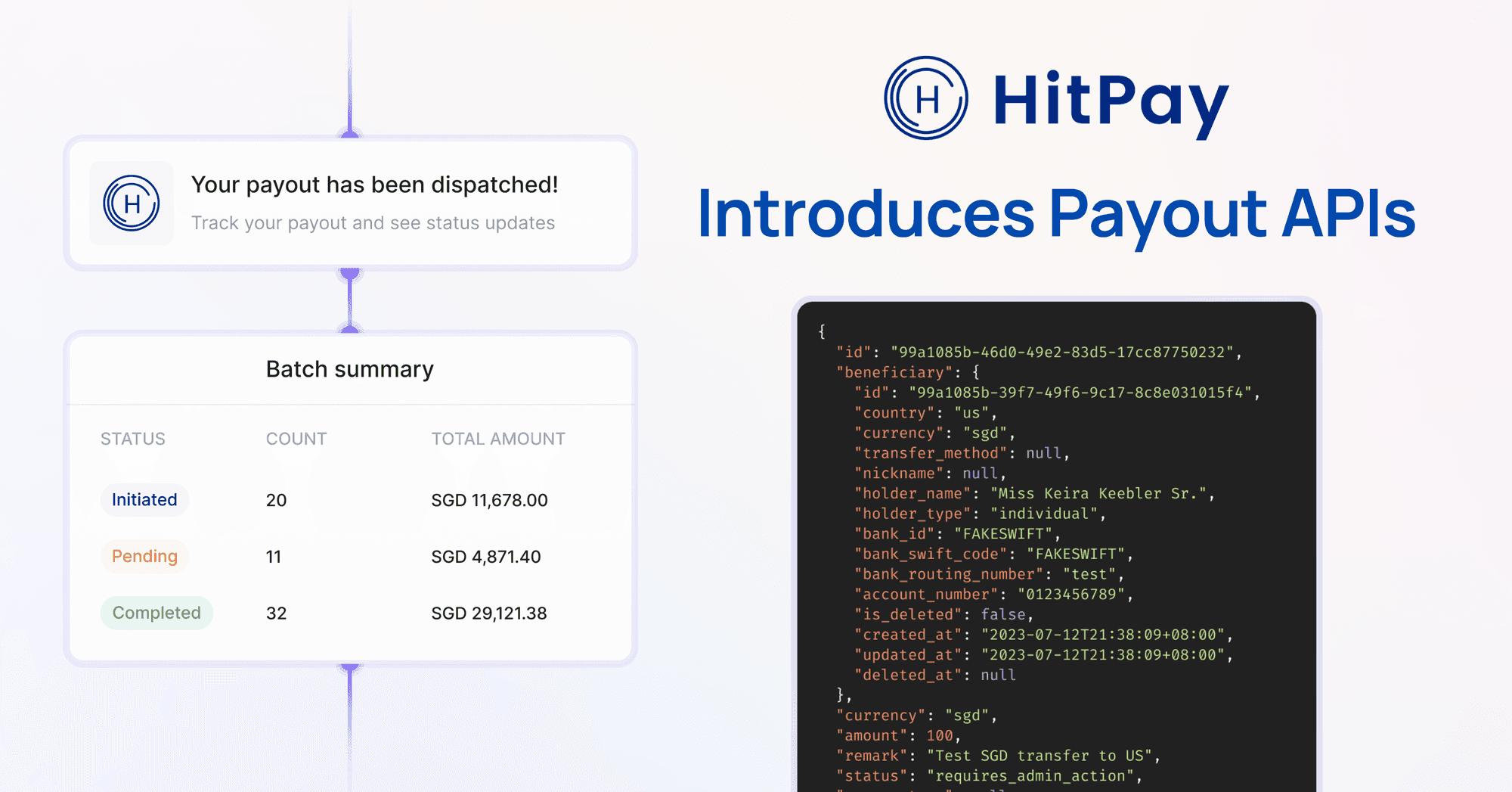

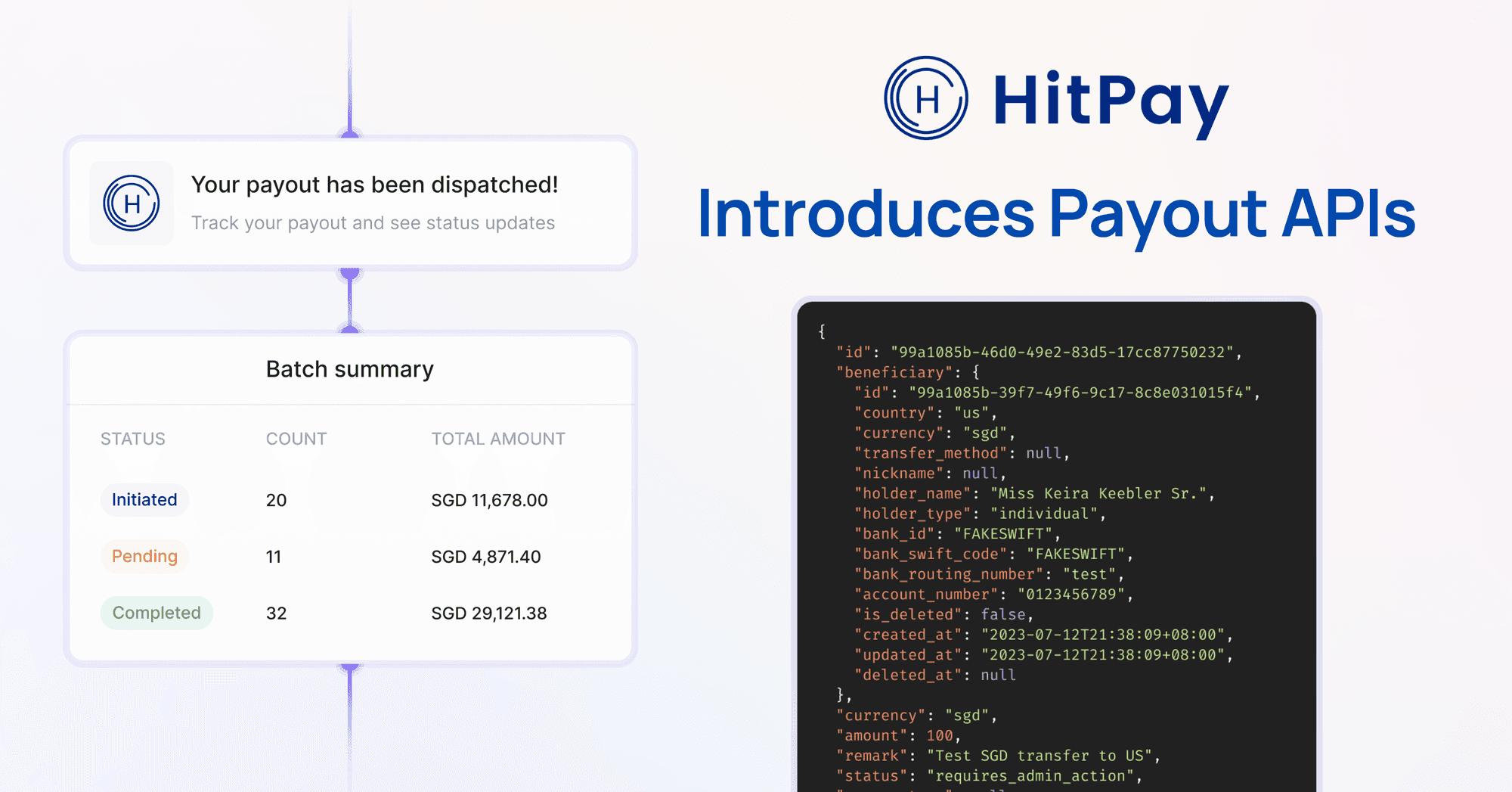

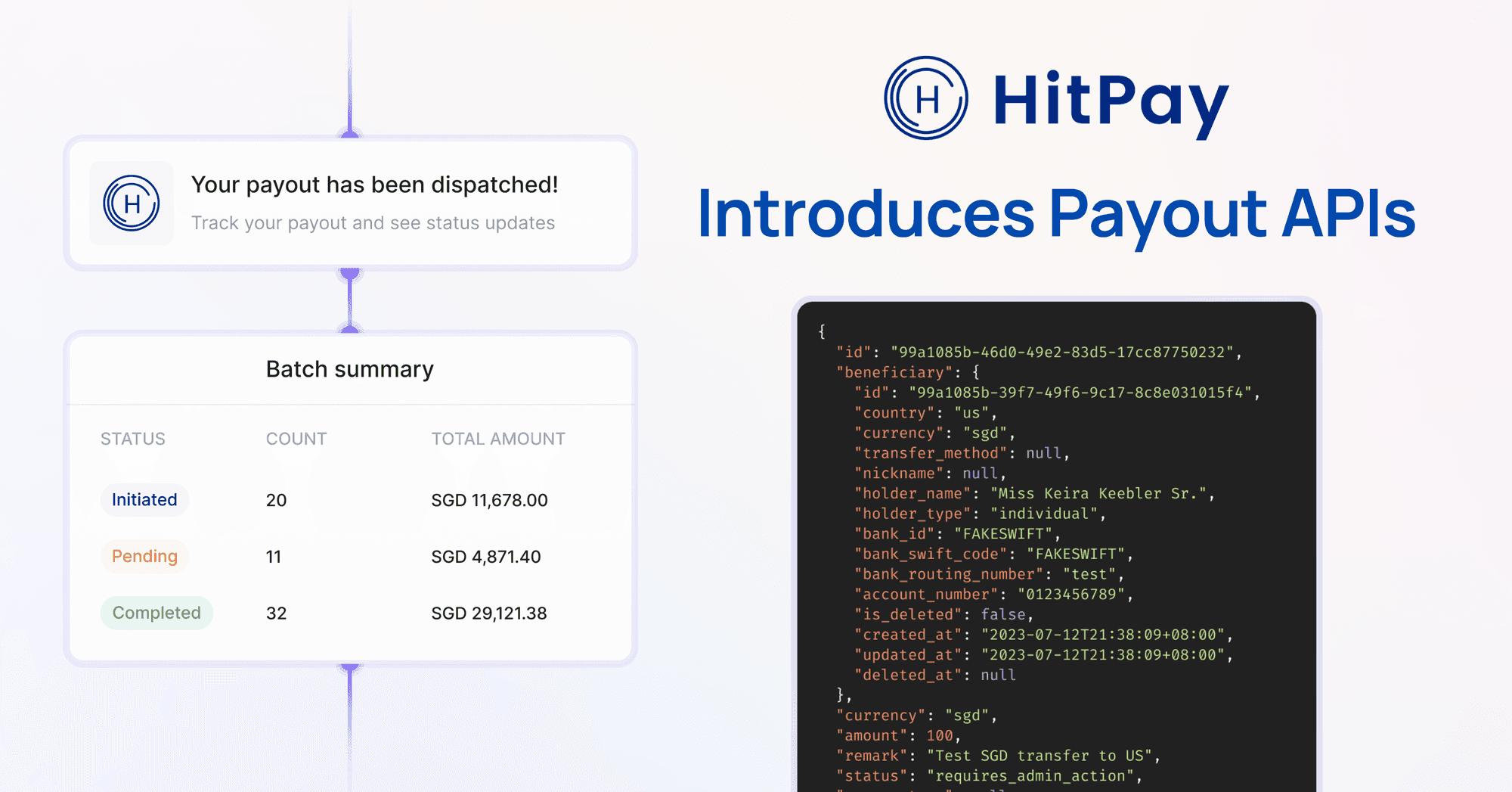

HitPay Introduces Payout APIs — Supports FAST, RTGS, InstaPay, and PESONet Disbursements

10 ธันวาคม 2566

HitPay's Payout APIs cover mass payouts in Singapore, Malaysia, and the Philippines, with additional payment networks launching in 2024.

Singapore, 11 Dec 2023 – HitPay, the commerce infrastructure for businesses, introduces mass payouts starting in Singapore, Malaysia, and the Philippines.

Businesses can now seamlessly pay workers, contractors, partners, and suppliers via HitPay. Marketplace and platform-based businesses can also securely manage mass payouts with HitPay's Payout APIs.

