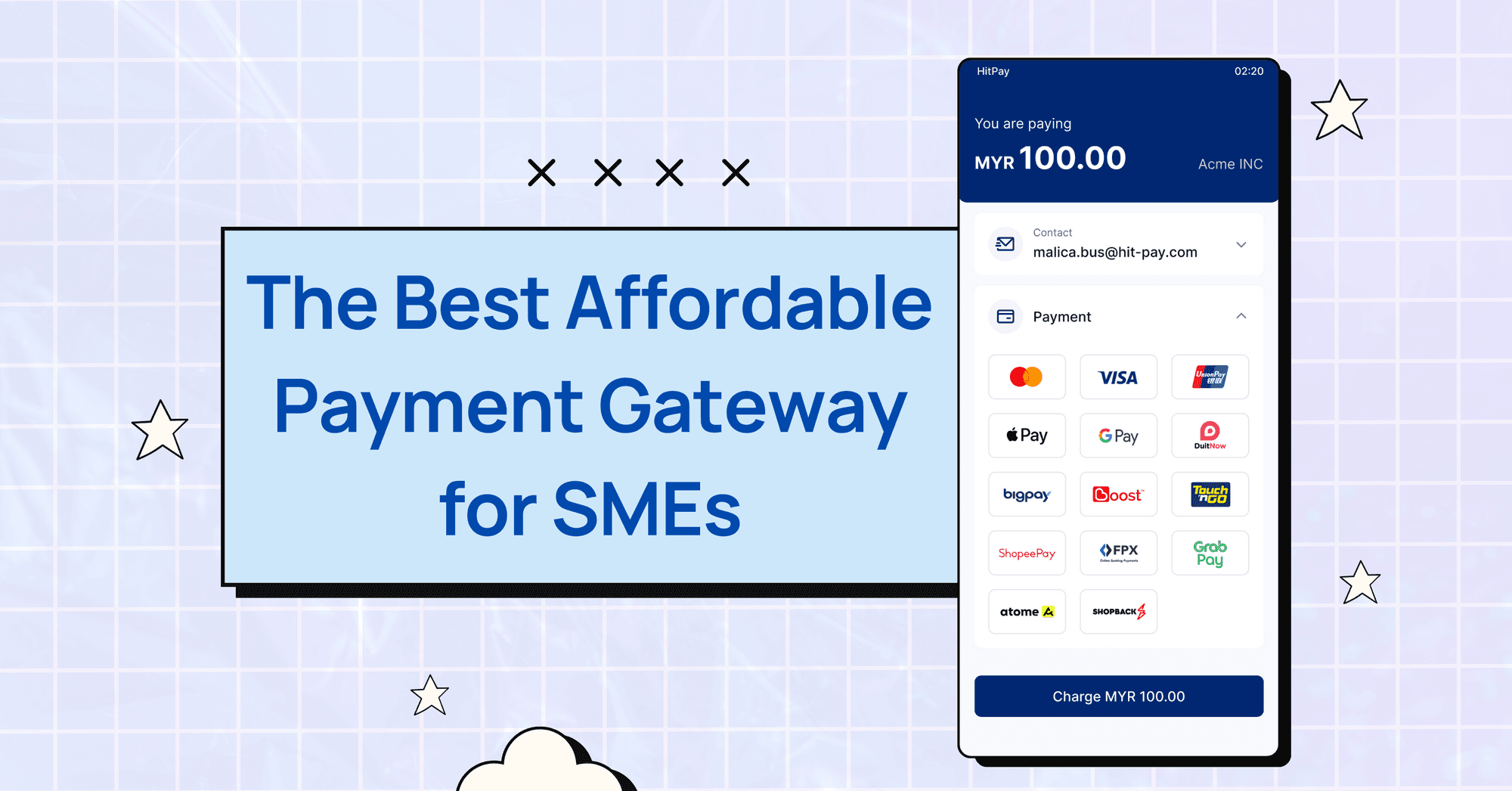

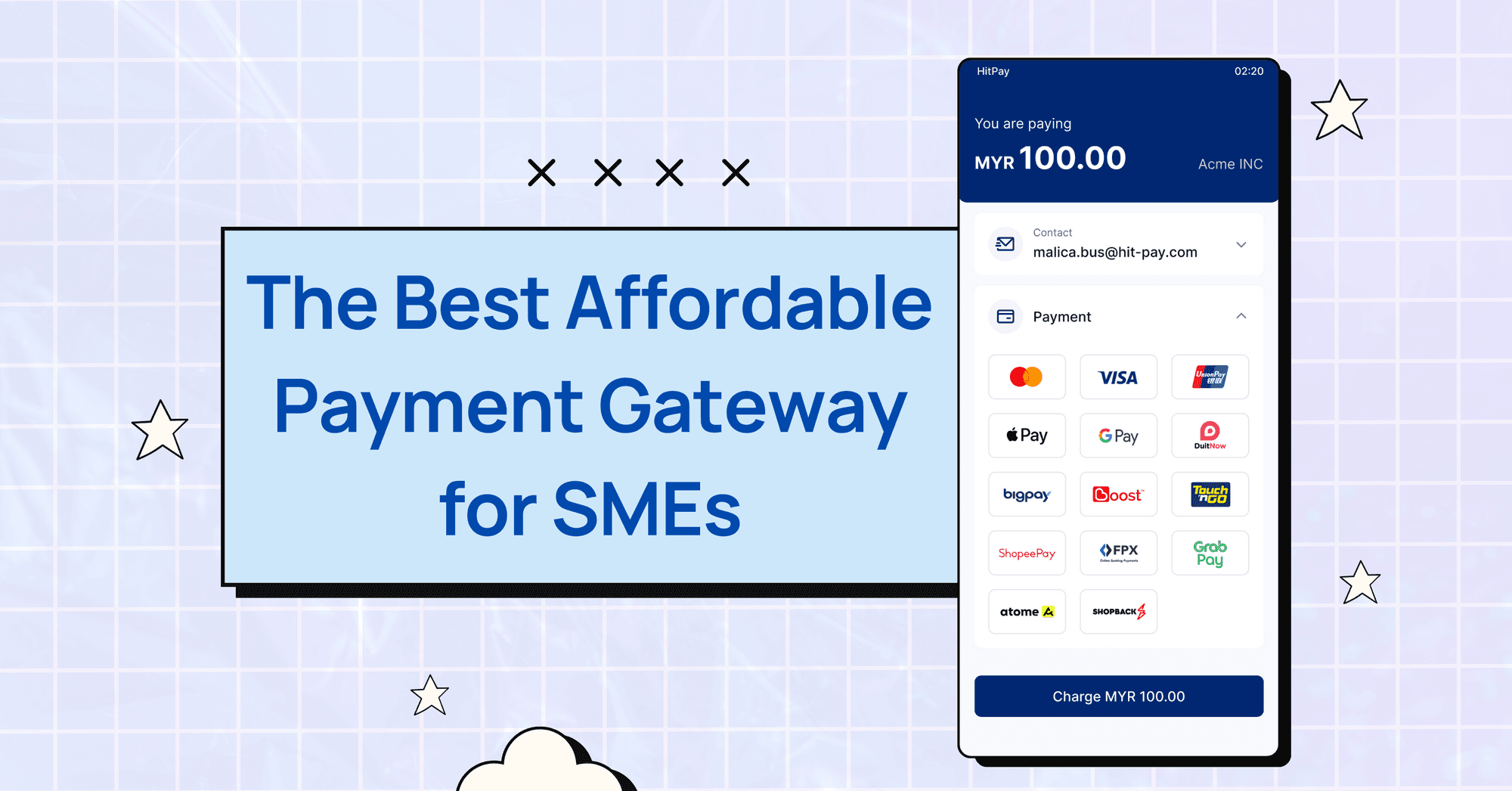

The Best Affordable Payment Gateway for SMEs In Malaysia

20 ตุลาคม 2566

HitPay is a reliable payment gateway for small businesses in Malaysia. It offers a wide range of features, including secure transactions, global reach, a user-friendly checkout experience, and integration with popular platforms.

Selecting the right payment gateway is crucial for small businesses, as it directly impacts their customer experience, security, and profitability. A reliable and cost-effective payment gateway can streamline transactions, boost customer confidence, and promote business growth.

As an SME in Malaysia, it is essential to consider factors such as processing fees, monthly software plans, transparency in pricing, and additional charges for setup or cancellation.

HitPay offers an affordable and convenient payment gateway for small businesses in Malaysia and beyond, with its competitive pricing, user-friendly interface, and secure transaction processing.

Payment gateways play a crucial role in the world of online transactions. Let's explore what they are, how they work, and the benefits for small businesses.

