Products

->

Online Payments

Products

->

Online Payments

Products

->

Online Payments

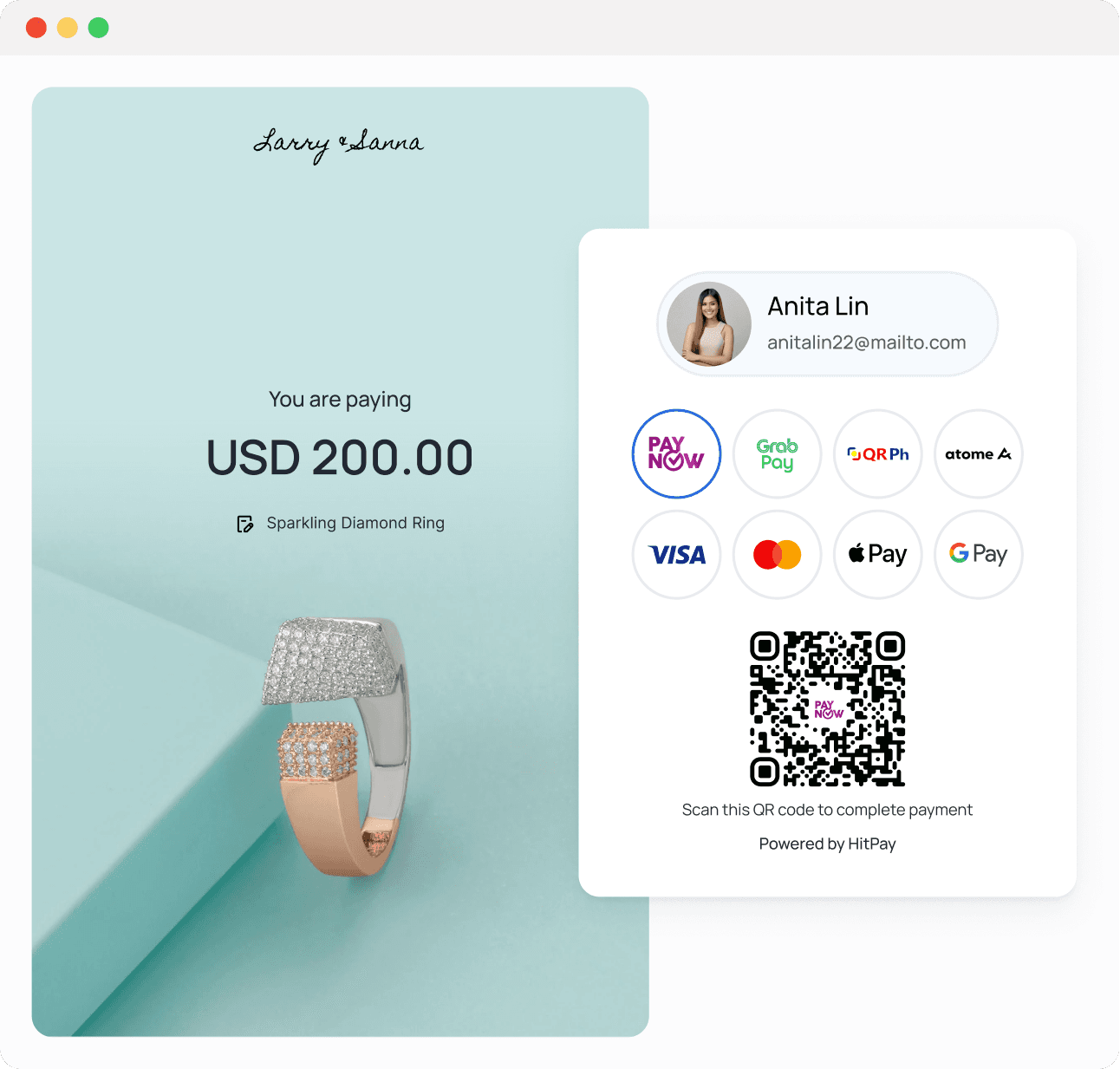

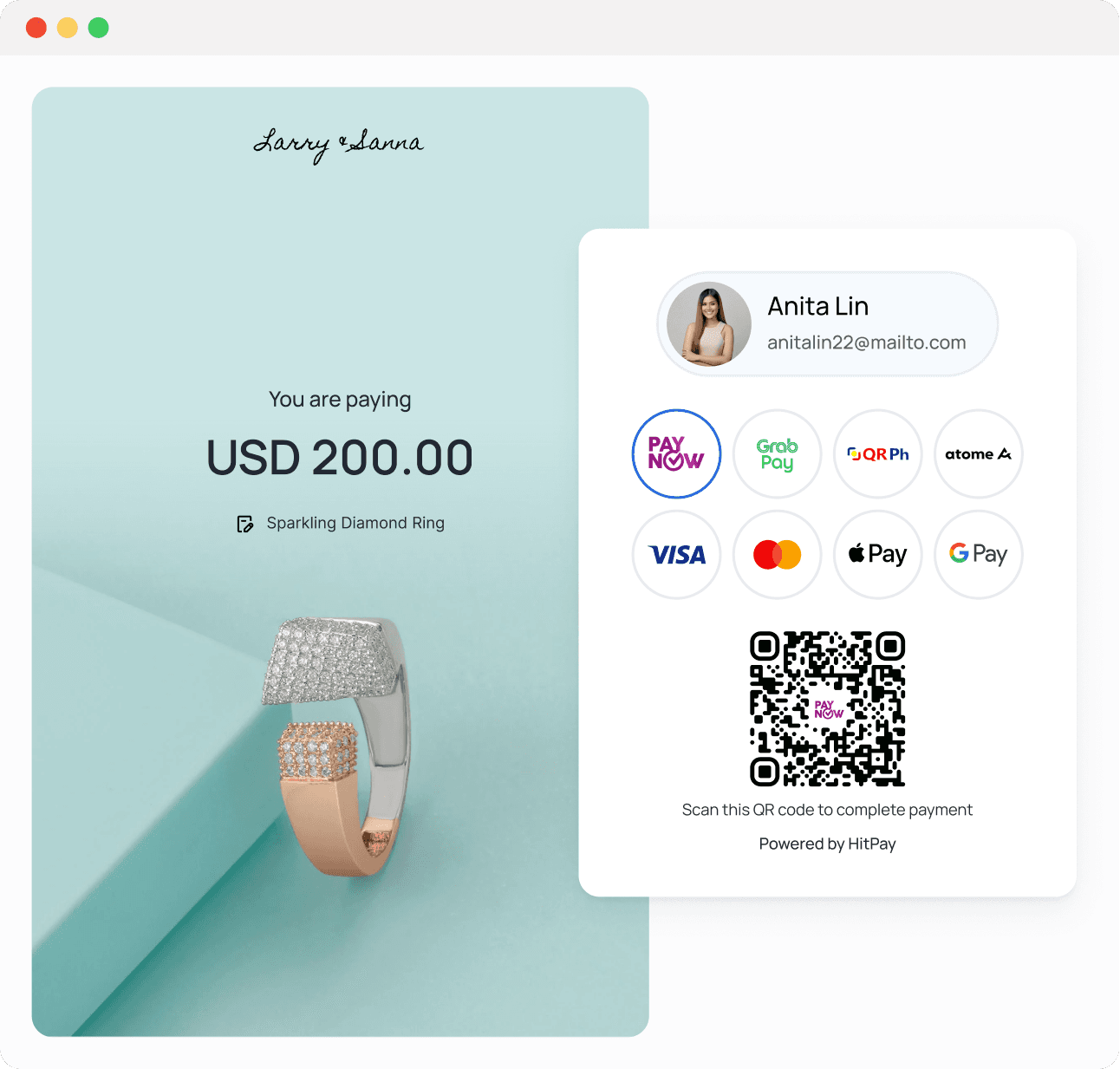

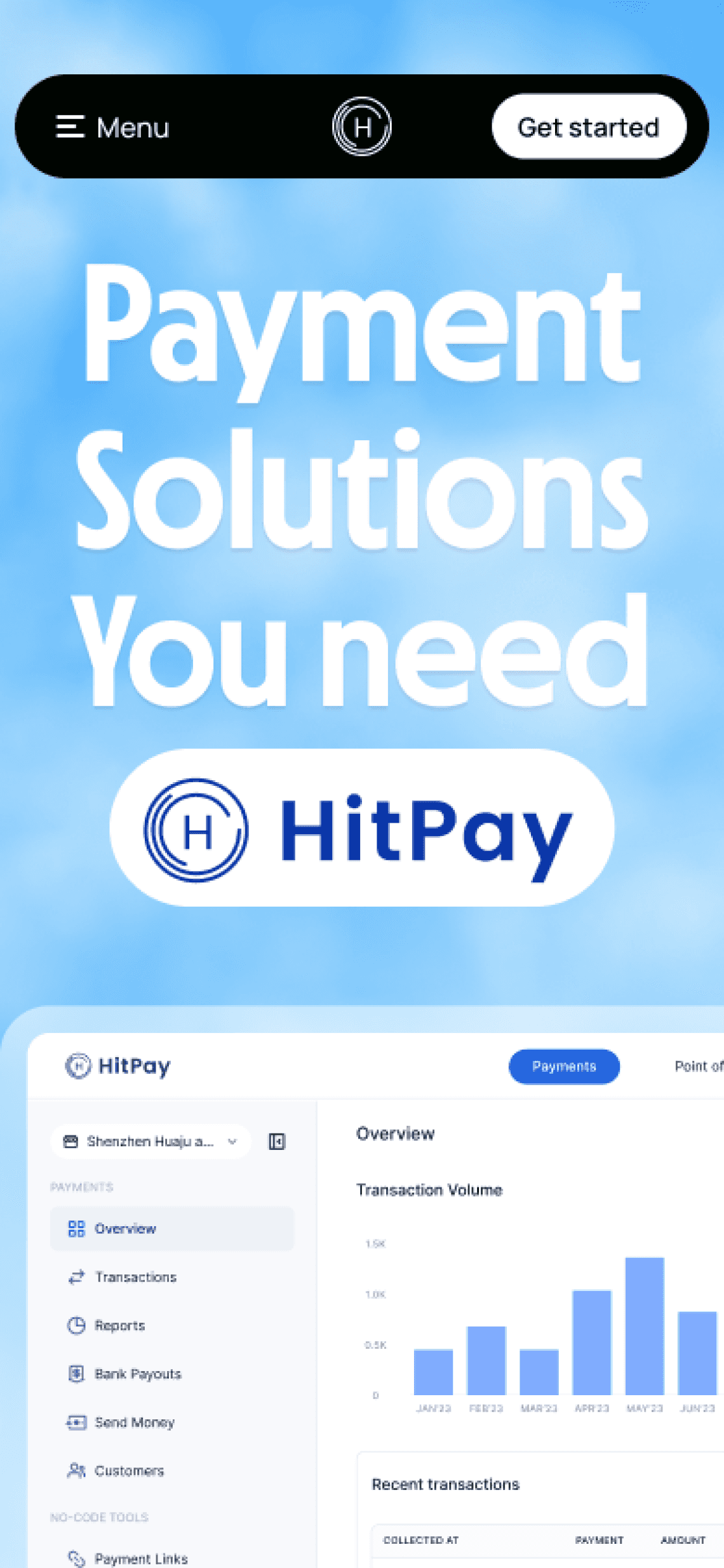

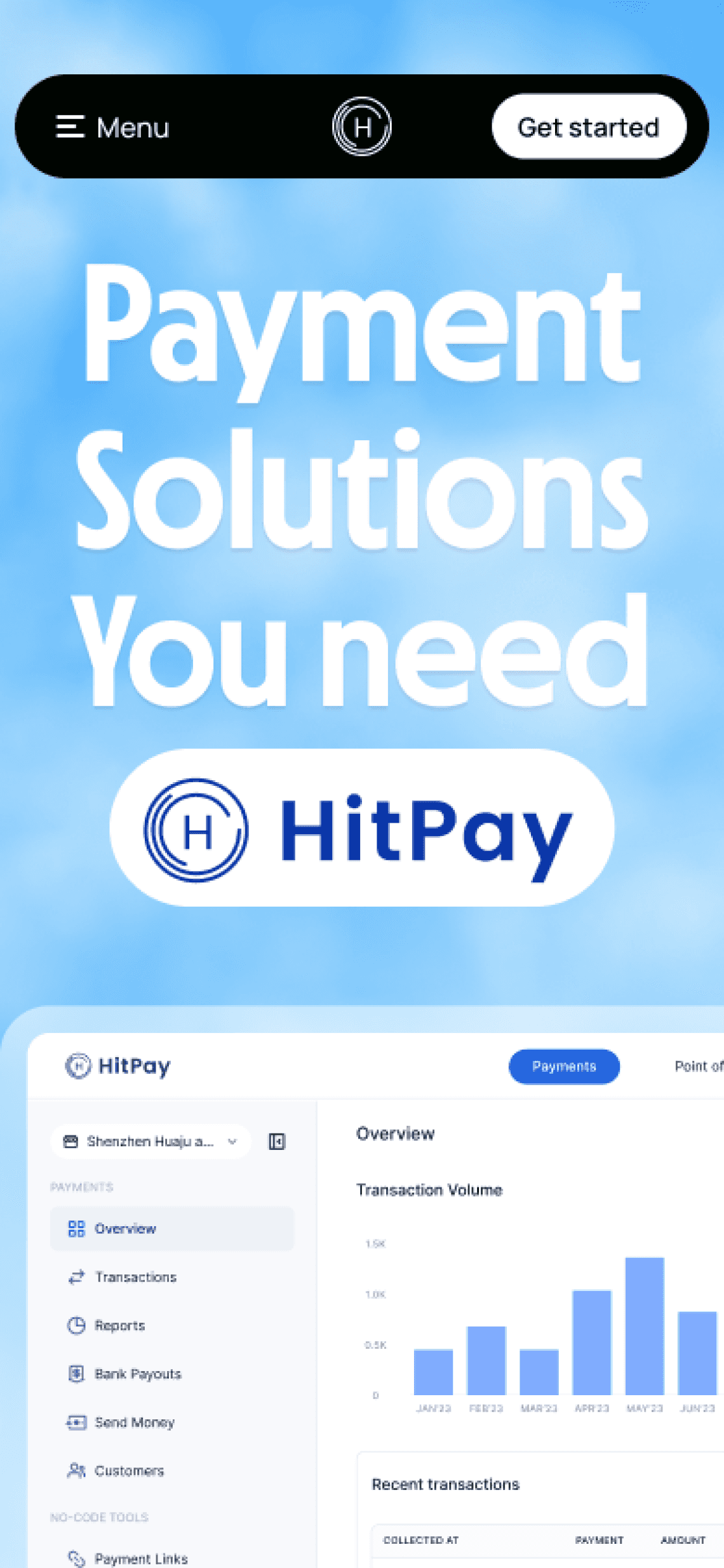

Seamless payments, every time

Seamless payments, every time

Seamless payments, every time

Tap into HitPay’s extensive local and global payment coverage. Accept payments through over 50 payment methods and more than 150 currencies - all in one platform.

