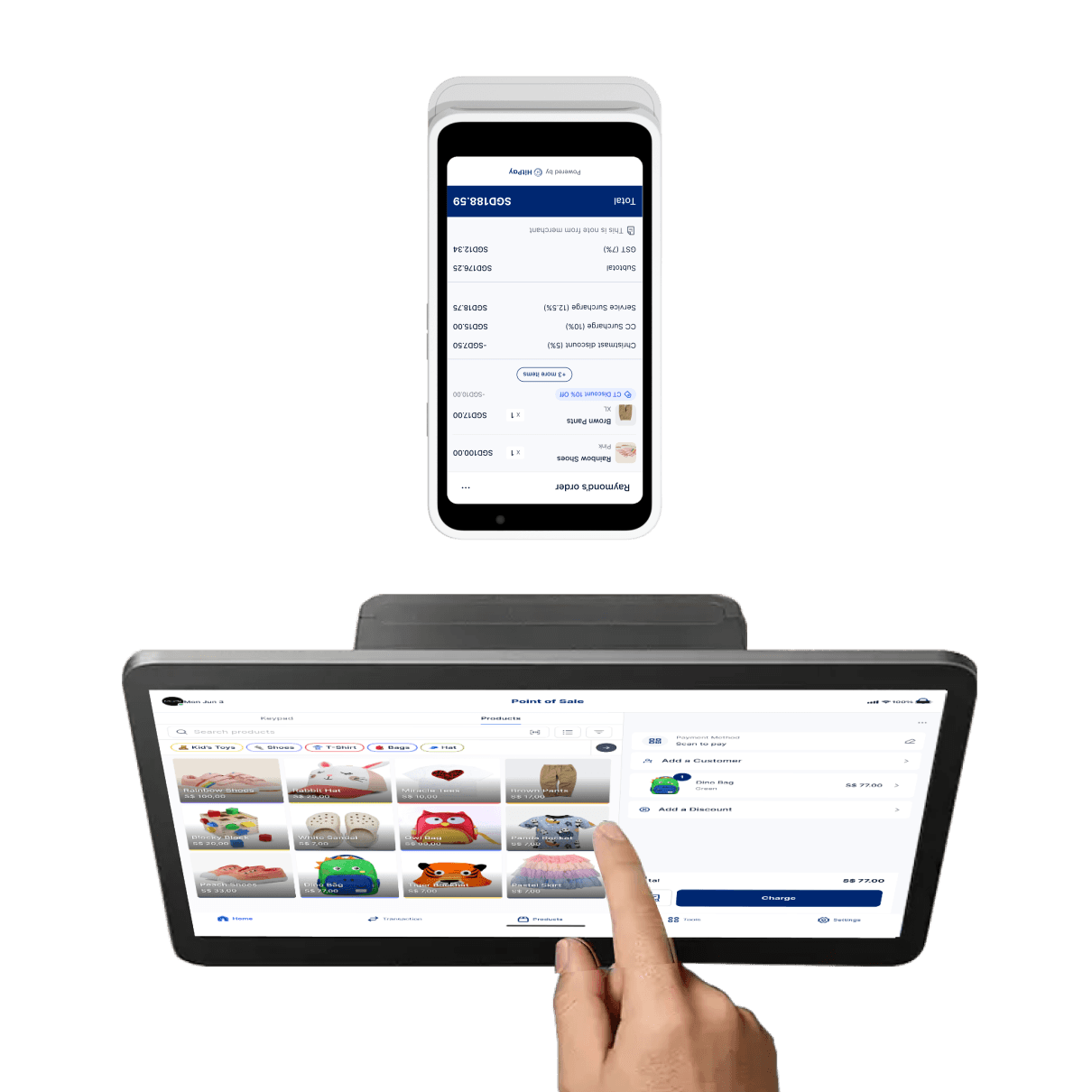

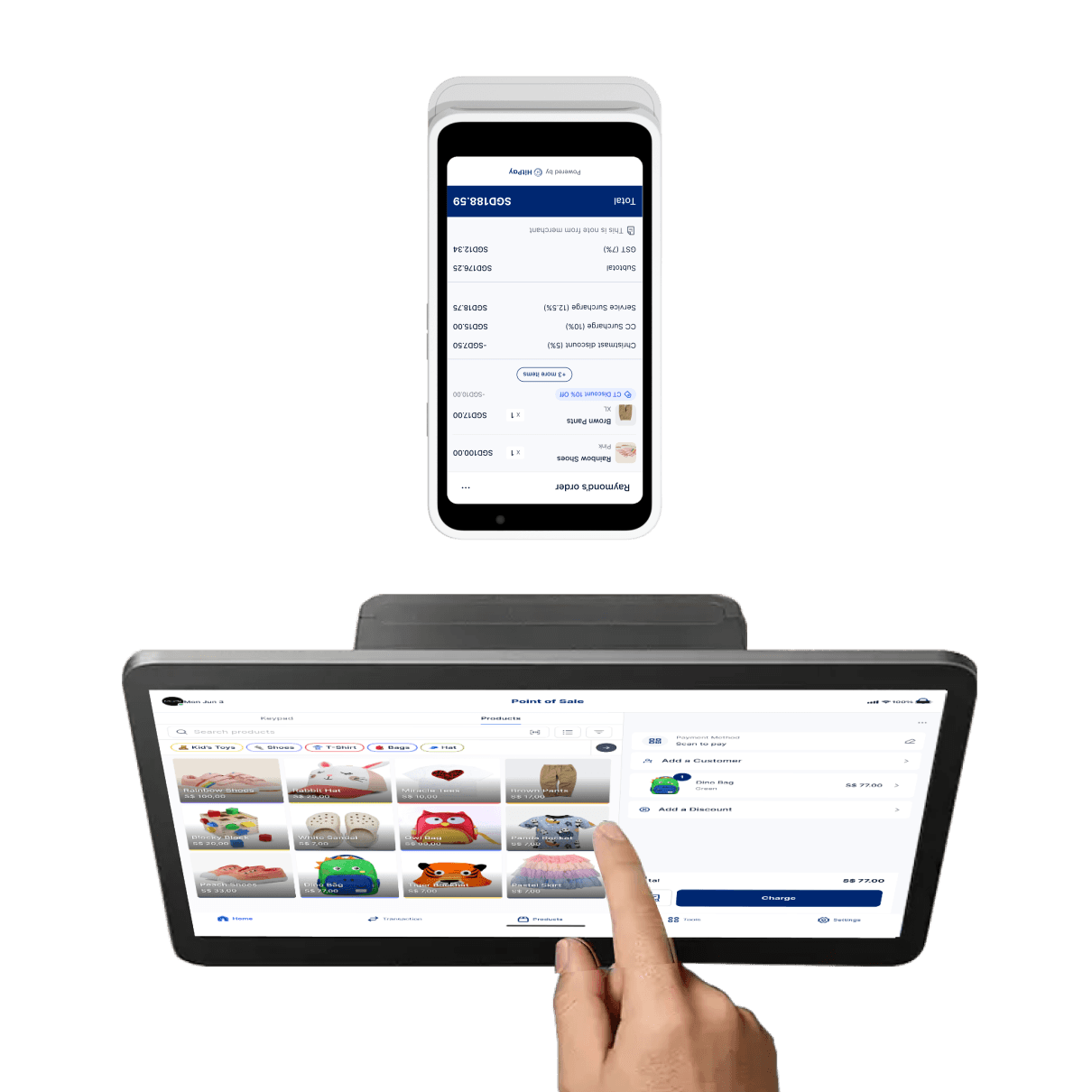

All-in-one POS solution

Card terminals

Collect payments on-the-go or in-store with card terminals built to match your business needs.

Countertop payments

Tap to pay

All-in-one POS solution

Card terminals

Collect payments on-the-go or in-store with card terminals built to match your business needs.

Countertop payments

Tap to pay

All-in-one POS solution

In-store payments designed

Quick and secure payments, all on one HitPay device.

Availability of features varies by market.

Availability of features varies by market.

Card terminals

Collect payments on-the-go or in-store with card terminals built to match your business needs.

Countertop payments

Optimize your in-store check-out experience with the HItPay App’s

Customer Display mode

Tap to Pay

Use the HItPay app to collect payments directly from your Android device.

All-in-one POS solution

The HitPay POS Max is the ultimate solution for your retail store, restaurant, or service business. Accept card and QR payments with an in-built receipt printer and barcode reader. Comes with comprehensive POS software capabilities including product, CRM, and location management.

HitPay Terminals

Singapore

Not sure which device fits your business the best? Take the quiz below to get a recommendation.

Tap to pay (android)

Price

No additional hardware needed

Connection

Built in NFC

Card usage options

Tap and Pay & Paywave

QR code payments

Yes, on device

Supported modes

Stand alone: Use without pairing with another device.

