The Ultimate Guide to Choosing a Xero Payment Gateway

November 8, 2023

In this article we discuss what payment gateways are, why they are important, and how to choose the right one for your Xero account. We also cover the factors to consider when choosing a payment gateway.

Xero is a cloud-based accounting software application that helps small and medium-sized businesses (SMEs) manage their finances. It offers a wide range of features, including:

Accounting: Xero can help you with all of your accounting tasks, including invoicing, bill payments, bank reconciliation, and financial reporting.

Compliance: Xero can help you stay compliant with New Zealand tax laws by automating tasks such as GST filing and PAYE payments.

Business insights: Xero provides real-time insights into your financial performance, so you can make informed decisions about your business.

Payment gateways are important for Xero users because they allow merchants to accept payments from customers online. Xero can then integrate with the payment gateway to automatically record the payments in the merchant's accounting records.

What is a payment gateway?

Payment gateways are online services that process payments for merchants. When a customer makes a purchase online, their payment information is sent to the payment gateway, which then processes the payment and sends the funds to the merchant's bank account.

Benefits of using Xero with a payment gateway

Integrating Xero with payment gateways can provide a number of benefits for merchants of all sizes. By using Xero and a payment gateway, merchants can save time, reduce errors, improve security, increase sales, and grow their business. We explore the benefits in detail:

Save time: Xero and payment gateways can save merchants a lot of time by automating the accounting and payment processing tasks. For example, Xero can automatically reconcile payments processed through a payment gateway, which saves merchants from having to manually enter each payment into their accounting records.

Reduce errors: Xero and payment gateways can help to reduce errors in the accounting records by automatically recording payments in Xero. This is because payment gateways verify the payment information before processing the payment, which helps to reduce the risk of errors such as incorrect amounts or duplicate payments.

Improve security: Xero and payment gateways use security measures to protect customer payment information. For example, Xero uses encryption to protect customer data, and payment gateways use fraud detection tools to help prevent fraudulent transactions.

Increase sales: Xero and payment gateways can help merchants to increase sales by making it easier for customers to pay for their purchases. For example, Xero allows merchants to send invoices to customers via email, and payment gateways allow customers to pay for invoices with a variety of payment methods, such as credit cards, debit cards, and PayPal.

Track sales and expenses more easily: Xero provides real-time insights into a merchant's financial performance, which can help them to track their sales and expenses more easily. This information can then be used to make better business decisions.

Improve customer service: By automating the payment processing process, Xero and payment gateways can help merchants to improve their customer service. For example, merchants can use Xero to send invoices to customers quickly and easily, and customers can use payment gateways to pay for invoices quickly and securely.

Factors to consider when choosing a payment gateway for Xero

Choosing a payment gateway for Xero is an important decision. There are a number of factors to consider when choosing a payment gateway for Xero, including the payment methods you want to offer, the transaction fees, the features and services offered, the security and fraud protection measures, and the level of customer support.

Payment methods

The first factor to consider is the payment methods you want to offer your customers. Some payment gateways support a wide range of payment methods, including credit cards, debit cards, PayPal, and Apple Pay. Others may only support a limited number of payment methods.

It's important to choose a payment gateway that supports the payment methods that your customers want to use. You should also consider the popularity of different payment methods in your target market. For example, if you're selling to customers in New Zealand, you'll want to make sure you offer POLi and Afterpay, as these are two of the most popular payment methods in the country.

Transaction fees

Another important factor to consider is the transaction fees charged by the payment gateway. Transaction fees are typically a percentage of each transaction, and they can vary from one payment gateway to the next.

It's important to compare the transaction fees charged by different payment gateways before making a decision. You should also consider the volume of transactions you expect to process. If you're processing a high volume of transactions, you may be able to negotiate a lower transaction fee with some payment gateways.

Features and services

In addition to accepting payments, some payment gateways also offer other features and services, such as fraud protection, recurring billing, and shopping cart integration.

It's important to choose a payment gateway that offers the features and services that are important to you. For example, if you're selling subscriptions, you'll want to choose a payment gateway that offers recurring billing. If you're concerned about fraud, you'll want to choose a payment gateway that offers robust fraud protection features.

Security and fraud protection

When choosing a payment gateway, it's important to consider the security measures that are in place to protect your customers' payment information. Payment gateways use a variety of security measures, such as encryption and fraud detection tools, to protect customer data.

It's important to choose a payment gateway that uses strong security measures to protect your customers' payment information. You should also make sure that the payment gateway is PCI compliant. PCI compliance is a set of security standards that payment gateways must meet in order to protect customer data.

Customer support

Finally, it's important to consider the level of customer support offered by the payment gateway. You should choose a payment gateway that offers responsive and helpful customer support.

This is important because you may need to contact the payment gateway for assistance if you have any problems with your account or if your customers have any problems processing payments.

Top 3 Xero payment gateways

Stripe

GoCardless

HitPay

Top 3 Xero payment gateways (Detailed Comparison)