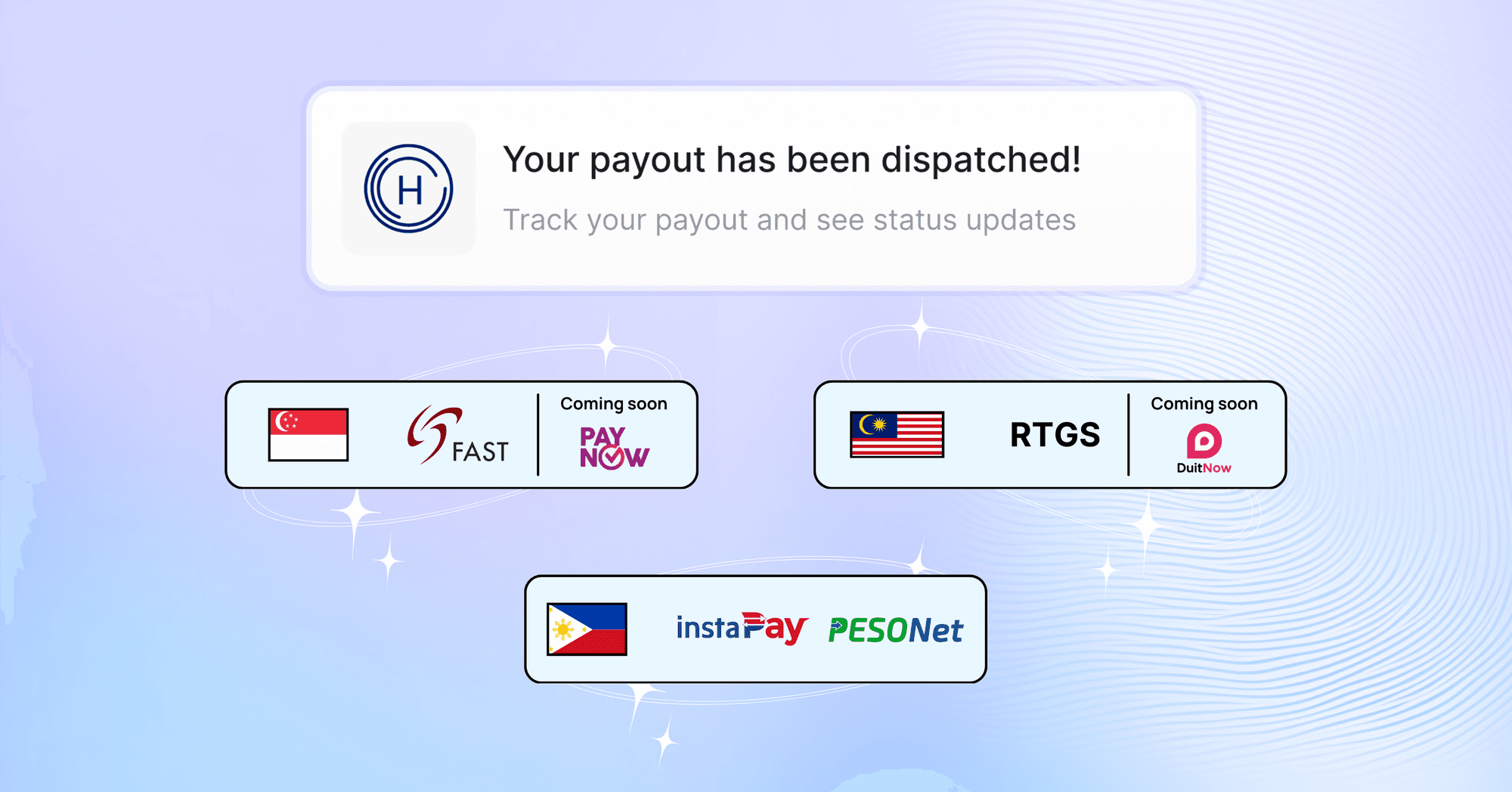

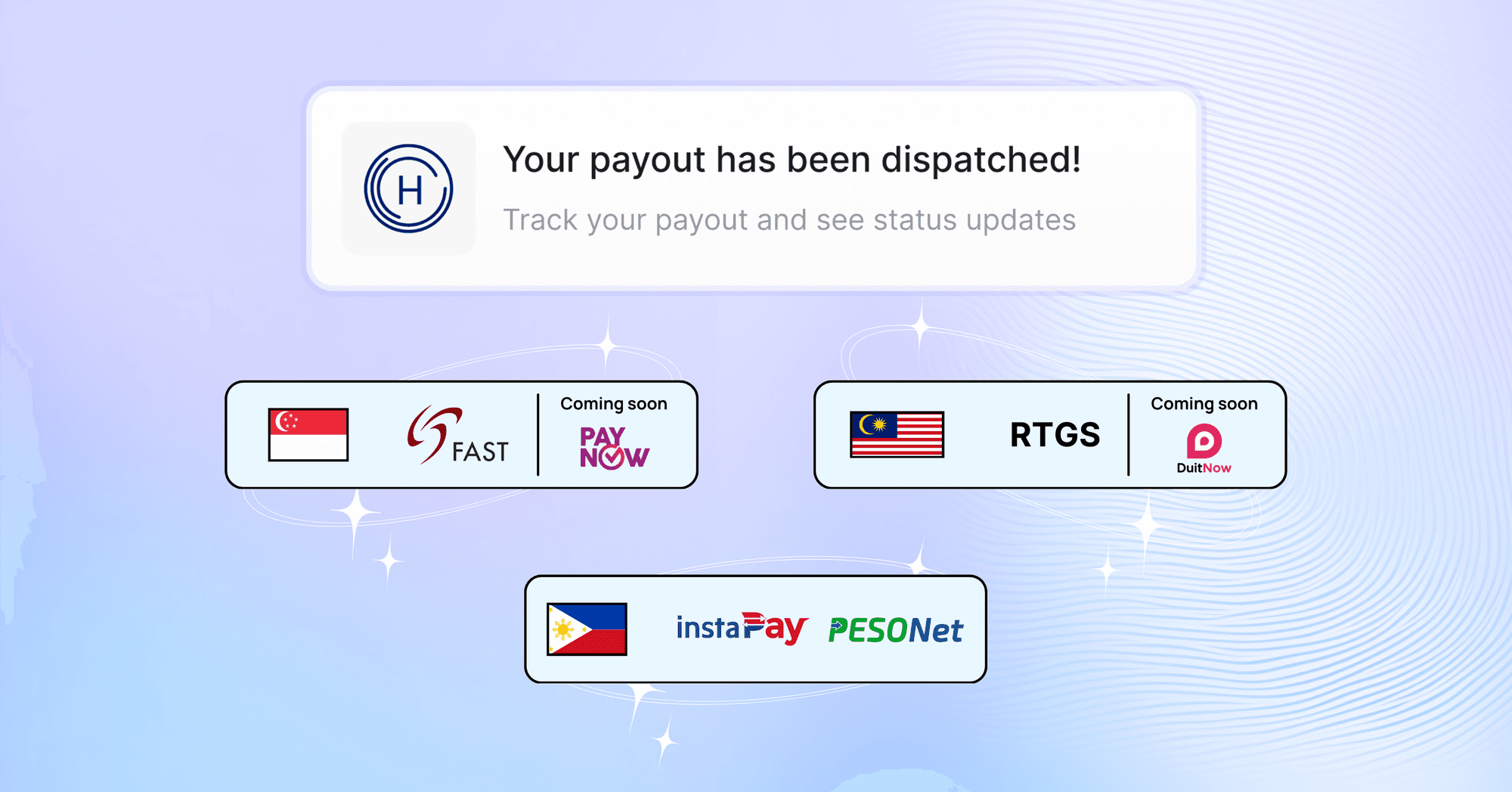

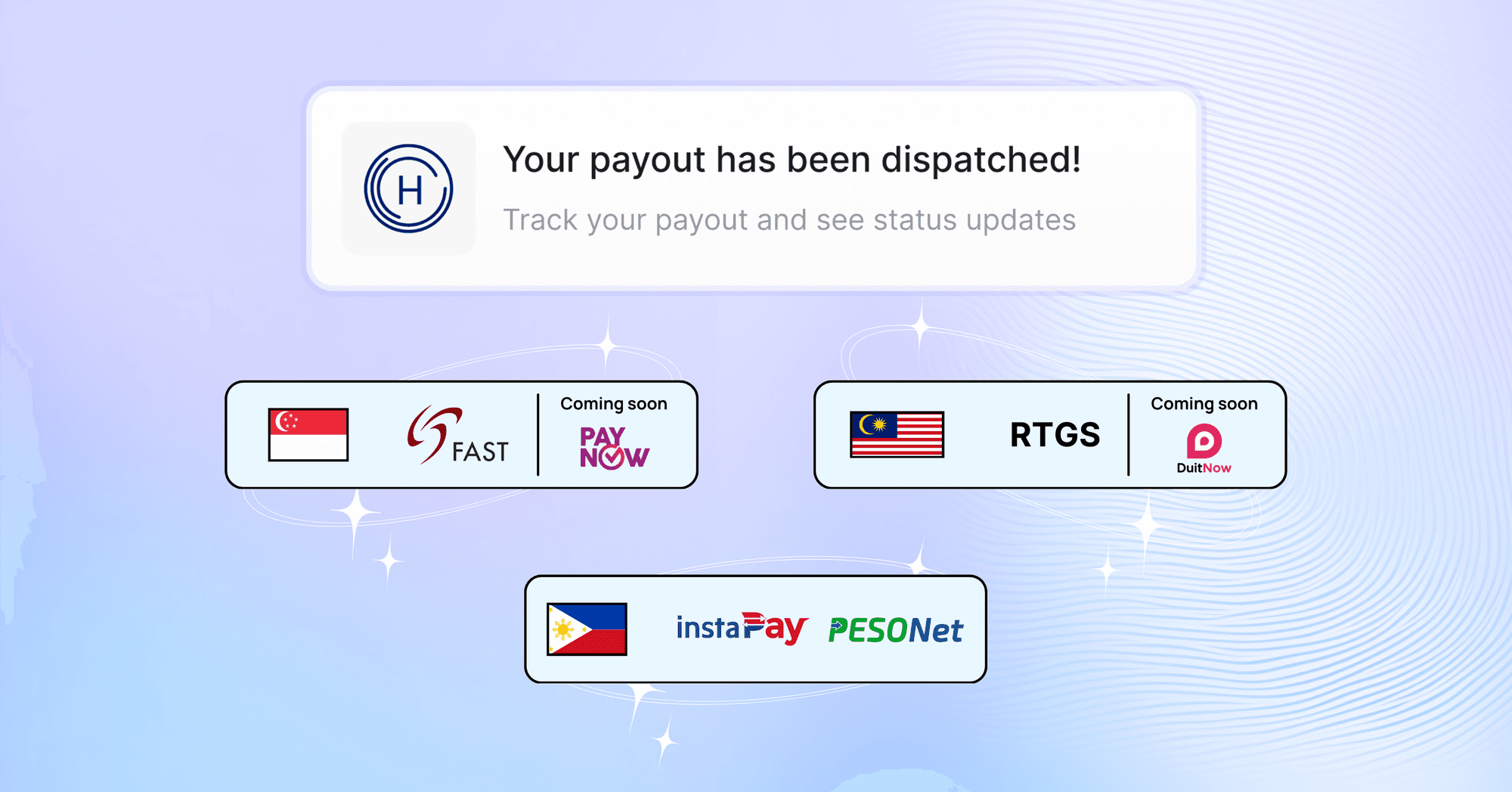

Supported payment networks include FAST in Singapore, RTGS in Malaysia, as well as InstaPay and PESONet in the Philippines.

HitPay will soon be supporting PayNow payouts in Singapore and DuitNow payouts in Malaysia, and will launch additional payment rails in 2024.

With the introduction of its Payout APIs, HitPay expands its end-to-end payment solutions that streamline online payments, point of sale (POS), and B2B payments.