In-Built Receipt

Printer?

-

In Built Barcode

Reader?

-

Price

SGD 30

SGD 85

SGD 350

Connection

Wifi and Cellular (SIM card needs to be purchased separately)

Bluetooth, pairs with mobile device for internet access

Wifi and Cellular (comes with a free SIM card)

Card usage options

-

Tap and Pay & PayWave

Insert card

Tap and Pay & PayWave

QR code payments

Supports Static QR

Supported when paired with mobile app

Supported when paired with mobile app

Supported modes

Stand alone: Use without pairing with another device.

Requires connection with HitPay mobile app

-

In-Built Receipt

Printer?

No. Does not support receipt printing.

No. Can be paired externally with HitPay Bluetooth Printers.

No. Can be paired externally with HitPay Bluetooth Printers.

In Built Barcode

Reader?

No.

No.

No.

Price

SGD 490

SGD 550

SGD 700

Connection

Wifi

Wifi and Cellular (free SIM card)

Wifi and Cellular (SIM card needs to be purchased separately)

Card usage options

Tap and Pay & PayWave

Insert card

Swipe card

Tap and Pay & PayWave

Insert card

Swipe card

Tap and Pay & PayWave

QR code payments

Yes, on device (Unless triggered via In-Person Payments APIs)

Yes, on device

Yes, on device

Supported modes

Stand alone: Use without pairing with another device.

Customer Display: Pair the terminal with another device for customer-facing use.

Desktop: Pair with computer on a web browser

Stand alone: Use without pairing with another device

Customer Display: Pair the terminal with another device for customer-facing use.

Desktop: Pair with computer on a web browser (HitPay's Web Point-of-Sale)

Mobile: Pair with HitPay mobile app (iOS/Android)

API Integration: Integrate via our In-person APIs to make charges and print receipts

Stand alone: Use without pairing with another device.

In-Built Receipt

Printer?

No. Can be paired with the HitPay WiFi Printer.

Yes. Can also be paired with HitPay Wifi/Bluetooth printers

Yes.

In Built Barcode

Reader?

Yes via built-in camera, but not ideal for high-volume retail checkouts.

No.

Yes with Infrared Barcode Scanning.

Have questions? Contact us.

HitPay Terminals

Singapore

Not sure which device fits your business the best? Take the quiz below to get a recommendation.

Tap to pay (android)

Price

No additional hardware needed

Connection

Built in NFC

Card usage options

Tap and Pay & Paywave

QR code payments

Yes, on device

Supported modes

Stand alone: Use without pairing with another device.

In-Built Receipt

Printer?

-

In Built Barcode

Reader?

-

Price

SGD 30

SGD 85

SGD 350

Connection

Wifi and Cellular (SIM card needs to be purchased separately)

Bluetooth, pairs with mobile device for internet access

Wifi and Cellular (comes with a free SIM card)

Card usage options

-

Tap and Pay & PayWave

Insert card

Tap and Pay & PayWave

QR code payments

Supports Static QR

Supported when paired with mobile app

Supported when paired with mobile app

Supported modes

Stand alone: Use without pairing with another device.

Requires connection with HitPay mobile app

-

In-Built Receipt

Printer?

No. Does not support receipt printing.

No. Can be paired externally with HitPay Bluetooth Printers.

No. Can be paired externally with HitPay Bluetooth Printers.

In Built Barcode

Reader?

No.

No.

No.

Price

SGD 490

SGD 550

SGD 700

Connection

Wifi

Wifi and Cellular (free SIM card)

Wifi and Cellular (SIM card needs to be purchased separately)

Card usage options

Tap and Pay & PayWave

Insert card

Swipe card

Tap and Pay & PayWave

Insert card

Swipe card

Tap and Pay & PayWave

QR code payments

Yes, on device (Unless triggered via In-Person Payments APIs)

Yes, on device

Yes, on device

Supported modes

Stand alone: Use without pairing with another device.

Customer Display: Pair the terminal with another device for customer-facing use.

Desktop: Pair with computer on a web browser

Stand alone: Use without pairing with another device

Customer Display: Pair the terminal with another device for customer-facing use.

Desktop: Pair with computer on a web browser (HitPay's Web Point-of-Sale)

Mobile: Pair with HitPay mobile app (iOS/Android)

API Integration: Integrate via our In-person APIs to make charges and print receipts

Stand alone: Use without pairing with another device.

In-Built Receipt

Printer?