What is a Payment Gateway?

A payment gateway is a digital service that facilitates secure online transactions between customers and merchants.

It acts as a bridge, enabling the exchange of payment information between the customer's bank and the merchant's bank. This ensures that payments are processed smoothly and securely.

Why is it important for businesses to choose an affordable payment gateway?

There are several reasons why it is important for businesses to choose an affordable payment gateway:

To save money on payment processing fees: Payment processing fees can be a significant expense for businesses, especially those that process a high volume of transactions. Choosing an affordable payment gateway can help businesses to save money on these fees and improve their bottom line.

To be more competitive: In today's competitive marketplace, businesses need to be able to offer their customers the best possible prices. By choosing an affordable payment gateway, businesses can keep their prices low and be more competitive with other businesses.

To attract and retain customers: Customers are increasingly looking for businesses that offer convenient and affordable payment options. By choosing an affordable payment gateway, businesses can make it easier and more affordable for their customers to pay for goods and services, which can lead to increased sales and customer loyalty.

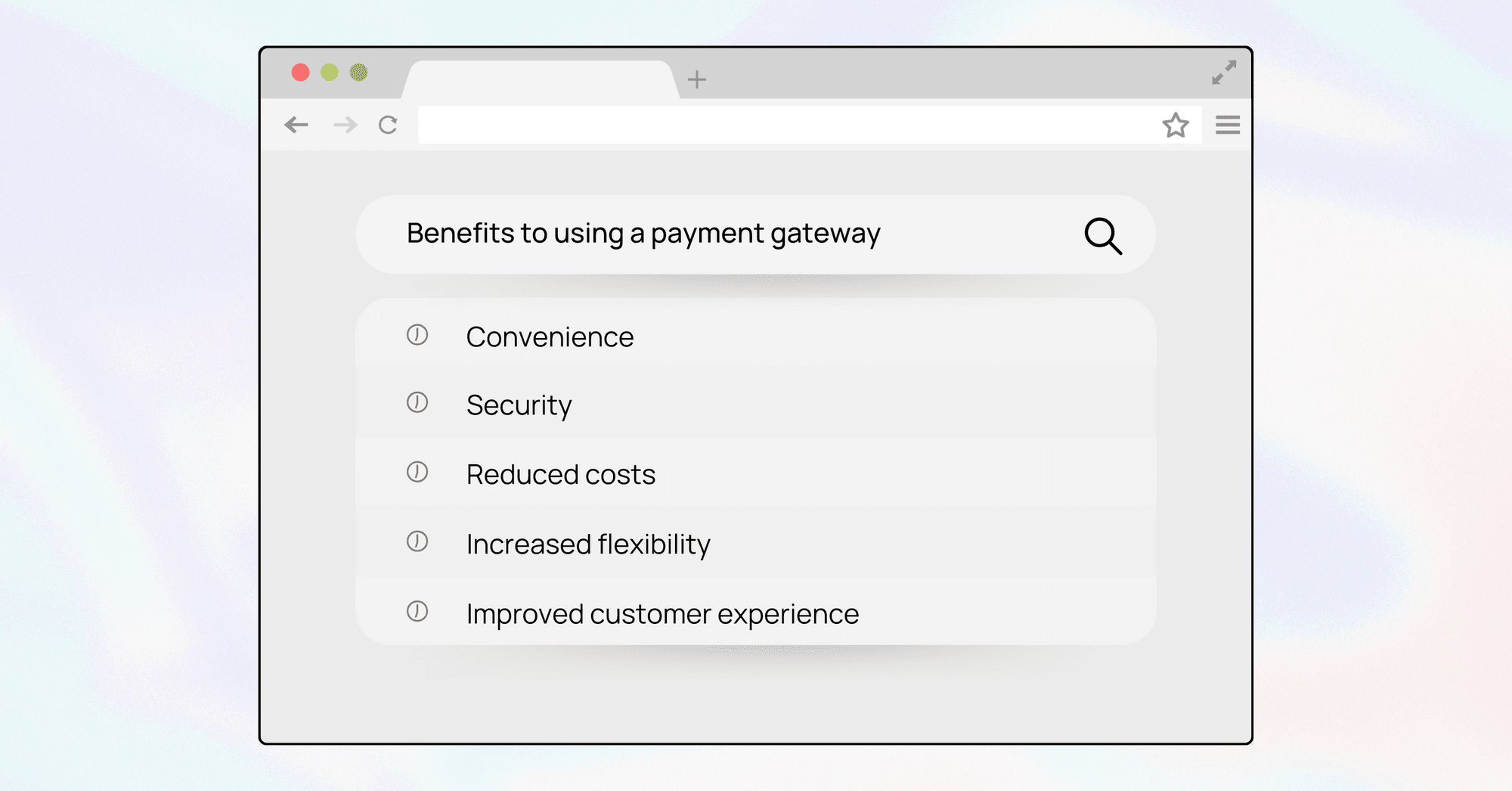

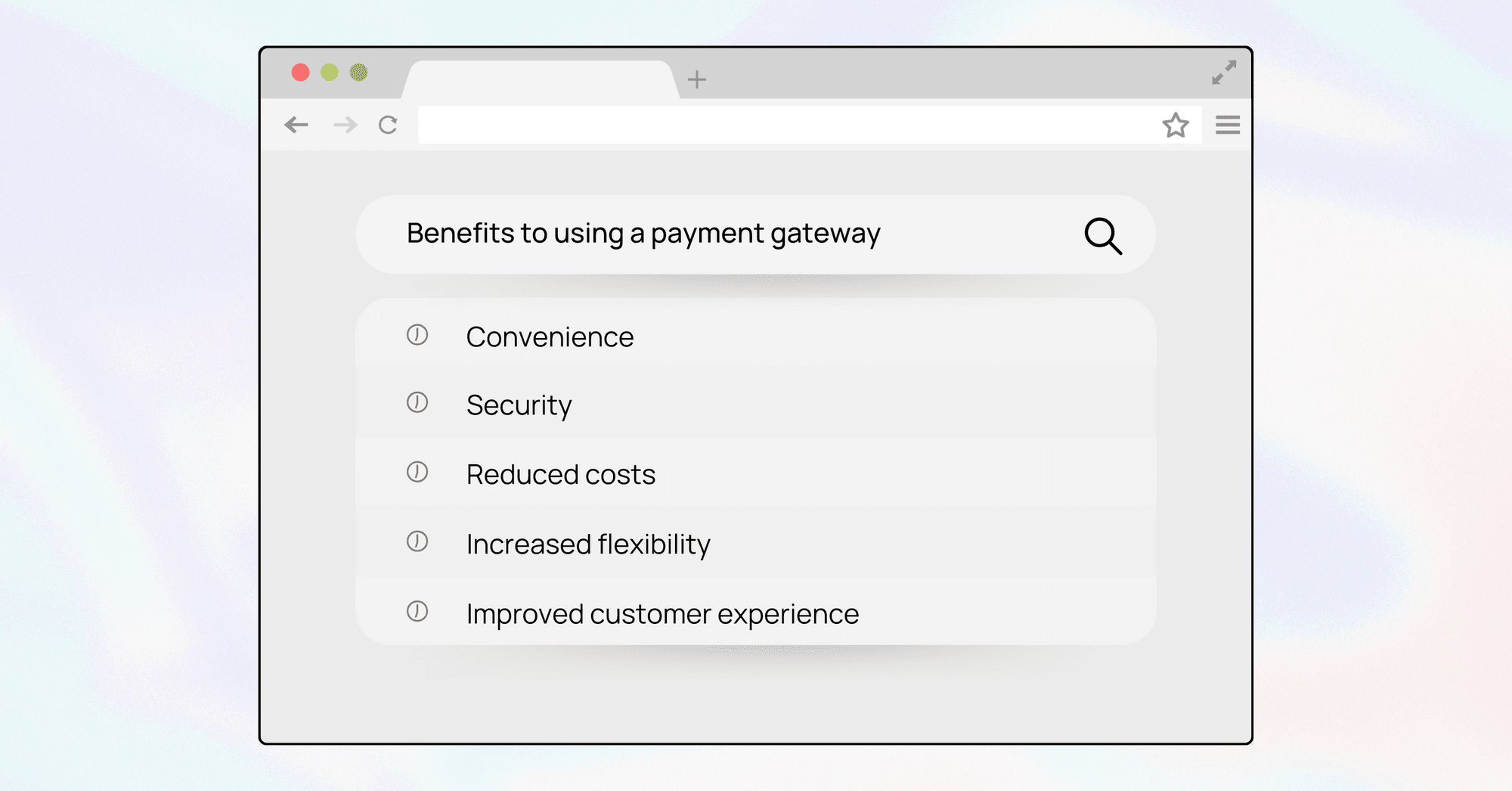

Benefits of Using a Payment Gateway

There are many benefits to using a payment gateway, including:

Convenience: Payment gateways allow customers to pay for goods and services quickly and easily, without having to leave the website or app where they are shopping. This can lead to an increase in sales and conversion rates.