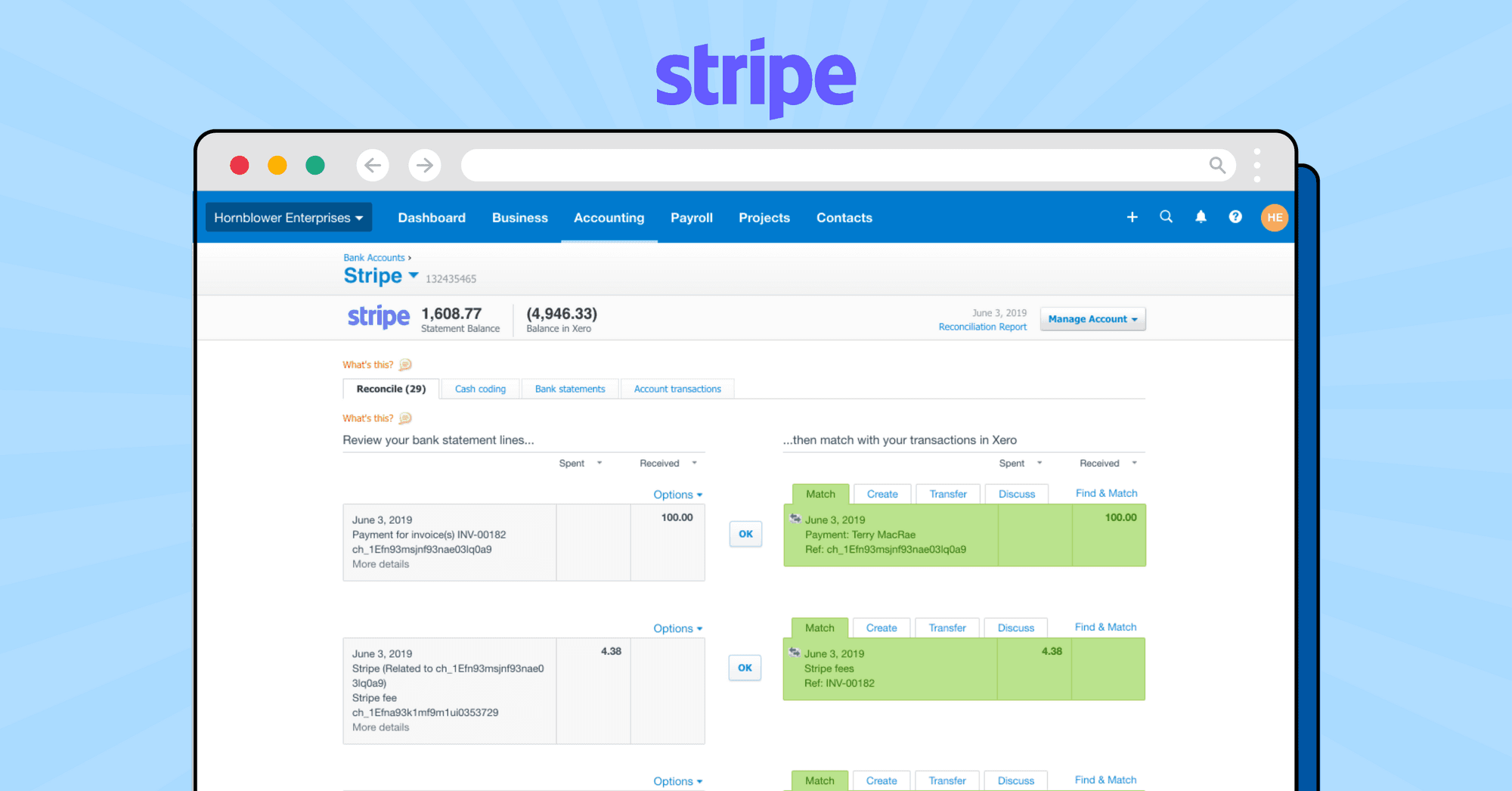

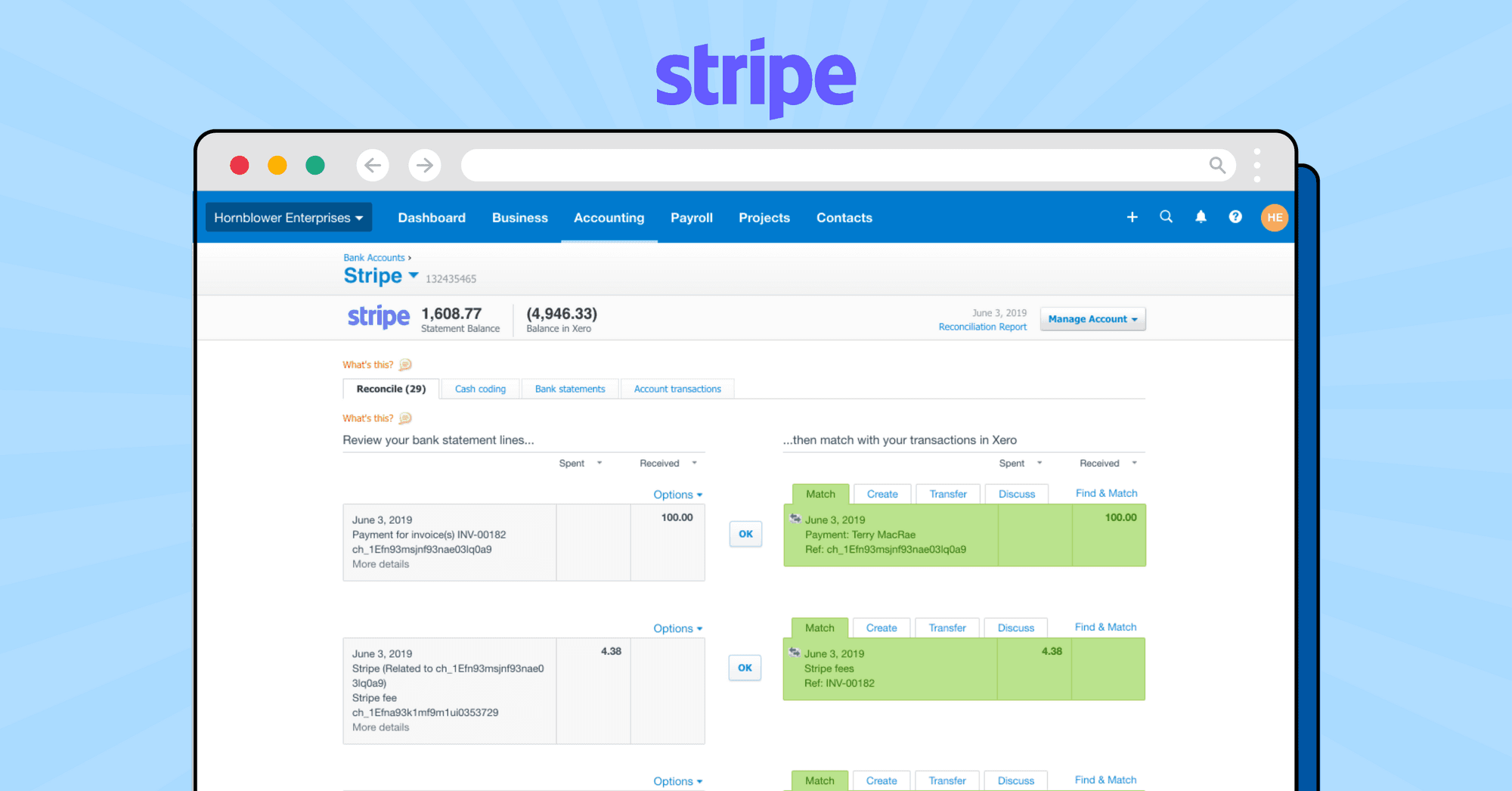

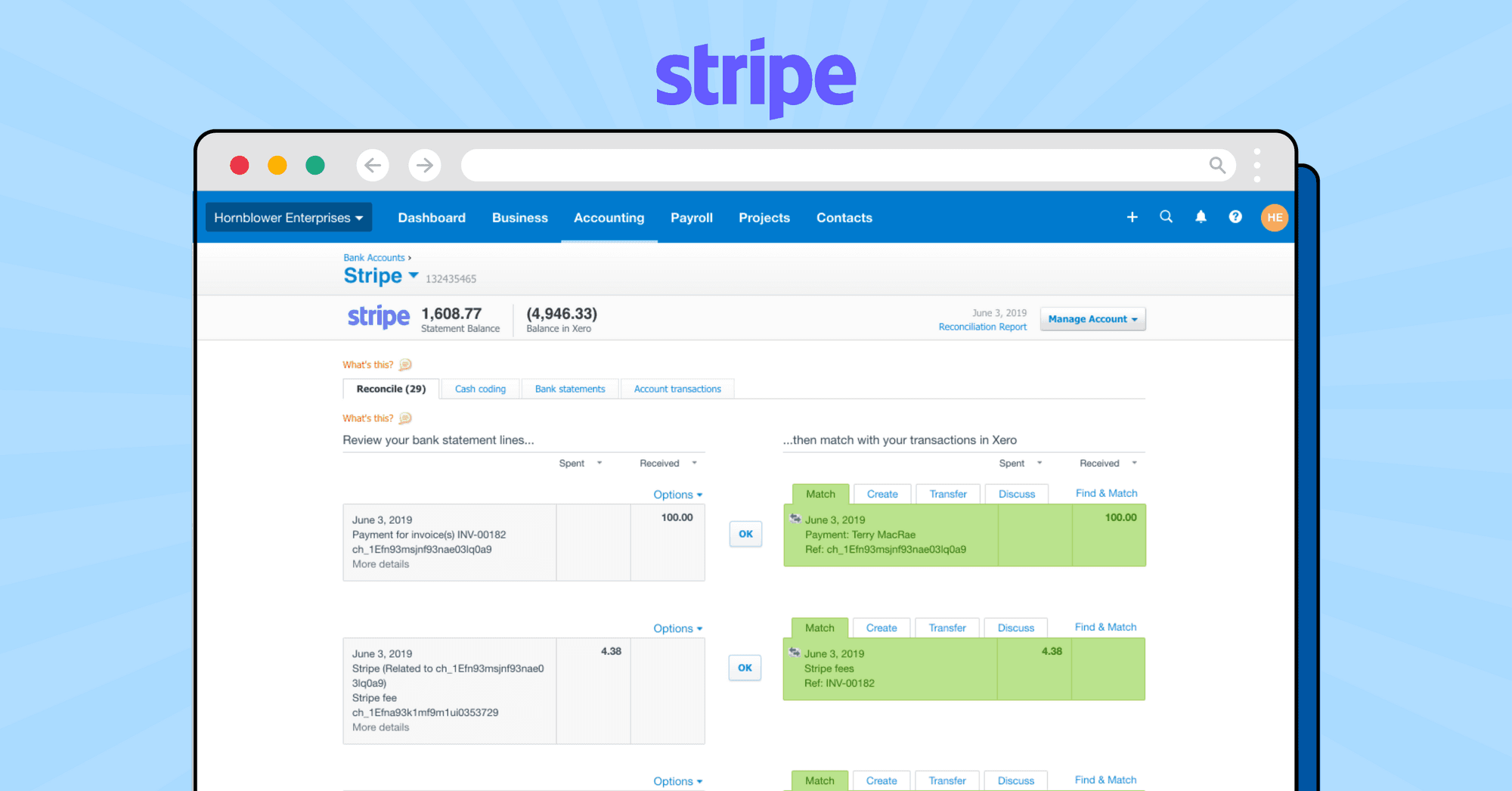

1) Stripe

The Stripe and Xero integration allows users to accept payments online and automatically sync their transactions with Xero. This integration saves businesses time and hassle by eliminating the need to manually reconcile payments.

Here are the key benefits of the Stripe and Xero integration:

Accept payments online: Businesses can add a Pay Now button to their invoices, allowing customers to pay with credit or debit cards, Apple Pay, and Google Pay.

Sync transactions with Xero: Stripe automatically syncs transactions with Xero, so users can track their payments and reconcile their accounts quickly and easily.

See cash flow data in one place: Xero provides a dashboard that shows all of a business's financial data, including Stripe payments, in one place. This gives users a clear overview of their cash flow and helps them make better financial decisions.

More insights into business performance: With Stripe and Xero integrated, businesses can see how their payment data is impacting their overall financial performance. This information can help them identify areas where they can improve their business.

Here's how to set up Stripe with Xero:

Log in to your Xero account.

Go to Settings > Payment Services.

Click Add Payment Service.

Select Stripe from the list of payment providers.

Fill in the required fields and click Connect to Stripe.

You will be redirected to Stripe to authorize the connection.

Click Authorize access to this account to complete the connection.

Once the integration is set up, customers can pay invoices online using their preferred payment method. Stripe will automatically sync the transactions with Xero, so users can track their payments and reconcile their accounts quickly and easily.