Tap into HitPay’s extensive local and global payment coverage. Accept payments through over 50 payment methods and more than 150 currencies - all in one platform.

Tap into HitPay’s extensive local and global payment coverage. Accept payments through over 50 payment methods and more than 150 currencies - all in one platform.

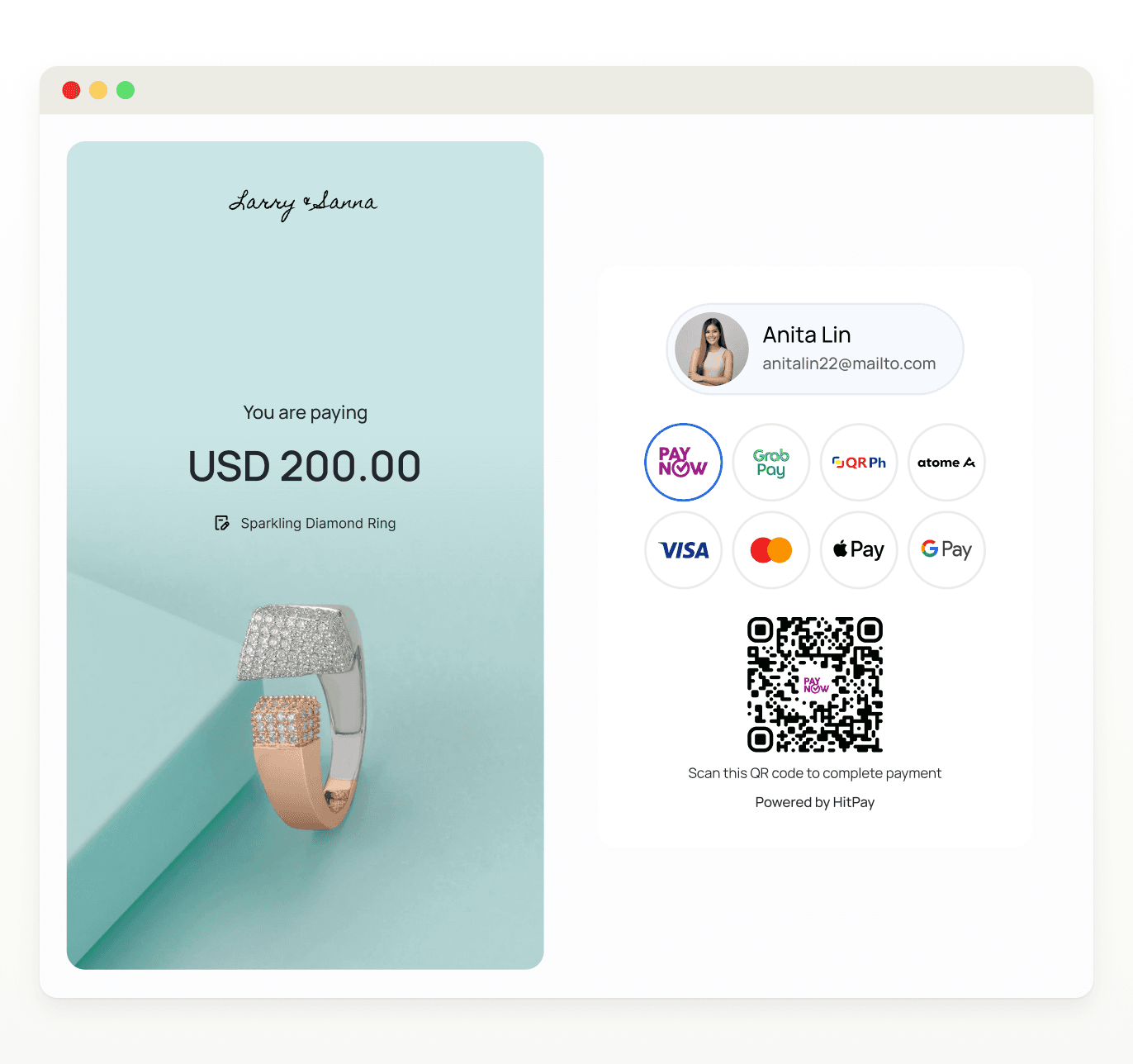

You are paying

USD 200.00

Sparkling Diamond Ring

Anita Lin

anitalin22@mailto.com

Scan this QR code to complete payment

Powered by HitPay

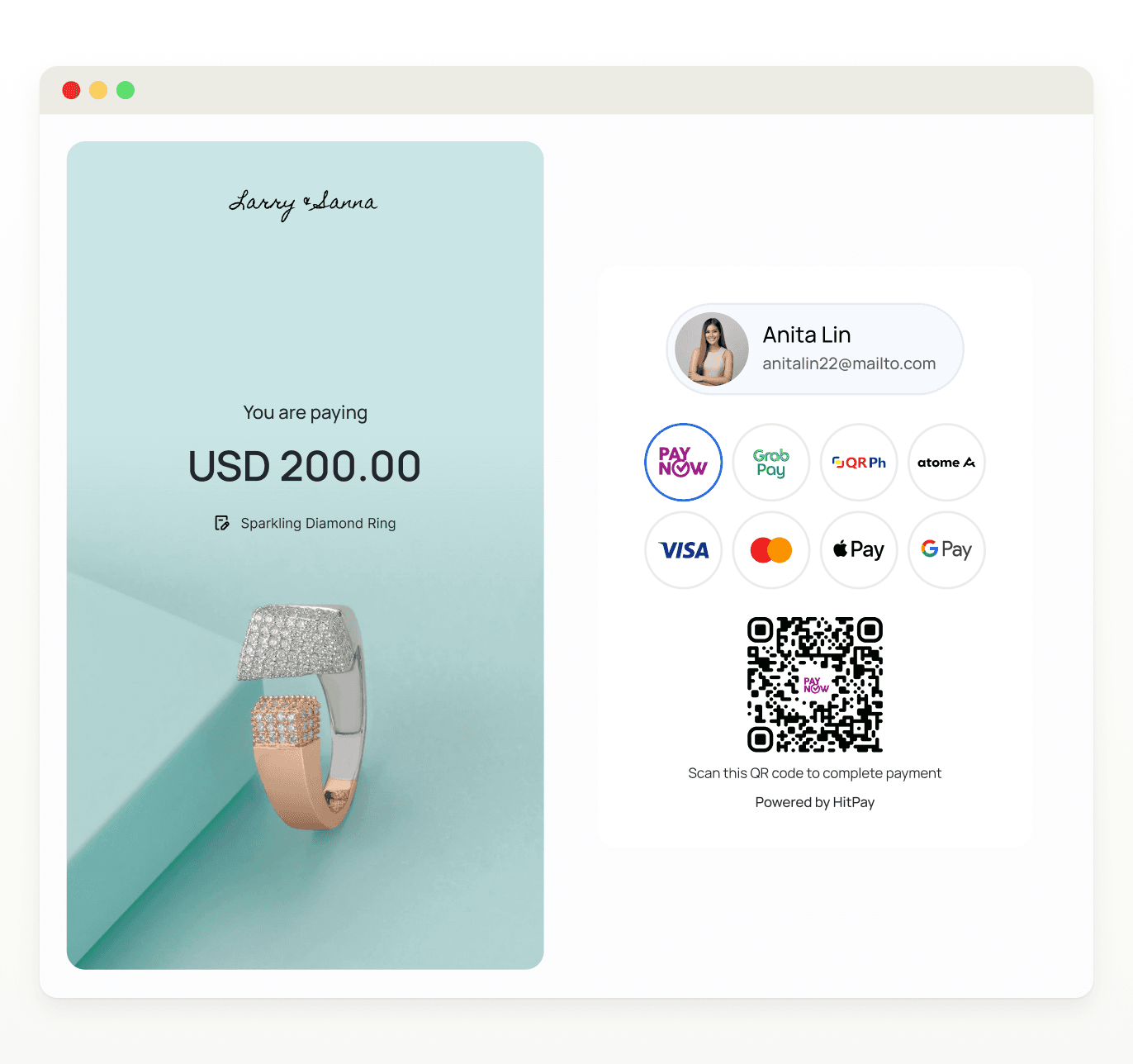

You are paying

USD 200.00

Sparkling Diamond Ring

Anita Lin

anitalin22@mailto.com

Scan this QR code to complete payment

Powered by HitPay

Accept payments the way your customers prefer

Accept payments the way your customers prefer

Accept payments the way your customers prefer

From cards and e-wallets to mobile wallets, BNPL, and QR codes, our payment gateway lets you offer the payment methods your customers trust. All with one connection.

Accept credit cards, local e-wallets, bank transfers, online payments, and over-the-counter payments with a simple API integration.

Accept credit cards, local e-wallets, bank transfers, online payments, and over-the-counter payments with a simple API integration.

Expand to new markets easily

Expand to new markets easily

Sell cross-border effortlessly with low transaction fees and competitive exchange rates. Enhance your global reach by offering your customers' preferred payment methods to boost conversions internationally.

Sell cross-border effortlessly with low transaction fees and competitive exchange rates. Enhance your global reach by offering your customers' preferred payment methods to boost conversions internationally.

Expand to new markets easily

Sell cross-border effortlessly with low transaction fees and competitive exchange rates. Enhance your global reach by offering your customers' preferred payment methods to boost conversions internationally.

Singapore

Indonesia

Malaysia

Vietnam

Philipines

Thailand

India

China

Australia

Rest of the world

You are paying

$S 120.50

Anita Lin

Tiong Bahru, SG

Scan this QR code to complete payment

Singapore

Indonesia

Malaysia

Vietnam

Philipines

Thailand

India

China

Australia

Rest of the world

You are paying

$S 120.50

Anita Lin

Tiong Bahru, SG

Scan this QR code to complete payment

Take payments your way

Access a wide range of popular payment methods with no coding required. Accept payments online, in-person or on the go.