Security: Payment gateways use a variety of security measures to protect customer data from fraud and theft. This can help to build trust with customers and reduce the risk of chargebacks.

Reduced costs: Payment gateways can help businesses to reduce their costs by streamlining the payment process and eliminating the need to process payments manually. This can free up time and resources for other tasks.

Increased flexibility: Payment gateways allow businesses to accept a variety of payment methods, including credit cards, debit cards, e-wallets, and bank transfers. This can make it easier for customers to pay for goods and services, and it can also help businesses to expand into new markets.

Improved customer experience: Payment gateways can help to improve the customer experience by providing a seamless and secure checkout process. This can lead to repeat business and increased customer loyalty.

In addition to these general benefits, payment gateways can also offer specific features that can be helpful for businesses of all sizes. For example, some payment gateways offer recurring billing, fraud protection, and analytics tools.

Features to Look for in a Payment Gateway

When choosing a payment gateway, it is important to consider the following attributes:

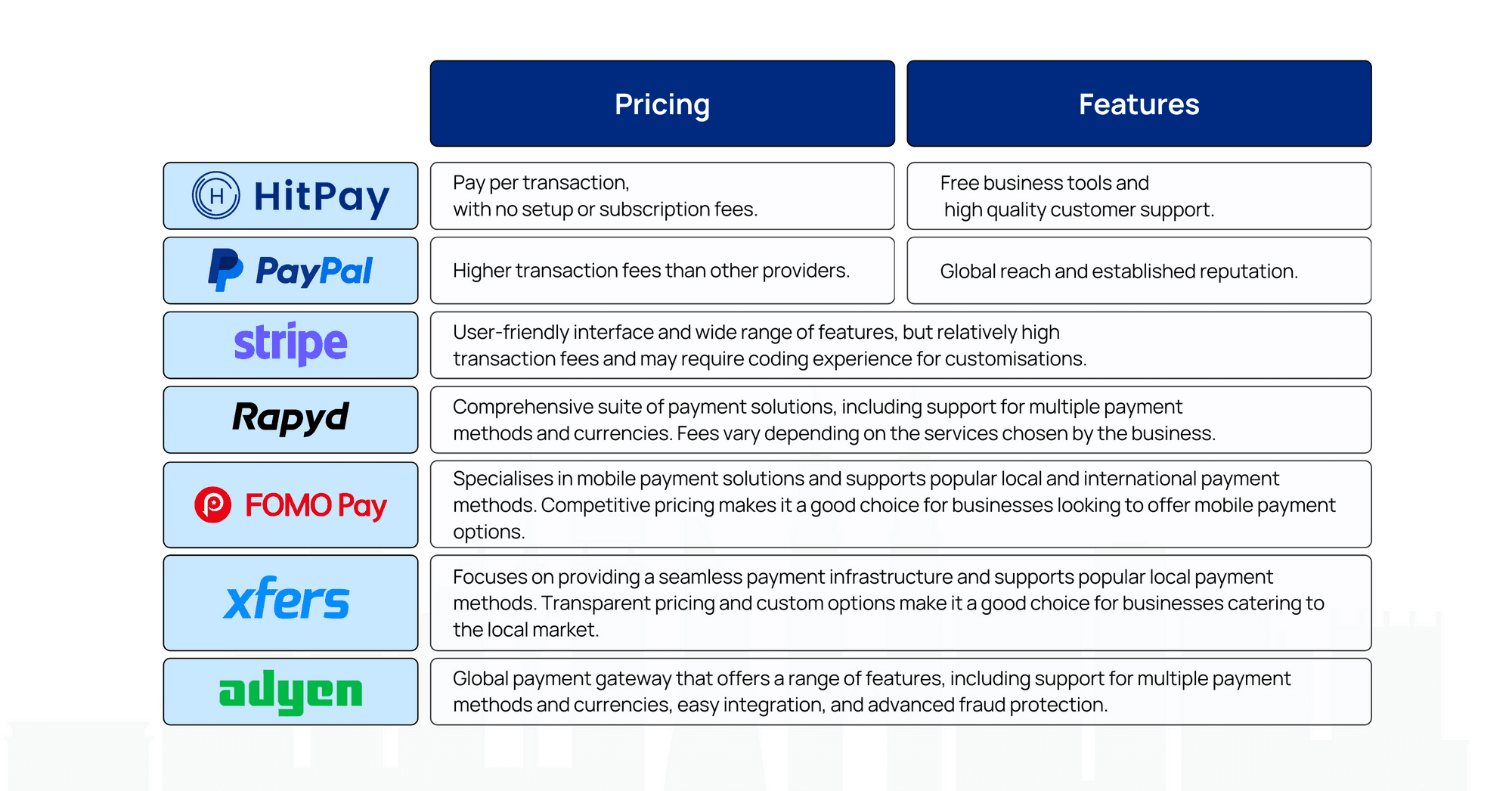

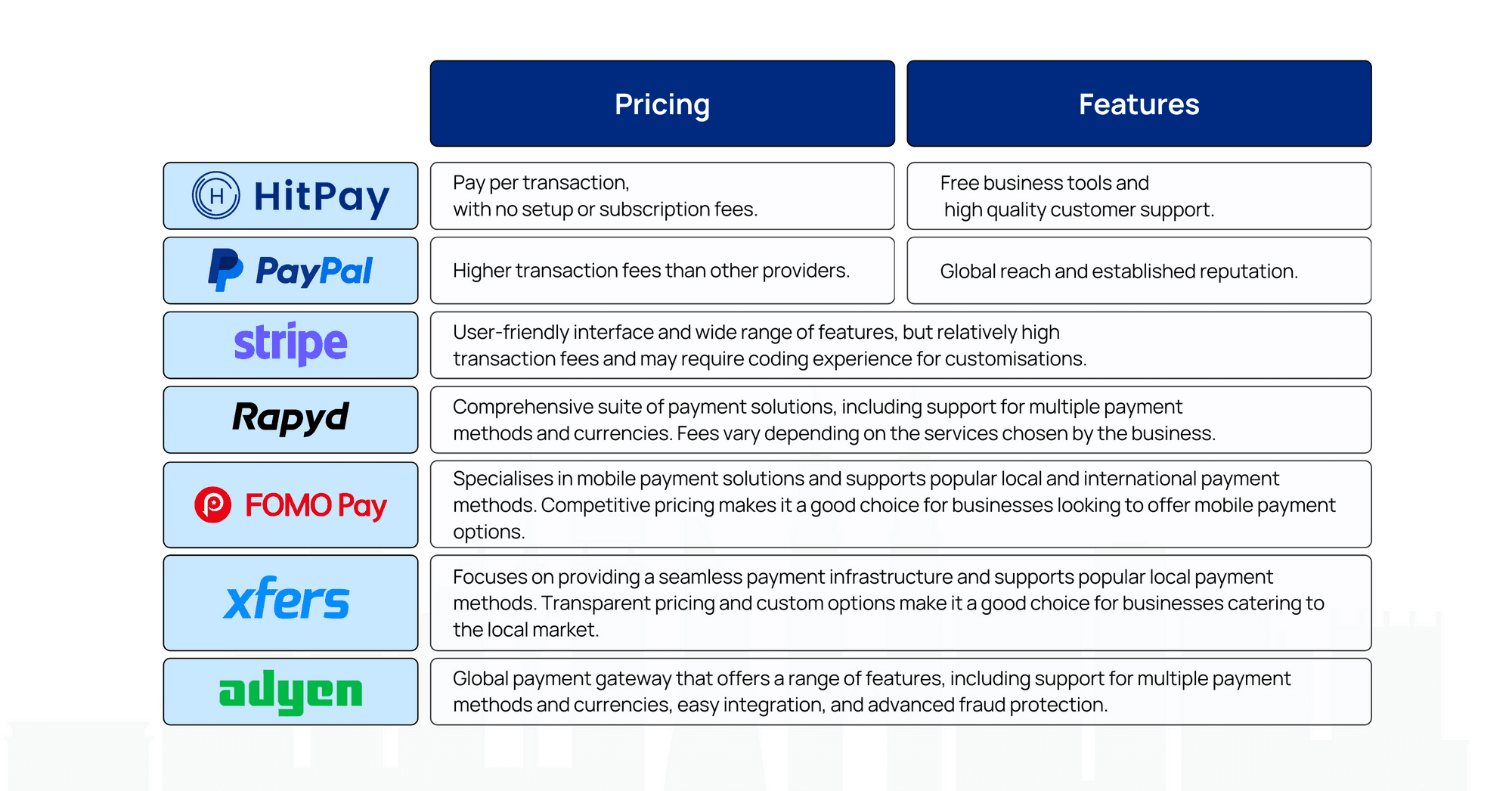

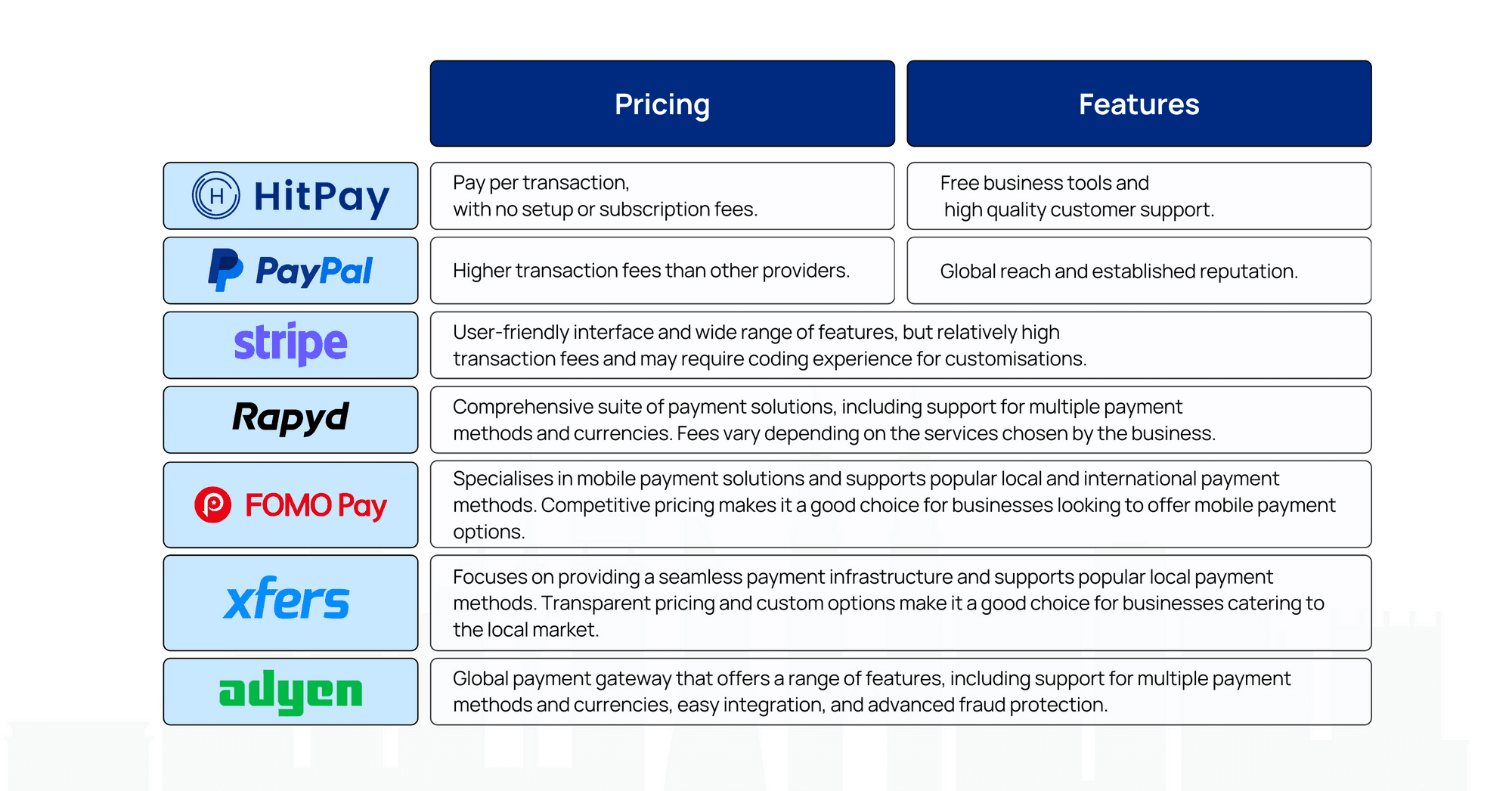

Pricing: Payment gateways charge a variety of fees, including transaction fees, monthly fees, and setup fees as shown below:

Transaction fees: These are charged for each transaction that you process, and the amount can vary depending on the payment gateway and the payment method used.

Setup fees: Some payment gateways charge a one-time fee to set up your account.

Monthly fees: Certain gateways require you to pay a monthly subscription fee to continue using their services.