No. Can be paired with the HitPay WiFi Printer.

Yes. Can also be paired with HitPay Wifi/Bluetooth printers

Yes.

In Built Barcode

Reader?

Yes via built-in camera, but not ideal for high-volume retail checkouts.

No.

Yes with Infrared Barcode Scanning.

Have questions? Contact us.

HitPay Terminals

Not sure which device fits your business the best? Take the quiz below to get a recommendation.

Transparent, upfront pricing with no surprises

Transparent, upfront pricing with no surprises

No hidden fees here. Skip any rental and subscription fees -- only pay when you make a sale.

No hidden fees here. HitPay card terminals have no rental and no subscription fees — only pay when you make a sale.

Singapore

Domestic cards

2.3%

(min fee S$0.20)

F&B merchants

2.5%

(min fee S$0.20)

Other industries

International cards

3.2%

(min fee S$0.20)

Singapore

Domestic cards

2.3%

(min fee S$0.20)

F&B merchants

2.5%

(min fee S$0.20)

Other industries

International cards

3.2%

(min fee S$0.20)

Singapore

Domestic cards

2.3%

(min fee S$0.20)

F&B merchants

2.5%

(min fee S$0.20)

Other industries

International cards

3.2%

(min fee S$0.20)

Transparent, upfront pricing with no surprises

No hidden fees here. Skip any rental and subscription fees -- only pay when you make a sale.

Singapore

Domestic cards

2.3%

(min fee S$0.20)

F&B merchants

2.5%

(min fee S$0.20)

Other industries

International cards

3.2%

(min fee S$0.20)

Singapore

Domestic cards

2.3%

(min fee S$0.20)

F&B merchants

2.5%

(min fee S$0.20)

Other industries

International cards

3.2%

(min fee S$0.20)

Integrated hardware tailored

to your business needs

Integrated hardware tailored to your business needs

Integrated hardware tailored

to your business needs

From barcode scanners to receipt printers, our versatile hardware solutions help you streamline business operations and optimize your in-store checkout experience.

Boost efficiency and revenue with powerful tools. Manage inventory, track sales, analyze data, and enhance customer relationships seamlessly.

Availability of features varies by market.

Availability of features varies by market.

Availability of features varies by market.

Swift and secure transactions

Enjoy secure, error-free payments with our sleek and secure payment terminals.

Swift and secure transactions

Enjoy secure, error-free payments with our sleek and secure payment terminals.

Swift and secure transactions

Enjoy secure, error-free payments with our sleek and secure payment terminals.

Swift and secure transactions

Enjoy secure, error-free payments with our sleek and secure payment terminals.

Efficient order fulfillment

Streamline order processing with integrated printers for quick, accurate fulfillment and delivery.

Efficient order fulfillment

Streamline order processing with integrated printers for quick, accurate fulfillment and delivery.

Efficient order fulfillment

Streamline order processing with integrated printers for quick, accurate fulfillment and delivery.

Efficient order fulfillment

Streamline order processing with integrated printers for quick, accurate fulfillment and delivery.

Streamlined checkout experience

Speed up checkout with barcode scanners for swift, accurate product identification.

Streamlined checkout experience

Speed up checkout with barcode scanners for swift, accurate product identification.

Streamlined checkout experience

Speed up checkout with barcode scanners for swift, accurate product identification.

Streamlined checkout experience

Speed up checkout with barcode scanners for swift, accurate product identification.

Transparent real-time purchase information

Transparent transactions with customer-facing screens showing real-time purchase details.

Transparent real-time purchase information

Transparent transactions with customer-facing screens showing real-time purchase details.

Transparent real-time purchase information

Transparent transactions with customer-facing screens showing real-time purchase details.

Transparent real-time purchase information

Transparent transactions with customer-facing screens showing real-time purchase details.

Frequently Asked Questions

Frequently Asked Questions

How can I order a HitPay terminal from the dashboard?

You can Order a HitPay terminal from the dashboard by navigating to Point of Sale > Terminals.

What are the payment methods supported by HitPay Terminal?

HitPay’s credit card terminals support Visa, Mastercard, and American Express cards. In addition, mobile wallets such as Apple Pay, Google Pay, Samsung Pay, and Fitbit Pay are also supported on HitPay Terminal. HitPay’s WisePOS E terminal can also generate PayNow QR codes in Singapore, as well as Scan-to-Pay QR codes — which customers can scan using their mobile device to be redirected to a checkout page, where they can access all other payment methods available on your HitPay account.