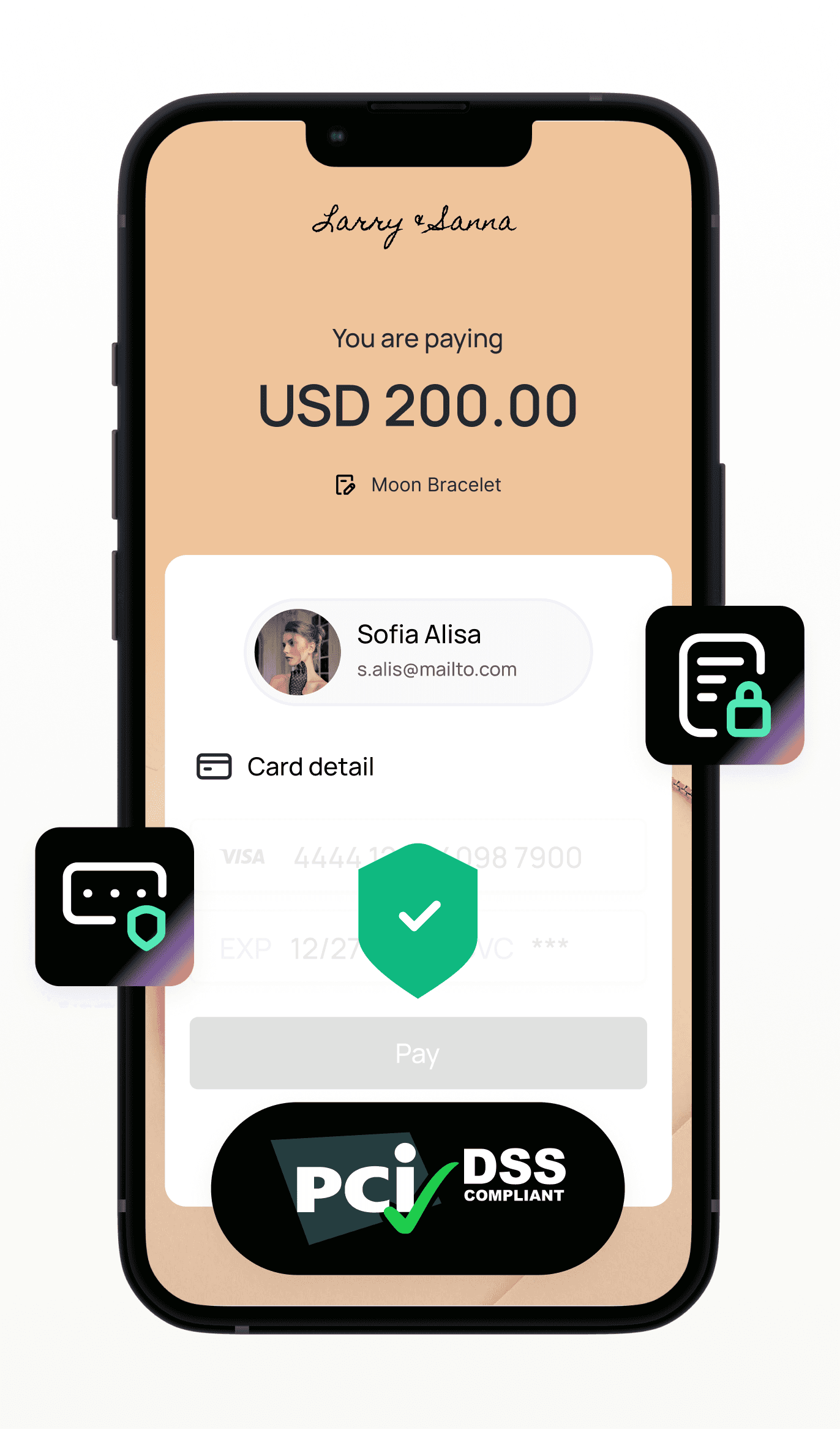

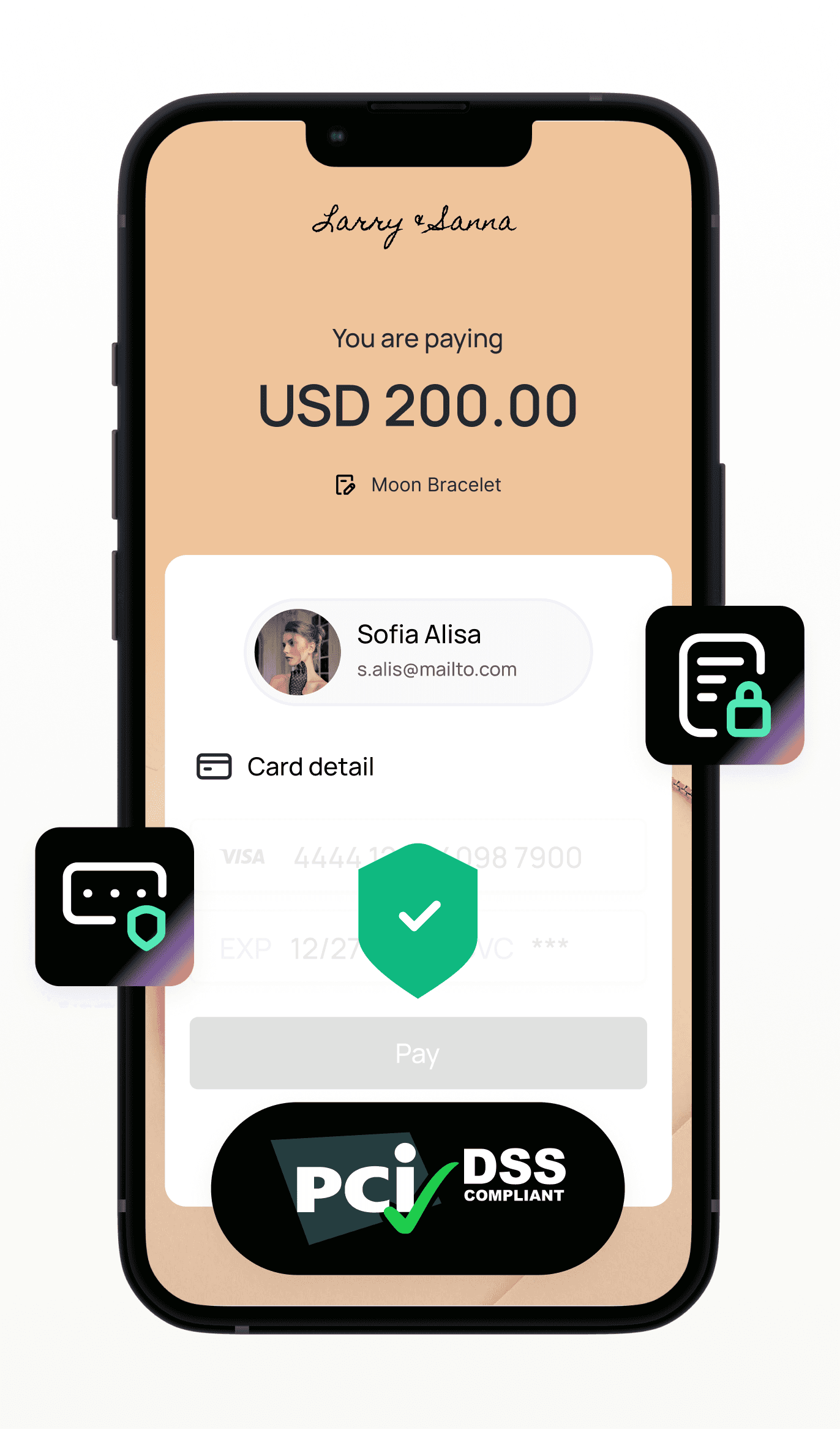

Personalized checkout

Make HitPay’s checkout truly yours. Customize payment methods, checkout rules, and design elements effortlessly to match your brand.

Mobile-first experience

Don’t let mobile slow you down. HitPay’s optimized checkout ensures a seamless experience on any device, driving higher conversion rates for your business.

Secure and compliant

Leave the security to us. With PCI DSS compliance and advanced encryption, your customers' data is protected, so you can focus on growing your business.