One Payout API for Mass Disbursements

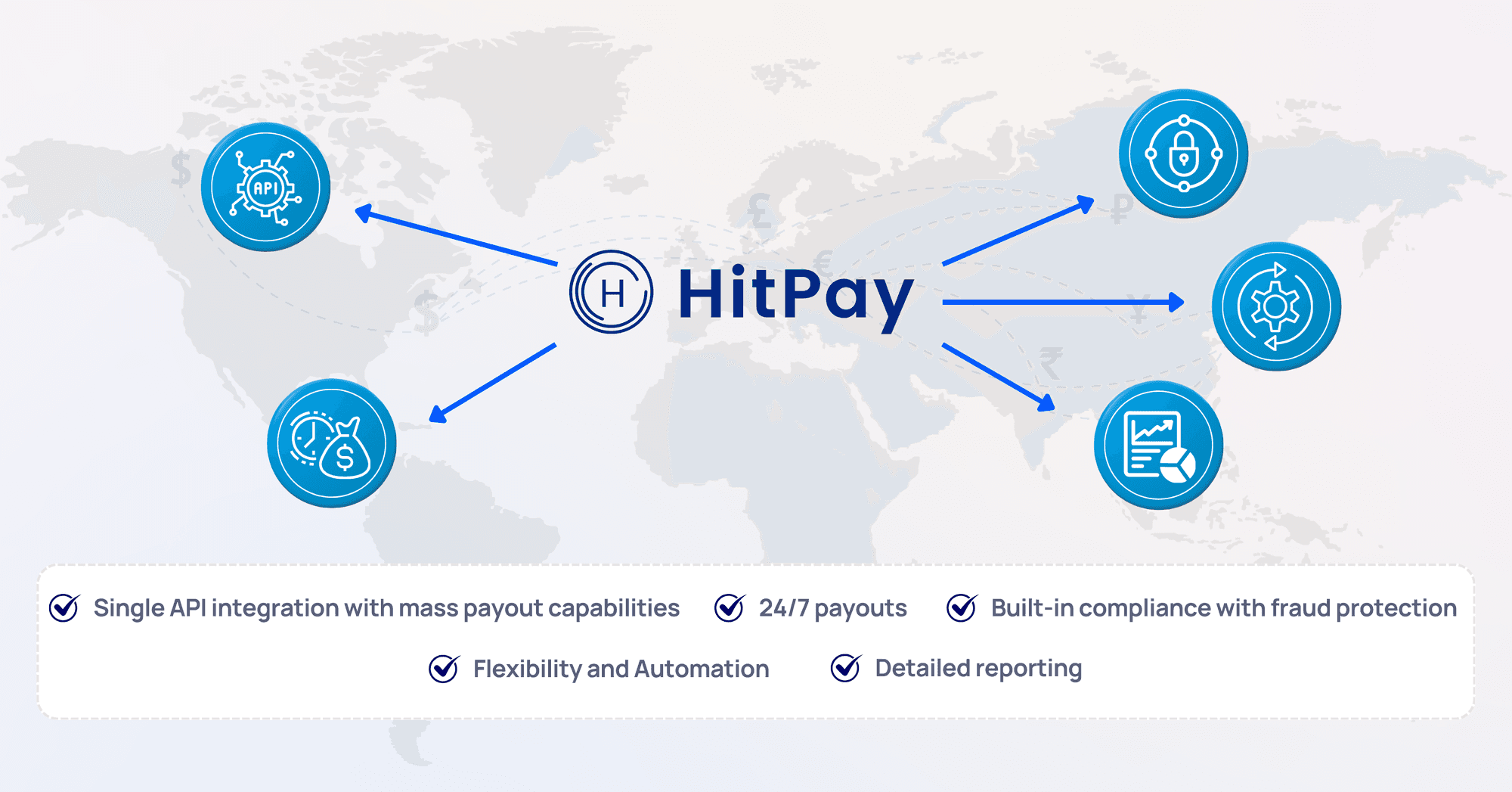

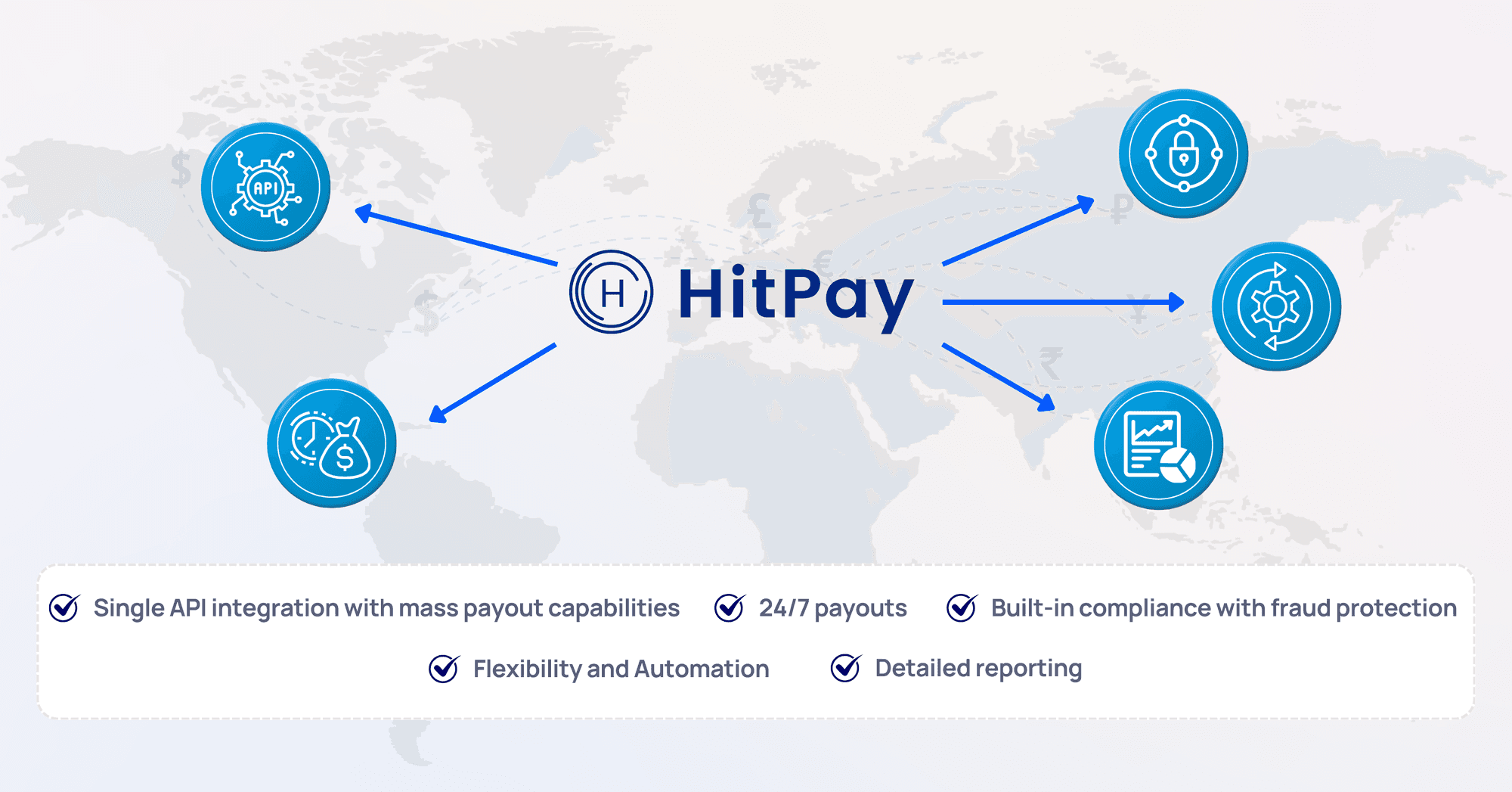

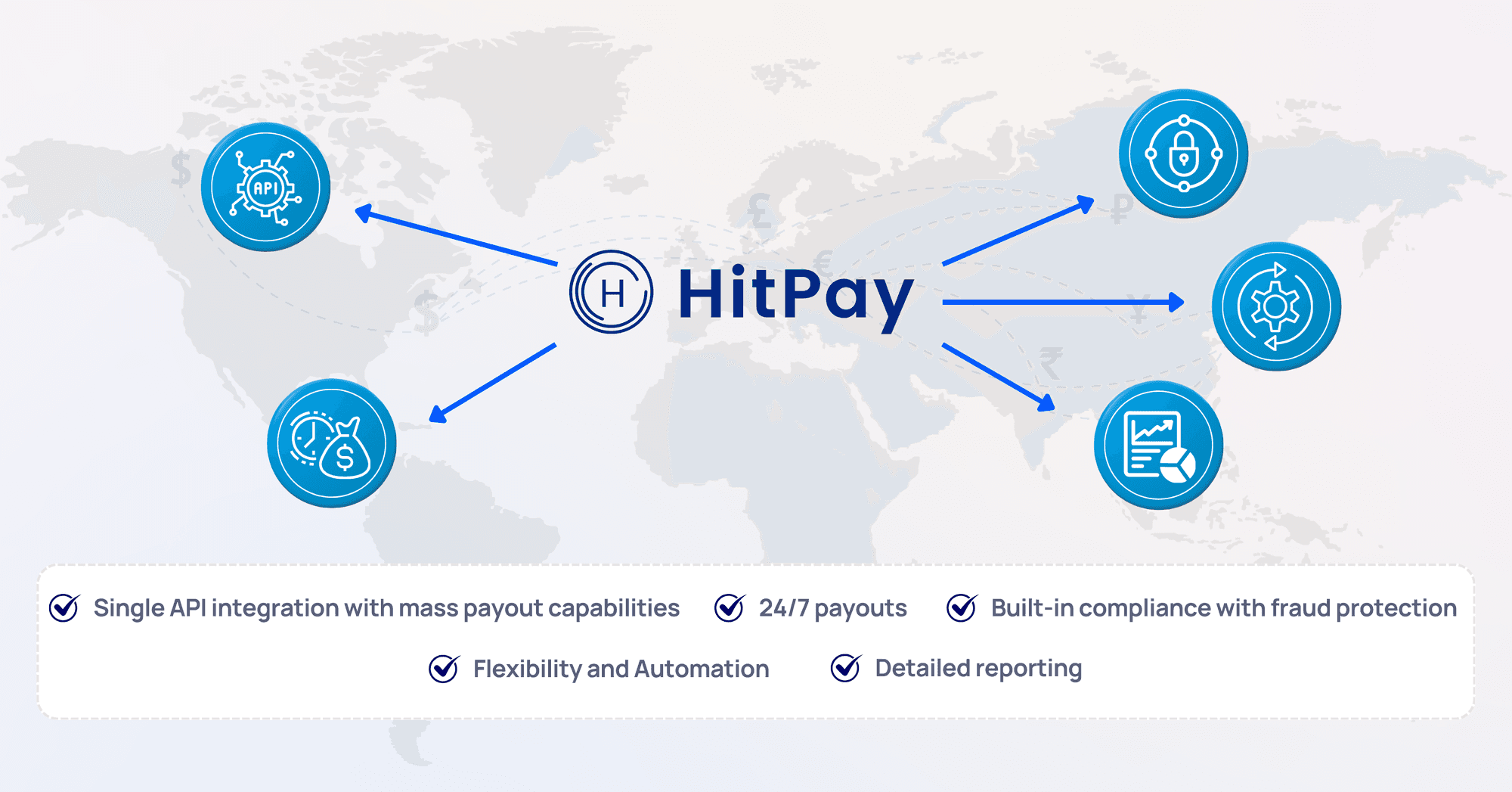

HitPay's Payout APIs help businesses streamline operations and improve cash flow efficiency, with features including:

Single API integration with mass payout capabilities: With a single Payout API call, businesses can send payouts to one or multiple recipients, without the need for intermediaries.

Built-in compliance with fraud protection: HitPay's Payout APIs have built-in compliance features, including transaction monitoring and fraud protection. HitPay is a registered operator of a payment system (OPS) regulated under the Bangko Sentral Ng Pilipinas (BSP), and is regulated by the Monetary Authority of Singapore (MAS).

Flexibility and Automation: Businesses can set up flexible payout instructions and reconciliation based on their payment preferences.

Detailed reporting: Businesses receive comprehensive insights on their transactions, enabling better tracking and management of payouts — all on one account.

24/7 payouts (available in Singapore and the Philippines): Businesses can send funds with no cut-off times or restrictions. This ensures timely payments — increasing loyalty with partners and platform users, and speeding up access to funds.

HitPay currently enables domestic mass payouts in the following countries:

Singapore, via FAST. Support for PayNow payouts is coming soon

Malaysia, via RTGS. Support for DuitNow payouts is coming soon

Philippines, via InstaPay and PESONet

Additional Payout Networks Coming in 2024

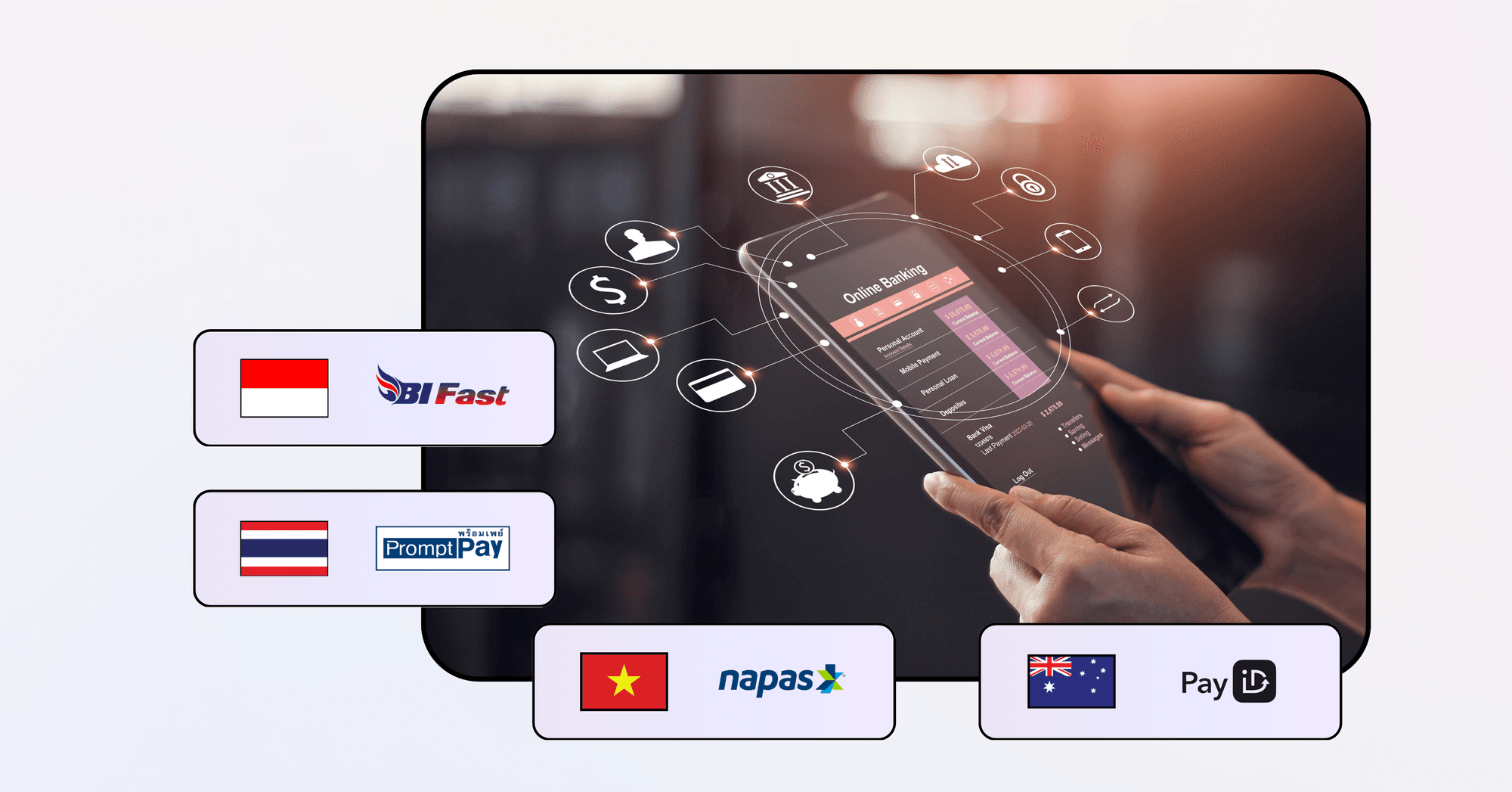

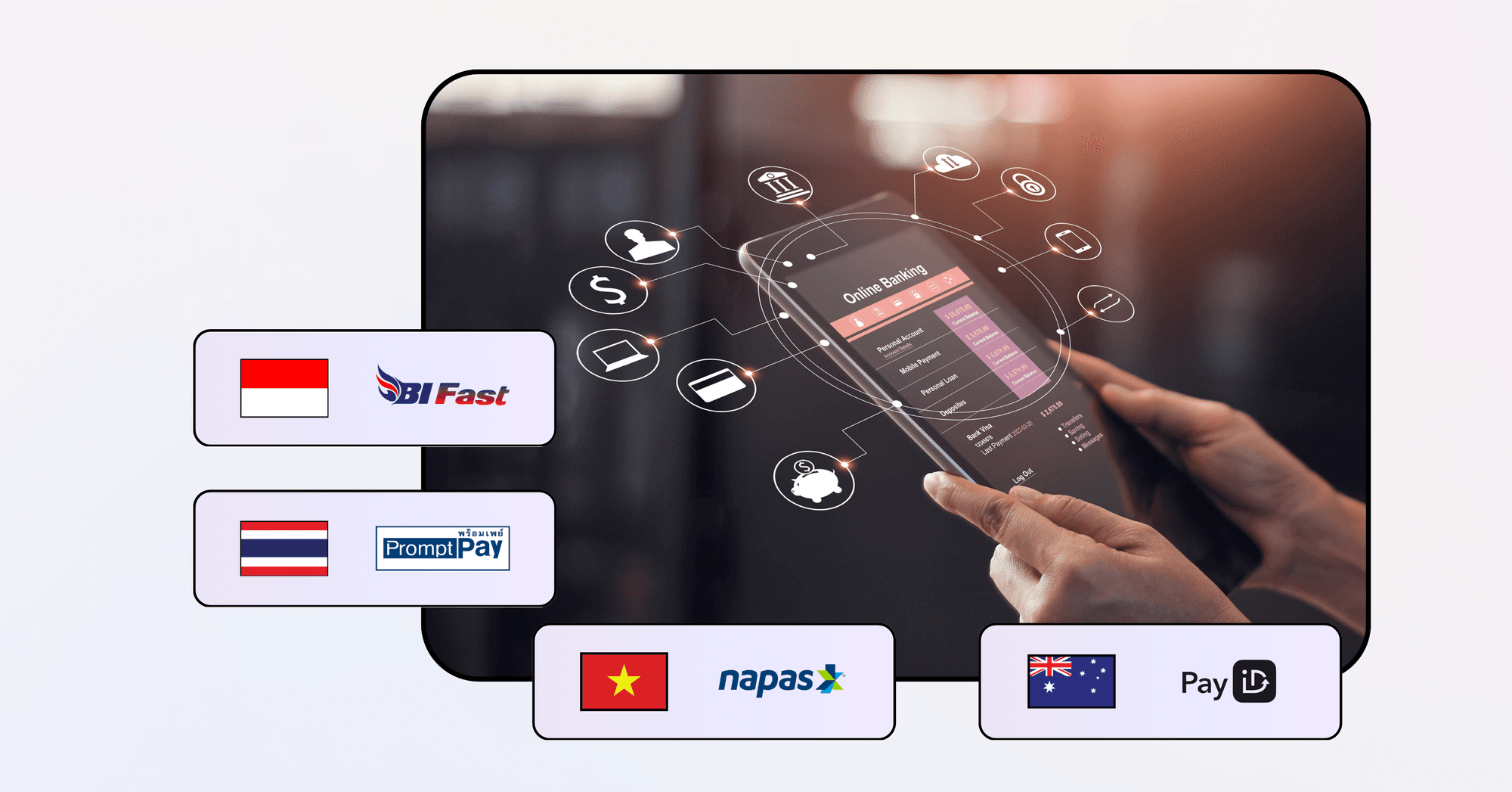

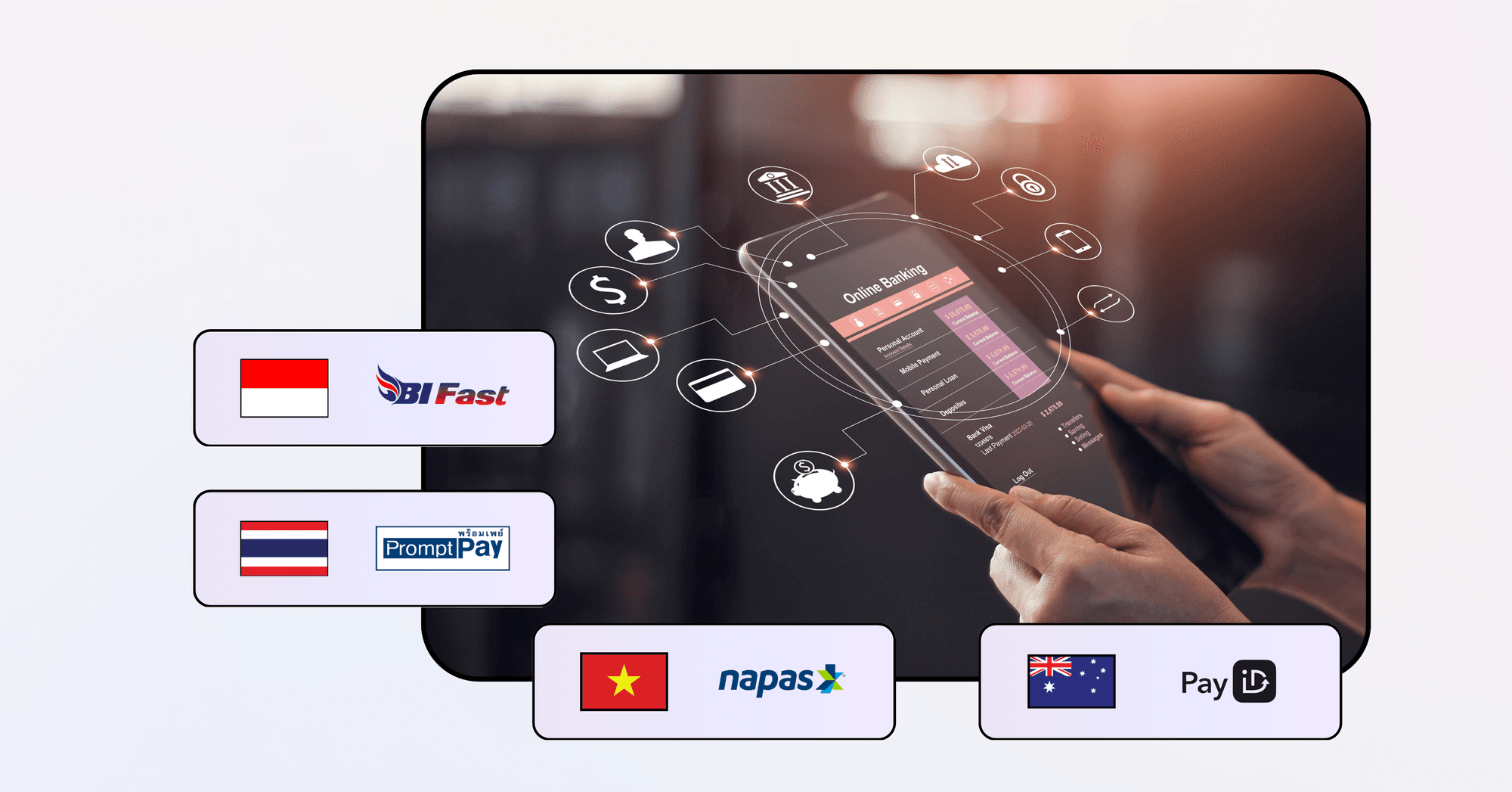

HitPay will support additional payment rails in the coming year, expanding its mass payout capabilities to more countries. Upcoming releases in 2024 include domestic payouts in Indonesia, Thailand, Vietnam, and Australia, as well as global cross-border payouts using real-time payment networks, e-wallets, and OTC channels.

Domestic Payouts in Indonesia, Thailand, Vietnam, and Australia

HitPay will introduce domestic payouts in additional countries, including:

Additional payment networks will be announced in the coming year.

Global Cross-Border Payouts

Alongside the expansion of its domestic payout rails, HitPay will also introduce global cross-border payouts using payment networks, e-wallets, and OTC channels. This will provide businesses with a comprehensive solution for managing payouts in different countries and currencies, with just one integration.

Streamlining Mass Disbursements with HitPay Payout APIs

Interested businesses and platforms in Singapore, Malaysia, and the Philippines can access HitPay's Payout API documentation here.

คุณอาจชอบโพสต์เหล่านี้

HitPay Introduces Payout APIs — Supports FAST, RTGS, InstaPay, and PESONet Disbursements

10 ธันวาคม 2566

HitPay's Payout APIs cover mass payouts in Singapore, Malaysia, and the Philippines, with additional payment networks launching in 2024.

Singapore, 11 Dec 2023 – HitPay, the commerce infrastructure for businesses, introduces mass payouts starting in Singapore, Malaysia, and the Philippines.

Businesses can now seamlessly pay workers, contractors, partners, and suppliers via HitPay. Marketplace and platform-based businesses can also securely manage mass payouts with HitPay's Payout APIs.

Supported payment networks include FAST in Singapore, RTGS in Malaysia, as well as InstaPay and PESONet in the Philippines.

HitPay will soon be supporting PayNow payouts in Singapore and DuitNow payouts in Malaysia, and will launch additional payment rails in 2024.

With the introduction of its Payout APIs, HitPay expands its end-to-end payment solutions that streamline online payments, point of sale (POS), and B2B payments.

One Payout API for Mass Disbursements

HitPay's Payout APIs help businesses streamline operations and improve cash flow efficiency, with features including:

Single API integration with mass payout capabilities: With a single Payout API call, businesses can send payouts to one or multiple recipients, without the need for intermediaries.

Built-in compliance with fraud protection: HitPay's Payout APIs have built-in compliance features, including transaction monitoring and fraud protection. HitPay is a registered operator of a payment system (OPS) regulated under the Bangko Sentral Ng Pilipinas (BSP), and is regulated by the Monetary Authority of Singapore (MAS).

Flexibility and Automation: Businesses can set up flexible payout instructions and reconciliation based on their payment preferences.

Detailed reporting: Businesses receive comprehensive insights on their transactions, enabling better tracking and management of payouts — all on one account.

24/7 payouts (available in Singapore and the Philippines): Businesses can send funds with no cut-off times or restrictions. This ensures timely payments — increasing loyalty with partners and platform users, and speeding up access to funds.

HitPay currently enables domestic mass payouts in the following countries:

Singapore, via FAST. Support for PayNow payouts is coming soon

Malaysia, via RTGS. Support for DuitNow payouts is coming soon

Philippines, via InstaPay and PESONet

Additional Payout Networks Coming in 2024

HitPay will support additional payment rails in the coming year, expanding its mass payout capabilities to more countries. Upcoming releases in 2024 include domestic payouts in Indonesia, Thailand, Vietnam, and Australia, as well as global cross-border payouts using real-time payment networks, e-wallets, and OTC channels.

Domestic Payouts in Indonesia, Thailand, Vietnam, and Australia

HitPay will introduce domestic payouts in additional countries, including:

Additional payment networks will be announced in the coming year.

Global Cross-Border Payouts

Alongside the expansion of its domestic payout rails, HitPay will also introduce global cross-border payouts using payment networks, e-wallets, and OTC channels. This will provide businesses with a comprehensive solution for managing payouts in different countries and currencies, with just one integration.

Streamlining Mass Disbursements with HitPay Payout APIs

Interested businesses and platforms in Singapore, Malaysia, and the Philippines can access HitPay's Payout API documentation here.

คุณอาจชอบโพสต์เหล่านี้

HitPay Introduces Payout APIs — Supports FAST, RTGS, InstaPay, and PESONet Disbursements

10 ธันวาคม 2566

HitPay's Payout APIs cover mass payouts in Singapore, Malaysia, and the Philippines, with additional payment networks launching in 2024.