Currency conversion fees: If your business accepts payments in multiple currencies, you may be charged a fee for converting the funds to your local currency.

Features: Payment gateways offer a variety of features, such as support for multiple payment methods, recurring billing, and fraud protection. It is important to choose a payment gateway that offers the features that are important to your business.

Customer support: It is important to choose a payment gateway that offers good customer support in case you have any problems.

Security: Payment gateways use a variety of security measures to protect customer data from fraud and theft. It is important to choose a payment gateway that has a strong security track record.

Ease of use: It is important to choose a payment gateway that is easy to set up and use. This will save you time and hassle in the long run.

In addition to these general attributes, you may also want to consider the following factors when choosing a payment gateway:

International support: If you sell products or services to customers outside of your home country, you will need to choose a payment gateway that supports international payments.

Integration with your e-commerce platform: If you use an e-commerce platform, such as Shopify or WooCommerce, you will need to choose a payment gateway that integrates with your platform. This will make it easier to accept payments from your customers.

Payment processing speed: If you need to process payments quickly, you will need to choose a payment gateway that offers fast payment processing times.

Fraud protection: Fraud prevention features, such as 3D Secure and address verification, can help to protect your business from fraud.

Analytics tools: Payment gateways often offer analytics tools that can help you to track your sales and payment data. This information can be helpful for making business decisions.

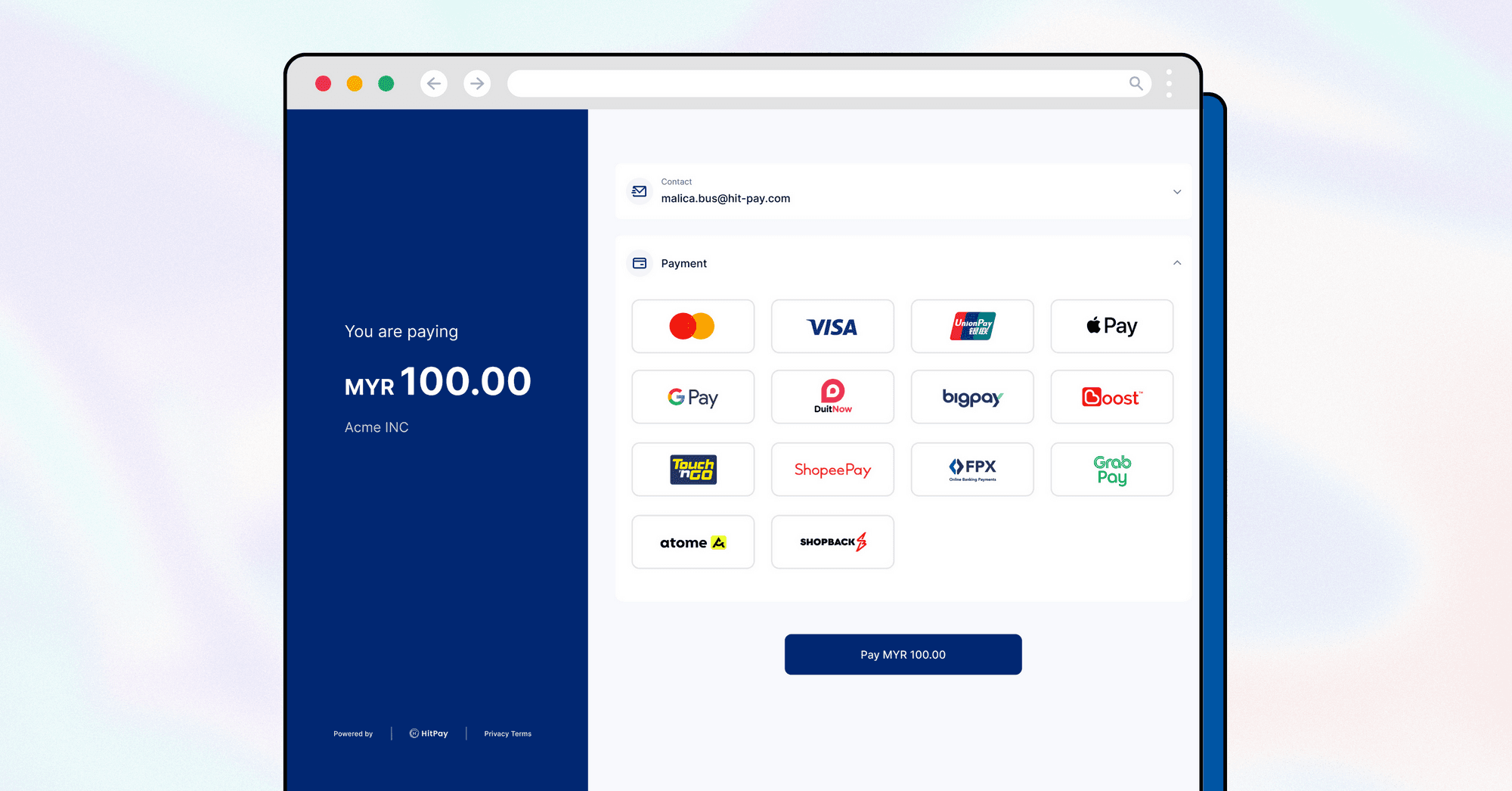

HitPay: An Affordable and Reliable Payment Gateway for Small Businesses In Malaysia