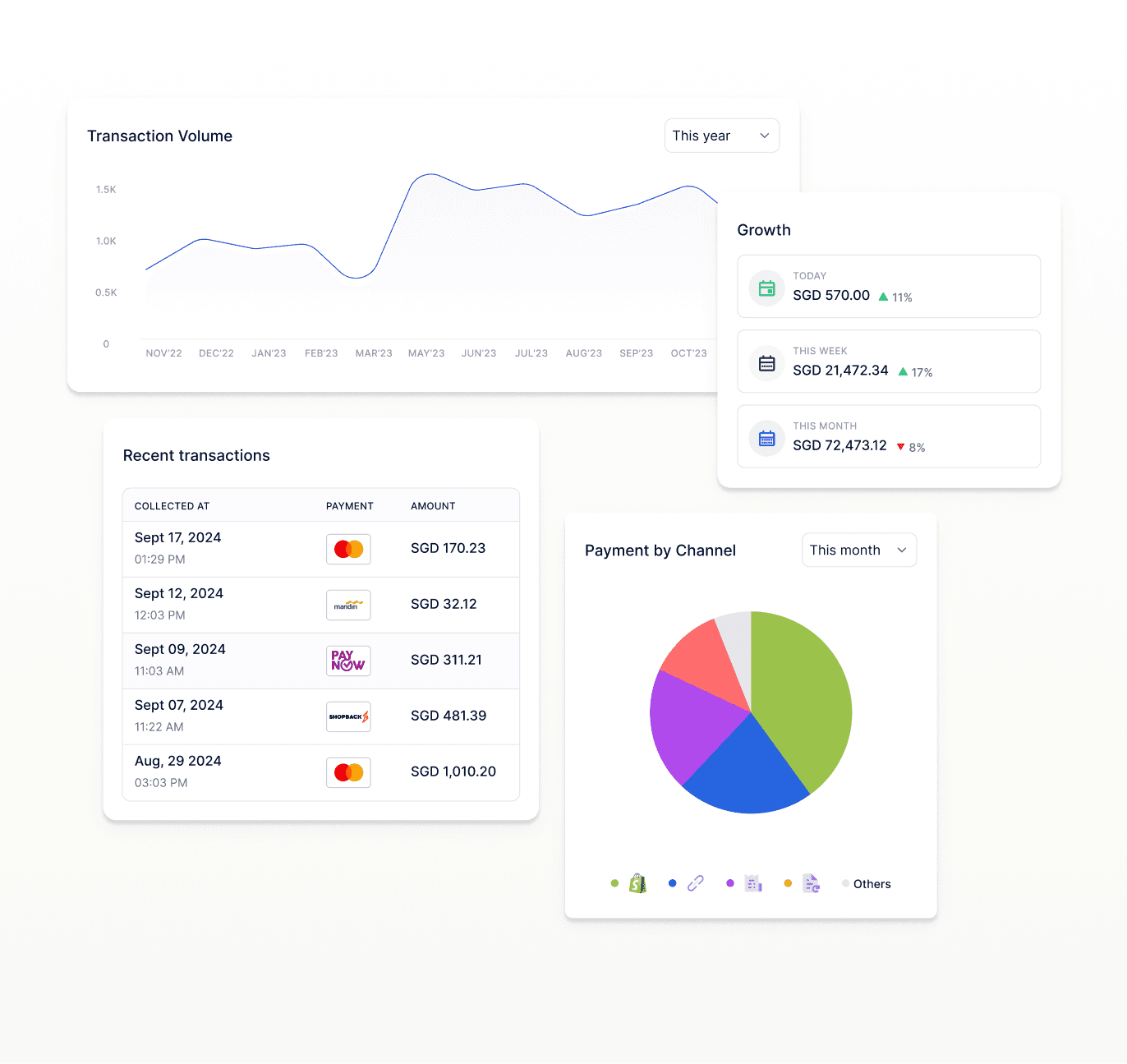

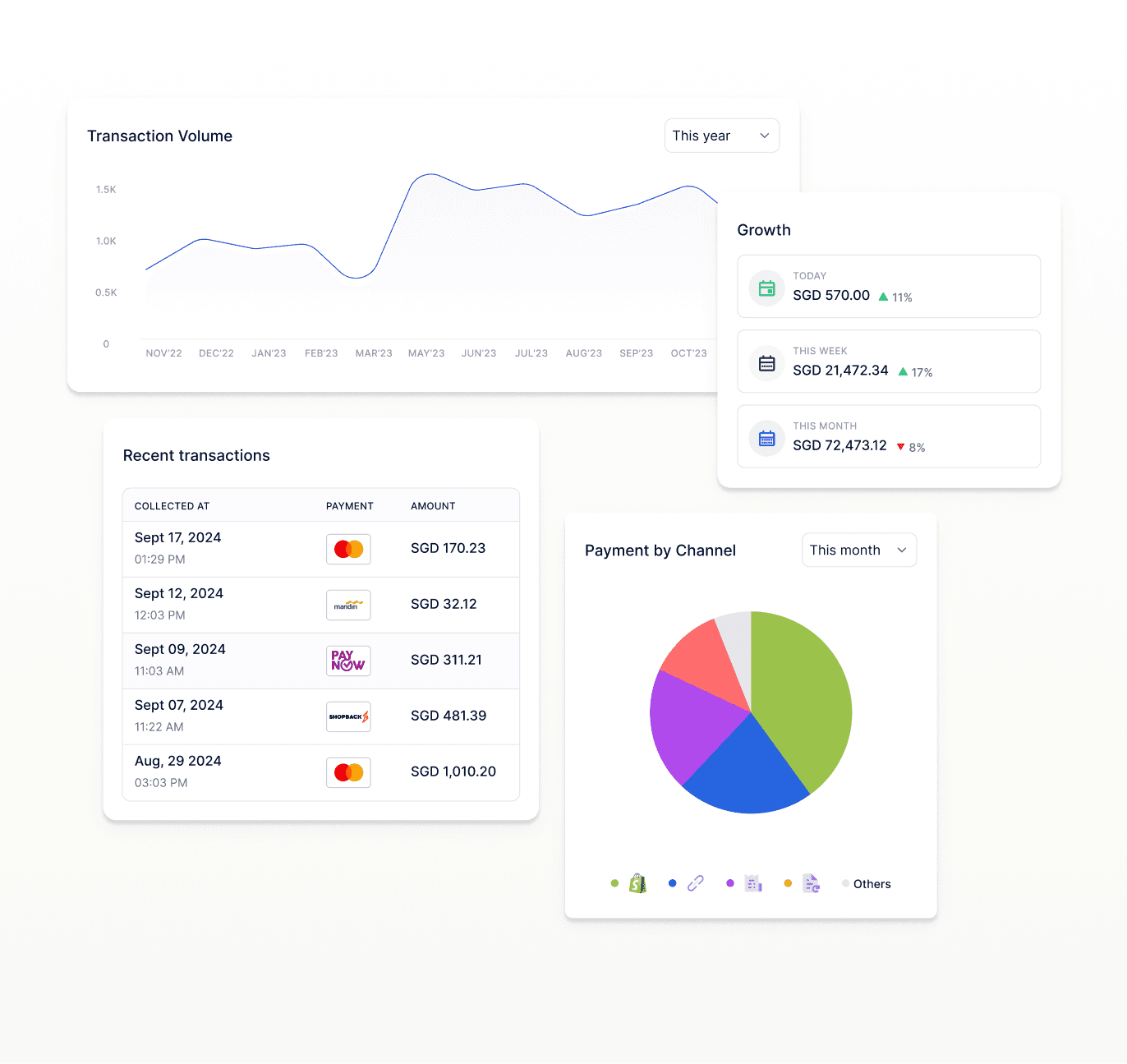

Insights on demand

Get the data you need without the complexity. Our all-in-one platform provides real-time reporting and analytics, giving you real-time insights into your transactions.

Take payments your way

Take payments your way

Access a wide range of popular payment methods with no coding required. Accept payments online, in-person or on the go.

Access a wide range of popular payment methods with no coding required. Accept payments online, in-person or on the go.

Personalized checkout

Make HitPay’s checkout truly yours. Customize payment methods, checkout rules, and design elements effortlessly to match your brand.

Mobile-first experience

Don’t let mobile slow you down. HitPay’s optimized checkout ensures a seamless experience on any device, driving higher conversion rates for your business.

Secure and compliant

Leave the security to us. With PCI DSS compliance and advanced encryption, your customers' data is protected, so you can focus on growing your business.

Insights on demand

Get the data you need without the complexity. Our all-in-one platform provides real-time reporting and analytics, giving you real-time insights into your transactions.

You are paying

USD 200.00

Sparkling Diamond Ring

Anita Lin

anitalin22@mailto.com

Scan this QR code to complete payment

Powered by HitPay

Aqua

Night

Sunrise

Personalized checkout

Make HitPay’s checkout truly yours. Customize payment methods, checkout rules, and design elements effortlessly to match your brand.

Mobile-first experience

Don’t let mobile slow you down. HitPay’s optimized checkout ensures a seamless experience on any device, driving higher conversion rates for your business.

Secure and compliant

Leave the security to us. With PCI DSS compliance and advanced encryption, your customers' data is protected, so you can focus on growing your business.

Insights on demand

Get the data you need without the complexity. Our all-in-one platform provides real-time reporting and analytics, giving you real-time insights into your transactions.

You are paying

USD 200.00

Sparkling Diamond Ring

Anita Lin

anitalin22@mailto.com

Scan this QR code to complete payment

Powered by HitPay

Aqua

Night

Sunrise

Personalized checkout

Make HitPay’s checkout truly yours. Customize payment methods, checkout rules, and design elements effortlessly to match your brand.