Overall, the Stripe and Xero integration is a great way for businesses to save time and hassle, and get more insights into their business performance.

2) GoCardless

The GoCardless and Xero integration allows users to collect direct debit payments from customers and automatically sync their transactions with Xero. This integration saves businesses time and hassle by eliminating the need to manually reconcile payments.

Here are the key benefits of the GoCardless and Xero integration:

Collect direct debit payments: Businesses can add a GoCardless payment button to their invoices, allowing customers to set up recurring or one-off direct debit payments.

Sync transactions with Xero: GoCardless automatically syncs transactions with Xero, so users can track their payments and reconcile their accounts quickly and easily.

See cash flow data in one place: Xero provides a dashboard that shows all of a business's financial data, including GoCardless payments, in one place. This gives users a clear overview of their cash flow and helps them make better financial decisions.

More insights into business performance: With GoCardless and Xero integrated, businesses can see how their payment data is impacting their overall financial performance. This information can help them identify areas where they can improve their business.

Here's how to set up GoCardless with Xero:

Log in to your Xero account.

Go to Settings > Payment Services.

Click Add Payment Service.

Select GoCardless from the list of payment providers.

Fill in the required fields and click Connect to GoCardless.

You will be redirected to GoCardless to authorize the connection.

Click Authorize access to this account to complete the connection.