What currencies can I charge in using HitPay Terminal?

The terminal is only able to accept payments in your default home currency. This means that if for example, you are a Singapore-registered merchant, the terminal will only work in SGD. Likewise, MYR will work for Malaysia-registered merchants. If you wish to charge in foreign currencies, you can log in to the HitPay app and use the manual Key in Card details from the payment options to accept in-person payments in over 30 global currencies

Is there a warranty for Card Readers?

HitPay offers a one-year warranty on our credit card terminals from the purchase date. If it's faulty and you return it as directed within a year, we may fix, replace, or refund you. This warranty only covers proper use and undamaged items and is non-transferable. For warranty issues, contact us with the device's serial number and problem description at support@hit-pay.com.

Which countries are HitPay terminals available?

HitPay terminals are currently available in Australia, Hong Kong, Malaysia, New Zealand, Philippines, and Singapore.

How can I order a HitPay terminal from the dashboard?

You can Order a HitPay terminal from the dashboard by navigating to Point of Sale > Terminals.

What are the payment methods supported by HitPay Terminal?

HitPay’s credit card terminals support Visa, Mastercard, and American Express cards. In addition, mobile wallets such as Apple Pay, Google Pay, Samsung Pay, and Fitbit Pay are also supported on HitPay Terminal. HitPay’s WisePOS E terminal can also generate PayNow QR codes in Singapore, as well as Scan-to-Pay QR codes — which customers can scan using their mobile device to be redirected to a checkout page, where they can access all other payment methods available on your HitPay account.

What currencies can I charge in using HitPay Terminal?

The terminal is only able to accept payments in your default home currency. This means that if for example, you are a Singapore-registered merchant, the terminal will only work in SGD. Likewise, MYR will work for Malaysia-registered merchants. If you wish to charge in foreign currencies, you can log in to the HitPay app and use the manual Key in Card details from the payment options to accept in-person payments in over 30 global currencies

Is there a warranty for Card Readers?

HitPay offers a one-year warranty on our credit card terminals from the purchase date. If it's faulty and you return it as directed within a year, we may fix, replace, or refund you. This warranty only covers proper use and undamaged items and is non-transferable. For warranty issues, contact us with the device's serial number and problem description at support@hit-pay.com.

Which countries are HitPay terminals available?

HitPay terminals are currently available in Australia, Hong Kong, Malaysia, New Zealand, Philippines, and Singapore.

How can I order a HitPay terminal from the dashboard?

You can Order a HitPay terminal from the dashboard by navigating to Point of Sale > Terminals.

What are the payment methods supported by HitPay Terminal?

HitPay’s credit card terminals support Visa, Mastercard, and American Express cards. In addition, mobile wallets such as Apple Pay, Google Pay, Samsung Pay, and Fitbit Pay are also supported on HitPay Terminal. HitPay’s WisePOS E terminal can also generate PayNow QR codes in Singapore, as well as Scan-to-Pay QR codes — which customers can scan using their mobile device to be redirected to a checkout page, where they can access all other payment methods available on your HitPay account.

What currencies can I charge in using HitPay Terminal?

The terminal is only able to accept payments in your default home currency. This means that if for example, you are a Singapore-registered merchant, the terminal will only work in SGD. Likewise, MYR will work for Malaysia-registered merchants. If you wish to charge in foreign currencies, you can log in to the HitPay app and use the manual Key in Card details from the payment options to accept in-person payments in over 30 global currencies

Is there a warranty for Card Readers?

HitPay offers a one-year warranty on our credit card terminals from the purchase date. If it's faulty and you return it as directed within a year, we may fix, replace, or refund you. This warranty only covers proper use and undamaged items and is non-transferable. For warranty issues, contact us with the device's serial number and problem description at support@hit-pay.com.

Which countries are HitPay terminals available?

HitPay terminals are currently available in Australia, Hong Kong, Malaysia, New Zealand, Philippines, and Singapore.

Still have questions?

Contact our team.

Still have questions?

Contact our team.

Still have questions?

Contact our team.

Let's get you set up

Create an account instantly or contact us to create a custom package for your business.

business software

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapore 089109

Let's get you set up

Create an account instantly or contact us to create a custom package for your business.

business software

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapore 089109

Let's get you set up

Create an account instantly or contact us to create a custom package for your business.

business software

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapore 089109

Let's get you set up

Create an account instantly or contact us to create a custom package for your business.

business software

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapore 089109