Mobile-first experience

Don’t let mobile slow you down. HitPay’s optimized checkout ensures a seamless experience on any device, driving higher conversion rates for your business.

Secure and compliant

Leave the security to us. With PCI DSS compliance and advanced encryption, your customers' data is protected, so you can focus on growing your business.

Insights on demand

Get the data you need without the complexity. Our all-in-one platform provides real-time reporting and analytics, giving you real-time insights into your transactions.

You are paying

USD 200.00

Sparkling Diamond Ring

Anita Lin

anitalin22@mailto.com

Scan this QR code to complete payment

Powered by HitPay

Aqua

Night

Sunrise

Personalized checkout

Make HitPay’s checkout truly yours. Customize payment methods, checkout rules, and design elements effortlessly to match your brand.

Mobile-first experience

Don’t let mobile slow you down. HitPay’s optimized checkout ensures a seamless experience on any device, driving higher conversion rates for your business.

Secure and compliant

Leave the security to us. With PCI DSS compliance and advanced encryption, your customers' data is protected, so you can focus on growing your business.

Insights on demand

Get the data you need without the complexity. Our all-in-one platform provides real-time reporting and analytics, giving you real-time insights into your transactions.

You are paying

USD 200.00

Sparkling Diamond Ring

Anita Lin

anitalin22@mailto.com

Scan this QR code to complete payment

Powered by HitPay

Aqua

Night

Sunrise

Personalized checkout

Make HitPay’s checkout truly yours. Customize payment methods, checkout rules, and design elements effortlessly to match your brand.

Mobile-first experience

Don’t let mobile slow you down. HitPay’s optimized checkout ensures a seamless experience on any device, driving higher conversion rates for your business.

Secure and compliant

Leave the security to us. With PCI DSS compliance and advanced encryption, your customers' data is protected, so you can focus on growing your business.

Insights on demand

Get the data you need without the complexity. Our all-in-one platform provides real-time reporting and analytics, giving you real-time insights into your transactions.

You are paying

USD 200.00

Sparkling Diamond Ring

Anita Lin

anitalin22@mailto.com

Scan this QR code to complete payment

Powered by HitPay

Aqua

Night

Sunrise

HitPay's suite of no-code products gives you the flexibility to accept payments the way you prefer.

HitPay's suite of no-code products gives you the flexibility to accept payments the way you prefer.

HitPay's suite of no-code products gives you the flexibility to accept payments the way you prefer.

Collect payments in-person, integrate HitPay with your existing store, or use or suite of tools that allow you to collect payments the way that works best for you and your customers.

Collect payments in-person, integrate HitPay with your existing store, or use or suite of tools that allow you to collect payments the way that works best for you and your customers.

Collect payments in-person, integrate HitPay with your existing store, or use or suite of tools that allow you to collect payments the way that works best for you and your customers.

Plugins for your

eCommerce store

Compatible with popular platforms like Shopify, WooCommerce, and more

Seamless checkout experience with customizable UI

Quick and hassle-free setup process

Share payment links

Easy sharing: Send payment links via email, SMS, or social media

Convenient QR codes: Convert links into QR codes for quick payments

Set up recurring billing

Flexible billing: Set up one-time or recurring payments with ease

Subscription management: Automatically handle renewals and reduce customer churn

Send invoices

Automated reminders: Set up automated payment reminders to ensure timely payments

Track payments: Easily monitor invoice statuses and payment history

← Prev

/

Next →

Plugins for your

eCommerce store

Compatible with popular platforms like Shopify, WooCommerce, and more

Seamless checkout experience with customizable UI

Quick and hassle-free setup process

Share payment links

Easy sharing: Send payment links via email, SMS, or social media

Convenient QR codes: Convert links into QR codes for quick payments

Set up recurring billing

Flexible billing: Set up one-time or recurring payments with ease

Subscription management: Automatically handle renewals and reduce customer churn

Send invoices

Automated reminders: Set up automated payment reminders to ensure timely payments

Track payments: Easily monitor invoice statuses and payment history

← Prev

/

Next →

Plugins for your

eCommerce store

Compatible with popular platforms like Shopify, WooCommerce, and more

Seamless checkout experience with customizable UI

Quick and hassle-free setup process

Share payment links

Easy sharing: Send payment links via email, SMS, or social media

Convenient QR codes: Convert links into QR codes for quick payments

Set up recurring billing

Flexible billing: Set up one-time or recurring payments with ease

Subscription management: Automatically handle renewals and reduce customer churn

Send invoices

Automated reminders: Set up automated payment reminders to ensure timely payments

Track payments: Easily monitor invoice statuses and payment history

← Prev

/

Next →

Plugins for your

eCommerce store

Compatible with popular platforms like Shopify, WooCommerce, and more

Seamless checkout experience with customizable UI

Quick and hassle-free setup process

Share payment links

Easy sharing: Send payment links via email, SMS, or social media

Convenient QR codes: Convert links into QR codes for quick payments

Set up recurring billing

Flexible billing: Set up one-time or recurring payments with ease

Subscription management: Automatically handle renewals and reduce customer churn

Send invoices

Automated reminders: Set up automated payment reminders to ensure timely payments

Track payments: Easily monitor invoice statuses and payment history

← Prev

/

Next →

Plugins for your

eCommerce store

Compatible with popular platforms like Shopify, WooCommerce, and more

Seamless checkout experience with customizable UI

Quick and hassle-free setup process

Share payment links

Easy sharing: Send payment links via email, SMS, or social media

Convenient QR codes: Convert links into QR codes for quick payments

Setup recurring billings

Flexible billing: Set up one-time or recurring payments with ease

Subscription management: Automatically handle renewals and reduce customer churn

Send invoices

Automated reminders: Set up automated payment reminders to ensure timely payments

Track payments: Easily monitor invoice statuses and payment history

Easily integrate with our payments and payouts APIs

Easily integrate with our payments and payouts APIs

Easily integrate with our payments and payouts APIs

Access APIs that seamlessly integrate across platforms, enabling seamless payouts across a wide range of markets with just one easy integration.

Access APIs that seamlessly integrate across platforms, enabling seamless payouts across a wide range of markets with just one easy integration.

Access APIs that seamlessly integrate across platforms, enabling seamless payouts across a wide range of markets with just one easy integration.