Once the integration is set up, customers can pay invoices online by setting up a direct debit. GoCardless will automatically sync the transactions with Xero, so users can track their payments and reconcile their accounts quickly and easily.

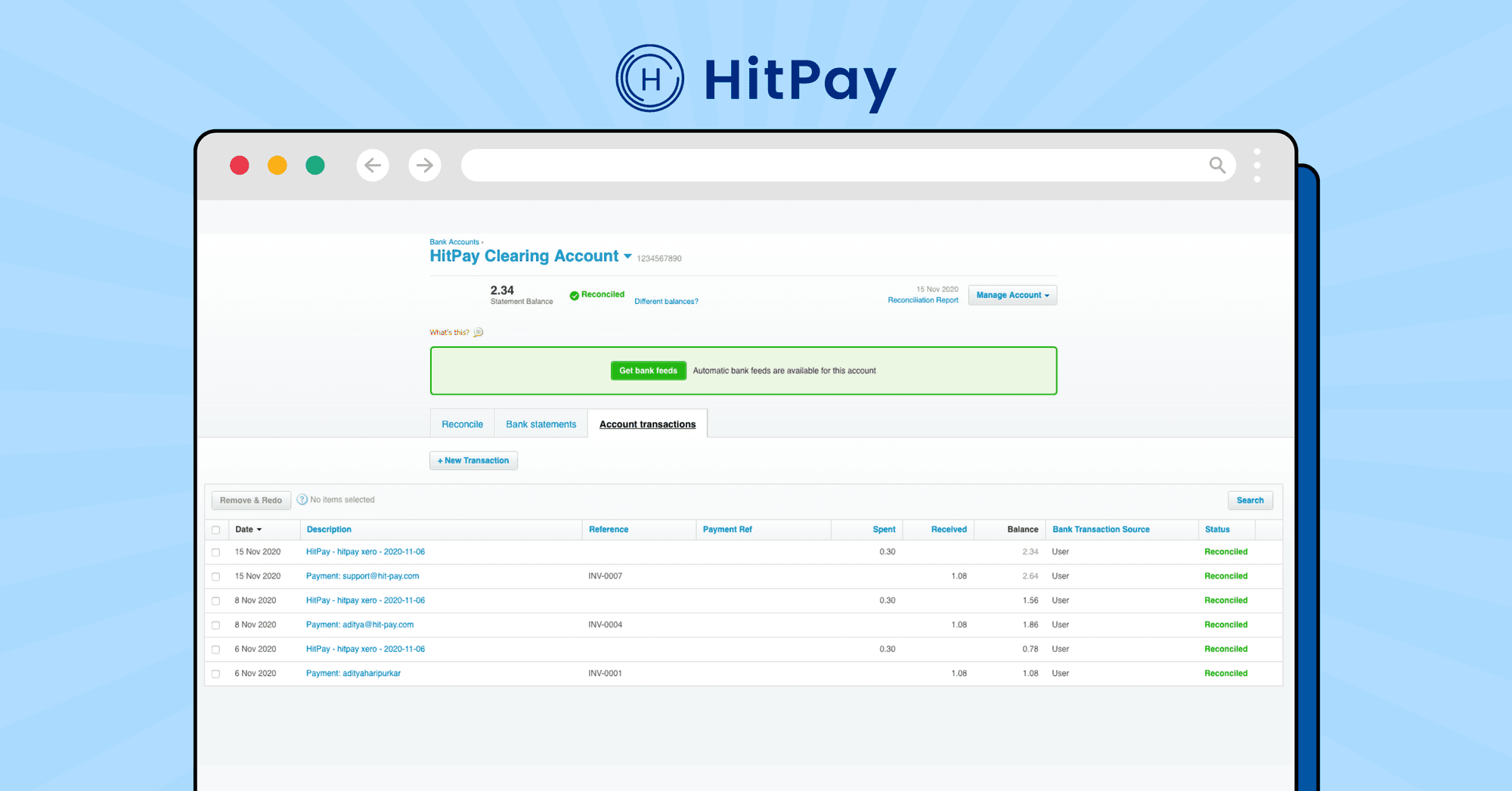

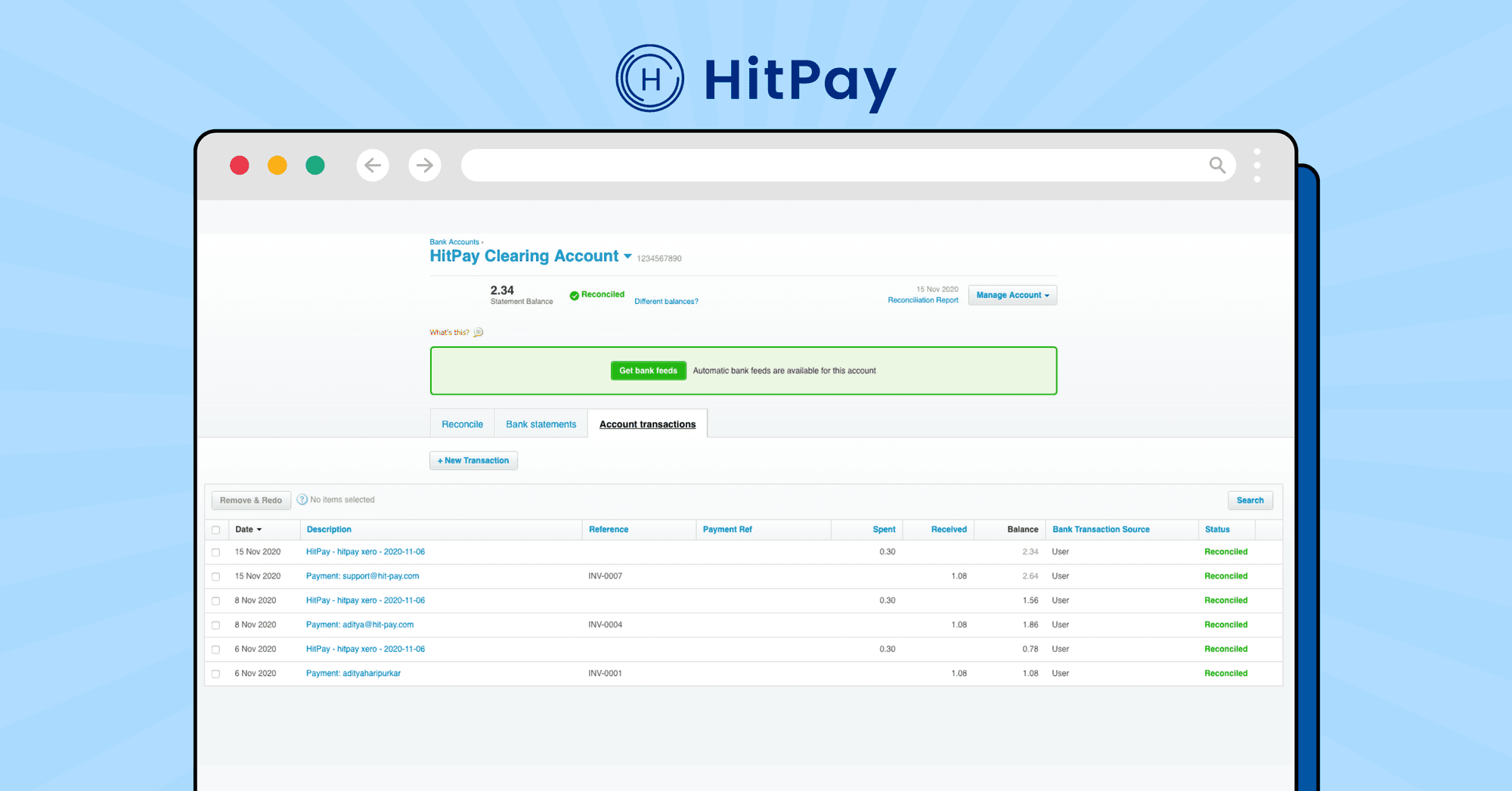

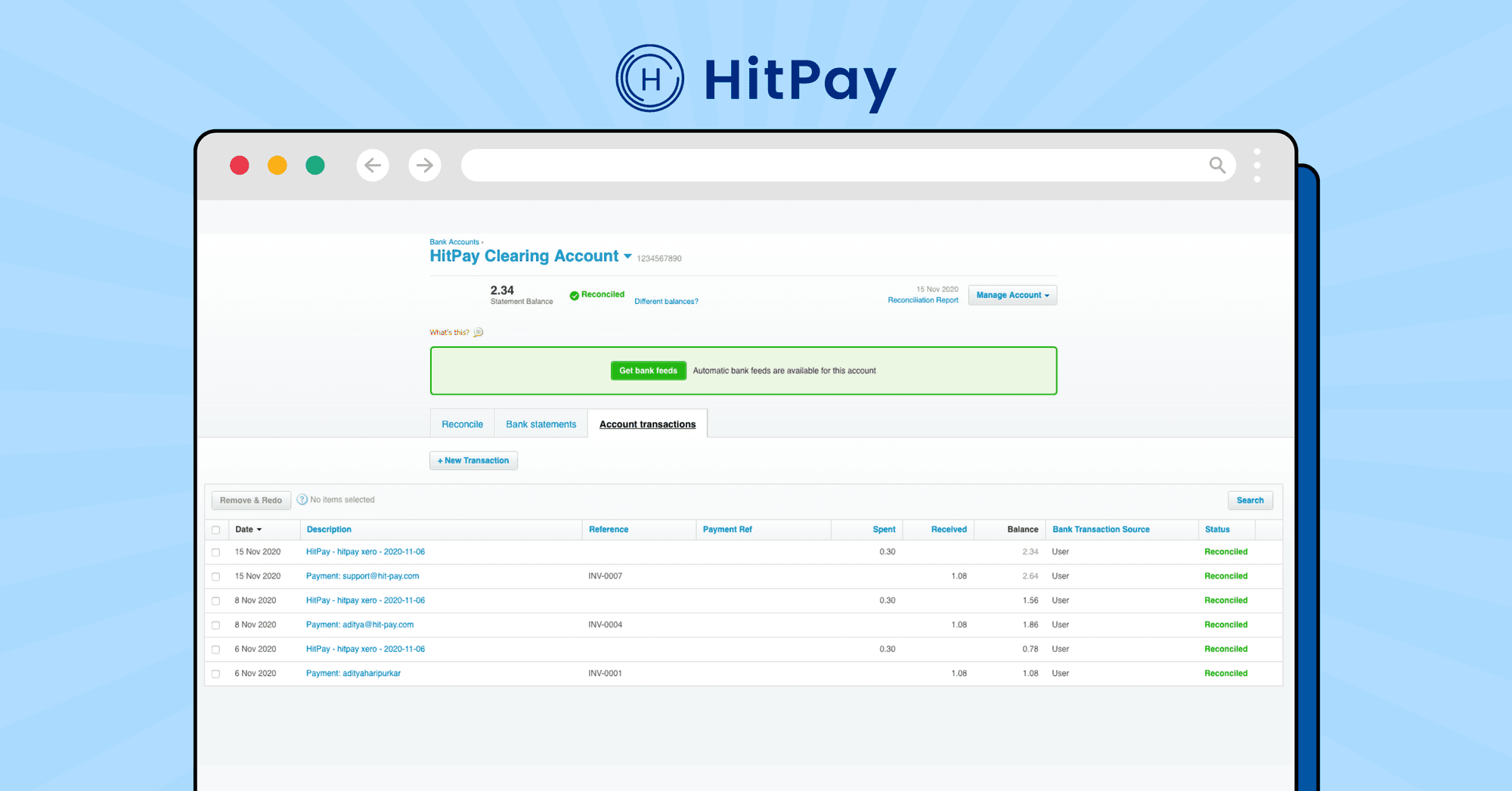

3) HitPay

The HitPay integration for Xero users allows businesses to accept payments from customers using cards and other supported payment methods in Xero online invoicing. It also automates the reconciliation of payments and invoices, making it easier for businesses to manage their finances.

Here are some of the benefits of the HitPay integration for Xero users:

Accept payments from customers using cards and other supported payment methods: HitPay supports a wide range of payment methods, including credit cards and debit cards. This gives businesses more flexibility in how they accept payments from their customers.

Automate the reconciliation of payments and invoices: HitPay automatically reconciles payments and invoices in Xero, saving businesses time and hassle.

Get a real-time view of your cash flow: HitPay provides a real-time view of your cash flow, so you can always see how much money is coming in and going out.

Improve your customer experience: HitPay makes it easy for customers to pay their invoices, which can improve their overall experience with your business.

To set up the HitPay integration for Xero, you will need to create a HitPay account and connect it to your Xero account. Once the integration is set up, you can start accepting payments from customers using cards and other supported payment methods.