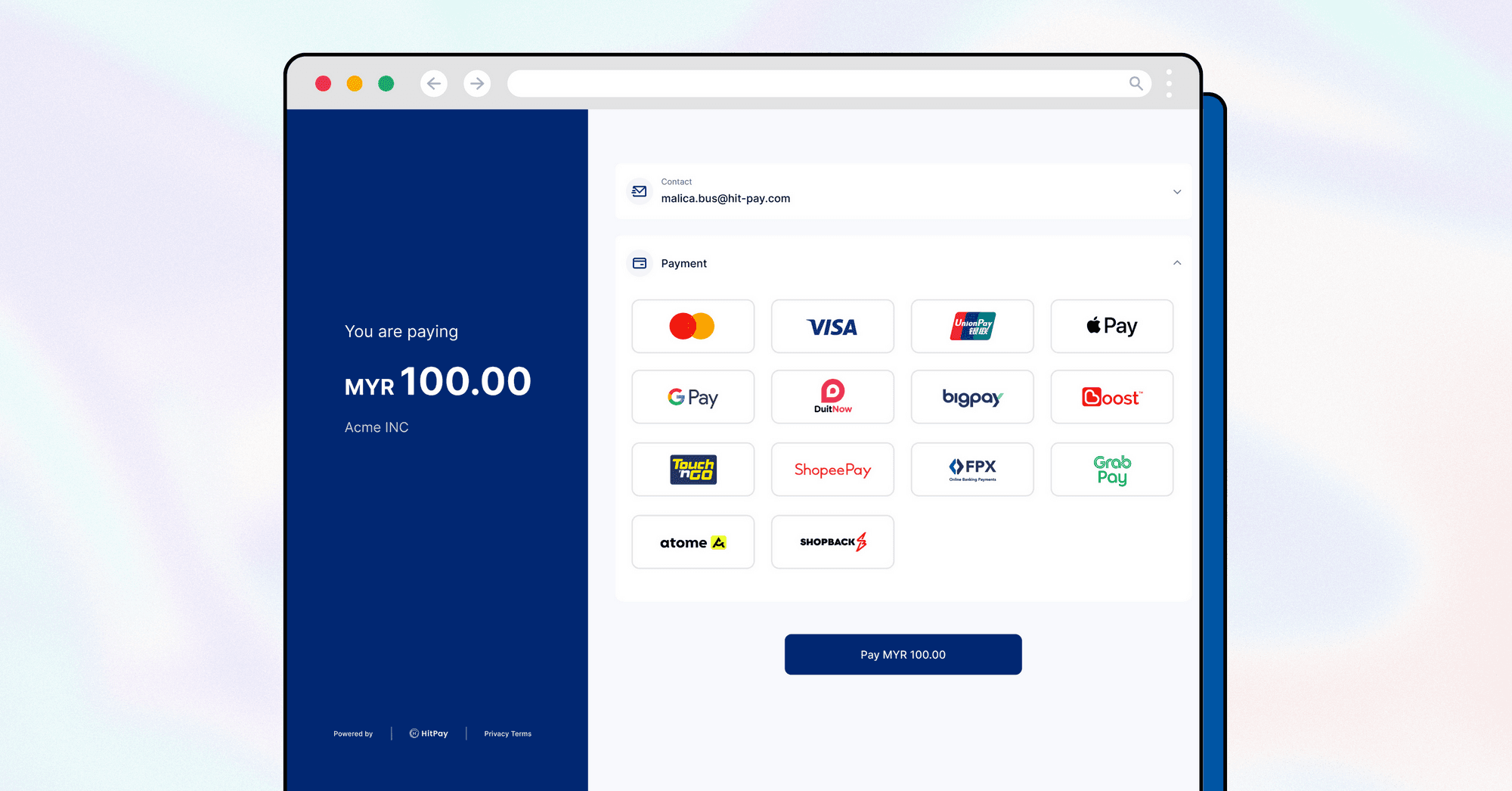

HitPay is a Singapore-based payment gateway that offers a wide range of features and benefits for small businesses in Malaysia, including:

Seamless integration with popular e-commerce platforms

Support for multiple payment methods, including cards, bank transfers, e-wallets, and pay later options

Competitive pricing, with no setup, recurring, or upfront costs

Easy-to-use dashboard and advanced online checkout rules

SME-friendly approach with instant or quick verification and same or next-day payouts

Benefits of HitPay Payment Gateway

HitPay offers various payment processing options, including online, point of sale (POS), and business-to-business (B2B) payments, catering to the diverse needs of small businesses in multiple industries.

For example, an online retail business can use HitPay to accept payments from customers on its website and mobile app. A brick-and-mortar store can use HitPay to accept payments from customers at the checkout counter. And a B2B business can use HitPay to accept payments from other businesses for goods and services rendered. Some of the other benefits include:

Global Reach and Secure Transactions:

Strong security measures ensure the safe processing of transactions.

Global reach allows small businesses to expand their customer base internationally.