Node.js

Ruby

Python

Go

PHP

Java

.NET

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

const form = new FormData();

form.append("beneficiary_id", "9ad4789a-c864-48a6-a657-7fdfc57ba1fc");

form.append(

"beneficiary",

'{\n "country": "

);

form.append("source_currency", "

form.append("source_amount", "123");

form.append("payment_amount", "123");

form.append("remark", "

form.append("attached_file", "

const options = {

method: "POST",

headers: {

"X-BUSINESS-API-KEY": "

"Content-Type": "multipart/form-data",

},

};

options.body = form;

fetch("https://api.sandbox.hit-pay.com/v1/transfers", options)

.then((response) => response.json())

.then((response) => console.log(response));

Node.js

Ruby

Python

Go

PHP

Java

.NET

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

const form = new FormData();

form.append("beneficiary_id", "9ad4789a-c864-48a6-a657-7fdfc57ba1fc");

form.append(

"beneficiary",

'{\n "country": "

);

form.append("source_currency", "

form.append("source_amount", "123");

form.append("payment_amount", "123");

form.append("remark", "

form.append("attached_file", "

const options = {

method: "POST",

headers: {

"X-BUSINESS-API-KEY": "

"Content-Type": "multipart/form-data",

},

};

options.body = form;

fetch("https://api.sandbox.hit-pay.com/v1/transfers", options)

.then((response) => response.json())

.then((response) => console.log(response));

Node.js

Ruby

Python

Go

PHP

Java

.NET

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

const form = new FormData();

form.append("beneficiary_id", "9ad4789a-c864-48a6-a657-7fdfc57ba1fc");

form.append(

"beneficiary",

'{\n "country": "

);

form.append("source_currency", "

form.append("source_amount", "123");

form.append("payment_amount", "123");

form.append("remark", "

form.append("attached_file", "

const options = {

method: "POST",

headers: {

"X-BUSINESS-API-KEY": "

"Content-Type": "multipart/form-data",

},

};

options.body = form;

fetch("https://api.sandbox.hit-pay.com/v1/transfers", options)

.then((response) => response.json())

.then((response) => console.log(response));

Boost sales with global and local payment options

Boost sales with global and local payment options

Boost sales with global and local payment options

Expand your reach and increase conversions. Offer customers their preferred payment methods, from international standards to local favorites.

Expand your reach and increase conversions. Offer customers their preferred payment methods, from international standards to local favorites.

Expand your reach and increase conversions. Offer customers their preferred payment methods, from international standards to local favorites.

Singapore

Malaysia

Indonesia

Philippines

Thailand

Global

Visa

Mastercard

American Express

UnionPay

Apple Pay

Google Pay

PayNow

GrabPay

PayLater by Grab

ShopeePay

SPayLater

ShopBack

Atome

WeChat Pay

Singapore

Malaysia

Indonesia

Philippines

Thailand

Global

Visa

Mastercard

American Express

UnionPay

Apple Pay

Google Pay

PayNow

GrabPay

PayLater by Grab

ShopeePay

SPayLater

ShopBack

Atome

WeChat Pay

Singapore

Malaysia

Indonesia

Philippines

Thailand

Global

Visa

Mastercard

American Express

UnionPay

Apple Pay

Google Pay

PayNow

GrabPay

PayLater by Grab

ShopeePay

SPayLater

ShopBack

Atome

WeChat Pay

Singapore

Malaysia

Indonesia

Philippines

Thailand

Global

Visa

Mastercard

American Express

UnionPay

Apple Pay

Google Pay

PayNow

GrabPay

PayLater by Grab

ShopeePay

SPayLater

ShopBack

Atome

WeChat Pay

Singapore

Malaysia

Indonesia

Philippines

Thailand

Global

Visa

Mastercard

American Express

UnionPay

Apple Pay

Google Pay

PayNow

GrabPay

PayLater by Grab

ShopeePay

SPayLater

ShopBack

Atome

WeChat Pay

Singapore

Malaysia

Indonesia

Philippines

Thailand

Global

Airwallex

Atome

PayNow

GrabPay

Alipay

QRPH

Shopback

ShopeePay

Visa

Mastercard

American Express

Maestro

JCB

Union Pay

Apple Pay

Google Pay

WeChat Pay

Singapore

Malaysia

Indonesia

Philippines

Thailand

Global

Airwallex

Atome

PayNow

GrabPay

Alipay

QRPH

Shopback

ShopeePay

Visa

Mastercard

American Express

Maestro

JCB

Union Pay

Apple Pay

Google Pay

WeChat Pay

We offer competitive pricing in the market

No rental, subscription, or hidden fees. HitPay

charges only when you make a sale.

No recurring, subscription, or hidden fees. Setting up a HitPay account is free, with competitive pay-per-transaction fees.

Singapore

Custom pricing

Built for businesses with large payments volume or unique payment use cases

Contact sales

Singapore

Custom pricing

Built for businesses with large payments volume or unique payment use cases

Contact sales

Singapore

Custom pricing

Built for businesses with large payments volume or unique payment use cases

Contact sales

Frequently Asked Questions

Can I use HitPay for international transactions?

Absolutely! HitPay supports international transactions, making it easy to accept payments from customers worldwide. With support for over 100 currencies, you can seamlessly manage payments across borders with ease.

Can I use HitPay for international transactions?

Absolutely! HitPay supports international transactions, making it easy to accept payments from customers worldwide. With support for over 100 currencies, you can seamlessly manage payments across borders with ease.

Can I use HitPay for international transactions?

Absolutely! HitPay supports international transactions, making it easy to accept payments from customers worldwide. With support for over 100 currencies, you can seamlessly manage payments across borders with ease.

Can I initiate refunds using the HitPay platform?

Can I initiate refunds using the HitPay platform?

Can I initiate refunds using the HitPay platform?

Are there any setup fees or subscription charges to use HitPay?

Are there any setup fees or subscription charges to use HitPay?

Are there any setup fees or subscription charges to use HitPay?

Can I customize my payment interface to match my brand's identity?

Can I customize my payment interface to match my brand's identity?

Can I customize my payment interface to match my brand's identity?

Is HitPay suitable for businesses of all sizes?

Is HitPay suitable for businesses of all sizes?

Is HitPay suitable for businesses of all sizes?

What if I have more questions that aren't covered here?

What if I have more questions that aren't covered here?

What if I have more questions that aren't covered here?

Have questions?

Frequently Asked Questions

Can I use HitPay for international transactions?

Absolutely! HitPay supports international transactions, making it easy to accept payments from customers worldwide. With support for over 100 currencies, you can seamlessly manage payments across borders with ease.

Can I initiate refunds using the HitPay platform?

Are there any setup fees or subscription charges to use HitPay?

Can I customize my payment interface to match my brand's identity?

Is HitPay suitable for businesses of all sizes?

What if I have more questions that aren't covered here?

Have questions?

Frequently Asked Questions

Can I use HitPay for international transactions?

Absolutely! HitPay supports international transactions, making it easy to accept payments from customers worldwide. With support for over 100 currencies, you can seamlessly manage payments across borders with ease.

Can I initiate refunds using the HitPay platform?

Are there any setup fees or subscription charges to use HitPay?

Can I customize my payment interface to match my brand's identity?

Is HitPay suitable for businesses of all sizes?

What if I have more questions that aren't covered here?

Have questions?

Let's get you set up

Create an account instantly or contact us to create a custom package for your business.

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapore 089109

Let's get you set up

Create an account instantly to get started or contact us to design

a custom package for your business.

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapore 089109

Let's get you set up

Create an account instantly to get started or contact us to design a custom package

for your business.

business software

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapore 089109

Let's get you set up

Create an account instantly to get started or contact us

to design a custom package for your business.

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapore 089109

Let's get you set up

Create an account instantly or contact us to create a custom package for your business.

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

All other countries

HitPay Payment Solutions Pte Ltd ("HitPay") is licensed as a Major Payment Institution (PS20200643) under Singapore's Payment Services Act for the provision of Domestic Money Transfer Services, Cross-Border Money Transfer Services and Merchant Acquisition Services. This can be confirmed on the MAS Financial Institutions Directory here. HitPay may also provide these services in conjunction with other MAS licensed or exempt partners.

HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, Singapore 089109