Here are the steps on how to set up the HitPay integration for Xero:

Create a HitPay account.

Connect your HitPay account to your Xero account.

Add HitPay as a payment option in your Xero account.

Start sending invoices with the HitPay payment option.

Once you have completed these steps, your customers will be able to pay their invoices using cards and other supported payment methods. HitPay will automatically reconcile the payments and invoices in Xero, making it easier for you to manage your finances.

If you are a Xero user, we highly recommend considering integrating HitPay into your accounting software. It is a great way to save time and hassle, accept payments from customers using a variety of methods, and improve your customer experience.

Have questions about HitPay?

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

Read also:

The Ultimate Guide to Choosing a Xero Payment Gateway

November 8, 2023

In this article we discuss what payment gateways are, why they are important, and how to choose the right one for your Xero account. We also cover the factors to consider when choosing a payment gateway.

Xero is a cloud-based accounting software application that helps small and medium-sized businesses (SMEs) manage their finances. It offers a wide range of features, including:

Accounting: Xero can help you with all of your accounting tasks, including invoicing, bill payments, bank reconciliation, and financial reporting.

Compliance: Xero can help you stay compliant with New Zealand tax laws by automating tasks such as GST filing and PAYE payments.

Business insights: Xero provides real-time insights into your financial performance, so you can make informed decisions about your business.

Payment gateways are important for Xero users because they allow merchants to accept payments from customers online. Xero can then integrate with the payment gateway to automatically record the payments in the merchant's accounting records.

What is a payment gateway?

Payment gateways are online services that process payments for merchants. When a customer makes a purchase online, their payment information is sent to the payment gateway, which then processes the payment and sends the funds to the merchant's bank account.

Benefits of using Xero with a payment gateway

Integrating Xero with payment gateways can provide a number of benefits for merchants of all sizes. By using Xero and a payment gateway, merchants can save time, reduce errors, improve security, increase sales, and grow their business. We explore the benefits in detail:

Save time: Xero and payment gateways can save merchants a lot of time by automating the accounting and payment processing tasks. For example, Xero can automatically reconcile payments processed through a payment gateway, which saves merchants from having to manually enter each payment into their accounting records.

Reduce errors: Xero and payment gateways can help to reduce errors in the accounting records by automatically recording payments in Xero. This is because payment gateways verify the payment information before processing the payment, which helps to reduce the risk of errors such as incorrect amounts or duplicate payments.

Improve security: Xero and payment gateways use security measures to protect customer payment information. For example, Xero uses encryption to protect customer data, and payment gateways use fraud detection tools to help prevent fraudulent transactions.

Increase sales: Xero and payment gateways can help merchants to increase sales by making it easier for customers to pay for their purchases. For example, Xero allows merchants to send invoices to customers via email, and payment gateways allow customers to pay for invoices with a variety of payment methods, such as credit cards, debit cards, and PayPal.

Track sales and expenses more easily: Xero provides real-time insights into a merchant's financial performance, which can help them to track their sales and expenses more easily. This information can then be used to make better business decisions.

Improve customer service: By automating the payment processing process, Xero and payment gateways can help merchants to improve their customer service. For example, merchants can use Xero to send invoices to customers quickly and easily, and customers can use payment gateways to pay for invoices quickly and securely.

Factors to consider when choosing a payment gateway for Xero

Choosing a payment gateway for Xero is an important decision. There are a number of factors to consider when choosing a payment gateway for Xero, including the payment methods you want to offer, the transaction fees, the features and services offered, the security and fraud protection measures, and the level of customer support.

Payment methods

The first factor to consider is the payment methods you want to offer your customers. Some payment gateways support a wide range of payment methods, including credit cards, debit cards, PayPal, and Apple Pay. Others may only support a limited number of payment methods.

It's important to choose a payment gateway that supports the payment methods that your customers want to use. You should also consider the popularity of different payment methods in your target market. For example, if you're selling to customers in New Zealand, you'll want to make sure you offer POLi and Afterpay, as these are two of the most popular payment methods in the country.

Transaction fees

Another important factor to consider is the transaction fees charged by the payment gateway. Transaction fees are typically a percentage of each transaction, and they can vary from one payment gateway to the next.

It's important to compare the transaction fees charged by different payment gateways before making a decision. You should also consider the volume of transactions you expect to process. If you're processing a high volume of transactions, you may be able to negotiate a lower transaction fee with some payment gateways.

Features and services

In addition to accepting payments, some payment gateways also offer other features and services, such as fraud protection, recurring billing, and shopping cart integration.

It's important to choose a payment gateway that offers the features and services that are important to you. For example, if you're selling subscriptions, you'll want to choose a payment gateway that offers recurring billing. If you're concerned about fraud, you'll want to choose a payment gateway that offers robust fraud protection features.

Security and fraud protection

When choosing a payment gateway, it's important to consider the security measures that are in place to protect your customers' payment information. Payment gateways use a variety of security measures, such as encryption and fraud detection tools, to protect customer data.

It's important to choose a payment gateway that uses strong security measures to protect your customers' payment information. You should also make sure that the payment gateway is PCI compliant. PCI compliance is a set of security standards that payment gateways must meet in order to protect customer data.

Customer support

Finally, it's important to consider the level of customer support offered by the payment gateway. You should choose a payment gateway that offers responsive and helpful customer support.

This is important because you may need to contact the payment gateway for assistance if you have any problems with your account or if your customers have any problems processing payments.

Top 3 Xero payment gateways

Stripe

GoCardless

HitPay

Top 3 Xero payment gateways (Detailed Comparison)

1) Stripe

The Stripe and Xero integration allows users to accept payments online and automatically sync their transactions with Xero. This integration saves businesses time and hassle by eliminating the need to manually reconcile payments.

Here are the key benefits of the Stripe and Xero integration:

Accept payments online: Businesses can add a Pay Now button to their invoices, allowing customers to pay with credit or debit cards, Apple Pay, and Google Pay.

Sync transactions with Xero: Stripe automatically syncs transactions with Xero, so users can track their payments and reconcile their accounts quickly and easily.

See cash flow data in one place: Xero provides a dashboard that shows all of a business's financial data, including Stripe payments, in one place. This gives users a clear overview of their cash flow and helps them make better financial decisions.

More insights into business performance: With Stripe and Xero integrated, businesses can see how their payment data is impacting their overall financial performance. This information can help them identify areas where they can improve their business.

Here's how to set up Stripe with Xero:

Log in to your Xero account.