Singapore, 11 Dec 2023 – HitPay, the commerce infrastructure for businesses, introduces mass payouts starting in Singapore, Malaysia, and the Philippines.

Businesses can now seamlessly pay workers, contractors, partners, and suppliers via HitPay. Marketplace and platform-based businesses can also securely manage mass payouts with HitPay's Payout APIs.

Supported payment networks include FAST in Singapore, RTGS in Malaysia, as well as InstaPay and PESONet in the Philippines.

HitPay will soon be supporting PayNow payouts in Singapore and DuitNow payouts in Malaysia, and will launch additional payment rails in 2024.

With the introduction of its Payout APIs, HitPay expands its end-to-end payment solutions that streamline online payments, point of sale (POS), and B2B payments.

One Payout API for Mass Disbursements

HitPay's Payout APIs help businesses streamline operations and improve cash flow efficiency, with features including:

Single API integration with mass payout capabilities: With a single Payout API call, businesses can send payouts to one or multiple recipients, without the need for intermediaries.

Built-in compliance with fraud protection: HitPay's Payout APIs have built-in compliance features, including transaction monitoring and fraud protection. HitPay is a registered operator of a payment system (OPS) regulated under the Bangko Sentral Ng Pilipinas (BSP), and is regulated by the Monetary Authority of Singapore (MAS).

Flexibility and Automation: Businesses can set up flexible payout instructions and reconciliation based on their payment preferences.

Detailed reporting: Businesses receive comprehensive insights on their transactions, enabling better tracking and management of payouts — all on one account.

24/7 payouts (available in Singapore and the Philippines): Businesses can send funds with no cut-off times or restrictions. This ensures timely payments — increasing loyalty with partners and platform users, and speeding up access to funds.

HitPay currently enables domestic mass payouts in the following countries:

Singapore, via FAST. Support for PayNow payouts is coming soon

Malaysia, via RTGS. Support for DuitNow payouts is coming soon

Philippines, via InstaPay and PESONet

Additional Payout Networks Coming in 2024

HitPay will support additional payment rails in the coming year, expanding its mass payout capabilities to more countries. Upcoming releases in 2024 include domestic payouts in Indonesia, Thailand, Vietnam, and Australia, as well as global cross-border payouts using real-time payment networks, e-wallets, and OTC channels.

Domestic Payouts in Indonesia, Thailand, Vietnam, and Australia

HitPay will introduce domestic payouts in additional countries, including:

Additional payment networks will be announced in the coming year.

Global Cross-Border Payouts

Alongside the expansion of its domestic payout rails, HitPay will also introduce global cross-border payouts using payment networks, e-wallets, and OTC channels. This will provide businesses with a comprehensive solution for managing payouts in different countries and currencies, with just one integration.

Streamlining Mass Disbursements with HitPay Payout APIs

Interested businesses and platforms in Singapore, Malaysia, and the Philippines can access HitPay's Payout API documentation here.

คุณอาจชอบโพสต์เหล่านี้

มาทำให้คุณตั้งค่ากันเถอะ

สร้างบัญชีทันทีหรือติดต่อเราเพื่อสร้างแพ็คเกจที่กำหนดเองสำหรับธุรกิจของคุณ.

ซอฟต์แวร์ธุรกิจ

บริษัท

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

ประเทศอื่น ๆ ทั้งหมด

บริษัท HitPay Payment Solutions Pte Ltd ("HitPay") ได้รับอนุญาตเป็นสถาบันการชำระเงินขนาดใหญ่ (PS20200643) ภายใต้พระราชบัญญัติการบริการการชำระเงินของสิงคโปร์สำหรับการให้บริการการโอนเงินภายในประเทศ, การโอนเงินข้ามพรมแดน และบริการการจัดหาผู้ค้า ซึ่งสามารถยืนยันได้ในไดเรกทอรีสถาบันการเงินของ MAS ที่นี่. HitPay ยังสามารถให้บริการเหล่านี้ร่วมกับพันธมิตรอื่น ๆ ที่ได้รับอนุญาตหรือยกเว้นโดย MAS.

บริษัท HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, สิงคโปร์ 089109

มาทำให้คุณตั้งค่ากันเถอะ

สร้างบัญชีทันทีเพื่อเริ่มต้นหรือติดต่อเรา

เพื่อออกแบบแพ็คเกจที่กำหนดเองสำหรับธุรกิจของคุณ.

ซอฟต์แวร์ธุรกิจ

บริษัท

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

ประเทศอื่น ๆ ทั้งหมด

บริษัท HitPay Payment Solutions Pte Ltd ("HitPay") ได้รับอนุญาตเป็นสถาบันการชำระเงินขนาดใหญ่ (PS20200643) ภายใต้พระราชบัญญัติการบริการการชำระเงินของสิงคโปร์สำหรับการให้บริการการโอนเงินภายในประเทศ, การโอนเงินข้ามพรมแดน และบริการการจัดหาผู้ค้า ซึ่งสามารถยืนยันได้ในไดเรกทอรีสถาบันการเงินของ MAS ที่นี่. HitPay ยังสามารถให้บริการเหล่านี้ร่วมกับพันธมิตรอื่น ๆ ที่ได้รับอนุญาตหรือยกเว้นโดย MAS.

บริษัท HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, สิงคโปร์ 089109

มาทำให้คุณตั้งค่ากันเถอะ

สร้างบัญชีทันทีเพื่อเริ่มต้นหรือติดต่อเราเพื่อออกแบบ

แพ็คเกจที่กำหนดเองสำหรับธุรกิจของคุณ.

ซอฟต์แวร์ธุรกิจ

บริษัท

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

ประเทศอื่น ๆ ทั้งหมด

บริษัท HitPay Payment Solutions Pte Ltd ("HitPay") ได้รับอนุญาตเป็นสถาบันการชำระเงินขนาดใหญ่ (PS20200643) ภายใต้พระราชบัญญัติการบริการการชำระเงินของสิงคโปร์สำหรับการให้บริการการโอนเงินภายในประเทศ, การโอนเงินข้ามพรมแดน และบริการการจัดหาผู้ค้า ซึ่งสามารถยืนยันได้ในไดเรกทอรีสถาบันการเงินของ MAS ที่นี่. HitPay ยังสามารถให้บริการเหล่านี้ร่วมกับพันธมิตรอื่น ๆ ที่ได้รับอนุญาตหรือยกเว้นโดย MAS.

บริษัท HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, สิงคโปร์ 089109

มาทำให้คุณตั้งค่ากันเถอะ

สร้างบัญชีทันทีเพื่อเริ่มต้นหรือ ติดต่อเราสำหรับการออกแบบแพ็คเกจที่กำหนดเอง

สำหรับธุรกิจของคุณ.

ซอฟต์แวร์ธุรกิจ

บริษัท

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

ประเทศอื่น ๆ ทั้งหมด

HitPay Payment Solutions Pte Ltd ("HitPay") ได้รับใบอนุญาตเป็นสถาบันการชำระเงินที่สำคัญ (PS20200643) ภายใต้พระราชบัญญัติการชำระเงินของสิงคโปร์ สำหรับการให้บริการโอนเงินภายในประเทศ, การโอนเงินข้ามพรมแดน และบริการการจัดหาค่าใช้จ่ายให้กับพ่อค้า ซึ่งสามารถยืนยันได้ในไดเรกทอรีสถาบันการเงิน MAS ที่นี่. HitPay อาจให้บริการเหล่านี้ในความร่วมมือกับพันธมิตรที่ได้รับใบอนุญาตหรือได้รับการยกเว้นจาก MAS อื่น ๆ

HitPay Payment Solutions Pte Ltd

1 ถนนเคียงไทร, สิงคโปร์ 089109