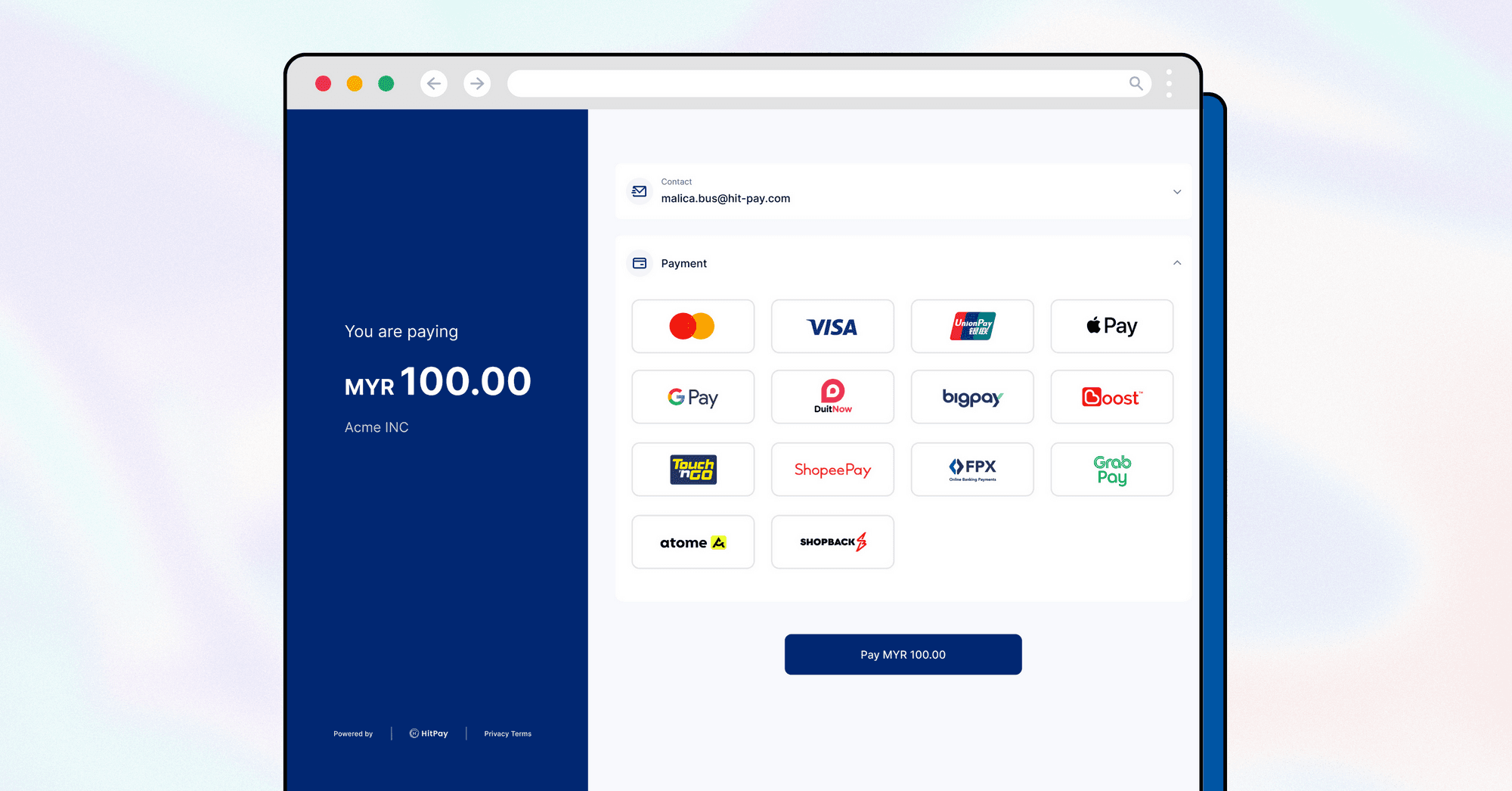

User-friendly Checkout Experience

Enhances customer satisfaction.

Promotes repeat business and fosters long-term customer relationships.

Integration with Popular Platforms

Seamless integration with popular platforms like Shopify.

Streamlines the payment processing experience for small businesses.

Ensures smooth operations and efficient management of transactions.

No-code Tools and Competitive Pricing

No-code tools make it easy for small businesses to get started with HitPay.

Competitive pricing makes HitPay an attractive option for small businesses.

Additional Business Software

HitPay offers additional business software, such as POS, online store, and recurring billing, without monthly subscription fees.

Provides small businesses with a comprehensive payment solution that meets their unique needs and budget constraints.

HitPay vs Other Payment Gateways in Malaysia

When choosing a payment gateway for your business in Malaysia, it's important to compare the fees and features of different providers. Here's a closer look at some of the most popular options:

HitPay

Pricing: Pay per transaction, with no setup or subscription fees.

Features: Free business tools and high quality customer support

PayPal

Pricing: Higher transaction fees than other providers.

Features: Global reach and established reputation.

Unlike global payment gateways (PayPal), HitPay allows you to pay with local payment methods like FPX, DuitNow, GrabPay, and Shopback PayLater. HitPay also accepts international and local credit cards.

Other popular payment gateways in Malaysia:

Stripe: User-friendly interface and wide range of features, but relatively high transaction fees and may require coding experience for customisations.

Rapyd: Comprehensive suite of payment solutions, including support for multiple payment methods and currencies. Fees vary depending on the services chosen by the business.

FOMO Pay: Specialises in mobile payment solutions and supports popular local and international payment methods. Competitive pricing makes it a good choice for businesses looking to offer mobile payment options.

Xfers: Focuses on providing a seamless payment infrastructure and supports popular local payment methods. Transparent pricing and custom options make it a good choice for businesses catering to the local market.

Adyen: Global payment gateway that offers a range of features, including support for multiple payment methods and currencies, easy integration, and advanced fraud protection.

HitPay is a good option for small businesses that are looking for an affordable and reliable payment gateway with a wide range of features.

For Malaysian SME's, HitPay offers competitive pricing, support for multiple payment methods including FPX, DuitNow, Visa, Mastercard and GrabPay.

It has a user-friendly dashboard, and integration with popular e-commerce platforms. HitPay is also known for its SME-friendly approach, instant or quick verification, and same or next-day payouts.

Ultimately, the best payment gateway for your business will depend on your specific needs and requirements. However, by considering the factors listed above, you can make an informed decision that will help you to save money, grow your business, and improve the customer experience.

Have questions about HitPay?

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

Read also:

คุณอาจชอบโพสต์เหล่านี้

The Best Affordable Payment Gateway for SMEs In Malaysia

20 ตุลาคม 2566

HitPay is a reliable payment gateway for small businesses in Malaysia. It offers a wide range of features, including secure transactions, global reach, a user-friendly checkout experience, and integration with popular platforms.

Selecting the right payment gateway is crucial for small businesses, as it directly impacts their customer experience, security, and profitability. A reliable and cost-effective payment gateway can streamline transactions, boost customer confidence, and promote business growth.

As an SME in Malaysia, it is essential to consider factors such as processing fees, monthly software plans, transparency in pricing, and additional charges for setup or cancellation.

HitPay offers an affordable and convenient payment gateway for small businesses in Malaysia and beyond, with its competitive pricing, user-friendly interface, and secure transaction processing.

Payment gateways play a crucial role in the world of online transactions. Let's explore what they are, how they work, and the benefits for small businesses.

What is a Payment Gateway?

A payment gateway is a digital service that facilitates secure online transactions between customers and merchants.

It acts as a bridge, enabling the exchange of payment information between the customer's bank and the merchant's bank. This ensures that payments are processed smoothly and securely.

Why is it important for businesses to choose an affordable payment gateway?

There are several reasons why it is important for businesses to choose an affordable payment gateway:

To save money on payment processing fees: Payment processing fees can be a significant expense for businesses, especially those that process a high volume of transactions. Choosing an affordable payment gateway can help businesses to save money on these fees and improve their bottom line.

To be more competitive: In today's competitive marketplace, businesses need to be able to offer their customers the best possible prices. By choosing an affordable payment gateway, businesses can keep their prices low and be more competitive with other businesses.

To attract and retain customers: Customers are increasingly looking for businesses that offer convenient and affordable payment options. By choosing an affordable payment gateway, businesses can make it easier and more affordable for their customers to pay for goods and services, which can lead to increased sales and customer loyalty.

Benefits of Using a Payment Gateway

There are many benefits to using a payment gateway, including:

Convenience: Payment gateways allow customers to pay for goods and services quickly and easily, without having to leave the website or app where they are shopping. This can lead to an increase in sales and conversion rates.

Security: Payment gateways use a variety of security measures to protect customer data from fraud and theft. This can help to build trust with customers and reduce the risk of chargebacks.

Reduced costs: Payment gateways can help businesses to reduce their costs by streamlining the payment process and eliminating the need to process payments manually. This can free up time and resources for other tasks.

Increased flexibility: Payment gateways allow businesses to accept a variety of payment methods, including credit cards, debit cards, e-wallets, and bank transfers. This can make it easier for customers to pay for goods and services, and it can also help businesses to expand into new markets.

Improved customer experience: Payment gateways can help to improve the customer experience by providing a seamless and secure checkout process. This can lead to repeat business and increased customer loyalty.

In addition to these general benefits, payment gateways can also offer specific features that can be helpful for businesses of all sizes. For example, some payment gateways offer recurring billing, fraud protection, and analytics tools.

Features to Look for in a Payment Gateway

When choosing a payment gateway, it is important to consider the following attributes:

Pricing: Payment gateways charge a variety of fees, including transaction fees, monthly fees, and setup fees as shown below:

Transaction fees: These are charged for each transaction that you process, and the amount can vary depending on the payment gateway and the payment method used.

Setup fees: Some payment gateways charge a one-time fee to set up your account.

Monthly fees: Certain gateways require you to pay a monthly subscription fee to continue using their services.

Currency conversion fees: If your business accepts payments in multiple currencies, you may be charged a fee for converting the funds to your local currency.

Features: Payment gateways offer a variety of features, such as support for multiple payment methods, recurring billing, and fraud protection. It is important to choose a payment gateway that offers the features that are important to your business.

Customer support: It is important to choose a payment gateway that offers good customer support in case you have any problems.

Security: Payment gateways use a variety of security measures to protect customer data from fraud and theft. It is important to choose a payment gateway that has a strong security track record.

Ease of use: It is important to choose a payment gateway that is easy to set up and use. This will save you time and hassle in the long run.

In addition to these general attributes, you may also want to consider the following factors when choosing a payment gateway:

International support: If you sell products or services to customers outside of your home country, you will need to choose a payment gateway that supports international payments.

Integration with your e-commerce platform: If you use an e-commerce platform, such as Shopify or WooCommerce, you will need to choose a payment gateway that integrates with your platform. This will make it easier to accept payments from your customers.

Payment processing speed: If you need to process payments quickly, you will need to choose a payment gateway that offers fast payment processing times.

Fraud protection: Fraud prevention features, such as 3D Secure and address verification, can help to protect your business from fraud.

