HitPay Recurring Billing allows businesses to set up recurring payment schedules for customers. Payments are automatically processed on a recurring basis on predefined dates, reducing manual effort and ensuring timely payments.

HitPay Recurring Billing is beneficial for a wide range of businesses, including: a subscription businesses and services, membership-based organizations, SaaS companies, subscription services, utility providers, and any business that collects recurring payments from customers.

Yes, security is a top priority for HitPay. Our Recurring Billing solution adheres to strict security standards, including PCI DSS compliance, to protect recurring billing process, and ensure the security of your transactions.

Yes, you have the flexibility to customize billing schedules and amounts for individual customers. HitPay Recurring Billing allows you to tailor your billing strategy to meet the unique needs of your clients.

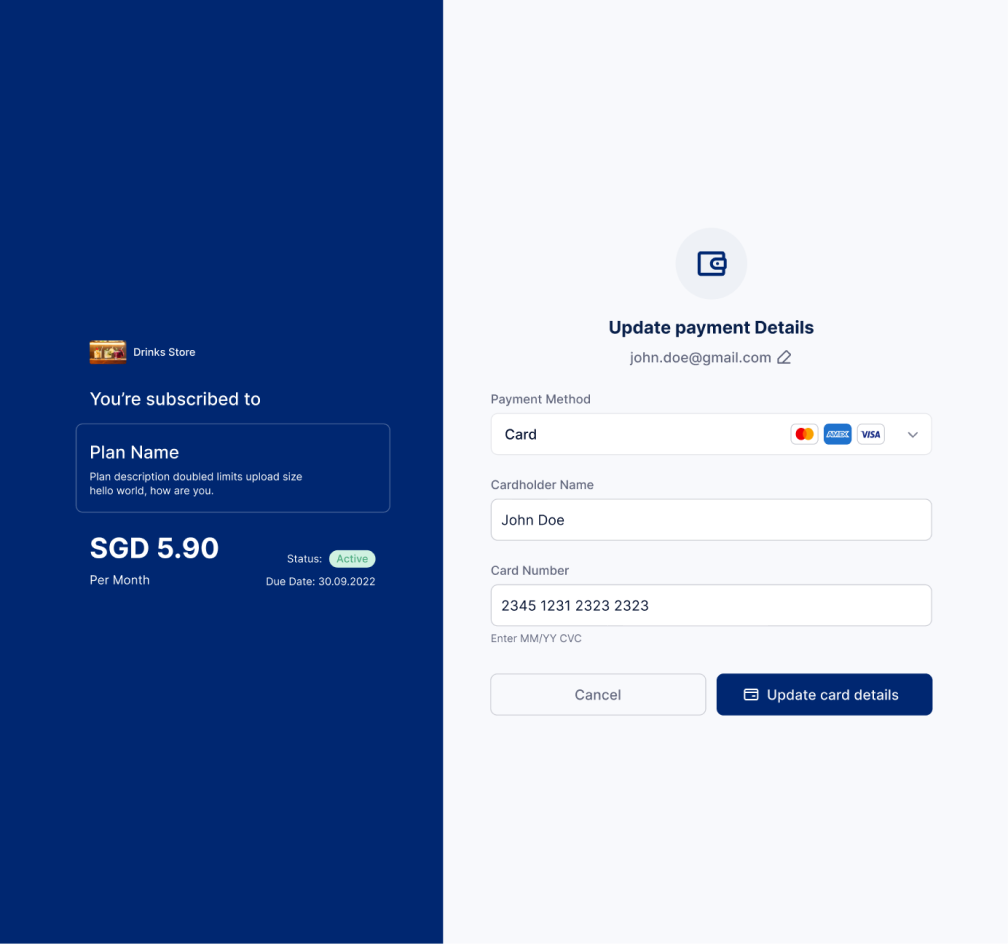

HitPay Recurring Billing supports automatic payments, by credit cards and digital wallets like Apple Pay and Google Pay.

To get started with HitPay Recurring Billing, sign up for an account on our website. You'll find step-by-step guides to help you set up your recurring billing system.

Transaction fees apply when using HitPay Recurring Billing. Please refer to our pricing page or contact our sales team for more details.

Yes, HitPay Recurring Billing allows you to manage recurring payments easily. You can pause, cancel, or modify recurring payment schedules for individual customers as needed.

%20Logo%201.webp)

-min.webp)