Go to Settings > Payment Services.

Click Add Payment Service.

Select Stripe from the list of payment providers.

Fill in the required fields and click Connect to Stripe.

You will be redirected to Stripe to authorize the connection.

Click Authorize access to this account to complete the connection.

Once the integration is set up, customers can pay invoices online using their preferred payment method. Stripe will automatically sync the transactions with Xero, so users can track their payments and reconcile their accounts quickly and easily.

Overall, the Stripe and Xero integration is a great way for businesses to save time and hassle, and get more insights into their business performance.

2) GoCardless

The GoCardless and Xero integration allows users to collect direct debit payments from customers and automatically sync their transactions with Xero. This integration saves businesses time and hassle by eliminating the need to manually reconcile payments.

Here are the key benefits of the GoCardless and Xero integration:

Collect direct debit payments: Businesses can add a GoCardless payment button to their invoices, allowing customers to set up recurring or one-off direct debit payments.

Sync transactions with Xero: GoCardless automatically syncs transactions with Xero, so users can track their payments and reconcile their accounts quickly and easily.

See cash flow data in one place: Xero provides a dashboard that shows all of a business's financial data, including GoCardless payments, in one place. This gives users a clear overview of their cash flow and helps them make better financial decisions.

More insights into business performance: With GoCardless and Xero integrated, businesses can see how their payment data is impacting their overall financial performance. This information can help them identify areas where they can improve their business.

Here's how to set up GoCardless with Xero:

Log in to your Xero account.

Go to Settings > Payment Services.

Click Add Payment Service.

Select GoCardless from the list of payment providers.

Fill in the required fields and click Connect to GoCardless.

You will be redirected to GoCardless to authorize the connection.

Click Authorize access to this account to complete the connection.

Once the integration is set up, customers can pay invoices online by setting up a direct debit. GoCardless will automatically sync the transactions with Xero, so users can track their payments and reconcile their accounts quickly and easily.

3) HitPay

The HitPay integration for Xero users allows businesses to accept payments from customers using cards and other supported payment methods in Xero online invoicing. It also automates the reconciliation of payments and invoices, making it easier for businesses to manage their finances.

Here are some of the benefits of the HitPay integration for Xero users:

Accept payments from customers using cards and other supported payment methods: HitPay supports a wide range of payment methods, including credit cards and debit cards. This gives businesses more flexibility in how they accept payments from their customers.

Automate the reconciliation of payments and invoices: HitPay automatically reconciles payments and invoices in Xero, saving businesses time and hassle.

Get a real-time view of your cash flow: HitPay provides a real-time view of your cash flow, so you can always see how much money is coming in and going out.

Improve your customer experience: HitPay makes it easy for customers to pay their invoices, which can improve their overall experience with your business.

To set up the HitPay integration for Xero, you will need to create a HitPay account and connect it to your Xero account. Once the integration is set up, you can start accepting payments from customers using cards and other supported payment methods.

Here are the steps on how to set up the HitPay integration for Xero:

Create a HitPay account.

Connect your HitPay account to your Xero account.

Add HitPay as a payment option in your Xero account.

Start sending invoices with the HitPay payment option.

Once you have completed these steps, your customers will be able to pay their invoices using cards and other supported payment methods. HitPay will automatically reconcile the payments and invoices in Xero, making it easier for you to manage your finances.

If you are a Xero user, we highly recommend considering integrating HitPay into your accounting software. It is a great way to save time and hassle, accept payments from customers using a variety of methods, and improve your customer experience.

Have questions about HitPay?

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

Read also:

The Ultimate Guide to Choosing a Xero Payment Gateway

November 8, 2023

In this article we discuss what payment gateways are, why they are important, and how to choose the right one for your Xero account. We also cover the factors to consider when choosing a payment gateway.

Xero is a cloud-based accounting software application that helps small and medium-sized businesses (SMEs) manage their finances. It offers a wide range of features, including:

Accounting: Xero can help you with all of your accounting tasks, including invoicing, bill payments, bank reconciliation, and financial reporting.

Compliance: Xero can help you stay compliant with New Zealand tax laws by automating tasks such as GST filing and PAYE payments.

Business insights: Xero provides real-time insights into your financial performance, so you can make informed decisions about your business.

Payment gateways are important for Xero users because they allow merchants to accept payments from customers online. Xero can then integrate with the payment gateway to automatically record the payments in the merchant's accounting records.

What is a payment gateway?

Payment gateways are online services that process payments for merchants. When a customer makes a purchase online, their payment information is sent to the payment gateway, which then processes the payment and sends the funds to the merchant's bank account.

Benefits of using Xero with a payment gateway

Integrating Xero with payment gateways can provide a number of benefits for merchants of all sizes. By using Xero and a payment gateway, merchants can save time, reduce errors, improve security, increase sales, and grow their business. We explore the benefits in detail:

Save time: Xero and payment gateways can save merchants a lot of time by automating the accounting and payment processing tasks. For example, Xero can automatically reconcile payments processed through a payment gateway, which saves merchants from having to manually enter each payment into their accounting records.

Reduce errors: Xero and payment gateways can help to reduce errors in the accounting records by automatically recording payments in Xero. This is because payment gateways verify the payment information before processing the payment, which helps to reduce the risk of errors such as incorrect amounts or duplicate payments.

Improve security: Xero and payment gateways use security measures to protect customer payment information. For example, Xero uses encryption to protect customer data, and payment gateways use fraud detection tools to help prevent fraudulent transactions.

Increase sales: Xero and payment gateways can help merchants to increase sales by making it easier for customers to pay for their purchases. For example, Xero allows merchants to send invoices to customers via email, and payment gateways allow customers to pay for invoices with a variety of payment methods, such as credit cards, debit cards, and PayPal.

Track sales and expenses more easily: Xero provides real-time insights into a merchant's financial performance, which can help them to track their sales and expenses more easily. This information can then be used to make better business decisions.

Improve customer service: By automating the payment processing process, Xero and payment gateways can help merchants to improve their customer service. For example, merchants can use Xero to send invoices to customers quickly and easily, and customers can use payment gateways to pay for invoices quickly and securely.

Factors to consider when choosing a payment gateway for Xero

Choosing a payment gateway for Xero is an important decision. There are a number of factors to consider when choosing a payment gateway for Xero, including the payment methods you want to offer, the transaction fees, the features and services offered, the security and fraud protection measures, and the level of customer support.