Analytics tools: Payment gateways often offer analytics tools that can help you to track your sales and payment data. This information can be helpful for making business decisions.

HitPay: An Affordable and Reliable Payment Gateway for Small Businesses In Malaysia

HitPay is a Singapore-based payment gateway that offers a wide range of features and benefits for small businesses in Malaysia, including:

Seamless integration with popular e-commerce platforms

Support for multiple payment methods, including cards, bank transfers, e-wallets, and pay later options

Competitive pricing, with no setup, recurring, or upfront costs

Easy-to-use dashboard and advanced online checkout rules

SME-friendly approach with instant or quick verification and same or next-day payouts

Benefits of HitPay Payment Gateway

HitPay offers various payment processing options, including online, point of sale (POS), and business-to-business (B2B) payments, catering to the diverse needs of small businesses in multiple industries.

For example, an online retail business can use HitPay to accept payments from customers on its website and mobile app. A brick-and-mortar store can use HitPay to accept payments from customers at the checkout counter. And a B2B business can use HitPay to accept payments from other businesses for goods and services rendered. Some of the other benefits include:

Global Reach and Secure Transactions:

Strong security measures ensure the safe processing of transactions.

Global reach allows small businesses to expand their customer base internationally.

User-friendly Checkout Experience

Enhances customer satisfaction.

Promotes repeat business and fosters long-term customer relationships.

Integration with Popular Platforms

Seamless integration with popular platforms like Shopify.

Streamlines the payment processing experience for small businesses.

Ensures smooth operations and efficient management of transactions.

No-code Tools and Competitive Pricing

No-code tools make it easy for small businesses to get started with HitPay.

Competitive pricing makes HitPay an attractive option for small businesses.

Additional Business Software

HitPay offers additional business software, such as POS, online store, and recurring billing, without monthly subscription fees.

Provides small businesses with a comprehensive payment solution that meets their unique needs and budget constraints.

HitPay vs Other Payment Gateways in Malaysia

When choosing a payment gateway for your business in Malaysia, it's important to compare the fees and features of different providers. Here's a closer look at some of the most popular options:

HitPay

Pricing: Pay per transaction, with no setup or subscription fees.

Features: Free business tools and high quality customer support

PayPal

Pricing: Higher transaction fees than other providers.

Features: Global reach and established reputation.

Unlike global payment gateways (PayPal), HitPay allows you to pay with local payment methods like FPX, DuitNow, GrabPay, and Shopback PayLater. HitPay also accepts international and local credit cards.

Other popular payment gateways in Malaysia:

Stripe: User-friendly interface and wide range of features, but relatively high transaction fees and may require coding experience for customisations.

Rapyd: Comprehensive suite of payment solutions, including support for multiple payment methods and currencies. Fees vary depending on the services chosen by the business.

FOMO Pay: Specialises in mobile payment solutions and supports popular local and international payment methods. Competitive pricing makes it a good choice for businesses looking to offer mobile payment options.

Xfers: Focuses on providing a seamless payment infrastructure and supports popular local payment methods. Transparent pricing and custom options make it a good choice for businesses catering to the local market.

Adyen: Global payment gateway that offers a range of features, including support for multiple payment methods and currencies, easy integration, and advanced fraud protection.

HitPay is a good option for small businesses that are looking for an affordable and reliable payment gateway with a wide range of features.

For Malaysian SME's, HitPay offers competitive pricing, support for multiple payment methods including FPX, DuitNow, Visa, Mastercard and GrabPay.

It has a user-friendly dashboard, and integration with popular e-commerce platforms. HitPay is also known for its SME-friendly approach, instant or quick verification, and same or next-day payouts.

Ultimately, the best payment gateway for your business will depend on your specific needs and requirements. However, by considering the factors listed above, you can make an informed decision that will help you to save money, grow your business, and improve the customer experience.

Have questions about HitPay?

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

Read also:

คุณอาจชอบโพสต์เหล่านี้

The Best Affordable Payment Gateway for SMEs In Malaysia

20 ตุลาคม 2566

HitPay is a reliable payment gateway for small businesses in Malaysia. It offers a wide range of features, including secure transactions, global reach, a user-friendly checkout experience, and integration with popular platforms.

Selecting the right payment gateway is crucial for small businesses, as it directly impacts their customer experience, security, and profitability. A reliable and cost-effective payment gateway can streamline transactions, boost customer confidence, and promote business growth.

As an SME in Malaysia, it is essential to consider factors such as processing fees, monthly software plans, transparency in pricing, and additional charges for setup or cancellation.

HitPay offers an affordable and convenient payment gateway for small businesses in Malaysia and beyond, with its competitive pricing, user-friendly interface, and secure transaction processing.

Payment gateways play a crucial role in the world of online transactions. Let's explore what they are, how they work, and the benefits for small businesses.

What is a Payment Gateway?

A payment gateway is a digital service that facilitates secure online transactions between customers and merchants.

It acts as a bridge, enabling the exchange of payment information between the customer's bank and the merchant's bank. This ensures that payments are processed smoothly and securely.

Why is it important for businesses to choose an affordable payment gateway?

There are several reasons why it is important for businesses to choose an affordable payment gateway:

To save money on payment processing fees: Payment processing fees can be a significant expense for businesses, especially those that process a high volume of transactions. Choosing an affordable payment gateway can help businesses to save money on these fees and improve their bottom line.

To be more competitive: In today's competitive marketplace, businesses need to be able to offer their customers the best possible prices. By choosing an affordable payment gateway, businesses can keep their prices low and be more competitive with other businesses.

To attract and retain customers: Customers are increasingly looking for businesses that offer convenient and affordable payment options. By choosing an affordable payment gateway, businesses can make it easier and more affordable for their customers to pay for goods and services, which can lead to increased sales and customer loyalty.

Benefits of Using a Payment Gateway

There are many benefits to using a payment gateway, including:

Convenience: Payment gateways allow customers to pay for goods and services quickly and easily, without having to leave the website or app where they are shopping. This can lead to an increase in sales and conversion rates.

Security: Payment gateways use a variety of security measures to protect customer data from fraud and theft. This can help to build trust with customers and reduce the risk of chargebacks.

Reduced costs: Payment gateways can help businesses to reduce their costs by streamlining the payment process and eliminating the need to process payments manually. This can free up time and resources for other tasks.

Increased flexibility: Payment gateways allow businesses to accept a variety of payment methods, including credit cards, debit cards, e-wallets, and bank transfers. This can make it easier for customers to pay for goods and services, and it can also help businesses to expand into new markets.

Improved customer experience: Payment gateways can help to improve the customer experience by providing a seamless and secure checkout process. This can lead to repeat business and increased customer loyalty.

In addition to these general benefits, payment gateways can also offer specific features that can be helpful for businesses of all sizes. For example, some payment gateways offer recurring billing, fraud protection, and analytics tools.

Features to Look for in a Payment Gateway

When choosing a payment gateway, it is important to consider the following attributes:

Pricing: Payment gateways charge a variety of fees, including transaction fees, monthly fees, and setup fees as shown below:

Transaction fees: These are charged for each transaction that you process, and the amount can vary depending on the payment gateway and the payment method used.

Setup fees: Some payment gateways charge a one-time fee to set up your account.

Monthly fees: Certain gateways require you to pay a monthly subscription fee to continue using their services.

Currency conversion fees: If your business accepts payments in multiple currencies, you may be charged a fee for converting the funds to your local currency.

Features: Payment gateways offer a variety of features, such as support for multiple payment methods, recurring billing, and fraud protection. It is important to choose a payment gateway that offers the features that are important to your business.

Customer support: It is important to choose a payment gateway that offers good customer support in case you have any problems.

Security: Payment gateways use a variety of security measures to protect customer data from fraud and theft. It is important to choose a payment gateway that has a strong security track record.

Ease of use: It is important to choose a payment gateway that is easy to set up and use. This will save you time and hassle in the long run.

In addition to these general attributes, you may also want to consider the following factors when choosing a payment gateway:

International support: If you sell products or services to customers outside of your home country, you will need to choose a payment gateway that supports international payments.

Integration with your e-commerce platform: If you use an e-commerce platform, such as Shopify or WooCommerce, you will need to choose a payment gateway that integrates with your platform. This will make it easier to accept payments from your customers.

Payment processing speed: If you need to process payments quickly, you will need to choose a payment gateway that offers fast payment processing times.

Fraud protection: Fraud prevention features, such as 3D Secure and address verification, can help to protect your business from fraud.

Analytics tools: Payment gateways often offer analytics tools that can help you to track your sales and payment data. This information can be helpful for making business decisions.

HitPay: An Affordable and Reliable Payment Gateway for Small Businesses In Malaysia

HitPay is a Singapore-based payment gateway that offers a wide range of features and benefits for small businesses in Malaysia, including:

Seamless integration with popular e-commerce platforms

Support for multiple payment methods, including cards, bank transfers, e-wallets, and pay later options

Competitive pricing, with no setup, recurring, or upfront costs

Easy-to-use dashboard and advanced online checkout rules

SME-friendly approach with instant or quick verification and same or next-day payouts

Benefits of HitPay Payment Gateway

HitPay offers various payment processing options, including online, point of sale (POS), and business-to-business (B2B) payments, catering to the diverse needs of small businesses in multiple industries.

For example, an online retail business can use HitPay to accept payments from customers on its website and mobile app. A brick-and-mortar store can use HitPay to accept payments from customers at the checkout counter. And a B2B business can use HitPay to accept payments from other businesses for goods and services rendered. Some of the other benefits include:

Global Reach and Secure Transactions:

Strong security measures ensure the safe processing of transactions.

Global reach allows small businesses to expand their customer base internationally.

User-friendly Checkout Experience

Enhances customer satisfaction.

Promotes repeat business and fosters long-term customer relationships.

Integration with Popular Platforms

Seamless integration with popular platforms like Shopify.

Streamlines the payment processing experience for small businesses.

Ensures smooth operations and efficient management of transactions.

No-code Tools and Competitive Pricing

No-code tools make it easy for small businesses to get started with HitPay.

Competitive pricing makes HitPay an attractive option for small businesses.

Additional Business Software

HitPay offers additional business software, such as POS, online store, and recurring billing, without monthly subscription fees.

Provides small businesses with a comprehensive payment solution that meets their unique needs and budget constraints.

HitPay vs Other Payment Gateways in Malaysia

When choosing a payment gateway for your business in Malaysia, it's important to compare the fees and features of different providers. Here's a closer look at some of the most popular options:

HitPay

Pricing: Pay per transaction, with no setup or subscription fees.

Features: Free business tools and high quality customer support

PayPal

Pricing: Higher transaction fees than other providers.

Features: Global reach and established reputation.

Unlike global payment gateways (PayPal), HitPay allows you to pay with local payment methods like FPX, DuitNow, GrabPay, and Shopback PayLater. HitPay also accepts international and local credit cards.

Other popular payment gateways in Malaysia:

Stripe: User-friendly interface and wide range of features, but relatively high transaction fees and may require coding experience for customisations.

Rapyd: Comprehensive suite of payment solutions, including support for multiple payment methods and currencies. Fees vary depending on the services chosen by the business.

FOMO Pay: Specialises in mobile payment solutions and supports popular local and international payment methods. Competitive pricing makes it a good choice for businesses looking to offer mobile payment options.

Xfers: Focuses on providing a seamless payment infrastructure and supports popular local payment methods. Transparent pricing and custom options make it a good choice for businesses catering to the local market.

Adyen: Global payment gateway that offers a range of features, including support for multiple payment methods and currencies, easy integration, and advanced fraud protection.

HitPay is a good option for small businesses that are looking for an affordable and reliable payment gateway with a wide range of features.

For Malaysian SME's, HitPay offers competitive pricing, support for multiple payment methods including FPX, DuitNow, Visa, Mastercard and GrabPay.

It has a user-friendly dashboard, and integration with popular e-commerce platforms. HitPay is also known for its SME-friendly approach, instant or quick verification, and same or next-day payouts.

Ultimately, the best payment gateway for your business will depend on your specific needs and requirements. However, by considering the factors listed above, you can make an informed decision that will help you to save money, grow your business, and improve the customer experience.

Have questions about HitPay?

If you're a customer who has questions about paying with HitPay, feel free to contact us on our website.

Are you a merchant who wants to offer more payment methods with HitPay's secure payment gateway?

Set up an account for free or find out more with a 1-on-1 demo.

Read also:

คุณอาจชอบโพสต์เหล่านี้

เราไปตั้งค่าคุณกันเถอะ

สร้างบัญชีทันทีหรือติดต่อเราสำหรับสร้างแพ็คเกจที่กำหนดเองสำหรับธุรกิจของคุณ.

ซอฟต์แวร์ธุรกิจ

บริษัท

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

ประเทศอื่น ๆ ทั้งหมด

บริษัท HitPay Payment Solutions Pte Ltd ("HitPay") ได้รับอนุญาตเป็นสถาบันการชำระเงินขนาดใหญ่ (PS20200643) ภายใต้พระราชบัญญัติการบริการการชำระเงินของสิงคโปร์สำหรับการให้บริการการโอนเงินภายในประเทศ, การโอนเงินข้ามพรมแดน และบริการการจัดหาผู้ค้า ซึ่งสามารถยืนยันได้ในไดเรกทอรีสถาบันการเงินของ MAS ที่นี่. HitPay ยังสามารถให้บริการเหล่านี้ร่วมกับพันธมิตรอื่น ๆ ที่ได้รับอนุญาตหรือยกเว้นโดย MAS.

บริษัท HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, สิงคโปร์ 089109

เราไปตั้งค่าคุณกันเถอะ

สร้างบัญชีทันทีหรือติดต่อเราสำหรับสร้างแพ็คเกจที่กำหนดเองสำหรับธุรกิจของคุณ.

ซอฟต์แวร์ธุรกิจ

บริษัท

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

ประเทศอื่น ๆ ทั้งหมด

บริษัท HitPay Payment Solutions Pte Ltd ("HitPay") ได้รับอนุญาตเป็นสถาบันการชำระเงินขนาดใหญ่ (PS20200643) ภายใต้พระราชบัญญัติการบริการการชำระเงินของสิงคโปร์สำหรับการให้บริการการโอนเงินภายในประเทศ, การโอนเงินข้ามพรมแดน และบริการการจัดหาผู้ค้า ซึ่งสามารถยืนยันได้ในไดเรกทอรีสถาบันการเงินของ MAS ที่นี่. HitPay ยังสามารถให้บริการเหล่านี้ร่วมกับพันธมิตรอื่น ๆ ที่ได้รับอนุญาตหรือยกเว้นโดย MAS.

บริษัท HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, สิงคโปร์ 089109

เราไปตั้งค่าคุณกันเถอะ

สร้างบัญชีทันทีหรือติดต่อเราสำหรับสร้างแพ็คเกจที่กำหนดเองสำหรับธุรกิจของคุณ.

ซอฟต์แวร์ธุรกิจ

บริษัท

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

ประเทศอื่น ๆ ทั้งหมด

บริษัท HitPay Payment Solutions Pte Ltd ("HitPay") ได้รับอนุญาตเป็นสถาบันการชำระเงินขนาดใหญ่ (PS20200643) ภายใต้พระราชบัญญัติการบริการการชำระเงินของสิงคโปร์สำหรับการให้บริการการโอนเงินภายในประเทศ, การโอนเงินข้ามพรมแดน และบริการการจัดหาผู้ค้า ซึ่งสามารถยืนยันได้ในไดเรกทอรีสถาบันการเงินของ MAS ที่นี่. HitPay ยังสามารถให้บริการเหล่านี้ร่วมกับพันธมิตรอื่น ๆ ที่ได้รับอนุญาตหรือยกเว้นโดย MAS.

บริษัท HitPay Payment Solutions Pte Ltd

1 Keong Saik Road, สิงคโปร์ 089109

เราไปตั้งค่าคุณกันเถอะ

สร้างบัญชีทันทีหรือติดต่อเราสำหรับสร้างแพ็คเกจที่กำหนดเองสำหรับธุรกิจของคุณ.

ซอฟต์แวร์ธุรกิจ

บริษัท

Singapore

Philippines

Malaysia

Indonesia

Thailand

Australia & New Zealand

ประเทศอื่น ๆ ทั้งหมด

HitPay Payment Solutions Pte Ltd ("HitPay") ได้รับใบอนุญาตเป็นสถาบันการชำระเงินที่สำคัญ (PS20200643) ภายใต้พระราชบัญญัติการชำระเงินของสิงคโปร์ สำหรับการให้บริการโอนเงินภายในประเทศ, การโอนเงินข้ามพรมแดน และบริการการจัดหาค่าใช้จ่ายให้กับพ่อค้า ซึ่งสามารถยืนยันได้ในไดเรกทอรีสถาบันการเงิน MAS ที่นี่. HitPay อาจให้บริการเหล่านี้ในความร่วมมือกับพันธมิตรที่ได้รับใบอนุญาตหรือได้รับการยกเว้นจาก MAS อื่น ๆ

HitPay Payment Solutions Pte Ltd

1 ถนนเคียงไทร, สิงคโปร์ 089109