Payment methods

The first factor to consider is the payment methods you want to offer your customers. Some payment gateways support a wide range of payment methods, including credit cards, debit cards, PayPal, and Apple Pay. Others may only support a limited number of payment methods.

It's important to choose a payment gateway that supports the payment methods that your customers want to use. You should also consider the popularity of different payment methods in your target market. For example, if you're selling to customers in New Zealand, you'll want to make sure you offer POLi and Afterpay, as these are two of the most popular payment methods in the country.

Transaction fees

Another important factor to consider is the transaction fees charged by the payment gateway. Transaction fees are typically a percentage of each transaction, and they can vary from one payment gateway to the next.

It's important to compare the transaction fees charged by different payment gateways before making a decision. You should also consider the volume of transactions you expect to process. If you're processing a high volume of transactions, you may be able to negotiate a lower transaction fee with some payment gateways.

Features and services

In addition to accepting payments, some payment gateways also offer other features and services, such as fraud protection, recurring billing, and shopping cart integration.

It's important to choose a payment gateway that offers the features and services that are important to you. For example, if you're selling subscriptions, you'll want to choose a payment gateway that offers recurring billing. If you're concerned about fraud, you'll want to choose a payment gateway that offers robust fraud protection features.

Security and fraud protection

When choosing a payment gateway, it's important to consider the security measures that are in place to protect your customers' payment information. Payment gateways use a variety of security measures, such as encryption and fraud detection tools, to protect customer data.

It's important to choose a payment gateway that uses strong security measures to protect your customers' payment information. You should also make sure that the payment gateway is PCI compliant. PCI compliance is a set of security standards that payment gateways must meet in order to protect customer data.

Customer support

Finally, it's important to consider the level of customer support offered by the payment gateway. You should choose a payment gateway that offers responsive and helpful customer support.

This is important because you may need to contact the payment gateway for assistance if you have any problems with your account or if your customers have any problems processing payments.

Top 3 Xero payment gateways

Stripe

GoCardless

HitPay

Top 3 Xero payment gateways (Detailed Comparison)

1) Stripe

The Stripe and Xero integration allows users to accept payments online and automatically sync their transactions with Xero. This integration saves businesses time and hassle by eliminating the need to manually reconcile payments.

Here are the key benefits of the Stripe and Xero integration:

Accept payments online: Businesses can add a Pay Now button to their invoices, allowing customers to pay with credit or debit cards, Apple Pay, and Google Pay.

Sync transactions with Xero: Stripe automatically syncs transactions with Xero, so users can track their payments and reconcile their accounts quickly and easily.

See cash flow data in one place: Xero provides a dashboard that shows all of a business's financial data, including Stripe payments, in one place. This gives users a clear overview of their cash flow and helps them make better financial decisions.

More insights into business performance: With Stripe and Xero integrated, businesses can see how their payment data is impacting their overall financial performance. This information can help them identify areas where they can improve their business.

Here's how to set up Stripe with Xero:

Log in to your Xero account.

Go to Settings > Payment Services.

Click Add Payment Service.

Select Stripe from the list of payment providers.

Fill in the required fields and click Connect to Stripe.

You will be redirected to Stripe to authorize the connection.

Click Authorize access to this account to complete the connection.

Once the integration is set up, customers can pay invoices online using their preferred payment method. Stripe will automatically sync the transactions with Xero, so users can track their payments and reconcile their accounts quickly and easily.

Overall, the Stripe and Xero integration is a great way for businesses to save time and hassle, and get more insights into their business performance.

2) GoCardless

The GoCardless and Xero integration allows users to collect direct debit payments from customers and automatically sync their transactions with Xero. This integration saves businesses time and hassle by eliminating the need to manually reconcile payments.

Here are the key benefits of the GoCardless and Xero integration:

Collect direct debit payments: Businesses can add a GoCardless payment button to their invoices, allowing customers to set up recurring or one-off direct debit payments.

Sync transactions with Xero: GoCardless automatically syncs transactions with Xero, so users can track their payments and reconcile their accounts quickly and easily.

See cash flow data in one place: Xero provides a dashboard that shows all of a business's financial data, including GoCardless payments, in one place. This gives users a clear overview of their cash flow and helps them make better financial decisions.

More insights into business performance: With GoCardless and Xero integrated, businesses can see how their payment data is impacting their overall financial performance. This information can help them identify areas where they can improve their business.

Here's how to set up GoCardless with Xero:

Log in to your Xero account.

Go to Settings > Payment Services.

Click Add Payment Service.

Select GoCardless from the list of payment providers.

Fill in the required fields and click Connect to GoCardless.

You will be redirected to GoCardless to authorize the connection.

Click Authorize access to this account to complete the connection.

Once the integration is set up, customers can pay invoices online by setting up a direct debit. GoCardless will automatically sync the transactions with Xero, so users can track their payments and reconcile their accounts quickly and easily.

3) HitPay

The HitPay integration for Xero users allows businesses to accept payments from customers using cards and other supported payment methods in Xero online invoicing. It also automates the reconciliation of payments and invoices, making it easier for businesses to manage their finances.

Here are some of the benefits of the HitPay integration for Xero users:

Accept payments from customers using cards and other supported payment methods: HitPay supports a wide range of payment methods, including credit cards and debit cards. This gives businesses more flexibility in how they accept payments from their customers.

Automate the reconciliation of payments and invoices: HitPay automatically reconciles payments and invoices in Xero, saving businesses time and hassle.

Get a real-time view of your cash flow: HitPay provides a real-time view of your cash flow, so you can always see how much money is coming in and going out.

Improve your customer experience: HitPay makes it easy for customers to pay their invoices, which can improve their overall experience with your business.

To set up the HitPay integration for Xero, you will need to create a HitPay account and connect it to your Xero account. Once the integration is set up, you can start accepting payments from customers using cards and other supported payment methods.

Here are the steps on how to set up the HitPay integration for Xero:

Create a HitPay account.

Connect your HitPay account to your Xero account.

Add HitPay as a payment option in your Xero account.

Start sending invoices with the HitPay payment option.

Once you have completed these steps, your customers will be able to pay their invoices using cards and other supported payment methods. HitPay will automatically reconcile the payments and invoices in Xero, making it easier for you to manage your finances.

If you are a Xero user, we highly recommend considering integrating HitPay into your accounting software. It is a great way to save time and hassle, accept payments from customers using a variety of methods, and improve your customer experience.

Have questions about HitPay?

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

Read also: